|

|

市場調査レポート

商品コード

1477896

アジア太平洋地域の病原菌または植物病害の検出・監視市場:用途・製品・国別の分析・予測 (2023-2028年)Asia-Pacific Pathogen or Plant Disease Detection and Monitoring Market: Focus on Application, Product, and Country - Analysis and Forecast, 2023-2028 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋地域の病原菌または植物病害の検出・監視市場:用途・製品・国別の分析・予測 (2023-2028年) |

|

出版日: 2024年05月13日

発行: BIS Research

ページ情報: 英文 75 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

中国を除くアジア太平洋地域の病原菌または植物病害の検出・監視の市場規模は、2023年の3億2,920万米ドルから、予測期間中は9.86%のCAGRで推移し、2028年には5億2,690万米ドルの規模に成長すると予測されています。

同市場の成長は、特に新興諸国における食糧安全保障と品質に関する懸念の高まりに起因すると予測されます。これらの地域は、植物病害による作物生産の大幅な損失とポストハーベスト管理の困難に直面しています。また、バイオセンサー、POCデバイス、リモートセンシング、ナノテクノロジーなどの新しい検出方法の進歩が、効率的で信頼性が高く、手頃な価格の現場診断ソリューションに有望な展望を示しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2028年 |

| 2023年評価 | 3億2,920万米ドル |

| 2028年予測 | 5億2,690万米ドル |

| CAGR | 9.86% |

市場の分類

セグメンテーション1:用途別

- オープンフィールド

- 管理環境

セグメンテーション2:製品別

- 診断キット

- デジタルソリューション

- 検査サービス

セグメンテーション3:国別

- 日本

- 韓国

- インド

- オーストラリア・ニュージーランド

- その他

当レポートでは、アジア太平洋地域の病原菌または植物病害の検出・監視の市場を調査し、業界の動向、エコシステム、進行中のプログラム、市場成長促進要因・抑制要因、ケーススタディ、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

調査範囲

エグゼクティブサマリー

第1章 市場

- 業界展望

- 市場の定義

- 進行中の動向

- エコシステム/進行中のプログラム

- 事業力学

- 事業促進要因

- 事業上の課題

- 市場戦略と開発

- 事業機会

- ケーススタディ

- スタートアップの情勢

第2章 地域

- 病原菌または植物病害の検出・監視市場:地域別

- アジア太平洋

- アジア太平洋(国別)

- 中国

第3章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 市場シェア分析

第4章 調査手法

List of Figures

- Figure 1: Factors Driving the Need for Pathogen or Plant Disease Detection and Monitoring Market

- Figure 2: Asia-Pacific Pathogen or Plant Disease Detection and Monitoring Market, $Billion, 2022-2028

- Figure 3: Market Dynamics of the Pathogen or Plant Disease Detection and Monitoring Market

- Figure 4: Asia-Pacific Pathogen or Plant Disease Detection and Monitoring Market (by Application), $Billion, 2022-2028

- Figure 5: Asia-Pacific Pathogen or Plant Disease Detection and Monitoring Market (by Product), $Billion, 2022-2028

- Figure 6: Pathogen or Plant Disease Detection and Monitoring Market (by Region), $Million, 2022

- Figure 7: Literature Review Study on an AI-Based Strategy for Detecting and Monitoring Pest-Infested Crops and Leaves

- Figure 8: Adoption of Genetically Engineered Crops in the U.S., 2000-2023

- Figure 9: Share of Key Market Strategies and Developments, January 2019-October 2023

- Figure 10: Share of Product Development and Innovations (by Company), January 2019-October 2023

- Figure 11: Share of Partnerships, Collaborations, and Joint Ventures (by Company), January 2019-October 2023

- Figure 12: Libelium Comunicaciones Distribuidas S.L.- Agribio cooperative Case Study

- Figure 13: Ceres Imaging- Cardella Winery Case Study

- Figure 14: Total Investment in the Pathogen or Plant Disease Detection and Monitoring Market, $Million, 2018-2023

- Figure 15: Top Investments in the Plant Disease or Pathogen Detection and Monitoring Market, January 2018-July 2023

- Figure 16: Competitive Benchmarking Matrix for Key Pathogen or Plant Disease Detection and Monitoring Product Manufacturers

- Figure 17: Competitive Benchmarking Matrix for Key Plant Disease or Pathogen Detection and Monitoring Service Providers

- Figure 18: Market Share Analysis of Pathogen or Plant Disease Detection and Monitoring Market (by Company), 2022

- Figure 19: Market Share Analysis of Pathogen or Plant Disease Detection and Monitoring Market (by Company), 2022

- Figure 20: Pathogen or Plant Disease Detection and Monitoring Market: Research Methodology

- Figure 21: Data Triangulation

- Figure 22: Top-Down and Bottom-Up Approach

- Figure 23: Assumptions and Limitations

List of Tables

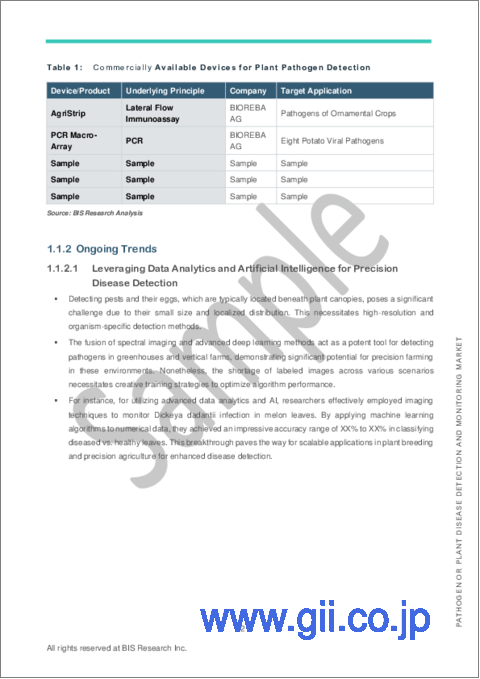

- Table 1: Commercially Available Devices for Plant Pathogen Detection

- Table 2: Key Consortiums, Associations, and Regulatory Bodies in the Pathogen or Plant Disease Detection and Monitoring Market

- Table 3: Example of Fungicide Treatment

- Table 4: Summary of Plant Pathogens, Pathways, and Distribution, Food and Agriculture Organization (FAO) Report, 2021

- Table 5: Mergers and Acquisitions, January 2019-October 2023

- Table 6: Some Examples of Point-of-Care Diagnostics (POCD)

Introduction to Asia-Pacific Pathogen or Plant Disease Detection and Monitoring Market

The Asia-Pacific pathogen or plant disease detection and monitoring market (excluding China) was valued at $329.2 million in 2023, and it is expected to grow with a CAGR of 9.86% during the forecast period 2023-2028 to reach $526.9 million by 2028. The growth of the pathogen and plant disease detection and monitoring market is anticipated to stem from increasing concerns regarding food security and quality, especially in developing countries. These regions face significant crop production losses and post-harvest management difficulties due to plant diseases. Furthermore, advancements in novel detection methods, such as biosensors, point-of-care devices, remote sensing, and nanotechnology, offer promising prospects for efficient, reliable, and affordable in-field diagnostic solutions.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2028 |

| 2023 Evaluation | $329.2 Million |

| 2028 Forecast | $526.9 Million |

| CAGR | 9.86% |

Market Introduction

The Asia-Pacific (APAC) region's pathogen and plant disease detection and monitoring market are witnessing significant growth due to various factors. With a growing population and increasing food demand, there's a pressing need for enhanced food security and quality assurance measures across the region. Developing nations in APAC, in particular, face substantial challenges in crop production and post-harvest management attributed to plant diseases. Consequently, there's a rising demand for advanced detection and monitoring technologies to mitigate these losses. The market is further propelled by ongoing progress in innovative diagnostic methods, such as biosensors, point-of-care devices, remote sensing, and nanotechnology, offering swift, reliable, and cost-effective solutions for in-field diagnostics. With governments and stakeholders increasingly focusing on agricultural sustainability and productivity, the APAC region presents lucrative opportunities for companies in the pathogen and plant disease detection market.

Market Segmentation:

Segmentation 1: by Application

- Open Field

- Controlled Environment

Segmentation 2: by Product

- Diagnostic Kits

- Digital Solutions

- Laboratory Services

Segmentation 3: by Country

- Japan

- South Korea

- India

- Australia and New Zealand

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: In the realm of plant disease, technological advancements are transforming agricultural landscapes. Pathogen or plant disease detection and monitoring market solutions utilize diverse technologies such as IoT sensors, drones, and data analytics. These tools offer precise insights into crop health, optimizing irrigation, pest management, and harvest times. Innovations such as satellite imaging and remote sensing provide a holistic view of fields, empowering farmers to make informed decisions. The market encompasses a range of solutions, from real-time monitoring platforms to AI-driven predictive analysis, enabling farmers to enhance productivity and reduce resource wastage significantly.

Growth/Marketing Strategy: The pathogen or plant disease detection and monitoring market has witnessed remarkable growth strategies by key players. Business expansions, collaborations, and partnerships have been pivotal. Companies are venturing into foreign markets, forging alliances, and engaging in research collaborations to enhance their technological prowess. Collaborative efforts between tech companies and agricultural experts are driving the development of cutting-edge monitoring tools. Additionally, strategic joint ventures are fostering the integration of diverse expertise, amplifying the market presence of these solutions. This collaborative approach is instrumental in developing comprehensive, user-friendly, and efficient phytopathogen detection and monitoring systems.

Competitive Strategy: In the competitive landscape of plant disease diagnosis, manufacturers are diversifying their product portfolios to cover various crops and farming practices. Market segments include soil analysis tools, disease detection systems, and climate analysis solutions. Competitive benchmarking illuminates the strengths of market players, emphasizing their unique offerings and regional strengths. Partnerships with research institutions and agricultural organizations are driving innovation.

Table of Contents

Scope of the Study

Executive Summary

1 Market

- 1.1 Industry Outlook

- 1.1.1 Market Definition

- 1.1.2 Ongoing Trends

- 1.1.2.1 Leveraging Data Analytics and Artificial Intelligence for Precision Disease Detection

- 1.1.3 Ecosystem/Ongoing Programs

- 1.1.3.1 Consortiums, Associations, and Regulatory Bodies

- 1.1.3.2 Government Programs

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Rising Threat of Fungicide Resistance Crops

- 1.2.1.2 Frequent Outbreaks of Emerging Plant Diseases

- 1.2.2 Business Challenges

- 1.2.2.1 Lack of Accuracy and Sample Security

- 1.2.2.2 Rapid Adoption of Genetically Modified Organism (GMO) or Gene Adopted Crops

- 1.2.3 Market Strategies and Developments

- 1.2.3.1 Business Strategies

- 1.2.3.1.1 Product Development and Innovations

- 1.2.3.1.2 Market Development

- 1.2.3.2 Corporate Strategies

- 1.2.3.2.1 Mergers and Acquisitions

- 1.2.3.2.2 Partnerships, Collaborations, and Joint Ventures

- 1.2.3.2.3 Snapshot of Corporate Strategies Adopted by the Key Players in the Market

- 1.2.3.1 Business Strategies

- 1.2.4 Business Opportunities

- 1.2.4.1 Innovations in Point-of-Care Diagnostics

- 1.2.4.2 Rapid Adoption of Integrated Solutions

- 1.2.1 Business Drivers

- 1.3 Case Studies

- 1.3.1 Libelium Comunicaciones Distribuidas S.L. - Agribio cooperative Case Study

- 1.3.2 Ceres Imaging- Cardella Winery Case Study

- 1.4 Start-Up Landscape

- 1.4.1 Funding Analysis

- 1.4.1.1 Total Investment

- 1.4.1.2 Leading Investment by Start-Up Companies

- 1.4.1 Funding Analysis

2 Region

- 2.1 Pathogen or Plant Disease Detection and Monitoring Market (by Region)

- 2.2 Asia-Pacific

- 2.2.1 Asia-Pacific (by Country)

- 2.2.1.1 Japan

- 2.2.1.2 Australia and New Zealand

- 2.2.1.3 South Korea

- 2.2.1.4 India

- 2.2.1.5 Rest-of-Asia-Pacific

- 2.2.1 Asia-Pacific (by Country)

- 2.3 China

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.2 Market Share Analysis

4 Research Methodology

- 4.1 Primary Data Sources

- 4.2 Secondary Data Sources

- 4.3 Market Estimation and Forecast