|

|

市場調査レポート

商品コード

1485695

防衛エレクトロニクスの陳腐化市場- 世界および地域別分析:タイプ別、システム別、プラットフォーム別、地域別 - 分析と予測(2024年~2034年)Defense Electronics Obsolescence Market - A Global and Regional Analysis: Focus on Type, System, Platform, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 防衛エレクトロニクスの陳腐化市場- 世界および地域別分析:タイプ別、システム別、プラットフォーム別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年05月29日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

防衛エレクトロニクスの陳腐化市場は、世界の技術進歩や防衛戦略の進化に牽引され、大きな変革期を迎えています。

防衛システムの高度な電子部品への依存度が高まるにつれ、陳腐化管理の課題はより切迫したものとなっています。楽観的シナリオを考慮すると、2024年の市場規模は28億8,000万米ドルで、7.83%のCAGRで拡大し、2034年には61億2,000万米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年評価 | 28億8,000万米ドル |

| 2034年予測 | 61億2,000万米ドル |

| CAGR | 7.83% |

政府や防衛関連企業は、老朽化したシステムを維持しながら新技術を統合するというジレンマに取り組んでおり、しばしば製造中止部品、製造ソースの減少、進化するサイバーセキュリティの脅威などの問題に直面しています。このため、防衛エレクトロニクスシステムの寿命と有効性を確保するために、ライフサイクル予測、技術投入、サプライチェーンの回復力などの陳腐化管理ソリューションに対する需要が高まっています。

さらに、防衛エレクトロニクスの陳腐化市場では、陳腐化管理に対する積極的かつ予測的なアプローチへのシフトが見られます。技術革新の急速なペースに伴い、利害関係者は陳腐化リスクを予測し、ミッションクリティカルなシステムに影響を与える前に軽減する戦略を採用しつつあります。この動向は、予測分析、アジャイル開発手法、共同サプライチェーンパートナーシップへの投資を促進し、陳腐化の課題に直面した際の俊敏性と回復力を高めています。さらに、モジュラー設計やオープンアーキテクチャ設計の台頭により、アップグレードや部品交換が容易になり、特定のベンダーへの依存度が低下し、長期的には陳腐化リスクが軽減されます。全体として、防衛機関が近代化の取り組みを優先し、作戦準備態勢を維持するための革新的なソリューションを求めていることから、防衛用電子機器の陳腐化市場はさらなる成長の態勢を整えています。

当レポートでは、世界の防衛エレクトロニクスの陳腐化市場について調査し、市場の概要とともに、タイプ別、システム別、プラットフォーム別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の見通し

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- バリューチェーン分析

- 価格予測

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 使用事例

- エンドユーザーと購入基準

- 主要な世界的イベントの影響分析

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 防衛エレクトロニクスの陳腐化市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 防衛エレクトロニクスの陳腐化市場(プラットフォーム別)

第3章 防衛エレクトロニクスの陳腐化市場(製品別)

- 製品セグメンテーション

- 製品概要

- 防衛エレクトロニクスの陳腐化市場(タイプ別)

- 防衛エレクトロニクスの陳腐化市場(システム別)

第4章 防衛エレクトロニクスの陳腐化市場(地域別)

- 防衛エレクトロニクスの陳腐化市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- RTX

- BAE Systems

- L3Harris Technologies, Inc.

- Thales

- Elbit Systems Ltd.

- Northrop Grumman

- Lockheed Martin Corporation

- General Dynamics Corporation

- Boeing

- Airbus

- Leonardo S.p.A.

- Saab AB

- Sparton

- Rheinmetall AG

- Dassault Aviation

- その他

第6章 調査手法

Introduction to Defense Electronics Obsolescence Market

The defense electronics obsolescence market is undergoing a significant transformation driven by technological advancements and evolving defense strategies worldwide. As defense systems become increasingly reliant on sophisticated electronic components, the challenge of obsolescence management becomes more pressing. Considering the optimistic scenario the market is valued at $2.88 Billion in 2024 and is expected to grow at a CAGR of 7.83% to reach $6.12 Billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $2.88 Billion |

| 2034 Forecast | $6.12 Billion |

| CAGR | 7.83% |

Governments and defense contractors are grappling with the dilemma of maintaining aging systems while integrating new technologies, often facing issues such as discontinued parts, diminishing manufacturing sources, and evolving cybersecurity threats. This has fueled a growing demand for obsolescence management solutions, including lifecycle forecasting, technology insertion, and supply chain resilience, to ensure the longevity and effectiveness of defense electronics systems.

Moreover, the defense electronics obsolescence market is witnessing a shift towards proactive and predictive approaches to obsolescence management. With the rapid pace of technological innovation, stakeholders are adopting strategies that anticipate obsolescence risks and mitigate them before they impact mission-critical systems. This trend is driving investment in predictive analytics, agile development methodologies, and collaborative supply chain partnerships to enhance agility and resilience in the face of obsolescence challenges. Additionally, the rise of modular and open architecture designs is enabling easier upgrades and component replacements, reducing reliance on specific vendors and mitigating obsolescence risks in the long term. Overall, the defense electronics obsolescence market is poised for further growth as defense organizations prioritize modernization efforts and seek innovative solutions to sustain operational readiness.

Based on the platform, the market has been segmented into land, naval, and airborne. Based on type, the market has been segmented into logistics obsolescence, functional obsolescence, and technology obsolescence.

North America leads the defense electronics obsolescence market due to its substantial defense spending, advanced technological base, and robust industrial capabilities. The region's dominance is supported by strategic investments in research and development, ensuring that its defense systems remain operationally effective and technologically advanced. This leadership is crucial in maintaining global stability and protecting national security interests amid increasing geopolitical complexities. The focus on innovative obsolescence management strategies further strengthens North America's position in the market.

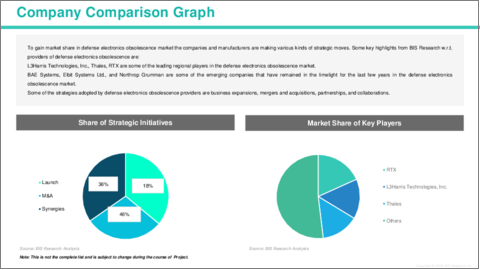

In the competitive landscape of the defense electronics obsolescence market, several key players are vying for market share by offering comprehensive solutions to address the evolving needs of defense organizations. Established companies such as BAE Systems, Lockheed Martin Corporation, and Northrop Grumman continue to dominate the market with their extensive experience in defense systems integration and obsolescence management. These industry giants leverage their global presence, technological expertise, and long-standing relationships with defense agencies to deliver tailored solutions that mitigate obsolescence risks and ensure the reliability of critical defense electronics.

Furthermore, recent developments in the market have seen the emergence of innovative solutions aimed at tackling obsolescence challenges more effectively. One notable launch in April 2023 in this product category is the introduction of AI-driven predictive analytics platforms by companies like Raytheon Technologies. These advanced analytics tools harness machine learning algorithms to forecast obsolescence risks, optimize inventory management, and facilitate proactive decision-making. Such advancements not only enhance the competitiveness of market incumbents but also pave the way for a new era of intelligent obsolescence management in the defense electronics sector. As competition intensifies, companies are expected to continue investing in technological innovation and strategic partnerships to maintain their competitive edge in this dynamic market landscape.

Market Segmentation:

Segmentation 1: by Platform

- Land

- Naval

- Airborne

Segmentation 2: by Type

- Logistics Obsolescence

- Functional Obsolescence

- Technology Obsolescence

Segmentation 3: by System

- Communication System

- Navigation System

- Human Machine Interface

- Flight Control System

- Targeting System

- Electronic Warfare System

- Sensors

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this Report add value to an Organization?

Product/Innovation Strategy: The global defense electronics obsolescence market has been extensively segmented based on various categories, such as platform, type, and system. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global defense electronics obsolescence market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, type portfolio, and market penetration.

Some prominent names in the market include:

- RTX

- BAE Systems

- L3Harris Technologies, Inc.

- Thales

- Elbit Systems Ltd.

Key Questions Answered in this Report:

- What are the main factors driving the demand for defense electronics obsolescence market?

- What are the major patents filed by the companies active in the defense electronics obsolescence market?

- Who are the key players in the defense electronics obsolescence market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the defense electronics obsolescence market?

- What are the strategies adopted by the key companies to gain a competitive edge in defense electronics obsolescence market?

- What is the futuristic outlook for the defense electronics obsolescence market in terms of growth potential?

- What is the current estimation of the defense electronics obsolescence market and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- What could be the impact of growing application in the defense electronics obsolescence market?

- Which regions demonstrate the highest adoption rates for defense electronics obsolescence market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Year, by Country

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Defense Electronics Obsolescence Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Defense Electronics Obsolescence Market (by Platform)

- 2.3.1 Land

- 2.3.2 Naval

- 2.3.3 Airborne

3. Defense Electronics Obsolescence Market (by Products)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Defense Electronics Obsolescence Market (by Type)

- 3.3.1 Logistics Obsolescence

- 3.3.2 Functional Obsolescence

- 3.3.3 Technology Obsolescence

- 3.4 Defense Electronics Obsolescence Market (by System)

- 3.4.1 Communication System

- 3.4.2 Navigation System

- 3.4.3 Human Machine Interface

- 3.4.4 Flight Control System

- 3.4.5 Targeting System

- 3.4.6 Electronic Warfare System

- 3.4.7 Sensors

4. Defense Electronics Obsolescence Market (by Region)

- 4.1 Defense Electronics Obsolescence Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 RTX

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 BAE Systems

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 L3Harris Technologies, Inc.

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 Thales

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Elbit Systems Ltd.

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Northrop Grumman

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Lockheed Martin Corporation

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 General Dynamics Corporation

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Boeing

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Airbus

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Leonardo S.p.A.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Saab AB

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Sparton

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Rheinmetall AG

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Dassault Aviation

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Other Key Players

- 5.2.1 RTX