|

|

市場調査レポート

商品コード

1420109

世界およびアジア太平洋の無人航空機システム(UAS)市場- 世界と地域の分析:用途別、ドローンタイプ別、運用モード別、インフラ別、航続距離別、コンポーネント別、国別分析 - 分析と予測(2023年~2033年)Global and Asia-Pacific Unmanned Aerial System (UAS) Market - A Global and Regional Analysis: Focus on Application, Drone Type, Mode of Operation, Infrastructure, Range, Component, and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 世界およびアジア太平洋の無人航空機システム(UAS)市場- 世界と地域の分析:用途別、ドローンタイプ別、運用モード別、インフラ別、航続距離別、コンポーネント別、国別分析 - 分析と予測(2023年~2033年) |

|

出版日: 2024年02月05日

発行: BIS Research

ページ情報: 英文 129 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

無人航空機システム(UAS)の出現は、ドローンとして知られることもありますが、重要な技術的進歩を意味し、様々な商業および政府部門の業務を変化させます。

遠隔操縦機能と適応性の高いアーキテクチャを特徴とするこれらのシステムは、軍事用途にとどまらず、農業、不動産、インフラ、緊急サービスなどの産業にも広がっています。農業分野では、UASは農家が作物の健康状態をチェックし、灌漑を監視し、農薬散布を最適化できる包括的な航空画像を提供することで、精密農業を変革しています。不動産ビジネスでは、UASを空撮に使用することで、没入感のある物件ビューを提供し、マーケティング手法を向上させています。ドローンは、インフラ検査、損傷評価、建設進捗モニタリングにおいて重要な役割を果たし、従来の技術に代わる、より安全で費用対効果の高い選択肢を提供しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年評価 | 181億米ドル |

| 2033年予測 | 724億2,000万米ドル |

| CAGR | 14.87% |

ドローンとして知られることもある無人航空機システム(UAS)は、20世紀初頭、航空とラジコンの技術開発が飛躍的に進んだ時代に初めて開発されました。UASの起源は、オーストリアが1849年にベニスに爆弾を積んだ一連の無人の無線操縦気球を打ち上げた第一次世界大戦にまで遡ることができます。しかし、第二次世界大戦中、UASの概念はより明確になり、その主な理由は射撃訓練、偵察、戦闘任務の必要性にあっています。特に、俳優であり発明家でもあったレジナルドデニーは、1930年代にラジオプレーンOQ-2を開発しました。現代の文脈では、無人航空機システムのオペレーターが重要であり、無人航空機の操縦と運用の監督を担当しています。

現在、無人航空機は急速な技術進歩を遂げ、商業、環境、公共サービスなど幅広い産業で使用されるようになっています。AI、機械学習、センサー技術における最先端のブレークスルーは、UASの自律性、信頼性、適応性を大幅に向上させています。DJIやParrotなどの企業は、リアルタイムデータ処理、障害物回避、飛行耐久時間の延長などの高度な機能を備えたドローンを常に開発・生産しています。また、この分野では、精密農業、インフラ検査、災害管理、配送サービス向けの統合ソリューションの開発に重点を置いた、ハイテク大手とドローン新興企業との戦略的提携も増加しており、UAS産業の力強い成長と、自律技術と空中作業の未来を形作る極めて重要な役割を実証しています。

無人航空機システム(UAS)の導入は、様々な産業分野での変革期を告げており、より高い効率性、データ収集の改善、運用パラダイムの根本的な転換を特徴としています。UAS技術は従来の農業手法を変革し、作物のモニタリング、健康評価、土地管理に高解像度の空中画像を提供することで精密農業を可能にしました。この詳細なレベルのデータにより、賢明な意思決定が可能になり、資源配分が最適化され、環境への影響を抑えながら農業の収量が大幅に増加します。さらに、インフラや建設の分野では、UASは橋や高層ビル、風力タービンなど、アクセスしにくい建物の広範な検査を実施するのに有用であることが証明されています。これにより、構造上の欠陥を早期に発見できるようになり、より高い安全基準が保証されるだけでなく、手作業による検査の必要性が減り、労働災害の危険性が最小限に抑えられるため、大幅なコスト削減にもつながります。

当レポートでは、世界およびアジア太平洋の無人航空機システム(UAS)市場について調査し、市場の概要とともに、用途別、ドローンタイプ別、運用モード別、インフラ別、航続距離別、コンポーネント別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界の展望

第2章 用途

- 世界およびアジア太平洋の無人航空機システム(UAS)市場(用途別)

- 市場概要

- 商業

- 政府

第3章 製品

- 世界およびアジア太平洋の無人航空機システム(UAS)市場(ドローンタイプ別)

- 市場概要

- 固定翼

- ロータリーウィング

- 世界およびアジア太平洋の無人航空機システム(UAS)市場(運用モード別)

- 市場概要

- 遠隔操縦

- 半自律型

- 自律型

- 世界およびアジア太平洋の無人航空機システム(UAS)市場(インフラ別)

- 市場概要

- 無人交通管理(UTM)

- ドローンレセプタクル

- 世界およびアジア太平洋の無人航空機システム(UAS)市場(航続距離別)

- 市場概要

- VLOS

- BVLOS

- 世界およびアジア太平洋の無人航空機システム(UAS)市場(コンポーネント別)

- 市場概要

- 機体

- ペイロード

- 誘導ナビゲーション制御

- 推進システム

第4章 地域

- 世界およびアジア太平洋の無人航空機システム(UAS)市場(地域別)

- 北米、欧州、その他の地域

- アジア太平洋

第5章 調査手法

List of Figures

- Figure 1: Global and Asia-Pacific Unmanned Aerial System (UAS) Market, $Billion, 2022-2033

- Figure 2: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type), $Billion, 2023 and 2033

- Figure 3: Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type), $Billion, 2023 and 2033

- Figure 4: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation), $Billion, 2023 and 2033

- Figure 5: Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation), $Billion, 2023 and 2033

- Figure 6: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Infrastructure), $Billion, 2023 and 2033

- Figure 7: Asia-Pacific Unmanned Aerial System (UAS) Market (by Infrastructure), $Million, 2023 and 2033

- Figure 8: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Range), $Billion, 2023 and 2033

- Figure 9: Asia-Pacific Unmanned Aerial System (UAS) Market (by Range), $Billion, 2023 and 2033

- Figure 10: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Component), $Billion, 2023 and 2033

- Figure 11: Asia-Pacific Unmanned Aerial System (UAS) Market (by Component), $Billion, 2023 and 2033

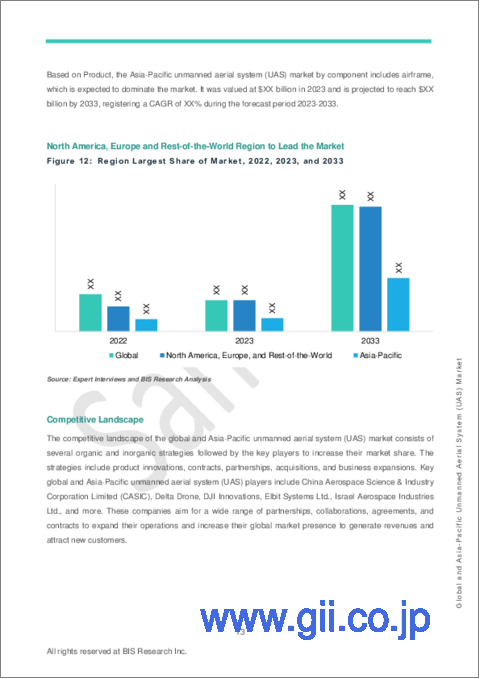

- Figure 12: Region Largest Share of Market, 2022, 2023, and 2033

- Figure 13: Global and Asia-Pacific Unmanned Aerial System (UAS) Market Coverage

- Figure 14: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Application)

- Figure 15: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type)

- Figure 16: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation)

- Figure 17: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Infrastructure)

- Figure 18: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Range)

- Figure 19: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Component)

- Figure 20: Research Methodology

- Figure 21: Top-Down and Bottom-Up Approach

- Figure 22: Assumptions and Limitations

List of Tables

- Table 1: Key Players

- Table 2: Funding and Investment Scenario, January 2019-January 2024

- Table 3: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 4: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 5: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 6: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Autonomous ((Application)), $Million, 2022-2033

- Table 7: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Infrastructure), $Million, 2022-2033

- Table 8: Patents, January 2023-December 2023

- Table 9: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 10: Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 11: Global and Asia-Pacific Unmanned Aerial System (UAS) Market, by Region, (by application), $Million, 2022-2033

- Table 12: North America, Europe, and Rest-of-the-World Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 13: North America, Europe, and Rest-of-the-World Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 14: North America, Europe, and Rest-of-the-World Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 15: North America, Europe, and Rest-of-the-World Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 16: North America, Europe, and Rest-of-the-World Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 17: Asia-Pacific Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 18: Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 19: Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 20: Asia-Pacific Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 21: Asia-Pacific Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 22: China Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 23: China Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 24: China Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 25: China Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 26: China Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 27: Singapore Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 28: Singapore Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 29: Singapore Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 30: Singapore Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 31: Singapore Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 32: Japan Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 33: Japan Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 34: Japan Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 35: Japan Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 36: Japan Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 37: South Korea Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 38: South Korea Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 39: South Korea Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 40: South Korea Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 41: South Korea Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 42: Thailand Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 43: Thailand Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 44: Thailand Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 45: Thailand Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 46: Thailand Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 47: Indonesia Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 48: Indonesia Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 49: Indonesia Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 50: Indonesia Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 51: Indonesia Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 52: Philippines Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 53: Philippines Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 54: Philippines Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 55: Philippines Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 56: Philippines Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 57: Vietnam Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 58: Vietnam Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 59: Vietnam Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 60: Vietnam Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 61: Vietnam Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

- Table 62: Rest-of-Asia-Pacific Unmanned Aerial System (UAS) Market (by Application), $Million, 2022-2033

- Table 63: Rest-of-Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type), $Million, 2022-2033

- Table 64: Rest-of-Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation), $Million, 2022-2033

- Table 65: Rest-of-Asia-Pacific Unmanned Aerial System (UAS) Market (by Range), $Million, 2022-2033

- Table 66: Rest-of-Asia-Pacific Unmanned Aerial System (UAS) Market (by Component), $Million, 2022-2033

“The Global and Asia-Pacific Unmanned Aerial System (UAS) Market Expected to Reach $72.42 Billion by 2033.”

Introduction of Unmanned Aerial System (UAS)

The emergence of unmanned aerial systems (UAS), occasionally known as drones, represents a significant technological advancement, changing operations in a variety of commercial and government sectors. These systems, distinguished by their remote piloting capabilities and adaptable architecture, have spread beyond military applications to industries including agriculture, real estate, infrastructure, and emergency services. In agriculture, UAS is transforming precision farming by delivering comprehensive aerial images that allow farmers to check crop health, monitor irrigation, and optimize pesticide distribution. The real estate business uses UAS for aerial photography, which provides immersive property views and improves marketing methods. Drones play an important role in infrastructure inspections, damage assessments, and construction progress monitoring, providing a safer and more cost-effective alternative to traditional techniques.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $18.10 Billion |

| 2033 Forecast | $72.42 Billion |

| CAGR | 14.87% |

Market Introduction

Unmanned aerial systems (UAS), sometimes known as drones, were first developed in the early twentieth century, in an era of tremendous technical developments in aviation and radio control. The origins of UAS may be traced back to World War I when Austria launched a series of unmanned, radio-controlled balloons loaded with bombs on Venice in 1849. However, during World War II, the notion of UAS became more defined, owing mostly to the requirement for target practice, reconnaissance, and combat missions. Notably, Reginald Denny, an actor and inventor, developed the Radioplane OQ-2 in the 1930s, which represented a significant milestone. In the contemporary context, the unmanned aircraft systems operator is crucial, being responsible for piloting and overseeing the operations of unmanned aerial vehicles.

Nowadays, unmanned drones are characterized by fast technical progress and rising use across a wide range of industries, including commercial, environmental, and public service activities. Cutting-edge breakthroughs in AI, machine learning, and sensor technologies are greatly improving UAS's autonomy, dependability, and adaptability. Companies such as DJI and Parrot are constantly developing and producing drones with advanced features such as real-time data processing, obstacle avoidance, and extended flying endurance. The sector is also seeing an increase in strategic partnerships between tech giants and drone start-ups, with a focus on developing integrated solutions for precision agriculture, infrastructure inspection, disaster management, and delivery services, demonstrating the UAS industry's robust growth and pivotal role in shaping the future of autonomous technology and aerial operations.

Industrial Impact

The introduction of unmanned aerial systems (UAS) has signaled a transformational period in a variety of industrial sectors, characterized by higher efficiency, improved data collecting, and a fundamental shift in operating paradigms. UAS technology has transformed traditional agricultural methods, allowing precision agriculture by providing high-resolution airborne imagery for crop monitoring, health evaluation, and land management. This detailed level of data enables educated decision-making, optimizes resource allocation, and considerably increases agricultural yields while reducing environmental effects. Furthermore, in the field of infrastructure and construction, UAS have proven useful in conducting extensive inspections of difficult-to-access buildings such as bridges, skyscrapers, and wind turbines. This not only assures greater safety standards by allowing early detection of structural flaws, but it also results in significant cost savings by decreasing the need for manual inspections and minimizing the danger of workplace accidents.

Simultaneously, UAV system technology is at the forefront of altering emergency response and catastrophe management procedures. In situations when every second counts, UAS provides quick, real-time observation and evaluation of disaster-stricken areas without exposing people to dangerous conditions. This feature facilitates the quick and efficient deployment of emergency services, which improves the efficacy of rescue operations. Furthermore, in environmental monitoring and conservation activities, unmanned aerial system (UAS) or unmanned aerial vehicle (UAV) provides an unprecedented platform for large-scale data collecting and habitat monitoring, enabling insights into patterns and changes that are invisible at ground level. This high-level overview provides a more thorough and proactive approach to environmental stewardship, which helps to preserve biodiversity and manage natural resources sustainably. As these systems mature and include powerful AI and machine learning algorithms, UAS's potential to promote innovation and operational excellence across sectors is likely to grow, ushering in a new era of industrial efficiency and environmental awareness.

Market Segmentation:

Segmentation 1: by Application

- Commercial

- Government

Commercial Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Application)

The global and Asia-Pacific unmanned aerial system (UAS) market is led by the commercial application segment, which held a 98.11% share in 2022. The growing emphasis on technological advancement, shifting consumer preferences, and favorable economic conditions are expected to create demand and opportunities for expansion. For instance, in February 2023, Zipline International, Inc. received authorization from the FAA to use drones for commercial package deliveries in the vicinity of Salt Lake City. These drones are permitted to operate beyond the operator's visual line of sight without the need for visual observers.

Segmentation 2: by Drone Type

- Fixed Wing

- Rotary Wing

Rotary Wing Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type)

The global and Asia-Pacific unmanned aerial system (UAS) market is led by the rotary wing drone type segment, which held a 78.88% share in 2022. The growing demand within the segment is propelled by technological advancements such as advanced imaging technologies, such as light detection and ranging (LiDAR) and high-resolution cameras, commercial adoption, and supportive regulatory environments.

Segmentation 3: by Mode of Operation

- Remotely Piloted

- Semi-Autonomous

- Autonomous

Remotely Piloted Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation)

The global and Asia-Pacific unmanned aerial system (UAS) market is led by the remotely piloted mode of operation segment, which held a 64.83% share in 2022. The segment's growth is driven by the increased adoption of remotely piloted UAVs for diverse applications, including surveillance, reconnaissance, border patrolling, and monitoring, and the surge in demand for advanced technologies in UAVs.

Segmentation 4: by Infrastructure

- Unmanned Traffic Management (UTM)

- Drone Receptacle

Drone Receptacle Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Infrastructure)

The global and Asia-Pacific unmanned aerial system (UAS) market was led by the drone receptacle infrastructure segment in 2022. The segment's expansion is driven by the rising number of UAVs and UASs and their increasing applications across various sectors, including agriculture, logistics, surveillance, and transportation.

Segmentation 5: by Range

- Visual-Line-of-Sight (VLOS)

- Beyond-Visual-Line-of-Sight (BVLOS)

Visual-Line-of-Sight (VLOS) Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Range)

The global and Asia-Pacific unmanned aerial system (UAS) market is led by the visual-line-of-sight (VLOS) range segment, which held a 65.12% share in 2022. The advanced autonomous VLOS drones with enhanced capabilities for various applications in both military and commercial sectors present in the market have been experiencing robust growth due to the increasing adoption of these technologies in various industries and the continuous development of advanced drones.

Segmentation 6: by Component

- Airframe

- Payload

- Guidance Navigation Control

- Propulsion Systems

Airframe Segment to Witness the Highest Growth between 2023 and 2033 in the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Component)

The airframe component segment dominated the global and Asia-Pacific unmanned aerial system (UAS) market (by component) in 2022. Being the essential component of the body of the UAV, the demand for this component is everlasting.

Segmentation 7: by Region

- North America, Europe, and Rest-of-the-World

- Asia-Pacific - Japan, Singapore, China, South Korea, Thailand, Indonesia, the Philippines, Vietnam, and Rest-of-Asia-Pacific

North America, Europe, and Rest-of-the-World were the highest-growing markets among all the regions, registering a CAGR of 14.87%. The regions are anticipated to gain traction in terms of UAS adoption owing to technological advancements, favorable economic conditions, and different consumer preferences. Moreover, favorable government policies are also expected to support the growth of the UAS market in North America, Europe, and Rest-of-the-World during the forecast period.

Recent Developments in the Global and Asia-Pacific Unmanned Aerial System (UAS) Market

- In November 2022, the Israel Innovation Authority (IAA) unveiled the commencement of a second phase, amounting to $17.5 million, for Israel's National Drone Initiative. This phase explored the applications of large cargo and passenger-carrying heavy drones operating within controlled airspace.

- In March 2023, the China Aerospace Science and Technology Corp. delivered the first CH-4 combat drone system to the Democratic Republic of Congo (DRC) to aid Kinshasa in its efforts to combat rebels backed by Rwanda on the DRC territory. This deployment underscores a strategic move to enhance the DRC's military capabilities in addressing security challenges within its borders.

- In February 2022, ST Engineering, Sumitomo Corporation, and Skyports collaborated to establish a consortium offering unmanned aircraft (UA) services for shore-to-ship parcel deliveries in Singapore. The consortium planned to leverage its combined operational and technological capabilities to enhance the use of autonomous UA for delivering maritime essentials to vessels at anchorage.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available for deployment and their potential globally. Moreover, the study provides the reader with a detailed understanding of the global and Asia-Pacific unmanned aerial system (UAS) market based on applications on the basis of application (commercial and government), products on the basis of drone type (fixed wing, rotary wing), mode of operation (remotely piloted, semi-autonomous, and autonomous), infrastructure (unmanned traffic management (UTM), and drone receptacle), range (visual-line-of-sight (VLOS), and beyond-visual-line-of-sight (BVLOS)), and component (airframe, payload, guidance navigation control, and propulsion system).

Growth/Marketing Strategy: The global and Asia-Pacific unmanned aerial system (UAS) market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been partnerships and contracts to strengthen their position in the global and Asia-Pacific unmanned aerial system (UAS) market. For instance, in July 2021, the Singapore Army unveiled its new Veloce 15 mini-unmanned aerial vehicles (V15 mini-UAV), featuring hybrid vertical take-off and landing (VTOL) capabilities. The V15 is the army's first locally developed hybrid fixed-wing VTOL platform.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, are employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Based on the classification, the average selling price (ASP) has been calculated using the weighted average method.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and/or other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The term "product" in this document may refer to "drone type" as and where relevant.

- The term "manufacturers/suppliers" may refer to "systems providers" or "technology providers" as and where relevant.

Primary Research

The primary sources involve industry experts from the aerospace and defense industry, including drone manufacturers manufacturing for the commercial and/or government industry and UAS component manufacturers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Spacenews, Businessweek, and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as www.nasa.gov.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Some prominent names established in this market are:

|

|

Table of Contents

Executive Summary

Scope of the Study

1. Market

- 1.1. Industry Outlook

- 1.1.1. Overview: Global and Asia-Pacific Unmanned Aerial System (UAS) Market

- 1.1.1.1. Expansion of Drone Delivery Networks

- 1.1.2. Automated UAS Captured Data Management/Usage

- 1.1.2.1. Trends

- 1.1.2.1.1. Integration of Drone-as-a-Service (DaaS) with Cloud-Based Infrastructure and Services

- 1.1.2.1.2. Growing Need for Drones Integrated with AI/ML, Enhanced Sensors, and Advanced Communications

- 1.1.2.2. Key Players

- 1.1.2.1. Trends

- 1.1.3. Start-Ups and Investment Landscape

- 1.1.1. Overview: Global and Asia-Pacific Unmanned Aerial System (UAS) Market

2. Application

- 2.1. Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Application)

- 2.1.1. Market Overview

- 2.1.1.1. Demand Analysis of Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Application)

- 2.1.2. Commercial

- 2.1.2.1. Critical Infrastructure Inspection

- 2.1.2.2. Mapping

- 2.1.2.3. Package Delivery

- 2.1.2.4. Construction

- 2.1.2.5. Mining

- 2.1.2.6. Insurance

- 2.1.3. Government

- 2.1.3.1. Border Patrol

- 2.1.3.2. Firefighting

- 2.1.3.3. Search and Rescue

- 2.1.3.4. Law Enforcement

- 2.1.1. Market Overview

3. Product

- 3.1. Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type)

- 3.1.1. Market Overview

- 3.1.1.1. Demand Analysis of Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type)

- 3.1.2. Fixed Wing

- 3.1.3. Rotary Wing

- 3.1.1. Market Overview

- 3.2. Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation)

- 3.2.1. Market Overview

- 3.2.1.1. Demand Analysis for Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation)

- 3.2.2. Remotely Piloted

- 3.2.3. Semi-Autonomous

- 3.2.4. Autonomous

- 3.2.4.1. Autonomous (by Application)

- 3.2.1. Market Overview

- 3.3. Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Infrastructure)

- 3.3.1. Market Overview

- 3.3.1.1. Demand Analysis for Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Infrastructure)

- 3.3.2. Unmanned Traffic Management (UTM)

- 3.3.3. Drone Receptacle

- 3.3.1. Market Overview

- 3.4. Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Range)

- 3.4.1. Market Overview

- 3.4.1.1. Demand Analysis for Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Range)

- 3.4.2. Visual-Line-of-Sight (VLOS)

- 3.4.3. Beyond-Visual-Line-of-Sight (BVLOS)

- 3.4.1. Market Overview

- 3.5. Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Component)

- 3.5.1. Market Overview

- 3.5.1.1. Demand Analysis for Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Component)

- 3.5.2. Airframe

- 3.5.3. Payload

- 3.5.4. Guidance Navigation Control

- 3.5.5. Propulsion System

- 3.5.1. Market Overview

4. Region

- 4.1. Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Region)

- 4.2. North America, Europe, and Rest-of-the-World

- 4.2.1. Market

- 4.2.1.1. Business Drivers

- 4.2.1.2. Business Challenges

- 4.2.1.3. Key Manufacturers and Suppliers in North America, Europe, and Rest-of-the-World

- 4.2.2. Application

- 4.2.2.1. North America, Europe, and Rest-of-the-World Unmanned Aerial System (UAS) Market (by Application)

- 4.2.3. Product

- 4.2.3.1. North America, Europe, and Rest-of-the-World Unmanned Aerial System (UAS) Market (by Product)

- 4.2.1. Market

- 4.3. Asia-Pacific

- 4.3.1. Market

- 4.3.1.1. Key Manufacturers and Suppliers in Asia-Pacific

- 4.3.1.2. Business Drivers

- 4.3.1.3. Business Challenges

- 4.3.2. Application

- 4.3.2.1. Asia-Pacific Unmanned Aerial System (UAS) Market (by Application)

- 4.3.3. Product

- 4.3.3.1. Asia-Pacific Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4. Asia-Pacific (by Country)

- 4.3.4.1. China

- 4.3.4.1.1. Market

- 4.3.4.1.1.1. Key Manufacturers and Suppliers in China

- 4.3.4.1.2. Application

- 4.3.4.1.2.1. China Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.1.3. Product

- 4.3.4.1.3.1. China Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.1.1. Market

- 4.3.4.2. Singapore

- 4.3.4.2.1. Market

- 4.3.4.2.1.1. Key Manufacturers and Suppliers in Singapore

- 4.3.4.2.2. Application

- 4.3.4.2.2.1. Singapore Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.2.3. Product

- 4.3.4.2.3.1. Singapore Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.2.1. Market

- 4.3.4.3. Japan

- 4.3.4.3.1. Market

- 4.3.4.3.1.1. Key Manufacturers and Suppliers in Japan

- 4.3.4.3.2. Application

- 4.3.4.3.2.1. Japan Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.3.3. Product

- 4.3.4.3.3.1. Japan Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.3.1. Market

- 4.3.4.4. South Korea

- 4.3.4.4.1. Market

- 4.3.4.4.1.1. Key Manufacturers and Suppliers in South Korea

- 4.3.4.4.2. Application

- 4.3.4.4.2.1. South Korea Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.4.3. Product

- 4.3.4.4.3.1. South Korea Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.4.1. Market

- 4.3.4.5. Thailand

- 4.3.4.5.1. Market

- 4.3.4.5.1.1. Key Manufacturers and Suppliers in Thailand

- 4.3.4.5.2. Application

- 4.3.4.5.2.1. Thailand Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.5.3. Product

- 4.3.4.5.3.1. Thailand Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.5.1. Market

- 4.3.4.6. Indonesia

- 4.3.4.6.1. Market

- 4.3.4.6.1.1. Key Manufacturers and Suppliers in Indonesia

- 4.3.4.6.2. Application

- 4.3.4.6.2.1. Indonesia Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.6.3. Product

- 4.3.4.6.3.1. Indonesia Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.6.1. Market

- 4.3.4.7. Philippines

- 4.3.4.7.1. Market

- 4.3.4.7.1.1. Key Manufacturers and Suppliers in the Philippines

- 4.3.4.7.2. Application

- 4.3.4.7.2.1. Philippines Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.7.3. Product

- 4.3.4.7.3.1. Philippines Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.7.1. Market

- 4.3.4.8. Vietnam

- 4.3.4.8.1. Market

- 4.3.4.8.1.1. Key Manufacturers and Suppliers in Vietnam

- 4.3.4.8.2. Application

- 4.3.4.8.2.1. Vietnam Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.8.3. Product

- 4.3.4.8.3.1. Vietnam Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.8.1. Market

- 4.3.4.9. Rest-of-Asia-Pacific

- 4.3.4.9.1. Market

- 4.3.4.9.1.1. Key Manufacturers and Suppliers in Rest-of-Asia-Pacific

- 4.3.4.9.2. Application

- 4.3.4.9.2.1. Rest-of-Asia-Pacific Unmanned Aerial System (UAS) Market (by Application)

- 4.3.4.9.3. Product

- 4.3.4.9.3.1. Rest-of-Asia-Pacific Unmanned Aerial System (UAS) Market (by Product)

- 4.3.4.9.1. Market

- 4.3.4.1. China

- 4.3.1. Market

5. Research Methodology

- 5.1. Factors for Data Prediction and Modeling