|

|

市場調査レポート

商品コード

1510276

自動車用フィルター市場- 世界および地域別分析:車両タイプ別、推進力タイプ別、フィルタータイプ別、地域別 - 分析と予測(2024年~2034年)Automotive Filters Market - A Global and Regional Analysis: Focus on Vehicle Type, Propulsion Type, Filter Type, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用フィルター市場- 世界および地域別分析:車両タイプ別、推進力タイプ別、フィルタータイプ別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年07月10日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

自動車用フィルターの市場規模は、様々な市場促進要因に後押しされ、著しい成長を遂げています。

楽観的シナリオでは、2024年の市場規模は132億9,000万米ドルと評価され、2.25%のCAGRで拡大し、2034年には166億米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 132億9,000万米ドル |

| 2034年の予測 | 166億米ドル |

| CAGR | 2.25% |

道路インフラの強化や自動車販売の増加に伴う世界の自動車保有台数の拡大により、自動車用フィルターの需要は大幅に増加する見通しです。自動車の性能を最大限に維持し、機械的な故障を回避するためには、これらのフィルターを適時に交換することが不可欠です。乗用車セグメントでは、必須フィルターの交換間隔は通常OEMの推奨に沿ったものとなっており、エアフィルター、オイルフィルター、燃料フィルターは年1回、キャビンフィルターは年2回の交換が必要です。乗用車と大型商用車の保有台数の増加が予想されるため、自動車用フィルターのアフターマーケット需要は旺盛です。この需要の高まりは、自動車業界の進化するニーズに適応する上で、フィルターメーカーとサプライヤーの重要な役割を浮き彫りにしています。

自動車用フィルター市場は、高度なろ過技術の採用により促進されています。この変化は、濾過効率、耐久性、環境持続可能性の向上を業界が追求し続けていることに起因しています。ナノファイバーフィルター、活性炭フィルター、高効率微粒子空気(HEPA)フィルターなどの先端技術は、より微細な粒子や汚染物質を捕捉する優れた性能により、脚光を浴びています。自動車メーカーとフィルターメーカーが技術革新と持続可能性を優先するにつれて、高度なろ過技術の統合が加速し、市場成長が促進され、消費者によりクリーンで健康的な運転体験が提供されると予想されます。

当レポートでは、世界の自動車用フィルター市場について調査し、市場の概要とともに、車両タイプ別、推進力タイプ別、フィルタータイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 自動車用フィルター市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 自動車用フィルター市場(車両タイプ別)

- 自動車用フィルター市場(推進タイプ別)

第3章 自動車用フィルター市場(製品別)

- 製品セグメンテーション

- 製品概要

- 自動車用フィルター市場(フィルタータイプ別)

第4章 自動車用フィルター市場(地域別)

- 自動車用フィルター市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- MANN+HUMMEL

- Donaldson Company, Inc.

- Robert Bosch GmbH

- MAHLE GmbH

- Sogefi SpA

- DENSO CORPORATION

- Ahlstrom

- TOYOTA BOSHOKU CORPORATION

- Parker Hannifin Corp

- Cummins Inc.

- Freudenberg Group

- UFI Filters

- Hengst SE

- K&N Engineering, Inc.

- GUD Holdings Limited

第6章 調査手法

Introduction to Automotive Filters Market

The automotive filters market is undergoing significant growth, propelled by various key factors and market drivers. In an optimistic scenario, the market is evaluated at a valuation of $13.29 billion in 2024 and is projected to expand at a CAGR of 2.25% to reach $16.60 billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $13.29 Billion |

| 2034 Forecast | $16.60 Billion |

| CAGR | 2.25% |

The expansion of global vehicle fleets, driven by enhancements in road infrastructure and increased vehicle sales, is poised to significantly elevate the demand for automotive filters. Timely replacement of these filters is imperative to maintain peak vehicle performance and avert mechanical breakdowns. In the passenger car segment, replacement intervals for essential filters typically align with OEM recommendations, necessitating annual replacement for air, oil, and fuel filters, while cabin filters require replacement biannually. With the anticipated growth in passenger and heavy commercial vehicle fleets, a robust aftermarket demand for automotive filters emerges. This escalating demand underscores the critical role of filter manufacturers and suppliers in adapting to the evolving needs of the automotive industry.

The automotive filters market is witnessing a notable trend towards the adoption of advanced filtration technologies. This shift is driven by the industry's continuous pursuit of enhancing filtration efficiency, durability, and environmental sustainability. Advanced technologies such as nanofiber filters, activated carbon filters, and high-efficiency particulate air (HEPA) filters are gaining prominence due to their superior performance in capturing finer particles and pollutants. As automakers and filter manufacturers prioritize innovation and sustainability, the integration of advanced filtration technologies is expected to accelerate, driving market growth and offering consumers cleaner and healthier driving experiences.

Furthermore, technological advancements and innovations in automotive filter manufacturing processes are creating lucrative opportunities for market expansion. Companies specializing in automotive filters, such as MANN+HUMMEL, Robert Bosch Gmbh, and Donaldson Company, Inc., are at the forefront of developing cutting-edge solutions tailored to the specific needs of the automotive filters market. Their expertise in automotive filters, engineering capabilities, and customer-centric approach are instrumental in shaping the global automotive filters market landscape.

Overall, the global automotive filters market is witnessing robust growth, driven increase in advanced filtration technologies durable, and increasing demand for electric vehicle (ev) filters, coupled with technological advancements and innovations in filter manufacturing.

Market Segmentation:

Segmentation 1: by Vehicle Type

- Passenger Cars

- Light Commercial Vehicle (LCV)

- Trucks

- Buses

Segmentation 2: by Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Vehicles

Segmentation 3: by Filter Type

- Air Filter

- Oil Filter

- Fuel Filter

- Coolant Filter

- Others

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global automotive filters market has been extensively segmented based on various categories, such as vehicle type, propulsion type, and filter type. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global global automotive filters market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- MANN+HUMMEL

- Donaldson Company, Inc.

- Robert Bosch GmbH

- MAHLE GmbH

- Sogefi SpA

- DENSO CORPORATION

- Ahlstrom

- Parker Hannifin Corp

- Cummins Inc.

Key Questions Answered in this Report:

- What are the main factors driving the demand for automotive filters market?

- What are the major patents filed by the companies active in the automotive filters market?

- Who are the key players in the automotive filters market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the automotive filters market?

- What are the strategies adopted by the key companies to gain a competitive edge in automotive filters market?

- What is the futuristic outlook for the automotive filters market in terms of growth potential?

- What is the current estimation of the automotive filters market and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for automotive filters market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Increase in Advanced Filtration Technologies

- 1.1.2 Increasing Demand for Electric Vehicle (EV) Filters

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

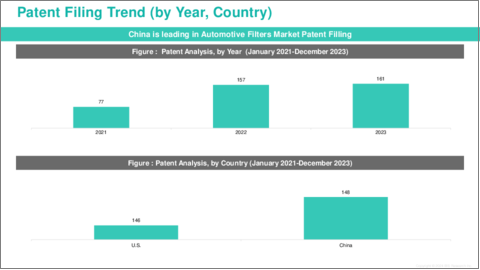

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Automotive Filters Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Automotive Filters Market (by Vehicle Type)

- 2.3.1 Passenger Vehicle

- 2.3.2 Light Commercial Vehicle (LCV)

- 2.3.3 Trucks

- 2.3.4 Buses

- 2.4 Automotive Filters Market (by Propulsion Type)

- 2.4.1 Internal Combustion Engine (ICE)

- 2.4.2 Electric Vehicles

3. Automotive Filters Market (by Products)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Automotive Filters Market (by Filter Type)

- 3.3.1 Air Filter

- 3.3.2 Oil Filter

- 3.3.3 Fuel Filter

- 3.3.4 Coolant Filter

- 3.3.5 Others

4. Automotive Filters Market (by Region)

- 4.1 Automotive Filters Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Spain

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.3.11 Rest-of-Europe

- 4.3.11.1 Market by Application

- 4.3.11.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 MANN+HUMMEL

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Donaldson Company, Inc.

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Robert Bosch GmbH

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 MAHLE GmbH

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Sogefi SpA

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 DENSO CORPORATION

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Ahlstrom

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 TOYOTA BOSHOKU CORPORATION

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Parker Hannifin Corp

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Cummins Inc.

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Freudenberg Group

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 UFI Filters

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Hengst SE

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 K&N Engineering, Inc.

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 GUD Holdings Limited

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.1 MANN+HUMMEL