|

|

市場調査レポート

商品コード

1510275

生分解性プラスチック市場- 世界および地域別分析:最終用途産業別、タイプ別、地域別 - 分析と予測(2024年~2034年)Biodegradable Plastics Market - A Global and Regional Analysis: Focus on End-use Industry, Type, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 生分解性プラスチック市場- 世界および地域別分析:最終用途産業別、タイプ別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年07月10日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

生分解性プラスチック市場は、特にプラスチック廃棄物の削減とカーボンフットプリントの最小化を目指す地域において、従来のプラスチックに関連する環境問題を解決する有望なソリューションとして浮上しています。

生分解性プラスチックは、植物由来材料や廃棄物バイオマスなどの再生可能な資源に由来し、様々な用途に持続可能な代替手段を提供するため、世界中の産業で採用が進んでいます。市場規模は、2024年に101億4,000万米ドルになるとみられ、CAGR 16.33%で成長し、2034年には460億3,000万米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 101億4,000万米ドル |

| 2034年の予測 | 460億3,000万米ドル |

| CAGR | 16.33% |

環境意識の高まりとプラスチック汚染を軽減するための厳しい規制が、生分解性プラスチックの需要を促進しています。さらに、持続可能な慣行と循環型経済原則への注目の高まりが、市場の成長を促進しています。さらに、バイオプラスチック製造技術の進歩は、再生可能な原料の統合とともに、今後数年間の市場拡大を促進すると予想されています。

その可能性にもかかわらず、生分解性プラスチック市場は、拡張性、費用対効果、使用済み製品の管理に関する課題に直面しています。しかし、こうした課題はバリューチェーン全体における革新と協力の機会にもなります。さらに、持続可能なパッケージング・ソリューションとバイオベース材料に向けた市場の進化は、市場参入企業が新たな動向と消費者の嗜好を活用する道を提供しています。

当レポートでは、世界の生分解性プラスチック市場について調査し、市場の概要とともに、最終用途産業別、タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 生分解性プラスチック市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 生分解性プラスチック市場(最終用途産業別)

第3章 生分解性プラスチック市場(製品別)

- 製品セグメンテーション

- 製品概要

- 生分解性プラスチック市場(タイプ別)

第4章 生分解性プラスチック市場(地域別)

- 生分解性プラスチック市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- BASF SE

- NATUREWORKS

- NOVAMONT

- TOTAL CORBION

- BIOME BIOPLASTICS

- DANIMER SCIENTIFIC

- FKUR KUNSTSOFF

- MITSUBISHI CHEMICAL HOLDING CORPORATION

- PLANTIC TECHNOLOGIES

- TORAY INDUSTRIES

- FUTERRO

- GREEN DOT BIOPLASTICS

- SYNBRA TECHNOLOGIES

- SPHERE

- TIANAN BIOLOGIC MATERIALS

- その他の主要参入企業

第6章 調査手法

Introduction to the Biodegradable Plastics Market

The biodegradable plastics market has emerged as a promising solution to address environmental concerns associated with conventional plastics, particularly in regions aiming to reduce plastic waste and minimize carbon footprint. Biodegradable plastics, derived from renewable sources such as plant-based materials or waste biomass, offer a sustainable alternative for various applications, driving their adoption across industries worldwide. In an optimistic projection, the market, valued at $10.14 billion in 2024, is projected to grow at a CAGR of 16.33%, reaching $46.03 billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $10.14 Billion |

| 2034 Forecast | $46.03 Billion |

| CAGR | 16.33% |

Rising environmental awareness coupled with stringent regulations to mitigate plastic pollution are driving the demand for biodegradable plastics. Additionally, the increasing focus on sustainable practices and circular economy principles is fostering market growth. Furthermore, advancements in bioplastic manufacturing technologies, along with the integration of renewable feedstocks, are anticipated to drive market expansion in the coming years.

Despite its potential, the biodegradable plastics market faces challenges related to scalability, cost-effectiveness, and end-of-life management. However, these challenges also present opportunities for innovation and collaboration across the value chain. Moreover, the market's evolution towards sustainable packaging solutions and bio-based materials offers avenues for market players to capitalize on emerging trends and consumer preferences.

Europe, led by the U.K., Germany, and Italy, dominates the biodegradable plastics market, owing to stringent regulatory frameworks and growing consumer demand for eco-friendly products. Additionally, technological advancements in biopolymer production and sustainable packaging solutions enhance Europe's competitiveness in the market. Moreover, the region's robust industrial infrastructure and focus on environmental sustainability drive the adoption of biodegradable plastics across various sectors, solidifying its position as a key player in the global market.

Key players such as NatureWorks, BASF SE, and Total Corbion are at the forefront of market expansion, leveraging their expertise and strategic partnerships to drive innovation and capture a significant market share. Companies are investing in research and development to enhance the performance and versatility of biodegradable plastics, catering to diverse end-user applications. For instance, in March 2023, NatureWorks announced a strategic partnership with a leading packaging manufacturer to develop compostable packaging solutions for food and beverage applications. Investments in infrastructure and sustainable production processes are crucial for the growth and scalability of the biodegradable plastics market, supporting its integration into existing supply chains and waste management systems.

Market Segmentation:

Segmentation 1: by End-Use Industry

- Packaging

- Consumer Goods

- Textiles

- Agriculture & Horticulture

- Others

Segmentation 2: by Type

- PLA

- Starch Blends

- PHA

- Biodegradable Polyesters

- Others

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global biodegradable plastics market has been extensively segmented based on various categories, such as type, end-use industry, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global biodegradable plastics market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- BASF SE

- NATUREWORKS

- NOVAMONT

- TOTAL CORBION

- BIOME BIOPLASTICS

- PLANTIC TECHNOLOGIES

Key Questions Answered in this Report:

- What are the main factors driving the demand for biodegradable plastics market?

- What are the major patents filed by the companies active in biodegradable plastics market?

- Who are the key players in the biodegradable plastics market, and what are their respective market shares?

- What are the strategies adopted by the key companies to gain a competitive edge in biodegradable plastics market?

- What is the futuristic outlook for the biodegradable plastics market in terms of growth potential?

- What is the current estimation of the biodegradable plastics market, and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for biodegradable plastics market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

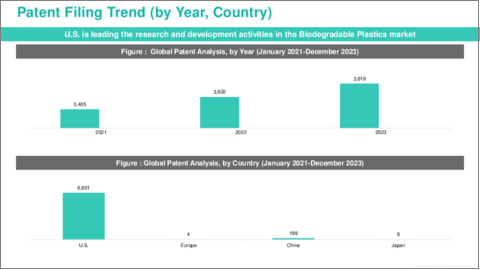

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Biodegradable Plastics Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Biodegradable Plastics Market (by End-use Industry)

- 2.3.1 Packaging

- 2.3.1.1 Rigid Packaging

- 2.3.1.2 Flexible Packaging

- 2.3.2 Consumer Goods

- 2.3.2.1 Electrical Appliances

- 2.3.2.2 Domestic Appliances

- 2.3.2.3 Others

- 2.3.3 Textiles

- 2.3.3.1 Medical & Healthcare Textile

- 2.3.3.2 Personal care, clothes, and other textiles

- 2.3.4 Agriculture & Horticulture

- 2.3.4.1 Tapes & Mulch Films

- 2.3.4.2 Others

- 2.3.5 Others

- 2.3.1 Packaging

3. Biodegradable Plastics Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Biodegradable Plastics Market (by Type)

- 3.3.1 PLA

- 3.3.2 Starch Blends

- 3.3.3 PHA

- 3.3.4 Biodegradable Polyesters

- 3.3.4.1 PCL

- 3.3.4.2 PBAT

- 3.3.4.3 PBS

- 3.3.5 Others

- 3.3.5.1 Regenerative Cellulose

- 3.3.5.2 Cellulose Derivative

4. Biodegradable Plastics Market (by Region)

- 4.1 Biodegradable Plastics Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America Biodegradable Plastics Market (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Market by Application

- 4.2.6.1.2 Market by Product

- 4.2.6.2 Canada

- 4.2.6.3 Mexico

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe Biodegradable Plastics Market (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 France

- 4.3.6.3 U.K.

- 4.3.6.4 Italy

- 4.3.6.5 Rest-of-Europe

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific Biodegradable Plastics Market (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 Japan

- 4.4.6.3 India

- 4.4.6.4 South Korea

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World Biodegradable Plastics Market (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.1 South America

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 BASF SE

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 NATUREWORKS

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 NOVAMONT

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 TOTAL CORBION

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 BIOME BIOPLASTICS

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 DANIMER SCIENTIFIC

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 FKUR KUNSTSOFF

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 MITSUBISHI CHEMICAL HOLDING CORPORATION

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 PLANTIC TECHNOLOGIES

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 TORAY INDUSTRIES

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 FUTERRO

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 GREEN DOT BIOPLASTICS

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 SYNBRA TECHNOLOGIES

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 SPHERE

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 TIANAN BIOLOGIC MATERIALS

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.16 Other Key Players

- 5.3.1 BASF SE