|

|

市場調査レポート

商品コード

1489281

農業用潤滑油市場- 世界および地域別分析:農機具別、製品タイプ別、カテゴリータイプ別、地域別 - 分析と予測(2024年~2034年)Agricultural Lubricant Market - A Global and Regional Analysis: Focus on Farm Equipment, Product Type, Category Type, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 農業用潤滑油市場- 世界および地域別分析:農機具別、製品タイプ別、カテゴリータイプ別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年06月06日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

農業用潤滑油市場は、農機具の効率的な操作とメンテナンスの必要性により、農業機械産業全体の中で重要なセグメントとして浮上してきました。

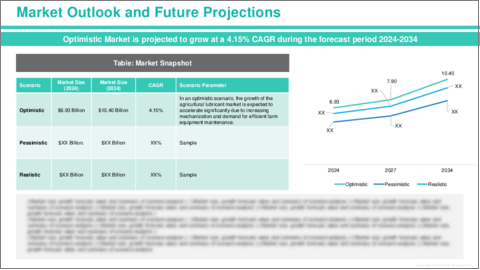

これらの特殊な潤滑剤は、農業環境に蔓延する過酷な条件に耐えるように配合されており、機械の円滑な機能と寿命の延長を保証しています。世界の農業の機械化と技術の進歩に伴い、農業用潤滑油の需要は着実に増加しています。楽観的シナリオを考慮すると、2024年の市場規模は69億3,000万米ドルで、CAGR 4.15%で成長し、2034年には104億米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年評価 | 69億3,000万米ドル |

| 2034年予測 | 104億米ドル |

| CAGR | 4.15% |

農業用潤滑油市場の成長を後押しする要因はいくつかあります。特に発展途上地域における農業セクターの拡大は、先進的な農業機械の導入に伴う大きな推進力となっています。さらに、持続可能な農業の実践が重視され、ダウンタイムとメンテナンスコストを削減する必要性が、高性能潤滑油の需要をさらに煽っています。さらに、精密農業への動向と潤滑油使用の利点に関する意識の高まりが、市場情勢を形成しています。

有望な成長見通しにもかかわらず、農業用潤滑油市場は、不安定な原材料価格や潤滑油の配合を管理する厳しい環境規制などの課題に直面しています。しかし、こうした課題は、市場参入企業が環境に優しい潤滑剤ソリューションを革新・開発する機会にもなっています。さらに、新興国における未開発の可能性と、バイオベースの潤滑油への注目の高まりは、市場の拡大と製品ポートフォリオの多様化の道を提供します。

当レポートでは、世界の農業用潤滑油市場について調査し、市場の概要とともに、農機具別、製品タイプ別、カテゴリータイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の見通し

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 農業用潤滑油市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 農業用潤滑油市場(農機具別)

第3章 農業用潤滑油市場(製品別)

- 製品セグメンテーション

- 製品概要

- 農業用潤滑油市場(製品タイプ別)

- 農業用潤滑油市場(カテゴリータイプ別)

第4章 農業用潤滑油市場(地域別)

- 農業用潤滑油市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- ExxonMobil Corporation

- Quaker Chemical Corporation

- Fuchs Petrolub SE

- BP p.l.c.

- TotalEnergies SE

- Apar Industries Ltd.

- Shell plc.

- Calumet Specialty Products Partners, L.P.

- Chevron Corporation

- China Petroleum & Chemical Corp (Sinopec Corporation)

- Repsol SA

- Phillips 66 Company

- Raj Petro Specialities Pvt. Ltd.

- Nynas AB

- Valvoline, Inc

- その他

第6章 調査手法

Introduction to Agricultural Lubricant Market

The agricultural lubricant market has emerged as a crucial segment within the broader agricultural machinery industry, driven by the need for efficient operation and maintenance of farm equipment. These specialized lubricants are formulated to withstand the harsh conditions prevalent in agricultural settings, ensuring smooth functioning and prolonged lifespan of machinery. With increasing mechanization and technological advancements in farming practices globally, the demand for agricultural lubricants is witnessing a steady rise. Considering the optimistic scenario the market is valued at $6.93 billion in 2024 and is expected to grow at a CAGR of 4.15% to reach $10.40 billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $6.93 Billion |

| 2034 Forecast | $10.40 Billion |

| CAGR | 4.15% |

Several factors propel the growth of the agricultural lubricant market. The expansion of the agricultural sector, particularly in developing regions, is a significant driver, accompanied by the adoption of advanced farming machinery. Moreover, the emphasis on sustainable agriculture practices and the need to reduce downtime and maintenance costs further fuel the demand for high-performance lubricants. Additionally, the trend towards precision farming and increasing awareness about the benefits of lubricant usage are shaping the market landscape.

Despite the promising growth prospects, the agricultural lubricant market faces challenges such as volatile raw material prices and stringent environmental regulations governing the formulation of lubricants. However, these challenges also present opportunities for market players to innovate and develop eco-friendly lubricant solutions. Furthermore, the untapped potential in emerging economies and the rising focus on bio-based lubricants offer avenues for market expansion and diversification of product portfolios.

North America and Europe are anticipated to dominate the agricultural lubricant market, attributed to the presence of established farming infrastructure and a strong focus on technological advancements. Leading companies in the market include Exxon Mobil Corporation, Chevron Corporation, FUCHS, and TotalEnergies, among others. These companies maintain their market positions through strategic partnerships, product innovation, and extensive distribution networks, catering to the diverse lubrication needs of agricultural machinery users worldwide.

Market Segmentation:

Segmentation 1: by Farm Equipment

- Tractors

- Combines

- Implements

Segmentation 2: by Product Type

- Engine Oil

- UTTO (Transmission and Hydraulic Oil)

- Coolant

- Grease

Segmentation 3: by Category Type

- Mineral-oil Based Lubricants

- Synthetic-oil Based Lubricants

- Bio-oil Based Lubricants

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global agricultural lubricant market has been extensively segmented based on various categories, such as farm equipment, product type, and category type. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global agricultural lubricant market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- ExxonMobil Corporation

- Shell plc.

- TotalEnergies SE

- BP p.l.c.

- Phillips 66 Company

- Valvoline, Inc

Key Questions Answered in this Report:

- What are the main factors driving the demand for agricultural lubricant market?

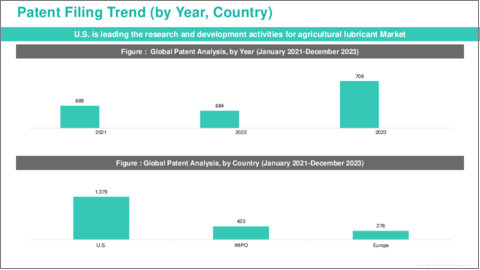

- What are the major patents filed by the companies active in agricultural lubricant market?

- Who are the key players in the agricultural lubricant market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the agricultural lubricant market?

- What are the strategies adopted by the key companies to gain a competitive edge in agricultural lubricant market?

- What is the futuristic outlook for the agricultural lubricant market in terms of growth potential?

- What is the current estimation of the agricultural lubricant market, and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for agricultural lubricant market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Agricultural Lubricant Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Agricultural Lubricant Market (by Farm Equipment)

- 2.3.1 Tractors

- 2.3.2 Combines

- 2.3.3 Implements

3. Agricultural Lubricant Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Agricultural Lubricant Market (by Product Type)

- 3.3.1 Engine Oil

- 3.3.2 UTTO (Transmission and Hydraulic Oil)

- 3.3.3 Coolant

- 3.3.4 Grease

- 3.4 Agricultural Lubricant Market (by Category Type)

- 3.4.1 Mineral-oil Based Lubricants

- 3.4.2 Synthetic-oil Based Lubricants

- 3.4.3 Bio-oil Based Lubricants

4. Agricultural Lubricant Market (by Region)

- 4.1 Agricultural Lubricant Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Spain

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.3.11 Rest-of-Europe

- 4.3.11.1 Market by Application

- 4.3.11.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 Rest-of-Asia-Pacific

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 ExxonMobil Corporation

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Quaker Chemical Corporation

- 5.2.1 ExxonMobil Corporation

- 5.2.2.1. Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Fuchs Petrolub SE

- 5.2.3.1. Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 BP p.l.c.

- 5.2.4.1. Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 TotalEnergies SE

- 5.2.5.1. Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Apar Industries Ltd.

- 5.2.6.1. Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Shell plc.

- 5.2.7.1. Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Calumet Specialty Products Partners, L.P.

- 5.2.8.1. Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Chevron Corporation

- 5.2.9.1. Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 China Petroleum & Chemical Corp (Sinopec Corporation)

- 5.2.10.1. Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Repsol SA

- 5.2.11.1. Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Phillips 66 Company

- 5.2.12.1. Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Raj Petro Specialities Pvt. Ltd.

- 5.2.13.1. Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Nynas AB

- 5.2.14.1. Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Valvoline, Inc

- 5.2.15.1. Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Others