|

|

市場調査レポート

商品コード

1415354

動物用ワクチン市場 - 世界および地域別分析:タイプ別、疾患別、技術別、投与経路別、流通チャネル別、地域別 - 分析と予測(2023年~2033年)Veterinary Vaccine Market - A Global and Regional Analysis: Focus on Type, Disease, Technology, Route of Administration, Distribution Channel, and Region - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 動物用ワクチン市場 - 世界および地域別分析:タイプ別、疾患別、技術別、投与経路別、流通チャネル別、地域別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年01月24日

発行: BIS Research

ページ情報: 英文 165 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の動物用ワクチンの市場規模は、2022年に94億4,000万米ドルとなりました。

同市場は、予測期間の2023年~2033年には7.30%のCAGRで拡大し、2033年には198億6,000万米ドルに達すると予測されています。市場の拡大は、動物用ヘルスケアに変革的な影響を与えることを示唆しており、規制の複雑さに対処し、技術革新を取り入れることに長けた企業が大きな成功を収めると見込まれています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価額 | 98億2,000万米ドル |

| 2033年予測 | 198億6,000万米ドル |

| CAGR | 7.3% |

世界の動物用ワクチン市場は成熟期にあります。需要と採用の大幅な増加を特徴とするこの段階は、動物用ワクチンの認知度と受容度の高まりを反映しています。主な促進要因としては、動物個体数の増加とワクチンに対する認識、獣医保健を推進するための政府の取り組み、疾病予防の重視の高まりなどが挙げられます。規制の複雑さや動物用ワクチンの研究開発(R&D)の高コストといった課題があるため、全体的な軌道は市場のダイナミックな拡大を示唆しています。

動物用ワクチン市場は、動物福祉と公衆衛生の双方に多大な影響を及ぼす動物保健産業において重要な位置を占めています。効果的なワクチンが入手可能で広く使用されることで、ペットから家畜に至るまで、動物の様々な感染症の予防と制御に貢献しています。これは個々の動物の健康と幸福を守るだけでなく、動物個体群の全体的な健康維持にも重要な役割を果たしています。さらに、動物から人への人獣共通感染症の感染を防ぐことで、動物用ワクチンは公衆衛生に貢献し、疾病発生のリスクを低減します。

ワクチン研究開発における業界の進歩は、新たな感染症の脅威に絶えず対処し、農業の持続可能性を促進し、食の安全を確保し、人間と動物の調和のとれた共存を育んでいます。その結果、動物用ワクチン市場の影響は動物の健康にとどまらず、世界の保健戦略や広範なエコシステムに不可欠な要素となっています。

当レポートでは、世界の動物用ワクチン市場について調査し、市場の概要とともに、タイプ別、疾患別、技術別、投与経路別、流通チャネル別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 市場フットプリント

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 疫学

- 市場力学:概要

第2章 世界の動物用ワクチン市場、タイプ別

- サマリー

- 家畜ワクチン

- ブタワクチン

- 家禽ワクチン

- コンパニオンアニマルワクチン

- 水産養殖ワクチン

第3章 世界の動物用ワクチン市場、疾患別

- サマリー

- アフリカ豚コレラ

- 口蹄疫

- ニューカッスル病

- 鳥インフルエンザ

- プチ反芻動物の害虫

- その他

第4章 世界の動物用ワクチン市場、技術別

- サマリー

- 弱毒化生ワクチン

- 不活化ワクチン

- トキソイドワクチン

- 組換えワクチン

- 結合型ワクチン

- その他ワクチン

第5章 世界の動物用ワクチン市場、投与経路別

- サマリー

- 注射ワクチン

- 経口ワクチン

- 鼻腔内/スプレーワクチン

第6章 世界の動物用ワクチン市場、流通チャネル別

- サマリー

- 動物病院、クリニック

- 小売薬局

- 獣医学研究機関

第7章 地域別

- 地域別の概要

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第8章 市場-競合ベンチマーキングと企業プロファイル

- 競合情勢

- Benchmark Holdings plc

- Bimeda Corporate

- Biogenesis Bago

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Elanco Animal Health Incorporated

- Huvepharma

- Merck & Co., Inc. (Merck Animal Health)

- Phibro Animal Health Corporation

- SAN Group GmbH (SAN Vet)

- Vaxxinova International BV

- Virbac

- Zoetis, Inc.

第9章 調査手法

List of Figures

- Figure 1: Global Veterinary Vaccine Market (by Region), $Billion, 2022, 2026, and 2033

- Figure 2: Global Veterinary Vaccine Market (by Type), $Billion, 2022, 2026, and 2033

- Figure 3: Global Veterinary Vaccine Market (by Technology), $Billion, 2022, 2026, and 2032

- Figure 4: Key Events to Keep Track of the Veterinary Vaccine Market

- Figure 5: Global Veterinary Vaccine Market, $Billion, 2022-2033

- Figure 6: Initiatives of Companies Targeting Emerging Economies

- Figure 7: Benefits of Personalized and Customized Veterinary Vaccine Trend

- Figure 8: Supply Chain Overview for Veterinary Vaccine

- Figure 9: Patent Published (by Country), January 2020-November 2023

- Figure 10: Patent Published (by Year), January 2020-November 2023

- Figure 11: U.S. FDA Overview of Veterinary Vaccine

- Figure 12: USDA Overview of Veterinary Vaccine

- Figure 13: Veterinary Vaccine Regulatory Approval Process Overview in Japan

- Figure 14: Application Process for Veterinary Vaccines in Australia

- Figure 15: Epidemiology of Foot and Mouth Disease, 2015-2022

- Figure 16: Epidemiology of Avian Influenza Virus, 2015-2022

- Figure 17: Epidemiology of Newcastle Disease, 2015-2022

- Figure 18: Epidemiology of Peste des Petits Ruminant Virus, 2015-2022

- Figure 19: Impact Analysis of Market Dynamics

- Figure 20: Growing Biomass of Livestock Animals, 2019-2022

- Figure 21: Global Livestock Vaccine Sales, % Change, 2018-2022

- Figure 22: Different Government Initiatives

- Figure 23: Timeline of Disease Outbreaks in Animals

- Figure 24: Factors Contributing to High Costs of R&D

- Figure 25: Impact of High Cost of R&D

- Figure 26: Regulatory Process for Veterinary Vaccine

- Figure 27: Major Technological Advancements in Veterinary Vaccine

- Figure 28: Companies Focused on Companion Animal Health

- Figure 29: People Owning Pet Globally

- Figure 30: Strategic Initiatives, 2020-2023

- Figure 31: Share of Strategic Initiatives

- Figure 32: Data Triangulation

- Figure 33: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Global Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 4: Global Veterinary Vaccine Market (by Livestock Vaccines), $Billion, 2022-2033

- Table 5: Global Veterinary Vaccine Market (by Companion Animal Vaccines), $Billion, 2022-2033

- Table 6: Global Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 7: Global Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 8: Global Veterinary Vaccine Market (by Route of Administration), $Billion, 2022-2033

- Table 9: Global Veterinary Vaccine Market (by Distribution Channel), $Billion, 2022-2033

- Table 10: Global Veterinary Vaccine Market (by Region), $Billion, 2022-2033

- Table 11: North America Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 12: North America Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 13: North America Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 14: U.S. Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 15: U.S. Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 16: North America Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 17: Canada Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 18: Canada Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 19: Canada Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 20: Europe Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 21: Europe Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 22: Europe Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 23: Germany Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 24: Germany Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 25: Germany Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 26: U.K. Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 27: U.K. Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 28: U.K. Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 29: France Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 30: France Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 31: France Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 32: Italy Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 33: Italy Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 34: Italy Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 35: Spain Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 36: Spain Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 37: Spain Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 38: Rest-of-Europe Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 39: Rest-of-Europe Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 40: Rest-of-Europe Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 41: Asia-Pacific Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 42: Asia-Pacific Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 43: Asia-Pacific Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 44: China Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 45: China Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 46: China Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 47: India Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 48: India Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 49: India Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 50: Japan Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 51: Japan Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 52: Japan Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 53: Australia Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 54: Australia Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 55: Australia Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 56: South Korea Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 57: South Korea Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 58: South Korea Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 59: Rest-of-Asia-Pacific Veterinary Vaccine Market (by Type), $Billion, 2022-2033

- Table 60: Rest-of-Asia-Pacific Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 61: Rest-of-Asia-Pacific Veterinary Vaccine Market (by Technology), $Billion, 2022-2033

- Table 62: Middle East and Africa Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 63: Middle East and Africa Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 64: Middle East and Africa Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 65: K.S.A. Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 66: K.S.A. Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 67: K.S.A. Veterinary Vaccine Market (by Technology), Million, 2022-2033

- Table 68: U.A.E. Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 69: U.A.E. Veterinary Vaccine Market (by Disease), $Billion, 2022-2033

- Table 70: U.A.E. Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 71: Turkiye Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 72: Turkiye Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 73: Turkiye Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 74: South Africa Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 75: South Africa Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 76: South Africa Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 77: Israel Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 78: Israel Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 79: Israel Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 80: Rest-of-Middle East and Africa Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 81: Rest-of-Middle East and Africa Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 82: Rest-of-Middle East and Africa Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 83: Latin America Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 84: Latin America Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 85: Latin America Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 86: Brazil Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 87: Brazil Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 88: Brazil Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 89: Mexico Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 90: Mexico Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 91: Mexico Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 92: Rest-of-Latin America Veterinary Vaccine Market (by Type), $Million, 2022-2033

- Table 93: Rest-of-Latin America Veterinary Vaccine Market (by Disease), $Million, 2022-2033

- Table 94: Rest-of-Latin America Veterinary Vaccine Market (by Technology), $Million, 2022-2033

- Table 95: Market Share

“The Global Veterinary Vaccine Market Expected to Reach $19.86 Billion by 2033.”

Global Veterinary Vaccine Market Overview

In 2022, the global veterinary vaccine market held a value of $9.44 billion. The market is expected to grow at a CAGR of 7.30% during the forecast period 2023-2033 and attain a value of $19.86 billion by 2033. The market's trajectory suggests a transformative impact on veterinary healthcare, with companies adept at addressing regulatory complexities and embracing technological innovations poised for significant success.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $9.82 Billion |

| 2033 Forecast | $19.86 Billion |

| CAGR | 7.3% |

Market Lifecycle Stage

The global veterinary vaccine market is in a growing mature phase. Characterized by a significant increase in demand and adoption, this stage reflects the rising recognition and acceptance of veterinary vaccines. Key drivers include the growing population of animals and awareness of vaccines, government initiatives for promoting veterinary health, and increasing emphasis on disease prevention. Due to challenges such as regulatory complexities and high cost of research and development (R&D) of veterinary vaccines, the overall trajectory suggests a dynamic and expanding market.

Industry Impact

The veterinary vaccine market holds significant importance in the animal health industry, with profound impacts on both animal welfare and public health. The availability and widespread use of effective vaccines contribute to the prevention and control of various infectious diseases in animals, ranging from pets to livestock. This not only safeguards the health and well-being of individual animals but also plays a crucial role in maintaining the overall health of animal populations. Furthermore, by preventing the transmission of zoonotic diseases from animals to humans, veterinary vaccines contribute to public health and reduce the risk of disease outbreaks.

The industry's advancements in vaccine research and development continually address emerging infectious threats, promoting sustainability in agriculture, ensuring food safety, and fostering a harmonious coexistence between humans and animals. As a result, the veterinary vaccine market's impact extends beyond animal health, making it an integral component of global health strategies and broader ecosystem.

Market Segmentation:

Segmentation 1: by Type

- Livestock Vaccines

- Bovine Vaccines

- Small Ruminant Vaccines

- Porcine Vaccines

- Poultry Vaccines

- Companion Animal Vaccines

- Canine Vaccines

- Feline Vaccines

- Equine Vaccines

- Aquaculture Vaccines

Livestock Vaccines to Dominate the Global Veterinary Vaccine Market (by Type)

The livestock vaccines segment dominated the global veterinary vaccine market (by type) in FY2022. The dominance of livestock vaccines in the global veterinary vaccine market, categorized by type, underscores the critical role these vaccines play in safeguarding the health and productivity of livestock populations. Livestock vaccines are instrumental in preventing and controlling a variety of infectious diseases that can have profound economic implications for the agriculture sector. As livestock farming continues to be a significant component of the global food supply chain, the demand for vaccines tailored to the specific needs of cattle, poultry, swine, and other livestock remains high.

Segmentation 2: by Disease

- African Swine Fever

- Foot and Mouth Disease

- Newcastle Disease

- Avian Influenza (Bird Flu)

- Peste des Petits Ruminants

- Other Diseases

Avian Influenza (Bird Flu) to Dominate the Global Veterinary Vaccine Market (by Disease)

Avian influenza (bird flu) dominated the global veterinary vaccine market (by disease) in FY2022. Avian influenza is a highly contagious viral infection that primarily affects birds, including poultry. Given the potential for rapid transmission and severe economic consequences in the poultry industry, there is a heightened focus on developing and administering effective vaccines to prevent and control avian influenza outbreaks.

Segmentation 3: by Technology

- Live Attenuated Vaccines

- Inactivated Vaccines

- Toxoid Vaccines

- Recombinant Vaccines

- Conjugate Vaccines

- Other Vaccines

Inactivated Vaccines to Dominate the Global Veterinary Vaccine Market (by Technology)

The global veterinary vaccine market (by technology) was dominated by the inactivated vaccines segment in FY2022. Inactivated vaccines, also known as killed vaccines, are produced from pathogens that have been rendered non-infectious, typically through processes such as heat or chemicals. This technology offers a safe and effective means of stimulating an immune response in animals without the risk of causing disease. The prevalence of inactivated vaccines in the veterinary market underscores their established track record in providing protection against various diseases in animals.

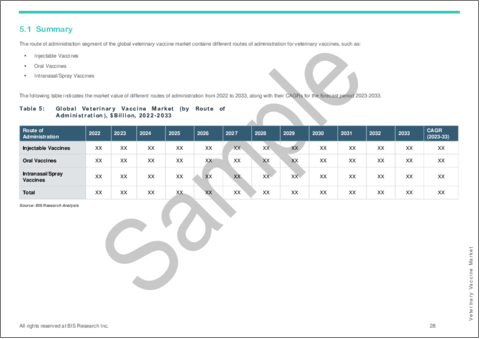

Segmentation 4: by Route of Administration

- Injectable Vaccines

- Oral Vaccines

- Intranasal/Spray Vaccines

Injectable Vaccines to Dominate the Global Veterinary Vaccine Market (by Route of Administration)

The global veterinary vaccine market (by route of administration) was dominated by the injectable vaccines segment in FY2022. Injectable vaccines are administered through injection, providing a direct and efficient means of delivering antigens to stimulate an immune response in animals. This route of administration is commonly used across various species, including livestock and companion animals. The dominance of injectable vaccines underscores their practicality, ease of administration, and established effectiveness in promoting immunity against a range of diseases.

Segmentation 5: by Distribution Channel

- Veterinary Hospitals and Clinics

- Retail Pharmacies

- Veterinary Research Institutes

Veterinary Hospitals and Clinics to Continue its Dominance in the Global Veterinary Vaccine Market (by Distribution Channel)

The veterinary hospitals and clinics segment accounted for the largest share of the global veterinary vaccine market (by distribution channel) in FY2022. Veterinary hospitals and clinics serve as primary points of contact for animal owners seeking preventive healthcare for their pets and livestock. These establishments not only provide vaccination services but also offer expertise and guidance on the appropriate immunization schedules and tailored healthcare plans for individual animals. The dominance of this distribution channel reflects the trust placed in professional veterinary care and the integral role veterinarians play in promoting animal health.

Segmentation 6: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Among regions, North America held the largest market value in 2022, and the trend is anticipated to continue during the forecast period 2023-2033.

Demand - Drivers, Restraints, and Opportunities

Market Drivers:

Growing Population of Animals and Awareness of Vaccine: The global veterinary vaccine market is experiencing a notable upswing, primarily propelled by the escalating population of animals and the rising incidence of veterinary diseases. As the demand for effective healthcare solutions for animals intensifies, the veterinary vaccine market has become a crucial component in safeguarding the health and well-being of diverse animal species.

Market Restraints:

High Cost of Research and Development (R&D) of Veterinary Vaccine: The high cost of researching and developing veterinary vaccines can be a major obstacle to their development and accessibility, posing challenges for both animal health and veterinary industry. The intricate nature of developing vaccines tailored for diverse animal species, coupled with rigorous regulatory requirements, contributes to elevated expenses, thereby affecting the accessibility and affordability of veterinary vaccines.

Market Opportunities:

Technological Advancements in Veterinary Vaccine: Technological advancements in veterinary vaccine development present significant opportunities for the veterinary vaccine market. Innovations such as genetic engineering, adjuvant technologies, and novel delivery methods enhance vaccine efficacy, safety, and convenience.

How can this report add value to an organization?

Workflow/Innovation Strategy: The veterinary vaccine market (by type) has been segmented into detailed segments of types of vaccines based on species, including livestock, poultry, porcine, companion animals, and aquaculture animals. Moreover, the study provides the reader with a detailed understanding of the different technologies and diseases.

Growth/Marketing Strategy: The veterinary vaccine market encompasses a range of vaccinations available for animals. Since the market is in a growing mature phase, there are upcoming technologies present that can further enhance the adoption of veterinary vaccines in the market.

Competitive Strategy: Key players in the global veterinary vaccine market have been analyzed and profiled in the study, including manufacturers involved in new product launches, acquisitions, expansions, and strategic collaborations. Moreover, a detailed competitive benchmarking of the players operating in the global veterinary vaccine market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2022. The historical year analysis has been done from FY2020 to FY2021, and the market size has been calculated for FY2022 and projected for the period 2023-2033.

- The geographical distribution of the market revenue is estimated to be the same as the company's net revenue distribution. All the numbers are adjusted to two digits after decimals for report presentation reasons. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. CAGR is calculated from 2023 to 2033.

- The market has been mapped based on different types of products available in the market and based on several indications. All the key manufacturing companies that have a significant number of offerings to the veterinary vaccine market have been considered and profiled in the report.

- In the study, the primary respondent's verification has been considered to finalize the estimated market for the veterinary vaccine market.

- The latest annual reports of each market player have been taken into consideration for market revenue calculation.

- Market strategies and developments of key players have been considered for the calculation of sub-segment split.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year. The currency conversion rate has been taken from the historical exchange rate of the Oanda website or from the annual reports of the respective company, if stated.

Primary Research

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding of the numbers of the various markets for market type

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- World Organization for Animal Health (WOAH), Food and Agriculture Organization of the United Nations (FAO), PubMed, and National Center for Biotechnology Information (NCBI)

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolio

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentations, split-ups, and percentage shares

- Data for market value

- Key industry trends of the top players in the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The global veterinary vaccine market is a dynamic and rapidly evolving sector that plays a crucial role in maintaining animal health and safeguarding public health. With a focus on preventing and controlling infectious diseases in various animal species, including livestock, pets, and wildlife, the market has witnessed significant growth in recent years.

Key factors driving this expansion include rising awareness about zoonotic diseases, increasing demand for animal protein, and growing emphasis on animal welfare. The market is characterized by a diverse range of vaccines targeting different pathogens, with ongoing advancements in research and development contributing to the introduction of innovative and more effective vaccine formulations.

Some of the prominent companies in this market are:

|

|

Companies that are not a part of the aforementioned pool have been well-represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1. Markets

- 1.1. Market Footprint

- 1.2. Trends: Current and Future Impact Assessment

- 1.2.1. Targeting Emerging Economies

- 1.2.2. Trends toward Personalized and Customized Veterinary Vaccines

- 1.3. Supply Chain Overview

- 1.4. Research and Development Review

- 1.4.1. Patent Publishing Trend (by Country)

- 1.4.2. Patent Publishing Trend (by Year)

- 1.5. Regulatory Landscape

- 1.5.1. U.S.

- 1.5.2. European Union

- 1.5.3. Japan

- 1.5.4. Australia

- 1.6. Epidemiology

- 1.7. Market Dynamics: Overview

- 1.7.1. Market Drivers

- 1.7.2. Market Restraints

- 1.7.3. Market Opportunities

2. Global Veterinary Vaccine Market (by Type)

- 2.1. Summary

- 2.1.1. Livestock Vaccines

- 2.1.1.1. Bovine Vaccines

- 2.1.1.2. Small Ruminant Vaccines

- 2.1.2. Porcine Vaccines

- 2.1.3. Poultry Vaccines

- 2.1.4. Companion Animal Vaccines

- 2.1.4.1. Canine Vaccines

- 2.1.4.2. Feline Vaccines

- 2.1.4.3. Equine Vaccines

- 2.1.5. Aquaculture Vaccines

- 2.1.1. Livestock Vaccines

3. Global Veterinary Vaccine Market (by Disease)

- 3.1. Summary

- 3.1.1. African Swine Fever

- 3.1.2. Foot and Mouth Disease

- 3.1.3. Newcastle Disease

- 3.1.4. Avian Influenza (Bird Flu)

- 3.1.5. Peste des Petits Ruminants

- 3.1.6. Other Diseases

4. Global Veterinary Vaccine Market (by Technology)

- 4.1. Summary

- 4.1.1. Live Attenuated Vaccines

- 4.1.2. Inactivated Vaccines

- 4.1.3. Toxoid Vaccines

- 4.1.4. Recombinant Vaccines

- 4.1.5. Conjugate Vaccines

- 4.1.6. Other Vaccines

5. Global Veterinary Vaccine Market (by Route of Administration)

- 5.1. Summary

- 5.1.1. Injectable Vaccines

- 5.1.2. Oral Vaccines

- 5.1.3. Intranasal/Spray Vaccines

6. Global Veterinary Vaccine Market (by Distribution Channel)

- 6.1. Summary

- 6.1.1. Veterinary Hospitals and Clinics

- 6.1.2. Retail Pharmacies

- 6.1.3. Veterinary Research Institutes

7. Regions

- 7.1. Regional Summary

- 7.2. Drivers and Restraints

- 7.3. North America

- 7.3.1. Regional Overview

- 7.3.1.1. Driving Factors for Market Growth

- 7.3.1.2. Factors Challenging the Market

- 7.3.2. U.S.

- 7.3.3. Canada

- 7.3.1. Regional Overview

- 7.4. Europe

- 7.4.1. Regional Overview

- 7.4.1.1. Driving Factors for Market Growth

- 7.4.1.2. Factors Challenging the Market

- 7.4.2. Germany

- 7.4.3. U.K.

- 7.4.4. France

- 7.4.5. Italy

- 7.4.6. Spain

- 7.4.7. Rest-of-Europe

- 7.4.1. Regional Overview

- 7.5. Asia-Pacific

- 7.5.1. Regional Overview

- 7.5.1.1. Driving Factors for Market Growth

- 7.5.1.2. Factors Challenging the Market

- 7.5.2. China

- 7.5.3. India

- 7.5.4. Japan

- 7.5.5. Australia

- 7.5.6. South Korea

- 7.5.7. Rest-of-Asia-Pacific

- 7.5.1. Regional Overview

- 7.6. Middle East and Africa

- 7.6.1. Regional Overview

- 7.6.1.1. Driving Factors for Market Growth

- 7.6.1.2. Factors Challenging the Market

- 7.6.2. K.S.A.

- 7.6.3. U.A.E.

- 7.6.4. Turkiye

- 7.6.5. South Africa

- 7.6.6. Israel

- 7.6.7. Rest-of-Middle East and Africa

- 7.6.1. Regional Overview

- 7.7. Latin America

- 7.7.1. Regional Overview

- 7.7.1.1. Driving Factors for Market Growth

- 7.7.1.2. Factors Challenging the Market

- 7.7.2. Brazil

- 7.7.3. Mexico

- 7.7.4. Rest-of-Latin America

- 7.7.1. Regional Overview

8. Markets - Competitive Benchmarking & Company Profiles

- 8.1. Competitive Landscape

- 8.1.1. Benchmark Holdings plc

- 8.1.1.1. Overview

- 8.1.1.2. Top Products

- 8.1.1.3. Top Competitors

- 8.1.1.4. Key Personnel

- 8.1.1.5. Analyst View

- 8.1.2. Bimeda Corporate

- 8.1.2.1. Overview

- 8.1.2.2. Top Products

- 8.1.2.3. Top Competitors

- 8.1.2.4. Key Personnel

- 8.1.2.5. Analyst View

- 8.1.3. Biogenesis Bago

- 8.1.3.1. Overview

- 8.1.3.2. Top Products

- 8.1.3.3. Top Competitors

- 8.1.3.4. Key Personnel

- 8.1.3.5. Analyst View

- 8.1.4. Boehringer Ingelheim International GmbH

- 8.1.4.1. Overview

- 8.1.4.2. Top Products

- 8.1.4.3. Top Competitors

- 8.1.4.4. Key Personnel

- 8.1.4.5. Analyst View

- 8.1.5. Ceva Sante Animale

- 8.1.5.1. Overview

- 8.1.5.2. Top Products

- 8.1.5.3. Top Competitors

- 8.1.5.4. Key Personnel

- 8.1.5.5. Analyst View

- 8.1.6. Elanco Animal Health Incorporated

- 8.1.6.1. Overview

- 8.1.6.2. Top Products

- 8.1.6.3. Top Competitors

- 8.1.6.4. Key Personnel

- 8.1.6.5. Analyst View

- 8.1.7. Huvepharma

- 8.1.7.1. Overview

- 8.1.7.2. Top Products

- 8.1.7.3. Top Competitors

- 8.1.7.4. Key Personnel

- 8.1.7.5. Analyst View

- 8.1.8. Merck & Co., Inc. (Merck Animal Health)

- 8.1.8.1. Overview

- 8.1.8.2. Top Products

- 8.1.8.3. Top Competitors

- 8.1.8.4. Key Personnel

- 8.1.8.5. Analyst View

- 8.1.9. Phibro Animal Health Corporation

- 8.1.9.1. Overview

- 8.1.9.2. Top Products

- 8.1.9.3. Top Competitors

- 8.1.9.4. Key Personnel

- 8.1.9.5. Analyst View

- 8.1.10. SAN Group GmbH (SAN Vet)

- 8.1.10.1. Overview

- 8.1.10.2. Top Products

- 8.1.10.3. Top Competitors

- 8.1.10.4. Key Personnel

- 8.1.10.5. Analyst View

- 8.1.11. Vaxxinova International BV

- 8.1.11.1. Overview

- 8.1.11.2. Top Products

- 8.1.11.3. Top Competitors

- 8.1.11.4. Key Personnel

- 8.1.11.5. Analyst View

- 8.1.12. Virbac

- 8.1.12.1. Overview

- 8.1.12.2. Top Products

- 8.1.12.3. Top Competitors

- 8.1.12.4. Key Personnel

- 8.1.12.5. Analyst View

- 8.1.13. Zoetis, Inc.

- 8.1.13.1. Overview

- 8.1.13.2. Top Products

- 8.1.13.3. Top Competitors

- 8.1.13.4. Key Personnel

- 8.1.13.5. Analyst View

- 8.1.1. Benchmark Holdings plc

9. Research Methodology

- 9.1. Data Sources

- 9.1.1. Primary Data Sources

- 9.1.2. Secondary Data Sources

- 9.1.3. Data Triangulation