|

|

市場調査レポート

商品コード

1501762

航空宇宙用リベット装置の世界市場- 世界および地域別分析:リベットタイプ別、装置タイプ別、技術別、最終用途別、地域別 - 分析と予測(2024年~2034年)Aerospace Riveting Equipment Market - A Global and Regional Analysis: Focus on Rivet Type, Equipment Type, Technology, End Use, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 航空宇宙用リベット装置の世界市場- 世界および地域別分析:リベットタイプ別、装置タイプ別、技術別、最終用途別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年06月28日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

航空宇宙用リベット装置の市場規模は、民間航空、軍事防衛、宇宙探査を含む航空宇宙部門の拡大により、大きな成長を経験しています。

楽観的シナリオを考慮すると、市場は2024年に1億1,880万米ドルと評価され、CAGR4.58%で拡大し、2034年には1億8,590万米ドルに達すると予想されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年評価 | 1億1,880万米ドル |

| 2034年予測 | 1億8,590万米ドル |

| CAGR | 4.58% |

高度なリベット装置の需要は、より耐久性があり軽量な航空機の必要性によって煽られています。自動リベッティングマシンやプログラム可能なロボットシステムのような革新は、強化された精度と労働コストの削減を提供するので、ますます人気が高まっています。さらに、航空機構造における複合材やチタンのような新素材へのシフトは、構造的完全性を損なうことなくこれらの材料を扱うことができる特殊なリベッティング技術の開発を促しています。

地域的には、北米と欧州が成熟した航空宇宙産業と主要な航空機製造業者と供給業者の存在に起因して、かなりの市場シェアを占めています。しかし、アジア太平洋は、航空インフラへの投資の増加や世界の航空宇宙大手による製造施設の設立により、急成長市場として浮上しています。自動化に向けた進行中の動向と、より効率的な航空機を求める世界の動きは、航空宇宙用リベット装置市場を引き続き前進させると予想されます。

航空宇宙用リベット装置市場における相手先ブランド製造業者(OEM)セグメントの優位性は、いくつかの重要な要因に起因します。第一に、OEMは航空機製造の最前線にあり、安全性、性能、効率のための進化する業界標準を満たすために革新的なリベッティングソリューションを絶えず求めています。航空機の設計がより高度になり、複合材のような材料が脚光を浴びるにつれて、OEMは正確な組立と構造的完全性を保証するために最先端のリベット装置に依存しています。加えて、航空旅行需要の増加や航空会社による機体拡大構想などの要因による新しい航空機の需要の増加が、OEMセグメントの成長を促進しています。

当レポートでは、世界の航空宇宙用リベット装置市場について調査し、市場の概要とともに、リベットタイプ別、装置タイプ別、技術別、最終用途別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の見通し

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 航空宇宙用リベット装置市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 航空宇宙用リベット装置市場(最終用途別)

第3章 航空宇宙用リベット装置市場(製品別)

- 製品セグメンテーション

- 製品概要

- 航空宇宙用リベット装置市場(リベットタイプ別)

- 航空宇宙用リベット装置市場(機器タイプ別)

- 航空宇宙用リベット装置市場(技術別)

第4章 航空宇宙用リベット装置市場(地域別)

- 航空宇宙用リベット装置市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- Atlas Copco AB

- Bollhoff Group

- Broetje-Automation GmbH

- Cherry Aerospace

- Dassault Systemes

- Eaton

- Howmet Aerospace Inc.

- Ingersoll Rand

- LAS Aerospace Ltd

- Lockheed Martin Corporation

- MP Industrial

- Northrop Grumman

- SFS Group Germany GmbH

- STANLEY Engineered Fastening

- Sumake Industrial Co., Ltd.

- その他の主要企業

第6章 調査手法

Introduction to Aerospace Riveting Equipment Market

The aerospace riveting equipment market is experiencing significant growth, driven by the expanding aerospace sector, which includes commercial aviation, military defense, and space exploration. Considering the optimistic scenario the market is valued at $118.8 million in 2024 and is expected to grow at a CAGR of 4.58% to reach $185.9 million by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $118.8 Million |

| 2034 Forecast | $185.9 Million |

| CAGR | 4.58% |

The demand for advanced riveting equipment is fueled by the need for more durable and lightweight aircraft, which are crucial for improving fuel efficiency and reducing emissions. Innovations such as automated riveting machines and programmable robotic systems are becoming increasingly popular, as they offer enhanced precision and reduced labor costs. Additionally, the shift towards newer materials such as composites and titanium in aircraft construction is prompting the development of specialized riveting technologies that can handle these materials without compromising structural integrity.

Regionally, North America and Europe hold substantial market shares, attributed to their mature aerospace industries and the presence of major aircraft manufacturers and suppliers. However, Asia-Pacific is emerging as a rapidly growing market, thanks to increasing investments in aviation infrastructure and the establishment of manufacturing facilities by global aerospace giants. The ongoing trend towards automation and the global push for more efficient aircraft are expected to continue driving the aerospace riveting equipment market forward.

The dominance of the original equipment manufacturer (OEM) segment in the aerospace riveting equipment market can be attributed to several key factors. Firstly, OEMs are at the forefront of aircraft production, continuously seeking innovative riveting solutions to meet evolving industry standards for safety, performance, and efficiency. As aircraft designs become more advanced and materials like composites gain prominence, OEMs rely on cutting-edge riveting equipment to ensure precise assembly and structural integrity. Additionally, the increasing demand for new aircraft, driven by factors such as rising air travel demand and fleet expansion initiatives by airlines, fuels the growth of the OEM segment.

As major OEMs like Boeing and others ramp up production to fulfill massive backlogs of aircraft orders, the demand for riveting equipment to support these manufacturing activities experiences a corresponding surge. Moreover, OEMs often establish long-term partnerships with riveting equipment suppliers to ensure access to cutting-edge technologies and reliable support services throughout the aircraft production lifecycle. This strategic collaboration between OEMs and equipment manufacturers further reinforces the OEM segment's leadership position in driving market growth within the aerospace riveting equipment industry.

North America's leadership in the aerospace riveting equipment market stems from its robust aerospace industry ecosystem, encompassing major manufacturers, suppliers, and research institutions. The region boasts a long-standing history of aviation innovation and technological expertise, with prominent companies like Boeing and Lockheed Martin Corporation driving advancements in aircraft design and production. Moreover, North America's substantial defense spending fuels demand for aerospace riveting equipment for military aircraft production and maintenance. Additionally, the region benefits from a skilled workforce and a supportive regulatory environment, facilitating the development and adoption of cutting-edge riveting technologies. These factors collectively position North America as a primary hub for aerospace riveting equipment, driving growth and innovation in the market.

In the competitive landscape of the aerospace riveting equipment market, several key players vie for market share and prominence. Established industry leaders such as Atlas Copco AB, Dassault Systemes, and Cherry Aerospace dominate the market with their extensive product portfolios and global presence. These companies leverage their technological expertise and longstanding partnerships with major aerospace manufacturers to maintain their competitive edge. Additionally, they continuously invest in research and development to introduce innovative riveting solutions that address evolving industry requirements, such as lightweight materials and automation integration. However, the market also features a multitude of smaller players and niche manufacturers that cater to specific segments or regional markets, offering specialized riveting equipment tailored to unique customer needs.

Moreover, the competitive landscape is characterized by strategic collaborations, mergers, and acquisitions aimed at expanding market reach and enhancing product offerings. Companies often engage in partnerships with aerospace manufacturers or technology providers to co-develop advanced riveting solutions or integrate complementary technologies. Furthermore, the increasing emphasis on sustainability and environmental responsibility presents an opportunity for companies to differentiate themselves through the development of eco-friendly riveting equipment and processes. Overall, the aerospace riveting equipment market is marked by intense competition, driving continuous innovation and advancement in riveting technologies to meet the evolving demands of the aerospace industry.

Market Segmentation:

Segmentation 1: by Rivet Type

- Blind Rivet

- Semi-Tubular Rivet

- Solid Rivet

- Others

Segmentation 2: by Equipment Type

- Hydraulic Riveting Equipment

- Pneumatic Riveting Equipment

- Electric Riveting Equipment

Segmentation 3: by Technology

- Automated Riveting Equipment

- Manual Riveting Equipment

Segmentation 4: by End Use

- Original Equipment Manufacturer (OEM)

- Maintenance, Repair, and Overhaul (MRO)

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global aerospace riveting equipment market has been extensively segmented based on various categories, such as rivet type, equipment type, technology, and end use. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global aerospace riveting equipment market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- Atlas Copco AB

- Broetje-Automation GmbH

- Cherry Aerospace

- Howmet Aerospace Inc.

Key Questions Answered in this Report:

- What are the main factors driving the demand for global aerospace riveting equipment market?

- How many patents have been filed by the companies active in the global aerospace riveting equipment market?

- Who are the key players in the global aerospace riveting equipment market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the global aerospace riveting equipment market?

- What are the strategies adopted by the key companies to gain a competitive edge in global aerospace riveting equipment market?

- What is the futuristic outlook for the global aerospace riveting equipment market in terms of growth potential?

- What is the current estimation of the global aerospace riveting equipment market and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- What could be the impact of growing application in the global aerospace riveting equipment market?

- Which regions demonstrate the highest adoption rates for global aerospace riveting equipment market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

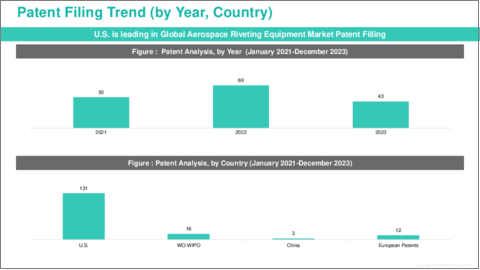

- 1.3.1 Patent Filing Trend by Year, by Country

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Aerospace Riveting Equipment Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Aerospace Riveting Equipment Market (by End Use)

- 2.3.1 Original Equipment Manufacturer (OEM)

- 2.3.2 Maintenance, Repair, and Overhaul (MRO)

3. Aerospace Riveting Equipment Market (by Products)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Aerospace Riveting Equipment Market (by Rivet Type)

- 3.3.1 Blind Rivet

- 3.3.2 Semi-Tubular Rivet

- 3.3.3 Solid Rivet

- 3.3.4 Others

- 3.4 Aerospace Riveting Equipment Market (by Equipment Type)

- 3.4.1 Hydraulic Riveting Equipment

- 3.4.2 Pneumatic Riveting Equipment

- 3.4.3 Electric Riveting Equipment

- 3.5 Aerospace Riveting Equipment Market (by Technology)

- 3.5.1 Automated Riveting Equipment

- 3.5.2 Manual Riveting Equipment

4. Aerospace Riveting Equipment Market (by Region)

- 4.1 Aerospace Riveting Equipment Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 Australia

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Atlas Copco AB

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Bollhoff Group

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Broetje-Automation GmbH

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 Cherry Aerospace

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Dassault Systemes

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Eaton

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Howmet Aerospace Inc.

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Ingersoll Rand

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 LAS Aerospace Ltd

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Lockheed Martin Corporation

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 MP Industrial

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Northrop Grumman

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 SFS Group Germany GmbH

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 STANLEY Engineered Fastening

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Sumake Industrial Co., Ltd.

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Other Key Players

- 5.2.1 Atlas Copco AB