|

|

市場調査レポート

商品コード

1667212

エッジデータセンターの世界市場:製品・用途・国別の分析・予測 (2025~2034年)Edge Data Center Market - A Global and Regional Analysis: Focus on Product, Application, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| エッジデータセンターの世界市場:製品・用途・国別の分析・予測 (2025~2034年) |

|

出版日: 2025年03月04日

発行: BIS Research

ページ情報: 英文 116 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のエッジデータセンターの市場規模は、2024年の206億2,560万米ドルから、予測期間中は17.63%のCAGRで堅調に推移し、2034年には1,097億8,130万米ドルに達すると予測されています。

エッジデータセンターの市場成長の主な促進要因の1つは、低遅延データ処理とリアルタイムコンピューティングに対する需要の高まりです。この成長は、5Gネットワークの急速な拡大、IoT用途の採用拡大、新興デジタル技術をサポートする分散コンピューティングインフラの必要性によってもさらに促進されています。

また、モジュラーデータセンターアーキテクチャとAI主導の自動化の進歩により、エッジデータセンターの効率的な展開と管理が可能になります。エネルギー効率の高いデータセンターを推進する政府の政策や、スマートシティ構想への投資も、エッジデータセンター市場の拡大に寄与しています。企業が拡張性、セキュリティ、運用効率を優先し続ける中、エッジデータセンターの需要は今後数年間で大幅に急増すると予想されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2034年 |

| 2025年評価 | 254億6,000万米ドル |

| 2034年予測 | 1,097億8,000万米ドル |

| CAGR | 17.63% |

用途別では、IT・通信セグメントが市場をリード:

予測期間中は主に低遅延コンピューティングとネットワーク最適化への需要の増加により、IT・通信セグメントがエッジデータセンター市場の主要用途になると予測されています。5Gインフラ、クラウドサービス、IoT用途の急速な拡大が、このセグメントをさらに推進しています。さらに、データトラフィックの増加、リアルタイム処理への依存度の増加、安全で高速な接続性の必要性も、IT・通信分野でのエッジデータセンターの採用を促進しています。ネットワーク仮想化、AI主導の分析、モジュール型データセンター設計の進歩により、エッジコンピューティングソリューションの効率性、拡張性、展開が強化され、このセグメントの優位性が強化されると予想されています。

市場セグメンテーション:

セグメンテーション1:エンドユーザー産業別

- IT・通信

- 銀行・金融サービス・保険 (BFSI)

- 政府・公共部門

- ヘルスケア

- 製造

- 自動車

- 小売

- その他

セグメンテーション2:タイプ別

- オンプレミスエッジ

- ネットワークエッジ

- 地域エッジ

セグメント3:地域別

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

当レポートでは、世界のデータセンター向けGPUの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の動向、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 動向:現在および将来の影響評価

- エッジデータセンター市場を形成する動向

- 5Gネットワークの展開

- IoTデバイスの普及

- ソフトウェア定義ネットワーク (SDN) 技術の採用

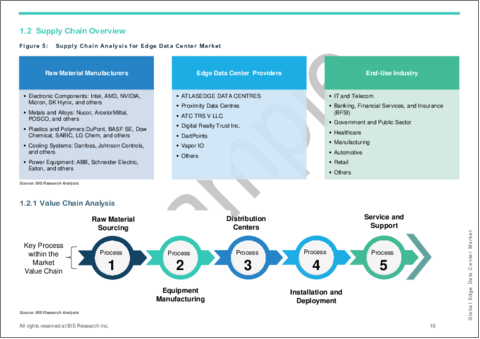

- サプライチェーンの概要

- バリューチェーン分析

- マーケットマップ

- 研究開発レビュー

- 特許出願動向 (国別・企業別)

- 技術分析

- 現在の技術と今後の技術

- エッジ導入数が最も多い主要国

- 時代遅れになる恐れのある技術

- 投資家、事業者、企業への影響

- 規制状況

- ユースケース

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 用途

- 用途のセグメンテーション

- 用途の概要

- 世界のエッジデータセンター市場 (用途別)

- IT・通信

- 銀行・金融サービス・保険 (BFSI)

- 政府および公共部門

- ヘルスケア

- 製造

- 自動車

- 小売

- その他

第3章 製品

- 製品セグメンテーション

- 製品概要

- 世界のエッジデータセンター市場 (タイプ別)

- オンプレミスエッジ

- ネットワークエッジ

- リージョナルエッジ

第4章 地域

- 地域別概要

- 北米

- 北米の主要市場参入企業

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 米国

- 用途

- 製品

- カナダ

- 用途

- 製品

- 欧州

- 欧州の主要参入企業

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- フランス

- 用途

- 製品

- ドイツ

- 用途

- 製品

- 英国

- 用途

- 製品

- その他

- 用途

- 製品

- アジア太平洋

- アジア太平洋の主要参入企業

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 中国

- 用途

- 製品

- 日本

- 用途

- 製品

- オーストラリア

- 用途

- 製品

- その他

- 用途

- 製品

- その他の地域

- その他の地域における主要な市場参入企業

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 南米

- 用途

- 製品

- 中東・アフリカ

- 用途

- 製品

第5章 市場:競合ベンチマーキング・企業プロファイル

- 競合情勢

- 企業プロファイル

- ATLASEDGE DATA CENTRES

- ATC TRS V LLC

- Cologix

- Vapor IO

- DartPoints

- Digital Realty

- Edge Centres

- EdgeConneX

- Ubiquity Management, LLC

- Leading Edge Data Centres

- Proximity Data Centres

- Switch

- Vertiv Group Corp

- Evoque Data Center Solutions

- Flexential

第6章 調査手法

List of Figures

- Figure 1: Global Edge Data Center Market (by Region), $Million, 2024, 2027, and 2034

- Figure 2: Global Edge Data Center Market (by End-Use Industry), $Million, 2024, 2027, and 2034

- Figure 3: Global Edge Data Center Market (by Type), $Million, 2024, 2027, and 2034

- Figure 4: Global Population Coverage by Technology, 2023 and 2029

- Figure 5: Supply Chain Analysis for Edge Data Center Market

- Figure 6: Patent Filed (by Country), January 2020-December 2023

- Figure 7: Patent Filed (by Company), January 2020-December 2023

- Figure 8: Tottenham Hotspur Stadium, Edge Computing for Smart Stadium Management

- Figure 9: McLaren Racing-Edge Data Computing for Formula One Performance

- Figure 10: Comcast-Edge Computing for Enterprise Resource Planning (ERP)

- Figure 11: Edge Computing for Disaster Recovery

- Figure 12: Edge Computing for Scalable FinTech Operations

- Figure 13: Villa-Tech-Expanding Cloud Services with Edge Computing

- Figure 14: Impact Analysis of Edge Data Center Market Navigating Factors, 2023-2033

- Figure 15: AI Publications (% of Total) by Sector and Geographic Area, 2021

- Figure 16: Global Data Generated Annually (Estimated), 2010-2025

- Figure 17: U.S. Edge Data Center Market, $Million, 2023-2034

- Figure 18: Canada Edge Data Center Market, $Million, 2023-2034

- Figure 19: France Edge Data Center Market, $Million, 2023-2034

- Figure 20: Germany Edge Data Center Market, $Million, 2023-2034

- Figure 21: U.K. Edge Data Center Market, $Million, 2023-2034

- Figure 22: Rest-of-Europe Edge Data Center Market, $Million, 2023-2034

- Figure 23: China Edge Data Center Market, $Million, 2023-2034

- Figure 24: Japan Edge Data Center Market, $Million, 2023-2034

- Figure 25: Australia Edge Data Center Market, $Million, 2023-2034

- Figure 26: Rest-of-Asia-Pacific Edge Data Center Market, $Million, 2023-2034

- Figure 27: South America Edge Data Center Market, $Million, 2023-2034

- Figure 28: Middle East and Africa Edge Data Center Market, $Million, 2023-2034

- Figure 29: Strategic Initiatives, 2023

- Figure 30: Share of Strategic Initiatives, 2023

- Figure 31: Data Triangulation

- Figure 32: Top-Down and Bottom-Up Approach

- Figure 33: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Edge Data Center Market, Opportunities across Regions

- Table 3: Regulatory Landscape across Countries

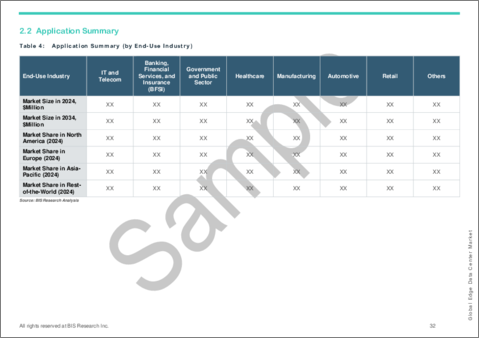

- Table 4: Application Summary (by End-Use Industry)

- Table 5: Global Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 6: Product Summary (by Type)

- Table 7: Global Edge Data Center Market (by Type), $Million, 2023-2034

- Table 8: Global Edge Data Center Market (by Region), $Million, 2023-2034

- Table 9: North America Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 10: North America Edge Data Center Market (by Type), $Million, 2023-2034

- Table 11: U.S. Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 12: U.S. Edge Data Center Market (by Type), $Million, 2023-2034

- Table 13: Canada Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 14: Canada Edge Data Center Market (by Type), $Million, 2023-2034

- Table 15: Europe Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 16: Europe Edge Data Center Market (by Type), $Million, 2023-2034

- Table 17: France Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 18: France Edge Data Center Market (by Type), $Million, 2023-2034

- Table 19: Germany Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 20: Germany Edge Data Center Market (by Type), $Million, 2023-2034

- Table 21: U.K. Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 22: U.K. Edge Data Center Market (by Type), $Million, 2023-2034

- Table 23: Rest-of-Europe Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 24: Rest-of-Europe Edge Data Center Market (by Type), $Million, 2023-2034

- Table 25: Asia-Pacific Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 26: Asia-Pacific Edge Data Center Market (by Type), $Million, 2023-2034

- Table 27: China Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 28: China Edge Data Center Market (by Type), $Million, 2023-2034

- Table 29: Japan Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 30: Japan Edge Data Center Market (by Type), $Million, 2023-2034

- Table 31: Australia Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 32: Australia Edge Data Center Market (by Type), $Million, 2023-2034

- Table 33: Rest-of-Asia-Pacific Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 34: Rest-of-Asia-Pacific Edge Data Center Market (by Type), $Million, 2023-2034

- Table 35: Rest-of-the-World Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 36: Rest-of-the-World Edge Data Center Market (by Type), $Million, 2023-2034

- Table 37: South America Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 38: South America Edge Data Center Market (by Type), $Million, 2023-2034

- Table 39: Middle East and Africa Edge Data Center Market (by End-Use Industry), $Million, 2024-2034

- Table 40: Middle East and Africa Edge Data Center Market (by Type), $Million, 2023-2034

- Table 41: Market Share, 2023

Global Edge Data Center Market Overview

The global edge data center market, valued at $20,625.6 million in 2024, is expected to reach $109,781.3 million by 2034, exhibiting a robust CAGR of 17.63% during the forecast period 2025-2034. One of the primary drivers for the growth of the edge data center market is the increasing demand for low-latency data processing and real-time computing. This growth is further fueled by the rapid expansion of 5G networks, the increasing adoption of IoT applications, and the need for decentralized computing infrastructure to support emerging digital technologies.

Additionally, advancements in modular data center architecture and AI-driven automation enable more efficient deployment and management of edge data centers. Government policies promoting energy-efficient data centers and investments in smart city initiatives are also contributing to the expansion of the edge data center market. As businesses continue to prioritize scalability, security, and operational efficiency, the demand for edge data centers is expected to surge significantly over the coming years.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $25.46 Billion |

| 2034 Forecast | $109.78 Billion |

| CAGR | 17.63% |

Introduction to the Edge Data Center Market

The edge data center market has emerged as a crucial sector enabling low-latency data processing and decentralized computing to support evolving digital infrastructure. This market focuses on the deployment of compact, high-performance data centers that optimize network efficiency, reduce data transmission costs, and enhance real-time computing capabilities. The edge data center market is gaining significant traction globally, driven by the rapid expansion of 5G technology, the increasing adoption of IoT applications, and the growing demand for efficient data management solutions. Key market participants include companies specializing in edge data center deployment, infrastructure solutions, and modular data center architectures.

Segmentation in the edge data center market includes applications such as IT and telecom, banking, financial services, and insurance (BFSI), government and public sector, healthcare, manufacturing, automotive, and retail, each leveraging edge computing to enhance operational efficiency. By type, the market has been categorized into on-premise edge, network edge, and regional edge, catering to different levels of scalability and connectivity. The market has been geographically segmented into North America, Europe, Asia-Pacific, and the Rest-of-the-World, reflecting varying regional approaches to edge computing adoption, influenced by technological advancements, regulatory policies, and industry-specific requirements.

Industrial Impact

The edge data center market is significantly impacting various industries, particularly in IT and Telecom, banking, financial services and insurance (BFSI), healthcare, manufacturing, automotive, and retail. In the IT and Telecom sector, edge data centers are revolutionizing network infrastructure by enabling low-latency data processing, reducing congestion in core networks, and supporting the expansion of 5G and IoT ecosystems. This shift enhances real-time computing capabilities, improves data security, and enables faster content delivery, making operations more efficient and scalable.

In the BFSI industry, edge data centers play a vital role in ensuring secure and real-time financial transactions. They reduce data transmission delays, improve fraud detection mechanisms, and support automated banking services, making digital financial operations more reliable and efficient. The healthcare sector is also experiencing transformation through edge computing, which facilitates real-time patient monitoring, AI-driven diagnostics, and remote healthcare services, ultimately enhancing patient care and medical data security.

The manufacturing and automotive industries benefit from edge data centers by supporting smart factory automation, AI-driven predictive maintenance, and autonomous vehicle technologies. These improvements drive operational efficiency, reduce downtime, and optimize supply chain processes. In the retail sector, edge data centers enable personalized shopping experiences, real-time inventory management, and enhanced cybersecurity, allowing businesses to improve customer engagement and operational efficiency.

Overall, the edge data center market has been reshaping digital infrastructure across multiple industries, fostering innovation, scalability, and real-time data processing, ultimately improving efficiency, security, and connectivity in the evolving digital landscape.

In 2023, the global edge data center market reached a valuation of $16,705.2 million. Over the forecast period, the market is projected to exhibit a CAGR of 17.63%, reaching $109,781.3 million by 2034. The surge in demand for edge data centers is driven by the increasing need for low-latency computing, real-time data processing, and decentralized infrastructure. The growing adoption of 5G technology, IoT applications, and AI-driven analytics is further accelerating market expansion.

Additionally, industries such as IT and telecom, BFSI, healthcare, manufacturing, automotive, and retail are increasingly leveraging edge computing solutions to enhance network performance, reduce data transmission costs, and ensure data security. Stricter government regulations on data privacy and energy efficiency, along with rising investments in smart city projects and digital transformation, are fueling the adoption of edge data centers. Businesses across various sectors are recognizing the operational, financial, and technological advantages of edge computing, contributing to the rapid growth of the edge data center market.

Market Segmentation:

Segmentation 1: by End-Use Industry

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Healthcare

- Manufacturing

- Automotive

- Retail

- Others

IT and Telecom Segment to Dominate the Global Edge Data Center Market (by Application)

During the forecast period 2025-2034, the IT and telecom segment is expected to be the leading application in the edge data center market, primarily due to the increasing demand for low-latency computing and network optimization. The rapid expansion of 5G infrastructure, cloud services, and IoT applications is further propelling this segment. Additionally, growing data traffic, increased reliance on real-time processing, and the need for secure, high-speed connectivity are driving the adoption of edge data centers in the IT and Telecom sector. Advancements in network virtualization, AI-driven analytics, and modular data center designs are expected to enhance edge computing solutions' efficiency, scalability, and deployment, reinforcing this segment's dominance.

Segmentation 2: by Type

- On-Premise Edge

- Network Edge

- Regional Edge

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Recent Developments in the Global Edge Data Center Market

- In June 2023, SBA Communications, a tower firm, launched a new edge data center at a tower location in the Dallas Fort Worth area of Texas, U.S.

- In October 2023, Edge Centers, one of the frontrunners in the edge data center sector in the U.S., celebrated the inauguration of its fifth cutting-edge facility. This achievement marks a significant industry milestone, also demonstrating the infrastructural expansion of the edge data centers in the U.S.

- In December 2023, Cologix, a leading hyperscale edge data center provider, successfully finalized the acquisition of two Cyxtera data center colocation provider facilities located in Vancouver and Montreal, Canada.

- In December 2023, Arcus, an independent infrastructure fund management company, announced the establishment of Portus Data Centers, a new edge data center platform for the Germany edge data center market. Moreover, in December 2023, Arcus also acquired IPHH Internet Port Hamburg, a prominent regional data center operator and internet service provider, providing significant growth in the edge data center market.

- In November 2023, Rakuten Mobile, Inc. announced that its research and development (R&D) project into advanced edge cloud technologies for next-generation communications has been selected by Japan's National Institute of Information and Communications Technology (NICT). The objective of this project for the company is to enhance the functionalities of the edge platform and provide robust services within the edge cloud to meet the escalating communication demands anticipated in the post-5G era. This initiative aims to contribute to the expansion of the edge data center market.

Demand - Drivers, Challenges, and Opportunities

Market Driver: Minimizing Latency and Bandwidth Usage

- Minimizing latency and bandwidth usage is a key driver of the edge data center market, as businesses demand real-time data processing for applications such as video streaming, IoT, and AI-driven analytics. Traditional cloud data centers often suffer from high latency due to long transmission distances, impacting performance. Edge data centers, strategically located near end users, enable faster data processing, reduced congestion, and improved service reliability. Studies show that 55% of users can access edge servers with under 10 ms latency, rising to 82% at 20 ms latency, compared to centralized cloud solutions. This shift toward edge computing transforms digital infrastructure, optimizing network efficiency and driving technological advancements across industries.

Market Challenge: Lack of Consideration of Security-by-Design

- One of the major challenges hindering the widespread adoption of edge data centers is the lack of security by design in their infrastructure. As edge computing prioritizes performance and agility for applications such as IoT, smart cities, and autonomous systems, security is often overlooked during design. This increases exposure to cyber threats, data breaches, and network vulnerabilities, making edge data centers more susceptible to attacks. Without robust security frameworks, businesses face higher data integrity and privacy risks, creating a significant challenge for the edge data center market. Addressing this requires integrated cybersecurity measures from the initial design phase to ensure resilient and secure edge computing environments.

Market Opportunity: Surge in Investment by Data Center Providers

- The edge data center market has been witnessing a surge in investment from data center providers, driven by the growing demand for localized data processing, reduced latency, and support for IoT, AI, and 5G technologies. This shift toward decentralized computing is enhancing connectivity, data sovereignty, and user experience across digital services. For example, in February 2024, Azora and Core Capital announced a $530 million investment in constructing six edge data centers across Spain and Portugal, totaling 60MW capacity. Similarly, in May 2023, CTRLS Datacenters Ltd. invested $18.1 million in an edge data center in Odisha, India, reinforcing the rising demand for localized infrastructure. These strategic investments highlight the expanding role of edge data centers in scaling digital ecosystems and driving future technological advancements.

How can this report add value to an organization?

Practice/Innovation Strategy: The segmentation of the edge data center market provides a comprehensive understanding of the technologies, infrastructure types, and deployment strategies used in edge computing. It highlights key components such as on-premise edge, network edge, and regional edge data centers, showcasing how these solutions enhance data processing efficiency, reduce latency, and support real-time computing. Additionally, the study offers a detailed analysis of current edge data center deployments, highlighting innovations in modular infrastructure, energy-efficient cooling solutions, and AI-driven network optimization. This insight helps businesses and stakeholders understand the evolution of edge computing and its role in building scalable, secure, and high-performance digital ecosystems.

Growth/Marketing Strategy: The global edge data center market has seen major development by key participants operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategies of the companies have been partnership, collaboration, and joint venture activities to strengthen their position in the global edge data center market.

Competitive Strategy: Key players in the global edge data center market analyzed and profiled in the study include project developers and accounting tool providers. The analysis covers market segments by applications, products by type, regional presence, and the impact of key market strategies. Additionally, detailed competitive benchmarking has been conducted to illustrate how players compare, providing a clear view of the market landscape. The study also examines comprehensive competitive strategies, such as partnerships, agreements, and collaborations, to help identify untapped revenue opportunities in the edge data center market.

Research Methodology

Data Sources

Primary Data Sources

The primary sources involve industry experts from the data center industry and various stakeholders such as standards and certification organizations, edge computing project developers, and accounting tool providers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for regional analysis

Secondary Data Sources

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as ITU, Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global edge data center market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as Data Center Dynamics and Data Center Knowledge.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies profiled in the edge data center market have been selected based on inputs gathered from primary experts and through an analysis of company coverage, product portfolio, application, and market penetration. The edge data center market is characterized by the presence of companies developing advanced data center infrastructure and offering innovative solutions to enhance decentralized computing. The edge data center market has been witnessing significant growth, driven by the increasing adoption of IoT, real-time data processing needs, and the expansion of 5G networks.

Major edge data center market players include AtlasEdge Data Centres, ATC TRS V LLC, Cologix, Vapor IO, DartPoints, Digital Realty, Edge Centres, and EdgeConneX. These companies focus on deploying modular and scalable data centers, optimizing energy efficiency, and integrating AI-driven solutions to improve operational performance. The edge data center market attracts substantial investment as businesses seek to reduce latency, enhance network reliability, and support emerging digital applications.

Some prominent edge data center market accounting tool providers have been given here.

- ATLASEDGE DATA CENTRES

- ATC TRS V LLC

- Cologix

- Vapor IO

- DartPoints

- Digital Realty

- Edge Centres

- EdgeConneX

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends Shaping Edge Data Center Market

- 1.1.2 5G Network Deployment

- 1.1.3 Proliferation of Internet of Things (IoT) Devices

- 1.1.4 Adoption of Software-Defined Networking (SDN) Technology

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Market Map

- 1.2.2.1 Edge Data Center Market (by Type)

- 1.2.2.1.1 On-Premise Edge Providers

- 1.2.2.1.2 Network Edge Providers

- 1.2.2.1.3 Regional Edge Providers

- 1.2.2.1 Edge Data Center Market (by Type)

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country and Company)

- 1.4 Technological Analysis

- 1.4.1 Current and Upcoming Technologies

- 1.4.2 Key Countries with the Highest Number of Edge Deployments

- 1.4.3 Technologies at Risk of Becoming Obsolete

- 1.5 Implications for Investors, Operators, and Enterprises

- 1.6 Regulatory Landscape

- 1.7 Use Cases

- 1.8 Market Dynamics Overview

- 1.8.1 Market Drivers

- 1.8.1.1 Minimizing Latency and Bandwidth Usage

- 1.8.1.1.1 Case Study: Comparing Edge Servers and Cloud Locations for Enhanced User Experience

- 1.8.1.2 Increasing Focus on Providing Personalized AI Services

- 1.8.1.1 Minimizing Latency and Bandwidth Usage

- 1.8.2 Market Restraints

- 1.8.2.1 Lack of Consideration of Security-by-Design

- 1.8.2.2 Non-Migratability of Security Frameworks

- 1.8.3 Market Opportunities

- 1.8.3.1 Surge in Investment by Data Center Providers

- 1.8.3.2 Increase in Data Generation

- 1.8.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Global Edge Data Center Market (by Application)

- 2.3.1 IT and Telecom

- 2.3.2 Banking, Financial Services, and Insurance (BFSI)

- 2.3.3 Government and Public Sector

- 2.3.4 Healthcare

- 2.3.5 Manufacturing

- 2.3.6 Automotive

- 2.3.7 Retail

- 2.3.8 Others

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Global Edge Data Center Market (by Type)

- 3.3.1 On-Premise Edge

- 3.3.2 Network Edge

- 3.3.3 Regional Edge

4 Regions

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Key Market Participants in North America

- 4.2.2 Regional Overview

- 4.2.3 Driving Factors for Market Growth

- 4.2.4 Factors Challenging the Market

- 4.2.5 Application

- 4.2.6 Product

- 4.2.7 U.S.

- 4.2.8 Application

- 4.2.9 Product

- 4.2.10 Canada

- 4.2.11 Application

- 4.2.12 Product

- 4.3 Europe

- 4.3.1 Key Market Participants in Europe

- 4.3.2 Regional Overview

- 4.3.3 Driving Factors for Market Growth

- 4.3.4 Factors Challenging the Market

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 France

- 4.3.8 Application

- 4.3.9 Product

- 4.3.10 Germany

- 4.3.11 Application

- 4.3.12 Product

- 4.3.13 U.K.

- 4.3.14 Application

- 4.3.15 Product

- 4.3.16 Rest-of-Europe

- 4.3.17 Application

- 4.3.18 Product

- 4.4 Asia-Pacific

- 4.4.1 Key Market Participants in Asia-Pacific

- 4.4.2 Regional Overview

- 4.4.3 Driving Factors for Market Growth

- 4.4.4 Factors Challenging the Market

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 China

- 4.4.8 Application

- 4.4.9 Product

- 4.4.10 Japan

- 4.4.11 Application

- 4.4.12 Product

- 4.4.13 Australia

- 4.4.14 Application

- 4.4.15 Product

- 4.4.16 Rest-of-Asia-Pacific

- 4.4.17 Application

- 4.4.18 Product

- 4.5 Rest-of-the-World

- 4.5.1 Key Market Participants in Rest-of-the-World

- 4.5.2 Regional Overview

- 4.5.3 Driving Factors for Market Growth

- 4.5.4 Factors Challenging the Market

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 South America

- 4.5.8 Application

- 4.5.9 Product

- 4.5.10 Middle East and Africa

- 4.5.11 Application

- 4.5.12 Product

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Competitive Landscape

- 5.2 Company Profile

- 5.2.1 ATLASEDGE DATA CENTRES

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share, 2023

- 5.2.2 ATC TRS V LLC

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share, 2023

- 5.2.3 Cologix

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share, 2023

- 5.2.4 Vapor IO

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share, 2023

- 5.2.5 DartPoints

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share, 2023

- 5.2.6 Digital Realty

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share, 2023

- 5.2.7 Edge Centres

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share, 2023

- 5.2.8 EdgeConneX

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share, 2023

- 5.2.9 Ubiquity Management, LLC

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share, 2023

- 5.2.10 Leading Edge Data Centres

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share, 2023

- 5.2.11 Proximity Data Centres

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share, 2023

- 5.2.12 Switch

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share, 2023

- 5.2.13 Vertiv Group Corp

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share, 2023

- 5.2.14 Evoque Data Center Solutions

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share, 2023

- 5.2.15 Flexential

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share, 2023

- 5.2.1 ATLASEDGE DATA CENTRES

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast