|

|

市場調査レポート

商品コード

1529092

戦術データリンク市場- 世界および地域別分析:用途別、プラットフォーム別、コンポーネント別、周波数別、地域別 - 分析と予測(2024年~2034年)Tactical Data Link Market - A Global and Regional Analysis: Focus on Application, Platform, Component, Frequency, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 戦術データリンク市場- 世界および地域別分析:用途別、プラットフォーム別、コンポーネント別、周波数別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年08月08日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

戦術データリンクの市場規模は、様々な市場促進要因に後押しされ、大きな成長を遂げています。

楽観的シナリオでは、2024年の市場規模は94億5,000万米ドルと評価され、CAGR 5.01%で拡大し、2034年には154億1,000万米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 94億5,000万米ドル |

| 2034年の予測 | 154億1,000万米ドル |

| CAGR | 5.01% |

戦術データリンクは、リアルタイムのデータ交換と軍事プラットフォーム間の相互運用可能な通信を促進し、状況認識と作戦効果を高める上で重要な役割を果たしています。持続可能性と環境保護を重視する傾向が高まっていることも、世界の戦術データリンク市場の重要な促進要因となっています。さらに、無人システム、自律型プラットフォーム、ネットワーク中心戦争のコンセプトの統合が進んでいることも、市場の成長をさらに後押ししています。

ソフトウェア定義アーキテクチャ、人工知能、機械学習などの技術的進歩は、戦術データリンクシステムの展望を再形成し、より大きな柔軟性、相互運用性、セキュリティを提供しています。さらに、サイバー脅威が高まる中、サイバーセキュリティへの注目が高まっており、戦術データリンクソリューションにおける強固な暗号化とサイバーセキュリティ対策の重要性が強調されています。

当レポートでは、世界の戦術データリンク市場について調査し、市場の概要とともに、用途別、プラットフォーム別、コンポーネント別、周波数別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 戦術データリンク市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 戦術データリンク市場(用途別)

- 戦術データリンク市場(プラットフォーム別)

第3章 戦術データリンク市場(製品別)

- 製品セグメンテーション

- 製品概要

- 戦術データリンク市場(コンポーネント別)

- 戦術データリンク市場(周波数別)

- 戦術データリンク市場(データリンクタイプ別)

第4章 戦術データリンク市場(地域別)

- 戦術データリンク市場- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- BAE Systems

- General Dynamics Corporation

- Collins Aerospace

- Honeywell International Inc.

- Northrop Grumman

- L3Harris Technologies, Inc.

- Viasat, Inc.

- Thales

- Lockheed Martin Corporation

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Saab AB

- Curtiss-Wright Corporation

- ASELSAN

- Leidos

第6章 調査手法

Introduction to Tactical Data Link Market

The tactical data link market is undergoing significant growth, propelled by various key factors and market drivers. In an optimistic scenario, the market is evaluated at a valuation of $9.45 billion in 2024 and is projected to expand at a CAGR of 5.01% to reach $15.41 billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $9.45 Billion |

| 2034 Forecast | $15.41 Billion |

| CAGR | 5.01% |

Tactical data links play a critical role in facilitating real-time data exchange and interoperable communication between military platforms, enhancing situational awareness, and operational effectiveness. The rising emphasis on sustainability and environmental conservation acts as another significant driver for the global tactical data link market. Additionally, the growing integration of unmanned systems, autonomous platforms, and network-centric warfare concepts further fuels market growth.

Technological advancements such as software-defined architectures, artificial intelligence, and machine learning are reshaping the landscape of tactical data link systems, offering greater flexibility, interoperability, and security. Moreover, the increasing focus on cybersecurity amid rising cyber threats underscores the importance of robust encryption and cybersecurity measures in tactical data link solutions.

Furthermore, technological advancements and innovations in tactical data link are creating lucrative opportunities for market expansion. Companies specializing in rail composites, such as Collins Aerospace, L3harris Technologies, Inc., Thales are at the forefront of developing cutting-edge solutions tailored to the specific needs of the industry. Their expertise in composite materials, engineering capabilities, and customer-centric approach are instrumental in shaping the global tactical data link market landscape.

Overall, the tactical data link market presents lucrative opportunities for manufacturers, suppliers, and service providers. Understanding the market dynamics, technological trends, and regional developments is essential for stakeholders to capitalize on emerging opportunities and navigate challenges in this competitive landscape.

Market Segmentation:

Segmentation 1: by Application

- Command and Control

- Intelligence, Surveillance and Reconnaissance

- Electronic Warfare

- Radio Communications

Segmentation 2: by Platform

- Ground

- Airbourne

- Naval

- Unmanned Systems

- Weapons

Segmentation 3: by Component

- Hardware

- Terminals

- Radio Sets

- Modems

- Routers

- Controllers

- Transceivers

- Monitors

- Others

- Software Solutions

Segmentation 4: by Frequency

- High Frequency

- Ultra High Frequency

Segmentation 5: by Data Link Type

- Link 11

- Link 16

- Link 22

- Others

Segmentation 6: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a comprehensive product/innovation strategy for the tactical data link market, identifying opportunities for market entry, technology adoption, and sustainable growth. It offers actionable insights, helping organizations gain a competitive edge, and capitalize on the increasing demand.

Growth/Marketing Strategy: This report offers a comprehensive growth and marketing strategy designed specifically for the tactical data link market. It presents a targeted approach to identifying specialized market segments, establishing a competitive advantage, and implementing creative marketing initiatives aimed at optimizing market share and financial performance. By harnessing these strategic recommendations, organizations can elevate their market presence, seize emerging prospects, and efficiently propel revenue expansion.

Competitive Strategy: This report crafts a strong competitive strategy tailored to the tactical data link market. It evaluates market rivals, suggests methods to stand out, and offers guidance for maintaining a competitive edge. By adhering to these strategic directives, companies can position themselves effectively in the face of market competition, ensuring sustained prosperity and profitability.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- BAE Systems

- Collins Aerospace

- General Dynamics Corporation

- Honeywell International Inc.

- Northrop Grumman

- L3Harris Technologies, Inc.

- Viasat, Inc.

- Lockheed Martin Corporation

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

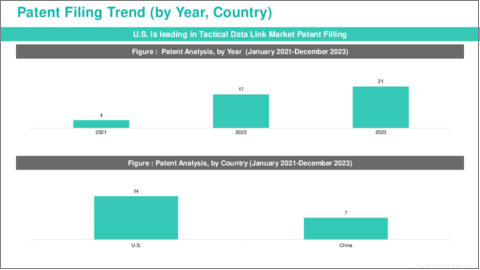

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Tactical Data Link Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Tactical Data Link Market (by Application)

- 2.3.1 Command and Control

- 2.3.2 Intelligence, Surveillance and Reconnaissance

- 2.3.3 Electronic Warfare

- 2.3.4 Radio Communications

- 2.4 Tactical Data Link Market (by Platform)

- 2.4.1 Ground

- 2.4.2 Airbourne

- 2.4.3 Naval

- 2.4.4 Unmanned Systems

- 2.4.5 Weapons

3. Tactical Data Link Market (by Products)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Tactical Data Link Market (by Component)

- 3.3.1 Hardware

- 3.3.1.1 Terminals

- 3.3.1.2 Radio Sets

- 3.3.1.3 Modems

- 3.3.1.4 Routers

- 3.3.1.5 Controllers

- 3.3.1.6 Transceivers

- 3.3.1.7 Monitors

- 3.3.1.8 Others

- 3.3.2 Software Solutions

- 3.3.1 Hardware

- 3.4 Tactical Data Link Market (by Frequency)

- 3.4.1 High Frequency

- 3.4.2 Ultra-High Frequency

- 3.5 Tactical Data Link Market (by Data Link Type)

- 3.5.1 Link 11

- 3.5.2 Link 16

- 3.5.3 Link 22

- 3.5.4 Others

4. Tactical Data Link Market by Region

- 4.1 Tactical Data Link Market - by Region

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Spain

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.3.11 Rest-of-Europe

- 4.3.11.1 Market by Application

- 4.3.11.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 BAE Systems

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 General Dynamics Corporation

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Collins Aerospace

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 Honeywell International Inc.

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Northrop Grumman

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 L3Harris Technologies, Inc.

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Viasat, Inc.

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Thales

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Lockheed Martin Corporation

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Leonardo S.p.A.

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Elbit Systems Ltd.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Saab AB

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Curtiss-Wright Corporation

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 ASELSAN

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Leidos

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.1 BAE Systems