|

|

市場調査レポート

商品コード

1524068

欧州の不耕起および最小耕起装置市場:製品別、用途別、国別 - 分析と予測(2023年~2028年)Europe No-Till and Minimum-Till Equipment Market: Focus on Product, Application, and Country - Analysis and Forecast, 2023-2028 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の不耕起および最小耕起装置市場:製品別、用途別、国別 - 分析と予測(2023年~2028年) |

|

出版日: 2024年08月01日

発行: BIS Research

ページ情報: 英文 72 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の不耕起および最小耕起装置の市場規模(英国を除く)は、2023年に13億3,930万米ドルとなりました。

同市場は、2038年には17億5,350万米ドルに達すると予測され、予測期間の2023年~2028年のCAGRは5.54%になる見込みです。不耕起および最小耕起装置市場は、世界の農業界における継続的な技術進歩の結果、予測期間中に急速に拡大すると予想されます。被覆作物戦略は、土壌の健全性と肥沃度を向上させることにより、不耕起および最小耕起装置分野の成長を加速させます。農家は、浸食を減らし、雑草を制御し、有機物を改善するために被覆作物を使用します。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2028年 |

| 2023年の評価 | 13億3,930万米ドル |

| 2028年の予測 | 17億5,350万米ドル |

| CAGR | 5.54% |

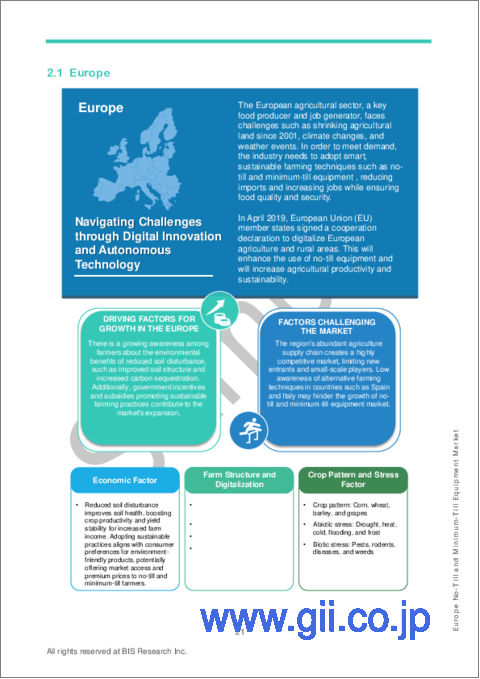

欧州の不耕起および最小耕起装置市場は、持続可能な農法に対する意識の高まりと土壌の健全性を向上させる必要性によって急速に拡大しています。不耕起・最小耕起農法は土壌の撹乱を減らし、保水性を高め、炭素固定を増加させる。こうした農法は、欧州の農家が厳しい環境規制を満たし、より環境に優しい農業技術を導入しようと努力していることから、人気を集めています。

ドイツ、フランス、英国などの主要国では、持続可能な農業の促進を目的とした政府の奨励策や研究イニシアティブに後押しされ、不耕起栽培や最小耕起栽培機器の使用を先駆的に進めています。この市場の特徴は、土壌の健全性を維持しながら作物の収量を最大化することを目的とした、播種・植え付け機械の技術的進歩です。

持続可能な農業ソリューションへの需要が高まるにつれて、欧州の不耕起・最小耕起機械市場はさらに拡大し、環境と農業生産性に大きなメリットをもたらすことになります。

当レポートでは、欧州の不耕起および最小耕起装置市場について調査し、市場の概要とともに、製品別、用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

調査範囲

エグゼクティブサマリー

第1章 市場

- 業界展望

- ビジネスダイナミクス

- 資金調達と投資の情勢

第2章 地域

- 欧州

- 英国

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競争ポジションマトリックス

- 市場シェア分析

- 企業プロファイル

- Vaderstad Group

- Salford Group Inc.

- CNH Industrial N.V.

第4章 調査手法

List of Figures

- Figure 1: Factors Driving the Need for No-Till and Minimum-Till Equipment Market

- Figure 2: Europe No-Till and Minimum-Till Equipment Market, $Billion, 2022-2028

- Figure 3: Europe No-Till and Minimum-Till Equipment Market (by Application), $Billion, 2022-2028

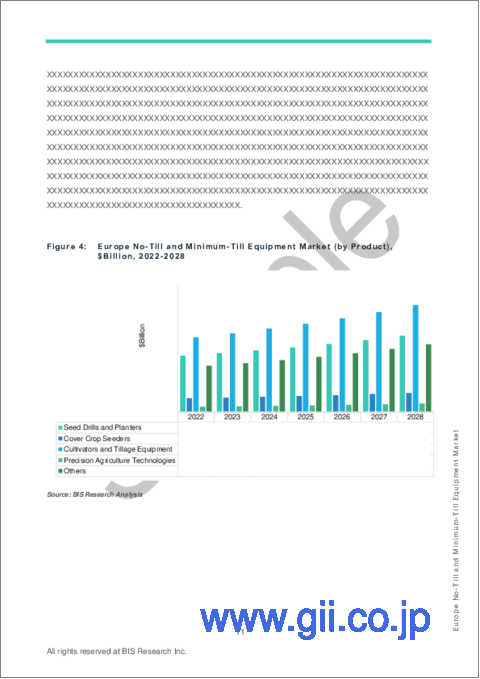

- Figure 4: Europe No-Till and Minimum-Till Equipment Market (by Product), $Billion, 2022-2028

- Figure 5: No-Till and Minimum-Till Equipment Market (by Region), $Billion, 2022

- Figure 6: Soil Fertility Trends After 10 Years (2005-2015) of Conservation Tillage in Organic Farming

- Figure 7: Winter Runoff Analysis: Treatment Comparison and Phase-Specific Means with Standard Errors in the Four-Year Rotation

- Figure 8: Comparison of Average Crop Machinery Cost Per Acre from 2010-2014 using No-Till and Tilled

- Figure 9: Share of Key Market Strategies and Developments, January 2019-November 2023

- Figure 10: Share of Product Development and Innovations (by Company), January 2019-November 2023

- Figure 11: Share of Market Development (by Company), January 2019-November 2023

- Figure 12: Share of Mergers and Acquisitions (by Company), January 2019- November 2023

- Figure 13: Comparison of Percentage of Corn Acres and their Yield Levels in Advanced No-Till and Minimum-Tilled

- Figure 14: Salford Group Inc.(part of Linamar Corporation) - Case Study

- Figure 15: Kinze Manufacturing - Case Study

- Figure 16: Investment and Funding Landscape (by Year), $Million, January 2019-November 2023

- Figure 17: Investment and Funding Landscape (by Company), Share (%), January 2019-November 2023

- Figure 18: Investment and Funding Landscape (by Country), Share (%), January 2019-November 2023

- Figure 19: Competitive Benchmarking for Key No-Till and Minimum-Till Equipment Providers

- Figure 20: Market Share Analysis of No-Till and Minimum-Till Equipment Market, 2022

- Figure 21: Vaderstad Group: Product and Customer Portfolio Analysis

- Figure 22: Salford Group Inc: Product and Customer Portfolio Analysis

- Figure 23: CNH Industrial N.V.: Product and Customer Portfolio Analysis

- Figure 24: Data Triangulation

- Figure 25: Top-Down and Bottom-Up Approach

- Figure 26: Assumptions and Limitations

List of Tables

- Table 1: Key Consortiums and Associations in the Europe No-Till and Minimum-Till Equipment Market

- Table 2: Description and Impact of Government Initiative

Introduction to Europe No-Till and Minimum-Till Equipment Market

The Europe no-till and minimum-till equipment market (excluding U.K.) was valued at $1,339.3 million in 2023 and is expected to reach $1,753.5 million by 2038, growing at a CAGR of 5.54% during the forecast period 2023-2028. The market for no-till and minimum-till equipment is expected to expand rapidly over the forecast period as a result of ongoing technological advancements in the global agricultural industry. Cover cropping strategies accelerate growth in the no-till and minimum-till equipment sectors by improving soil health and fertility. Farmers use cover crops to reduce erosion, control weeds, and improve organic matter.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2028 |

| 2023 Evaluation | $1,339.3 Million |

| 2028 Forecast | $1,753.5 Million |

| CAGR | 5.54% |

Market Introduction

The European no-till and minimum-till equipment market is expanding rapidly, driven by growing awareness of sustainable agricultural practices and the need to improve soil health. No-till and minimum-till farming methods reduce soil disturbance, improve water retention, and increase carbon sequestration. These practices are gaining popularity as European farmers strive to meet stringent environmental regulations and implement more environmentally friendly farming techniques.

Key countries such as Germany, France, and the United Kingdom are pioneering the use of no-till and minimum-till equipment, aided by government incentives and research initiatives aimed at promoting sustainable agriculture. The market is characterized by technological advancements in seeding and planting machinery, which are intended to maximize crop yields while maintaining soil integrity.

As the demand for sustainable farming solutions grows, Europe's no-till and minimum-till equipment markets are set to expand further, providing significant environmental and agricultural productivity benefits.

Market Segmentation

Segmentation 1: by Application

- Farms and Agricultural Fields

- Orchards and Vineyards

- Pastures and Grazing Lands

- Nurseries and Urban Agriculture

- Others

Segmentation 2: by Product

- Seed Drills and Planters

- Cover Crop Seeders

- Cultivators and Tillage Equipment

- Precision Agriculture Technologies

- Others

Segmentation 3: by Region

- Europe - Germany, France, Netherlands, Italy, Belgium, Ukraine, Switzerland, Greece, and Rest-of-Europe

- U.K.

How can this report add value to an organization?

Product/Innovation Strategy: In the dynamic landscape of the no-till and minimum-till equipment market, significant advancements are revolutionizing agricultural practices, with a dedicated focus on optimizing farm performance. Harnessing cutting-edge solutions, including AI-driven analytics and real-time monitoring platforms, no-till and minimum-till equipment provide detailed insights into soil health, crop management, and resource utilization. Innovations such as precision agriculture techniques contribute to efficient farming practices, ensuring optimal crop yield and environmental sustainability. The market encompasses a diverse range of solutions, from state-of-the-art planting equipment to precision seeding systems, empowering farmers to enhance operational efficiency and minimize resource utilization effectively.

Growth/Marketing Strategy: The Europe no-till and minimum-till equipment market is undergoing a remarkable transformation, mirroring the growth strategies observed in the server GPU sector. Key players in the industry are strategically expanding their business horizons, fostering collaborations, and entering partnerships to fortify their global presence. This trend aligns with the shift toward climate-smart agriculture, where companies are not only focused on technological advancements but also on sustainable farming practices. The synergy between technology firms and agricultural experts is driving the development of cutting-edge, climate-smart monitoring tools. Joint ventures and collaborative initiatives are instrumental in integrating diverse expertise, ultimately enhancing the market presence of these climate-smart solutions. This collaborative approach is pivotal in creating comprehensive, user-friendly, and efficient solutions for the evolving landscape of no-till and minimum-till agriculture.

Competitive Strategy: In the ever-evolving landscape of the Europe no-till and minimum-till equipment market, manufacturers are diversifying their product offerings to address a wide range of agricultural needs and practices. Comprehensive competitive analysis underscores the specific capabilities of market participants, showcasing their tailored solutions and specialized knowledge in different regions. Collaborations with agricultural research institutions and technology organizations play a crucial role in fostering innovation and steering the continual transformation of the no-till and minimum-till equipment sector.

Table of Contents

Scope of the Study

Executive Summary

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Ongoing Trends

- 1.1.1.1 Expansion of Cover Cropping Techniques for Soil Health Enhancement

- 1.1.1.2 Integration of Digital Farming Platforms for Data-Driven Decision-Making

- 1.1.1.3 Emerging Automation in No-Till and Minimum-Till Equipment

- 1.1.2 Ecosystem/Ongoing Programs

- 1.1.2.1 Consortiums and Associations

- 1.1.2.2 Government Initiatives and their Impacts

- 1.1.1 Ongoing Trends

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Environmental Sustainability and Soil Health

- 1.2.1.2 Water Conservation and Efficiency

- 1.2.1.3 Reduced Chemical Usage and Pesticide Management

- 1.2.1.4 Governmental Support and Policy Initiatives

- 1.2.2 Business Challenges

- 1.2.2.1 Initial Capital Investments

- 1.2.2.2 Supply Chain Disruptions in the No-Till and Minimum-Till Equipment Market

- 1.2.2.3 Knowledge and Skill Gap

- 1.2.3 Market Strategies and Developments

- 1.2.3.1 Business Strategies

- 1.2.3.1.1 Product Development and Innovations

- 1.2.3.1.2 Market Development

- 1.2.3.2 Corporate Strategies

- 1.2.3.2.1 Mergers and Acquisitions

- 1.2.3.2.2 Partnerships, Collaborations, Joint Ventures, and Alliances

- 1.2.3.2.3 Others

- 1.2.3.1 Business Strategies

- 1.2.4 Business Opportunities

- 1.2.4.1 Advanced No-Till and Minimum-Till Equipment Technology

- 1.2.4.2 Eco-Friendly Farming Input Supply Chain

- 1.2.5 Case Studies

- 1.2.1 Business Drivers

- 1.3 Funding and Investment Landscape

- 1.3.1 Funding Analysis (by Year)

- 1.3.2 Funding Analysis (by Company)

- 1.3.3 Funding Analysis (by Country)

2 Regions

- 2.1 Europe

- 2.1.1 Europe (by Country)

- 2.1.1.1 Italy

- 2.1.1.2 France

- 2.1.1.3 Germany

- 2.1.1.4 Netherland

- 2.1.1.5 Belgium

- 2.1.1.6 Switzerland

- 2.1.1.7 Greece

- 2.1.1.8 Ukraine

- 2.1.1.9 Rest-of-Europe

- 2.1.1 Europe (by Country)

- 2.2 U. K.

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.1.1 Competitive Position Matrix

- 3.1.2 Market Share Analysis

- 3.2 Company Profiles

- 3.2.1 Vaderstad Group

- 3.2.1.1 Company Overview

- 3.2.1.2 Product and Customer Portfolio Analysis

- 3.2.2 Salford Group Inc. (part of Linamar Corporation)

- 3.2.2.1 Company Overview

- 3.2.2.2 Product and Customer Portfolio Analysis

- 3.2.3 CNH Industrial N.V.

- 3.2.3.1 Company Overview

- 3.2.3.2 Product and Customer Portfolio Analysis

- 3.2.1 Vaderstad Group

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.2 Market Estimation and Forecast

- 4.2.1 Factors for Data Prediction and Modeling