|

|

市場調査レポート

商品コード

1560925

パッシブ認証市場 - 世界および地域別分析:最終用途産業別、組織規模別、展開タイプ別、コンポーネント別、ビジネス機能別、地域別 - 分析と予測(2024年~2034年)Passive Authentication Market - A Global and Regional Analysis: Focus on End-use Industry, Organization Size, Deployment Type, Component, Business Function, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| パッシブ認証市場 - 世界および地域別分析:最終用途産業別、組織規模別、展開タイプ別、コンポーネント別、ビジネス機能別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年09月25日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

パッシブ認証市場は、サイバーセキュリティとユーザー体験の情勢を急速に変化させ、両者を直感的でシームレスなインタラクションに融合させています。

デジタル取引やオンライン活動がさまざまな分野でユビキタス化するにつれ、ユーザの利便性を妨げないセキュリティ対策の必要性が高まっています。パッシブ認証は、行動パターンやバイオメトリクスの分析を通じてユーザーの身元を目立たないように検証することで、理想的なソリューションを提供します。楽観的シナリオでは、パッシブ認証の市場規模は、2024年に19億2,000万になるとみられ、21.26%のCAGRで拡大し、2034年には132億米ドルに達すると予測されています。この技術は、キーストロークの動態、デバイスの操作パターン、さらにはリアルタイムで処理される生体測定値などのデータを活用し、ユーザーの積極的な参加なしにユーザーを認証します。この市場の高まりは、日常生活におけるデジタル技術の統合が進むとともに、安全性と使いやすさの両方を確保する非侵入型のセキュリティソリューションに対するニーズが高まっていることが背景にあります。

パッシブ認証市場の主な促進要因の一つは、金融サービス分野での需要の高まりです。銀行や金融機関は特に熱心にこの技術を採用し、顧客体験を向上させながらセキュリティを強化しています。例えば、大手銀行は、ユーザーがどのようにパスワードを入力するか、またはバンキングアプリを操作するかを分析するシステムを導入し、不正行為を示す異常な行動を検出する継続的な認証を可能にしています。このアプリは、取引の安全性を確保するだけでなく、ユーザー体験を合理化し、手作業による認証ステップを繰り返す必要性を排除します。同様に、小売業では、パッシブ認証システムがオンライントランザクションにおける不正行為を防止するために使用されており、ショッピング体験を妨げることなく、ユーザーの対話パターンを通して微妙に検証しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 19億2,000万米ドル |

| 2034年の予測 | 132億米ドル |

| CAGR | 21.26% |

しかし、同市場は、特にデータ・プライバシーとバイオメトリクス情報の倫理的利用に関して、大きな課題に直面しています。ユーザーはしばしば、自分のデータがどのように監視、保存、使用されているのかについて懸念を表明します。また、データ利用に厳しい制限を課す欧州連合(EU)の一般データ保護規則(GDPR)のような複雑な状況を乗り切らなければならないため、規制状況も大きな課題となっています。このような課題の一例は、特定のハイテク企業に対する消費者の反発に見ることができます。このような事件は、社会的信用を獲得し維持するために、透明性のある慣行と強固なデータ保護対策の必要性を浮き彫りにしています。

パッシブ認証市場は、特に、まだ先進的なセキュリティ慣行を完全には導入していない新たな業界への拡大を通じて、多くのビジネスチャンスをもたらしています。教育やヘルスケアは、パッシブ認証の統合がセキュリティプロトコルに革命をもたらす代表的な例です。学校や大学では、この技術によってデータセキュリティやアクセスコントロールシステムを強化し、さまざまなデジタルリソースにアクセスする学生や職員の身元をシームレスに検証することができます。ヘルスケアでは、パッシブ認証によって、患者記録や病院システムへのアクセスを保護し、機密情報へのアクセスが許可された担当者のみに行われるようにすることで、医療データ保護基準へのコンプライアンスを向上させることができます。技術の継続的な進歩とサイバー脅威の高度化は、パッシブ認証市場のさらなる革新と採用に拍車をかけ、将来のセキュリティエコシステムの重要な構成要素になる可能性が高いとみられています。

当レポートでは、世界のパッシブ認証市場について調査し、市場の概要とともに、最終用途産業別、組織規模別、展開タイプ別、コンポーネント別、ビジネス機能別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 パッシブ認証市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- パッシブ認証市場(最終用途産業別)

第3章 パッシブ認証市場(製品別)

- 製品セグメンテーション

- 製品概要

- パッシブ認証市場(組織規模別)

- パッシブ認証市場(展開タイプ別)

- パッシブ認証市場(コンポーネント別)

- パッシブ認証市場(ビジネス機能別)

第4章 パッシブ認証市場(地域別)

- パッシブ認証市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- IBM Corporation

- Cisco Systems, Inc.

- Thales Group

- NEC Corporation

- OneSpan, Inc.

- Verint Systems, Inc.

- Aware, Inc.

- Pindrop Security, Inc.

- Equifax, Inc.

- Nuance Communications, Inc.

- BioCatch Ltd.

- ID R&D Inc.

- Fortress Identity

- Early Warning Services

- Trust Stamp

- その他

第6章 調査手法

Introduction to Passive Authentication Market

The passive authentication market is rapidly transforming the landscape of cybersecurity and user experience, melding them into an intuitive and seamless interaction. As digital transactions and online activities become ubiquitous across various sectors, the need for security measures that do not impede user convenience has escalated. Passive authentication, by verifying users' identities unobtrusively through the analysis of behaviour patterns and biometrics, offers an ideal solution. In an optimistic scenario, the market, valued at $1.92 billion in 2024, is anticipated to grow at a CAGR of 21.26%, reaching $13.20 billion by 2034. This technology harnesses data like keystroke dynamics, device handling patterns, and even biometric readings, processed in real-time, to authenticate users without their active participation. The rise of this market is fueled by the increasing integration of digital technologies in everyday life and the corresponding need for non-intrusive security solutions that ensure both safety and ease of use.

One of the primary drivers of the passive authentication market is the heightened demand within the financial services sector. Banks and financial institutions are particularly keen adopters, leveraging this technology to enhance security while improving customer experience. For instance, major banks have implemented systems that analyze how a user types of their password or interacts with a banking app, allowing for continuous authentication that detects any unusual behaviour indicative of fraud. This application not only secures transactions but also streamlines the user experience, negating the need for repeated manual authentication steps. Similarly, in retail, passive authentication systems are used to prevent fraud in online transactions, subtly verifying users through their interaction patterns without disrupting the shopping experience.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $1.92 Billion |

| 2034 Forecast | $13.20 Billion |

| CAGR | 21.26% |

However, the market faces significant challenges, particularly regarding data privacy and the ethical use of biometric information. Users often express concerns about how their data is being monitored, stored, and used. Regulatory challenges are also prominent as companies must navigate complex landscapes like the European Union's General Data Protection Regulation (GDPR), which imposes stringent restrictions on data usage. An instance of these challenges can be seen in the consumer backlash against certain tech companies, where users questioned the extent of data monitoring and its security. Such incidents highlight the need for transparent practices and robust data protection measures to gain and maintain public trust.

The passive authentication market presents numerous opportunities, particularly through expansion into new verticals that have yet to fully adopt advanced security practices. Education and healthcare are prime examples where the integration of passive authentication can revolutionize security protocols. In schools and universities, this technology can enhance data security and access control systems, seamlessly verifying the identity of students and staff as they access various digital resources. In healthcare, passive authentication can secure access to patient records and hospital systems, ensuring that sensitive information is accessed only by authorized personnel, thus improving compliance with health data protection standards. The ongoing advancement of technology and the increasing sophistication of cyber threats are likely to spur further innovations and adoption in the passive authentication market, making it a critical component of future security ecosystems.

Market Segmentation

Segmentation 1: by End-use Industry

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Telecom and IT

- Retail and consumer goods

- Healthcare

- Media and entertainment

- Others

Segmentation 2: by Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Segmentation 3: by Deployment Type

- On-premises

- Cloud

Segmentation 4: by Component

- Services

- Solution

Segmentation 5: by Business Function

- Compliance management

- Marketing management

- Risk management

- Others

Segmentation 6: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global passive authentication market has been extensively segmented based on various categories, such as end-use industry, business function, component, deployment type, and organization size. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global passive authentication market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- IBM Corporation

- Cisco Systems, Inc.

- NEC Corporation

- Nuance Communications, Inc.

- BioCatch Ltd.

Key Questions Answered in this Report:

- What are the main factors driving the demand for passive authentication market?

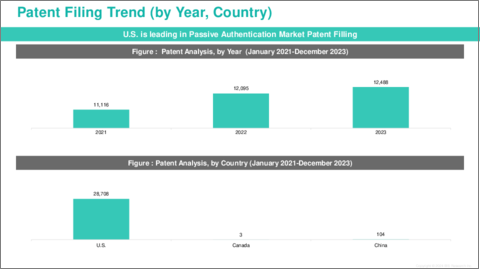

- What are the major patents filed by the companies active in the passive authentication market?

- Who are the key players in thepassive authentication market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the passive authentication market?

- What are the strategies adopted by the key companies to gain a competitive edge in passive authentication market?

- What is the futuristic outlook for the passive authentication market in terms of growth potential?

- What is the current estimation of the passive authentication market and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates forpassive authentication market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Passive Authentication Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Passive Authentication Market (by End-use Industry)

- 2.3.1 Banking, Financial Services, and Insurance (BFSI)

- 2.3.2 Government

- 2.3.3 Telecom and IT

- 2.3.4 Retail and consumer goods

- 2.3.5 Healthcare

- 2.3.6 Media and entertainment

- 2.3.7 Others

3. Passive Authentication Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Passive Authentication Market (by Organization Size)

- 3.3.1 Small and Medium-sized Enterprises (SMEs)

- 3.3.2 Large enterprises

- 3.4 Passive Authentication Market (by Deployment Type)

- 3.4.1 On-premises

- 3.4.2 Cloud

- 3.5 Passive Authentication Market (by Component)

- 3.5.1 Solution

- 3.5.2 Services

- 3.6 Passive Authentication Market (by Business Function)

- 3.6.1 Compliance management

- 3.6.2 Marketing management

- 3.6.3 Risk management.

- 3.6.4 Others

4. Passive Authentication Market (by Region)

- 4.1 Passive Authentication Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 IBM Corporation

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Cisco Systems, Inc.

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Thales Group

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 NEC Corporation

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 OneSpan, Inc.

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Verint Systems, Inc.

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Aware, Inc.

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Pindrop Security, Inc.

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Equifax, Inc.

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Nuance Communications, Inc.

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 BioCatch Ltd.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 ID R&D Inc.

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Fortress Identity

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Early Warning Services

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Trust Stamp

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Others

- 5.2.1 IBM Corporation