|

|

市場調査レポート

商品コード

1482295

自動車用セラミックス市場- 世界および地域別分析:用途別、材料別、車両タイプ別、地域別 - 分析と予測(2024年~2034年)Automotive Ceramics Market - A Global and Regional Analysis: Focus on Application, Material, Vehicle Type, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用セラミックス市場- 世界および地域別分析:用途別、材料別、車両タイプ別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年05月22日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

自動車用セラミックスの市場規模は、様々な要因や市場促進要因に後押しされ、大きな成長を遂げています。

楽観的な予測では、2024年の市場規模は28億米ドルとなり、CAGR 5.92%で拡大するとみられ、2034年には49億8,000万米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年評価 | 28億米ドル |

| 2034年予測 | 49億8,000万米ドル |

| CAGR | 5.92% |

この成長の主な促進要因は、さまざまな部門にわたって製造コストを削減しながら自動車性能を強化する上で、アドバンストセラミックスが提供する利点が認められつつあることです。アドバンストセラミックスは、自動車部品の構造的完全性、軽量化、耐久性を強化する上で極めて重要な役割を果たし、それによって運転効率と費用対効果を高めています。この需要は、市場における製品競争力と差別化を確保する上で、先端材料の重要性を業界が認識していることから生じています。

さらに、持続可能性への関心の高まりと環境規制の遵守が、自動車用途における先端セラミックスの採用を促進しています。二酸化炭素排出量を削減し、環境に優しい製造方法を促進するための協調的な努力により、組織は再生可能な資源やリサイクル材料に由来するアドバンストセラミックスの採用を増やしています。この動向は、自動車製造工程における持続可能な材料の使用を奨励することを目的とした政府の取り組みや奨励策によって、さらに加速されています。

当レポートでは、世界の自動車用セラミックス市場について調査し、市場の概要とともに、用途別、材料別、車両タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 自動車用セラミックス市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 自動車用セラミックス市場(用途別)

第3章 自動車用セラミックス市場(製品別)

- 製品セグメンテーション

- 製品概要

- 自動車用セラミックス市場(材料別)

- 自動車用セラミックス市場(車両タイプ別)

第4章 自動車用セラミックス市場(地域別)

- 自動車用セラミックス市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- Ceramtec GmbH

- Kyocera Corporation

- Niterra

- Coorstek Inc.

- Saint-Gobain Ceramic

- Morgan Advanced Materials

- Elan Technologies

- 3M

- Ibiden Co., Ltd.

- Corning Incorporated

- Almatis

- Dyson Technical Ceramics

- Inmatec Technologies GmbH

- International Syalons Limited

- Blasch Automotive Ceramics, Inc.

- その他の主要企業

第6章 調査手法

Introduction to Automotive Ceramics Market

The automotive ceramics market is experiencing significant growth, propelled by various key factors and market drivers. In an optimistic projection, the market is valued at $2.80 billion in 2024, with an anticipated expansion at a CAGR of 5.92% to reach $4.98 billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $2.80 Billion |

| 2034 Forecast | $4.98 Billion |

| CAGR | 5.92% |

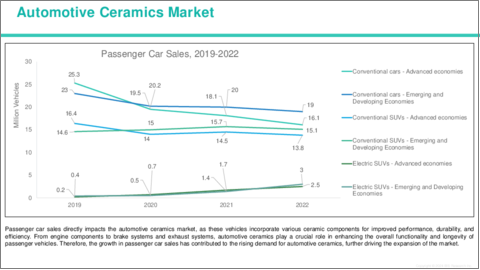

A primary catalyst for this growth is the increasing acknowledgment of the advantages offered by advanced ceramics in enhancing automotive performance while reducing manufacturing costs across different sectors. Advanced ceramics play a pivotal role in augmenting structural integrity, lightweighting, and durability of automotive components, thereby enhancing operational efficiency and cost-effectiveness. This demand emanates from industries recognizing the significance of advanced materials in ensuring product competitiveness and differentiation in the market.

Moreover, the escalating focus on sustainability and adherence to environmental regulations are propelling the adoption of advanced ceramics in automotive applications. With a concerted effort to reduce carbon emissions and promote eco-friendly manufacturing practices, organizations are increasingly embracing advanced ceramics derived from renewable sources or recycled materials. This trend is further accelerated by government initiatives and incentives aimed at encouraging the use of sustainable materials in automotive manufacturing processes.

Furthermore, continuous technological advancements and innovations in ceramic manufacturing processes are opening avenues for market expansion. Key players in the automotive ceramics sector, such as 3M, Elan Technologies, and Saint-Gobain Ceramic, are leading the development of innovative solutions tailored to the diverse needs of the automotive industry. Their expertise in materials science, coupled with engineering capabilities and customer-centric approach, are pivotal in shaping the automotive ceramics market landscape.

In summary, the automotive ceramics market is witnessing robust growth, driven by the increasing recognition of its benefits, sustainability imperatives, and technological advancements, all supported by the proactive efforts of industry leaders to deliver innovative solutions.

Market Segmentation:

Segmentation 1: by Application

- Engine Parts

- Exhaust Systems

- Automotive Electronics

- Braking Systems

- Others

Segmentation 2: by Material

- Titanate Oxide

- Zirconia Oxide

- Alumina Oxide

- Others

Segmentation 3: by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global automotive ceramics market has been extensively segmented based on various categories, such as application, material, and vehicle type,. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global automotive ceramics market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing company coverage, product portfolio, and market penetration.

Some of the prominent companies in this market are:

- Ceramtec GmbH

- Kyocera Corporation

- Niterra

- Coorstek Inc.

- Saint-Gobain Ceramic

- Morgan Advanced Materials

- Elan Technologies

- 3M

- Ibiden Co., Ltd.

- Corning Incorporated

Key Questions Answered in this Report:

- What are the main factors driving the demand for automotive ceramics market?

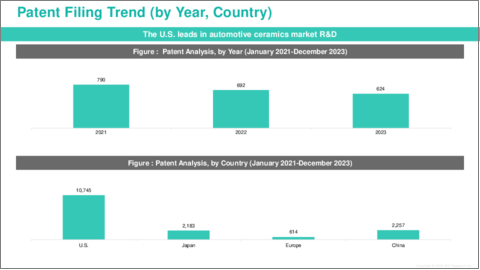

- What are the major patents filed by the companies active in the automotive ceramics market?

- Who are the key players in the automotive ceramics market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the automotive ceramics market?

- What are the strategies adopted by the key companies to gain a competitive edge in automotive ceramics market?

- What is the futuristic outlook for the automotive ceramics market in terms of growth potential?

- What is the current estimation of the automotive ceramics market, and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for automotive ceramics market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Automotive Ceramics Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Automotive Ceramics Market (by Application)

- 2.3.1 Engine Parts

- 2.3.2 Exhaust Systems

- 2.3.3 Automotive Electronics

- 2.3.4 Braking Systems

- 2.3.5 Others

3. Automotive Ceramics Market (by Products)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Automotive Ceramics Market (by Material)

- 3.3.1 Titanate Oxide

- 3.3.2 Zirconia Oxide

- 3.3.3 Alumina Oxide

- 3.3.4 Others

- 3.4 Automotive Ceramics Market (by Vehicle Type)

- 3.4.1 Passenger Vehicle

- 3.4.2 Commercial Vehicle

4. Automotive Ceramics Market (by Region)

- 4.1 Automotive Ceramics Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Ceramtec GmbH

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Kyocera Corporation

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Niterra

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 Coorstek Inc.

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Saint-Gobain Ceramic

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Morgan Advanced Materials

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Elan Technologies

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 3M

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Ibiden Co., Ltd.

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Corning Incorporated

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Almatis

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Dyson Technical Ceramics

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Inmatec Technologies GmbH

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 International Syalons Limited

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Blasch Automotive Ceramics, Inc.

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Other Key Companies

- 5.2.1 Ceramtec GmbH