|

|

市場調査レポート

商品コード

1392998

ゲノム癌パネルおよびプロファイリングの世界市場 (2023-2033年):組織検査・癌パネルタイプ・癌タイプ・用途・技術・エンドユーザー・地域別の分析・予測Genomic Cancer Panel and Profiling Market - A Global and Regional Analysis: Focus on Tissue Testing, Cancer Panel Type, Cancer Type, Application, Technology, End User, and Region - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| ゲノム癌パネルおよびプロファイリングの世界市場 (2023-2033年):組織検査・癌パネルタイプ・癌タイプ・用途・技術・エンドユーザー・地域別の分析・予測 |

|

出版日: 2023年12月05日

発行: BIS Research

ページ情報: 英文 198 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のゲノム癌パネルおよびプロファイリングの市場規模は、2022年の99億米ドルから、予測期間中は9.43%のCAGRで堅調に推移し、2033年には265億9,000万米ドルの規模に成長すると予測されています。

この成長の原動力は、ゲノム研究の進展と腫瘍分野における精密医療への注目の高まりです。

同市場は、癌の早期発見に対する需要の増加によっても、大きく成長しています。リキッドバイオプシー検査の人気と評価の高まりや、人々のライフスタイルの変化による癌リスクの増加も市場成長に影響を与えています。

当レポートでは、世界のゲノム癌パネルおよびプロファイリングの市場を調査し、市場の背景・概要、市場成長への各種影響因子の分析、特許動向、法規制環境、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業の分析などをまとめています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2033年 |

| 2023年評価 | 108億米ドル |

| 2033年予測 | 265億9,000万米ドル |

| CAGR | 9.43% |

目次

第1章 市場

- 製品の定義

- 包含基準と除外基準

- 市場範囲

- 調査手法

- 市場概要

第2章 業界分析

- 法的要件

- 特許分析

第3章 市場力学

- 概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第4章 競合考察

- 概要

- 主要な戦略と展開

- 成長シェア分析

第5章 組織検査別

- 概要

- 固形組織検査

- 液体組織検査

第6章 癌パネルタイプ別

- 概要

- 単一遺伝子パネル

- 複数遺伝子パネル

第7章 癌タイプ別

- 概要

- 肺癌

- 乳癌

- 結腸癌

- 前立腺癌

- その他の癌

第8章 用途別

- 概要

- 臨床

- 研究

第9章 技術別

- 概要

- 次世代シーケンス (NGS)

- ポリメラーゼ連鎖反応 (PCR)

- 蛍光In-Situハイブリダイゼーション (FISH)

- 免疫組織化学 (IHC)

- その他

第10章 エンドユーザー別

- 概要

- 研究・学術機関

- 臨床・診断ラボ

- 病院

- その他

第11章 地域別

- 概要

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- その他の地域

第12章 企業プロファイル

- Agilent Technologies, Inc.

- ARUP Laboratories

- Burning Rock DX

- Caris Life Sciences

- Danaher Corporation (Integrated DNA Technologies, Inc.)

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd

- Fulgent Genetics

- Genecast Biotechnology Co., Ltd

- Illumina, Inc.

- Invitae Corporation

- Laboratory Corporation of America Holdings.

- Paragon Genomics

- Tempus

- Thermo Fisher Scientific Inc.

List of Figures

- Figure 1: Global Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 2: Global Genomic Cancer Panel and Profiling Market (by Tissue Testing), % Share, 2022 and 2033

- Figure 3: Global Genomic Cancer Panel and Profiling Market (by Cancer Panel Type), % Share, 2022 and 2033

- Figure 4: Global Genomic Cancer Panel and Profiling Market (by Cancer Type), % Share, 2022 and 2033

- Figure 5: Global Genomic Cancer Panel and Profiling Market (by Application), % Share, 2022 and 2033

- Figure 6: Global Genomic Cancer Panel and Profiling Market (by Technology), % Share 2022 and 2033

- Figure 7: Global Genomic Cancer Panel and Profiling Market (by End User), % Share 2022 and 2033

- Figure 8: Global Genomic Cancer Panel and Profiling Market Snapshot (by Region), $Billion, 2022

- Figure 9: Global Genomic Cancer Panel and Profiling Market Segmentation

- Figure 10: Global Genomic Cancer Panel and Profiling Market: Research Methodology

- Figure 11: Primary Research Methodology

- Figure 12: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 13: Top-Down Approach (Segment-Wise Analysis)

- Figure 14: Genomic Cancer Panel and Profiling Workflow, End User Perspective

- Figure 15: Genomic Cancer Panel and Profiling Workflow, Laboratory Technician Perspective

- Figure 16: Global Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 17: General Testing Criterion According to the NCCN Guidelines

- Figure 18: Reimbursement Components in the U.S.

- Figure 19: Global Genomic Cancer Panel and Profiling Market, Patent Analysis (by Year), January 2020-October 2023

- Figure 20: Global Genomic Cancer Panel and Profiling Market, Patent Analysis (by Country), January 2020-October 2023

- Figure 21: Global Genomic Cancer Panel and Profiling Market Dynamics

- Figure 22: Cancer Profiling Cases in Developed Countries

- Figure 23: Share of Global Cancer Prevalence, 2010-2019

- Figure 24: Share of Global Age-Standardized Death Rate of Cancer, 2010-2019

- Figure 25: Genomic Research Funding by National Human Genome Research Institute (NHGRI), $Million, 2020, 2021, and 2022

- Figure 26: Key Players Offering

- Figure 27: Reimbursement Reductions Adopted for Oncology Testing as per PAMA Revisions

- Figure 28: Cost Difference between the Multi-Gene Panel Test and Usual Care Screening Test

- Figure 29: Share of Key Developments, January 2020-October 2023

- Figure 30: Number of Product Launches, Approvals, and Upgradations (by Company), January 2020-October 2023

- Figure 31: Growth-Share Analysis of the Global Genomic Cancer Panel and Profiling Market (by Technology), 2022

- Figure 32: Global Genomic Cancer Panel and Profiling Market (by Tissue Testing)

- Figure 33: Global Genomic Cancer Panel and Profiling Market (by Tissue Testing), % Share, 2022 and 2033

- Figure 34: Global Genomic Cancer Panel and Profiling Market (Solid Tissue Testing), $Billion, 2022-2033

- Figure 35: Global Genomic Cancer Panel and Profiling Market (Liquid Tissue Testing), $Billion, 2022-2033

- Figure 36: Global Genomic Cancer Panel and Profiling Market (by Cancer Panel Type)

- Figure 37: Global Genomic Cancer Panel and Profiling Market (by Cancer Panel Type), % Share, 2022 and 2033

- Figure 38: Global Genomic Cancer Panel and Profiling Market (Single-Gene Panel), $Billion, 2022-2033

- Figure 39: Global Genomic Cancer Panel and Profiling Market (Multi-Gene Panel), $Billion, 2022-2033

- Figure 40: Global Genomic Cancer Panel and Profiling Market (by Cancer Type)

- Figure 41: Global Genomic Cancer Panel and Profiling Market (by Cancer Type), % Share, 2022 and 2033

- Figure 42: Global Genomic Cancer Panel and Profiling Market (Lung Cancer), $Billion, 2022-2033

- Figure 43: Global Genomic Cancer Panel and Profiling Market (Breast Cancer), $Billion, 2022-2033

- Figure 44: Global Genomic Cancer Panel and Profiling Market (Colon Cancer), $Billion, 2022-2033

- Figure 45: Estimated New Cancer Cases and Deaths for Prostate Cancer, 2022

- Figure 46: Global Genomic Cancer Panel and Profiling Market (Prostate Cancer), $Billion, 2022-2033

- Figure 47: Global Genomic Cancer Panel and Profiling Market (Other Cancers), $Billion, 2022-2033

- Figure 48: Global Genomic Cancer Panel and Profiling Market (by Application)

- Figure 49: Global Genomic Cancer Panel and Profiling Market (by Application), % Share, 2022 and 2033

- Figure 50: Global Genomic Cancer Panel and Profiling Market (Clinical), $Billion, 2022-2033

- Figure 51: Global Genomic Cancer Panel and Profiling Market (by Clinical), $Million, 2022-2033

- Figure 52: Global Genomic Cancer Panel and Profiling Market (Research), $Billion, 2022-2033

- Figure 53: Global Genomic Cancer Panel and Profiling Market (by Technology)

- Figure 54: Global Genomic Cancer Panel and Profiling Market (by Technology), % Share, 2022 and 2033

- Figure 55: Global Genomic Cancer Panel and Profiling Market (Next-Generation Sequencing), $Billion, 2022-2033

- Figure 56: Global Genomic Cancer Panel and Profiling Market (Polymerase Chain Reaction), $Billion, 2022-2033

- Figure 57: Global Genomic Cancer Panel and Profiling Market (Fluorescence In-Situ Hybridization), $Billion, 2022-2033

- Figure 58: Global Genomic Cancer Panel and Profiling Market (Immunohistochemistry), $Billion, 2022-2033

- Figure 59: Global Genomic Cancer Panel and Profiling Market (Others), $Billion, 2022-2033

- Figure 60: Global Genomic Cancer Panel and Profiling Market (by End User)

- Figure 61: Global Genomic Cancer Panel and Profiling Market (by End User), % Share 2022 and 2033

- Figure 62: Global Genomic Cancer Panel and Profiling Market (Research and Academic Institutes), $Billion, 2022-2033

- Figure 63: Global Genomic Cancer Panel and Profiling Market (Clinical and Diagnostics Laboratories), $Billion, 2022-2033

- Figure 64: Global Genomic Cancer Panel and Profiling Market (Hospitals), $Billion, 2022-2033

- Figure 65: Global Genomic Cancer Panel and Profiling Market (Other End Users), $Billion, 2022-2033

- Figure 66: Global Genomic Cancer Panel and Profiling Market Snapshot (by Region), $Billion, 2022

- Figure 67: North America Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 68: North America Genomic Cancer Panel and Profiling Market (by Application), $Million, 2022-2033

- Figure 69: North America Genomic Cancer Panel and Profiling Market (by End User), $Million, 2022-2033

- Figure 70: North America Genomic Cancer Panel and Profiling Market (by Country), $Billion, 2022-2033

- Figure 71: U.S. Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 72: Canada Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 73: Europe Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 74: Europe Genomic Cancer Panel and Profiling Market (by Application), $Million, 2022-2033

- Figure 75: Europe Genomic Cancer Panel and Profiling Market (by End User), $Million, 2022-2033

- Figure 76: Europe Genomic Cancer Panel and Profiling Market (by Country), $Billion, 2022-2033

- Figure 77: Germany Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 78: France Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 79: U.K. Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 80: Italy Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 81: Spain Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 82: Rest-of-Europe Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 83: Asia-Pacific Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 84: Asia-Pacific Genomic Cancer Panel and Profiling Market (by Application), $Million, 2022-2033

- Figure 85: Asia-Pacific Genomic Cancer Panel and Profiling Market (by End User), $Million, 2022-2033

- Figure 86: Asia-Pacific Genomic Cancer Panel and Profiling Market (by Country), $Billion, 2022-2033

- Figure 87: China Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 88: Japan Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 89: India Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 90: Australia Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 91: South Korea Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 92: Rest-of-Asia-Pacific Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 93: Latin America Genomic Cancer Panel and Profiling Market, $Billion, 2022-2033

- Figure 94: Latin America Genomic Cancer Panel and Profiling Market (by Application), $Million, 2022-2033

- Figure 95: Latin America Genomic Cancer Panel and Profiling Market (by End User), $Million, 2022-2033

- Figure 96: Latin America Genomic Cancer Panel and Profiling Market (by Country), $Billion, 2022-2033

- Figure 97: Brazil Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 98: Mexico Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 99: Rest-of-Latin America Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 100: Rest-of-the-World Genomic Cancer Panel and Profiling Market, $Million, 2022-2033

- Figure 101: Rest-of-the-World Genomic Cancer Panel and Profiling Market (by Application), $Million, 2022-2033

- Figure 102: Rest-of-the-World Genomic Cancer Panel and Profiling Market (by End User), $Million, 2022-2033

- Figure 103: Global Genomic Cancer Panel and Profiling Market, Total Number of Companies Profiled

- Figure 104: Agilent Technologies, Inc.: Product Portfolio

- Figure 105: Agilent Technologies, Inc.: Overall Financials, $Million, 2020-2022

- Figure 106: Agilent Technologies, Inc.: Revenue (by Segment), $Million, 2020-2022

- Figure 107: Agilent Technologies, Inc.: Revenue (by Region), $Million, 2020-2022

- Figure 108: Agilent Technologies, Inc.: R&D Expenditure, $Million, 2020-2022

- Figure 109: ARUP Laboratories: Overall Product Portfolio

- Figure 110: Burning Rock DX: Product Portfolio

- Figure 111: Caris Life Sciences: Overall Product Portfolio

- Figure 112: Danaher Corporation (Integrated DNA Technologies, Inc.): Product Portfolio

- Figure 113: Danaher Corporation (Integrated DNA Technologies, Inc.): Overall Financials, $Million, 2020-2022

- Figure 114: Danaher Corporation (Integrated DNA Technologies, Inc.): Revenue (by Segment), $Million, 2020-2022

- Figure 115: Danaher Corporation (Integrated DNA Technologies, Inc.): Revenue (by Region), $Million, 2020-2022

- Figure 116: Danaher Corporation (Integrated DNA Technologies, Inc.): R&D Expenditure, $Million, 2020-2022

- Figure 117: Exact Sciences Corporation: Product Portfolio

- Figure 118: Exact Sciences Corporation: Overall Financials, $Million, 2019-2021

- Figure 119: Exact Sciences Corporation: Revenue (by Segment), $Million, 2019-2021

- Figure 120: Exact Sciences Corporation: Revenue (by Region), $Million, 2019-2021

- Figure 121: Exact Sciences Corporation: R&D Expenditure, $Million, 2019-2021

- Figure 122: F. Hoffmann-La Roche Ltd: Product Portfolio

- Figure 123: F. Hoffmann-La Roche Ltd: Overall Financials, $Million, 2020-2022

- Figure 124: F. Hoffmann-La Roche Ltd: Revenue (by Segment), $Million, 2020-2022

- Figure 125: F. Hoffmann-La Roche Ltd: R&D Expenditure, $Million, 2020-2022

- Figure 126: Fulgent Genetics: Product Portfolio

- Figure 127: Fulgent Genetics: Overall Financials, $Million, 2020-2022

- Figure 128: Fulgent Genetics: Revenue (by Region), $Million, 2020-2022

- Figure 129: Fulgent Genetics: R&D Expenditure, $Million, 2020-2022

- Figure 130: Genecast Biotechnology Co., Ltd: Product Portfolio

- Figure 131: Illumina, Inc.: Product Portfolio

- Figure 132: Illumina, Inc.: Overall Financials, $Million, 2020-2022

- Figure 133: Illumina, Inc.: Revenue (by Segment), $Million, 2020-2022

- Figure 134: Illumina, Inc.: Revenue (by Region), $Million, 2020-2022

- Figure 135: Illumina, Inc.: R&D Expenditure, $Million, 2020-2022

- Figure 136: Invitae Corporation: Overall Product Portfolio

- Figure 137: Invitae Corporation: Overall Financials, $Million, 2020-2022

- Figure 138: Invitae Corporation: Revenue (by Segment), $Million, 2020-2022

- Figure 139: Invitae Corporation: Revenue (by Region), $Million, 2020-2022

- Figure 140: Invitae Corporation: R&D Expenditure, $Million, 2020-2022

- Figure 141: Laboratory Corporation of America Holdings.: Product Portfolio

- Figure 142: Laboratory Corporation of America Holdings.: Overall Financials, $Million, 2020-2022

- Figure 143: Laboratory Corporation of America Holdings.: Revenue (by Segment), $Million, 2020-2022

- Figure 144: Laboratory Corporation of America Holdings.: Revenue (by Region), $Million, 2020-2022

- Figure 145: Paragon Genomics: Product Portfolio

- Figure 146: Tempus: Product Portfolio

- Figure 147: Thermo Fisher Scientific Inc.: Product Portfolio

- Figure 148: Thermo Fisher Scientific Inc.: Overall Financials, $Million, 2020-2022

- Figure 149: Thermo Fisher Scientific Inc.: Revenue (by Segment), $Million, 2020-2022

- Figure 150: Thermo Fisher Scientific Inc.: Revenue (by Region), $Million, 2020-2022

- Figure 151: Thermo Fisher Scientific Inc.: R&D Expenditure, $Million, 2020-2022

List of Tables

- Table 1: Global Genomic Cancer Panel and Profiling Market, Impact Analysis

- Table 2: Technological Trends in the Global Genomic Cancer Panel and Profiling Market

- Table 3: Global Genomic Cancer Panel and Profiling Market, Impact Analysis

- Table 4: Global Genomic Cancer Panel and Profiling Market, Pipeline Tests

- Table 5: Ongoing Cancer-Based Biomarkers Trials

- Table 6: North America Genomic Cancer Panel and Profiling Market, Impact Analysis

- Table 7: Europe Genomic Cancer Panel and Profiling Market, Impact Analysis

- Table 8: Asia-Pacific Genomic Cancer Panel and Profiling Market, Impact Analysis

- Table 9: Latin America Genomic Cancer Panel and Profiling Market, Impact Analysis

- Table 10: Rest-of-the-World Genomic Cancer Panel and Profiling Market, Impact Analysis

“Global Genomic Cancer Panel and Profiling Market Expected to Reach $26.59 Billion by 2033.”

Global Genomic Cancer Panel and Profiling Market Overview

The global genomic cancer panel and profiling market is expected to reach $26.59 billion by 2033 from $9.90 billion in 2022. The global genomic cancer panel and profiling market is expected to grow at a robust rate of 9.43% during the forecast period 2023-2033. This growth is driven by advancements in genomic research and an increasing focus on precision medicine within the field of oncology.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $10.80 Billion |

| 2033 Forecast | $26.59 Billion |

| CAGR | 9.43% |

Introduction to Genomic Cancer Panel and Profiling

Genomic cancer panels and profiling represent a modern approach to detecting cancer by studying the genetic details of tumors before symptoms appear. The significant advantages of employing these panels lie in their ability to provide comprehensive genetic insights, facilitating early detection and the formulation of personalized treatment plans. The genomic cancer panel and profiling market is on the rise due to the transformative potential these technologies hold in reshaping cancer management. By enhancing the understanding of cancer genetics, these panels offer a more precise means of identifying specific genetic alterations, enabling healthcare professionals to tailor interventions accordingly.

The global genomic cancer panel and profiling market has significant growth, attributed to the increasing demand for early cancer detection while treating cancer patients. The increasing popularity and appreciation of liquid biopsy tests have also played a critical role in the market growth. Furthermore, the increased cancer risk due to the changing lifestyle of people is also influencing the market growth.

Impact

The genomic cancer panel and profiling market has made an impact in the following ways:

Personalized Treatment:

Doctors can use these panels to find specific changes in a person's cancer genes. This helps create treatments that are just for that person and the type of cancer.

Finding Cancer Early:

The panels can also help catch cancer early by spotting certain gene markers linked to different cancers. Finding cancer early makes it easier to treat and beat.

Helping Doctors Choose Treatments:

Doctors can make better choices about treatments using genetic info. They can pick treatments that work well and skip ones that might not help as much.

Research and Testing New Treatments:

The genetic info from these panels helps researchers find new ways to treat cancer. It's also useful for testing new drugs in trials.

Clinical Trials and Research:

Genomic cancer profiling has contributed significantly to the identification of new therapeutic targets. This information is crucial for the development of novel drugs and the design of clinical trials, ultimately advancing cancer research and treatment options.

Prognostic Information:

Genomic profiling can provide insights into the aggressiveness of a particular cancer and help predict the likelihood of recurrence. This information assists in developing appropriate follow-up plans and adjusting treatment strategies.

Cost-Efficiency:

Advances in genomic sequencing technologies have led to a decrease in the cost of genomic profiling. This makes it more accessible to a larger patient population, allowing more individuals to benefit from personalized cancer treatment.

Market Segmentation:

Segmentation 1: by Tissue Testing

- Solid Tissue Testing

- Liquid Tissue Testing

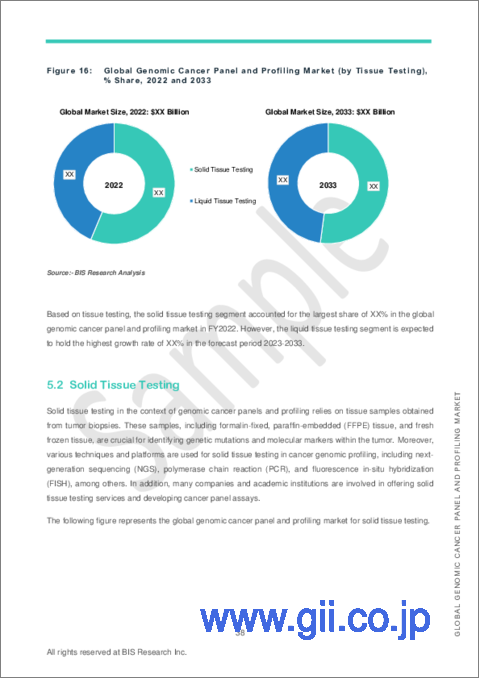

Liquid tissue testing is becoming the primary method in the global genomic cancer panel and profiling market, particularly when it comes to testing tissues. This means that using liquid samples for testing, rather than traditional methods, is expected to become more common and important in understanding and treating cancer.

Segmentation 2: by Cancer Panel Type

- Single-Gene Panel

- Multi-Gene Panel

Multi-gene panel segment dominated the global genomic cancer panel and profiling market (by cancer panel type) in FY2022. These panels, which examine multiple genes simultaneously, are taking a leading role in shaping the understanding and analysis of cancer at the genomic level on a global scale.

Segmentation 3: by Cancer Type

- Lung Cancer

- Breast Cancer

- Colon Cancer

- Prostate Cancer

- Other Cancers

Breast cancer dominated the global genomic cancer panel and profiling market (by cancer type) in FY2022. Breast cancer is one of the most common types of cancer globally, with a high incidence rate. The large number of cases makes it a key focus for genomic profiling efforts.

Segmentation 4: by Application

- Clinical

- Research

Clinical segment dominated the global genomic cancer panel and profiling market (by application) in FY2022. Genomic cancer panels provide critical information that helps clinicians make more informed decisions about the most effective treatments for individual patients. This personalized approach enhances the overall efficacy of cancer care.

Segmentation 5: by Technology

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Fluorescence In-Situ Hybridization (FISH)

- Immunohistochemistry (IHC)

- Others

Next-Generation Sequencing (NGS) segment dominated the global genomic cancer panel and profiling market (by technology) in FY2022. NGS offers comprehensive, cost-effective, and efficient genomic analysis, making it a preferred technology for researchers and clinicians in the field of cancer genomics.

Segmentation 6: by End User

- Hospitals

- Clinical and Diagnostic Laboratories

- Research and Academic Institutes

- Other End Users

Hospitals segment dominated the global genomic cancer panel and profiling market (by end user) in FY2022. Hospitals often have multidisciplinary teams of healthcare professionals, including oncologists, pathologists, and genetic counselors. This collaborative approach is essential for the effective utilization of genomic information in cancer care.

Segmentation 7: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest-of-the-World

Based on region, North America dominated the global genomic cancer panel and profiling market in terms of market size in FY2022. However, the Asia-Pacific region, encompassing numerous emerging economies, is projected to exhibit a CAGR of 11.81% during the forecast period from 2023 to 2033.

Recent Developments in the Global Genomic Cancer Panel and Profiling Market

- In April 2023, Agilent Technologies, Inc. introduced the NGS assay, SureSelect Cancer CGP, to advance precision oncology through comprehensive genomic profiling (CGP). This assay expands the range of biomarkers available for solid tumor profiling with a rapid and highly efficient workflow.

- In January 2023, FOUNDATION MEDICINE, INC. (F. Hoffmann-La Roche Ltd) got FDA approval for its FoundationOne Liquid CDx test as a companion diagnostic for Rozlytrek. This test is relevant for ROS1+NSCLC patients and NTRK fusion-positive solid tumors patients.

- In October 2023, Invitae Corporation. received FDA market authorization for its Common Hereditary Cancers Panel. This achievement marks the first FDA-approved broad panel designed to detect germline variants linked to hereditary cancers.

- In February 2023, Exact Sciences Corp. introduced the OncoExTra therapy selection test in the U.S. OncoExTra is an advanced next-generation sequencing (NGS) genomic test that encompasses both DNA and RNA analysis, offering a comprehensive molecular profile of the patient's cancer. This test furnishes precise and actionable personalized results for doctors and their patients.

- In January 2023, F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.), in partnership with Natera, Inc., launched a FoundationOne Tracker early access program for clinical use, which is a personalized circulating tumor DNA (ctDNA) monitoring assay. The test investigational use version is now available for clinical trials.

- In April 2023, Agilent and Theragen Bio successfully partnered to advance bioinformatic solutions for cancer genomic profiling in South Korea. This collaboration integrated Agilent's SureSelect Cancer CGP assay with Theragen Bio's localized analysis software, leading to a transformation in translational research and a substantial boost in precision oncology within the region.

- In July 2023, Illumina Inc. and Pillar Biosciences Inc. formed a strategic partnership to offer Pillar's oncology assays worldwide as part of Illumina's oncology products. This collaboration provides advanced next-generation sequencing solutions, improving the efficiency and cost-effectiveness of oncology testing for personalized cancer treatment.

- In January 2022, Thermo Fisher Scientific, Inc. made an agreement with Oncocyte Corporation for the distribution of Thermo Fisher Scientific, Inc.'s two IVD assays on Thermo Fisher Scientific's Ion Torrent Genexus System. Oncocyte Corporation will also validate the company's Oncomine Comprehensive assay plus on the Genexus system.

Demand - Drivers, Restraints, and Opportunities

Market Driver:

Rising Need for Cancer Profiling in Developed Countries Drives Demand for Genomic Panels and Profiling Tests: Developed countries often have aging populations, where a larger proportion of individuals are in the elderly age group. Cancer incidence tends to increase with age, and as the population ages, the overall burden of cancer rises. This demographic trend drives a steady demand for cancer treatment and related healthcare services. Genomic cancer panels contribute to this by helping identify genetic markers associated with early-stage cancers. Early detection allows for timely and targeted interventions, potentially improving treatment outcomes and reducing the overall burden of the disease.

Market Restraint:

Significant Implications of Reimbursement Reductions Impacting Growth of the Genomic Cancer Panel and Profiling Market: Reimbursement reductions in the genomic cancer panel and profiling market have significant implications for both healthcare providers and patients. These reductions often lead to reduced financial support for these valuable diagnostic tests. As a result, healthcare providers may face challenges in offering these tests to patients, potentially limiting their accessibility.

Market Opportunity:

Robust Pipeline of Genomic Cancer Panels and Profiling Tests Poised to Revolutionize Cancer Diagnosis: Genomic cancer panel and profiling tests are an emerging field in health technology that has the potential to disrupt the traditional models of cancer screening. With these tests, a single and non-invasive blood test can assess multiple cancer types at once, with the help of which more cancer can be detected at an earlier stage when accompanied by screening programs. The technology is still in its developmental stage, and there are numerous tests presently under development with self-funded research. Additionally, very few of these tests are FDA-approved, and most of them are being prescribed as laboratory-developed tests that do not require FDA approvals.

How can this report add value to an organization?

Product/Innovation Strategy: The global genomic cancer panel and profiling market has been extensively segmented based on various categories, such as tissue testing, cancer panel type, cancer type, application, technology, end user, and region. This can help readers get a clear overview of the segments accounting for the largest share and the ones that are well-positioned to grow in the coming years.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research was performed to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Exact revenue information, up to a certain extent, was extracted for each company from secondary sources and databases. The revenues related to the product and end user were estimated for each market player based on fact-based proxy indicators as well as primary inputs.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report provides a market study of genomic cancer panels and profiling.

- The market contribution of the genomic cancer panel and profiling anticipates the launch of products in the future, which has been calculated based on historical analysis. This analysis has been supported by proxy factors such as the innovation scale of the companies, the status of funding, collaborations, customer base, and patent scenario.

- The scope of availability of genomic cancer panels and profiling in a particular region has been assessed based on a comprehensive analysis of companies' prospects, the regional end-user perception, and other factors impacting the launch of products in that region.

- The base year considered for the calculation of the market size is 2022. A historical year analysis has been done for the period FY2018-FY2021. The market size has been estimated for FY2022 and projected for the period FY2023-FY2033.

- Revenues of the companies have been referenced from their annual reports for FY2021 and FY2022. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, product approval status, market collaborations, and operational history.

- Regional distribution of the market revenue has been estimated based on the companies in each region and the adoption rate of advance dental and robotics solutions. All the numbers have been adjusted to a single digit after the decimal for better presentation in the report. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. The CAGR has been calculated for the period 2023-2033.

- The market has been mapped based on the available genomic cancer panel and profiling. All the key companies with significant offerings in this field have been considered and profiled in this report.

- Market strategies and developments of key players have been considered for the calculation of the potential of the market in the forecast period.

Primary Research:

The primary sources involve industry experts in the global genomic cancer panel and profiling market, including the market players offering genomic cancer panels and profiling. Resources such as COOs, vice presidents, product managers, directors, and territory managers have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings for advance dental and robotics solutions

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Centers for Disease Control and Prevention (CDC), American Dental Association (ADA), World Health Organization (WHO), and National Center for Biotechnology Information, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolios

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentation and percentage share estimates

- Company and country understanding and data for market value estimation

- Key industries/market trends

- Developments among top players

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names in this market are:

|

|

Table of Contents

1 Markets

- 1.1 Product Definition

- 1.2 Inclusion and Exclusion Criteria

- 1.2.1 Inclusion Criteria

- 1.2.2 Exclusion Criteria

- 1.3 Market Scope

- 1.3.1 Scope of the Study

- 1.3.2 Key Questions Answered in this Report

- 1.4 Research Methodology

- 1.4.1 Global Genomic Cancer Panel and Profiling Market: Research Methodology

- 1.4.2 Data Sources

- 1.4.3 Market Estimation Model

- 1.4.4 Criteria for Company Profiling

- 1.5 Market Overview

- 1.5.1 Market Definition

- 1.5.2 Market Footprint and Growth Potential

- 1.5.3 Future Potential

2 Industry Analysis

- 2.1 Legal Requirements

- 2.1.1 Regulation of Genetic Tests

- 2.1.2 NCCN Guidelines

- 2.1.3 Reimbursement Scenario

- 2.2 Patent Analysis

- 2.2.1 Patent Filing Trend

- 2.2.2 Patent Analysis (by Year)

- 2.2.3 Patent Analysis (by Country)

3 Market Dynamics

- 3.1 Overview

- 3.1.1 Impact Analysis

- 3.2 Market Drivers

- 3.2.1 Rising Need for Cancer Profiling in Developed Countries Driving Demand for Genomic Panels and Profiling Tests

- 3.2.2 Increase in Genomic Research Funding Expanding the Market for Genomic Cancer Panels and Profiling

- 3.2.3 Technological Advancements in the Field of Informatics Expanding Consumer Reach

- 3.3 Market Restraints

- 3.3.1 Significant Implications of Reimbursement Reductions Impacting Growth of the Genomic Cancer Panel and Profiling Market

- 3.3.2 Impact of High-Cost Pressure Hindering Development in Genomic Cancer Panel and Profiling Testing

- 3.4 Market Opportunities

- 3.4.1 Robust Pipeline of Genomic Cancer Panels and Profiling Tests Poised to Revolutionize Cancer Diagnosis

- 3.4.2 Discovery of New Biomarkers Presents an Opportunity for the Development of Diagnostics Tools and Technologies

4 Competitive Insights

- 4.1 Overview

- 4.2 Key Strategies and Developments

- 4.2.1 Product Launches, Approvals, and Upgradations

- 4.2.2 Synergistic Activities

- 4.2.3 Mergers and Acquisitions

- 4.2.4 Business Expansions, Funding, and Licenses

- 4.3 Growth-Share Analysis

- 4.3.1 Growth-Share Analysis (by Technology), 2022

5 By Tissue Testing

- 5.1 Overview

- 5.2 Solid Tissue Testing

- 5.3 Liquid Tissue Testing

6 By Cancer Panel Type

- 6.1 Overview

- 6.2 Single-Gene Panel

- 6.3 Multi-Gene Panel

7 By Cancer Type

- 7.1 Overview

- 7.2 Lung Cancer

- 7.3 Breast Cancer

- 7.4 Colon Cancer

- 7.5 Prostate Cancer

- 7.6 Other Cancers

8 By Application

- 8.1 Overview

- 8.2 Clinical

- 8.2.1 By Clinical

- 8.3 Research

9 By Technology

- 9.1 Overview

- 9.2 Next-Generation Sequencing (NGS)

- 9.3 Polymerase Chain Reaction (PCR)

- 9.4 Fluorescence In-Situ Hybridization (FISH)

- 9.5 Immunohistochemistry (IHC)

- 9.6 Others

10 By End User

- 10.1 Overview

- 10.2 Research and Academic Institutes

- 10.3 Clinical and Diagnostic Laboratories

- 10.4 Hospitals

- 10.5 Other End Users

11 By Region

- 11.1 Overview

- 11.2 North America

- 11.2.1 Key Dynamics

- 11.2.2 U.S.

- 11.2.3 Canada

- 11.3 Europe

- 11.3.1 Key Dynamics

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 U.K.

- 11.3.5 Italy

- 11.3.6 Spain

- 11.3.7 Rest-of-Europe

- 11.4 Asia-Pacific

- 11.4.1 Key Dynamics

- 11.4.2 China

- 11.4.3 Japan

- 11.4.4 India

- 11.4.5 Australia

- 11.4.6 South Korea

- 11.4.7 Rest-of-Asia-Pacific

- 11.5 Latin America

- 11.5.1 Key Dynamics

- 11.5.2 Brazil

- 11.5.3 Mexico

- 11.5.4 Rest-of-Latin America

- 11.6 Rest-of-the-World

- 11.6.1 Key Dynamics

12 Company Profiles

- 12.1 Overview

- 12.2 Agilent Technologies, Inc.

- 12.2.1 Company Overview

- 12.2.2 Role of Agilent Technologies, Inc. in the Global Genomic Cancer Panel and Profiling Market

- 12.2.3 Corporate Strategies

- 12.2.4 Financials

- 12.2.5 Analyst Perspective

- 12.3 ARUP Laboratories

- 12.3.1 Company Overview

- 12.3.2 Role of ARUP Laboratories in the Global Genomic Cancer Panel and Profiling Market

- 12.3.3 Corporate Strategies

- 12.3.4 Analyst Perspective

- 12.4 Burning Rock DX

- 12.4.1 Company Overview

- 12.4.2 Role of Burning Rock DX in the Global Genomic Cancer Panel and Profiling Market

- 12.4.3 Business Strategies

- 12.4.4 Analyst Perspective

- 12.5 Caris Life Sciences

- 12.5.1 Company Overview

- 12.5.2 Role of Caris Life Sciences in the Global Genomic Cancer Panel and Profiling Market

- 12.5.3 Corporate Strategies

- 12.5.4 Analyst Perspective

- 12.6 Danaher Corporation (Integrated DNA Technologies, Inc.)

- 12.6.1 Company Overview

- 12.6.2 Role of Danaher Corporation (Integrated DNA Technologies, Inc.) in the Global Genomic Cancer Panel and Profiling Market

- 12.6.3 Financials

- 12.6.4 Analyst Perspective

- 12.7 Exact Sciences Corporation

- 12.7.1 Company Overview

- 12.7.2 Role of Exact Sciences Corporation in the Global Genomic Cancer Panel and Profiling Market

- 12.7.3 Corporate Strategies

- 12.7.4 Business Strategies

- 12.7.5 Financials

- 12.7.6 Analyst Perspective

- 12.8 F. Hoffmann-La Roche Ltd

- 12.8.1 Company Overview

- 12.8.2 Role of F. Hoffmann-La Roche Ltd in the Global Genomic Cancer Panel and Profiling Market

- 12.8.3 Corporate Strategies

- 12.8.4 Business Strategies

- 12.8.5 Financials

- 12.8.6 Analyst Perspective

- 12.9 Fulgent Genetics

- 12.9.1 Company Overview

- 12.9.2 Role of Fulgent Genetics in the Global Genomic Cancer Panel and Profiling Market

- 12.9.3 Financials

- 12.9.4 Analyst Perspective

- 12.1 Genecast Biotechnology Co., Ltd

- 12.10.1 Company Overview

- 12.10.2 Role of Genecast Biotechnology Co., Ltd in the Global Genomic Cancer Panel and Profiling Market

- 12.10.3 Analyst Perspective

- 12.11 Illumina, Inc.

- 12.11.1 Company Overview

- 12.11.2 Role of Illumina, Inc. in the Global Genomic Cancer Panel and Profiling Market

- 12.11.3 Corporate Strategies

- 12.11.4 Business Strategies

- 12.11.5 Financials

- 12.11.6 Analyst Perspective

- 12.12 Invitae Corporation

- 12.12.1 Company Overview

- 12.12.2 Role of Invitae Corporation in the Global Genomic Cancer Panel and Profiling Market

- 12.12.3 Corporate Strategies

- 12.12.4 Financials

- 12.12.5 Key Insights about the Financial Health of the Company

- 12.12.6 Analyst Perspective

- 12.13 Laboratory Corporation of America Holdings.

- 12.13.1 Company Overview

- 12.13.2 Role of Laboratory Corporation of America Holdings. in Global Genomic Cancer Panel and Profiling Market

- 12.13.3 Corporate Strategies

- 12.13.4 Business Strategies

- 12.13.5 Financials

- 12.13.6 Analyst's Perspective

- 12.14 Paragon Genomics

- 12.14.1 Company Overview

- 12.14.2 Role of Paragon Genomics in the Global Genomic Cancer Panel and Profiling Market

- 12.14.3 Analyst Perspective

- 12.15 Tempus

- 12.15.1 Company Overview

- 12.15.2 Role of Tempus in the Global Genomic Cancer Panel and Profiling Market

- 12.15.3 Analyst Perspective

- 12.16 Thermo Fisher Scientific Inc.

- 12.16.1 Company Overview

- 12.16.2 Role of Thermo Fisher Scientific Inc. in the Global Genomic Cancer Panel and Profiling Market

- 12.16.3 Financials

- 12.16.4 Analyst Perspective