|

|

市場調査レポート

商品コード

1580138

ホワイトオイル市場- 世界および地域別分析:用途別、機能性別、グレード別、製品別、国別 - 分析と予測(2024年~2034年)White Oil Market - A Global and Regional Analysis: Focus on Application, Functionality, Grade, Products, and Country Level Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| ホワイトオイル市場- 世界および地域別分析:用途別、機能性別、グレード別、製品別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年10月31日

発行: BIS Research

ページ情報: 英文 175 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

ホワイトオイル市場は、医薬品、化粧品、食品加工、工業用途など、様々な産業で使用される高度に精製された多様な鉱物ベースの油を包含しています。

製品処方における純度と安全性への要求の高まりに後押しされ、ホワイトオイルはローション、軟膏、潤滑剤、可塑剤の製造に不可欠な成分となっています。精製プロセスの革新により、医薬品グレードや食品グレードなど、厳しい規制基準を満たすホワイトオイルが開発されています。ExxonMobil、Sonneborn LLC、Sasolなどの主要市場企業が市場を独占し、安全で無害な原料への需要の高まりに応える高品質の製品を提供しています。さらに、持続可能性と環境に優しい製造方法に対する意識の高まりが消費者の嗜好を形成し、企業がより持続可能な製造プロセスを採用するよう後押ししています。ホワイトオイル市場は、技術の進歩や消費者ニーズの変化に後押しされ、進化を続けています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 38億9,500万米ドル |

| 2034年の予測 | 85億9,760万米ドル |

| CAGR | 8.24% |

ホワイトオイル市場には、医薬品、化粧品、食品加工、工業用途などの分野で使用される、高度に精製された多種多様な鉱物ベースの油が含まれます。この市場は、パーソナルケア、医薬品、食品関連の用途において、純粋で無害な成分への需要が高まっている結果、拡大しています。精製プロセスにおける技術革新により、ホワイトオイルの品質と安全性が向上し、各社は厳しい規制基準を満たす医薬品グレードや食品グレードのオイルを開発しています。ExxonMobil、Sonneborn LLC、Sasolなどの主要企業が市場を独占し、幅広い業界のニーズに応えるために絶えず革新を続けています。製品の安全性と持続可能性に対する消費者の意識が高まるにつれ、ホワイトオイル市場は成長すると予想され、各社は嗜好の変化に対応するため、環境に優しい生産方法にも注力しています。

ホワイトオイル市場は産業界に大きな影響を与え、医薬品、化粧品、プラスチック、食品加工など複数の産業で大きな成長を牽引しています。ExxonMobil、Sonneborn LLC、Sasolなどの大手企業は、生産施設、流通網、研究開発に多額の投資を行い、経済活動を刺激し、幅広いサプライヤーやサービスプロバイダーを支援しています。高度に精製された鉱物油の需要は、精製プロセスや製品配合の技術的進歩を後押ししています。

当レポートでは、世界のホワイトオイル市場について調査し、市場の概要とともに、用途別、機能性別、グレード別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況(地域別)

- ホワイトオイルの持続可能性と環境への影響

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 応用

- 用途のセグメンテーション

- 用途の概要

- ホワイトオイル市場(用途別)

- ホワイトオイル市場(機能別)

第3章 製品

- 製品セグメンテーション

- 製品概要

- ホワイトオイル市場(製品タイプ別)

- ホワイトオイル市場(グレード別)

第4章 地域

- 地域別概要

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Bharat Petroleum Corporation Limited

- BP p.l.c.

- Chevron Corporation

- Gandhar Oil Refinery

- Exxon Mobil Corporation

- FUCHS

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd

- H&R GROUP

- Renkert Oil

- Sasol Limited

- Savita Oil Technologies Limited

- Shell International B.V.

- TotalEnergies

- Calumet, Inc.

- HF Sinclair Corporation

- その他

- 顧客展望:企業一覧(用途タイプ別)

第6章 調査手法

List of Figures

- Figure 1: Optimistic, Realistic, and Pessimistic Global White Oil Market Scenarios

- Figure 2: White Oil Market (by Region), 2023, 2026, and 2034

- Figure 3: White Oil Market (by Application Type), 2023, 2026, and 2034

- Figure 4: White Oil Market (by Functionality Type), 2023, 2026, and 2034

- Figure 5: White Oil Market (by Product Type), 2023, 2026, and 2034

- Figure 6: White Oil Market (by Grade Type), 2023, 2026, and 2034

- Figure 7: White Oil Market, Recent Developments

- Figure 8: Analysis and Forecast Note

- Figure 9: Innovative Refining Technologies Driving Advancements in the White Oil Market

- Figure 10: Key Impacts of Nanotechnology on White Oil Applications

- Figure 11: Major Advantages of Bio-Based Alternatives to White Oil

- Figure 12: Supply Chain of the Global White Oil Market

- Figure 13: Value Chain of the Global White Oil Market

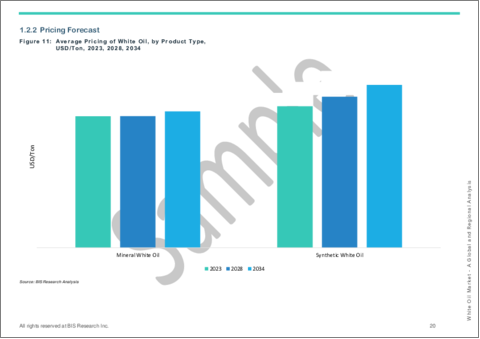

- Figure 14: Average Pricing of White Oil, by Product Type, USD/Ton, 2023, 2028, 2034

- Figure 15: Patent Published (by Country), January 2021-August 2024

- Figure 16: Patent Published (by Company), January 2021-August 2024

- Figure 17: Patents Published (by Year), January 2021-August 2024

- Figure 18: Patent Published (by Legal Status), January 2021-August 2024

- Figure 19: Patent Published (by Document Type), January 2021-August 2024

- Figure 20: Key Steps in Sustainable Sourcing of Raw Materials for the White Oil Market

- Figure 21: Major Use Cases of White Oil Across Various Industries

- Figure 22: Impact Analysis of Global White Oil Market Navigating Factors, 2024-2034

- Figure 23: Global Motor Vehicle Production, Million Units, 2021-2023

- Figure 24: Global Plastic Production, Metric Tonne (Mt), 2020-2022

- Figure 25: Technical/Industrial Grade White Oil Applications

- Figure 26: Pharmaceutical Grade White Oil Applications

- Figure 27: Cosmetic Grade White Oil Applications

- Figure 28: Food Grade White Oil Applications

- Figure 29: Other Applications

- Figure 30: U.S. White Oil Market, $Million, 2023-2034

- Figure 31: Canada White Oil Market, $Million, 2023-2034

- Figure 32: Mexico White Oil Market, $Million, 2023-2034

- Figure 33: Germany White Oil Market, $Million, 2023-2034

- Figure 34: France White Oil Market, $Million, 2023-2034

- Figure 35: U.K. White Oil Market, $Million, 2023-2034

- Figure 36: Italy White Oil Market, $Million, 2023-2034

- Figure 37: Spain White Oil Market, $Million, 2023-2034

- Figure 38: Rest-of-Europe White Oil Market, $Million, 2023-2034

- Figure 39: China White Oil Market, $Million, 2023-2034

- Figure 40: Japan White Oil Market, $Million, 2023-2034

- Figure 41: India White Oil Market, $Million, 2023-2034

- Figure 42: South Korea White Oil Market, $Million, 2023-2034

- Figure 43: Rest-of-Asia-Pacific White Oil Market, $Million, 2023-2034

- Figure 44: South America White Oil Market, $Million, 2023-2034

- Figure 45: Middle East and Africa White Oil Market, $Million, 2023-2034

- Figure 46: Next Frontiers in the Global White Oil Market

- Figure 47: Data Triangulation

- Figure 48: Top-Down and Bottom-Up Approach

- Figure 49: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Leading Players in the Global White Oil Market

- Table 4: Trends in the Global White Oil Market

- Table 5: Key Patents Driving the White Oil Market Forward, 2023-2024

- Table 6: U.S. FDA Compliance for Pharmaceutical and Food-Grade White Oil

- Table 7: U.S. EPA Guidelines for Industrial Use

- Table 8: REACH Compliance for Cosmetic and Personal Care Use

- Table 9: EU Regulations for Food-Grade White Oil

- Table 10: Regulations Governing White Oil Use in Cosmetics and Pharmaceuticals in China, India, and Japan

- Table 11: ASEAN Regulations for Food Industry Applications

- Table 12: Application Summary for the Global White Oil Market

- Table 13: White Oil Market (by Application), $Million, 2023-2034

- Table 14: White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 15: Product Summary for the Global White Oil Market

- Table 16: White Oil Market (by Product Type), $Million, 2023-2034

- Table 17: White Oil Market (by Grade Type), $Million, 2023-2034

- Table 18: White Oil Market (by Region), $Million, 2023-2034

- Table 19: North America White Oil Market (by Application), $Million, 2023-2034

- Table 20: North America White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 21: North America White Oil Market (by Product Type), $Million, 2023-2034

- Table 22: North America White Oil Market (by Grade Type), $Million, 2023-2034

- Table 23: U.S. White Oil Market (by Application), $Million, 2023-2034

- Table 24: U.S. White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 25: U.S. White Oil Market (by Product Type), $Million, 2023-2034

- Table 26: U.S. White Oil Market (by Grade Type), $Million, 2023-2034

- Table 27: Canada White Oil Market (by Application), $Million, 2023-2034

- Table 28: Canada White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 29: Canada White Oil Market (by Product Type), $Million, 2023-2034

- Table 30: Canada White Oil Market (by Grade Type), $Million, 2023-2034

- Table 31: Mexico White Oil Market (by Application), $Million, 2023-2034

- Table 32: Mexico White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 33: Mexico White Oil Market (by Product Type), $Million, 2023-2034

- Table 34: Mexico White Oil Market (by Grade Type), $Million, 2023-2034

- Table 35: Europe White Oil Market (by Application), $Million, 2023-2034

- Table 36: Europe White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 37: Europe White Oil Market (by Product Type), $Million, 2023-2034

- Table 38: Europe White Oil Market (by Grade Type), $Million, 2023-2034

- Table 39: Germany White Oil Market (by Application), $Million, 2023-2034

- Table 40: Germany White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 41: Germany White Oil Market (by Product Type), $Million, 2023-2034

- Table 42: Germany White Oil Market (by Grade Type), $Million, 2023-2034

- Table 43: France White Oil Market (by Application), $Million, 2023-2034

- Table 44: France White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 45: France White Oil Market (by Product Type), $Million, 2023-2034

- Table 46: France White Oil Market (by Grade Type), $Million, 2023-2034

- Table 47: U.K. White Oil Market (by Application), $Million, 2023-2034

- Table 48: U.K. White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 49: U.K. White Oil Market (by Product Type), $Million, 2023-2034

- Table 50: U.K. White Oil Market (by Grade Type), $Million, 2023-2034

- Table 51: Italy White Oil Market (by Application), $Million, 2023-2034

- Table 52: Italy White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 53: Italy White Oil Market (by Product Type), $Million, 2023-2034

- Table 54: Italy White Oil Market (by Grade Type), $Million, 2023-2034

- Table 55: Spain White Oil Market (by Application), $Million, 2023-2034

- Table 56: Spain White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 57: Spain White Oil Market (by Product Type), $Million, 2023-2034

- Table 58: Spain White Oil Market (by Grade Type), $Million, 2023-2034

- Table 59: Rest-of-Europe White Oil Market (by Application), $Million, 2023-2034

- Table 60: Rest-of-Europe White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 61: Rest-of-Europe Market (by Product Type), $Million, 2023-2034

- Table 62: Rest-of-Europe White Oi Market (by Grade Type), $Million, 2023-2034

- Table 63: Asia-Pacific White Oil Market (by Application), $Million, 2023-2034

- Table 64: Asia-Pacific White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 65: Asia-Pacific White Oil Market (by Product Type), $Million, 2023-2034

- Table 66: Asia-Pacific White Oil Market (by Grade Type), $Million, 2023-2034

- Table 67: China White Oil Market (by Application), $Million, 2023-2034

- Table 68: China White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 69: China White Oil Market (by Product Type), $Million, 2023-2034

- Table 70: China White Oil Market (by Grade Type), $Million, 2023-2034

- Table 71: Japan White Oil Market (by Application), $Million, 2023-2034

- Table 72: Japan White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 73: Japan White Oil Market (by Product Type), $Million, 2023-2034

- Table 74: Japan White Oil Market (by Grade Type), $Million, 2023-2034

- Table 75: India White Oil Market (by Application), $Million, 2023-2034

- Table 76: India White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 77: India White Oil Market (by Product Type), $Million, 2023-2034

- Table 78: India White Oil Market (by Grade Type), $Million, 2023-2034

- Table 79: South Korea France White Oil Market (by Application), $Million, 2023-2034

- Table 80: South Korea White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 81: South Korea White Oil Market (by Product Type), $Million, 2023-2034

- Table 82: South Korea White Oil Market (by Grade Type), $Million, 2023-2034

- Table 83: Rest-of-Asia-Pacific White Oil Market (by Application), $Million, 2023-2034

- Table 84: Rest-of-Asia-Pacific White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 85: Rest-of-Asia-Pacific White Oil Market (by Product Type), $Million, 2023-2034

- Table 86: Rest-of-Asia-Pacific White Oil Market (by Grade Type), $Million, 2023-2034

- Table 87: Rest-of-the-World White Oil Market (by Application), $Million, 2023-2034

- Table 88: Rest-of-the-World White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 89: Rest-of-the-World White Oil Market (by Product Type), $Million, 2023-2034

- Table 90: Rest-of-the-World White Oil Market (by Grade Type), $Million, 2023-2034

- Table 91: South America White Oil Market (by Application), $Million, 2023-2034

- Table 92: South America White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 93: South America White Oil Market (by Product Type), $Million, 2023-2034

- Table 94: South America White Oil Market (by Grade Type), $Million, 2023-2034

- Table 95: Middle East and Africa India White Oil Market (by Application), $Million, 2023-2034

- Table 96: Middle East and Africa White Oil Market (by Functionality Type), $Million, 2023-2034

- Table 97: Middle East and Africa White Oil Market (by Product Type), $Million, 2023-2034

- Table 98: Middle East and Africa White Oil Market (by Grade Type), $Million, 2023-2034

- Table 99: Market Share, 2023

- Table 100: Other Key Players in the Global White Oil Market

Introduction of the White Oil Market

The white oil market encompasses a diverse range of highly refined, mineral-based oils used across various industries, including pharmaceuticals, cosmetics, food processing, and industrial applications. Driven by the increasing demand for purity and safety in product formulations, white oil serves as an essential ingredient in producing lotions, ointments, lubricants, and plasticizers. Innovations in refining processes have led to the development of white oils that meet stringent regulatory standards, including pharmaceutical-grade and food-grade variants. Key market players, such as ExxonMobil, Sonneborn LLC, and Sasol, dominate the market, providing high-quality products that cater to the growing demand for safe, non-toxic ingredients. Additionally, rising awareness of sustainability and eco-friendly production practices has been shaping consumer preferences, pushing companies to adopt more sustainable manufacturing processes. The white oil market continues to evolve, driven by technological advancements and shifting consumer needs.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $3,895.0 Million |

| 2034 Forecast | $8,597.6 Million |

| CAGR | 8.24% |

The white oil market includes a wide variety of highly refined mineral-based oils used across sectors such as pharmaceuticals, cosmetics, food processing, and industrial applications. This market has been growing as a result of increasing demand for pure and non-toxic ingredients in personal care, pharmaceutical products, and food-related applications. Innovations in the refinement processes have improved the quality and safety of white oil, with companies developing pharmaceutical-grade and food-grade oils to meet stringent regulatory standards. Leading companies such as ExxonMobil, Sonneborn LLC, and Sasol dominate the market, continuously innovating to meet the needs of a broad range of industries. As consumer awareness of product safety and sustainability increases, the white oil market is expected to grow, with companies also focusing on eco-friendly production methods to meet changing preferences.

Industrial Impact

The white oil market has a significant industrial impact, driving substantial growth across several industries, such as pharmaceuticals, cosmetics, plastics, and food processing. Major players such as ExxonMobil, Sonneborn LLC, and Sasol invest heavily in production facilities, distribution networks, and research and development, stimulating economic activity and supporting a wide range of suppliers and service providers. The demand for highly refined mineral oils boosts technological advancements in refining processes and product formulation.

Additionally, the focus on product purity and safety fosters stringent quality control measures, impacting industries such as pharmaceuticals and cosmetics, where white oil is a crucial ingredient. The market's emphasis on eco-friendly and sustainable practices drives investments in cleaner production methods, reducing the environmental footprint of white oil manufacturing. Overall, the white oil market plays a dynamic role in supporting industrial innovation and contributing to economic growth across multiple sectors.

Market Segmentation

Segmentation 1: by Product Type

- Mineral White Oil

- Light Grade

- Heavy Grade

- Synthetic White Oil

- Polyalphaolefin (PAO)

- Polybutene

- Others

Mineral White Oil Segment to Dominate the White Oil Market (by Product Type)

The white oil market, based on product type, is led by mineral white oil. It was valued at $2,676.0 million in 2023 and is expected to be $6,083.4 million in 2034. The mineral white oil segment has been growing due to its widespread applications across various industries, including pharmaceuticals, cosmetics, and food processing, coupled with increasing consumer demand for high-purity, non-toxic ingredients. The trend toward sustainability and regulatory compliance further drives this growth as manufacturers seek reliable, safe products for their formulations.

Segmentation 2: by Grade Type

- Technical/Industrial Grade

- Pharmaceutical Grade

- Cosmetic Grade

- Food Grade

- Others

Segmentation 3: by Application

- Healthcare and Pharmaceuticals

- Personal Care and Cosmetics

- Food and Beverage

- Textiles

- Automotive and Industrial

- Agriculture

- Plastics, Polymers, and Adhesives

- Others

Segmentation 4: by Functionality Type

- Lubrication

- Moisturization

- Emollient

- Solvent

- Protective Coating

- Plasticizer

- Release Agent

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Recent Developments in the White Oil Market

- In February 2024, Chevron Lummus Global LLC (CLG) launched a state-of-the-art white oil hydroprocessing unit at Hongrun Petrochemical (Weifang) Co., Ltd. in Shandong Province, China. This facility integrates CLG's advanced ISODEWAXING and ISOFINISHING technologies, enabling the production of ultra-pure white oil tailored to specific industrial needs. The complex includes two specialized units, i.e., one with a capacity of 500,000 metric tons per year (MTPA) for API Group III industrial-grade white oil and another producing 200,000 tons per year (TPA) of food-grade white oil. This development meets the rising global demand for high-quality white oils while enhancing operational efficiency and minimizing environmental impact.

How can this Report add value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available globally. Moreover, the study provides the reader with a detailed understanding of the white oil market by products based on category and preparation.

Growth/Marketing Strategy: The white oil market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been launching processing units to strengthen their position in the white oil market.

Competitive Strategy: Key players in the white oil market have been analyzed and profiled in the study of white oil products. Moreover, a detailed competitive benchmarking of the players operating in the white oil market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, have been employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Exact revenue information, up to a certain extent, has been extracted for each company from secondary sources and databases. Revenues specific to product/service/technology were then estimated based on fact-based proxy indicators as well as primary inputs.

- Based on the classification, the average selling price (ASP) has been calculated using the weighted average method.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The term "product" in this document may refer to "service" or "technology" as and where relevant.

- The term "manufacturers/suppliers" may refer to "service providers" or "technology providers" as and where relevant.

Primary Research

The primary sources involve industry experts from the white oil industry, including white oil product providers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Businessweek and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The white oil market consists of several key market players that have solidified their presence due to their broad product portfolios and market penetration. Leading companies such as ExxonMobil Corporation, Sonneborn LLC, and Sasol dominate the market by offering high-quality white oils across pharmaceuticals, cosmetics, and food processing industries. Additionally, emerging players such as Savita Oil Technologies and Apar Industries Ltd. have been making significant strides, especially in niche markets such as technical-grade white oil.

Intense market competition drives these companies to innovate constantly, focusing on enhancing purity, quality, and sustainability. The demand for customized and sustainable white oil solutions further intensifies the competitive landscape, leading to frequent product development and strategic acquisitions. Consumer preference for high-purity white oils in sectors such as personal care and pharmaceuticals plays a critical role in shaping the strategies of key market players and propelling market growth.

Some prominent names established in this market are:

- Bharat Petroleum Corporation Limited

- BP p.l.c.

- Chevron Corporation

- Gandhar Oil Refinery

- Exxon Mobil Corporation

- FUCHS

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Ltd.

- H&R GROUP

- Renkert Oil

- Sasol Limited

- Savita Oil Technologies Limited

- Shell International B.V.

- Total Energies

- Calumet, Inc.

- HF Sinclair Corporation

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Advancements in Refining Technologies

- 1.1.2 Nanotechnology and its Impact on White Oil Applications

- 1.1.3 Bio-Based Alternatives to White Oil

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Product Margin Analysis

- 1.2.3 Pricing Forecast

- 1.3 Research and Development Review

- 1.3.1 Patent Publishing Trend

- 1.4 Regulatory Landscape (by Region)

- 1.4.1 North America Regulatory Landscape

- 1.4.1.1 FDA Compliance for Pharmaceutical and Food-Grade White Oil

- 1.4.1.2 EPA Guidelines for Industrial Use

- 1.4.2 Europe Regulatory Landscape

- 1.4.2.1 REACH Compliance for Cosmetic and Personal Care Use

- 1.4.2.2 EU Regulations for Food-Grade White Oil

- 1.4.3 Asia-Pacific Regulatory Landscape

- 1.4.3.1 Regulations Governing White Oil Use in Cosmetics and Pharmaceuticals in China, India, and Japan

- 1.4.3.2 ASEAN Regulations for Food Industry Applications

- 1.4.4 Rest-of-the-World Regulatory Landscape

- 1.4.4.1 Halal Certification for White Oil in Food and Personal Care

- 1.4.4.2 Industrial Safety Standards for White Oil in Lubricants

- 1.4.1 North America Regulatory Landscape

- 1.5 Sustainability and Environmental Impact of White Oil

- 1.5.1 Sustainable Sourcing of Raw Materials

- 1.5.2 Environmental Regulations Impacting the Production of White Oil

- 1.5.3 Eco-Friendly Alternatives and Innovations

- 1.6 Stakeholder Analysis

- 1.6.1 Use Case

- 1.6.2 End User and Buying Criteria

- 1.7 Impact Analysis for Key Global Events

- 1.8 Market Dynamics Overview

- 1.8.1 Market Drivers

- 1.8.1.1 Growth in the Automotive Sector

- 1.8.1.2 Expanding Pharmaceutical and Personal Care Industry

- 1.8.1.3 Rising Plastic Production

- 1.8.2 Market Challenges

- 1.8.2.1 Fluctuating Raw Material Prices

- 1.8.2.2 Stringent Regulatory Compliance

- 1.8.3 Market Opportunities

- 1.8.3.1 Expansion in Specialty and Sustainable Grades

- 1.8.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 White Oil Market (by Application)

- 2.3.1 Healthcare and Pharmaceuticals

- 2.3.2 Personal Care and Cosmetics

- 2.3.3 Food and Beverage

- 2.3.4 Textiles

- 2.3.5 Automotive and Industrial

- 2.3.6 Agriculture

- 2.3.7 Plastics, Polymers, and Adhesives

- 2.3.8 Others

- 2.4 White Oil Market (by Functionality Type)

- 2.4.1 Lubrication

- 2.4.2 Moisturization

- 2.4.3 Emollient

- 2.4.4 Solvent

- 2.4.5 Protective Coating

- 2.4.6 Plasticizer

- 2.4.7 Release Agent

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 White Oil Market (by Product Type)

- 3.3.1 Mineral White Oil

- 3.3.1.1 Light Grade

- 3.3.1.2 Heavy Grade

- 3.3.2 Synthetic White Oil

- 3.3.2.1 Polyalphaolefin (PAO)

- 3.3.2.2 Polybutene

- 3.3.2.3 Others

- 3.3.1 Mineral White Oil

- 3.4 White Oil Market (by Grade Type)

- 3.4.1 Technical/Industrial Grade

- 3.4.2 Pharmaceutical Grade

- 3.4.3 Cosmetic Grade

- 3.4.4 Food Grade

- 3.4.5 Others

4 Regions

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America White Oil Market (by Country)

- 4.2.6.1 U.S.

- 4.2.6.2 Canada

- 4.2.6.3 Mexico

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe White Oil Market (by Country)

- 4.3.6.1 Germany

- 4.3.6.2 France

- 4.3.6.3 U.K.

- 4.3.6.4 Italy

- 4.3.6.5 Spain

- 4.3.6.6 Rest-of-Europe

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific White Oil Market (by Country)

- 4.4.6.1 China

- 4.4.6.2 Japan

- 4.4.6.3 India

- 4.4.6.4 South Korea

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World White Oil Market (by Region)

- 4.5.6.1 South America

- 4.5.6.2 Middle East and Africa

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Bharat Petroleum Corporation Limited

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share, 2023

- 5.2.2 BP p.l.c.

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share, 2023

- 5.2.3 Chevron Corporation

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share, 2023

- 5.2.4 Gandhar Oil Refinery

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share, 2023

- 5.2.5 Exxon Mobil Corporation

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share, 2023

- 5.2.6 FUCHS

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share, 2023

- 5.2.7 Idemitsu Kosan Co.,Ltd.

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share, 2023

- 5.2.8 Indian Oil Corporation Ltd

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share, 2023

- 5.2.9 H&R GROUP

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.1 Market Share, 2023

- 5.2.10 Renkert Oil

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share, 2023

- 5.2.11 Sasol Limited

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share, 2023

- 5.2.12 Savita Oil Technologies Limited

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share, 2023

- 5.2.13 Shell International B.V.

- 5.2.13.1 Overview

- 5.2.13.2 'Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share, 2023

- 5.2.14 TotalEnergies

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share, 2023

- 5.2.15 Calumet, Inc.

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share, 2023

- 5.2.16 HF Sinclair Corporation

- 5.2.16.1 Overview

- 5.2.16.2 Top Products/Product Portfolio

- 5.2.16.3 Top Competitors

- 5.2.16.4 Target Customers

- 5.2.16.5 Key Personnel

- 5.2.16.6 Analyst View

- 5.2.16.7 Market Share, 2023

- 5.2.17 Other Players

- 5.2.1 Bharat Petroleum Corporation Limited

- 5.3 Customer Outlook: List of Companies (by Application Type)

- 5.3.1 Healthcare and Pharmaceuticals

- 5.3.1.1 List of Customer Companies

- 5.3.2 Personal Care and Cosmetics

- 5.3.2.1 List of Customer Companies

- 5.3.3 Food and Beverage

- 5.3.3.1 List of Customer Companies

- 5.3.4 Textiles

- 5.3.4.1 List of Customer Companies

- 5.3.5 Automotive and Industrial

- 5.3.5.1 List of Customer Companies

- 5.3.6 Agriculture

- 5.3.6.1 List of Customer Companies

- 5.3.7 Plastics, Polymers, and Adhesives

- 5.3.7.1 List of Customer Companies

- 5.3.8 Others

- 5.3.8.1 List of Customer Companies

- 5.3.1 Healthcare and Pharmaceuticals

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast