|

|

市場調査レポート

商品コード

1466830

アジア太平洋のソリッドステートバッテリー市場:電解質タイプ別、バッテリータイプ別、容量別、用途別、国別分析:分析と予測(2023年~2032年)Asia-Pacific Solid-State Battery Market: Focus on Electrolyte Type, Battery Type, Capacity, Application, and Country - Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋のソリッドステートバッテリー市場:電解質タイプ別、バッテリータイプ別、容量別、用途別、国別分析:分析と予測(2023年~2032年) |

|

出版日: 2024年04月23日

発行: BIS Research

ページ情報: 英文 106 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋のソリッドステートバッテリーの市場規模(中国を除く)は、2023年に6,440万米ドルとなりました。

同市場は、予測期間の2023年~2032年に32.28%のCAGRで拡大し、2032年には7億9,860万米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年評価 | 6,440万米ドル |

| 2032年予測 | 7億9,860万米ドル |

| CAGR | 32.28% |

アジア太平洋のソリッドステートバッテリー市場は、さまざまな要因によって急速に拡大しています。電気自動車(EV)、携帯機器、再生可能エネルギー貯蔵ソリューションの需要が高まる中、より高いエネルギー密度、より高い安全性、より長い寿命を提供するエネルギー貯蔵技術の強化に対するニーズが高まっています。

ソリッドステートバッテリーは、通常のリチウムイオンバッテリーを大幅に改善し、より高いエネルギー密度、高速充電、固体電解質組成による安全性の向上などの利点を提供します。これらの電池は、自動車、家電、エネルギー貯蔵など、さまざまな産業を変革します。

活気ある産業部門、技術革新、再生可能エネルギープロジェクトに対する政府の強力な支援で知られるアジア太平洋地域は、ソリッドステートバッテリー技術のブレークスルーをリードしています。中国、日本、韓国などの国々は、ソリッドステートバッテリーの研究開発、商業化の最前線にあり、国内外からの投資を集めています。

さらに、この地域のEV市場は、政府のインセンティブ、環境規制、クリーンな交通機関に対する顧客の嗜好に後押しされ、電気自動車でのソリッドステートバッテリーの使用に大きな見通しをもたらしています。さらに、太陽光発電や風力発電などの再生可能エネルギーの利用が増加しているため、アジア太平洋諸国では革新的なエネルギー貯蔵システムの需要が高まっています。

当レポートでは、アジア太平洋のソリッドステートバッテリー市場について調査し、市場の概要とともに、電解質タイプ別、バッテリータイプ別、容量別、用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界展望

- ナトリウムイオン電池市場のスナップショット

- ビジネスダイナミクス

- スタートアップの情勢

第2章 地域

- 中国

- アジア太平洋と日本

第3章 市場:競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競争ポジションマトリックス

- 主要企業向け製品マトリックス

- 主要企業の市場シェア分析、2022年

- 企業プロファイル

- ProLogium Technology Co., Ltd.

- Toyota Motor Corporation

- SAMSUNG SDI CO., LTD.

- Hitachi Zosen Corporation

- Ganfeng Lithium Group Co., Ltd.

- SK on Co., Ltd.

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Solid-State Battery Market Snapshot, $Million, 2022, 2023, and 2032

- Figure 2: Asia-Pacific Solid-State Battery Market (by Application), $Million, 2022 and 2032

- Figure 3: Asia-Pacific Solid-State Battery Market (by Electrolyte Type), $Million, 2022 and 2032

- Figure 4: Asia-Pacific Solid-State Battery Market (by Battery Type), $Million, 2022 and 2032

- Figure 5: Asia-Pacific Solid-State Battery Market (by Capacity), $Million, 2022 and 2032

- Figure 6: Solid-State Battery Market (by Region), $Million, 2022, 2032

- Figure 7: Supply Chain Analysis of Solid-State Battery Market

- Figure 8: Comparative Analysis Between Lithium-Ion and Solid-State Batteries

- Figure 9: Comparative Analysis in Terms of Power Density

- Figure 10: Electric Vehicle Solid-State Battery Market, MWh, 2022 and 2032

- Figure 11: Sodium-Ion Battery Market Snapshot, 2021-2031

- Figure 12: Clean Energy Investment in the Net Zero Pathway, 2016-2020, 2030, and 2050

- Figure 13: Increasing Electric Vehicle (EV) Adoption, 2020-2030

- Figure 14: Research Methodology

- Figure 15: Top-Down and Bottom-Up Approach

- Figure 16: Solid-State Battery Market Influencing Factors

- Figure 17: Assumptions and Limitations

List of Tables

- Table 1: Government Initiatives Related to Solid-State Battery Development

- Table 2: Automotive OEM Activities Related to Solid-State Battery Development

- Table 3: Announced Solid-State Battery Projects

- Table 4: Key Product Development, 2022-2023

- Table 5: Key Market Development, 2022-2023

- Table 6: Partnerships, Collaborations, Agreements, Investments, and Contracts, 2022-2023

- Table 7: Solid-State Battery Market (by Region), $Million, 2022-2032

- Table 8: Solid-State Battery Market (by Region), MWh, 2022-2032

- Table 9: China Solid-State Battery Market (by Application), $Million, 2022-2032

- Table 10: China Solid-State Battery Market (by Application), MWh, 2022-2032

- Table 11: China Solid-State Battery Market (by Electrolyte Type), $Million, 2022-2032

- Table 12: China Solid-State Battery Market (by Electrolyte Type), MWh, 2022-2032

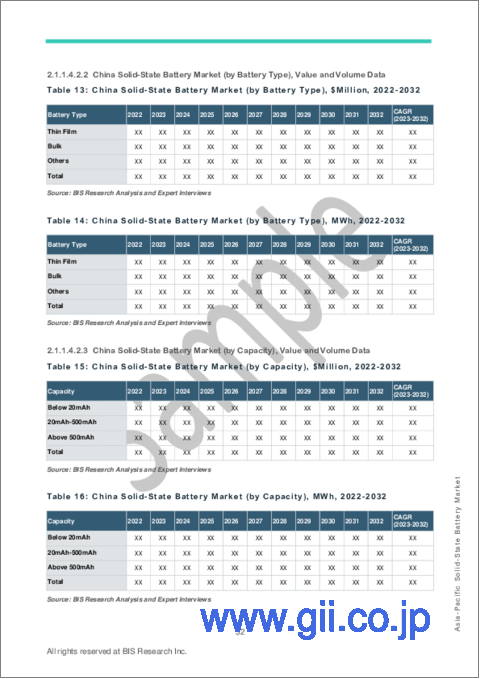

- Table 13: China Solid-State Battery Market (by Battery Type), $Million, 2022-2032

- Table 14: China Solid-State Battery Market (by Battery Type), MWh, 2022-2032

- Table 15: China Solid-State Battery Market (by Capacity), $Million, 2022-2032

- Table 16: China Solid-State Battery Market (by Capacity), MWh, 2022-2032

- Table 17: Asia-Pacific and Japan Solid-State Battery Market (by Application), $Million, 2022-2032

- Table 18: Asia-Pacific and Japan Solid-State Battery Market (by Application), MWh, 2022-2032

- Table 19: Asia-Pacific and Japan Solid-State Battery Market (by Electrolyte Type), $Million, 2022-2032

- Table 20: Asia-Pacific and Japan Solid-State Battery Market (by Electrolyte Type), MWh, 2022-2032

- Table 21: Asia-Pacific and Japan Solid-State Battery Market (by Battery Type), $Million, 2022-2032

- Table 22: Asia-Pacific and Japan Solid-State Battery Market (by Battery Type), MWh, 2022-2032

- Table 23: Asia-Pacific and Japan Solid-State Battery Market (by Capacity), $Million, 2022-2032

- Table 24: Asia-Pacific and Japan Solid-State Battery Market (by Capacity), MWh, 2022-2032

- Table 25: Japan Solid-State Battery Market (by Application), $Million, 2022-2032

- Table 26: Japan Solid-State Battery Market (by Application), MWh, 2022-2032

- Table 27: Japan Solid-State Battery Market (by Electrolyte Type), $Million, 2022-2032

- Table 28: Japan Solid-State Battery Market (by Electrolyte Type), MWh, 2022-2032

- Table 29: Japan Solid-State Battery Market (by Battery Type), $Million, 2022-2032

- Table 30: Japan Solid-State Battery Market (by Battery Type), MWh, 2022-2032

- Table 31: Japan Solid-State Battery Market (by Capacity), $Million, 2022-2032

- Table 32: Japan Solid-State Battery Market (by Capacity), MWh, 2022-2032

- Table 33: South Korea Solid-State Battery Market (by Application), $Million, 2022-2032

- Table 34: South Korea Solid-State Battery Market (by Application), MWh, 2022-2032

- Table 35: South Korea Solid-State Battery Market (by Electrolyte Type), $Million, 2022-2032

- Table 36: South Korea Solid-State Battery Market (by Electrolyte Type), MWh, 2022-2032

- Table 37: South Korea Solid-State Battery Market (by Battery Type), $Million, 2022-2032

- Table 38: South Korea Solid-State Battery Market (by Battery Type), MWh, 2022-2032

- Table 39: South Korea Solid-State Battery Market (by Capacity), $Million, 2022-2032

- Table 40: South Korea Solid-State Battery Market (by Capacity), MWh, 2022-2032

- Table 41: India Solid-State Battery Market (by Application), $Million, 2022-2032

- Table 42: India Solid-State Battery Market (by Application), MWh, 2022-2032

- Table 43: India Solid-State Battery Market (by Electrolyte Type), $Million, 2022-2032

- Table 44: India Solid-State Battery Market (by Electrolyte Type), MWh, 2022-2032

- Table 45: India Solid-State Battery Market (by Battery Type), $Million, 2022-2032

- Table 46: India Solid-State Battery Market (by Battery Type), MWh, 2022-2032

- Table 47: India Solid-State Battery Market (by Capacity), $Million, 2022-2032

- Table 48: India Solid-State Battery Market (by Capacity), MWh, 2022-2032

- Table 49: Taiwan Solid-State Battery Market (by Application), $Million, 2022-2032

- Table 50: Taiwan Solid-State Battery Market (by Application), MWh, 2022-2032

- Table 51: Taiwan Solid-State Battery Market (by Electrolyte Type), $Million, 2022-2032

- Table 52: Taiwan Solid-State Battery Market (by Electrolyte Type), MWh, 2022-2032

- Table 53: Taiwan Solid-State Battery Market (by Battery Type), $Million, 2022-2032

- Table 54: Taiwan Solid-State Battery Market (by Battery Type), MWh, 2022-2032

- Table 55: Taiwan Solid-State Battery Market (by Capacity), $Million, 2022-2032

- Table 56: Taiwan Solid-State Battery Market (by Capacity), MWh, 2022-2032

- Table 57: Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Application), $Million, 2022-2032

- Table 58: Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Application), MWh, 2022-2032

- Table 59: Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Electrolyte Type), $Million, 2022-2032

- Table 60: Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Electrolyte Type), MWh, 2022-2032

- Table 61: Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Battery Type), $Million, 2022-2032

- Table 62: Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Battery Type), MWh, 2022-2032

- Table 63: Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Capacity), $Million, 2022-2032

- Table 64: Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Capacity), MWh, 2022-2032

- Table 65: Product Matrix for Key Companies

- Table 66: Market Share of Key Companies, 2022

Introduction to Asia-Pacific (APAC) Solid-State Battery Market

The Asia-Pacific solid-state battery market (excluding China) was valued at $64.4 million in 2023, and it is expected to grow with a CAGR of 32.28% during the forecast period 2023-2032 to reach $798.6 million by 2032. The rising need for effective and sustainable agricultural methods is expected to drive the expansion of the smart vineyard and orchard equipment market globally, particularly in the APAC region.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $64.4 Million |

| 2032 Forecast | $798.6 Million |

| CAGR | 32.28% |

Market Introduction

The solid-state battery market in Asia-Pacific (APAC) is expanding rapidly, owing to a number of factors. With the rising demand for electric vehicles (EVs), portable devices, and renewable energy storage solutions, there is a greater need for enhanced energy storage technologies that provide higher energy density, more safety, and a longer lifespan.

Solid-state batteries are a considerable improvement over ordinary lithium-ion batteries, providing benefits such as higher energy density, faster charging, and increased safety due to their solid electrolyte composition. These batteries are set to transform a variety of industries, including automotive, consumer electronics, and energy storage.

The APAC area, recognized for its vibrant industrial sector, technological innovation, and strong government support for renewable energy projects, is leading the way in solid-state battery technology breakthroughs. Countries such as China, Japan, and South Korea are in the forefront of solid-state battery research, development, and commercialization, attracting both domestic and international investment.

Furthermore, the region's thriving EV market, fueled by government incentives, environmental restrictions, and customer preferences for clean transportation, offers enormous prospects for the use of solid-state batteries in electric vehicles. Furthermore, the growing use of renewable energy sources such as solar and wind power increases the demand for innovative energy storage systems in APAC countries.

Overall, the APAC solid-state battery market provides tremendous prospects for industry players to capitalize on the region's growing demand for high-performance, safe, and sustainable energy storage solutions across various sectors.

Market Segmentation:

Segmentation 1: by Application

- Electric Vehicle

- Passenger Vehicle

- Commercial Vehicle

- Consumer Electronics

- Medical Devices

- Energy Storage System

- Others

Segmentation 2: by Electrolyte Type

- Polymer

- Sulfide

- Oxide

- Others

Segmentation 3: by Battery Type

- Thin Film

- Bulk

- Others

Segmentation 4: by Capacity

- Below 20mAh

- 20mAh to 500mAh

- Above 500mAh

Segmentation 5: by Country

- Japan

- South Korea

- India

- Taiwan

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different polymers used for solid-state battery and their potential in APAC region. Moreover, the study gives the reader a detailed understanding of the different solutions provided by the solid-state battery providers, encompassing aspects such as battery capacity and battery type. In contrast to traditional batteries, solid-state batteries exhibit outstanding thermal resilience, a comparatively lower self-discharge rate, heightened tolerance, and non-flammability.

Growth/Marketing Strategy: The APAC solid-state battery market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been partnership, collaboration, and joint venture activities to strengthen their position in the APAC solid-state battery market.

Competitive Strategy: Key players in the APAC solid-state battery market analyzed and profiled in the study involve solid-state battery-based product manufacturers, including market segments covered by distinct electrolyte types, capacity, battery type, applications served, and regional presence, as well as the influence of important market tactics. Moreover, a detailed competitive benchmarking of the players operating in the APAC solid-state battery market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, type portfolio, and market penetration.

Some prominent names in the market include:

- ProLogium Technology Co., Ltd.

- Toyota Motor Corporation

- SAMSUNG SDI CO., LTD.

- Hitachi Zosen Corporation

- SK on Co., Ltd.

Table of Contents

Executive Summary

Scope of the Study

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Trends: Current and Future

- 1.1.1.1 Growing Support from the Government Through Investment in Advanced Energy Storage Technologies

- 1.1.1.2 Increasing R&D Activities on Solid-State Battery

- 1.1.2 Supply Chain Analysis

- 1.1.3 Ecosystem/Ongoing Programs

- 1.1.3.1 Consortiums and Associations

- 1.1.3.2 Regulatory Bodies

- 1.1.3.3 Government Programs

- 1.1.4 Comparative Analysis

- 1.1.4.1 Lithium-Ion Batteries vs. Solid-State Batteries

- 1.1.4.2 Comparison in Terms of Power Density of Various Batteries

- 1.1.5 List of Key Planned Solid-State Battery Projects

- 1.1.6 Future of Solid-State Battery in EVs and the Role of EV Manufacturers in Advancing Solid-State Battery Development

- 1.1.6.1 Current Market Outlook

- 1.1.6.2 Research and Development

- 1.1.6.2.1 Solid-State Battery with Pure Silicon Anode

- 1.1.6.2.2 Recent Electrode Design of MIT's Solid-State Battery

- 1.1.6.3 Future Market Outlook

- 1.1.7 Impact of COVID-19 on the Solid-State Battery Market

- 1.1.1 Trends: Current and Future

- 1.2 Snapshot of Sodium-Ion Battery Market

- 1.2.1 Leading Countries in the Sodium-Ion Battery Market

- 1.2.2 Leading Companies in the Sodium-Ion Battery Market

- 1.2.3 Sodium-Ion Battery Market Projections

- 1.3 Business Dynamics

- 1.3.1 Business Drivers

- 1.3.1.1 Rising Renewable Energy Generation

- 1.3.1.2 Rapid Growth of the Electric Vehicle Market

- 1.3.1.3 Growing Concerns Related to Lithium-Ion Battery Failure and Explosion

- 1.3.2 Business Challenges

- 1.3.2.1 Intense Competition from Other Advanced Battery Technologies

- 1.3.2.2 Lack of Industrial Supply Chain

- 1.3.3 Business Strategies

- 1.3.3.1 Product Development

- 1.3.3.2 Market Development

- 1.3.4 Corporate Strategies

- 1.3.4.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 1.3.5 Business Opportunities

- 1.3.5.1 Rising Popularity of Solid-State Batteries in the Medical Sector

- 1.3.5.2 Advancements in Solid-State Battery Technologies and Chemistries

- 1.3.1 Business Drivers

- 1.4 Start-Up Landscape

- 1.4.1 Key Start-Ups in the Ecosystem

2 Region

- 2.1 China

- 2.1.1 Market

- 2.1.1.1 Buyer Attributes

- 2.1.1.2 Key Manufacturers/Suppliers in China

- 2.1.1.3 Business Drivers

- 2.1.1.4 Business Challenges

- 2.1.1.4.1 Application

- 2.1.1.4.1.1 China Solid-State Battery Market (by Application), Value and Volume Data

- 2.1.1.4.2 Product

- 2.1.1.4.2.1 China Solid-State Battery Market (by Electrolyte Type), Value and Volume Data

- 2.1.1.4.2.2 China Solid-State Battery Market (by Battery Type), Value and Volume Data

- 2.1.1.4.2.3 China Solid-State Battery Market (by Capacity), Value and Volume Data

- 2.1.1.4.1 Application

- 2.1.1 Market

- 2.2 Asia-Pacific and Japan

- 2.2.1 Market

- 2.2.1.1 Key Manufacturers/Suppliers in Asia-Pacific and Japan

- 2.2.1.2 Business Drivers

- 2.2.1.3 Business Challenges

- 2.2.1.3.1 Application

- 2.2.1.3.1.1 Asia-Pacific and Japan Solid-State Battery Market (by Application), Value and Volume Data

- 2.2.1.3.2 Product

- 2.2.1.3.2.1 Asia-Pacific and Japan Solid-State Battery Market (by Electrolyte Type), Value and Volume Data

- 2.2.1.3.2.2 Asia-Pacific and Japan Solid-State Battery Market (by Battery Type), Value and Volume Data

- 2.2.1.3.2.3 Asia-Pacific and Japan Solid-State Battery Market (by Capacity), Value and Volume Data

- 2.2.1.3.1 Application

- 2.2.2 Asia-Pacific and Japan (by Country)

- 2.2.2.1 Japan

- 2.2.2.1.1 Market

- 2.2.2.1.1.1 Buyer Attributes

- 2.2.2.1.1.2 Key Manufacturers/Suppliers in Japan

- 2.2.2.1.1.3 Business Drivers

- 2.2.2.1.1.4 Business Challenges

- 2.2.2.1.2 Application

- 2.2.2.1.2.1 Japan Solid-State Battery Market (by Application), Value and Volume Data

- 2.2.2.1.3 Product

- 2.2.2.1.3.1 Japan Solid-State Battery Market (by Electrolyte Type), Value and Volume Data

- 2.2.2.1.3.2 Japan Solid-State Battery Market (by Battery Type), Value and Volume Data

- 2.2.2.1.3.3 Japan Solid-State Battery Market (by Capacity), Value and Volume Data

- 2.2.2.1.1 Market

- 2.2.2.2 South Korea

- 2.2.2.2.1 Market

- 2.2.2.2.1.1 Buyer Attributes

- 2.2.2.2.1.2 Key Manufacturers/Suppliers in South Korea

- 2.2.2.2.1.3 Business Drivers

- 2.2.2.2.1.4 Business Challenges

- 2.2.2.2.2 Application

- 2.2.2.2.2.1 South Korea Solid-State Battery Market (by Application), Value and Volume Data

- 2.2.2.2.3 Product

- 2.2.2.2.3.1 South Korea Solid-State Battery Market (by Electrolyte Type), Value and Volume Data

- 2.2.2.2.3.2 South Korea Solid-State Battery Market (by Battery Type), Value and Volume Data

- 2.2.2.2.3.3 South Korea Solid-State Battery Market (by Capacity), Value and Volume Data

- 2.2.2.2.1 Market

- 2.2.2.3 India

- 2.2.2.3.1 Market

- 2.2.2.3.1.1 Buyer Attributes

- 2.2.2.3.1.2 Key Manufacturers/Suppliers in India

- 2.2.2.3.1.3 Business Drivers

- 2.2.2.3.1.4 Business Challenges

- 2.2.2.3.2 Application

- 2.2.2.3.2.1 India Solid-State Battery Market (by Application), Value and Volume Data

- 2.2.2.3.3 Product

- 2.2.2.3.3.1 India Solid-State Battery Market (by Electrolyte Type), Value and Volume Data

- 2.2.2.3.3.2 India Solid-State Battery Market (by Battery Type), Value and Volume Data

- 2.2.2.3.3.3 India Solid-State Battery Market (by Capacity), Value and Volume Data

- 2.2.2.3.1 Market

- 2.2.2.4 Taiwan

- 2.2.2.4.1 Market

- 2.2.2.4.1.1 Buyer Attributes

- 2.2.2.4.1.2 Key Manufacturers/Suppliers in Taiwan

- 2.2.2.4.1.3 Business Drivers

- 2.2.2.4.1.4 Business Challenges

- 2.2.2.4.2 Application

- 2.2.2.4.2.1 Taiwan Solid-State Battery Market (by Application), Value and Volume Data

- 2.2.2.4.3 Product

- 2.2.2.4.3.1 Taiwan Solid-State Battery Market (by Electrolyte Type), Value and Volume Data

- 2.2.2.4.3.2 Taiwan Solid-State Battery Market (by Battery Type), Value and Volume Data

- 2.2.2.4.3.3 Taiwan Solid-State Battery Market (by Capacity), Value and Volume Data

- 2.2.2.4.1 Market

- 2.2.2.5 Rest-of-Asia-Pacific and Japan

- 2.2.2.5.1 Market

- 2.2.2.5.1.1 Buyer Attributes

- 2.2.2.5.1.2 Key Manufacturers/Suppliers in Rest-of-Asia-Pacific and Japan

- 2.2.2.5.1.3 Business Drivers

- 2.2.2.5.1.4 Business Challenges

- 2.2.2.5.2 Application

- 2.2.2.5.2.1 Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Application), Value and Volume Data

- 2.2.2.5.3 Product

- 2.2.2.5.3.1 Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Electrolyte Type), Value and Volume Data

- 2.2.2.5.3.2 Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Battery Type), Value and Volume Data

- 2.2.2.5.3.3 Rest-of-Asia-Pacific and Japan Solid-State Battery Market (by Capacity), Value and Volume Data

- 2.2.2.5.1 Market

- 2.2.2.1 Japan

- 2.2.1 Market

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.1.1 Competitive Position Matrix

- 3.1.2 Product Matrix for Key Companies

- 3.1.3 Market Share Analysis of Key Companies, 2022

- 3.2 Company Profiles

- 3.2.1 ProLogium Technology Co., Ltd.

- 3.2.1.1 Company Overview

- 3.2.1.1.1 Role of ProLogium Technology Co., Ltd. in the Solid-State Battery Market

- 3.2.1.1.2 Product Portfolio

- 3.2.1.2 Business Strategies

- 3.2.1.2.1 Product Development

- 3.2.1.3 Corporate Strategies

- 3.2.1.3.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.2.1.4 Analyst View

- 3.2.1.1 Company Overview

- 3.2.2 Toyota Motor Corporation

- 3.2.2.1 Company Overview

- 3.2.2.1.1 Role of Toyota Motor Corporation in the Solid-State Battery Market

- 3.2.2.1.2 Product Portfolio

- 3.2.2.2 R&D Analysis

- 3.2.2.3 Analyst View

- 3.2.2.1 Company Overview

- 3.2.3 SAMSUNG SDI CO., LTD.

- 3.2.3.1 Company Overview

- 3.2.3.1.1 Role of SAMSUNG SDI CO., LTD. in the Solid-State Battery Market

- 3.2.3.1.2 Product Portfolio

- 3.2.3.2 Business Strategies

- 3.2.3.2.1 Market Development

- 3.2.3.3 R&D Analysis

- 3.2.3.4 Analyst View

- 3.2.3.1 Company Overview

- 3.2.4 Hitachi Zosen Corporation

- 3.2.4.1 Company Overview

- 3.2.4.1.1 Role of Hitachi Zosen Corporation in the Solid-State Battery Market

- 3.2.4.1.2 Product Portfolio

- 3.2.4.2 Business Strategies

- 3.2.4.2.1 Product Development

- 3.2.4.3 Analyst View

- 3.2.4.1 Company Overview

- 3.2.5 Ganfeng Lithium Group Co., Ltd.

- 3.2.5.1 Company Overview

- 3.2.5.1.1 Role of Ganfeng Lithium Group Co., Ltd. in the Solid-State Battery Market

- 3.2.5.1.2 Product Portfolio

- 3.2.5.2 Business Strategies

- 3.2.5.2.1 Market Development

- 3.2.5.3 Corporate Strategies

- 3.2.5.3.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.2.5.4 R&D Analysis

- 3.2.5.5 Analyst View

- 3.2.5.1 Company Overview

- 3.2.6 SK on Co., Ltd.

- 3.2.6.1 Company Overview

- 3.2.6.1.1 Role of SK on Co., Ltd. in the Solid-State Battery Market

- 3.2.6.1.2 Product Portfolio

- 3.2.6.2 Business Strategies

- 3.2.6.2.1 Market Development

- 3.2.6.3 Corporate Strategies

- 3.2.6.3.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.2.6.4 Analyst View

- 3.2.6.1 Company Overview

- 3.2.1 ProLogium Technology Co., Ltd.