|

|

市場調査レポート

商品コード

1599906

アジア太平洋のニードルコークス市場:用途別、タイプ別、グレード別、最終用途別、国別 - 分析と予測(2023年~2033年)Asia-Pacific Needle Coke Market: Focus on Application, Type, Grade, End Use, and Country-Level Analysis - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋のニードルコークス市場:用途別、タイプ別、グレード別、最終用途別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年11月29日

発行: BIS Research

ページ情報: 英文 85 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋のニードルコークスの市場規模は、2023年に17億5,000万米ドルとなりました。

同市場は8.87%のCAGRで拡大し、2033年には40億9,000万米ドルに達すると予測されています。都市化、工業化、インフラ開拓、経済拡大、鉄鋼と電気自動車へのニーズの高まりが、アジア太平洋の市場拡大を後押しする主な要因です。しかし、不十分なインフラ、不安定な経済諸国、一貫性のない規制、国際的な予測不可能性などの問題が、この地域の継続的発展の妨げとなっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 17億5,000万米ドル |

| 2033年の予測 | 40億9,000万米ドル |

| CAGR | 8.87% |

アジア太平洋のニードルコークス市場は、電気アーク炉(EAF)用電極や電気自動車用リチウムイオン電池の製造に高級コークスの需要が高まっているため、大幅に拡大しています。黒鉛濃度が高く不純物が少ないことで知られるニードルコークスは、こうした用途、特に超高出力(UHP)黒鉛電極の製造に不可欠です。

産業基盤の拡大、再生可能エネルギーへの投資の増加、電気自動車製造の増加に伴い、中国、日本、インドなどの国々がアジア太平洋市場の主要参入国となっています。バッテリー技術の向上、鉄鋼セクターの成長、再生可能エネルギーへの移行はすべて、ニードルコークスの需要増加に寄与しています。アジア太平洋のビジネスが拡大と近代化を続ける中、ニードルコークス市場は、製造業やエネルギー貯蔵部門における先端技術や材料への需要の高まりに支えられ、大きな成長を遂げようとしています。

当レポートでは、アジア太平洋のニードルコークス市場について調査し、市場の概要とともに、用途別、タイプ別、グレード別、最終用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 主要な世界的出来事の影響分析-COVID-19

- ニードルコークス市場における主要企業の最近の動向

- 市場力学の概要

第2章 地域

- 地域別概要

- アジア太平洋

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- China Petroleum & Chemical Corporation

- Shangdong Jingyang Technology Co. Ltd.

- Shanxi Hongte Coal Chemical Industry Co., Ltd.

- Indian Oil Corporation Ltd

- Mitsubishi Chemical Corporation

- NIPPON STEEL CORPORATION

- Sumitomo Corporation

- Baotailong New Materials Co., Ltd.

- POSCO FUTURE M

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Needle Coke Market (by Application), 2022, 2026, and 2033

- Figure 2: Asia-Pacific Needle Coke Market (by End Use), 2022, 2026, and 2033

- Figure 3: Asia-Pacific Needle Coke Market (by Type), 2022, 2026, and 2033

- Figure 4: Asia-Pacific Needle Coke Market (by Grade), 2022, 2026, and 2033

- Figure 5: Needle Coke Market, Recent Developments

- Figure 6: Sale of Electric Cars, Million Units, 2020-2022

- Figure 7: Supply Chain and Risks within the Supply Chain

- Figure 8: Value Chain Analysis

- Figure 9: Patent Analysis (by Number of Patents), January 2020-December 2023

- Figure 10: Patent Analysis (by Countries), January 2020-December 2023

- Figure 11: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 12: Primary Aluminum Production, Thousand Metric Tons, 2020-2023

- Figure 13: China Needle Coke Market, $Million, 2022-2033

- Figure 14: Japan Needle Coke Market, $Million, 2022-2033

- Figure 15: India Needle Coke Market, $Million, 2022-2033

- Figure 16: South Korea Needle Coke Market, $Million, 2022-2033

- Figure 17: Rest-of-Asia-Pacific Needle Coke Market, $Million, 2022-2033

- Figure 18: Strategic Initiatives, 2020-2023

- Figure 19: Share of Strategic Initiatives, 2020-2023

- Figure 20: Data Triangulation

- Figure 21: Top-Down and Bottom-Up Approach

- Figure 22: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Needle Coke Market, Opportunities across Regions

- Table 3: Major Key Investor of Solid-State Batteries

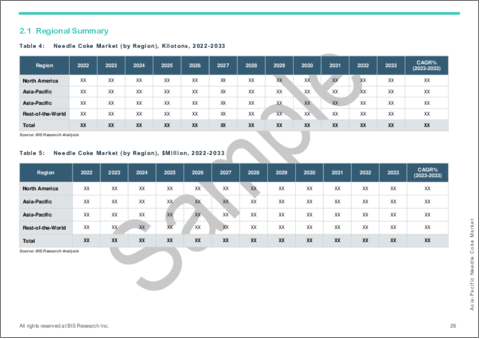

- Table 4: Needle Coke Market (by Region), Kilotons, 2022-2033

- Table 5: Needle Coke Market (by Region), $Million, 2022-2033

- Table 6: Needle Coke Supply (by Region), Kilotons, 2022-2033

- Table 7: Needle Coke Demand-Supply (by Type), Kilotons, 2022-2033

- Table 8: Asia-Pacific Needle Coke Demand-Supply (Supply - Demand), Kilotons, 2022-2033

- Table 9: Asia-Pacific Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 10: Asia-Pacific Needle Coke Market (by Application), $Million, 2022-2033

- Table 11: Asia-Pacific Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 12: Asia-Pacific Needle Coke Market (by End Use), $Million, 2022-2033

- Table 13: Asia-Pacific Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 14: Asia-Pacific Needle Coke Market (by Type), $Million, 2022-2033

- Table 15: Asia-Pacific Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 16: Asia-Pacific Needle Coke Market (by Grade), $Million, 2022-2033

- Table 17: China Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 18: China Needle Coke Market (by Application), $Million, 2022-2033

- Table 19: China Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 20: China Needle Coke Market (by End Use), $Million, 2022-2033

- Table 21: China Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 22: China Needle Coke Market (by Type), $Million, 2022-2033

- Table 23: China Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 24: China Needle Coke Market (by Grade), $Million, 2022-2033

- Table 25: Japan Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 26: Japan Needle Coke Market (by Application), $Million, 2022-2033

- Table 27: Japan Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 28: Japan Needle Coke Market (by End Use), $Million, 2022-2033

- Table 29: Japan Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 30: Japan Needle Coke Market (by Type), $Million, 2022-2033

- Table 31: Japan Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 32: Japan Needle Coke Market (by Grade), $Million, 2022-2033

- Table 33: India Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 34: India Needle Coke Market (by Application), $Million, 2022-2033

- Table 35: India Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 36: India Needle Coke Market (by End Use), $Million, 2022-2033

- Table 37: India Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 38: India Needle Coke Market (by Type), $Million, 2022-2033

- Table 39: India Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 40: India Needle Coke Market (by Grade), $Million, 2022-2033

- Table 41: South Korea Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 42: South Korea Needle Coke Market (by Application), $Million, 2022-2033

- Table 43: South Korea Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 44: South Korea Needle Coke Market (by End Use), $Million, 2022-2033

- Table 45: South Korea Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 46: South Korea Needle Coke Market (by Type), $Million, 2022-2033

- Table 47: South Korea Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 48: South Korea Needle Coke Market (by Grade), $Million, 2022-2033

- Table 49: Rest-of-Asia-Pacific Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 50: Rest-of-Asia-Pacific Needle Coke Market (by Application), $Million, 2022-2033

- Table 51: Rest-of-Asia-Pacific Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 52: Rest-of-Asia-Pacific Needle Coke Market (by End Use), $Million, 2022-2033

- Table 53: Rest-of-Asia-Pacific Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 54: Rest-of-Asia-Pacific Needle Coke Market (by Type), $Million, 2022-2033

- Table 55: Rest-of-Asia-Pacific Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 56: Rest-of-Asia-Pacific Needle Coke Market (by Grade), $Million, 2022-2033

- Table 57: Market Share, 2022

Introduction to Asia-Pacific Needle Coke Market

The Asia-Pacific needle coke market was valued at $1.75 billion in 2023, and it is expected to grow at a CAGR of 8.87% and reach $4.09 billion by 2033. Urbanization, industrialization, infrastructure development, economic expansion, and the growing need for steel and electric vehicles are the main factors propelling market expansion in the APAC region. But issues including inadequate infrastructure, unstable economies, inconsistent regulations, and international unpredictability stand in the way of the region's continued development.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $1.75 Billion |

| 2033 Forecast | $4.09 Billion |

| CAGR | 8.87% |

The market for needle coke in Asia-Pacific is expanding significantly because to the growing requirement for premium coke in the fabrication of electrodes for electric arc furnaces (EAF) and lithium-ion batteries for electric cars. Known for having a high graphite concentration and few impurities, needle coke is essential for these applications, particularly for making ultra-high-power (UHP) graphite electrodes.

With expanding industrial bases, more investments in renewable energy, and increased manufacturing of electric vehicles, countries such as China, Japan, and India are major players in the APAC market. Improvements in battery technology, the growth of the steel sector, and the move toward renewable energy sources all contribute to the increased demand for needle coke. As APAC's businesses continue to to expand and modernize, the needle coke market is poised for significant growth, supported by rising demand for advanced technologies and materials in manufacturing and energy storage sectors.

Market Segmentation:

Segmentation 1: by Application

- Graphite Electrodes

- Lithium-Ion Battery Anode

- Specialty Carbon Products

- Others

Segmentation 2: by End Use

- Aluminium and Steel Industry

- Automotive Industry

- Other Industrial

Segmentation 3: by Type

- Oil-Based

- Coal-Based

Segmentation 4: by Grade

- Intermittent Grade

- Premium Grade

- Super-Premium Grade

Segmentation 5: by Region

- Asia-Pacific: China, Japan, South Korea, India, and Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different grades and types. Moreover, the study provides the reader with a detailed understanding of the Asia-Pacific needle coke market based on the end user.

Growth/Marketing Strategy: The Asia-Pacific needle coke market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, and joint ventures. The company's favored strategy has been product developments, business expansions, and acquisitions to strengthen its position in the needle coke market.

Competitive Strategy: Key players in the Asia-Pacific needle coke market analyzed and profiled in the study involve needle coke manufacturers and the overall ecosystem. Moreover, a detailed competitive benchmarking of the players operating in the needle coke market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled in the needle coke market have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- China Petroleum & Chemical Corporation

- Shandong Jingyang Technology Co. Ltd

- Shanxi Hongte Coal Chemical Industry Co., Ltd.

- Indian Oil Corporation Ltd

- Mitsubishi Chemical Corporation

- NIPPON STEEL CORPORATION

- Sumitomo Corporation

- Baotailong New Materials Co., Ltd.

- POSCO FUTURE M

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Overview

- 1.1.2 Surging Electric Vehicle Sales

- 1.1.3 Growing Demand for Solid-State Lithium-Metal Batteries

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Market Map

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Number of Patents and Country)

- 1.4 Impact Analysis for Key Global Events - COVID-19 and

Russia-Ukraine War 29

- 1.5 Recent Developments by Key Players in the Needle Coke Market

- 1.6 Market Dynamics Overview

- 1.6.1 Market Drivers

- 1.6.1.1 Carbon Reduction Mandates and Environmental Standards

- 1.6.1.2 Surging Demand for Graphite Electrodes

- 1.6.1.3 Growth in Aluminum Production

- 1.6.2 Market Challenges

- 1.6.2.1 Spiraling Raw Material Prices

- 1.6.2.2 Expansion of Production Capacity

- 1.6.3 Market Opportunities

- 1.6.3.1 Vertical Integration of Needle Coke Business

- 1.6.3.2 Evolution of Needle Coke in UHP Graphite Electrode Applications

- 1.6.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Asia-Pacific

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Demand-Supply Analysis in Asia-Pacific

- 2.2.5 Application

- 2.2.6 Product

- 2.2.7 Asia-Pacific (by Country)

- 2.2.7.1 China

- 2.2.7.2 Japan

- 2.2.7.3 India

- 2.2.7.4 South Korea

- 2.2.7.5 Rest-of-Asia-Pacific

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 China Petroleum & Chemical Corporation

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2022

- 3.2.2 Shangdong Jingyang Technology Co. Ltd.

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.3 Shanxi Hongte Coal Chemical Industry Co., Ltd.

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.4 Indian Oil Corporation Ltd

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.5 Mitsubishi Chemical Corporation

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2022

- 3.2.6 NIPPON STEEL CORPORATION

- 3.2.6.1 Overview

- 3.2.6.2 Top Products/Product Portfolio

- 3.2.6.3 Top Competitors

- 3.2.6.4 Target Customers

- 3.2.6.5 Key Personnel

- 3.2.6.6 Analyst View

- 3.2.6.7 Market Share, 2022

- 3.2.7 Sumitomo Corporation

- 3.2.7.1 Overview

- 3.2.7.2 Top Products/Product Portfolio

- 3.2.7.3 Top Competitors

- 3.2.7.4 Target Customers

- 3.2.7.5 Key Personnel

- 3.2.7.6 Analyst View

- 3.2.8 Baotailong New Materials Co., Ltd.

- 3.2.8.1 Overview

- 3.2.8.2 Top Products/Product Portfolio

- 3.2.8.3 Top Competitors

- 3.2.8.4 Target Customers

- 3.2.8.5 Key Personnel

- 3.2.8.6 Analyst View

- 3.2.9 POSCO FUTURE M

- 3.2.9.1 Overview

- 3.2.9.2 Top Products/Product Portfolio

- 3.2.9.3 Top Competitors

- 3.2.9.4 Target Customers

- 3.2.9.5 Key Personnel

- 3.2.9.6 Analyst View

- 3.2.1 China Petroleum & Chemical Corporation

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast