|

|

市場調査レポート

商品コード

1463258

アジア太平洋の電子コネクタ市場:用途別、製品タイプ別、国別:分析と予測(2023年~2032年)Asia-Pacific Electronic Connector Market: Focus on Application, Product Type, and Country - Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の電子コネクタ市場:用途別、製品タイプ別、国別:分析と予測(2023年~2032年) |

|

出版日: 2024年04月17日

発行: BIS Research

ページ情報: 英文 128 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の電子コネクタの市場規模(中国を除く)は、2023年の167億5,000万米ドルから2032年には336億5,000万米ドルに達し、予測期間の2023年~2032年のCAGRは8.06%になると予測されています。

APACの電子コネクタ市場は、自動車・輸送、コンピュータ・周辺機器、通信などの分野からの革新的で効率的な電子接続に対する需要の増加により拡大すると予測されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年の評価額 | 167億5,000万米ドル |

| 2032年予測 | 336億5,000万米ドル |

| CAGR | 8.06% |

電子コネクタは、電気回路のシームレスな結合を可能にする部品であり、多様なアプリケーションにおける電子コネクタの多様性により、その市場売上は緩やかに増加しています。電気自動車、無人運転車、第5世代携帯移動通信(5G)、モノのインターネット(IoT)、ロボット工学の台頭は、主要な市場開発活動を促進すると思われます。

電子コネクタ市場は成熟期を迎えています。電子コネクタ市場は、最新の電子機器における高性能な電子接続に対する需要の高まりに後押しされています。製造業によるインダストリー4.0のイントロダクションも電子コネクタ市場を牽引しています。

当レポートでは、アジア太平洋の電子コネクタ市場について調査し、市場の概要とともに、用途別、製品タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界展望

- ビジネスダイナミクス

第2章 地域

- 中国

- 市場

- 用途

- 製品

- アジア太平洋と日本

- 市場

- 用途

- 製品

- アジア太平洋と日本:国別分析

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競争ポジションマトリックス

- 市場シェア分析

- 企業プロファイル

- Luxshare Precision Industry Co., Ltd.

- Foxconn Interconnect Technology Ltd

- YAZAKI Corporation

- Japan Aviation Electronics Industry, Ltd.

- HIROSE ELECTRIC CO., LTD.

- AVIC Optoelectronics Technology Co., Ltd.

- Sumitomo Wiring System, Ltd.

- LOTES CO., LTD.

- shenzhen Deren Electronics co., LTD.

- Korea Electric Terminal Co., Ltd.

- IRISO Electronics Co., Ltd.

- Hosiden Corporation

- Yamaichi Electronics Co., Ltd.

- I-PEX Inc.

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Electronic Connector Market Overview, $Billion, 2022-2032

- Figure 2: Asia-Pacific Electronic Connector Market (by Product Type), $Billion, 2022-2032

- Figure 3: Asia-Pacific Electronic Connector Market (by Application), $Billion, 2022-2032

- Figure 4: Electronic Connector Market (by Region), $Billion, 2022

- Figure 5: Key Companies Profiled

- Figure 6: Sale of Electric Vehicles, Million Units, 2020-2022

- Figure 7: Electronic Connector Market Supply Chain Analysis

- Figure 8: Business Dynamics for Electronic Connector Market

- Figure 9: Vehicle Production, Thousand Units, 2021 and 2022

- Figure 10: Installed Base of Connected Devices Worldwide (IoT), Billion Units, 2015-2025

- Figure 11: Clean Energy Investment in the Net Zero Pathway, $Trillion, 2016-2050

- Figure 12: Challenges for Electrical Connectors

- Figure 13: Effects and Preventive Measures of Corrosion in Electrical Connectors

- Figure 14: Key Business Strategies, 2020-2023

- Figure 15: Product Development (by Company), 2020-2023

- Figure 16: Market Development (by Company), 2020-2023

- Figure 17: Key Corporate Strategies, 2020-2023

- Figure 18: Mergers and Acquisitions (by Company), 2020-2023

- Figure 19: Partnerships, Joint Ventures, Collaborations, and Alliances (by Company), 2020-2023

- Figure 20: Key Applications of Micro Electrical Connectors in Various Industries

- Figure 21: Competitive Benchmarking for Electronic Connector Manufacturers in China

- Figure 22: Competitive Benchmarking for Electronic Connector Manufacturers in Asia-Pacific and Japan

- Figure 23: Competitive Benchmarking

- Figure 24: LOTES CO., LTD.: R&D Expenditure, $Million, 2020-2022

- Figure 25: I-PEX Inc.: R&D Expenditure, $Million, 2020-2022

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

List of Tables

- Table 1: Asia-Pacific Electronic Connector Market Overview

- Table 2: Consortiums, Associations, and Regulatory Bodies

- Table 3: Government Programs for Electronic Connectors

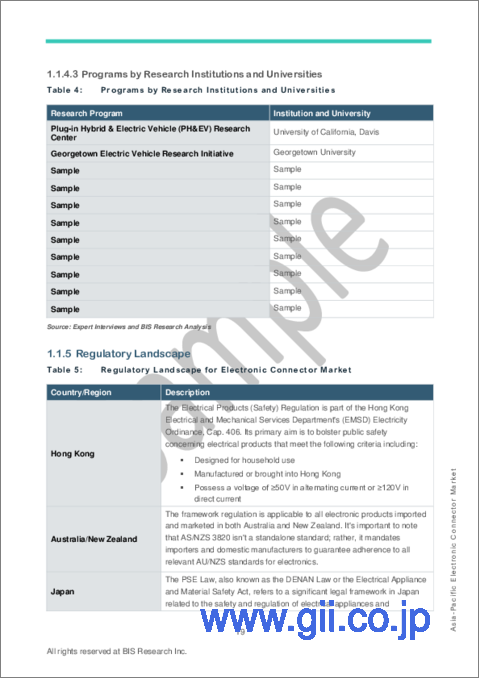

- Table 4: Programs by Research Institutions and Universities

- Table 5: Regulatory Landscape for Electronic Connector Market

- Table 6: Key Patent Mapping

- Table 7: Electronic Connector Market (by Region), $Billion, 2022-2032

- Table 8: China Electronic Connector Market (by Application), $Billion, 2022-2032

- Table 9: China Electronic Connector Market (by Product Type), $Billion, 2022-2032

- Table 10: Asia-Pacific and Japan Electronic Connector Market (by Application), $Billion, 2022-2032

- Table 11: Asia-Pacific and Japan Electronic Connector Market (by Product Type), $Billion, 2022-2032

- Table 12: Japan Electronic Connector Market (by Application), $Billion, 2022-2032

- Table 13: Japan Electronic Connector Market (by Product Type), $Billion, 2022-2032

- Table 14: South Korea Electronic Connector Market (by Application), $Billion, 2022-2032

- Table 15: South Korea Electronic Connector Market (by Product Type), $Billion, 2022-2032

- Table 16: India Electronic Connector Market (by Application), $Billion, 2022-2032

- Table 17: India Electronic Connector Market (by Product Type), $Billion, 2022-2032

- Table 18: Rest-of-Asia-Pacific and Japan Electronic Connector Market (by Application), $Billion, 2022-2032

- Table 19: Rest-of-Asia-Pacific and Japan Electronic Connector Market (by Product Type), $Billion, 2022-2032

- Table 20: Market Share Analysis: Electronic Connector Market

- Table 21: Luxshare Precision Industry Co., Ltd.: Product Portfolio

- Table 22: Luxshare Precision Industry Co., Ltd.: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 23: Foxconn Interconnect Technology Ltd: Product Portfolio

- Table 24: Foxconn Interconnect Technology Ltd: Market Development

- Table 25: Foxconn Interconnect Technology Ltd: Mergers and Acquisitions

- Table 26: Foxconn Interconnect Technology Ltd: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 27: YAZAKI Corporation: Product Portfolio

- Table 28: YAZAKI Corporation: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 29: Japan Aviation Electronics Industry, Ltd.: Product Portfolio

- Table 30: Japan Aviation Electronics Industry, Ltd.: Product Development

- Table 31: Japan Aviation Electronics Industry, Ltd.: Market Development

- Table 32: Japan Aviation Electronics Industry, Ltd.: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 33: HIROSE ELECTRIC CO., LTD.: Product Portfolio

- Table 34: HIROSE ELECTRIC CO., LTD.: Product Development

- Table 35: AVIC Optoelectronics Technology Co., Ltd.: Product Portfolio

- Table 36: AVIC Optoelectronics Technology Co., Ltd.: Market Development

- Table 37: AVIC Optoelectronics Technology Co., Ltd.: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 38: Sumitomo Wiring System, Ltd.: Product Portfolio

- Table 39: LOTES CO., LTD.: Product Portfolio

- Table 40: LOTES CO., LTD.: Market Development

- Table 41: shenzhen Deren Electronics co., LTD.: Product Portfolio

- Table 42: Korea Electric Terminal Co., Ltd.: Product Portfolio

- Table 43: IRISO Electronics Co., Ltd.: Product Portfolio

- Table 44: Hosiden Corporation: Product Portfolio

- Table 45: Yamaichi Electronics Co., Ltd.: Product Portfolio

- Table 46: Yamaichi Electronics Co., Ltd.: Product Development

- Table 47: Yamaichi Electronics Co., Ltd.: Market Development

- Table 48: I-PEX Inc.: Product Portfolio

- Table 49: I-PEX Inc.: Product Development

- Table 50: I-PEX Inc.: Partnerships, Joint Ventures, Collaborations, and Alliances

Introduction to Asia-Pacific Electronic Connector Market

The Asia-Pacific electronic connector market (excluding China) is projected to reach $33.65 billion by 2032 from $16.75 billion in 2023, growing at a CAGR of 8.06% during the forecast period 2023-2032. The APAC electronic connector market is predicted to expand due to increased demand for innovative and efficient electronic connections from sectors such as automotive and transportation, computers and peripherals, and telecommunications.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $16.75 Billion |

| 2032 Forecast | $33.65 Billion |

| CAGR | 8.06% |

Market Introduction

An electronic connector is a component that allows for the seamless coupling of electrical circuits, and its market sales are increasing moderately due to the diversity of electronic connectors in diverse applications. The rise of electric vehicles, driverless vehicles, the fifth generation of cellular mobile communications (5G), the Internet of Things (IoT), and robotics are likely to promote key market development activities.

The electronic connector market has reached maturity. The electronic connector market is being propelled by rising demand for high-performance electronic connections in modern electronic gadgets. The introduction of Industry 4.0 by manufacturing industries is also driving the electronic connector market.

Market Segmentation:

Segmentation 1: by Application

- Computers and Peripherals

- Consumer Electronics

- Automotive and Transportation

- Telecom

- Energy and Power

- Others (Industrial, Military, and Medical, among others)

Segmentation 2: by Product Type

- I/O Connectors

- Printed Circuit Board (PCB) Connectors

- RF Coaxial Connectors

- Fiber Optic Connectors

- Others (Circular Connectors, Rectangular Connectors, and others)

Segmentation 3: by Country

- Japan

- South Korea

- India

- Rest-of-Asia-Pacific and Japan

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of electronic connector products available by product type (I/O connectors, printed circuit board (PCB) connectors, RF coaxial connectors, fiber optic connectors, and others (circular connectors, rectangular connectors, and others)), by application (computers and peripherals, consumer electronics, automotive and transportation, telecom, energy and power, others (industrial, military, and medical, among others)). Increasing automotive and transportation demand worldwide is pushing the sales of electronic connector systems. Therefore, the electronic connector business is a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The APAC electronic connector market is exponentially growing, with enormous opportunities for the market players. Some strategies covered in this segment are product launches, partnerships and collaborations, business expansions, and investments. The companies' preferred strategies have been product launches, partnerships, and collaborations to strengthen their positions in the global electronic connector market.

Competitive Strategy: Key players in the APAC electronic connector market analyzed and profiled in the study involve electronic connector-based product manufacturers and start-ups. Moreover, a detailed competitive benchmarking of the players operating in the global electronic connector market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, type portfolio, and market penetration.

Some prominent names in the market include:

- YAZAKI Corporation

- HIROSE ELECTRIC CO., LTD.

- Sumitomo Wiring System, Ltd.

- Hosiden Corporation

Table of Contents

Executive Summary

Scope of the Study

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Overview: Electronic Connector

- 1.1.2 Trends: Current and Future

- 1.1.2.1 Growing Numbers of Electric Vehicles Worldwide

- 1.1.2.2 Growing Demand for High-Speed Data Transfer

- 1.1.2.3 Evolution of Wireless Connectivity

- 1.1.3 Supply Chain Analysis

- 1.1.4 Ecosystem/Ongoing Programs

- 1.1.4.1 Consortiums, Associations, and Regulatory Bodies

- 1.1.4.2 Government Programs

- 1.1.4.3 Programs by Research Institutions and Universities

- 1.1.5 Regulatory Landscape

- 1.1.6 Key Patent Mapping

- 1.1.6.1 Analyst View

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Rapidly Increasing Demand for Electrical Connectors in the Automotive Industry

- 1.2.1.2 Increasing Adoption of the Internet of Things (IoT)

- 1.2.1.3 Growing Demand for Renewable Energy Sources

- 1.2.2 Business Challenges

- 1.2.2.1 Intricate Design and Process of Manufacturing

- 1.2.2.2 Elevated Corrosion Levels and the Occurrence of Loose Connections

- 1.2.2.3 High Implementation Cost and Availability of Alternatives

- 1.2.3 Business Strategies

- 1.2.3.1 Product Development

- 1.2.3.2 Market Development

- 1.2.4 Corporate Strategies

- 1.2.4.1 Mergers and Acquisitions

- 1.2.4.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 1.2.5 Business Opportunities

- 1.2.5.1 Increasing Trend of Miniaturization in Electronics

- 1.2.5.2 Requirement of High-Performance Connectors in 5G Technology

- 1.2.1 Business Drivers

2 Regions

- 2.1 China

- 2.1.1 Market

- 2.1.1.1 Buyer Attributes

- 2.1.1.2 Key Suppliers and Product Manufacturers in China

- 2.1.1.3 Competitive Benchmarking

- 2.1.1.4 Business Challenges

- 2.1.1.5 Business Drivers

- 2.1.2 Application

- 2.1.2.1 China Electronic Connector Market (by Application), Value Data

- 2.1.3 Product

- 2.1.3.1 China Electronic Connector Market (by Product Type), Value Data

- 2.1.1 Market

- 2.2 Asia-Pacific and Japan

- 2.2.1 Market

- 2.2.1.1 Buyer Attributes

- 2.2.1.2 Key Suppliers and Product Manufacturers in Asia-Pacific and Japan

- 2.2.1.3 Competitive Benchmarking

- 2.2.1.4 Business Challenges

- 2.2.1.5 Business Drivers

- 2.2.2 Application

- 2.2.2.1 Asia-Pacific and Japan Electronic Connector Market (by Application), Value Data

- 2.2.3 Product

- 2.2.3.1 Asia-Pacific and Japan Electronic Connector Market (by Product Type), Value Data

- 2.2.4 Asia-Pacific and Japan: Country-Level Analysis

- 2.2.4.1 Japan

- 2.2.4.1.1 Market

- 2.2.4.1.1.1 Buyer Attributes

- 2.2.4.1.1.2 Key Suppliers and Product Manufacturers in Japan

- 2.2.4.1.1.3 Business Challenges

- 2.2.4.1.1.4 Business Drivers

- 2.2.4.1.2 Application

- 2.2.4.1.2.1 Japan Electronic Connector Market (by Application), Value Data

- 2.2.4.1.3 Product

- 2.2.4.1.3.1 Japan Electronic Connector Market (by Product Type), Value Data

- 2.2.4.1.1 Market

- 2.2.4.2 South Korea

- 2.2.4.2.1 Market

- 2.2.4.2.1.1 Buyer Attributes

- 2.2.4.2.1.2 Key Suppliers and Product Manufacturers in South Korea

- 2.2.4.2.1.3 Business Challenges

- 2.2.4.2.1.4 Business Drivers

- 2.2.4.2.2 Application

- 2.2.4.2.2.1 South Korea Electronic Connector Market (by Application), Value Data

- 2.2.4.2.3 Product

- 2.2.4.2.3.1 South Korea Electronic Connector Market (by Product Type), Value Data

- 2.2.4.2.1 Market

- 2.2.4.3 India

- 2.2.4.3.1 Market

- 2.2.4.3.1.1 Buyer Attributes

- 2.2.4.3.1.2 Key Suppliers and Product Manufacturers in India

- 2.2.4.3.1.3 Business Challenges

- 2.2.4.3.1.4 Business Drivers

- 2.2.4.3.2 Application

- 2.2.4.3.2.1 India Electronic Connector Market (by Application), Value Data

- 2.2.4.3.3 Product

- 2.2.4.3.3.1 India Electronic Connector Market (by Product Type), Value Data

- 2.2.4.3.1 Market

- 2.2.4.4 Rest-of-Asia-Pacific and Japan

- 2.2.4.4.1 Market

- 2.2.4.4.1.1 Buyer Attributes

- 2.2.4.4.1.2 Key Suppliers and Product Manufacturers in Rest-of-Asia-Pacific and Japan

- 2.2.4.4.1.3 Business Challenges

- 2.2.4.4.1.4 Business Drivers

- 2.2.4.4.2 Application

- 2.2.4.4.2.1 Rest-of-Asia-Pacific and Japan Electronic Connector Market (by Application), Value Data

- 2.2.4.4.3 Product

- 2.2.4.4.3.1 Rest-of-Asia-Pacific and Japan Electronic Connector Market (by Product Type), Value Data

- 2.2.4.4.1 Market

- 2.2.4.1 Japan

- 2.2.1 Market

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.1.1 Competitive Position Matrix

- 3.2 Market Share Analysis

- 3.3 Company Profiles

- 3.3.1 Luxshare Precision Industry Co., Ltd.

- 3.3.1.1 Company Overview

- 3.3.1.1.1 Role of Luxshare Precision Industry Co., Ltd. in the Electronic Connector Market

- 3.3.1.1.2 Product Portfolio

- 3.3.1.2 Corporate Strategies

- 3.3.1.2.1 Luxshare Precision Industry Co., Ltd.: Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.1.3 Production Sites and R&D Analysis

- 3.3.1.4 Analyst View

- 3.3.1.1 Company Overview

- 3.3.2 Foxconn Interconnect Technology Ltd

- 3.3.2.1 Company Overview

- 3.3.2.1.1 Role of Foxconn Interconnect Technology Ltd in the Electronic Connector Market

- 3.3.2.1.2 Product Portfolio

- 3.3.2.2 Business Strategies

- 3.3.2.2.1 Foxconn Interconnect Technology Ltd: Market Development

- 3.3.2.3 Corporate Strategies

- 3.3.2.3.1 Foxconn Interconnect Technology Ltd: Mergers and Acquisitions

- 3.3.2.3.2 Foxconn Interconnect Technology Ltd: Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.2.4 Production Sites and R&D Analysis

- 3.3.2.5 Analyst View

- 3.3.2.1 Company Overview

- 3.3.3 YAZAKI Corporation

- 3.3.3.1 Company Overview

- 3.3.3.1.1 Role of YAZAKI Corporation in the Electronic Connector Market

- 3.3.3.1.2 Product Portfolio

- 3.3.3.2 Corporate Strategies

- 3.3.3.2.1 YAZAKI Corporation: Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.3.3 Production Sites and R&D Analysis

- 3.3.3.4 Analyst View

- 3.3.3.1 Company Overview

- 3.3.4 Japan Aviation Electronics Industry, Ltd.

- 3.3.4.1 Company Overview

- 3.3.4.1.1 Role of Japan Aviation Electronics Industry, Ltd. in the Electronic Connector Market

- 3.3.4.1.2 Product Portfolio

- 3.3.4.2 Business Strategies

- 3.3.4.2.1 Japan Aviation Electronics Industry, Ltd.: Product Development

- 3.3.4.2.2 Japan Aviation Electronics Industry, Ltd.: Market Development

- 3.3.4.3 Corporate Strategies

- 3.3.4.3.1 Japan Aviation Electronics Industry, Ltd.: Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.4.4 Production Sites and R&D Analysis

- 3.3.4.5 Analyst View

- 3.3.4.1 Company Overview

- 3.3.5 HIROSE ELECTRIC CO., LTD.

- 3.3.5.1 Company Overview

- 3.3.5.1.1 Role of HIROSE ELECTRIC CO., LTD. in the Electronic Connector Market

- 3.3.5.1.2 Product Portfolio

- 3.3.5.2 Business Strategies

- 3.3.5.2.1 HIROSE ELECTRIC CO., LTD.: Product Development

- 3.3.5.3 Production Sites and R&D Analysis

- 3.3.5.4 Analyst View

- 3.3.5.1 Company Overview

- 3.3.6 AVIC Optoelectronics Technology Co., Ltd.

- 3.3.6.1 Company Overview

- 3.3.6.1.1 Role of AVIC Optoelectronics Technology Co., Ltd. in the Electronic Connector Market

- 3.3.6.1.2 Product Portfolio

- 3.3.6.2 Business Strategies

- 3.3.6.2.1 AVIC Optoelectronics Technology Co., Ltd.: Market Development

- 3.3.6.3 Corporate Strategies

- 3.3.6.3.1 AVIC Optoelectronics Technology Co., Ltd.: Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.6.4 Production Sites and R&D Analysis

- 3.3.6.5 Analyst View

- 3.3.6.1 Company Overview

- 3.3.7 Sumitomo Wiring System, Ltd.

- 3.3.7.1 Company Overview

- 3.3.7.1.1 Role of Sumitomo Wiring System, Ltd. in the Electronic Connector Market

- 3.3.7.1.2 Product Portfolio

- 3.3.7.2 Production Sites and R&D Analysis

- 3.3.7.3 Analyst View

- 3.3.7.1 Company Overview

- 3.3.8 LOTES CO., LTD.

- 3.3.8.1 Company Overview

- 3.3.8.1.1 Role of LOTES CO., LTD. in the Electronic Connector Market

- 3.3.8.1.2 Product Portfolio

- 3.3.8.2 Business Strategies

- 3.3.8.2.1 LOTES CO., LTD.: Market Development

- 3.3.8.3 Production Sites and R&D Analysis

- 3.3.8.4 Analyst View

- 3.3.8.1 Company Overview

- 3.3.9 shenzhen Deren Electronics co., LTD.

- 3.3.9.1 Company Overview

- 3.3.9.1.1 Role of shenzhen Deren Electronics co., LTD. in the Electronic Connector Market

- 3.3.9.1.2 Product Portfolio

- 3.3.9.2 Production Sites and R&D Analysis

- 3.3.9.3 Analyst View

- 3.3.9.1 Company Overview

- 3.3.10 Korea Electric Terminal Co., Ltd.

- 3.3.10.1 Company Overview

- 3.3.10.1.1 Role of Korea Electric Terminal Co., Ltd. in the Electronic Connector Market

- 3.3.10.1.2 Product Portfolio

- 3.3.10.2 Production Sites and R&D Analysis

- 3.3.10.3 Analyst View

- 3.3.10.1 Company Overview

- 3.3.11 IRISO Electronics Co., Ltd.

- 3.3.11.1 Company Overview

- 3.3.11.1.1 Role of IRISO Electronics Co., Ltd. in the Electronic Connector Market

- 3.3.11.1.2 Product Portfolio

- 3.3.11.2 Production Sites and R&D Analysis

- 3.3.11.3 Analyst View

- 3.3.11.1 Company Overview

- 3.3.12 Hosiden Corporation

- 3.3.12.1 Company Overview

- 3.3.12.1.1 Role of Hosiden Corporation in the Electronic Connector Market

- 3.3.12.1.2 Product Portfolio

- 3.3.12.2 Production Sites and R&D Analysis

- 3.3.12.3 Analyst View

- 3.3.12.1 Company Overview

- 3.3.13 Yamaichi Electronics Co., Ltd.

- 3.3.13.1 Company Overview

- 3.3.13.1.1 Role of Yamaichi Electronics Co., Ltd. in the Electronic Connector Market

- 3.3.13.1.2 Product Portfolio

- 3.3.13.2 Business Strategies

- 3.3.13.2.1 Yamaichi Electronics Co., Ltd.: Product Development

- 3.3.13.2.2 Yamaichi Electronics Co., Ltd.: Market Development

- 3.3.13.3 Production Sites and R&D Analysis

- 3.3.13.4 Analyst View

- 3.3.13.1 Company Overview

- 3.3.14 I-PEX Inc.

- 3.3.14.1 Company Overview

- 3.3.14.1.1 Role of I-PEX Inc. in the Electronic Connector Market

- 3.3.14.1.2 Product Portfolio

- 3.3.14.2 Business Strategies

- 3.3.14.2.1 I-PEX Inc.: Product Development

- 3.3.14.3 Corporate Strategies

- 3.3.14.3.1 I-PEX Inc.: Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.14.4 Production Sites and R&D Analysis

- 3.3.14.5 Analyst View

- 3.3.14.1 Company Overview

- 3.3.1 Luxshare Precision Industry Co., Ltd.

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast

- 4.2.1 Research Methodology - Top-Down and Bottom-Up Approach

- 4.2.2 Factors for Data Prediction and Modeling