|

|

市場調査レポート

商品コード

1599904

欧州のニードルコークス市場:用途別、タイプ別、グレード別、最終用途別、国別 - 分析と予測(2023年~2033年)Europe Needle Coke Market: Focus on Application, Type, Grade, End Use, and Country-Level Analysis - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のニードルコークス市場:用途別、タイプ別、グレード別、最終用途別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年11月29日

発行: BIS Research

ページ情報: 英文 74 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のニードルコークスの市場規模は、2023年に6億3,690万米ドルとなりました。

同市場は、6.31%のCAGRで拡大し、2033年には11億7,390万米ドルに達すると予測されています。インフラ開拓、経済拡大、都市化、工業化、鉄鋼や電気自動車へのニーズの高まりは、いずれも欧州市場に影響を与えています。しかし、インフラの制約、経済の不安定性、規制の不正、世界の不確実性といった問題が、この地域のさらなる発展の妨げとなっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 6億3,690万米ドル |

| 2033年の予測 | 11億7,390万米ドル |

| CAGR | 6.31% |

世界の石油化学およびエネルギー産業に不可欠なニードルコークスは、主に電気炉(EAF)電極の製造や、リチウムイオン電池やその他の高性能製品の重要な構成要素として利用されています。高純度の炭素物質であるニードルコークスは、その卓越した結晶構造が特徴で、過酷な環境下でも優れた導電性と安定性を発揮します。黒鉛電極の製造に不可欠で、黒鉛電極は鉄鋼を生産するための電炉で使用され、なくてはならないものです。

新興国を中心とした鉄鋼ニーズの高まりと、電気自動車(EV)セクターの爆発的な拡大がリチウムイオン電池の需要を押し上げており、これが欧州ニードルコークス市場の主な促進要因となっています。さらに、高品質の電極を必要とする電気アーク炉方式での製鉄が増加していることも、市場拡大に拍車をかけています。

とはいえ市場は、生産能力の制限、原料価格の変動、製造関連の環境問題などの障害に直面しています。こうした障害にもかかわらず、技術の継続的な開拓、電気自動車産業への投資の増加、よりクリーンで効果的なエネルギー源への傾向の高まりにより、市場は徐々に拡大すると予想されます。

当レポートでは、欧州のニードルコークス市場について調査し、市場の概要とともに、用途別、タイプ別、グレード別、最終用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 主要な世界的出来事の影響分析-COVID-19とロシア・ウクライナ戦争

- ニードルコークス市場における主要企業の最近の動向

- 市場力学の概要

第2章 地域

- 地域別概要

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

第4章 調査手法

List of Figures

- Figure 1: Europe Needle Coke Market (by Application), 2022, 2026, and 2033

- Figure 2: Europe Needle Coke Market (by End Use), 2022, 2026, and 2033

- Figure 3: Europe Needle Coke Market (by Type), 2022, 2026, and 2033

- Figure 4: Europe Needle Coke Market (by Grade), 2022, 2026, and 2033

- Figure 5: Needle Coke Market, Recent Developments

- Figure 6: Sale of Electric Cars, Million Units, 2020-2022

- Figure 7: Supply Chain and Risks within the Supply Chain

- Figure 8: Value Chain Analysis

- Figure 9: Patent Analysis (by Number of Patents), January 2020-December 2023

- Figure 10: Patent Analysis (by Countries), January 2020-December 2023

- Figure 11: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 12: Primary Aluminum Production, Thousand Metric Tons, 2020-2023

- Figure 13: Germany Needle Coke Market, $Million, 2022-2033

- Figure 14: France Needle Coke Market, $Million, 2022-2033

- Figure 15: U.K. Needle Coke Market, $Million, 2022-2033

- Figure 16: Italy Needle Coke Market, $Million, 2022-2033

- Figure 17: Rest-of-Europe Needle Coke Market, $Million, 2022-2033

- Figure 18: Strategic Initiatives, 2020-2023

- Figure 19: Share of Strategic Initiatives, 2020-2023

- Figure 20: Data Triangulation

- Figure 21: Top-Down and Bottom-Up Approach

- Figure 22: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Needle Coke Market, Opportunities across Regions

- Table 3: Major Key Investor of Solid-State Batteries

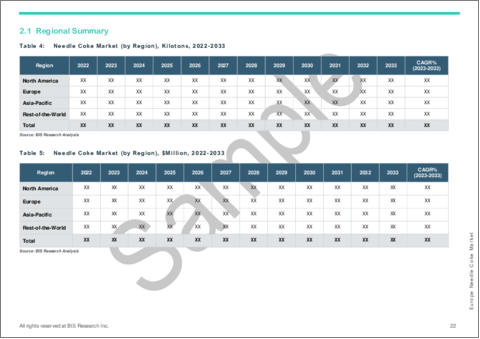

- Table 4: Needle Coke Market (by Region), Kilotons, 2022-2033

- Table 5: Needle Coke Market (by Region), $Million, 2022-2033

- Table 6: Needle Coke Supply (by Region), Kilotons, 2022-2033

- Table 7: Needle Coke Demand-Supply (by Type), Kilotons, 2022-2033

- Table 8: Europe Needle Coke Demand-Supply (Supply - Demand), Kilotons, 2022-2033

- Table 9: Europe Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 10: Europe Needle Coke Market (by Application), $Million, 2022-2033

- Table 11: Europe Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 12: Europe Needle Coke Market (by End Use), $Million, 2022-2033

- Table 13: Europe Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 14: Europe Needle Coke Market (by Type), $Million, 2022-2033

- Table 15: Europe Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 16: Europe Needle Coke Market (by Grade), $Million, 2022-2033

- Table 17: Germany Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 18: Germany Needle Coke Market (by Application), $Million, 2022-2033

- Table 19: Germany Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 20: Germany Needle Coke Market (by End Use), $Million, 2022-2033

- Table 21: Germany Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 22: Germany Needle Coke Market (by Type), $Million, 2022-2033

- Table 23: Germany Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 24: Germany Needle Coke Market (by Grade), $Million, 2022-2033

- Table 25: France Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 26: France Needle Coke Market (by Application), $Million, 2022-2033

- Table 27: France Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 28: France Needle Coke Market (by End Use), $Million, 2022-2033

- Table 29: France Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 30: France Needle Coke Market (by Type), $Million, 2022-2033

- Table 31: France Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 32: France Needle Coke Market (by Grade), $Million, 2022-2033

- Table 33: U.K. Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 34: U.K. Needle Coke Market (by Application), $Million, 2022-2033

- Table 35: U.K. Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 36: U.K. Needle Coke Market (by End Use), $Million, 2022-2033

- Table 37: U.K. Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 38: U.K. Needle Coke Market (by Type), $Million, 2022-2033

- Table 39: U.K. Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 40: U.K. Needle Coke Market (by Grade), $Million, 2022-2033

- Table 41: Italy Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 42: Italy Needle Coke Market (by Application), $Million, 2022-2033

- Table 43: Italy Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 44: Italy Needle Coke Market (by End Use), $Million, 2022-2033

- Table 45: Italy Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 46: Italy Needle Coke Market (by Type), $Million, 2022-2033

- Table 47: Italy Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 48: Italy Needle Coke Market (by Grade), $Million, 2022-2033

- Table 49: Rest-of-Europe Needle Coke Market (by Application), Kilotons, 2022-2033

- Table 50: Rest-of-Europe Needle Coke Market (by Application), $Million, 2022-2033

- Table 51: Rest-of-Europe Needle Coke Market (by End Use), Kilotons, 2022-2033

- Table 52: Rest-of-Europe Needle Coke Market (by End Use), $Million, 2022-2033

- Table 53: Rest-of-Europe Needle Coke Market (by Type), Kilotons, 2022-2033

- Table 54: Rest-of-Europe Needle Coke Market (by Type), $Million, 2022-2033

- Table 55: Rest-of-Europe Needle Coke Market (by Grade), Kilotons, 2022-2033

- Table 56: Rest-of-Europe Needle Coke Market (by Grade), $Million, 2022-2033

- Table 57: Market Share, 2022

Introduction to Europe Needle Coke Market

The Europe needle coke market was valued at $636.9 million in 2023, and it is expected to grow at a CAGR of 6.31% and reach $1,173.9 million by 2033. Infrastructure development, economic expansion, urbanization, industrialization, and the growing need for steel and electric vehicles all have an impact on the European market. However, issues like infrastructure constraints, economic instability, regulatory irregularities, and global uncertainty stand in the way of the region's further development.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $636.9 Million |

| 2033 Forecast | $1,173.9 Million |

| CAGR | 6.31% |

An integral part of the worldwide petrochemical and energy industries, needle coke is mostly utilized in the manufacturing of electric arc furnace (EAF) electrodes and as a vital component of lithium-ion batteries and other high-performance goods. A high-purity carbon substance, needle coke is distinguished by its exceptional crystalline structure, which provides it with exceptional conductivity and stability in harsh environments. It is essential to the creation of graphite electrodes, which are used in EAFs to produce steel and are indispensable.

The growing need for steel, particularly in emerging nations, and the electric vehicle (EV) sector's explosive expansion, which is driving up demand for lithium-ion batteries, are the main factors propelling the Europe needle coke market. Furthermore, the growing use of steelmaking in electric arc furnaces methods, which require high-quality electrodes, is further fueling market expansion.

The market is confronted with obstacles, nonetheless, including restricted production capacity, shifting raw material prices, and manufacturing-related environmental issues. Notwithstanding these obstacles, the market is anticipated to expand gradually due to the continuous development of technology, rising investments in the electric vehicle industry, and the growing trend toward cleaner and more effective energy sources.

Increasing manufacturing technologies, raising the quality of the material, and growing supply chains are the main goals of major companies in the needle coke market in order to satisfy demand worldwide.

Market Segmentation:

Segmentation 1: by Application

- Graphite Electrodes

- Lithium-Ion Battery Anode

- Specialty Carbon Products

- Others

Segmentation 2: by End Use

- Aluminium and Steel Industry

- Automotive Industry

- Other Industrial

Segmentation 3: by Type

- Oil-Based

- Coal-Based

Segmentation 4: by Grade

- Intermittent Grade

- Premium Grade

- Super-Premium Grade

Segmentation 5: by Region

- Europe: Germany, France, Italy, U.K., and Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different grades and types. Moreover, the study provides the reader with a detailed understanding of the Europe needle coke market based on the end user.

Growth/Marketing Strategy: The Europe needle coke market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, and joint ventures. The company's favored strategy has been product developments, business expansions, and acquisitions to strengthen its position in the needle coke market.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Overview

- 1.1.2 Surging Electric Vehicle Sales

- 1.1.3 Growing Demand for Solid-State Lithium-Metal Batteries

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Market Map

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Number of Patents and Country)

- 1.4 Regulatory Landscape

- 1.5 Impact Analysis for Key Global Events - COVID-19 and Russia-Ukraine War

- 1.6 Recent Developments by Key Players in the Needle Coke Market

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Carbon Reduction Mandates and Environmental Standards

- 1.7.1.2 Surging Demand for Graphite Electrodes

- 1.7.1.3 Growth in Aluminum Production

- 1.7.2 Market Challenges

- 1.7.2.1 Spiraling Raw Material Prices

- 1.7.2.2 Expansion of Production Capacity

- 1.7.3 Market Opportunities

- 1.7.3.1 Vertical Integration of Needle Coke Business

- 1.7.3.2 Evolution of Needle Coke in UHP Graphite Electrode Applications

- 1.7.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Demand-Supply Analysis in Europe

- 2.2.5 Application

- 2.2.6 Product

- 2.2.7 Europe (by Country)

- 2.2.7.1 Germany

- 2.2.7.2 France

- 2.2.7.3 U.K.

- 2.2.7.4 Italy

- 2.2.7.5 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast