|

|

市場調査レポート

商品コード

1382595

欧州の準軌道試験サービス市場の分析・予測:2022-2032年Europe Sub-Orbital Testing Services Market - Analysis and Forecast, 2022-2032 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の準軌道試験サービス市場の分析・予測:2022-2032年 |

|

出版日: 2023年11月17日

発行: BIS Research

ページ情報: 英文 70 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

欧州の準軌道試験サービスの市場規模は、2022年の1,640万米ドルから、予測期間中は6.48%のCAGRで推移し、2032年には3,070万米ドルに成長すると予測されています。

欧州の準軌道試験サービス市場では、さまざまなエンドユーザーからの需要の増加が準軌道ロケットプラットフォームへの投資を促進しています。一方、この分野の主な障害の1つは、準軌道打ち上げの高額な費用と長い試験手順であり、これが顧客の利用を制限しています。準軌道プラットフォームの再利用の可能性が費用を抑える機会となる可能性がありますが、現在のところ、再利用可能なソリューションを製造しているのは数社の大手企業のみで、競合がいないため、サービスプロバイダーに大きな価格決定力を与えています。

将来的には、より多くの企業が欧州の準軌道市場に参入し、準軌道試験サービスの打ち上げコストが下がることが予想されます。特に衛星質量1~50kgの小型衛星の配備が拡大するため、準軌道試験サービスのニーズが高まると考えられています。小型の宇宙船は、通常宇宙認証を取得していない市販の既製品 (COTS) のサブシステムやコンポーネントを多く使用するため、準軌道試験サービスプロバイダーは2022年から2032年にかけて需要が増加すると予想されています。

当レポートでは、欧州の軌道上試験サービスの市場を調査し、市場概要、市場成長への各種影響因子の分析、進行中のプログラム、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業の分析などをまとめています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2022-2032年 |

| 2022年の評価 | 1,640万米ドル |

| 2032年予測 | 3,070万米ドル |

| CAGR | 6.48% |

市場セグメンテーション:

セグメンテーション1:ペイロード容量別

- 1~50 Kg

- 51-200 Kg

- 201-500 Kg

- 501Kg以上

セグメンテーション2:用途別

- 手動

- 自動

セグメンテーション3:国別

- フランス

- ドイツ

- ロシア

- 英国

- その他の欧州

目次

第1章 市場

- 業界の展望

- 軌道下試験サービス市場:概要

- 進行中のプログラム

- 準軌道試験サービスプラットフォーム

- スタートアップと投資シナリオ

- 商用準軌道打上げサイト・スペースポート

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業戦略

- 企業戦略

- 事業機会

第2章 欧州

- 軌道下試験サービス市場 (地域別)

- 欧州

- 市場

- サービス

- 欧州 (国別)

第3章 市場:合ベンチマーキング・企業プロファイル

- 市場シェア分析

- PLD Space

- 企業概要

- 経営戦略

- 事業戦略

- アナリストの見解

- Skyrora Limited

- 企業概要

- 経営戦略

- アナリストの見解

第4章 調査手法

List of Figures

- Figure 1: Europe Sub-Orbital Testing Services Market, $Million, 2021-2032

- Figure 2: Europe Sub-Orbital Testing Services Market (by Payload Capacity), $Million, 2022 and 2032

- Figure 3: Europe Sub-Orbital Testing Services Market (by Application), $Million, 2022 and 2032

- Figure 4: Europe Sub-Orbital Testing Services Market (by End User), $Million, 2022 and 2032

- Figure 5: Sub-Orbital Testing Services Market (by Region), $Million, 2022

- Figure 6: Funding of Space Start-Ups (as of November 2022)

- Figure 7: Europe Sub-Orbital Testing Services Market, Business Dynamics

- Figure 8: Share of Key Market Strategies and Developments, January 2020- November 2022

- Figure 9: Sub-Orbital Testing Services Market Share (by Company), Fixed-Wing Platform, $Million, 2022

- Figure 10: Sub-Orbital Testing Services Market Share (by Company), High-Altitude Balloons, $Million, 2022

- Figure 11: Sub-Orbital Testing Services Market Share (by Company), Sounding Rocket, $Million, 2022

- Figure 12: Sub-Orbital Testing Services Market Share (by Company), Sub-orbital Reusable Launch Vehicle (SRLV), $Million, 2022

- Figure 13: Research Methodology

- Figure 14: Top-Down Approach

- Figure 15: Assumptions and Limitations

List of Tables

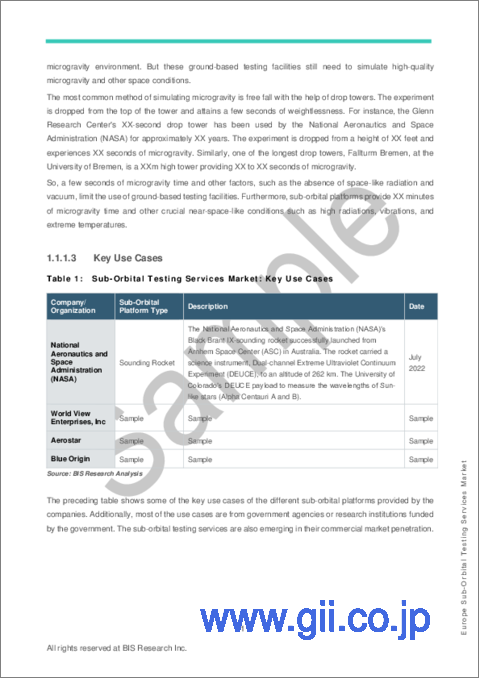

- Table 1: Sub-Orbital Testing Services Market: Key Use Cases

- Table 2: Start-Ups and Investment Scenario

- Table 3: Commercial Sub-Orbital Launch Sites and Spaceports

- Table 4: New Product Launches (by Company), January 2020-November 2022

- Table 5: Partnerships, Collaborations, Agreements, and Contracts, January 2020-November 2022

- Table 6: Mergers and Acquisitions, January 2020-November 2022

- Table 7: Sub-Orbital Testing Services Market (by Region), $Million, 2021-2032

- Table 8: Europe Sub-Orbital Testing Services Market (by Payload Capacity), $Million, 2021-2032

- Table 9: Europe Sub-Orbital Testing Services Market (by Application), $Million, 2021-2032

- Table 10: Germany Sub-Orbital Testing Services Market (by Payload Capacity), $Million, 2021-2032

- Table 11: Germany Sub-Orbital Testing Services Market (by Application), $Million, 2021-2032

- Table 12: U.K. Sub-Orbital Testing Services Market (by Payload Capacity), $Million, 2021-2032

- Table 13: U.K. Sub-Orbital Testing Services Market (by Application), $Million, 2021-2032

- Table 14: France Sub-Orbital Testing Services Market (by Payload Capacity), $Million, 2021-2032

- Table 15: France Sub-Orbital Testing Services Market (by Application), $Million, 2021-2032

- Table 16: Russia Sub-Orbital Testing Services Market (by Payload Capacity), $Million, 2021-2032

- Table 17: Russia Sub-Orbital Testing Services Market (by Application), $Million, 2021-2032

- Table 18: Rest-of-Europe Sub-Orbital Testing Services Market (by Payload Capacity), $Million, 2021-2032

- Table 19: Rest-of-Europe Sub-Orbital Testing Services Market (by Application), $Million, 2021-2032

- Table 20: PLD Space: Launch Site

- Table 21: PLD Space: Product Portfolio

- Table 22: PLD Space: Agreements

- Table 23: PLD Space: New Product Launches

- Table 24: Skyrora Limited: Launch Site

- Table 25: Skyrora Limited: Product Portfolio

- Table 26: Skyrora Limited: Agreements

“The Europe Sub-Orbital Testing Services Market Expected to Reach $30.7 Million by 2032.”

Introduction to Europe Sub-Orbital Testing Services Market

The Europe sub-orbital testing services market is estimated to reach $30.7 million by 2032 from $16.4 million in 2022, at a CAGR of 6.48% during the forecast period 2022-2032. The sub-orbital testing service providers have witnessed the demand from the government, research institutions, and growing commercial industry.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2022 - 2032 |

| 2022 Evaluation | $16.4 Million |

| 2032 Forecast | $30.7 Million |

| CAGR | 6.48% |

Market Introduction

Increased demand from a variety of end users is driving investments in sub-orbital launch vehicle platforms in the European sub-orbital testing services market. One of the main obstacles in this sector is the high expenses and lengthy testing procedures linked to sub-orbital launches, which limit customer use. The reusability of sub-orbital platforms offers a chance to mitigate this by cutting prices, however as of right now, only a few number of major companies produce reusable solutions, providing service providers significant pricing power because of the lack of competition.

In the future, more players are anticipated to enter the European sub-orbital market, which will lower the launch costs for sub-orbital testing services. There will be an increased need for sub-orbital testing services due to the expanding deployment of tiny satellites, especially in the 1-50 kg satellite mass segment. Sub-orbital testing service providers are expected to see a rise in demand between 2022 and 2032 since smaller spacecraft frequently use Commercial Off-The-Shelf (COTS) subsystems and components that are not normally space certified.

Market Segmentation:

Segmentation 1: by Payload Capacity

- 1-50 Kg

- 51-200 Kg

- 201-500 Kg

- 501 Kg and Above

Segmentation 2: by Application

- Human-Tended

- Automated

Segmentation 3: by Country

- France

- Germany

- Russia

- U.K.

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The service segment helps the reader understand the different end users that will generate the demand for sub-orbital testing services in Europe region. Moreover, the study provides the reader with a detailed understanding of the different sub-orbital testing services market based on payload capacity (1-50 kg, 51-200 kg, 201-500 kg, and 501 kg and above), and application (automated and human-tended).

Growth/Marketing Strategy: The Europe sub-orbital testing services market has seen major development by key players operating in the market, such as business expansion activities, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracted to strengthen their position in the Europe sub-orbital testing services market.

Competitive Strategy: Key players in the Europe sub-orbital testing services market analyzed and profiled in the study involve sub-orbital testing service providers. Moreover, a detailed competitive benchmarking of the players operating in the Europe sub-orbital testing services market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing company coverage, product portfolio, and market penetration.

Some of the prominent names established in this market are:

|

|

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Sub-Orbital Testing Services Market: Overview

- 1.1.1.1 Types of Sub-Orbital Testing

- 1.1.1.1.1 Automated

- 1.1.1.1.2 Human-Tended

- 1.1.1.2 Limitations of Existing Terrestrial Testing Services

- 1.1.1.3 Key Use Cases

- 1.1.1.1 Types of Sub-Orbital Testing

- 1.1.2 Ongoing Programs

- 1.1.2.1 NASA's Flight Opportunities Program

- 1.1.2.2 NASA Sounding Rocket Program (NSRP)

- 1.1.3 Sub-Orbital Testing Services Platforms

- 1.1.3.1 Sub-Orbital Reusable Launch Vehicle (SRLV)

- 1.1.3.2 Sounding Rocket

- 1.1.3.3 Fixed-Winged Platform (Parabolic Flights)

- 1.1.3.4 High-Altitude Balloons

- 1.1.4 Start-Ups and Investment Scenario

- 1.1.5 Commercial Sub-Orbital Launch Sites and Spaceports

- 1.1.1 Sub-Orbital Testing Services Market: Overview

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Need for Microgravity Testing Services

- 1.2.1.2 Limitations of Terrestrial Testing Service Capabilities

- 1.2.2 Business Challenges

- 1.2.2.1 Expensive Sub-Orbital Flight

- 1.2.2.2 Time Intensive Testing Process

- 1.2.2.3 Safety Concerns Associated with Impact Landing

- 1.2.2.4 Policy Challenges for Sub-Orbital Flights

- 1.2.3 Business Strategies

- 1.2.3.1 New Product Launches

- 1.2.4 Corporate Strategies

- 1.2.4.1 Partnerships, Collaborations, Agreements, and Contracts

- 1.2.4.2 Mergers and Acquisitions

- 1.2.5 Business Opportunities

- 1.2.5.1 Companies Offer Human-Tended Sub-Orbital Research

- 1.2.1 Business Drivers

2 Europe

- 2.1 Sub-Orbital Testing Services Market (by Region)

- 2.2 Europe

- 2.2.1 Market

- 2.2.1.1 Key Manufacturers and Service Providers in Europe

- 2.2.2 Service

- 2.2.2.1 Europe Sub-Orbital Testing Services Market (by Payload Capacity)

- 2.2.2.2 Europe Sub-Orbital Testing Services Market (by Application)

- 2.2.3 Europe (by Country)

- 2.2.3.1 Germany

- 2.2.3.1.1 Market

- 2.2.3.1.1.1 Key Manufacturers and Service Providers in Germany

- 2.2.3.1.2 Service

- 2.2.3.1.2.1 Germany Sub-Orbital Testing Services Market (by Payload Capacity)

- 2.2.3.1.2.2 Germany Sub-Orbital Testing Services Market (by Application)

- 2.2.3.1.1 Market

- 2.2.3.2 U.K.

- 2.2.3.2.1 Market

- 2.2.3.2.1.1 Key Manufacturers and Service Providers in the U.K.

- 2.2.3.2.2 Service

- 2.2.3.2.2.1 U.K. Sub-Orbital Testing Services Market (by Payload Capacity)

- 2.2.3.2.2.2 U.K. Sub-Orbital Testing Services Market (by Application)

- 2.2.3.2.1 Market

- 2.2.3.3 France

- 2.2.3.3.1 Market

- 2.2.3.3.1.1 Key Manufacturers and Service Providers in France

- 2.2.3.3.2 Service

- 2.2.3.3.2.1 France Sub-Orbital Testing Services Market (by Payload Capacity)

- 2.2.3.3.2.2 France Sub-Orbital Testing Services Market (by Application)

- 2.2.3.3.1 Market

- 2.2.3.4 Russia

- 2.2.3.4.1 Market

- 2.2.3.4.1.1 Key Manufacturers and Service Providers in Russia

- 2.2.3.4.2 Service

- 2.2.3.4.2.1 Russia Sub-Orbital Testing Services Market (by Payload Capacity)

- 2.2.3.4.2.2 Russia Sub-Orbital Testing Services Market (by Application)

- 2.2.3.4.1 Market

- 2.2.3.5 Rest-of-Europe

- 2.2.3.5.1 Market

- 2.2.3.5.1.1 Key Manufacturers and Service Providers in Rest-of-Europe

- 2.2.3.5.2 Service

- 2.2.3.5.2.1 Rest-of-Europe Sub-Orbital Testing Services Market (by Payload Capacity)

- 2.2.3.5.2.2 Rest-of-Europe Sub-Orbital Testing Services Market (by Application)

- 2.2.3.5.1 Market

- 2.2.3.1 Germany

- 2.2.1 Market

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Market Share Analysis

- 3.2 PLD Space

- 3.2.1 Company Overview

- 3.2.1.1 Role of PLD Space in the Europe Sub-Orbital Testing Services Market

- 3.2.1.2 Launch Site

- 3.2.1.3 Product Portfolio

- 3.2.2 Corporate Strategies

- 3.2.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.2.3 Business Strategies

- 3.2.3.1 New Product Launches

- 3.2.4 Analyst View

- 3.2.1 Company Overview

- 3.3 Skyrora Limited

- 3.3.1 Company Overview

- 3.3.1.1 Role of Skyrora Limited in the Europe Sub-Orbital Testing Services Market

- 3.3.1.2 Launch Site

- 3.3.1.3 Product Portfolio

- 3.3.2 Corporate Strategies

- 3.3.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.3.3 Analyst View

- 3.3.1 Company Overview

4 Research Methodology

- 4.1 Factors for Data Prediction and Modeling