|

|

市場調査レポート

商品コード

1408629

欧州の病原菌または植物病害の検出とモニタリング市場:分析と予測(2023年~2028年)Europe Pathogen or Plant Disease Detection and Monitoring Market: Analysis and Forecast, 2023-2028 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の病原菌または植物病害の検出とモニタリング市場:分析と予測(2023年~2028年) |

|

出版日: 2024年01月16日

発行: BIS Research

ページ情報: 英文 77 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の病原菌または植物病害の検出とモニタリングの市場規模(英国を除く)は、2023年に4億8,000万米ドルと評価され、予測期間の2023年~2028年に9.33%のCAGRで拡大し、2028年には7億4,960万米ドルに達すると予測されています。

発展途上国では、植物病害が農作物生産に多大な損失をもたらし、ポストハーベスト管理を困難にする主な原因となっていることから、病原体・植物病害の検出とモニタリング市場は、食糧安全保障と品質に対する需要が高まるにつれて拡大すると予想されます。さらに、バイオセンサー、ポイントオブケア機器、リモートセンシング、ナノテクノロジーなど、植物病原菌を特定するための斬新で独創的な技術の創出が進むことで、現場診断のための迅速で信頼でき、手頃なソリューションの可能性が提供されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2028年 |

| 2023年評価 | 4億8,000万米ドル |

| 2028年予測 | 7億4,960万米ドル |

| CAGR | 9.33% |

最先端技術は、病原菌や植物病害の継続的なモニタリングとともに、迅速かつ正確な検出を容易にし、欧州市場における農業の健康と作物管理の実践を変革しています。この分野には、病気の早期発見に不可欠な農業・園芸用ツールやサービスの開発、生産、販売が含まれます。これらのツールは、作物を保護し、食料安全保障を確保するためのタイムリーな介入・管理戦略の実施に役立っています。

欧州の市場は、気候変動、国際貿易力学、農業慣行の強化、規制枠組みなどの要因によって推進されています。特に、植物病原菌は、経済的に重要な作物の年間収量に最大40%の損失をもたらし、産業に大きな脅威を与えています。侵略的害虫は、少なくとも700億米ドルの年間財政負担をもたらし、生物多様性の世界の衰退に一役買っています。

当レポートでは、欧州の病原菌または植物病害の検出とモニタリング市場について調査し、市場の概要とともに、用途別、製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

調査範囲

エグゼクティブサマリー

第1章 市場

- 業界の展望

- ビジネスダイナミクス

- ケーススタディ

- スタートアップの情勢

第2章 地域

- 病原菌または植物病害の検出とモニタリング市場(地域別)

- 欧州

- 英国

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 市場シェア分析

- 企業プロファイル

- Abingdon Health

- BIOREBA AG

- Drone Ag

- Libelium Comunicaciones Distribuidas S.L.

- スタートアップ企業

- Agricolus

- GeoPard Agriculture

- Dronegy

- FIXAR-AERO, LLC

第4章 調査手法

List of Figures

- Figure 1: Factors Driving the Need for Pathogen or Plant Disease Detection and Monitoring Market

- Figure 2: Pathogen or Plant Disease Detection and Monitoring Market, $Billion, 2022-2028

- Figure 3: Market Dynamics of the Pathogen or Plant Disease Detection and Monitoring Market

- Figure 4: Pathogen or Plant Disease Detection and Monitoring Market (by Application), $Billion, 2022-2028

- Figure 5: Pathogen or Plant Disease Detection and Monitoring Market (by Product), $Billion, 2022-2028

- Figure 6: Pathogen or Plant Disease Detection and Monitoring Market (by Region), $Million, 2022

- Figure 7: Literature Review Study on an AI-Based Strategy for Detecting and Monitoring Pest-Infested Crops and Leaves

- Figure 8: Adoption of Genetically Engineered Crops in the U.S., 2000-2023

- Figure 9: Share of Key Market Strategies and Developments, January 2019-October 2023

- Figure 10: Share of Product Development and Innovations (by Company), January 2019-October 2023

- Figure 11: Share of Partnerships, Collaborations, and Joint Ventures (by Company), January 2019-October 2023

- Figure 12: Libelium Comunicaciones Distribuidas S.L.- Agribio cooperative Case Study

- Figure 13: Ceres Imaging- Cardella Winery Case Study

- Figure 14: Total Investment in the Pathogen or Plant Disease Detection and Monitoring Market, $Million, 2018-2023

- Figure 15: Top Investments in the Plant Disease or Pathogen Detection and Monitoring Market, January 2018-July 2023

- Figure 16: Competitive Benchmarking Matrix for Key Pathogen or Plant Disease Detection and Monitoring Product Manufacturers

- Figure 17: Competitive Benchmarking Matrix for Key Plant Disease or Pathogen Detection and Monitoring Service Providers

- Figure 18: Market Share Analysis of Pathogen or Plant Disease Detection and Monitoring Market (by Company), 2022

- Figure 19: Market Share Analysis of Pathogen or Plant Disease Detection and Monitoring Market (by Company), 2022

- Figure 20: Pathogen or Plant Disease Detection and Monitoring Market: Research Methodology

- Figure 21: Data Triangulation

- Figure 22: Top-Down and Bottom-Up Approach

- Figure 23: Assumptions and Limitations

List of Tables

- Table 1: Commercially Available Devices for Plant Pathogen Detection

- Table 2: Key Consortiums, Associations, and Regulatory Bodies in the Pathogen or Plant Disease Detection and Monitoring Market

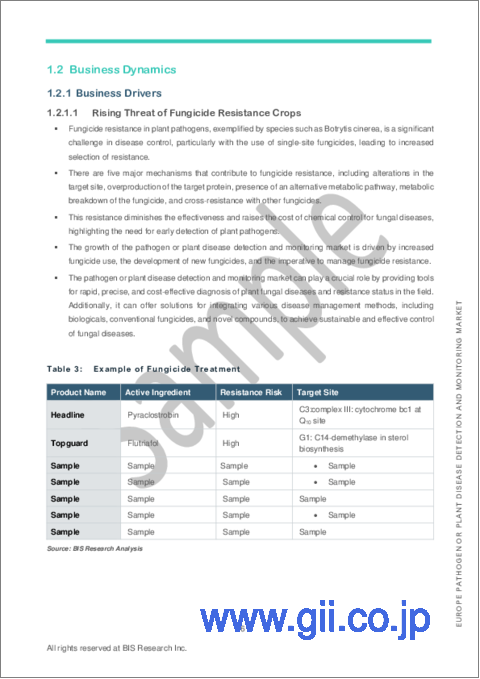

- Table 3: Example of Fungicide Treatment

- Table 4: Summary of Plant Pathogens, Pathways, and Distribution, Food and Agriculture Organization (FAO) Report, 2021

- Table 5: Mergers and Acquisitions, January 2019-October 2023

- Table 6: Some Examples of Point-of-Care Diagnostics (POCD)

“The Europe Pathogen or Plant Disease Detection and Monitoring Market (excluding U.K.) Expected to Reach $749.6 Million by 2028.”

Introduction to Europe Pathogen or Plant Disease Detection and Monitoring Market:

The Europe pathogen or plant disease detection and monitoring market (excluding U.K.) was valued at $480.0 million in 2023, and it is expected to grow with a CAGR of 9.33% during the forecast period 2023-2028 to reach $749.6 million by 2028. Provided that plant diseases are a major cause of significant crop production losses and post-harvest management difficulties in developing countries, the market for pathogen and plant disease detection and monitoring is expected to grow as demand for food security and quality increases. Furthermore, the advancements in the creation of novel and creative techniques for identifying plant pathogens, such as biosensors, point-of-care instruments, remote sensing, and nanotechnology, provide the possibility of quick, trustworthy, and affordable solutions for in-field diagnostics.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2028 |

| 2023 Evaluation | $480.0 Million |

| 2028 Forecast | 749.6 Million |

| CAGR | 9.33% |

Market introduction

Cutting-edge technology facilitates swift and precise detection, along with continuous monitoring of pathogens and plant diseases, transforming agricultural health and crop management practices in the European market. This sector encompasses the development, production, and sale of essential tools and services for agriculture and horticulture, crucial for early disease identification. These tools are instrumental in implementing timely intervention and management strategies to safeguard crops, ensuring food security.

The market in Europe is propelled by factors such as climate change, international trade dynamics, intensified agriculture practices, and regulatory frameworks. Notably, plant pathogens cause an annual loss of up to 40% in yield for economically significant crops, posing a substantial threat to the industry. Invasive pests contribute to an annual financial burden of at least $70 billion, playing a role in the broader global decline of biodiversity.

Market Segmentation

Segmentation 1: by Application

- Open Field

- Controlled Environment

Segmentation 2: by Product

- Diagnostic Kits

- Digital Solutions

- Laboratory Services

Segmentation 3: by Country

- Germany

- France

- Italy

- Spain

- Netherlands

- Belgium

- Switzerland

- Bulgaria

- Ukraine

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: In the realm of plant disease, technological advancements are transforming agricultural landscapes. Pathogen or plant disease detection and monitoring market solutions utilize diverse technologies such as IoT sensors, drones, and data analytics. These tools offer precise insights into crop health, optimizing irrigation, pest management, and harvest times. Innovations such as satellite imaging and remote sensing provide a holistic view of fields, empowering farmers to make informed decisions. The market encompasses a range of solutions, from real-time monitoring platforms to AI-driven predictive analysis, enabling farmers to enhance productivity and reduce resource wastage significantly.

Growth/Marketing Strategy: The pathogen or plant disease detection and monitoring market has witnessed remarkable growth strategies by key players. Business expansions, collaborations, and partnerships have been pivotal. Companies are venturing into European market, forging alliances, and engaging in research collaborations to enhance their technological prowess. Collaborative efforts between tech companies and agricultural experts are driving the development of cutting-edge monitoring tools. Additionally, strategic joint ventures are fostering the integration of diverse expertise, amplifying the market presence of these solutions. This collaborative approach is instrumental in developing comprehensive, user-friendly, and efficient phytopathogen detection and monitoring systems.

Competitive Strategy: In the competitive landscape of plant disease diagnosis, manufacturers are diversifying their product portfolios to cover various crops and farming practices. Market segments include soil analysis tools, disease detection systems, and climate analysis solutions. Competitive benchmarking illuminates the strengths of market players, emphasizing their unique offerings and regional strengths. Partnerships with research institutions and agricultural organizations are driving innovation.

Table of Contents

Scope of the Study

Executive Summary

1. Market

- 1.1. Industry Outlook

- 1.1.1. Market Definition

- 1.1.2. Ongoing Trends

- 1.1.2.1. Leveraging Data Analytics and Artificial Intelligence for Precision Disease Detection

- 1.1.3. Ecosystem/Ongoing Programs

- 1.1.3.1. Consortiums, Associations, and Regulatory Bodies

- 1.2. Business Dynamics

- 1.2.1. Business Drivers

- 1.2.1.1. Rising Threat of Fungicide Resistance Crops

- 1.2.1.2. Frequent Outbreaks of Emerging Plant Diseases

- 1.2.2. Business Challenges

- 1.2.2.1. Lack of Accuracy and Sample Security

- 1.2.2.2. Rapid Adoption of Genetically Modified Organism (GMO) or Gene Adopted Crops

- 1.2.3. Market Strategies and Developments

- 1.2.3.1. Business Strategies

- 1.2.3.1.1. Product Development and Innovations

- 1.2.3.1.2. Market Development

- 1.2.3.2. Corporate Strategies

- 1.2.3.2.1. Mergers and Acquisitions

- 1.2.3.2.2. Partnerships, Collaborations, and Joint Ventures

- 1.2.3.2.3. Snapshot of Corporate Strategies Adopted by the Key Players in the Market

- 1.2.3.1. Business Strategies

- 1.2.4. Business Opportunities

- 1.2.4.1. Innovations in Point-of-Care Diagnostics

- 1.2.4.2. Rapid Adoption of Integrated Solutions

- 1.2.1. Business Drivers

- 1.3. Case Studies

- 1.3.1. Libelium Comunicaciones Distribuidas S.L. - Agribio cooperative Case Study

- 1.3.2. Ceres Imaging- Cardella Winery Case Study

- 1.4. Start-Up Landscape

- 1.4.1. Funding Analysis

- 1.4.1.1. Total Investment

- 1.4.1.2. Leading Investment by Start-Up Companies

- 1.4.1. Funding Analysis

2. Region

- 2.1. Pathogen or Plant Disease Detection and Monitoring Market (by Region)

- 2.2. Europe

- 2.2.1. Europe (by Country)

- 2.2.1.1. Italy

- 2.2.1.2. France

- 2.2.1.3. Netherlands

- 2.2.1.4. Germany

- 2.2.1.5. Switzerland

- 2.2.1.6. Belgium

- 2.2.1.7. Spain

- 2.2.1.8. Bulgaria

- 2.2.1.9. Ukraine

- 2.2.1.10. Rest-of-Europe

- 2.2.1. Europe (by Country)

- 2.3. U.K.

3. Markets - Competitive Benchmarking & Company Profiles

- 3.1. Competitive Benchmarking

- 3.2. Market Share Analysis

- 3.3. Company Profiles

- 3.3.1. Abingdon Health

- 3.3.1.1. Company Overview

- 3.3.1.2. Product and Customer Portfolio Analysis

- 3.3.2. BIOREBA AG

- 3.3.2.1. Company Overview

- 3.3.2.2. Product and Customer Portfolio Analysis

- 3.3.3. Drone Ag

- 3.3.3.1. Company Overview

- 3.3.3.2. Product and Customer Portfolio Analysis

- 3.3.4. Libelium Comunicaciones Distribuidas S.L.

- 3.3.4.1. Company Overview

- 3.3.4.2. Product and Customer Portfolio Analysis

- 3.3.1. Abingdon Health

- 3.4. Start-Up Companies

- 3.4.1. Agricolus

- 3.4.1.1. Company Overview

- 3.4.1.2. Product and Customer Portfolio Analysis

- 3.4.2. GeoPard Agriculture

- 3.4.2.1. Company Overview

- 3.4.2.2. Product and Customer Portfolio Analysis

- 3.4.3. Dronegy

- 3.4.3.1. Company Overview

- 3.4.3.2. Product and Customer Portfolio Analysis

- 3.4.4. FIXAR-AERO, LLC

- 3.4.4.1. Company Overview

- 3.4.4.2. Product and Customer Portfolio Analysis

- 3.4.1. Agricolus

4. Research Methodology

- 4.1. Primary Data Sources

- 4.2. Secondary Data Sources

- 4.3. Market Estimation and Forecast