|

|

市場調査レポート

商品コード

1397345

英国のアンモニアクラッカー市場の分析・予測:2023-2032年U.K. Ammonia Crackers Market - Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| 英国のアンモニアクラッカー市場の分析・予測:2023-2032年 |

|

出版日: 2023年12月17日

発行: BIS Research

ページ情報: 英文 47 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

英国のアンモニアクラッカーの市場規模は、2022年の277万米ドルから、予測期間中は23.9%のCAGRで推移し、2032年には1,934万米ドルの規模に成長すると予測されています。

持続可能なエネルギー技術の利用が拡大し、数多くの産業で窒素ガスが必要とされていることから、英国のアンモニアクラッカー市場は今後数年で着実に成長すると予測されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2032年 |

| 2023年評価 | 281万米ドル |

| 2032年予測 | 1,934万米ドル |

| CAGR | 23.9% |

アンモニアクラッキングは、電子部品の中でも特に半導体や燃料電池用水素ガスの製造に広く利用されています。また、アンモニアアンモニアクラッカーを用いて製造される窒素ガスは、食品・飲料の包装や保存を含むさまざまな産業で使用されています。

水素燃料電池を含む持続可能なエネルギー源の増加や、さまざまな産業における窒素ガスのニーズの高まりが、今後数年間の英国でのアンモニアクラッカーへのニーズの拡大を促進すると予測されます。さらに、英国政府は温室効果ガス排出量の削減と持続可能なエネルギー技術の支援に重点を置いており、アンモニアクラッカーに対する同国のニーズを増加させると考えられています。

当レポートでは、英国のアンモニアクラッカーの市場を調査し、市場の背景・概要、市場成長への各種影響因子の分析、市場規模の推移・予測、各種区分別の詳細分析、競合情勢、主要企業の分析などをまとめています。

市場の分類

セグメンテーション1:エンドユーザー別

- 熱処理

- 金属

- 石油・ガス

- 発電

- モビリティ

- その他

セグメンテーション2:クラッカータイプ別

- 集中型

- 分散型

セグメンテーション3:容量別

- 小規模 (250 Nm3/hr未満)

- 中規模 (250-1,000 Nm3/hr)

- 大規模 (1,000 Nm3/hr超)

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界の展望

- 動向:現在と未来

- サプライチェーン分析

- アンモニアクラッカー市場のエコシステム

- COVID-19がアンモニアクラッカー市場に与える影響

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業戦略

- 経営戦略

- 事業機会

- スタートアップの情勢

- エコシステムにおける主要なスタートアップ企業

第2章 英国

- 英国

- 市場

- 用途

- 製品

第3章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 競合マトリックス

- 主要企業の製品マトリックス

- 主要企業の市場シェア分析

第4章 調査手法

List of Figures

- Figure 1: Ammonia Crackers Market, $Million, 2022, 2023, and 2032

- Figure 2: Ammonia Crackers Market (by End User), $Million, 2022 and 2032

- Figure 3: Ammonia Crackers Market (by Cracker Type), $Million, 2022 and 2032

- Figure 4: Ammonia Crackers Market (by Capacity), $Million, 2022 and 2032

- Figure 5: Ammonia Crackers Market (by Region), $Million, 2022 and 2032

- Figure 6: Supply Chain Analysis of the Ammonia Crackers Market

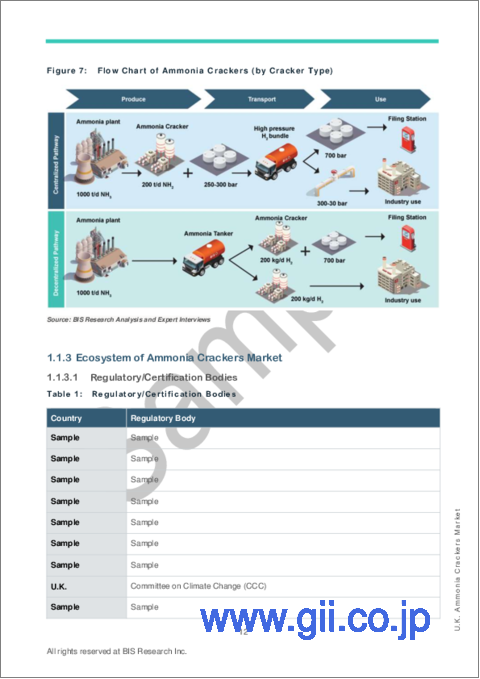

- Figure 7: Flow Chart of Ammonia Crackers (by Cracker Type)

- Figure 8: Global Automotive Production Units, 2019-2021

- Figure 9: Research Methodology

- Figure 10: Top-Down and Bottom-Up Approach

- Figure 11: Ammonia Crackers Market: Influencing Factors

- Figure 12: Assumptions and Limitations

List of Tables

- Table 1: Regulatory/Certification Bodies

- Table 2: Key Product and Market Developments

- Table 3: Key Mergers and Acquisitions, Partnerships, and Joint Ventures

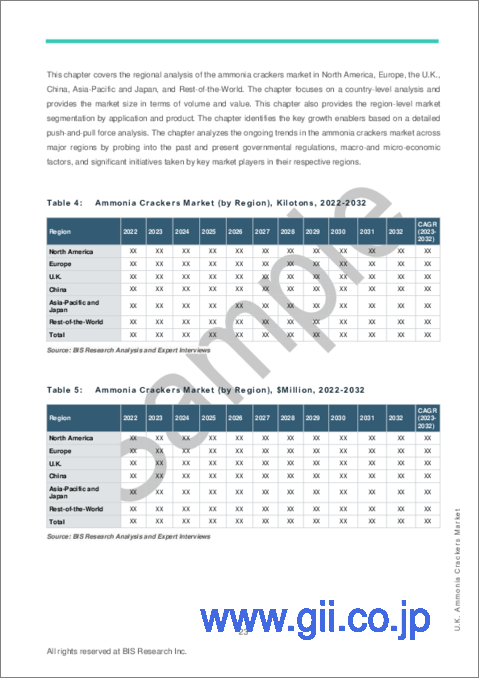

- Table 4: Ammonia Crackers Market (by Region), Kilotons, 2022-2032

- Table 5: Ammonia Crackers Market (by Region), $Million, 2022-2032

- Table 6: U.K. Ammonia Crackers Market (by End User), Kilotons, 2022-2032

- Table 7: U.K. Ammonia Crackers Market (by End User), $Million, 2022-2032

- Table 8: U.K. Ammonia Crackers Market (by Cracker Type), Kilotons, 2022-2032

- Table 9: U.K. Ammonia Crackers Market (by Cracker Type), $Million, 2022-2032

- Table 10: U.K. Ammonia Crackers Market (by Capacity), Kilotons, 2022-2032

- Table 11: U.K. Ammonia Crackers Market (by Capacity), $Million, 2022-2032

- Table 12: Product Matrix of Key Companies (by Capacity)

- Table 13: Market Shares of Key Companies, 2022

“The U.K. Ammonia Crackers Market Expected to Reach $19.34 Million by 2032.”

Introduction to U.K. Ammonia Crackers Market

The U.K. ammonia crackers market is projected to reach $19.34 million by 2032 from $2.77 million in 2022, growing at a CAGR of 23.9% during the forecast period 2023-2032. With the growing use of sustainable energy technologies and the need for nitrogen gas in numerous industries, the UK ammonia crackers market is anticipated to rise steadily in the upcoming years.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $2.81 Million |

| 2032 Forecast | $19.34 Million |

| CAGR | 23.9% |

Market Introduction

Ammonia cracking is widely utilized in the making of semiconductors and hydrogen gas for fuel cells, among other electronic components. Nitrogen gas is produced using ammonia crackers and used in a variety of industries, including food and beverage packaging and preservation.

A growing number of sustainable energy sources, including hydrogen fuel cells, and a growing need for nitrogen gas across a range of industries are projected to drive an increase in the UK's need for ammonia crackers in the upcoming years. Furthermore, the UK government's emphasis on lowering greenhouse gas emissions and supporting sustainable energy technology is probably going to increase the country's need for ammonia crackers.

Important companies including Linde AG, Air Products and Chemicals, Inc., and Praxair Technology, Inc. are among the leading competitors in the UK ammonia crackers market. These businesses are actively engaged in R&D to create new products and increase ammonia crackers' effectiveness.

The market for ammonia crackers in the UK is anticipated to increase steadily over the next several years due to the growing use of sustainable energy technologies and the need for nitrogen gas in a variety of industries.

Market Segmentation:

Segmentation 1: by End User

- Heat Treatment

- Metal Industry

- Oil and Gas

- Power Generation

- Mobility

- Others

Segmentation 2: by Cracker Type

- Centralized

- Decentralized

Segmentation 3: by Capacity

- Small Scale (<250 Nm3/hr)

- Medium Scale (250-1,000 Nm3/hr)

- Large Scale (>1,000 Nm3/hr)

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different cracker types and capacities involved in the ammonia crackers market. The cracker type segment has been segmented into centralized and decentralized. The capacity segment has been segmented into small scale (<250 Nm3/hr), medium scale (250-1,000 Nm3/hr) and large scale (>1,000 Nm3/hr). Moreover, the study provides the reader with a detailed understanding of the ammonia crackers market based on end user, including heat treatment, metal industry, oil and gas, power generation, mobility, and others. The increasing adoption of ammonia crackers in power generation and mobility sectors is expected to fuel market growth in the future.

Growth/Marketing Strategy: The U.K. ammonia crackers market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, and joint ventures. The favored strategy for the companies has been business partnerships to strengthen their position in the ammonia crackers market.

Competitive Strategy: Key players in the U.K. ammonia crackers market analyzed and profiled in the study involve ammonia cracker producers and the overall ecosystem. Moreover, a detailed competitive benchmarking of the players operating in the ammonia crackers market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

Executive Summary

Scope of the Study

1. Market

- 1.1. Industry Outlook

- 1.1.1. Trends: Current and Future

- 1.1.1.1. Ongoing Research for Scaling Up of Cracking Technologies

- 1.1.1.2. Transition towards Low-Carbon Hydrogen, Aiding the Growth of Ammonia Crackers

- 1.1.2. Supply Chain Analysis

- 1.1.3. Ecosystem of Ammonia Crackers Market

- 1.1.3.1. Regulatory/Certification Bodies

- 1.1.4. Impact of COVID-19 on the Ammonia Crackers Market

- 1.1.1. Trends: Current and Future

- 1.2. Business Dynamics

- 1.2.1. Business Drivers

- 1.2.1.1. Increasing Awareness Regarding Green Hydrogen

- 1.2.1.2. Increased Adoption of Ammonia Crackers in End-User Industries

- 1.2.1.3. Need for Effective Hydrogen Carrier

- 1.2.2. Business Challenges

- 1.2.2.1. Toxicity of Liquid Ammonia and Trace Amounts of Ammonia in Hydrogen after Decomposition

- 1.2.2.2. High Cost of Green Hydrogen Production and Requirement of Significant Amount of Energy in Cracking

- 1.2.3. Business Strategies

- 1.2.3.1. Product and Market Developments

- 1.2.4. Corporate Strategies

- 1.2.4.1. Mergers and Acquisitions, Partnerships, and Joint Ventures

- 1.2.5. Business Opportunities

- 1.2.5.1. Government Initiatives for Net-Zero Emission

- 1.2.5.2. Increasing Adoption of Green Hydrogen into Mobility Sector

- 1.2.1. Business Drivers

- 1.3. Start-Up Landscape

- 1.3.1. Key Start-Ups in the Ecosystem

2. U.K.

- 2.1. U.K.

- 2.1.1. Market

- 2.1.1.1. Key Producers and Suppliers in the U.K.

- 2.1.1.2. Business Drivers

- 2.1.1.3. Business Challenges

- 2.1.2. Application

- 2.1.2.1. U.K. Ammonia Crackers Market (by End User), Volume and Value Data

- 2.1.3. Product

- 2.1.3.1. U.K. Ammonia Crackers Market (by Cracker Type), Volume and Value Data

- 2.1.3.2. U.K. Ammonia Crackers Market (by Capacity), Volume and Value Data

- 2.1.1. Market

3. Market - Competitive Benchmarking and Company Profiles

- 3.1. Competitive Benchmarking

- 3.1.1. Competitive Position Matrix

- 3.1.2. Product Matrix of Key Companies (by Capacity)

- 3.1.3. Market Share Analysis of Key Companies, 2022

4. Research Methodology

- 4.1. Primary Data Sources

- 4.2. BIS Data Sources

- 4.3. Assumptions and Limitations