|

|

市場調査レポート

商品コード

1556451

アジア太平洋の生物農薬と生物肥料市場:作物タイプ別、製品タイプ別、由来別、剤形剤別、国別 - 分析と予測(2023年~2033年)Asia-Pacific Biopesticides and Biofertilizers Market: Focus on Crop Type, Product Type, Source, Formulation, and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の生物農薬と生物肥料市場:作物タイプ別、製品タイプ別、由来別、剤形剤別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年09月18日

発行: BIS Research

ページ情報: 英文 69 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の生物農薬と生物肥料の市場規模は、2023年に12億9,000万米ドルとなりました。

同市場は、14.21%のCAGRで拡大し、2033年には48億7,000万米ドルに達すると予測されています。生物農薬と生物肥料は、アジア太平洋地域では従来の化学物質投入に対して多くの利点を提供し、農業慣行を完全に変える可能性を秘めています。これらのバイオベースの代用品は、少ない資源で従来の農業に関連する土壌侵食や汚染を軽減することができます。生物農薬や生物肥料に持続可能な生産方法を用いることで、環境への悪影響が大幅に軽減され、温室効果ガスの排出量も減少する可能性があるといいます。さらに、抗生物質の使用を減らすことで、バイオベースのソリューションの使用は食中毒のリスクを減らし、より健全な生態系を育む可能性があります。生物農薬と生物肥料は、アジア太平洋で持続可能な農業への需要が高まる中、生態系に優しい農法を推進する上で重要な役割を果たすことが期待されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 12億9,000万米ドル |

| 2033年の予測 | 48億7,000万米ドル |

| CAGR | 14.21% |

アジア太平洋における生物農薬と生物肥料の市場は、持続可能な農法へのニーズの高まりにより大きく拡大しています。化学農薬や化学肥料の影響に対する環境問題の高まりが、農家や農業関連企業を、土壌の健全性と作物保護のための持続可能な解決策を提供するバイオベースの代替物の使用に駆り立てています。自然の栄養循環によって植物の成長を促すバイオ肥料や、天然生物に由来するバイオ農薬は、化学物質依存との戦いにおいて不可欠なツールになりつつあります。

有機農業や持続可能な農業への移行を促進するため、アジア太平洋全域の政府が法律を制定し、生物農薬や生物肥料の使用を奨励するインセンティブを提供しています。こうしたバイオベースの製品は、作物の収穫量を増やし、汚染、温室効果ガスの排出、土壌劣化を減少させ、長期的な土壌肥沃度を維持するため、特に望ましいです。さらに、有機農産物や無化学肥料農産物に対する消費者の需要の高まりが、市場の拡大を後押ししています。

微生物製剤の技術的進歩と、より効果的な生物農薬および生物肥料の開発が、この地域全体での採用をさらに後押ししています。アジア太平洋が環境の持続可能性と食糧安全保障を優先し続ける中、生物農薬と生物肥料市場は力強い成長を遂げ、技術革新と投資の大きな機会を提供します。

当レポートでは、アジア太平洋の生物農薬と生物肥料市場について調査し、市場の概要とともに、作物タイプ別、製品タイプ別、由来別、剤形剤別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 市場力学の概要

第2章 地域

- 地域別概要

- 促進要因と抑制要因

- アジア太平洋

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- UPL

- T.Stanes and Company Limited

- AgriLife (India) Private Limited

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Biopesticides and Biofertilizers Market (by Crop Type), $Million, 2022, 2026, and 2033

- Figure 2: Asia-Pacific Biopesticides and Biofertilizers Market (by Product Type), $Million, 2022, 2026, and 2033

- Figure 3: Asia-Pacific Biopesticides and Biofertilizers Market (by Source), $Million, 2022, 2026, and 2033

- Figure 4: Asia-Pacific Biopesticides and Biofertilizers Market (by Formulation), $Million, 2022, 2026, and 2033

- Figure 5: Biopesticides and Biofertilizers Market, Recent Developments

- Figure 6: Supply Chain and Risks within the Supply Chain

- Figure 7: Patent Analysis (by Product Type), January 2020-December 2023

- Figure 8: Patent Analysis (by Country), January 2020-December 2023

- Figure 9: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 10: Pesticide Consumption (by Country), Kiloton, 2020

- Figure 11: China Biopesticides and Biofertilizers Market, $Million, 2022-2033

- Figure 12: Japan Biopesticides and Biofertilizers Market, $Million, 2022-2033

- Figure 13: Australia and New Zealand Biopesticides and Biofertilizers Market, $Million, 2022-2033

- Figure 14: India Biopesticides and Biofertilizers Market, $Million, 2022-2033

- Figure 15: Indonesia Biopesticides and Biofertilizers Market, $Million, 2022-2033

- Figure 16: Rest-of-Asia-Pacific Biopesticides and Biofertilizers Market, $Million, 2022-2033

- Figure 17: Strategic Initiatives, 2020-2023

- Figure 18: Share of Strategic Initiatives

- Figure 19: Data Triangulation

- Figure 20: Top-Down and Bottom-Up Approach

- Figure 21: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Biopesticides and Biofertilizers Market, Opportunities across Regions

- Table 3: Pricing Analysis (by Product Type), $/Kg, 2022-2033

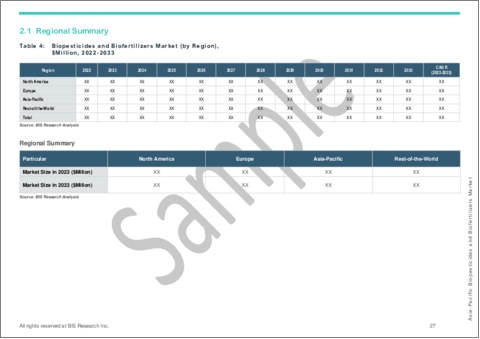

- Table 4: Biopesticides and Biofertilizers Market (by Region), $Million, 2022-2033

- Table 5: Asia-Pacific Biopesticides and Biofertilizers Market (by Crop Type), $Million, 2022-2033

- Table 6: Asia-Pacific Biopesticides and Biofertilizers Market (by Product Type), $Million, 2022-2033

- Table 7: Asia-Pacific Biopesticides and Biofertilizers Market (by Source), $Million, 2022-2033

- Table 8: Asia-Pacific Biopesticides and Biofertilizers Market (by Formulation), $Million, 2022-2033

- Table 9: China Biopesticides and Biofertilizers Market (by Crop Type), $Million, 2022-2033

- Table 10: China Biopesticides and Biofertilizers Market (by Product Type), $Million, 2022-2033

- Table 11: China Biopesticides and Biofertilizers Market (by Source), $Million, 2022-2033

- Table 12: China Biopesticides and Biofertilizers Market (by Formulation), $Million, 2022-2033

- Table 13: Japan Biopesticides and Biofertilizers Market (by Crop Type), $Million, 2022-2033

- Table 14: Japan Biopesticides and Biofertilizers Market (by Product Type), $Million, 2022-2033

- Table 15: Japan Biopesticides and Biofertilizers Market (by Source), $Million, 2022-2033

- Table 16: Japan Biopesticides and Biofertilizers Market (by Formulation), $Million, 2022-2033

- Table 17: Australia and New Zealand Biopesticides and Biofertilizers Market (by Crop Type), $Million, 2022-2033

- Table 18: Australia and New Zealand Biopesticides and Biofertilizers Market (by Product Type), $Million, 2022-2033

- Table 19: Australia and New Zealand Biopesticides and Biofertilizers Market (by Source), $Million, 2022-2033

- Table 20: Australia and New Zealand Biopesticides and Biofertilizers Market (by Formulation), $Million, 2022-2033

- Table 21: India Biopesticides and Biofertilizers Market (by Crop Type), $Million, 2022-2033

- Table 22: India Biopesticides and Biofertilizers Market (by Product Type), $Million, 2022-2033

- Table 23: India Biopesticides and Biofertilizers Market (by Source), $Million, 2022-2033

- Table 24: India Biopesticides and Biofertilizers Market (by Formulation), $Million, 2022-2033

- Table 25: Indonesia Biopesticides and Biofertilizers Market (by Crop Type), $Million, 2022-2033

- Table 26: Indonesia Biopesticides and Biofertilizers Market (by Product Type), $Million, 2022-2033

- Table 27: Indonesia Biopesticides and Biofertilizers Market (by Source), $Million, 2022-2033

- Table 28: Indonesia Biopesticides and Biofertilizers Market (by Formulation), $Million, 2022-2033

- Table 29: Rest-of-Asia-Pacific Biopesticides and Biofertilizers Market (by Crop Type), $Million, 2022-2033

- Table 30: Rest-of-Asia-Pacific Biopesticides and Biofertilizers Market (by Product Type), $Million, 2022-2033

- Table 31: Rest-of-Asia-Pacific Biopesticides and Biofertilizers Market (by Source), $Million, 2022-2033

- Table 32: Rest-of-Asia-Pacific Biopesticides and Biofertilizers Market (by Formulation), $Million, 2022-2033

- Table 33: Market Share

Introduction to Asia-Pacific Biopesticides and Biofertilizers Market

The Asia-Pacific biopesticides and biofertilizers market was valued at $1.29 billion in 2023, and it is expected to grow at a CAGR of 14.21% and reach $4.87 billion by 2033. Biopesticides and biofertilizers provide a number of advantages over conventional chemical inputs in the APAC region, and they have the potential to completely change agricultural practices. These bio-based substitutes can lessen soil erosion and pollution linked to conventional farming while using fewer resources. According to research, using sustainable production methods for biopesticides and biofertilizers may significantly lessen their negative effects on the environment, possibly even resulting in a decrease in greenhouse gas emissions. Furthermore, by reducing the use of antibiotics, the use of bio-based solutions may reduce the risk of foodborne illnesses and foster healthier ecosystems. Biopesticides and biofertilizers are well-positioned to play a crucial role in promoting ecologically friendly farming practices as the demand for sustainable agriculture grows in Asia-Pacific.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $1.29 Billion |

| 2033 Forecast | $4.87 Billion |

| CAGR | 14.21% |

The market for biopesticides and biofertilizers in the Asia-Pacific area is expanding significantly due to the region's growing need for sustainable farming methods. Growing environmental concerns about the effects of chemical pesticides and fertilizers are pushing farmers and agribusinesses to use bio-based alternatives that provide sustainable solutions for soil health and crop protection. Biofertilizers, which encourage plant growth through natural nutrient cycling, and biopesticides, which are derived from natural organisms, are becoming essential tools in the fight against chemical dependency.

To encourage the transition to organic farming and sustainable agriculture, governments throughout Asia-Pacific are enacting laws and offering incentives to encourage the use of biopesticides and biofertilizers. These bio-based products are especially desirable because they increase crop yields and decrease pollution, greenhouse gas emissions, soil degradation and maintaining long-term soil fertility. Additionally, increasing consumer demand for organic and chemical-free produce is pushing the market's expansion.

Technological advancements in microbial formulations and the development of more effective biopesticides and biofertilizers are further boosting adoption across the region. As APAC continues to prioritize environmental sustainability and food security, the biopesticides and biofertilizers market is set for robust growth, offering significant opportunities for innovation and investment.

Market Segmentation

Segmentation 1: by Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

Segmentation 2: by Product Type

- Biofertilizers

- Nitrogen Fixing

- Phosphate Stabilizers

- Others

- Biopesticides

- Bioinsecticides

- Biofungicides

- Bioherbicides

- Others

Segmentation 3: by Source

- Microorganism

- Bacteria

- Fungi

- Others

- Plant-Incorporated Protectants

- Biochemical

Segmentation 4: by Formulation

- Liquid

- Solid

Segmentation 5: by Country

- China

- Japan

- Australia and New Zealand

- India

- Indonesia

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of the biopesticides and biofertilizers available based on crop type (cereals and grains, oil seeds and pulses, fruits and vegetables, and others), product type (biofertilizers (nitrogen fixing, phosphate stabilizers, and others) and (biopesticides (bioinsecticides, biofungicides, bioherbicides, and others)), source (microorganism (bacteria (Rhizobium, Azotobacter, Azospirillum, and others), fungi, and others), plant-incorporated protectants, and biochemical) formulation (solid and liquid). The market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of biopesticides and biofertilizers. Therefore, the biopesticides and biofertilizers market is a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The Asia-Pacific biopesticides and biofertilizers market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development and partnerships and collaborations.

Competitive Strategy: The key players in the Asia-Pacific biopesticides and biofertilizers market analyzed and profiled in the study include biopesticides and biofertilizers manufacturers. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies in the biopesticides and biofertilizers market that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names in the market are:

- UPL

- T.Stanes and Company Limited

- AgriLife (India) Private Limited

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Overview

- 1.1.2 Rising Investments in Bio-Agriculture

- 1.1.3 Increasing Usage of Liquid Biofertilizers and Biopesticides as a Sustainable Solution for Agriculture

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Product Type and Country)

- 1.4 Regulatory Landscape

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Increase in Demand for Organic Food Due to Growing Awareness of the Adverse Impacts of Chemical Pesticides and Fertilizers on Human Health and Environment

- 1.5.1.2 Government Mandates and Phase-Out of Key Chemical Active Ingredients

- 1.5.2 Market Challenges

- 1.5.2.1 Technological Limitations for the Use of Biological Products

- 1.5.2.2 Preference for Chemical Pesticides among Farmers

- 1.5.3 Market Opportunities

- 1.5.3.1 Growth Opportunities in Developing Regions such as Asia-Pacific and Rest-of-the-World

- 1.5.3.2 Adoption of Nano-Biopesticides and Cutting-Edge Genetic Engineering Technology

- 1.5.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Asia-Pacific

- 2.3.1 Regional Overview

- 2.3.2 Driving Factors for Market Growth

- 2.3.3 Factors Challenging the Market

- 2.3.4 Application

- 2.3.5 Product

- 2.3.6 China

- 2.3.7 Japan

- 2.3.8 Australia and New Zealand

- 2.3.9 India

- 2.3.10 Indonesia

- 2.3.11 Rest-of-Asia-Pacific

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 UPL

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share

- 3.2.2 T.Stanes and Company Limited

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share

- 3.2.3 AgriLife (India) Private Limited

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share

- 3.2.4 Gujarat State Fertilizers & Chemicals Limited (GSFC)

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share

- 3.2.1 UPL

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast