|

|

市場調査レポート

商品コード

1578774

欧州の高高度航空プラットフォームステーション(HAAPS)市場:タイプ別、サブシステム別、エンドユーザー別、国別 - 分析と予測(2023年~2033年)Europe High-Altitude Aeronautical Platform Station (HAAPS) Market: Focus on Type, Subsystem, End User, and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の高高度航空プラットフォームステーション(HAAPS)市場:タイプ別、サブシステム別、エンドユーザー別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年10月29日

発行: BIS Research

ページ情報: 英文 59 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の高高度航空プラットフォームステーション(HAAPS)の市場規模は、2023年の4億640万米ドルから2033年には11億4,060万米ドルに達し、予測期間の2023年~2033年のCAGRは10.87%になると予測されています。

高高度航空ププラットフォームステーション(HAAPS)システムは、災害救援、環境監視、通信など様々な目的に使用される大気衛星です。HAAPSは、高度18~22km(約59,000~72,000フィート)の成層圏で運用されます。HAAPSは、無人航空機システム(UAS)とは対照的に、長時間の運用を目的とした自律飛行隊システムです。高高度での運用が可能なため、衛星や航空機の運用を補完することができ、標準的なUAS法とは異なり、その統合と配備を管理する特定の規制枠組みによって管理されます。HAAPSの運用が欧州全域で安全かつ効率的に行われるためには、さまざまな戦略的目的のために国内および国際的な空域規則を遵守しなければなりません。

HAAPSがさらに発展するにつれて、監視能力を高め、ネットワーク化を促進し、欧州の災害対応活動を強化する上で、HAAPSはますます重要になってきています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 4億640万米ドル |

| 2033年の予測 | 11億4,060万米ドル |

| CAGR | 10.87% |

洗練された通信システムや環境監視システムに対するニーズの高まりが、欧州の高高度航空プラットフォームステーション(HAAPS)市場を牽引しています。高度18~22kmの成層圏で機能するHAAPSは、環境監視、災害対応、通信をより広範囲にカバーすることで、人工衛星に代わる特徴的な機能を提供します。これらのプラットフォームは、長時間空中に留まることができるため、軍事・民生両方の用途に非常に有用です。

HAAPSは、孤立した場所での接続性を向上させ、気候モニタリングのような環境プロジェクトを支援するために、欧州では重要な技術とみなされています。自律システムの改善、経済的なエネルギー利用、国内外の組織による規制の後押しが、市場を推進する主な要因です。現在の衛星システムや地上システムを補完するため、欧州の政府や企業はHAAPS技術に投資しています。これが市場全体の拡大と、さまざまな産業における潜在能力の最大化に役立っています。

当レポートでは、欧州の高高度航空プラットフォームステーション(HAAPS)市場について調査し、市場の概要とともに、タイプ別、サブシステム別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 概要:欧州高高度航空プラットフォームステーション(HAAPS)

- 比較分析:HAAPS対衛星システム対地上システム

- バリューチェーン分析

- 規制状況

- 主要な世界的出来事の影響分析-COVID-19

- プロジェクト

- 市場力学の概要

第2章 地域

- 地域別概要

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Airbus

- Thales

- Prismatic Ltd

- Aurora Flight Sciences

- HEMERIA

- Zero 2 Infinity, S.L.

- Flying Whales

第4章 調査手法

List of Figures

- Figure 1: Europe High-Altitude Aeronautical Platform Station (HAAPS) Market (by Type), 2022, 2026, and 2033

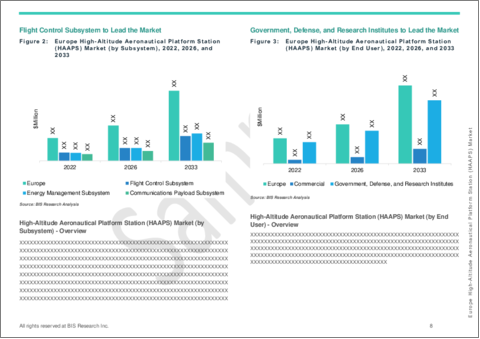

- Figure 2: Europe High-Altitude Aeronautical Platform Station (HAAPS) Market (by Subsystem), 2022, 2026, and 2033

- Figure 3: Europe High-Altitude Aeronautical Platform Station (HAAPS) Market (by End User), 2022, 2026, and 2033

- Figure 4: Impact Analysis of Market Navigating Factors, 2023- 2033

- Figure 5: France High-Altitude Aeronautical Platform Station (HAAPS) Market, $Million, 2022-2033

- Figure 6: Germany High-Altitude Aeronautical Platform Station (HAAPS) Market, $Million, 2022-2033

- Figure 7: U.K. High-Altitude Aeronautical Platform Station (HAAPS) Market, $Million, 2022-2033ple

- Figure 8: Rest-of-Europe High-Altitude Aeronautical Platform Station (HAAPS) Market, $Million, 2022-2033

- Figure 9: Strategic Initiatives, 2020-2023

- Figure 10: Share of Strategic Initiatives, 2020-2023

- Figure 11: Data Triangulation

- Figure 12: Top-Down and Bottom-Up Approach

- Figure 13: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: High-Altitude Aeronautical Platform Station Market, Opportunities across Regions

- Table 3: Comparative Analysis: HAAPS vs. Satellite Systems vs. Terrestrial Systems

- Table 4: Regulatory Landscape

- Table 5: Impact Analysis for Key Global Events - COVID-19

- Table 6: High-Altitude Aeronautical Platform Station (HAAPS) Market (by Region), $Million, 2022-2033

- Table 7: Europe High-Altitude Aeronautical Platform Station (HAAPS) Market (by End User), $Million, 2022-2033

- Table 8: Europe High-Altitude Aeronautical Platform Station (HAAPS) Market (by Type), $Million, 2022-2033

- Table 9: Europe High-Altitude Aeronautical Platform Station (HAAPS) Market (by Subsystem), $Million, 2022-2033

- Table 10: France High-Altitude Aeronautical Platform Station (HAAPS) Market (by End User), $Million, 2022-2033

- Table 11: Germany High-Altitude Aeronautical Platform Station (HAAPS) Market (by End User), $Million, 2022-2033

- Table 12: U.K. High-Altitude Aeronautical Platform Station (HAAPS) Market (by End User), $Million, 2022-2033

- Table 13: Rest-of-Europe High-Altitude Aeronautical Platform Station (HAAPS) Market (by End User), $Million, 2022-2033

- Table 14: Market Share, 2022

Introduction to Europe High-Altitude Aeronautical Platform Station (HAAPS) Market

The Europe high-altitude aeronautical platform station (HAAPS) market is estimated to reach $1,140.6 million by 2033 from $406.4 million in 2023, growing at a CAGR of 10.87% during the forecast period 2023-2033. The high-altitude aeronautical platform station (HAAPS) systems are atmospheric satellites used for a variety of purposes, such as disaster relief, environmental monitoring, and telecommunications. They operate in the stratosphere between 18 and 22 kilometers (about 59,000 and 72,000 feet). HAAPS are autonomous fleet systems intended for extended operations, in contrast to unmanned aircraft systems (UAS). They can supplement satellite and airplane operations due to their high altitude capabilities, and unlike standard UAS laws, they are governed by a specific regulatory framework that controls their integration and deployment. For HAAPS operations to be safe and efficient throughout Europe, they must adhere to national and international airspace rules for a variety of strategic purposes.

As HAAPS develops further, they are becoming more and more crucial in boosting monitoring capacities, facilitating networking, and strengthening European disaster response activities.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $406.4 Million |

| 2033 Forecast | $1,140.6 Million |

| CAGR | 10.87% |

Market Introduction

The growing need for sophisticated communication and environmental monitoring systems is driving the high-altitude aeronautical platform station (HAAPS) market in Europe. At altitudes between 18 and 22 kilometers, HAAPS function in the stratosphere and offer a distinctive substitute for satellites by providing greater coverage for environmental monitoring, disaster response, and telecommunications. These platforms are very useful for both military and civilian uses since they can stay in the air for extended periods of time.

HAAPS is regarded as a crucial technology in Europe for improving connectivity in isolated locations and assisting with environmental projects like climate monitoring. Improvements in autonomous systems, economical energy utilization, and regulatory backing from both domestic and foreign organizations are the main factors propelling the market. In order to supplement current satellite and terrestrial systems, European governments and businesses are investing in HAAPS technology. This is helping the market expand overall and maximizing its potential across a variety of industries.

Market Segmentation:

Segmentation 1: by End User

- Commercial

- Government, Defense, and Research Institutes

Segmentation 2: by Type

- UAVs

- Airships

- Balloons

Segmentation 3: by Subsystem

- Flight Control Subsystem

- Energy Management Subsystem

- Communications Payload Subsystem

Segmentation 4: by Region

- Europe - U.K., Germany, France, and Rest-of-the-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available for deployment and their potential in European region. Moreover, the study provides the reader with a detailed understanding of the Europe high-altitude aeronautical platform station (HAAPS) market based on applications on the basis of the end user (commercial and Government, Defense, and Research Institutes) and based on the products on the basis of type (UAVs, airships, balloons) and subsystems (flight control subsystem, energy management subsystem, and communications payload subsystem).

Growth/Marketing Strategy: The Europe high-altitude aeronautical platform station (HAAPS) market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been partnerships and contracts to strengthen their position in the Europe high-altitude aeronautical platform station (HAAPS) market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- Airbus

- Prismatic Ltd

- Aurora Flight Sciences

- HEMERIA

- Zero 2 Infinity, S.L.

- Flying Whales

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Overview: Europe High-Altitude Aeronautical Platform Station (HAAPS)

- 1.2 Comparative Analysis: HAAPS vs. Satellite Systems vs. Terrestrial Systems

- 1.3 Value Chain Analysis

- 1.4 Regulatory Landscape

- 1.5 Impact Analysis for Key Global Events - COVID-19

- 1.6 Projects

- 1.6.1 High-Altitude Platform Station (HAPS) Development Initiative

- 1.6.2 Uncrewed High-Altitude Platform (HAP)

- 1.6.3 The Perlan Project

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Emergence of Artificial Intelligence

- 1.7.1.2 Increase in Use of Composite Material

- 1.7.1.3 Miniaturization of HAAPS Instruments and Payloads

- 1.7.2 Market Challenges

- 1.7.2.1 Technical Challenges such as Low Solar Panel Efficiency and Less Structural Integrity

- 1.7.3 Market Opportunities

- 1.7.3.1 Increase in Digitalization in Defense

- 1.7.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application

- 2.2.5 Product

- 2.2.6 France

- 2.2.7 Germany

- 2.2.8 U.K.

- 2.2.9 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 Airbus

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2022

- 3.2.2 Thales

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2022

- 3.2.3 Prismatic Ltd

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share, 2022

- 3.2.4 Aurora Flight Sciences

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share, 2022

- 3.2.5 HEMERIA

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2022

- 3.2.6 Zero 2 Infinity, S.L.

- 3.2.6.1 Overview

- 3.2.6.2 Top Products/Product Portfolio

- 3.2.6.3 Top Competitors

- 3.2.6.4 Target Customers

- 3.2.6.5 Key Personnel

- 3.2.6.6 Analyst View

- 3.2.6.7 Market Share, 2022

- 3.2.7 Flying Whales

- 3.2.7.1 Overview

- 3.2.7.2 Top Products/Product Portfolio

- 3.2.7.3 Top Competitors

- 3.2.7.4 Target Customers

- 3.2.7.5 Key Personnel

- 3.2.7.6 Analyst View

- 3.2.7.7 Market Share, 2022

- 3.2.1 Airbus

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast