|

|

市場調査レポート

商品コード

1565179

商用車フリート管理用トラッキングデバイス市場 - 世界および地域別分析:用途別、国別 - 分析と予測(2024年~2032年)Tracking Devices Market for Commercial Vehicle Fleet Management - A Global and Regional Analysis: Focus on Application, and Country-Wise Analysis - Analysis and Forecast, 2024-2032 |

||||||

カスタマイズ可能

|

|||||||

| 商用車フリート管理用トラッキングデバイス市場 - 世界および地域別分析:用途別、国別 - 分析と予測(2024年~2032年) |

|

出版日: 2024年10月04日

発行: BIS Research

ページ情報: 英文 104 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の商用車フリート管理用トラッキングデバイスの市場規模は、2023年の34億9,000万米ドルから2032年には69億2,000万米ドルに達し、予測期間の2024年~2032年のCAGRは7.59%になると予測されています。

世界の商用車フリート管理用トラッキングデバイス市場は、いくつかの重要な要因によって大きな成長を遂げています。第一に、車両のリアルタイム追跡・監視に対する需要の高まりが、車両運用の最適化、効率改善、運用コスト削減に不可欠となっています。企業は現在、全体的な生産性を高め、規制へのコンプライアンスを確保するために、車両の位置、 促進要因の行動、燃料消費に関する正確なデータの必要性を優先しています。さらに、GPSとテレマティクス技術の進歩により、トラッキング・デバイスの価格と信頼性が向上したため、物流、運輸、配送サービスなど、さまざまな業界で広く採用されるようになりました。

eコマースの台頭とそれに伴う効率的なラストマイル配送ソリューションのニーズは、タイムリーで透明性の高い配送に対する顧客の期待に応えようと企業が努力する中で、市場をさらに押し上げています。さらに、追跡装置とIoTおよびAI技術の統合は、高度な分析と予測メンテナンス機能を車両管理者に提供し、ダウンタイムを最小限に抑え、車両の寿命を延ばしています。持続可能性が重要な焦点となる中、追跡装置はルートを最適化し、二酸化炭素排出量を削減することで、環境に優しい取り組みにも貢献しています。全体として、技術の進歩、規制要件、業務効率の融合が、車両管理における追跡装置市場の堅調な成長を世界的に後押ししています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2032年 |

| 2024年評価 | 38億6,000万米ドル |

| 2032年予測 | 69億2,000万米ドル |

| CAGR | 7.59% |

当レポートでは、世界の商用車フリート管理用トラッキングデバイス市場について調査し、市場の概要とともに、用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 主な調査結果

- 規制状況

- 動向:現在および将来の影響分析

- 貨物監視のためのモノのインターネット(IoT)センサーの統合

- 先進センサー技術の統合

第2章 地域

- 地域別概要

- 北米

- 欧州

- アジア太平洋

- 中東

- アフリカ

- ラテンアメリカ

第3章 市場-競合ベンチマーキングと企業プロファイル

- 主な戦略と開発

- 企業プロファイル

- Verizon Connect

- BlackBerry Limited

- Automile

- Digital Matter

- EROAD Inc.

- Momentum IOT, Inc.

- ClearPathGPS, Inc.

- M2M in Motion

- Geotab Inc.

- Linxup

- Azuga, a Bridgestone Company

- Rastrac

- ORBCOMM

第4章 調査手法

List of Figures

- Figure 1: Vehicle Theft in U.S., 2019-2023

- Figure 2: Global Tracking Devices Market for Commercial Vehicle Fleet Management, 2023-2032

- Figure 3: Market Dynamics for Global Tracking Devices Market for Commercial Vehicle Fleet Management

- Figure 4: Global Tracking Devices Market for Commercial Vehicle Fleet Management (by Industry), $Million, 2023

- Figure 5: Global Tracking Devices Market for Commercial Vehicle Fleet Management (by Region), 2023 and 2032

- Figure 6: Global Tracking Devices Market for Commercial Vehicle Fleet Management (by Region), 2023 and 2032

- Figure 7: Scenarios for the Next Decade

- Figure 8: Data Triangulation

- Figure 9: Top-Down and Bottom-Up Approach

- Figure 10: Assumptions and Limitations

List of Tables

- Table 1: Tracking Devices Market for Commercial Vehicle Fleet Management (by Region), $Million, 2023-2032

- Table 2: Tracking Devices Market for Commercial Vehicle Fleet Management (by Region), Thousand Units, 2023-2032

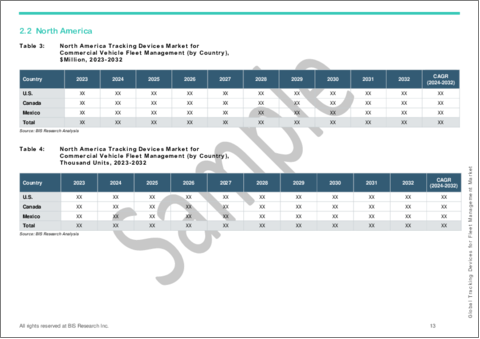

- Table 3: North America Tracking Devices Market for Commercial Vehicle Fleet Management (by Country), $Million, 2023-2032

- Table 4: North America Tracking Devices Market for Commercial Vehicle Fleet Management (by Country), Thousand Units, 2023-2032

- Table 5: U.S. Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 6: Canada Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 7: Mexico Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 8: Europe Tracking Devices Market for Commercial Vehicle Fleet Management (by Country), $Million, 2023-2032

- Table 9: Europe Tracking Devices Market for Commercial Vehicle Fleet Management (by Country), Thousand Units, 2023-2032

- Table 10: U.K. Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 11: France Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 12: Ireland Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 13: Spain Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 14: Italy Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 15: Scandinavia Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 16: Benelux Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 17: Poland Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 18: DACH Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 19: Portugal Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 20: Rest-of-Europe Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 21: Asia-Pacific Tracking Devices Market for Commercial Vehicle Fleet Management (by Country), $Million, 2024-2032

- Table 22: Asia-Pacific Tracking Devices Market for Commercial Vehicle Fleet Management (by Country), Thousand Units, 2023-2032

- Table 23: China Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 24: Australia Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 25: India Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 26: New Zealand Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 27: Rest-of-Asia-Pacific Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 28: Middle East Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 29: Africa Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 30: Latin America Tracking Devices Market for Commercial Vehicle Fleet Management (by Country), $Million, 2024-2032

- Table 31: Latin America Tracking Devices Market for Commercial Vehicle Fleet Management (by Country), Thousand Units, 2024-2032

- Table 32: Brazil Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 33: Argentina Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 34: Rest-of-Latin America Tracking Devices Market for Commercial Vehicle Fleet Management (by Application), $Million, 2023-2032

- Table 35: Key Initiatives, 2021-2024

Tracking Devices Market for Commercial Vehicle Fleet Management Overview

The global tracking device market for commercial vehicle fleet management is projected to reach $6.92 billion by 2032 from $3.49 billion in 2023, growing at a CAGR of 7.59% during the forecast period 2024-2032.

The global tracking device market for commercial vehicle fleet management is experiencing significant growth due to several key factors. Firstly, the increasing demand for real-time tracking and monitoring of vehicles has become essential for optimizing fleet operations, improving efficiency, and reducing operational costs. Companies are now prioritizing the need for accurate data on vehicle location, driver behavior, and fuel consumption to enhance overall productivity and ensure compliance with regulations. Additionally, advancements in GPS and telematics technology have made tracking devices more affordable and reliable, leading to widespread adoption across various industries, such as logistics, transportation, and delivery services. The rise of e-commerce and the subsequent need for efficient last-mile delivery solutions have further propelled the market as businesses strive to meet customer expectations for timely and transparent deliveries. Moreover, the integration of tracking devices with IoT and AI technologies is providing fleet managers with advanced analytics and predictive maintenance capabilities, minimizing downtime and enhancing vehicle lifespan. As sustainability becomes a critical focus, tracking devices also contribute to eco-friendly initiatives by optimizing routes and reducing carbon emissions. Overall, the convergence of technological advancements, regulatory requirements, and operational efficiency drives the robust growth of the tracking device market in fleet management globally.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2032 |

| 2024 Evaluation | $3.86 Billion |

| 2032 Forecast | $6.92 Billion |

| CAGR | 7.59% |

Market Segmentation:

Segmentation 1: by Application

- Food and Beverage

- Grocery

- Agriculture

- Construction

- Transportation

- Logistics

- Pharmaceutical

- Retail

- Mining

- Automotive

- Manufacturing

- Post and Parcel

- Petrochemical

- Waste Management

- Urban/Public Transport

- Defense

- Utilities

- Others

Segmentation 2: by Region

- North America

- Europe

- Asia-Pacific

- Middle East

- Africa

- Latin America

Demand - Drivers and Challenges

The following are the demand drivers for the global tracking devices market for commercial vehicle fleet management industry:

- Operational Efficiency

- Safety and Compliance

- Theft Prevention and Asset Recovery

- Regulatory Pressure

The market is expected to face some limitations as well due to the following challenges:

- Data Security and Privacy Concerns

- Integration Complexity

Key Market Players and Competition Synopsis

The companies that are profiled in the tracking device market for commercial vehicle fleet management have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Verizon Connect

- BlackBerry Limited

- Automile

- Digital Matter

Key Questions Answered in this Report:

- What is the estimated global market size for tracking devices market for commercial vehicle fleet management?

- Who are the primary players in the global tracking devices market for commercial vehicle fleet management industry?

- What are the different tracking devices products for fleet management?

- Which geographical area holds the largest market share in the global tracking devices market for commercial vehicle fleet management industry?

- What are the primary factors driving growth in the global tracking devices market for commercial vehicle fleet management industry?

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Key Findings

- 1.2 Regulatory Landscape

- 1.3 Trends: Current and Future Impact Analysis

- 1.3.1 Integrating Internet of Things (IoT) Sensors for Cargo Monitoring

- 1.3.2 Integration of Advanced Sensor Technologies

2 Regions

- 2.1 Regional Summary

- 2.2 North America

- 2.2.1 U.S.

- 2.2.2 Canada

- 2.2.3 Mexico

- 2.3 Europe

- 2.3.1 U.K.

- 2.3.2 France

- 2.3.3 Ireland

- 2.3.4 Spain

- 2.3.5 Italy

- 2.3.6 Scandinavia

- 2.3.7 Benelux

- 2.3.8 Poland

- 2.3.9 DACH

- 2.3.10 Portugal

- 2.3.11 Rest-of-Europe

- 2.4 Asia-Pacific

- 2.4.1 China

- 2.4.2 Australia

- 2.4.3 India

- 2.4.4 New Zealand

- 2.4.5 Rest-of-Asia-Pacific

- 2.5 Middle East

- 2.6 Africa

- 2.7 Latin America

- 2.7.1 Brazil

- 2.7.2 Argentina

- 2.7.3 Rest-of-Latin America

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Key Strategies and Developments

- 3.2 Company Profiles

- 3.2.1 Verizon Connect

- 3.2.1.1 Overview

- 3.2.1.2 Key Developments

- 3.2.1.3 Top Products/Product Portfolio

- 3.2.1.4 Geographical Presence

- 3.2.1.5 Business and Operating Model Analysis

- 3.2.1.6 Company Financials

- 3.2.1.7 Analyst View

- 3.2.2 BlackBerry Limited

- 3.2.2.1 Overview

- 3.2.2.2 Key Developments

- 3.2.2.3 Top Products/Product Portfolio

- 3.2.2.4 Geographical Presence

- 3.2.2.5 Business and Operating Model Analysis

- 3.2.2.6 Company Financials

- 3.2.2.7 Analyst View

- 3.2.3 Automile

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Geographical Presence

- 3.2.3.4 Business and Operating Model Analysis

- 3.2.3.5 Company Financials

- 3.2.3.6 Analyst View

- 3.2.4 Digital Matter

- 3.2.4.1 Overview

- 3.2.4.2 Key Developments

- 3.2.4.3 Top Products/Product Portfolio

- 3.2.4.4 Geographical Presence

- 3.2.4.5 Business and Operating Model Analysis

- 3.2.4.6 Company Financials

- 3.2.4.7 Analyst View

- 3.2.5 EROAD Inc.

- 3.2.5.1 Overview

- 3.2.5.2 Key Developments

- 3.2.5.3 Top Products/Product Portfolio

- 3.2.5.4 Geographical Presence

- 3.2.5.5 Business and Operating Model Analysis

- 3.2.5.6 Company Financials

- 3.2.5.7 Analyst View

- 3.2.6 Momentum IOT, Inc.

- 3.2.6.1 Overview

- 3.2.6.2 Key Developments

- 3.2.6.3 Top Products/Product Portfolio

- 3.2.6.4 Geographical Presence

- 3.2.6.5 Business and Operating Model Analysis

- 3.2.6.6 Company Financials

- 3.2.6.7 Analyst View

- 3.2.7 ClearPathGPS, Inc.

- 3.2.7.1 Overview

- 3.2.7.2 Key Developments

- 3.2.7.3 Top Products/Product Portfolio

- 3.2.7.4 Geographical Presence

- 3.2.7.5 Business and Operating Model Analysis

- 3.2.7.6 Company Financials

- 3.2.7.7 Analyst View

- 3.2.8 M2M in Motion

- 3.2.8.1 Overview

- 3.2.8.2 Key Developments

- 3.2.8.3 Top Products/Product Portfolio

- 3.2.8.4 Geographical Presence

- 3.2.8.5 Business and Operating Model Analysis

- 3.2.8.6 Company Financials

- 3.2.8.7 Analyst View

- 3.2.9 Geotab Inc.

- 3.2.9.1 Overview

- 3.2.9.2 Key Developments

- 3.2.9.3 Top Products/Product Portfolio

- 3.2.9.4 Geographical Presence

- 3.2.9.5 Business and Operating Model Analysis

- 3.2.9.6 Company Financials

- 3.2.9.7 Analyst View

- 3.2.10 Linxup

- 3.2.10.1 Overview

- 3.2.10.2 Key Developments

- 3.2.10.3 Top Products/Product Portfolio

- 3.2.10.4 Geographical Presence

- 3.2.10.5 Business and Operating Model Analysis

- 3.2.10.6 Company Financials

- 3.2.10.7 Analyst View

- 3.2.11 Azuga, a Bridgestone Company

- 3.2.11.1 Overview

- 3.2.11.2 Key Developments

- 3.2.11.3 Top Products/Product Portfolio

- 3.2.11.4 Geographical Presence

- 3.2.11.5 Business and Operating Model Analysis

- 3.2.11.6 Company Financials

- 3.2.11.7 Analyst View

- 3.2.12 Rastrac

- 3.2.12.1 Overview

- 3.2.12.2 Key Developments

- 3.2.12.3 Top Products/Product Portfolio

- 3.2.12.4 Geographical Presence

- 3.2.12.5 Business and Operating Model Analysis

- 3.2.12.6 Company Financials

- 3.2.12.7 Analyst View

- 3.2.13 ORBCOMM

- 3.2.13.1 Overview

- 3.2.13.2 Key Developments

- 3.2.13.3 Top Products/Product Portfolio

- 3.2.13.4 Geographical Presence

- 3.2.13.5 Business and Operating Model Analysis

- 3.2.13.6 Analyst View

- 3.2.1 Verizon Connect

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast