|

|

市場調査レポート

商品コード

1408028

アジア太平洋の代替正極材市場:分析と予測(2023年~2032年)Asia-Pacific Alternative Cathode Material Market: Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の代替正極材市場:分析と予測(2023年~2032年) |

|

出版日: 2024年01月15日

発行: BIS Research

ページ情報: 英文 70 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の代替正極材の市場規模(中国を除く)は、2023年に11億8,000万米ドルとなりました。

同市場は、予測期間の2023年~2032年に6.96%のCAGRで拡大し、2032年には21億6,000万米ドルに達すると予測されています。代替正極材市場の成長は、エネルギー密度を高めたリチウム電池に対するニーズの高まりからもたらされると予想されます。さらに、代替正極材料の費用対効果は、代替正極材料市場のさらなる発展に大きく貢献すると予測されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年評価 | 11億8,000万米ドル |

| 2032年予測 | 21億6,000万米ドル |

| CAGR | 6.96% |

アジア太平洋は、ダイナミックな代替正極材市場におけるエネルギー貯蔵ソリューションの方向性を決定する上で極めて重要です。この業界は、再生可能エネルギー貯蔵への要求の高まりと電気自動車需要の増加により、大きく拡大しています。特にナトリウムイオン電池やリチウム硫黄電池技術の専門知識を持つ重要な企業は、移り変わるエネルギー市場から利益を得るために戦略的な立場に身を置いています。代替正極材料の効率と価格の向上を目標に研究開発費を優先的に投じることは、企業にとって極めて重要です。イノベーションは、研究機関との協力努力や部門内の戦略的提携によって加速されるかもしれません。ダイナミックな業界をナビゲートし、新たなビジネスチャンスをつかむには、規制の変更や業界の動向について最新の情報を得る必要があります。

当レポートでは、アジア太平洋の代替正極材市場について調査し、市場の概要とともに、バッテリータイプ別、エンドユーザー別、材料タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界の展望

- ビジネスダイナミクス

- 正極材料の採掘

- さまざまなカソードタイプの使用例

- 主要なバッテリーミネラルの比較分析

- 分析:代替カソード材料が必要なのはなぜか

第2章 地域

- 中国

- アジア太平洋と日本

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 企業プロファイル

- Mitsubishi Electric Corporation

- Nippon Chemical Industrial CO., LTD.

- LG Chem

- POSCO

第4章 調査手法

List of Figures

- Figure 1: Alternative Cathode Material Market, $Billion, 2022-2032

- Figure 2: Alternative Cathode Material Market (by Battery Type), $Billion, 2022-2032

- Figure 3: Alternative Cathode Material Market (by End User), $Billion, 2022-2032

- Figure 4: Alternative Cathode Material Market (by Material Type), $Billion, 2022-2032

- Figure 5: Alternative Cathode Material Market (by Region), $Billion, 2022

- Figure 6: Alternative Cathode Material Market Supply Chain

- Figure 7: Competitive Benchmarking, 2022

- Figure 8: Mitsubishi Electric Corporation: Product Portfolio

- Figure 9: Nippon Chemical Industrial CO., LTD.: Product Portfolio

- Figure 10: LG Chem: Product Portfolio

- Figure 11: POSCO: Product Portfolio

- Figure 12: Data Triangulation

- Figure 13: Top-Down and Bottom-Up Approach

List of Tables

- Table 1: Alternative Cathode Material Market Overview

- Table 2: Key Consortiums and Associations

- Table 3: Regulatory Bodies

- Table 4: Government Programs

- Table 5: Programs by Research Institutions and Universities

- Table 6: Impact of Business Drivers

- Table 7: Impact of Business Restraints

- Table 8: Impact of Business Opportunities

- Table 9: Comparative Analysis of Key Battery Minerals

- Table 10: Alternative Cathode Material Market (by Region), Kiloton, 2022-2032

- Table 11: Alternative Cathode Material Market (by Region), $Billion, 2022-2032

“The Asia-Pacific Alternative Cathode Material Market (excluding China) Expected to Reach $2.16 Billion by 2032.”

Introduction to Asia-Pacific Alternative Cathode Material Market

The Asia-Pacific alternative cathode material market (excluding China) was valued at $1.18 billion in 2023, and it is expected to grow with a CAGR of 6.96% during the forecast period 2023-2032 to reach $2.16 billion by 2032. The growth of the alternative cathode material market is anticipated to result from the increasing need for lithium batteries with enhanced energy densities. Moreover, the cost-effectiveness of alternative cathode materials is projected to contribute significantly to the further advancement of the alternative cathode material market.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $1.18 Billion |

| 2032 Forecast | $2.16 Billion |

| CAGR | 6.96% |

Market Introduction

The Asia-Pacific area is vital in determining the direction of energy storage solutions in the dynamic APAC Alternative Cathode Material Market. The industry is expanding significantly because to the growing requirement for renewable energy storage and the growing demand for electric cars. Important companies, especially those with expertise in sodium-ion and lithium-sulfur battery technologies, are putting themselves in a strategic position to benefit from the shifting energy market. Prioritizing research and development expenditures with the goal of enhancing the efficiency and affordability of substitute cathode materials is crucial for companies. Innovation may be accelerated by cooperative efforts with research institutes and strategic alliances within the sector. Navigating the dynamic APAC Alternative Cathode Material industry and grabbing new opportunities requires being up to date on regulatory changes and industry trends.

Market Segmentation:

Segmentation 1: by Battery Type

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Others

Segmentation 2: by End User

- Automotive

- Consumer Electronics

- Power Tools

- Energy Storage Systems (ESS)

- Others

Segmentation 3: by Material Type

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminium Oxide (NCA)

- Lithium Iron Phosphate (LFP)

- Lithium Manganese Oxide (LMO)

- Others

Segmentation 4: by Country

- Japan

- South Korea

- Rest-of-Asia-Pacific and Japan

How can this report add value to an organization?

Product/Innovation Strategy: In the realm of alternative cathode material, technological advancements are transforming agricultural landscapes to create winning products, choose the right unmet needs, target the right customer group, and compete with substitute products. The product segment helps the readers understand the different types of alternative cathode materials. Also, the study provides the readers with a detailed understanding of the Asia-Pacific alternative cathode material market based on application and product.

Growth/Marketing Strategy: The alternative cathode material market has witnessed remarkable growth strategies by key players. Business expansions, collaborations, and partnerships have been pivotal. Companies are venturing into multiple markets, forging alliances, and engaging in research collaborations to enhance their technological prowess. Collaborative efforts between tech companies and agricultural experts are driving the development of cutting-edge monitoring tools. Additionally, strategic joint ventures are fostering the integration of diverse expertise, amplifying the market presence of these solutions. This collaborative approach is instrumental in developing comprehensive, user-friendly, and efficient alternative cathode materials.

Competitive Strategy: In the competitive landscape of alternative cathode material, manufacturers are diversifying their product portfolios to cover various applications. Market segments include battery type, end-user, and material type. Competitive benchmarking illuminates the strengths of market players, emphasizing their unique offerings and regional strengths. Partnerships with research institutions and agricultural organizations are driving innovation.

Key Market Players and Competition Synopsis

The featured companies have been meticulously chosen, drawing insights from primary experts and thorough evaluations of company coverage, product offerings, and market presence.

Some prominent names established in the market are:

|

|

Table of Contents

Executive Summary

Scope of the Study

1. Markets

- 1.1. Industry Outlook

- 1.1.1. Alternative Cathode Material Market: Overview

- 1.1.2. Trends: Current and Future

- 1.1.2.1. Reducing Cobalt Content in Cathode Materials

- 1.1.2.2. Shift to Lithium Iron Phosphate (LFP) Batteries

- 1.1.2.3. Shift toward Electric Vehicles

- 1.1.3. Supply Chain Network

- 1.1.3.1. Mining and Processing

- 1.1.3.2. Material Production

- 1.1.3.3. Cathode Production

- 1.1.3.4. Battery assembly

- 1.1.4. Ecosystem/Ongoing Programs

- 1.1.4.1. Consortiums and Associations

- 1.1.4.2. Regulatory Bodies

- 1.1.4.3. Government Programs

- 1.1.4.4. Programs by Research Institutions and Universities

- 1.2. Business Dynamics

- 1.2.1. Business Drivers

- 1.2.1.1. Concerns about Cobalt Availability

- 1.2.1.2. Rising Demand for Lithium-Ion Batteries with Higher Energy Densities

- 1.2.1.3. Lower Cost of Alternate Cathode Materials

- 1.2.1.4. Increasing Renewable Energy Integration

- 1.2.2. Business Challenges

- 1.2.2.1. Limited Commercialization

- 1.2.2.2. Supply Chain Uncertainties

- 1.2.2.3. Regulatory and Safety Concerns

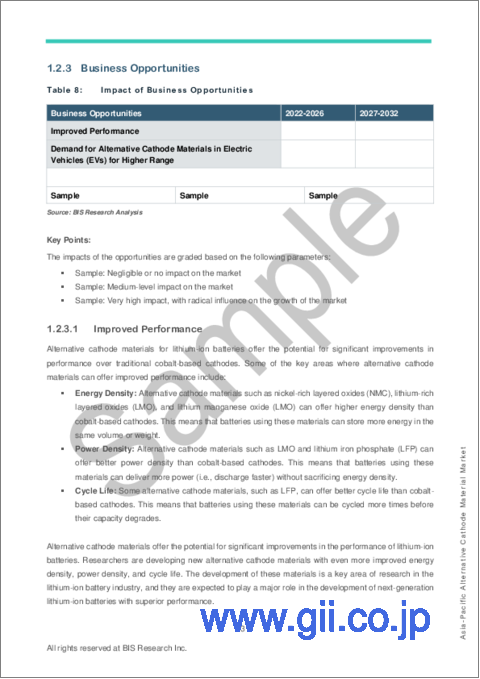

- 1.2.3. Business Opportunities

- 1.2.3.1. Improved Performance

- 1.2.3.2. Demand for Alternative Cathode Materials in Electric Vehicles (EVs) for Higher Range

- 1.2.1. Business Drivers

- 1.3. Mining of Cathode Materials

- 1.4. Use Cases of Various Cathode Types

- 1.5. Comparative Analysis of Key Battery Minerals

- 1.6. Analysis: Why is There a Need for Alternative Cathode Materials?

2. Regions

- 2.1. China

- 2.2. Asia-Pacific and Japan

- 2.2.1. Asia-Pacific and Japan: Country-Level Analysis

- 2.2.1.1. Japan

- 2.2.1.2. South Korea

- 2.2.1.3. Rest-of-Asia-Pacific and Japan

- 2.2.1. Asia-Pacific and Japan: Country-Level Analysis

3. Markets - Competitive Benchmarking & Company Profiles

- 3.1. Competitive Benchmarking

- 3.2. Company Profiles

- 3.2.1. Mitsubishi Electric Corporation

- 3.2.1.1. Company Overview

- 3.2.1.2. Product Portfolio

- 3.2.1.3. Analyst View

- 3.2.1.3.1. Regions of Growth

- 3.2.2. Nippon Chemical Industrial CO., LTD.

- 3.2.2.1. Company Overview

- 3.2.2.2. Product Portfolio

- 3.2.2.3. Analyst View

- 3.2.2.3.1. Regions of Growth

- 3.2.3. LG Chem

- 3.2.3.1. Company Overview

- 3.2.3.2. Product Portfolio

- 3.2.3.3. Analyst View

- 3.2.3.3.1. Regions of Growth

- 3.2.4. POSCO

- 3.2.4.1. Company Overview

- 3.2.4.2. Product Portfolio

- 3.2.4.3. Analyst View

- 3.2.4.3.1. Regions of Growth

- 3.2.1. Mitsubishi Electric Corporation

4. Research Methodology

- 4.1. Data Sources

- 4.1.1. Primary Data Sources

- 4.1.2. Secondary Data Sources

- 4.1.3. Data Triangulation

- 4.2. Market Estimation and Forecast

- 4.2.1. Factors for Data Prediction and Modeling