|

|

市場調査レポート

商品コード

1657955

アジア太平洋のリキッドバイオプシー市場:エンドユーザー・国別の分析・予測 (2024-2033年)Asia-Pacific Liquid Biopsy Market: Focus on End User and Country - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋のリキッドバイオプシー市場:エンドユーザー・国別の分析・予測 (2024-2033年) |

|

出版日: 2025年02月19日

発行: BIS Research

ページ情報: 英文 68 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋のリキッドバイオプシーの市場規模は、2024年の7億810万米ドルから、予測期間中はCAGR 17.08%で堅調に推移し、2033年には29億2,730万米ドルに達すると予測されています。

リキッドバイオプシーは、アジア太平洋における癌の検出とモニタリングのための画期的な非侵襲的診断ツールになりつつあります。この新しいアプローチは、最小限の侵襲性でリアルタイムのモニタリングを提供し、治療反応を評価し、早期癌再発検出の可能性を持っています。癌の有病率の上昇、研究発表の増加、臨床試験の増加により市場が拡大した結果、リキッドバイオプシー検査や製品に対するニーズが高まっています。低侵襲の診断技術が好まれるようになった結果、より革新的で効率的な検査が急速に開発されています。

さらに、癌の発見と治療管理を改善するために実施されている政府のイニシアチブの結果、市場はより急速に成長しています。オンラインプラットフォームや小売店を含む多くの流通チャネルがリキッドバイオプシー製品を製造し、地域全体における入手しやすさと幅広い消費者へのリーチを確保しています。これらの要因は、非侵襲的癌スクリーニングに対する患者の需要の増加とともに、アジア太平洋のリキッドバイオプシー市場の大きな勢いを後押しし、同地域全体でより効率的で利用しやすい癌検出ソリューションへの道を開いています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2033年 |

| 2024年評価 | 7億810万米ドル |

| 2033年予測 | 29億2,730万米ドル |

| CAGR | 17.08% |

アジア太平洋のリキッドバイオプシー市場は、癌のモニタリングと検出のための非侵襲的な代替手段として急速に拡大しており、従来の生検技術に比べ多くの利点をもたらしています。リキッドバイオプシーは、血液サンプルから循環腫瘍DNA (ctDNA)、RNA、エクソソームを調べることで、患者への不快感を最小限に抑えながら、癌の早期発見、リアルタイムのモニタリング、治療効果の評価を可能にします。この地域における癌罹患率の上昇、個別化医療と低侵襲診断ソリューションの必要性から、この技術はますます普及しています。

癌罹患率の上昇、バイオマーカー検出の技術開発、心臓病学や感染症学など腫瘍学以外の分野への応用拡大が、市場の発展の主な促進要因となっています。政府の取り組み、研究資金の増加、優先順位の変化などが、精密医療に向けたリキッドバイオプシーの利用拡大に寄与しています。この採用拡大は、政府のイニシアティブ、研究資金の増加、精密医療へのシフトによって支えられています。さらに、オンラインプラットフォームやヘルスケアプロバイダーを通じてリキッドバイオプシー検査が利用できるようになりつつあることは、アクセシビリティを高め、アジア太平洋全域での市場導入を促進し、早期診断とより良い治療モニタリングを通じて患者の転帰を改善しています。

当レポートでは、アジア太平洋のリキッドバイオプシーの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術開発・特許の動向、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

市場の分類:

セグメンテーション1:エンドユーザー別

- 学術・研究機関

- 臨床ラボ

- 製薬・バイオテクノロジー企業

- 企業

- その他

セグメンテーション2:地域別

- アジア太平洋

- 日本

- インド

- 中国

- 韓国

- オーストラリア

- シンガポール

- その他

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 市場動向

- サプライチェーン分析:アジア太平洋のリキッドバイオプシー市場

- 規制の枠組み

- COVID-19がアジア太平洋のリキッドバイオプシー市場に与える影響

- 最近発売された製品/サービス

- 償還シナリオ

- 資金調達シナリオ

- 製品マッピング分析

- 総市場規模と普及率

- リキッドバイオプシー市場:ステークホルダー分析

- リキッドバイオプシーに関する政府の取り組み

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 地域

- アジア太平洋

- 地域概要

- 市場成長推進因子

- 市場課題

- 検査数

- 市場規模・予測

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- シンガポール

- その他

第3章 市場:競合ベンチマーキング・企業プロファイル

- 企業プロファイル

- Sysmex Corporation

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Liquid Biopsy Market, $Million, 2024, 2028, and 2033

- Figure 2: Key Events to Keep Track of in the Liquid Biopsy Market

- Figure 3: Impact of COVID-19 on Liquid Biopsy Market

- Figure 4: Patent Published (by Country), January 2021-May 2024

- Figure 5: Number of Liquid Biopsy Patents (by Year), January 2021-May 2024

- Figure 6: Financing Analysis (by Latest Deal Amount), $Million, FY2023-2024

- Figure 7: Asia-Pacific Liquid Biopsy Market Scenario, 2023

- Figure 8: Frequently Used Technology in Liquid Biopsy

- Figure 9: Most Important Factors for Adoption of NGS-Based Liquid Biopsy

- Figure 10: Treatment Guidelines for Treatment of Cancer Patients

- Figure 11: Major Challenges Faced While Performing Liquid Biopsy

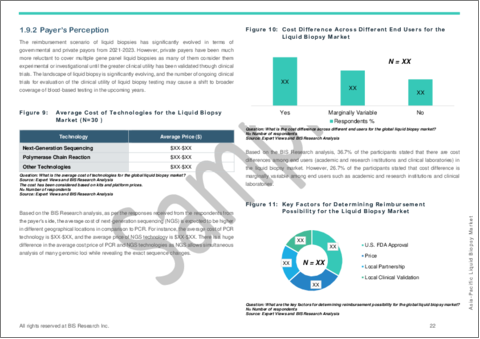

- Figure 12: Average Cost of Technologies for the Liquid Biopsy Market (N=30 )

- Figure 13: Cost Difference Across Different End Users for the Liquid Biopsy Market

- Figure 14: Key Factors for Determining Reimbursement Possibility for the Liquid Biopsy Market

- Figure 15: Estimated Cancer Incidence in 2020 and 2040

- Figure 16: Estimated New Cancer Cases (2022-2045): Both Sexes, Ages 0-85

- Figure 17: Upsurge in Research Publications in Liquid Biopsy, 2015-2023

- Figure 18: Comparison of Liquid Biopsy vs. Tissue Biopsy

- Figure 19: Asia-Pacific Liquid Biopsy Market, Test Volume, Thousand, 2023-2033

- Figure 20: Asia-Pacific Liquid Biopsy Market, $Million, 2023-2033

- Figure 21: China Liquid Biopsy Market, Test Volume, Thousand, 2023-2033

- Figure 22: China Liquid Biopsy Market, $Million, 2023-2033

- Figure 23: Japan Liquid Biopsy Market, Test Volume, Thousand, 2023-2033

- Figure 24: Japan Liquid Biopsy Market, $Million, 2023-2033

- Figure 25: India Liquid Biopsy Market, Test Volume, Thousand, 2023-2033

- Figure 26: India Liquid Biopsy Market, $Million, 2023-2033

- Figure 27: Australia Liquid Biopsy Market, Test Volume, Thousand, 2023-2033

- Figure 28: Australia Liquid Biopsy Market, $Million, 2023-2033

- Figure 29: South Korea Liquid Biopsy Market, Test Volume, Thousand, 2023-2033

- Figure 30: South Korea Liquid Biopsy Market, $Million, 2023-2033

- Figure 31: Singapore Liquid Biopsy Market, Test Volume, Thousand, 2023-2033

- Figure 32: Singapore Liquid Biopsy Market, $Million, 2023-2033

- Figure 33: Rest-of-Asia-Pacific Liquid Biopsy Market, Test Volume, Thousand, 2023-2033

- Figure 34: Rest-of-Asia-Pacific Liquid Biopsy Market, $Million, 2023-2033

- Figure 35: Data Triangulation

- Figure 36: Top-Down and Bottom-Up Approach

- Figure 37: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Asia-Pacific Liquid Biopsy Market, Market Opportunities

- Table 3: Product Launches, January 2021-April 2024

- Table 4: Some of the Strategic Funding, January 2022-April 2024

- Table 5: Launched Liquid Biopsy Tests from Players in the Liquid Biopsy Market

- Table 6: Reimbursement Scenario for Key Players' Offerings in the Liquid Biopsy Market

- Table 7: Liquid Biopsy Market: Key Players Patent Portfolio

- Table 8: Liquid Biopsy Product Mapping Analysis (by Technology)

- Table 9: Liquid Biopsy Product Mapping Analysis (by Sample)

- Table 10: Liquid Biopsy Product Mapping Analysis (by Circulating Biomarker)

- Table 11: Liquid Biopsy Product Mapping Analysis (by Clinical Application)

- Table 12: Government Initiatives for Liquid Biopsies

- Table 13: Impact Analysis of Market Navigating Factors, 2023-2033

- Table 14: Liquid Biopsy Market (by Region), $Million, 2023-2033

- Table 15: Asia-Pacific Liquid Biopsy Market (by End User), $Million, 2023-2033

- Table 16: China Liquid Biopsy Market (by End User), $Million, 2023-2033

- Table 17: Japan Liquid Biopsy Market (by End User), $Million, 2023-2033

- Table 18: India Liquid Biopsy Market (by End User), $Million, 2023-2033

- Table 19: Australia Liquid Biopsy Market (by End User), $Million, 2023-2033

- Table 20: South Korea Liquid Biopsy Market (by End User), $Million, 2023-2033

- Table 21: Singapore Liquid Biopsy Market (by End User), $Million, 2023-2033

- Table 22: Rest-of-Asia-Pacific Liquid Biopsy Market (by End User), $Million, 2023-2033

Introduction to Asia-Pacific Liquid Biopsy Market

The Asia-Pacific liquid biopsy market was valued at $708.1 million in 2024 and is expected to reach $2,927.3 million by 2033, growing at a CAGR of 17.08% during the forecast period 2024-2033. Liquid biopsies are becoming a revolutionary non-invasive diagnostic tool for cancer detection and monitoring in APAC. This novel approach provides real-time monitoring with minimal invasiveness, assesses treatment responses, and has the potential to detect early cancer recurrence detection. There is a greater need for liquid biopsy tests and products as a result of the market's expansion due to the rising prevalence of cancer, rising research publications, and growing clinical trials. More innovative and efficient tests have been developed quickly as a result of the growing preference for minimally invasive diagnostic techniques.

Additionally, the market has grown more quickly as a result of government initiatives that have been implemented to improve cancer detection and treatment management. Many distribution channels, including online platforms and retail outlets, have made liquid biopsy products enhancing accessibility and ensuring broader consumer reach across the region. These factors, along with increasing patient demand for non-invasive cancer screening, are helping the APAC liquid biopsy market gain significant momentum, paving the way for more efficient and accessible cancer detection solutions across the region.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $708.1 Million |

| 2033 Forecast | $2,927.3 Million |

| CAGR | 17.08% |

Market Introduction

The APAC Liquid Biopsy Market is expanding quickly as a non-invasive alternative for cancer monitoring and detection, providing a number of benefits over conventional biopsy techniques. With the least amount of discomfort to the patient, liquid biopsy enables early cancer detection, real-time monitoring, and evaluation of treatment responses by examining circulating tumor DNA (ctDNA), RNA, and exosomes from blood samples. Because of the rising incidence of cancer in the area and the need for personalized medicine and minimally invasive diagnostic solutions, this technology is becoming more and more popular.

Rising cancer rates, technological developments in biomarker detection, and the expansion of applications beyond oncology, such as in cardiology and infectious diseases, are the main factors propelling the market's growth. Government initiatives, rising research funding, and a change in priorities are all contributing to the increasing use of liquid biopsy toward precision medicine. The growing adoption of liquid biopsy is supported by government initiatives, increasing research funding, and a shift toward precision medicine. Moreover, the increasing availability of liquid biopsy tests through online platforms and healthcare providers is enhancing accessibility, driving market adoption across APAC, and improving patient outcomes through earlier diagnosis and better treatment monitoring.

Market Segmentation:

Segmentation 1: by End User

- Academic and Research Institutions

- Clinical Laboratories

- Pharmaceutical and Biotechnology

- Companies

- Other End Users

Segmentation 2: by Region

- Asia-Pacific

- Japan

- India

- China

- South Korea

- Australia

- Singapore

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The Asia-Pacific liquid biopsy market has been segmented based on various categories, such as end user and country.

Competitive Strategy: The Asia-Pacific liquid biopsy market is highly fragmented, with many smaller and private companies constantly entering the market. Key players in the liquid biopsy market analyzed and profiled in the study involve established players that offer various kinds of products and services.

Table of Contents

Executive Summary

Scope and Definition

1 Market

- 1.1 Market Trends

- 1.1.1 Increasing Product Launches in the Market

- 1.1.2 Growing Funding by the Key Players in the Market

- 1.2 Supply Chain Analysis: Asia-Pacific Liquid Biopsy Market

- 1.3 Regulatory Framework

- 1.3.1 Regulation in Other Countries

- 1.4 COVID-19 Impact on Asia-Pacific Liquid Biopsy Market

- 1.5 Recently Launched Product/Services

- 1.6 Reimbursement Scenario

- 1.7 Financing Scenario

- 1.7.1 Key Players Patent Portfolio

- 1.7.2 Key Players Stratification as per Raised Financing Value

- 1.7.3 Key Players Financing Analysis (by Company)

- 1.8 Product Mapping Analysis

- 1.8.1 By Technology

- 1.8.2 By Sample

- 1.8.3 By Circulating Biomarker

- 1.8.4 By Clinical Application

- 1.9 Total Addressable Market and Penetration

- 1.1 Liquid Biopsy Market: Stakeholder Analysis (N=30)

- 1.10.1 Physicians' Perception

- 1.10.2 Payer's Perception

- 1.10.3 Investors' Perception

- 1.11 Liquid Biopsy Government Initiatives

- 1.12 Market Dynamics Overview

- 1.12.1 Market Drivers

- 1.12.1.1 Rising Burden of Cancer

- 1.12.1.2 Growing Research Publications and Clinical Trials in Liquid Biopsy

- 1.12.1.3 Growing Adoption and Demand of Minimally Invasive Cancer Detection Methods

- 1.12.2 Market Restraints

- 1.12.2.1 Technical Limitations in Liquid Biopsy

- 1.12.2.2 Uncertain Reimbursement and Recommendations for Liquid Biopsy Tests

- 1.12.3 Market Opportunities

- 1.12.3.1 Integration of AI in Liquid Biopsy

- 1.12.3.2 Use of Liquid Biopsy for Precision Medicine in Oncology

- 1.12.1 Market Drivers

2 Regions

- 2.1 Asia-Pacific

- 2.1.1 Regional Overview

- 2.1.2 Driving Factors for Market Growth

- 2.1.3 Factors Challenging the Market

- 2.1.4 Test Volume

- 2.1.5 Market Size and Forecast

- 2.1.5.1 By End User

- 2.1.6 China

- 2.1.6.1 Test Volume

- 2.1.6.2 Market Size and Forecast

- 2.1.6.2.1 By End User

- 2.1.7 Japan

- 2.1.7.1 Test Volume

- 2.1.7.2 Market Size and Forecast

- 2.1.7.2.1 By End User

- 2.1.8 India

- 2.1.8.1 Test Volume

- 2.1.8.2 Market Size and Forecast

- 2.1.8.2.1 By End User

- 2.1.9 Australia

- 2.1.9.1 Test Volume

- 2.1.9.2 Market Size and Forecast

- 2.1.9.2.1 By End User

- 2.1.10 South Korea

- 2.1.10.1 Test Volume

- 2.1.10.2 Market Size and Forecast

- 2.1.10.2.1 By End User

- 2.1.11 Singapore

- 2.1.11.1 Test Volume

- 2.1.11.2 Market Size and Forecast

- 2.1.11.2.1 By End User

- 2.1.12 Rest-of-Asia-Pacific

- 2.1.12.1 Test Volume

- 2.1.12.2 Market Size and Forecast

- 2.1.12.2.1 By End User

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Company Profiles

- 3.1.1 Sysmex Corporation

- 3.1.1.1 Overview

- 3.1.1.2 Top Products

- 3.1.1.3 Top Competitors

- 3.1.1.4 Key Personnel

- 3.1.1.5 Analyst View

- 3.1.1 Sysmex Corporation

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast