|

|

市場調査レポート

商品コード

1379211

スマート作物モニタリングの世界市場 (2023-2028年):製品・用途・国別Global Smart Crop Monitoring Market: Focus on Product, Application, and Country - Analysis Forecast Period, 2023-2028 |

||||||

カスタマイズ可能

|

|||||||

| スマート作物モニタリングの世界市場 (2023-2028年):製品・用途・国別 |

|

出版日: 2023年11月06日

発行: BIS Research

ページ情報: 英文 128 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のスマート作物モニタリングの市場規模は、2022年の27億8,000万米ドルから、予測期間中は16.90%のCAGRで推移し、2028年には71億6,000万米ドルの規模に成長すると予測されています。

同市場の成長は、農業における作物収量の最適化と資源の効率的利用に対する需要の高まりによってもたらされると考えられています。

また、AI、機械学習、リモートセンシングなどの技術の進歩も市場成長をさらに促進すると予想されています。

急増する世界人口と、急速な都市化による農地の減少がスマート作物モニタリングソリューションの需要を促進する大きな要因となっています。耕作可能な土地が減少する中で、農業部門は限られたスペースで生産性を向上させなければならないという課題に直面しています。精密農業とIoTを活用したスマート作物モニタリング技術は、農家が限られたエリア内で収量を最大化することを可能にします。また、作物の健康状態、土壌状態、環境要因を正確に分析することで、これらのソリューションは資源利用を最適化し、単位面積当たりの生産性を確実に向上させます。この効率性は、貴重な農業資源を節約し環境への影響を最小限に抑えながら、増加する人口の食糧需要を満たすために極めて重要であり、作物モニタリングは現代農業に不可欠なツールとなっています。

当レポートでは、世界のスマート作物モニタリングの市場を調査し、市場概要、市場成長への各種影響因子の分析、法規制環境、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業の分析などをまとめています。

スマート作物モニタリング市場:概要

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2028年 |

| 2023年評価 | 32億8,000万米ドル |

| 2028年予測 | 71億6,000万米ドル |

| CAGR | 16.9% |

市場区分:

セグメンテーション1:用途別

- 病気と害虫の検出

- 栄養管理

- 雑草管理

- 作物保険

- その他

セグメンテーション2:製品別

- センサー技術

- ドローン

- ロボット

- ハンドヘルドデバイス

- ソフトウェア・モバイルアプリケーション

セグメンテーション3:地域別

- 北米:米国、カナダ、メキシコ

- 欧州:ドイツ、フランス、イタリア、スペイン、オランダ、ベルギー、スイス、その他

- 中国

- 英国

- アジア太平洋:日本、インド、オーストラリア、ニュージーランド、その他

- 南米:アルゼンチン、ブラジル、その他

- 中東・アフリカ:南アフリカ、トルコ、イスラエル、その他

目次

第1章 市場

- 業界の展望

- エコシステム/進行中のプログラム

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業機会

- 現在の動向

- 市場戦略と展開

第2章 用途

- 世界のスマート作物モニタリング市場(用途別)

- 病気と害虫の検出

- 栄養管理

- 雑草管理

- 作物保険

- その他

第3章 製品

- 世界のスマート作物モニタリング市場(製品別)

- センサー技術

- ドローン

- ロボット

- ハンドヘルドデバイス

- ソフトウェア・モバイルアプリケーション

- バリューチェーン/サプライチェーン分析

- 特許分析

第4章 地域

- 北米:国別

- 南米:国別

- 欧州:国別

- 英国

- 中東・アフリカ:国別

- 中国

- アジア太平洋:国別

第5章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 企業プロファイル

- CNH Industrial N.V.

- Deere & Company

- Climate LLC

- AGRIVI

- IBM Corporation

- KUBOTA Corporation

- Robert Bosch GmbH

- DJI

- Airbus

- Small Robot Company

- Semios

- Trimble Inc.

第6章 調査手法

List of Figures

- Figure 1: Scope Inclusion and Exclusion

- Figure 2: Scope Definition

- Figure 3: Factors Affecting Global Crop Production

- Figure 4: Global Smart Monitoring Market, $Billion, 2022-2028

- Figure 5: Market Dynamics for Global Smart Crop Monitoring Market

- Figure 6: Global Smart Crop Monitoring Market (by Application), $Million, 2022-2028

- Figure 7: Global Smart Crop Monitoring Market (by Product), $Million, 2022-2028

- Figure 8: Global Smart Crop Monitoring Market (by Region), 2022

- Figure 9: Plant Nutrient Consumption in U.S., 1960-2015

- Figure 10: EU Farm and Farmland by Land Size Class, 2018

- Figure 11: Cyber Attack Incidents with $1Million+ Reported Losses, 2009-2019

- Figure 12: Advantages of AI and ML in Smart Crop Monitoring

- Figure 13: Advantages of MTaaS

- Figure 14: Share of Key Market Strategies and Developments, 2019-2023

- Figure 15: Product Developments and Innovations (by Company)

- Figure 16: Partnerships, Collaborations, Joint Ventures, and Alliances

- Figure 17: Business Expansions

- Figure 18: Mergers and Acquisitions

- Figure 19: Competitive Market: High and Low Matrix for Smart Crop Monitoring Market

- Figure 20: Market Share Analysis of Smart Crop Monitoring Companies, 2022

- Figure 21: CNH Industrial N.V.: Product and Customer Portfolio Analysis

- Figure 22: Deere & Company: Product and Customer Portfolio Analysis

- Figure 23: Climate LLC: Product and Customer Portfolio Analysis

- Figure 24: AGRIVI: Product and Customer Portfolio Analysis

- Figure 25: IBM Corporation: Product and Customer Portfolio Analysis

- Figure 26: KUBOTA Corporation: Product and Customer Portfolio Analysis

- Figure 27: Robert Bosch GmbH: Product and Customer Portfolio Analysis

- Figure 28: DJI: Product and Customer Portfolio Analysis

- Figure 29: Airbus: Product and Customer Portfolio Analysis

- Figure 30: Small Robot Company: Product and Customer Portfolio Analysis

- Figure 31: Semios: Product and Customer Portfolio Analysis

- Figure 32: Trimble Inc.: Product and Customer Portfolio Analysis

- Figure 33: Data Triangulation

- Figure 34: Top-Down and Bottom-Up Approach

- Figure 35: Assumptions and Limitations

List of Tables

- Table 1: Consortiums and Associations

- Table 2: Key Regulatory Bodies on the Global Smart Crop Monitoring Market

- Table 3: Government Initiatives and Impacts

“Global Smart Crop Monitoring Market Expected to Reach $7.16 Billion by 2028.”

Introduction of Smart Crop Monitoring Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2028 |

| 2023 Evaluation | $3.28 Billion |

| 2028 Forecast | $7.16 Billion |

| CAGR | 16.9% |

The global smart crop monitoring market was valued at $2.78 billion in 2022, and it is expected to grow with a CAGR of 16.90% during the forecast period 2023-2028 to reach $7.16 billion by 2028. This growth of the crop monitoring market is likely to be driven by the increasing demand for optimized crop yields and efficient use of resources in agriculture. Additionally, advancements in technologies such as AI, machine learning, and remote sensing are expected to further propel crop monitoring growth.

Market Introduction

Smart crop monitoring refers to the utilization of advanced technologies, including satellite imagery, drones, sensors, and data analytics, to monitor and manage agricultural crops in a precise and efficient manner. It involves real-time data collection, analysis, and interpretation to optimize various aspects of farming, such as irrigation, pest management, fertilizer application, and overall crop health. Crop health monitoring enables farmers to make informed decisions, enhance productivity, conserve resources, and adopt sustainable agricultural practices, ultimately leading to increased yields and reduced environmental impact.

According to the USDA, approximately 1 billion pounds of conventional pesticides are utilized annually in the U.S. to manage weeds, insects, and other pests. Despite this substantial use of pesticides and herbicides, agricultural production has seen only marginal growth. A significant portion of these pesticides goes to waste due to uniform spraying methods.

With smart crop scouting and smart spraying, there is vast potential for input optimization and improved crop yields. By applying inputs such as pesticides and herbicides more precisely, farmers can ensure that they are used efficiently and effectively, reducing waste and potentially increasing crop yields.

The demand for smart crop monitoring is expected to grow in response to these challenges. These technologies can provide real-time data on crop health and soil conditions, enabling farmers to apply inputs more accurately and at the optimal time. This not only reduces wastage but also improves crop health and yield.

In 2022, the global smart crop monitoring industry reached a valuation of $2.78 billion. Over the forecast period, the market is projected to exhibit a CAGR of 16.9%, ultimately reaching a value of $7.16 billion by 2028. The shrinking availability of agricultural land due to rapid urbanization, combined with the burgeoning global population, is a significant catalyst driving the demand for smart crop monitoring solutions. As arable land diminishes, the agricultural sector faces intensified pressure to enhance productivity from limited space. Smart crop monitoring technologies, leveraging precision agriculture and IoT, enable farmers to maximize yields within confined areas. By precisely analyzing crop health, soil conditions, and environmental factors, these solutions optimize resource usage, ensuring higher productivity per unit of land. This efficiency is crucial for meeting the increasing food demands of a growing population while conserving valuable agricultural resources and minimizing environmental impact, making crop monitoring an essential tool in modern agriculture.

Market Segmentation:

Segmentation 1: by Application

- Disease and Pest Detection

- Nutrient Management

- Weed Management

- Crop Insurance

- Others

Based on application, the disease and pest detection segment is anticipated to drive the highest demand for smart crop monitoring market throughout the forecast period. With agriculture facing constant threats from diseases and pests that can devastate crops, early detection and swift action are imperative. Crop monitoring solutions equipped with advanced sensors, AI-driven analytics, and data processing capabilities enable real-time monitoring of crops. By identifying signs of diseases or pest infestations promptly, farmers can take proactive measures, preventing extensive damage and ensuring healthy yields. This critical application underscores the pivotal role smart crop monitoring plays in ensuring crop protection, enhancing agricultural productivity, and safeguarding global food supply chains.

Moreover, the integration of these applications with other smart farming technologies, such as remote sensing and machine learning, can provide farmers with more accurate and timely information about the health of their crops. This can enable them to take proactive measures to manage pests and diseases, further driving the demand for crop health monitoring solutions.

The demand for smart crop monitoring in the context of crop insurance is poised to experience substantial growth over the forecast period. Smart crop monitoring technologies, including satellite imagery, IoT devices, and data analytics, offer precise and real-time insights into crop health, yield forecasts, and potential risks. Insurers can leverage this data to assess risks accurately, streamline underwriting processes, and offer customized insurance policies to farmers. By integrating remote monitoring solutions, insurance companies can enhance their ability to evaluate claims efficiently, reduce fraudulent activities, and provide timely support to farmers impacted by various agricultural risks.

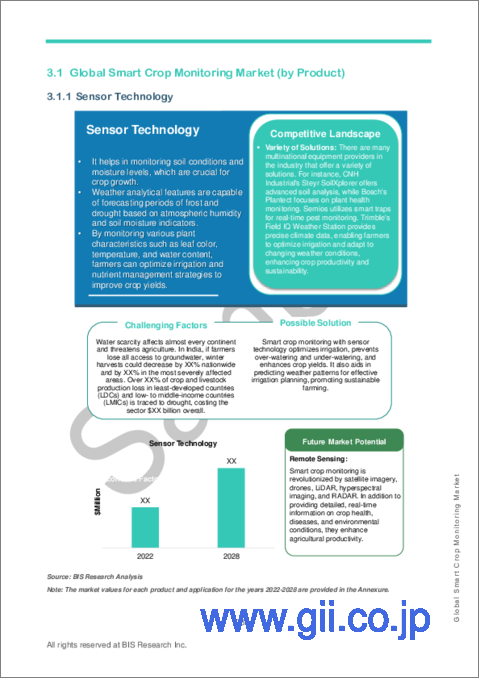

Segmentation 2: by Product

- Sensor Technology

- Drones

- Robots

- Handheld Devices

- Software and Mobile Applications

Based on product, the drones segment is poised for significant growth in the near future. Drones equipped with advanced sensors and imaging technologies offer farmers a bird's-eye view of their fields, enabling precise crop health assessments, pest detection, and yield predictions. This technology revolutionizes traditional farming methods by providing real-time data for informed decision-making. With the ability to cover large agricultural areas swiftly and efficiently, drones enhance productivity, optimize resource usage, and contribute to sustainable farming practices. The increasing adoption of drones in agriculture underscores their potential to revolutionize the industry, making them a key player in the future of smart crop monitoring.

The added advantage of handheld devices in smart crop monitoring is their cost-effectiveness compared to other monitoring products. Their affordability makes advanced technology accessible to a wider range of farmers, promoting widespread adoption. This cost efficiency ensures that even small-scale farmers can leverage cutting-edge solutions, enhancing agricultural practices without imposing a significant financial burden. Handheld devices democratize access to precision agriculture tools, fostering sustainability and innovation across diverse farming communities.

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, Netherlands, Belgium, Switzerland, and Rest-of-Europe

- China

- U.K.

- Asia-Pacific - Japan, India, Australia and New Zealand, and Rest-of-Asia-Pacific

- South America - Argentina, Brazil, and Rest-of-South America

- Middle East and Africa - South Africa, Turkey, Israel, and Rest-of-Middle East and Africa

Europe and North America dominate the smart crop monitoring industry due to their advanced agricultural infrastructure, technological innovation, and robust investment in precision farming. The growing emphasis on sustainable agriculture and the integration of IoT and AI technologies are driving substantial growth in these regions. With ongoing advancements and supportive policies, both Europe and North America are poised for significant expansion in smart crop monitoring solutions, ensuring efficient and eco-friendly farming practices in the future.

Asia-Pacific's dominance in the smart crop monitoring market is propelled by its dynamic agricultural landscape and the urgent need for sustainable practices. With diverse climates and varying farming challenges, the region leverages smart technologies to optimize crop management. Factors such as population growth, food security concerns, and environmental sustainability drive the adoption of smart crop monitoring solutions. Countries such as India, Australia, and Japan are pioneering precision agriculture, employing IoT, drones, and data analytics for informed decision-making. As governments promote digital agriculture initiatives, Asia-Pacific is poised to experience substantial market growth, fostering efficient and eco-conscious farming practices.

Recent Developments in the Global Smart Crop Monitoring Market

- In April 2023, Bosch BASF Smart Farming, in collaboration with AGCO Corporation, announced plans to incorporate and commercialize smart spraying technology on Fendt Rogator sprayers. They also intend to jointly innovate new features.

- In April 2023, GeoPard Agriculture introduced an advanced analytics platform for farmers and dealers utilizing John Deere technology. The platform offers features such as field mapping, variable rate application (VRA) maps, scouting tools, and data integration capabilities. It aims to help farmers optimize their operations and make data-driven decisions for improved productivity and profitability.

- In March 2023, Ceres Imaging expanded to serve Portugal and Spain, offering high-resolution aerial imagery and advanced analytics to help global farming enterprises protect yield, improve sustainability, and manage resources. Its unique capabilities include quantifiable plant-level insights and a quick 48-hour delivery turnaround for actionable information.

- In May 2022, Taranis extended its partnership with DroneNerds and DJI in the U.S. Through this partnership, Taranis utilized the world's largest DJI Matrice 300 (DJI M300) fleet of drones for Taranis' AI-powered precision scouting, producing high-resolution, leaf-level images as well as wide-angle field images.

Demand - Drivers, Challenges, and Opportunities

Market Drivers: Need for Input Optimization

Input optimization in agriculture is crucial for enhancing productivity, reducing costs, promoting sustainability, and mitigating the impacts of global challenges such as climate change and resource scarcity.

- Maximizing land productivity is crucial due to limited arable land. Smart crop monitoring can provide real-time data on soil conditions, helping farmers make informed decisions about planting, irrigation, and crop rotation.

- Labor shortages and rising costs require more efficient labor management. Data-driven insights from smart monitoring help farmers allocate labor resources more effectively.

- The Russia-Ukraine crisis has exacerbated already tight global fertilizer supplies, boosting prices to all-time highs. This has led to an increased need for precision agriculture to optimize the use of expensive inputs.

- Smart crop monitoring provides data on nutrient levels in the soil and crop health, enabling precise fertilizer applications based on actual needs.

- Reducing chemical inputs while maintaining yields is essential for environmental sustainability. Smart crop monitoring enables the adjustment of agrochemical application rates to minimize overuse by detecting pest and disease outbreaks early.

Market Challenges: Lack of Connectivity and Technical Awareness

The growth of smart crop monitoring is hampered significantly by challenges related to a lack of connectivity and technical awareness. In many agricultural regions, especially in developing countries, limited internet connectivity obstructs the seamless flow of data crucial for smart monitoring systems. The absence of robust network infrastructure impedes real-time data transmission, hindering farmers from accessing timely insights.

Furthermore, a lack of technical awareness among farmers and agricultural communities acts as a barrier. Many farmers, especially those in remote areas, may not be well-versed in the operation and benefits of smart crop monitoring technologies. This knowledge gap prevents them from adopting advanced monitoring solutions effectively, limiting the widespread implementation of these innovative tools. Bridging these gaps through awareness campaigns, improved connectivity, and user-friendly interfaces is essential to unlock the full potential of smart crop monitoring in global agriculture.

Market Opportunities: Focus on Sustainability

The growing global focus on sustainability presents a significant opportunity for the smart crop monitoring market and its solution providers. With increasing concerns about environmental impact and resource conservation, there is a rising demand for precision agriculture technologies that optimize resource usage and minimize ecological footprint. Smart crop monitoring, equipped with advanced sensors, IoT devices, and data analytics, enables farmers to make data-driven decisions. By precisely monitoring crops, water usage, and pesticide application, farmers can minimize wastage, conserve resources, and reduce the overall environmental impact of farming practices.

For smart crop monitoring solution providers, this trend translates into a growing market for their technologies and services. Farmers and agricultural enterprises are actively seeking sustainable practices and technologies that align with environmental regulations and consumer preferences for eco-friendly products. Smart crop monitoring solutions not only enhance crop yields and quality but also support sustainable farming practices. Providers offering innovative, eco-conscious solutions tailored to different agricultural needs stand to capitalize on this trend. Emphasizing the environmental benefits and long-term sustainability of their offerings can attract environmentally conscious farmers, driving the adoption of smart crop monitoring technologies in the agriculture sector.

How can this report add value to an organization?

Product/Innovation Strategy: In the realm of smart crop monitoring, technological advancements are transforming agricultural landscapes. Smart crop monitoring solutions utilize diverse technologies such as IoT sensors, drones, and data analytics. These tools offer precise insights into crop health, optimizing irrigation, pest management, and harvest times. Innovations such as satellite imaging and remote sensing provide a holistic view of fields, empowering farmers to make informed decisions. The market encompasses a range of solutions, from real-time monitoring platforms to AI-driven predictive analysis, enabling farmers to enhance productivity and reduce resource wastage significantly.

Growth/Marketing Strategy: The smart crop monitoring market has witnessed remarkable growth strategies by key players. Business expansions, collaborations, and partnerships have been pivotal. Companies are venturing into global markets, forging alliances, and engaging in research collaborations to enhance their technological prowess. Collaborative efforts between tech companies and agricultural experts are driving the development of cutting-edge monitoring tools. Additionally, strategic joint ventures are fostering the integration of diverse expertise, amplifying the market presence of these solutions. This collaborative approach is instrumental in developing comprehensive, user-friendly, and efficient smart crop monitoring systems.

Competitive Strategy: In the competitive landscape of smart crop monitoring, manufacturers are diversifying their product portfolios to cover various crops and farming practices. Market segments include soil analysis tools, disease detection systems, and climate analysis solutions. Competitive benchmarking illuminates the strengths of market players, emphasizing their unique offerings and regional strengths. Partnerships with research institutions and agricultural organizations are driving innovation.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The scope of this report has been focused on various types of smart crop monitoring hardware and software solutions.

- The market revenue has been calculated based on global smart crop monitoring solutions.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2019 to September 2023 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation have been employed.

- Any future economic downturn has not been considered for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Primary Research

The primary sources involve the smart crop monitoring industry experts and stakeholders such as data suppliers, platform developers, and service providers. Respondents such as vice presidents, CEOs, marketing directors, and technology and innovation directors have been interviewed to verify this research study's qualitative and quantitative aspects.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for region-wise analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The featured companies have been meticulously chosen, drawing insights from primary experts and thorough evaluations of company coverage, product offerings, and market presence.

Among the prominent players in the global smart crop monitoring market, private ventures and innovative startups dominate, commanding approximately 85% of the market share in 2021. The remaining 15% is held by public enterprises.

Some prominent names established in this market are:

Company Type 1: Public Companies

|

Company Type 2: Private Companies

|

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Ecosystem/Ongoing Programs

- 1.1.1.1 Consortiums and Associations

- 1.1.1.2 Regulatory Bodies

- 1.1.1.3 Government Initiatives and Impacts

- 1.1.1 Ecosystem/Ongoing Programs

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Need for Input Optimization

- 1.2.1.2 Growth in Farmland Consolidation

- 1.2.2 Business Challenges

- 1.2.2.1 Cyber and Online Data Security

- 1.2.2.2 Lack of Connectivity and Technical Awareness

- 1.2.3 Business Opportunities

- 1.2.3.1 Focus on Sustainability

- 1.2.3.2 Increase in Number of Cooperative Farming

- 1.2.4 Ongoing Trends

- 1.2.4.1 Integration with AI and ML

- 1.2.4.2 Monitoring Technology-as-a-Service (MTaaS)

- 1.2.5 Market Strategies and Developments

- 1.2.1 Business Drivers

2 Application

- 2.1 Global Smart Crop Monitoring Market (by Application)

- 2.1.1 Disease and Pest Detection

- 2.1.2 Nutrient Management

- 2.1.3 Weed Management

- 2.1.4 Crop Insurance

- 2.1.5 Others

3 Products

- 3.1 Global Smart Crop Monitoring Market (by Product)

- 3.1.1 Sensor Technology

- 3.1.2 Drones

- 3.1.3 Robots

- 3.1.4 Handheld Devices

- 3.1.5 Software and Mobile Applications

- 3.2 Value Chain/Supply Chain Analysis

- 3.3 Patent Analysis

4 Region

- 4.1 North America

- 4.1.1 North America (by Country)

- 4.1.1.1 U.S.

- 4.1.1.2 Canada

- 4.1.1.3 Mexico

- 4.1.1 North America (by Country)

- 4.2 South America

- 4.2.1 South America (by Country)

- 4.2.1.1 Brazil

- 4.2.1.2 Argentina

- 4.2.1.3 Rest-of-South America

- 4.2.1 South America (by Country)

- 4.3 Europe

- 4.3.1 Europe (by Country)

- 4.3.1.1 Germany

- 4.3.1.2 France

- 4.3.1.3 Spain

- 4.3.1.4 Italy

- 4.3.1.5 Netherlands

- 4.3.1.6 Switzerland

- 4.3.1.7 Belgium

- 4.3.1.8 Rest-of-Europe

- 4.3.1 Europe (by Country)

- 4.4 U.K.

- 4.5 Middle East and Africa

- 4.5.1 Middle East and Africa (by Country)

- 4.5.1.1 South Africa

- 4.5.1.2 Israel

- 4.5.1.3 Turkey

- 4.5.1.4 Rest-of-Middle East and Africa

- 4.5.1 Middle East and Africa (by Country)

- 4.6 China

- 4.7 Asia-Pacific

- 4.7.1 Asia Pacific (by Country)

- 4.7.1.1 Japan

- 4.7.1.2 Australia and New Zealand

- 4.7.1.3 India

- 4.7.1.4 Rest-of-APAC

- 4.7.1 Asia Pacific (by Country)

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Competitive Benchmarking

- 5.1.1 Competitive Position Matrix

- 5.1.2 Market Share Analysis

- 5.2 Company Profiles

- 5.2.1 CNH Industrial N.V.

- 5.2.1.1 Company Overview

- 5.2.1.1.1 Product and Customer Portfolio Analysis

- 5.2.1.1 Company Overview

- 5.2.2 Deere & Company

- 5.2.2.1 Company Overview

- 5.2.2.1.1 Product and Customer Portfolio Analysis

- 5.2.2.1 Company Overview

- 5.2.3 Climate LLC

- 5.2.3.1 Company Overview

- 5.2.3.1.1 Product and Customer Portfolio Analysis

- 5.2.3.1 Company Overview

- 5.2.4 AGRIVI

- 5.2.4.1 Company Overview

- 5.2.4.1.1 Product and Customer Portfolio Analysis

- 5.2.4.1 Company Overview

- 5.2.5 IBM Corporation

- 5.2.5.1 Company Overview

- 5.2.5.1.1 Product and Customer Portfolio Analysis

- 5.2.5.1 Company Overview

- 5.2.6 KUBOTA Corporation

- 5.2.6.1 Company Overview

- 5.2.6.1.1 Product and Customer Portfolio Analysis

- 5.2.6.1 Company Overview

- 5.2.7 Robert Bosch GmbH

- 5.2.7.1 Company Overview

- 5.2.7.1.1 Product and Customer Portfolio Analysis

- 5.2.7.1 Company Overview

- 5.2.8 DJI

- 5.2.8.1 Company Overview

- 5.2.8.1.1 Product and Customer Portfolio Analysis

- 5.2.8.1 Company Overview

- 5.2.9 Airbus

- 5.2.9.1 Company Overview

- 5.2.9.1.1 Product and Customer Portfolio Analysis

- 5.2.9.1 Company Overview

- 5.2.10 Small Robot Company

- 5.2.10.1 Company Overview

- 5.2.10.1.1 Product and Customer Portfolio Analysis

- 5.2.10.1 Company Overview

- 5.2.11 Semios

- 5.2.11.1 Company Overview

- 5.2.11.1.1 Product and Customer Portfolio Analysis

- 5.2.11.1 Company Overview

- 5.2.12 Trimble Inc.

- 5.2.12.1 Company Overview

- 5.2.12.1.1 Product and Customer Portfolio Analysis

- 5.2.12.1 Company Overview

- 5.2.1 CNH Industrial N.V.

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast