|

|

市場調査レポート

商品コード

1681516

欧州のホワイトオイル市場:用途・機能性・グレード・製品・国別の分析・予測 (2024-2034年)Europe White Oil Market: Focus on Application, Functionality, Grade, Products, and Country Level Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のホワイトオイル市場:用途・機能性・グレード・製品・国別の分析・予測 (2024-2034年) |

|

出版日: 2025年03月19日

発行: BIS Research

ページ情報: 英文 86 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のホワイトオイルの市場規模は、2023年の6億8,540万米ドルから、予測期間中は8.84%のCAGRで推移し、2034年には15億9,920万米ドルに達すると予測されています。

欧州市場において、ホワイトオイルは医薬品、化粧品、食品加工、工業用途などの産業で利用されています。製品処方における純度と安全性への要求の高まりにより、ホワイトオイルはローション、軟膏、潤滑剤、可塑剤の製造に欠かせないものとなっています。精製プロセスにおける最近の技術革新により、医薬品および食品グレードを含む、EUの厳しい規制基準に適合したホワイトオイルが生み出されています。ExxonMobil、Sonneborn LLC、Sasolといった主要企業は、安全で無害な原料への需要の高まりに応える最高品質の製品を提供しています。さらに、持続可能性と環境に優しい製造方法に対する消費者の意識の高まりにより、欧州企業はより環境に優しい製造方法へと舵を切っています。全体として、欧州のホワイトオイル市場は、技術の進歩や消費者の嗜好の変化に後押しされ、進化を続けています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2034年 |

| 2024年評価 | 6億8,540万米ドル |

| 2034年予測 | 15億9,920万米ドル |

| CAGR | 8.84% |

欧州のホワイトオイル市場は、精製油業界の中でもダイナミックに進化している分野です。高純度で精製された品質で知られるホワイトオイルは、医薬品、化粧品、食品加工、工業用途など、さまざまな分野で広く使用されています。無毒性、安定性、不活性といった固有の特性は、ローション、軟膏、潤滑油、可塑剤などの製剤に不可欠な成分となっています。

近年の精製技術の進歩により、欧州の厳しい規制基準を満たす高純度化が可能になっています。その結果、食品グレードや医薬品グレードのホワイトオイルといった特殊な製品が開発され、品質と安全性が最も重要視される用途において不可欠なものとなっています。ExxonMobil、Sonneborn LLC、Sasolといった主要企業は、高い製品水準を維持し、変化する業界の需要を満たすため、最先端の研究開発に絶えず投資しています。

さらに同市場では、環境に優しい製造方法と持続可能性がますます重視されるようになっています。企業は、環境への影響に対する消費者の意識の高まりと、より環境に優しい製造方法へのシフトに対応して、製品の有効性を維持しながらエコロジカルフットプリントを減らすために製造方法を変更しています。このような持続可能性の重視は、公衆衛生と環境安全性をより重視する、より大きな欧州規制の枠組みと一致しています。

セグメンテーション1:製品タイプ別

- ミネラルホワイトオイル

- 軽質グレード

- 重質グレード

- 合成ホワイトオイル

- ポリアルファオレフィン (PAO)

- ポリブテン

- その他

セグメンテーション2:グレードタイプ別

- 工業グレード

- 医薬品グレード

- 化粧品グレード

- 食品グレード

- その他

セグメンテーション3:用途別

- ヘルスケア・医薬品

- パーソナルケア・化粧品

- 食品・飲料

- 繊維製品

- 自動車・産業

- 農業

- プラスチック、ポリマー、接着剤

- その他

セグメンテーション4:機能タイプ別

- 潤滑

- 保湿

- エモリエント

- 溶剤

- 保護コーティング

- 可塑剤

- 離型剤

セグメンテーション5:国別

- ドイツ

- スペイン

- 英国

- フランス

- イタリア

- その他

当レポートでは、欧州のホワイトオイルの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術開発・特許の動向、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- 精製技術の進歩

- ナノテクノロジーとホワイトオイルの用途への影響

- ホワイトオイルのバイオベースの代替品

- サプライチェーンの概要

- バリューチェーン分析

- 製品マージン分析

- 価格予測

- 研究開発レビュー

- 特許公開の動向

- 規制状況 (地域別)

- 欧州の規制状況

- ホワイトオイルの持続可能性と環境への影響

- 持続可能な原材料調達

- ホワイトオイルの生産に影響を与える環境規制

- 環境に優しい代替品とイノベーション

- ステークホルダー分析

- 使用事例

- エンドユーザーと購入基準

- 主要な世界的イベントの影響分析

- 市場力学の概要

- 市場促進要因

- 市場の課題

- 市場機会

第2章 地域

- 地域サマリー

- 欧州

- 地域概要

- 市場成長推進因子

- 市場課題

- 用途

- 製品

- 欧州のホワイトオイル市場 (国別)

第3章 市場:競合ベンチマーキングと企業プロファイル

- 次なるフロンティア

- 地理的評価

- BP p.l.c.

- FUCHS

- H&R GROUP

- Shell International B.V.

- TotalEnergies

- 顧客の展望:企業一覧 (用途別)

- ヘルスケア・医薬品

- パーソナルケア・化粧品

- 食品・飲料

- 繊維

- 自動車および産業

- 農業

- プラスチック、ポリマー、接着剤

- その他

第4章 調査手法

List of Figures

- Figure 1: Optimistic, Realistic, and Pessimistic Europe White Oil Market Scenarios

- Figure 2: White Oil Market (by Region), 2023, 2026, and 2034

- Figure 3: Europe White Oil Market (by Application Type), 2023, 2026, and 2034

- Figure 4: Europe White Oil Market (by Functionality Type), 2023, 2026, and 2034

- Figure 5: Europe White Oil Market (by Product Type), 2023, 2026, and 2034

- Figure 6: Europe White Oil Market (by Grade Type), 2023, 2026, and 2034

- Figure 7: White Oil Market, Recent Developments

- Figure 8: Analysis and Forecast Note

- Figure 9: Innovative Refining Technologies Driving Advancements in the White Oil Market

- Figure 10: Key Impacts of Nanotechnology on White Oil Applications

- Figure 11: Major Advantages of Bio-Based Alternatives to White Oil

- Figure 12: Supply Chain of the White Oil Market

- Figure 13: Value Chain of the White Oil Market

- Figure 14: Average Pricing of White Oil, by Product Type, USD/Ton, 2023, 2028, 2034

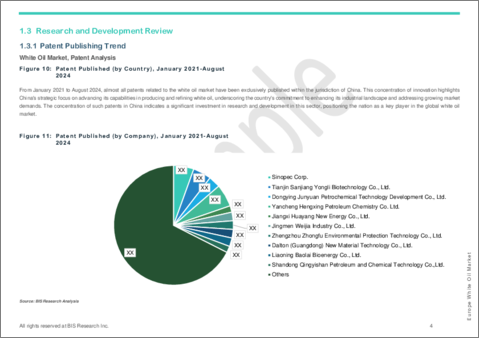

- Figure 15: Patent Published (by Country), January 2021-August 2024

- Figure 16: Patent Published (by Company), January 2021-August 2024

- Figure 17: Patents Published (by Year), January 2021-August 2024

- Figure 18: Patent Published (by Legal Status), January 2021-August 2024

- Figure 19: Patent Published (by Document Type), January 2021-August 2024

- Figure 20: Key Steps in Sustainable Sourcing of Raw Materials for the White Oil Market

- Figure 21: Major Use Cases of White Oil Across Various Industries

- Figure 22: Impact Analysis of White Oil Market Navigating Factors, 2024-2034

- Figure 23: Global Motor Vehicle Production, Million Units, 2021-2023

- Figure 24: Global Plastic Production, Metric Tonne (Mt), 2020-2022

- Figure 25: Germany White Oil Market, $Million, 2023-2034

- Figure 26: France White Oil Market, $Million, 2023-2034

- Figure 27: U.K. White Oil Market, $Million, 2023-2034

- Figure 28: Italy White Oil Market, $Million, 2023-2034

- Figure 29: Spain White Oil Market, $Million, 2023-2034

- Figure 30: Rest-of-Europe White Oil Market, $Million, 2023-2034

- Figure 31: Next Frontiers in the White Oil Market

- Figure 32: Data Triangulation

- Figure 33: Top-Down and Bottom-Up Approach

- Figure 34: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

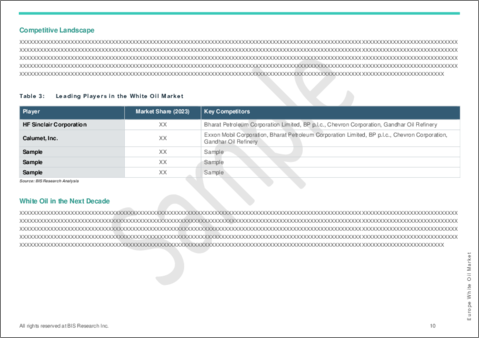

- Table 3: Leading Players in the White Oil Market

- Table 4: Trends in the White Oil Market

- Table 5: Key Patents Driving the White Oil Market Forward, 2023-2024

- Table 6: REACH Compliance for Cosmetic and Personal Care Use

- Table 7: EU Regulations for Food-Grade White Oil

- Table 8: White Oil Market (by Region), $Million, 2023-2034

- Table 9: Europe White Oil Market (by Application), $Million, 2023-2034

- Table 10: Europe White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 11: Europe White Oil Market (by Product Type), $Million, 2023-2034

- Table 12: Europe White Oil Market (by Grade Type), $Million, 2023-2034

- Table 13: Germany White Oil Market (by Application), $Million, 2023-2034

- Table 14: Germany White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 15: Germany White Oil Market (by Product Type), $Million, 2023-2034

- Table 16: Germany White Oil Market (by Grade Type), $Million, 2023-2034

- Table 17: France White Oil Market (by Application), $Million, 2023-2034

- Table 18: France White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 19: France White Oil Market (by Product Type), $Million, 2023-2034

- Table 20: France White Oil Market (by Grade Type), $Million, 2023-2034

- Table 21: U.K. White Oil Market (by Application), $Million, 2023-2034

- Table 22: U.K. White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 23: U.K. White Oil Market (by Product Type), $Million, 2023-2034

- Table 24: U.K. White Oil Market (by Grade Type), $Million, 2023-2034

- Table 25: Italy White Oil Market (by Application), $Million, 2023-2034

- Table 26: Italy White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 27: Italy White Oil Market (by Product Type), $Million, 2023-2034

- Table 28: Italy White Oil Market (by Grade Type), $Million, 2023-2034

- Table 29: Spain White Oil Market (by Application), $Million, 2023-2034

- Table 30: Spain White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 31: Spain White Oil Market (by Product Type), $Million, 2023-2034

- Table 32: Spain White Oil Market (by Grade Type), $Million, 2023-2034

- Table 33: Rest-of-Europe White Oil Market (by Application), $Million, 2023-2034

- Table 34: Rest-of-Europe White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 35: Rest-of-Europe Market (by Product Type), $Million, 2023-2034

- Table 36: Rest-of-Europe White Oi Market (by Grade Type), $Million, 2023-2034

- Table 37: Market Share, 2023

Introduction to Europe White Oil Market

The Europe white oil market is projected to reach $1,599.2 million by 2034 from $685.4 million in 2023, growing at a CAGR of 8.84% during the forecast period 2024-2034. In the European market, the white oil sector features a broad array of highly refined, mineral-based oils utilized in industries such as pharmaceuticals, cosmetics, food processing, and industrial applications. The rising demand for purity and safety in product formulations has made white oil indispensable in the manufacture of lotions, ointments, lubricants, and plasticizers. Recent innovations in refining processes have resulted in white oils that comply with stringent EU regulatory standards, including pharmaceutical- and food-grade variants. Major market players like ExxonMobil, Sonneborn LLC, and Sasol provide top-quality products that meet the increasing demand for safe, non-toxic ingredients. Furthermore, heightened consumer awareness around sustainability and eco-friendly production practices is steering European companies towards greener manufacturing methods. Overall, the European white oil market continues to evolve, driven by technological advancements and changing consumer preferences.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $685.4 Million |

| 2034 Forecast | $1,599.2 Million |

| CAGR | 8.84% |

The European white oil market is a dynamic and evolving segment within the refined oil industry. White oil, known for its high purity and refined quality, is widely used across various sectors, including pharmaceuticals, cosmetics, food processing, and industrial applications. Its inherent properties-non-toxicity, stability, and inertness-make it an essential component in formulations like lotions, ointments, lubricants, and plasticisers.

Higher purity levels that meet strict European regulatory standards have been made possible by advancements in refining technologies in recent years. Specialised varieties such as food-grade and pharmaceutical-grade white oils have been developed as a result, and they are essential in applications where quality and safety are of the utmost importance. Key players in the market, such as ExxonMobil, Sonneborn LLC, and Sasol, are notable for their constant investments in cutting-edge R&D to uphold high product standards and satisfy changing industry demands.

Furthermore, the market is placing an increasing amount of emphasis on eco-friendly production methods and sustainability. Businesses are modifying their production methods to lessen ecological footprints while preserving product efficacy in response to growing consumer awareness of environmental impact and a shift towards greener manufacturing practices. In addition to improving market competitiveness, this emphasis on sustainability is consistent with the larger European regulatory framework, which places a greater emphasis on public health and environmental safety.

All things considered, the European white oil market is expected to keep expanding due to technological developments, strict quality standards, and a proactive approach to sustainability. Together, these elements put the market in a position to serve a wide variety of uses, guaranteeing that white oil will continue to be a vital resource for businesses all over the continent.

Market Segmentation

Segmentation 1: by Product Type

- Mineral White Oil

- Light Grade

- Heavy Grade

- Synthetic White Oil

- Polyalphaolefin (PAO)

- Polybutene

- Others

Segmentation 2: by Grade Type

- Technical/Industrial Grade

- Pharmaceutical Grade

- Cosmetic Grade

- Food Grade

- Others

Segmentation 3: by Application

- Healthcare and Pharmaceuticals

- Personal Care and Cosmetics

- Food and Beverage

- Textiles

- Automotive and Industrial

- Agriculture

- Plastics, Polymers, and Adhesives

- Others

Segmentation 4: by Functionality Type

- Lubrication

- Moisturization

- Emollient

- Solvent

- Protective Coating

- Plasticizer

- Release Agent

Segmentation 5: by Country

- Germany

- Spain

- U.K.

- France

- Italy

- Rest-of-Europe

How can this report add value to an organization?

Growth/Marketing Strategy: The Europe white oil market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been launching processing units to strengthen their position in the white oil market.

Competitive Strategy: Key players in the Europe white oil market have been analyzed and profiled in the study of white oil products. Moreover, a detailed competitive benchmarking of the players operating in the white oil market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies profiled for the Europe white oil market have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- BP p.l.c.

- FUCHS

- H&R GROUP

- Shell International B.V.

- Total Energies

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Advancements in Refining Technologies

- 1.1.2 Nanotechnology and its Impact on White Oil Applications

- 1.1.3 Bio-Based Alternatives to White Oil

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Product Margin Analysis

- 1.2.3 Pricing Forecast

- 1.3 Research and Development Review

- 1.3.1 Patent Publishing Trend

- 1.4 Regulatory Landscape (by Region)

- 1.4.1 Europe Regulatory Landscape

- 1.4.1.1 REACH Compliance for Cosmetic and Personal Care Use

- 1.4.1.2 EU Regulations for Food-Grade White Oil

- 1.4.1 Europe Regulatory Landscape

- 1.5 Sustainability and Environmental Impact of White Oil

- 1.5.1 Sustainable Sourcing of Raw Materials

- 1.5.2 Environmental Regulations Impacting the Production of White Oil

- 1.5.3 Eco-Friendly Alternatives and Innovations

- 1.6 Stakeholder Analysis

- 1.6.1 Use Case

- 1.6.2 End User and Buying Criteria

- 1.7 Impact Analysis for Key Global Events

- 1.8 Market Dynamics Overview

- 1.8.1 Market Drivers

- 1.8.1.1 Growth in the Automotive Sector

- 1.8.1.2 Expanding Pharmaceutical and Personal Care Industry

- 1.8.1.3 Rising Plastic Production

- 1.8.2 Market Challenges

- 1.8.2.1 Fluctuating Raw Material Prices

- 1.8.2.2 Stringent Regulatory Compliance

- 1.8.3 Market Opportunities

- 1.8.3.1 Expansion in Specialty and Sustainable Grades

- 1.8.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application

- 2.2.5 Product

- 2.2.6 Europe White Oil Market (by Country)

- 2.2.6.1 Germany

- 2.2.6.2 France

- 2.2.6.3 U.K.

- 2.2.6.4 Italy

- 2.2.6.5 Spain

- 2.2.6.6 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 BP p.l.c.

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2023

- 3.2.2 FUCHS

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2023

- 3.2.3 H&R GROUP

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.1 Market Share, 2023

- 3.2.4 Shell International B.V.

- 3.2.4.1 Overview

- 3.2.4.2 'Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share, 2023

- 3.2.5 TotalEnergies

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2023

- 3.2.1 BP p.l.c.

- 3.3 Customer Outlook: List of Companies (by Application Type)

- 3.3.1 Healthcare and Pharmaceuticals

- 3.3.1.1 List of Customer Companies

- 3.3.2 Personal Care and Cosmetics

- 3.3.2.1 List of Customer Companies

- 3.3.3 Food and Beverage

- 3.3.3.1 List of Customer Companies

- 3.3.4 Textiles

- 3.3.4.1 List of Customer Companies

- 3.3.5 Automotive and Industrial

- 3.3.5.1 List of Customer Companies

- 3.3.6 Agriculture

- 3.3.6.1 List of Customer Companies

- 3.3.7 Plastics, Polymers, and Adhesives

- 3.3.7.1 List of Customer Companies

- 3.3.8 Others

- 3.3.8.1 List of Customer Companies

- 3.3.1 Healthcare and Pharmaceuticals

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast