|

|

市場調査レポート

商品コード

1594219

欧州の大口径弾薬市場:口径タイプ別、国別 - 分析と予測(2023年~2033年)Europe Large Caliber Ammunition Market: Focus on Caliber Type and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の大口径弾薬市場:口径タイプ別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年11月21日

発行: BIS Research

ページ情報: 英文 62 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の大口径弾薬の市場規模は、2023年の7億8,210万米ドルから2033年には16億8,610万米ドルに達すると予測され、予測期間の2023年のCAGRは7.98%になるとみられています。

大口径弾薬は、欧州全域の軍事兵器庫の主力であり、現代の防衛要件を満たすために不可欠な火力を提供します。戦車弾薬、大砲弾薬、海軍弾薬はすべて、一般的な小口径弾よりも大きな弾薬に分類され、それぞれが戦場で特定の機能を発揮します。欧州の大口径弾薬市場は、国防費の増加、地政学的緊張の高まり、および各国が最先端弾薬の製造と取得を優先せざるを得ない軍事技術の躍進によって活性化しています。

この競争の激しい業界では、Rheinmetall AG、BAE Systems、Nexter Systemsのようなトップクラスの防衛メーカーが不可欠です。なぜなら、彼らは欧州軍の変化するニーズを満たすために、技術革新と信頼性を優先しているからです。安全保障上の脅威が複雑化するにつれて、インテリジェントで高精度な誘導弾へのニーズは高まっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 7億8,210万米ドル |

| 2033年の予測 | 16億8,610万米ドル |

| CAGR | 7.98% |

防衛が進化を続け、欧州全域の能力が向上し、NATO加盟国間の相互運用性が重視されるようになるにつれて、大口径弾薬への投資は増加の一途をたどっています。先進砲弾から次世代戦車用弾薬に至るまで、欧州市場は、現代および将来の戦争シナリオの動的要件に適応しながら、大きく拡大する態勢を整えています。

欧州の大口径弾薬市場は、現代の紛争で変化するニーズに対応し、同地域の防衛インフラに不可欠な要素となっています。戦車戦闘、大砲攻撃、海上交戦は、一般的な小口径弾よりも大きな武器を含む大口径弾薬に大きく依存する軍事作戦のほんの一部に過ぎません。先進的な大口径弾薬は、地政学的緊張が高まり、各国が安全保障の優先順位を高めるにつれて、欧州全域で需要が高まっています。

当レポートでは、欧州の大口径弾薬市場について調査し、市場の概要とともに、口径タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 規制状況

- 市場力学の概要

第2章 地域

- 地域別概要

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 地理的評価

- Nammo AS

- Rheinmetall AG

- BAE Systems

- Nexter (a Company of KNDS)

- Saab AB

- UkrOboronProm

- Diehl Stiftung & Co. KG

- Leonardo S.p.A.

- MSM GROUP, s.r.o

第4章 調査手法

List of Figures

- Figure 1: Large Caliber Ammunition Market (by Region), 2022, 2026, and 2033

- Figure 2: Europe Large Caliber Ammunition Market (by Caliber Type), 2022, 2026, and 2033

- Figure 3: Large Caliber Ammunition Market, Recent Developments

- Figure 4: Supply Chain and Risks within the Supply Chain

- Figure 5: France Large Caliber Ammunition Market, $Million, 2022-2033

- Figure 6: Germany Large Caliber Ammunition Market, $Million, 2022-2033

- Figure 7: U.K. Large Caliber Ammunition Market, $Million, 2022-2033

- Figure 8: Rest-of-Europe Large Caliber Ammunition Market, $Million, 2022-2033

- Figure 9: Strategic Initiatives, 2020-2023

- Figure 10: Share of Strategic Initiatives

- Figure 11: Data Triangulation

- Figure 12: Top-Down and Bottom-Up Approach

- Figure 13: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Large Caliber Ammunition Market, Opportunities

- Table 3: Impact Analysis of Market Navigating Factors, 2023-2033

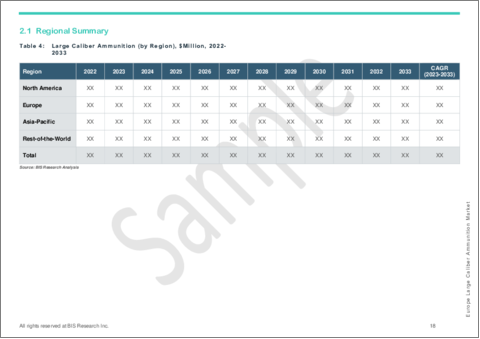

- Table 4: Large Caliber Ammunition (by Region), $Million, 2022-2033

- Table 5: Europe Large Caliber Ammunition Market (by Caliber Type), $Million, 2022-2033

- Table 6: Europe Large Caliber Ammunition Market (by Artillery Ammunition), $Million, 2022-2033

- Table 7: Europe Large Caliber Ammunition Market (by Tank Ammunition), $Million, 2022-2033

- Table 8: Europe Large Caliber Ammunition Market (by Mortar Ammunition), $Million, 2022-2033

- Table 9: Europe Large Caliber Ammunition Market (by Naval Ammunition), $Million, 2022-2033

- Table 10: France Large Caliber Ammunition Market (by Caliber Type), $Million, 2022-2033

- Table 11: Germany Large Caliber Ammunition Market (by Caliber Type), $Million, 2022-2033

- Table 12: U.K. Large Caliber Ammunition Market (by Caliber Type), $Million, 2022-2033

- Table 13: Rest-of-Europe Large Caliber Ammunition Market (by Caliber Type), $Million, 2022-2033

- Table 14: Market Share

Introduction to Europe Large Caliber Ammunition Market

The Europe large caliber ammunition market is projected to reach $1,686.1 million by 2033 from $782.1 million in 2023, growing at a CAGR of 7.98% during the forecast period 2023-2033. The mainstay of military arsenals throughout Europe, large-caliber ammunition offers vital firepower to meet contemporary defensive requirements. Tank, artillery, and naval ammunition are all classified as munitions larger than typical small-caliber rounds, and each has a specific function on the battlefield. The market for large-caliber ammunition in Europe is fueled by rising defense expenditures, elevated geopolitical tensions, and military technology breakthroughs that force countries to give priority to the creation and acquisition of cutting-edge munitions.

In this competitive industry, top defense producers like Rheinmetall AG, BAE Systems, and Nexter Systems are essential because they prioritize innovation and dependability to satisfy the changing needs of the European military. The need for intelligent, precisely guided munitions is growing as security threats become more complex.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $782.1 Million |

| 2033 Forecast | $1,686.1 Million |

| CAGR | 7.98% |

As defense continues to evolve, capabilities across Europe and increased emphasis on interoperability among NATO members, investment in large-caliber ammunition continues to grow. From advanced artillery shells to next-generation tank ammunition, the European market is poised for significant expansion, adapting to the dynamic requirements of contemporary and future warfare scenarios.

Market Introduction

The Europe Large Caliber Ammunition Market meets the changing needs of contemporary conflict and is an essential part of the region's defense infrastructure. Tank combat, artillery attacks, and naval engagements are just a few of the military operations that heavily rely on large-caliber ammunition, which includes weapons larger than typical small-caliber rounds. Advanced large-caliber munitions are becoming more and more in demand throughout Europe as geopolitical tensions increase and countries place a higher priority on security.

Increased defense spending, continuous military capability development, and the need to counter complex threats are major factors propelling market expansion. European countries are investing heavily in creating and acquiring cutting-edge weaponry as a result of their emphasis on bolstering their defenses. The focus on interoperability among NATO partners has also contributed to the market's growth.

Leading defense companies like Nexter Systems, BAE Systems, and Rheinmetall AG are at the forefront of innovation, creating precision-guided ammunition and smart munitions to satisfy the region's various operating requirements. By emphasizing technology innovations, these businesses are responding to the increasing need for dependability, effectiveness, and flexibility.

In order to ensure that Europe is prepared for both present and future defense challenges, the market for large-caliber ammunition is expected to increase steadily as the continent's security environment becomes more complicated.

Market Segmentation:

Segmentation 1: by Caliber Type

- Artillery Ammunition

- 155mm

- 105mm

- Others

- Tank Ammunition

- 120mm

- 105mm

- Others

- Mortar Ammunition

- 60mm

- 81mm

- 120mm

- Others

- Naval Ammunition

- 57mm

- 76mm

- 127mm

Segmentation 2: by Country

- France

- Germany

- U.K.

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of services available for deployment and their potential globally.

Growth/Marketing Strategy: The Europe large caliber ammunition market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been mergers and acquisitions to strengthen their position in the global large caliber ammunition market.

Competitive Strategy: Key players in the Europe large caliber ammunition market analyzed and profiled in the study involve companies offering large caliber ammunition. Moreover, a detailed competitive benchmarking of the players operating in the Europe large caliber ammunition market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- Nammo AS

- Rheinmetall AG

- BAE Systems

- Nexter (a Company of KNDS)

- Saab AB

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Overview

- 1.1.2 Smart Ammunition

- 1.1.3 Environment-Friendly Ammunition

- 1.1.4 Demand for Lightweight Ammunition

- 1.2 Supply Chain Overview

- 1.3 Regulatory Landscape

- 1.3.1 Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF)

- 1.3.2 International Traffic in Arms Regulations (ITAR)

- 1.4 Market Dynamics Overview

- 1.4.1 Market Drivers

- 1.4.1.1 Rising Geopolitical Tensions

- 1.4.1.2 Technological Advancements

- 1.4.2 Market Challenges

- 1.4.2.1 Environmental Impact

- 1.4.2.2 Rise in Ammunition Smuggling

- 1.4.3 Market Opportunities

- 1.4.3.1 Smart Ammunition Development

- 1.4.3.2 Increase in Defense Budget

- 1.4.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Product

- 2.2.5 France

- 2.2.6 Germany

- 2.2.7 U.K.

- 2.2.8 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Geographic Assessment

- 3.1.1 Nammo AS

- 3.1.1.1 Overview

- 3.1.1.2 Top Products/Product Portfolio

- 3.1.1.3 Top Competitors

- 3.1.1.4 Target Customers

- 3.1.1.5 Key Personnel

- 3.1.1.6 Analyst View

- 3.1.1.7 Market Share, 2022

- 3.1.2 Rheinmetall AG

- 3.1.2.1 Overview

- 3.1.2.2 Top Products/Product Portfolio

- 3.1.2.3 Top Competitors

- 3.1.2.4 Target Customers

- 3.1.2.5 Key Personnel

- 3.1.2.6 Analyst View

- 3.1.2.7 Market Share, 2022

- 3.1.3 BAE Systems

- 3.1.3.1 Overview

- 3.1.3.2 Top Products/Product Portfolio

- 3.1.3.3 Top Competitors

- 3.1.3.4 Target Customers

- 3.1.3.5 Key Personnel

- 3.1.3.6 Analyst View

- 3.1.3.7 Market Share, 2022

- 3.1.4 Nexter (a Company of KNDS)

- 3.1.4.1 Overview

- 3.1.4.2 Top Products/Product Portfolio

- 3.1.4.3 Top Competitors

- 3.1.4.4 Target Customers

- 3.1.4.5 Key Personnel

- 3.1.4.6 Analyst View

- 3.1.4.7 Market Share, 2022

- 3.1.5 Saab AB

- 3.1.5.1 Overview

- 3.1.5.2 Top Products/Product Portfolio

- 3.1.5.3 Top Competitors

- 3.1.5.4 Target Customers

- 3.1.5.5 Key Personnel

- 3.1.5.6 Analyst View

- 3.1.5.7 Market Share, 2022

- 3.1.6 UkrOboronProm

- 3.1.6.1 Overview

- 3.1.6.2 Top Products/Product Portfolio

- 3.1.6.3 Top Competitors

- 3.1.6.4 Target Customers

- 3.1.6.5 Key Personnel

- 3.1.6.6 Analyst View

- 3.1.6.7 Market Share, 2022

- 3.1.7 Diehl Stiftung & Co. KG

- 3.1.7.1 Overview

- 3.1.7.2 Top Products/Product Portfolio

- 3.1.7.3 Top Competitors

- 3.1.7.4 Target Customers

- 3.1.7.5 Key Personnel

- 3.1.7.6 Analyst View

- 3.1.7.7 Market Share, 2022

- 3.1.8 Leonardo S.p.A.

- 3.1.8.1 Overview

- 3.1.8.2 Top Products/Product Portfolio

- 3.1.8.3 Top Competitors

- 3.1.8.4 Target Customers

- 3.1.8.5 Key Personnel

- 3.1.8.6 Analyst View

- 3.1.8.7 Market Share, 2022

- 3.1.9 MSM GROUP, s.r.o

- 3.1.9.1 Overview

- 3.1.9.2 Top Products/Product Portfolio

- 3.1.9.3 Top Competitors

- 3.1.9.4 Target Customers

- 3.1.9.5 Key Personnel

- 3.1.9.6 Analyst View

- 3.1.9.7 Market Share, 2022

- 3.1.1 Nammo AS

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast