|

|

市場調査レポート

商品コード

1373572

生検デバイスの世界市場 (2023-2027年):製品タイプ・生検タイプ・部位・疾患タイプ・ガイダンス技術・地域別の分析・予測・競合分析・企業プロファイルGlobal Biopsy Devices Market - A Global and Regional Analysis: Focus on Product Type, Biopsy Type, Anatomy, Disease Type, Guidance Technique, Region, and Competitive Insights and Company Profiles - Analysis and Forecast, 2023-2027 |

||||||

カスタマイズ可能

|

|||||||

| 生検デバイスの世界市場 (2023-2027年):製品タイプ・生検タイプ・部位・疾患タイプ・ガイダンス技術・地域別の分析・予測・競合分析・企業プロファイル |

|

出版日: 2023年10月12日

発行: BIS Research

ページ情報: 英文 285 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の生検デバイスの市場規模は、2022年の58億5,280万米ドルから、予測期間中は15.15%のCAGRで推移し、2027年には118億6,940万米ドルの規模に成長すると予測されています。

生検デバイス市場:概要

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2027年 |

| 2023年評価 | 67億5,170万米ドル |

| 2027年予測 | 118億6,940万米ドル |

| CAGR | 15.15% |

市場需要促進要因:

癌の罹患率の上昇による生検デバイスの採用拡大:世界の生検デバイス市場は、主に世界の癌罹患率の増加により、大幅な拡大が見込まれています。癌は依然として健康上の主な関心事であり、癌の早期発見に対する需要の高まりにつながっています。世界人口の急速な高齢化と生活習慣に関連したリスク因子の拡大に伴い、さまざまな種類の癌の発生が着実に増加しており、生検の必要性が生じています。

生検の多様な用途が生検デバイス市場の成長を促進:生検デバイスの癌診断以外の多様な用途も生検デバイス市場の成長に寄与する重要な要因です。生検は、肝炎や非アルコール性脂肪性肝疾患 (NAFLD) などの肝疾患の診断に役立っており、世界の肝疾患患者の増加に対応しています。2023年にClinical and Molecular Hepatology誌に発表された「Global Incidence and Prevalence of Non-Alcoholic Fatty Liver Disease (非アルコール性脂肪性肝疾患の世界の発生率と有病率) 」と題する研究によると、NAFLDの世界の負担は大きく、今後も増加すると予測されています。さらに、2023年に発表された調査では、NAFLDの発症率は1,000人当たり46.9人で、2022年時点で世界の成人の32%に適応症が蔓延しているとも推定されています。

癌の早期発見を目指す政府の取り組みの拡大が生検デバイスの利用を促進:癌に対する認識を高めるために世界各国の政府が行っている取り組みや注目の高まりも生検デバイスの採用を後押しする重要な原動力となっています。各国政府は、癌の予後を改善する上で早期発見と正確な診断が重要であることを認識しています。その結果、積極的なプロモーションキャンペーン、スクリーニングプログラム、さまざまなチャネルを通じた早期発見の利点に関する情報の普及が、特にさまざまな政府のもとでの社会啓発キャンプやチャネルを通じて増加しています。

市場における無機的成長戦略の採用の増加:癌の罹患率が上昇し続けているため、より優れた製品とサービスの必要性がより明らかになりつつあります。主要企業は、契約、協力、提携などの無機的戦略を採用することにより、先進技術の製品・サービスを提供するために、市場の要求に応じて技術を調整しています。

当レポートでは、世界の生検デバイスの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、市場規模の推移・予測、各種区分別の詳細分析、競合情勢、主要企業の分析などをまとめています。

このレポートは2-3営業日でお届けします。

主な企業プロファイル

|

|

目次

第1章 市場の概要

- 製品の定義

- 包含と除外

- 主な調査結果

第2章 業界の展望

- 主要動向

- 従来の生検から低侵襲生検への移行

- 高度な画像技術と生検の統合

- 特許分析

- COVID-19による生検デバイスへの影響

- 製品ベンチマーキング

- 規制要件

第3章 世界の生検デバイス市場:市場力学

- 影響分析

- 市場促進要因

- 市場抑制要因

- 市場機会

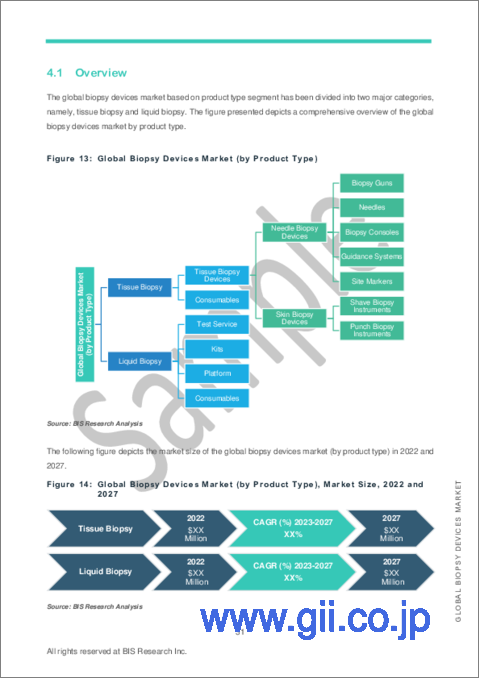

第4章 世界の生検デバイス市場:製品タイプ別

- 概要

- 成長シェア分析

- 組織生検

- 組織生検デバイス

- 消耗品

- リキッドバイオプシー

- テストサービス

- キット

- プラットホーム

- 消耗品

第5章 世界の生検デバイス市場:生検タイプ別

- 概要

- 成長シェア分析

- 組織生検

- 針生検

- 外科的生検

- 皮膚生検

- リキッドバイオプシー

第6章 世界の生検デバイス市場:部位別

- 概要

- 成長シェア分析

- 組織生検

- 胸

- 肺

- 骨

- 肝臓

- 子宮/子宮頸部/卵巣

- 腹部

- 前立腺

- 心臓

- 皮膚

- その他

- リキッドバイオプシー

- 胸

- 肺

- 前立腺

- その他

第7章 世界の生検デバイス市場:疾患タイプ別

- 概要

- 成長シェア分析

- 組織生検

- 癌

- 感染症

- 自己免疫疾患

- その他

- リキッドバイオプシー

- 癌

- 非癌性適応症

第8章 世界の生検デバイス市場:ガイダンス技術別

- 概要

- 成長シェア分析

- 超音波ガイド下生検

- X線ガイド下生検

- MRIガイド下生検

- CTガイド下生検

第9章 地域

- 概要

- 南北アメリカ

- 米国

- 欧州・中東・アフリカ

- ドイツ

- 英国

- フランス

- アジア太平洋

- 中国

- インド

第10章 競合情勢

- 概要

- 主な戦略・展開

- 生検デバイスエコシステムのアクティブ企業

- 世界・中国の企業の分析

- 企業プロファイル

- 組織生検市場の企業

- リキッドバイオプシー市場の企業

List of Figures

- Figure 1: Global Biopsy Devices Market, $Million, 2022-2027

- Figure 2: Global Biopsy Devices Market, Market Dynamics

- Figure 3: Global Biopsy Devices Market, Impact Analysis

- Figure 4: Comparative Analysis of Tissue Biopsy and Liquid Biopsy

- Figure 5: Global Biopsy Devices Market (by Product Type), % Share, 2022 and 2027

- Figure 6: Global Biopsy Devices Market (by Guidance Technique), %Share, 2022 and 2027

- Figure 7: Impact of COVID-19

- Figure 8: Global Biopsy Devices Market (by Region)

- Figure 9: Global Biopsy Devices Market Segmentation

- Figure 10: Global Biopsy Devices Market: Research Methodology

- Figure 11: Primary Research Methodology

- Figure 12: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 13: Top-Down Approach (Segment-Wise Analysis)

- Figure 14: Global Biopsy Devices Market, Patent Analysis (by Year), January 2020-December 2022

- Figure 15: Global Biopsy Devices Market, Patent Analysis (by Country), January 2020-December 2022

- Figure 16: Impact of COVID-19 on Manufacturers

- Figure 17: Global Biopsy Devices Market, Tissue Biopsy Impact Analysis

- Figure 18: Incidence of Cancer (by Region), 2020-2040

- Figure 19: Synergistic Activities, 2022-2023

- Figure 20: Global Biopsy Devices Market (by Product Type)

- Figure 21: Global Biopsy Devices Market (by Product Type), Market Size, 2022 and 2027

- Figure 22: Growth-Share Analysis for Global Biopsy Devices Market (by Product Type), 2022-2027

- Figure 23: Global Biopsy Devices Market (Tissue Biopsy), $Million, 2022-2027

- Figure 24: Global Biopsy Devices Market (Tissue Biopsy Devices), $Million, 2022-2027

- Figure 25: Global Biopsy Devices Market (Needle Biopsy Devices), $Million, 2022-2027

- Figure 26: Global Biopsy Devices Market (Guidance Systems), $Million, 2022-2027

- Figure 27: Global Biopsy Devices Market (Biopsy Consoles), $Million, 2022-2027

- Figure 28: Global Biopsy Devices Market (Site Markers), $Million, 2022-2027

- Figure 29: Global Biopsy Devices Market (Biopsy Guns), $Million, 2022-2027

- Figure 30: Global Biopsy Devices Market (Automated Systems), $Million, 2022-2027

- Figure 31: Global Biopsy Devices Market (Semi-Automated Systems), $Million, 2022-2027

- Figure 32: Global Biopsy Devices Market (Needles), $Million, 2022-2027

- Figure 33: Global Biopsy Devices Market (Skin Biopsy), $Million, 2022-2027

- Figure 34: Global Biopsy Devices Market (Punch Biopsy Instruments), $Million, 2022-2027

- Figure 35: Global Biopsy Devices Market (Shave Biopsy Instruments), $Million, 2022-2027

- Figure 36: Global Biopsy Devices Market (Consumables), $Million, 2022-2027

- Figure 37: Global Biopsy Devices Market (Forceps), $Million, 2022-2027

- Figure 38: Global Biopsy Devices Market (Trocars), $Million, 2022-2027

- Figure 39: Global Biopsy Devices Market (Trays), $Million, 2022-2027

- Figure 40: Global Biopsy Devices Market (Other Consumables), $Million, 2022-2027

- Figure 41: Global Biopsy Devices Market (Consumables (by Biopsy Type)), $Million, 2022-2027

- Figure 42: Global Biopsy Devices Market (Liquid Biopsy), $Million, 2022-2027

- Figure 43: Global Biopsy Devices Market (Testing Service), $Million, 2022-2027

- Figure 44: Global Biopsy Devices Market (Kits), $Million, 2022-2027

- Figure 45: Global Biopsy Devices Market (Platform), $Million, 2022-2027

- Figure 46: Global Biopsy Devices Market (Consumables), $Million, 2022-2027

- Figure 47: Global Biopsy Devices Market (by Biopsy Type)

- Figure 48: Global Biopsy Devices Market (by Biopsy Type), Market Size, 2022 and 2027

- Figure 49: Growth-Share Analysis for Global Biopsy Devices Market (by Biopsy Type), 2022-2027

- Figure 50: Global Biopsy Devices Market (Tissue Biopsy), $Million, 2022-2027

- Figure 51: Global Biopsy Devices Market (Needle Biopsy), $Million, 2022-2027

- Figure 52: Global Biopsy Devices Market (Surgical Biopsy), $Million, 2022-2027

- Figure 53: Global Biopsy Devices Market (Skin Biopsy), $Million, 2022-2027

- Figure 54: Global Biopsy Devices Market (Liquid Biopsy), $Million, 2022-2027

- Figure 55: Global Biopsy Devices Market (by Anatomy)

- Figure 56: Global Biopsy Devices Market (by Anatomy), Market Size, 2022 and 2027

- Figure 57: Growth-Share Analysis for Global Biopsy Devices Market (by Anatomy), 2022-2027

- Figure 58: Global Biopsy Devices Market (Tissue Biopsy), $Million, 2022-2027

- Figure 59: Global Biopsy Devices Market (Breast), $Million, 2022-2027

- Figure 60: Global Biopsy Devices Market (Lung), $Million, 2022-2027

- Figure 61: Global Biopsy Devices Market (Bone), $Million, 2022-2027

- Figure 62: Global Biopsy Devices Market (Liver), $Million, 2022-2027

- Figure 63: Global Biopsy Devices Market (Uterus/Cervix/Ovary), $Million, 2022-2027

- Figure 64: Global Biopsy Devices Market (Abdomen), $Million, 2022-2027

- Figure 65: Global Biopsy Devices Market (Prostate), $Million, 2022-2027

- Figure 66: Global Biopsy Devices Market (Cardiac), $Million, 2022-2027

- Figure 67: Global Biopsy Devices Market (Skin), $Million, 2022-2027

- Figure 68: Global Biopsy Devices Market (Others), $Million, 2022-2027

- Figure 69: Global Biopsy Devices Market (Liquid Biopsy), $Million, 2022-2027

- Figure 70: Global Biopsy Devices Market (Breast), $Million, 2022-2027

- Figure 71: Global Biopsy Devices Market (Lung), $Million, 2022-2027

- Figure 72: Global Biopsy Devices Market (Prostate), $Million, 2022-2027

- Figure 73: Global Biopsy Devices Market (Others), $Million, 2022-2027

- Figure 74: Global Biopsy Devices Market (by Disease Type)

- Figure 75: Global Biopsy Devices Market (by Disease Type), Market Size, 2022 and 2027

- Figure 76: Growth-Share Analysis for Global Biopsy Devices Market (by Disease Type), 2022-2027

- Figure 77: Global Biopsy Devices Market (Tissue Biopsy), $Million, 2022-2027

- Figure 78: Global Biopsy Devices Market (Cancer), $Million, 2022-2027

- Figure 79: Global Biopsy Devices Market (Infections), $Million, 2022-2027

- Figure 80: Global Biopsy Devices Market (Autoimmune Disorders), $Million, 2022-2027

- Figure 81: Global Biopsy Devices Market (Others), $Million, 2022-2027

- Figure 82: Global Biopsy Devices Market (Liquid Biopsy), $Million, 2022-2027

- Figure 83: Global Biopsy Devices Market (Cancer), $Million, 2022-2027

- Figure 84: Global Biopsy Devices Market (Non-Cancerous Indications), $Million, 2022-2027

- Figure 85: Global Biopsy Devices Market (by Guidance Technique)

- Figure 86: Global Biopsy Devices Market (by Guidance Technique), Market Size, 2022 and 2027

- Figure 87: Growth-Share Analysis for Global Biopsy Devices Market (by Guidance Technique), 2022-2027

- Figure 88: Global Biopsy Devices Market (Ultrasound-Guided Biopsy), $Million, 2022-2027

- Figure 89: Global Biopsy Devices Market (X-Ray-Guided Biopsy), $Million, 2022-2027

- Figure 90: Global Biopsy Devices Market (MRI-Guided Biopsy), $Million, 2022-2027

- Figure 91: Global Biopsy Devices Market (CT-Guided Biopsy), $Million, 2022-2027

- Figure 92: Global Biopsy Devices Market, by Region

- Figure 93: Americas Biopsy Devices Market, $Million, 2022-2027

- Figure 94: Americas Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 95: Americas Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 96: Americas Biopsy Devices Market (by Tissue Biopsy Device), $Million, 2022-2027

- Figure 97: Americas Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 98: Americas Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 99: Americas Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 100: Americas Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 101: Americas Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 102: Americas Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 103: Americas Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 104: Estimated New Cases and Deaths, U.S., 2023

- Figure 105: U.S. Biopsy Devices Market, $Million, 2022-2027

- Figure 106: U.S. Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 107: U.S. Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 108: U.S. Biopsy Devices Market (by Tissue Biopsy Devices), $Million, 2022-2027

- Figure 109: U.S. Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 110: U.S. Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 111: U.S. Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 112: U.S. Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 113: U.S. Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 114: U.S. Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 115: U.S. Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 116: Incidence of Cancer, EU5, 2020-2040

- Figure 117: EMEA Biopsy Devices Market, $Million, 2022-2027

- Figure 118: EMEA Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 119: EMEA Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 120: EMEA Biopsy Devices Market (by Tissue Biopsy Devices), $Million, 2022-2027

- Figure 121: EMEA Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 122: EMEA Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 123: EMEA Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 124: EMEA Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 125: EMEA Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 126: EMEA Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 127: EMEA Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 128: Incidence of Cancer and Mortality, Germany, 2020-2040

- Figure 129: Germany Biopsy Devices Market, $Million, 2022-2027

- Figure 130: Germany Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 131: Germany Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 132: Germany Biopsy Devices Market (by Tissue Biopsy Devices), $Million, 2022-2027

- Figure 133: Germany Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 134: Germany Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 135: Germany Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 136: Germany Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 137: Germany Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 138: Germany Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 139: Germany Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 140: Incidence of Cancer, U.K., 2020-2040

- Figure 141: U.K. Biopsy Devices Market, $Million, 2022-2027

- Figure 142: U.K. Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 143: U.K. Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 144: U.K. Biopsy Devices Market (by Tissue Biopsy Devices), $Million, 2022-2027

- Figure 145: U.K. Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 146: U.K. Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 147: U.K. Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 148: U.K. Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 149: U.K. Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 150: U.K. Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 151: U.K. Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 152: Incidence of Cancer, France, 2020-2040

- Figure 153: France Biopsy Devices Market, $Million, 2022-2027

- Figure 154: France Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 155: France Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 156: France Biopsy Devices Market (by Tissue Biopsy Devices), $Million, 2022-2027

- Figure 157: France Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 158: France Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 159: France Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 160: France Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 161: France Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 162: France Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 163: France Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 164: Incidence of Prostate Cancer, Asia, 2020-2040

- Figure 165: Asia-Pacific Biopsy Devices Market, $Million, 2022-2027

- Figure 166: Asia-Pacific Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 167: Asia-Pacific Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 168: Asia-Pacific Biopsy Devices Market (by Tissue Biopsy Devices), $Million, 2022-2027

- Figure 169: Asia-Pacific Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 170: Asia-Pacific Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 171: Asia-Pacific Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 172: Asia-Pacific Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 173: Asia-Pacific Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 174: Asia-Pacific Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 175: Asia-Pacific Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 176: Incidence of Cancer, China, 2020-2040

- Figure 177: China Biopsy Devices Market, $Million, 2022-2027

- Figure 178: China Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 179: China Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 180: China Biopsy Devices Market (by Tissue Biopsy Devices), $Million, 2022-2027

- Figure 181: China Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 182: China Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 183: China Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 184: China Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 185: China Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 186: China Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 187: China Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 188: Incidence of Cancer, India, 2020-2040

- Figure 189: India Biopsy Devices Market, $Million, 2022-2027

- Figure 190: India Biopsy Devices Market (by Tissue Biopsy), $Million, 2022-2027

- Figure 191: India Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 192: India Biopsy Devices Market (by Tissue Biopsy Devices), $Million, 2022-2027

- Figure 193: India Biopsy Devices Market (by Needle Biopsy Devices), $Million, 2022-2027

- Figure 194: India Biopsy Devices Market (by Biopsy Type), $Million, 2022-2027

- Figure 195: India Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 196: India Biopsy Devices Market (by Liquid Biopsy), $Million, 2022-2027

- Figure 197: India Biopsy Devices Market (by Product Type), $Million, 2022-2027

- Figure 198: India Biopsy Devices Market (by Anatomy), $Million, 2022-2027

- Figure 199: India Biopsy Devices Market (by Disease Type), $Million, 2022-2027

- Figure 200: Share of Key Developments and Strategies, January 2020-September 2023

- Figure 201: Number of Synergistic Activities (by Year), January 2020-September 2023

- Figure 202: Number of Product and Service Launches (by Year), January 2020-September 2023

- Figure 203: Number of Regulatory Accreditations (by Year), January 2020-September 2023

- Figure 204: Number of Mergers and Acquisitions (by Year), January 2020-September 2023

- Figure 205: Number of Regulatory Approvals (by Year), January 2020-September 2023

- Figure 206: Company Overview

- Figure 207: Company Overview

- Figure 208: Company Overview

- Figure 209: Company Overview

- Figure 210: Company Overview

- Figure 211: Company Overview

- Figure 212: Company Overview

- Figure 213: Company Overview

- Figure 214: Company Overview

- Figure 215: Company Overview

- Figure 216: Company Overview

- Figure 217: Company Overview

- Figure 218: Company Overview

- Figure 219: Company Overview

- Figure 220: Company Overview

- Figure 221: Company Overview

- Figure 222: Company Overview

- Figure 223: Company Overview

- Figure 224: Company Overview

- Figure 225: Company Overview

- Figure 226: Company Overview

- Figure 227: Company Overview

- Figure 228: Company Overview

- Figure 229: Company Overview

- Figure 230: Company Overview

- Figure 231: Company Overview

- Figure 232: Company Overview

- Figure 233: Company Overview

- Figure 234: Company Overview

- Figure 235: Company Overview

- Figure 236: Company Overview

- Figure 237: Company Overview

- Figure 238: Company Overview

List of Tables

- Table 1: Global Cancer Burden (by Cancer Type), 2020 and 2030

- Table 2: Global Biopsy Devices Market, Key Developments Analysis, January 2020-September 2023

- Table 3: Key Questions Answered in the Report

- Table 4: Global Biopsy Devices Market, Product Benchmarking by Tissue Biopsy

- Table 5: Global Biopsy Devices Market, Product Benchmarking by Liquid Biopsy

- Table 6: Some of the Guidance Systems Offered by Key Players

- Table 7: Some of the Automated Systems Offered by Key Players

- Table 8: Some of the Semi-Automated Systems Offered by Key Players

- Table 9: Some of the Needles Offered by Key Players

- Table 10: Biopsy Devices Ecosystem Active Players

- Table 11: Multinational Corporations (MNCs) vs. Local Players

“Global Biopsy Devices Market to Reach $11,869.4 Million by 2027.”

Introduction to Biopsy Devices Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2027 |

| 2023 Evaluation | $6,751.7 Million |

| 2027 Forecast | $11,869.4 Million |

| CAGR | 15.15% |

The global biopsy devices market is projected to reach $11,869.4 million by 2027 from $5,852.8 million in 2022, growing at a CAGR of 15.15% during the forecast period 2023-2027. The key factors driving the growth of the global biopsy devices market include an upsurge in the incidence of cancer leading to growth in the adoption of biopsy devices, diverse applications of biopsy procedures facilitating the growth of the biopsy devices market, rising government initiatives for early cancer detection driving the utilization of biopsy devices.

Market Introduction

Biopsy devices are medical instruments used to collect tissue samples from the body. They are used to diagnose a variety of conditions, including cancer, infections, and inflammatory diseases. Biopsy devices can be used to collect tissue samples from a variety of sites, including the skin, breasts, lungs, liver, and kidneys. Biopsy devices are an essential tool for diagnosing and monitoring a variety of medical conditions. By helping to improve the accuracy, safety, and convenience of biopsies, new biopsy devices are helping to improve the lives of patients around the world.

Impact Analysis:

The biopsy devices market has made an impact in the following ways:

Shift from Conventional Biopsies to Minimally Invasive Biopsies: The global biopsy devices market has been witnessing a significant shift toward the use of needle-based biopsy instruments, marking a transformative shift in diagnostic and monitoring practices. This trend is driven by several factors that collectively redefine the landscape of medical biopsies. For instance, needle-based biopsy offers a minimally invasive surgical alternative to traditional surgical biopsies, reducing patient discomfort and accelerating recovery times. Furthermore, needle-based biopsies are versatile, extending beyond cancer diagnosis to encompass liver diseases, infectious diseases, autoimmune disorders, and therapeutic monitoring, which eventually helps in early diagnosis and treatment of other chronic ailments.

Improved accuracy and precision of diagnosis: Biopsy devices have become increasingly accurate and precise over time, leading to earlier and more accurate diagnosis of diseases such as cancer.

Improved patient outcomes: By improving the accuracy, precision, and accessibility of biopsy procedures, biopsy devices have helped to improve patient outcomes for a wide range of diseases.

Integration of Advanced Imaging Technologies with Biopsy: The integration of advanced imaging technologies with biopsies represents a pivotal trend in the global biopsy devices market, signaling a paradigm shift in diagnostic and treatment approaches. This trend is characterized by the synergistic use of advanced imaging technologies with biopsy to enhance precision, reduce invasiveness, and improve patient recovery outcomes.

Research and Development: Continued growth in the biopsy market has encouraged further research and development in biopsy devices. This might include exploring new technologies and delivery methods to continually improve patient diagnosis, treatment, and recovery outcomes.

Impact of COVID-19

The COVID-19 pandemic led to a decrease in both cancer cases and biopsy procedures, and this decline could be attributed to several factors. The pandemic necessitated the postponement of various medical services, including cancer screening and diagnosis, due to the restrictions put in place to combat the epidemic. Consequently, there was a reduction in the number of cancer diagnostic tests conducted. Moreover, the pandemic resulted in significant drops in physician E&M visits, the administration of cancer screening tests, and cancer screening rates, including those for low-dose CT scans employed in the detection of lung cancer. Additionally, in specific regions, the pandemic caused a reduction in cancer resection surgeries and small biopsy diagnostic procedures, potentially leading to delayed diagnoses in various medical disciplines.

Market Segmentation:

Segmentation 1: by Product

- Tissue Biopsy

- Tissue Biopsy Devices

- Consumables

- Liquid Biopsy

- Test Service

- Kits

- Platforms

- Consumables

Tissue Biopsy: A tissue biopsy is a medical procedure in which a small sample of tissue is removed from the patient's body for examination under a microscope. Biopsies are performed for a variety of reasons, including to diagnose cancer, other diseases, or infections. They can also be used to monitor the progression of a disease or to assess the response to treatment.

Liquid Biopsy: A liquid biopsy is a non-invasive test that can be used to detect cancer cells and DNA in the blood. It is a newer type of biopsy that is still under development, but it has the potential to revolutionize the way cancer is diagnosed and monitored.

Segmentation 2: by Biopsy Type

- Tissue Biopsy

- Needle Biopsy

- Skin Biopsy

- Surgical Biopsy

- Liquid Biopsy

Based on biopsy type, the biopsy devices market is led by liquid biopsy, which held a 53.38% share in 2022.

Segmentation 3: by Disease Type

- Tissue Biopsy

- Cancer

- Infections

- Autoimmune Disorders

- Others

- Liquid Biopsy

- Cancer

- Non-Cancerous Indications

Segmentation 4: by Anatomy

- Tissue Biopsy

- Breast

- Lung

- Bone

- Liver

- Uterus/Cervix/Ovary

- Abdomen

- Prostate

- Cardiac

- Skin

- Others

- Liquid Biopsy

- Breast

- Lung

- Prostate

- Others

Segmentation 5: by Guidance Technique

- X-Ray-Guided Biopsy

- Ultrasound-Guided Biopsy

- MRI-Guided Biopsy

- CT-Guided Biopsy

Based on guidance technique, the X-ray-guided biopsy segment accounted for the largest share of 41.00% in the global biopsy devices market in 2022, and it is expected to grow at a CAGR of 4.68% during the forecast period 2023-2027.

Segmentation 6: by Region*

- Americas

- U.S.

- EMEA

- Germany

- U.K.

- France

- Asia-Pacific

- China

- India

All the regions and countries include a detailed analysis based on product type, biopsy type, and anatomy for tissue biopsy. At the same time, for liquid biopsy, the region segmentation includes analysis based on product type, biopsy type, disease type, and anatomy.

The U.K. dominated the EMEA biopsy devices market in 2022. The increasing cancer incidence, enhancements in healthcare infrastructure, and the adoption of digital health, resulting in a growing demand for biopsy devices.

Recent Developments in the Biopsy Devices Market

- In May 2023, Argon Medical Devices, Inc. announced the launch of the SuperCore Advantage Semi-Automatic Biopsy instrument as the latest inclusion in its portfolio of soft tissue biopsy products in the U.S.

- In May 2022, Terumo India partnered with Argon Medical in the Indian market. Its complementary product lines enabled Terumo to provide comprehensive medical solutions, addressing the growing demand for advanced tools in procedures such as biopsies and deep vein thrombosis treatments.

- In April 2023, GE Healthcare introduced the bkActiv system for surgical applications. This ultrasound imaging system provides surgeons with the confidence to make informed decisions during their surgical procedures.

- In January 2023, GE Healthcare successfully completed an acquisition agreement with the France-based company IMACTIS. In its announcement, GE Healthcare emphasized the potential of IMACTIS' computerized tomography (CT) navigation product, which has received approval for use in both Europe and the U.S. for safety in many ways.

- In April 2021, Olympus Corporation expanded its U.S. bronchoscopy product line by introducing the H-SteriScope Single-Use Bronchoscopes, a series of five premium endoscopes that received FDA 510(k) clearance. These devices have been designed for advanced diagnostic and therapeutic procedures.

- In May 2021, Olympus Corporation announced the introduction of the BF-UC190F endobronchial ultrasound bronchoscope, which received FDA 510(k) clearance. This new addition would strengthen its comprehensive EBUS device portfolio, enhancing its capabilities for minimally invasive lung cancer diagnosis and staging through needle biopsy procedures.

- In July 2022, the Food and Drug Administration granted approval for the incorporation of Siemens Healthineers' mobile imaging technology into Intuitive's robotic-assisted platform for minimally invasive lung biopsies.

- In April 2023, KDL announced that its disposable biopsy needle received marketing approval.

- In December 2021, Zhejiang Soudon Medical Technology Co., Ltd. Achieved the initial CFDA certificate for its biopsy forceps.

- In August 2023, Agilent Technologies Inc. halted the operations of its Resolution Bioscience liquid biopsy division. The company disclosed the termination of operations in the division, which the company purchased for $550 million in 2021.

- In January 2023, Agilent Technologies Inc. announced the acquisition of Avida Biomed.

- In November 2021, BGI Genomics launched CE-marked lung cancer and pan-cancer detection kits in December 2021 to identify actionable genomic alterations in multiple types of cancer and the genes from liquid biopsy samples of cancer patients.

- In June 2021, Biocept, Inc. collaborated with Quest Diagnostics to provide advanced NGS-based liquid biopsy testing for patients with lung cancer.

- In December 2021, Quest Diagnostics announced that it would now offer Biocept Inc.'s liquid biopsy test for lung cancer, thereby expanding its product portfolio of advanced cancer diagnostics.

- In September 2023, Dxcover Limited announced the augmentation of its executive team to facilitate the progression of its multi-cancer liquid biopsy platform.

- In February 2023, Dxcover Limited announced that it had raised $11.9 million in Series A and grant financing. The funding would bolster the continuous advancement of Dxcover Limited's liquid biopsy platform, aimed at detecting early-stage cancers such as those affecting the brain and colorectal region.

- In February 2022, Dxcover Limited secured the U.S. patent for cancer diagnostic devices, namely, the Dxcover autosampler and the Dxcover brain cancer liquid biopsy. The patent covers all of Dxcover Limited's hardware, including the Dxcover sample slides and autosampler accessories.

Demand - Drivers and Limitations

Market Demand Drivers:

Upsurge in Incidence of Cancer Leading to Growth in the Adoption of Biopsy Devices: The global biopsy devices market is all set to witness significant expansion, primarily due to the increasing incidence of cancer cases globally. Cancer continues to be a major health concern, eventually leading to a growing demand for precise and early cancer detection. With the rapidly aging global population and lifestyle-related risk factors becoming more prevalent, the occurrence of various cancer types is steadily rising, thereby necessitating the need for biopsy procedures.

Diverse Applications of Biopsy Procedures Facilitating the Growth of Biopsy Devices Market: The diverse applications of biopsy devices beyond cancer diagnosis are a significant factor contributing to the growth of the biopsy devices market. Biopsies are instrumental in diagnosing liver diseases such as hepatitis and non-alcoholic fatty liver disease (NAFLD), addressing the rising global liver disease cases. According to a study published in Clinical and Molecular Hepatology in 2023, titled "Global Incidence and Prevalence of Non-Alcoholic Fatty Liver Disease," the global burden of NAFLDs has been significant and is projected to rise. Moreover, the research published in 2023 also estimated that NAFLDs had an incidence rate of 46.9 cases per 1,000 people, with indications prevalent in 32% of adults worldwide as of 2022.

Rising Government Initiatives for Early Cancer Detection Driving the Utilization of Biopsy Devices: The increasing focus and initiatives undertaken by governments worldwide to raise awareness about cancer have emerged as a significant driver fueling the adoption of biopsy devices. Governments are recognizing the criticality of early detection and accurate diagnosis in improving cancer outcomes. As a result, active promotion campaigns, screening programs, and the dissemination of information about the benefits of early detection through various channels have been on the rise, especially through social awareness camps and channels under various governments.

Increasing Adoption of Inorganic Growth Strategies in the Market: Due to the ever-rising prevalence of cancers, the need for better products and services is becoming more evident. Several key players are aligning their technologies as per the market requirements to provide technologically advanced products and services by adopting inorganic strategies, such as agreements, partnerships, and collaborations.

With the ultimate aim of grabbing maximum market share through the introduction of effective products in the global biopsy devices market, several companies are coming together to provide better products and services in the domain of liquid biopsy to enable oncologists to effectively monitor and screen several types of cancers.

Market Restraints:

Risk of Infections Associated with Biopsies: Prostate biopsies are vital for diagnosing and monitoring prostate cancer, making it an integral component of urological practice. However, the risk of infection associated with prostate biopsy poses a significant constraint on the growth of biopsy devices.

According to a study published in the World Journal of Urology in 2021, titled "The Negative Aftermath of Prostate Biopsy: Prophylaxis, Complications, and Antimicrobial Stewardship: Results of the Global Prevalence Study of Infections in Urology 2010-2019," a prostate biopsy is one of the most commonly performed urological procedures globally, with over one million biopsies conducted annually in the U.S. alone.

High Cost of Biopsy Procedures: Liquid biopsy is gaining prominence as an emerging approach for molecular profiling using circulating tumor DNA (ctDNA) for therapeutic decision-making. The non-invasive nature of the technique and rapid results address challenges related to tissue availability and accessibility. Additionally, it can be the preferred approach for obtaining data on emerging resistance mechanisms in patients who have undergone prior treatments.

Market Opportunities:

Upsurge in Incidence of Cancer Leading to Growth in the Adoption of Biopsy Devices: Virtual biopsy represents a potent and non-invasive alternative for monitoring and controlling various cancer types. This innovative imaging-based approach can extract encoded information from standard medical imaging scans and generate probabilities to assist in tissue characterization for cancer screening, diagnosis, grading, treatment planning, and disease prognosis, eliminating the need for surgical or invasive procedures.

In comparison to conventional biopsies, virtual biopsies offer several advantages, including fewer risks of complications for the patient. Moreover, they present a cost-efficient alternative by eliminating the need for an operating room, resulting in lower expenses. Furthermore, patients can benefit from expedited tumor pathology reports, which can significantly impact their treatment timeline.

How can this report add value to an organization?

Product/Innovation Strategy: The global biopsy devices market has been extensively segmented based on various categories, such as products, types, guidance techniques, and regions. All the regions and countries include a detailed analysis based on product type, biopsy type, and anatomy for tissue biopsy. At the same time, for liquid biopsy, the region segmentation includes analysis based on product type, biopsy type, disease type, and anatomy. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Product and service launches, and synergistic activities accounted for the maximum number of key developments, i.e., nearly 67.96% of the total developments in the global biopsy devices market were between January 2021 and September 2023.

Competitive Strategy: The global biopsy devices market has numerous established players that have paved their way into providing tissue biopsy and liquid biopsy products in the market. Key players in the global biopsy devices market analyzed and profiled in the study involve established players offering various guidance systems, automated systems, semi-automated systems, and consumables, namely, trocars, biopsy forceps, and others, used in needle biopsy, skin biopsy, and surgical biopsy. At the same time, liquid biopsy includes assays/kits, instruments/platforms, and consumables.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research was performed to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Exact revenue information, up to a certain extent, was extracted for each company from secondary sources and databases. The revenues specific to the product/biopsy type/disease type/anatomy/guidance technique were then estimated for each market player based on fact-based proxy indicators as well as primary inputs.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report provides a market study of biopsy devices.

- The market contribution of the biopsy devices anticipated to be launched in the future has been calculated based on historical analysis. This analysis has been supported by proxy factors such as the innovation scale of the companies, the status of funding, collaborations, customer base, and patent scenario.

- The scope of availability of biopsy devices in a particular region has been assessed based on a comprehensive analysis of companies' prospects, the regional end-user perception, and other factors impacting the launch of biopsy devices in that region.

- The base year considered for the calculation of the market size is 2022. A historical year analysis has been done for the period FY2018-FY2021. The market size has been estimated for FY2022 and projected for the period FY2023-FY2027.

- Revenues of the companies have been referenced from their annual reports for FY2021 and FY2022. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, product approval status, market collaborations, and operational history.

- Regional distribution of the market revenue has been estimated based on the companies in each region and the adoption rate of biopsy devices. All the numbers have been adjusted to a single digit after the decimal for better presentation in the report. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation.

- The market has been mapped based on the available biopsy devices. All the key companies with significant offerings in this field have been considered and profiled in this report.

- Market strategies and developments of key players have been considered for the calculation of the potential of the market in the forecast period.

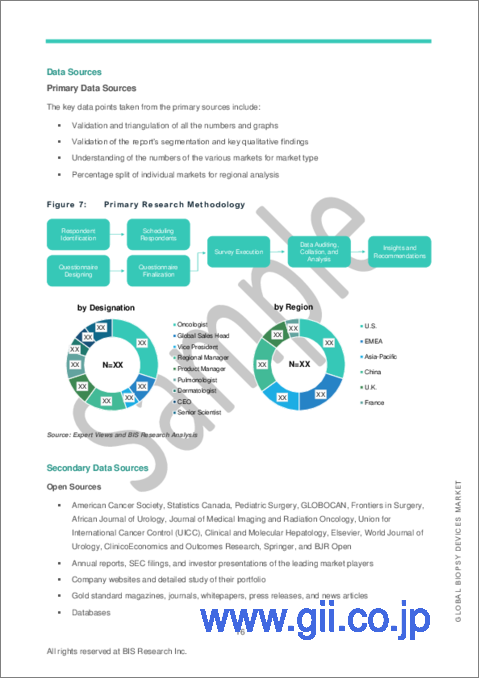

Primary Research:

The primary sources involve industry experts in the biopsy devices market, including the market players offering tissue biopsy products and liquid biopsy products. Resources such as COOs, vice presidents, product managers, directors, territory managers, and business development have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings for biopsy devices

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research:

Open Sources

- National Center for Biotechnology Information (NCBI), PubMed, Science Direct, American Heart Association (AHA), Mayo Clinic, World Health Organization (WHO), American Cancer Society, Statistics Canada, Pediatric Surgery, GLOBOCAN, Frontiers in Surgery, African Journal of Urology, Journal of Medical Imaging and Radiation Oncology, Union for International Cancer Control (UICC), Clinical and Molecular Hepatology, Elsevier, World Journal of Urology, ClinicoEconomics and Outcomes Research, Springer, and BJR Open

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolios

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentation and percentage share estimates

- company and country understanding, and data for market value estimation

- Key industry/market trends

- Developments among top players

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing company coverage, product portfolio, and market penetration.

Key Companies Profiled:

|

|

Table of Contents

1 Markets Overview

- 1.1 Product Definition

- 1.2 Inclusion and Exclusion

- 1.3 Key Findings

2 Industry Outlook

- 2.1 Key Trends

- 2.1.1 Shift from Conventional Biopsies to Minimally Invasive Biopsies

- 2.1.2 Integration of Advanced Imaging Technologies with Biopsy

- 2.2 Patent Analysis

- 2.2.1 Patent Analysis (by Year)

- 2.2.2 Patent Analysis (by Country)

- 2.3 Impact of COVID-19 on Biopsy Devices

- 2.4 Product Benchmarking

- 2.5 Regulatory Requirements

- 2.5.1 Regulatory and Legal Requirements and Framework in the U.S.

- 2.5.2 Regulatory and Legal Requirements and Framework in Europe

- 2.5.3 Regulatory and Legal Requirements and Framework in Asia-Pacific

- 2.5.3.1 China

- 2.5.3.2 Japan

- 2.5.3.3 India

- 2.5.3.4 Australia

3 Global Biopsy Devices Market: Market Dynamics

- 3.1 Impact Analysis

- 3.2 Market Drivers

- 3.2.1 Upsurge in Incidence of Cancer Leading to Growth in the Adoption of Biopsy Devices

- 3.2.2 Diverse Applications of Biopsy Procedures Facilitating the Growth of Biopsy Devices Market

- 3.2.3 Rising Government Initiatives for Early Cancer Detection Driving the Utilization of Biopsy Devices

- 3.2.4 Increasing Adoption of Inorganic Growth Strategies in the Market

- 3.3 Market Restraints

- 3.3.1 Risk of Infections Associated with Biopsies

- 3.3.2 High Cost of Biopsy Procedures

- 3.4 Market Opportunities

- 3.4.1 Continuous Advancements in Biopsy Devices and Techniques

- 3.4.2 Introduction of Virtual Biopsies

4 Global Biopsy Devices Market: by Product Type

- 4.1 Overview

- 4.2 Growth-Share Analysis

- 4.3 Tissue Biopsy

- 4.3.1 Tissue Biopsy Devices

- 4.3.1.1 Needle Biopsy Devices

- 4.3.1.1.1 Guidance Systems

- 4.3.1.1.2 Biopsy Consoles

- 4.3.1.1.3 Site Markers

- 4.3.1.1.4 Biopsy Guns

- 4.3.1.1.4.1 Automated Systems

- 4.3.1.1.4.2 Semi-Automated Systems

- 4.3.1.1.5 Needles

- 4.3.1.2 Skin Biopsy Devices

- 4.3.1.2.1 Punch Biopsy Instruments

- 4.3.1.2.2 Shave Biopsy Instruments

- 4.3.1.1 Needle Biopsy Devices

- 4.3.2 Consumables

- 4.3.2.1 Consumables (Product Type)

- 4.3.2.1.1 Forceps

- 4.3.2.1.2 Trocars

- 4.3.2.1.3 Trays

- 4.3.2.1.4 Other Consumables

- 4.3.2.2 Consumables (Biopsy Type)

- 4.3.2.1 Consumables (Product Type)

- 4.3.1 Tissue Biopsy Devices

- 4.4 Liquid Biopsy

- 4.4.1 Testing Service

- 4.4.2 Kits

- 4.4.3 Platform

- 4.4.4 Consumables

5 Global Biopsy Devices Market: by Biopsy Type

- 5.1 Overview

- 5.2 Growth-Share Analysis

- 5.3 Tissue Biopsy

- 5.3.1 Needle Biopsy

- 5.3.2 Surgical Biopsy

- 5.3.3 Skin Biopsy

- 5.4 Liquid Biopsy

6 Global Biopsy Devices Market: by Anatomy

- 6.1 Overview

- 6.2 Growth-Share Analysis

- 6.3 Tissue Biopsy

- 6.3.1 Breast

- 6.3.2 Lung

- 6.3.3 Bone

- 6.3.4 Liver

- 6.3.5 Uterus/Cervix/Ovary

- 6.3.6 Abdomen

- 6.3.7 Prostate

- 6.3.8 Cardiac

- 6.3.9 Skin

- 6.3.10 Others

- 6.4 Liquid Biopsy

- 6.4.1 Breast

- 6.4.2 Lung

- 6.4.3 Prostate

- 6.4.4 Others

7 Global Biopsy Devices Market: by Disease Type

- 7.1 Overview

- 7.2 Growth-Share Analysis

- 7.3 Tissue Biopsy

- 7.3.1 Cancer

- 7.3.2 Infections

- 7.3.3 Autoimmune Disorders

- 7.3.4 Others

- 7.4 Liquid Biopsy

- 7.4.1 Cancer

- 7.4.2 Non-Cancerous Indications

8 Global Biopsy Devices Market: by Guidance Technique

- 8.1 Overview

- 8.2 Growth-Share Analysis

- 8.3 Ultrasound-Guided Biopsy

- 8.4 X-Ray-Guided Biopsy

- 8.5 MRI-Guided Biopsy

- 8.6 CT-Guided Biopsy

9 Regions

- 9.1 Overview

- 9.2 Americas

- 9.2.1 Market Sizing and Forecast

- 9.2.1.1 Americas Biopsy Devices Market (by Tissue Biopsy)

- 9.2.1.1.1 Americas Biopsy Devices Market (by Product Type)

- 9.2.1.1.1.1 Americas Biopsy Devices Market (by Tissue Biopsy Device)

- 9.2.1.1.1.1.1 Americas Biopsy Devices Market (by Needle Biopsy Devices)

- 9.2.1.1.2 Americas Biopsy Devices Market (by Biopsy Type)

- 9.2.1.1.3 Americas Biopsy Devices Market (by Anatomy)

- 9.2.1.1.1 Americas Biopsy Devices Market (by Product Type)

- 9.2.1.2 Americas Biopsy Devices Market (by Liquid Biopsy)

- 9.2.1.2.1 Americas Biopsy Devices Market (by Product Type)

- 9.2.1.2.2 Americas Biopsy Devices Market (by Anatomy)

- 9.2.1.2.3 Americas Biopsy Devices Market (by Disease Type)

- 9.2.1.1 Americas Biopsy Devices Market (by Tissue Biopsy)

- 9.2.1 Market Sizing and Forecast

- 9.3 U.S.

- 9.3.1 Market Sizing and Forecast

- 9.3.1.1 U.S. Biopsy Devices Market (by Tissue Biopsy)

- 9.3.1.1.1 U.S. Biopsy Devices Market (by Product Type)

- 9.3.1.1.1.1 U.S. Biopsy Devices Market (by Tissue Biopsy Devices)

- 9.3.1.1.1.1.1 U.S. Biopsy Devices Market (by Needle Biopsy Devices)

- 9.3.1.1.2 U.S. Biopsy Devices Market (by Biopsy Type)

- 9.3.1.1.3 U.S. Biopsy Devices Market (by Anatomy)

- 9.3.1.1.1 U.S. Biopsy Devices Market (by Product Type)

- 9.3.1.2 U.S. Biopsy Devices Market (by Liquid Biopsy)

- 9.3.1.2.1 U.S. Biopsy Devices Market (by Product Type)

- 9.3.1.2.2 U.S. Biopsy Devices Market (by Anatomy)

- 9.3.1.2.3 U.S. Biopsy Devices Market (by Disease Type)

- 9.3.1.1 U.S. Biopsy Devices Market (by Tissue Biopsy)

- 9.3.1 Market Sizing and Forecast

- 9.4 EMEA

- 9.4.1 Market Sizing and Forecast

- 9.4.1.1 EMEA Biopsy Devices Market (by Tissue Biopsy)

- 9.4.1.1.1 EMEA Biopsy Devices Market (by Product Type)

- 9.4.1.1.1.1 EMEA Biopsy Devices Market (by Tissue Biopsy Devices)

- 9.4.1.1.1.1.1 EMEA Biopsy Devices Market (by Needle Biopsy Devices)

- 9.4.1.1.2 EMEA Biopsy Devices Market (by Biopsy Type)

- 9.4.1.1.3 EMEA Biopsy Devices Market (by Anatomy)

- 9.4.1.1.1 EMEA Biopsy Devices Market (by Product Type)

- 9.4.1.2 EMEA Biopsy Devices Market (by Liquid Biopsy)

- 9.4.1.2.1 EMEA Biopsy Devices Market (by Product Type)

- 9.4.1.2.2 EMEA Biopsy Devices Market (by Anatomy)

- 9.4.1.2.3 EMEA Biopsy Devices Market (by Disease Type)

- 9.4.1.1 EMEA Biopsy Devices Market (by Tissue Biopsy)

- 9.4.1 Market Sizing and Forecast

- 9.5 Germany

- 9.5.1 Market Sizing and Forecast

- 9.5.1.1 Germany Biopsy Devices Market (by Tissue Biopsy)

- 9.5.1.1.1 Germany Biopsy Devices Market (by Product Type)

- 9.5.1.1.1.1 Germany Biopsy Devices Market (by Tissue Biopsy Devices)

- 9.5.1.1.1.1.1 Germany Biopsy Devices Market (by Needle Biopsy Devices)

- 9.5.1.1.2 Germany Biopsy Devices Market (by Biopsy Type)

- 9.5.1.1.3 Germany Biopsy Devices Market (by Anatomy)

- 9.5.1.1.1 Germany Biopsy Devices Market (by Product Type)

- 9.5.1.2 Germany Biopsy Devices Market (by Liquid Biopsy)

- 9.5.1.2.1 Germany Biopsy Devices Market (by Product Type)

- 9.5.1.2.2 Germany Biopsy Devices Market (by Anatomy)

- 9.5.1.2.3 Germany Biopsy Devices Market (by Disease Type)

- 9.5.1.1 Germany Biopsy Devices Market (by Tissue Biopsy)

- 9.5.1 Market Sizing and Forecast

- 9.6 U.K.

- 9.6.1 Market Sizing and Forecast

- 9.6.1.1 U.K. Biopsy Devices Market (by Tissue Biopsy)

- 9.6.1.1.1 U.K. Biopsy Devices Market (by Product Type)

- 9.6.1.1.1.1 U.K. Biopsy Devices Market (by Tissue Biopsy Devices)

- 9.6.1.1.1.1.1 U.K. Biopsy Devices Market (by Needle Biopsy Devices)

- 9.6.1.1.2 U.K. Biopsy Devices Market (by Biopsy Type)

- 9.6.1.1.3 U.K. Biopsy Devices Market (by Anatomy)

- 9.6.1.1.1 U.K. Biopsy Devices Market (by Product Type)

- 9.6.1.2 U.K. Biopsy Devices Market (by Liquid Biopsy)

- 9.6.1.2.1 U.K. Biopsy Devices Market (by Product Type)

- 9.6.1.2.2 U.K. Biopsy Devices Market (by Anatomy)

- 9.6.1.2.3 U.K. Biopsy Devices Market (by Disease Type)

- 9.6.1.1 U.K. Biopsy Devices Market (by Tissue Biopsy)

- 9.6.1 Market Sizing and Forecast

- 9.7 France

- 9.7.1 Market Sizing and Forecast

- 9.7.1.1 France Biopsy Devices Market (by Tissue Biopsy)

- 9.7.1.1.1 France Biopsy Devices Market (by Product Type)

- 9.7.1.1.1.1 France Biopsy Devices Market (by Tissue Biopsy Devices)

- 9.7.1.1.1.1.1 France Biopsy Devices Market (by Needle Biopsy Devices)

- 9.7.1.1.2 France Biopsy Devices Market (by Biopsy Type)

- 9.7.1.1.3 France Biopsy Devices Market (by Anatomy)

- 9.7.1.1.1 France Biopsy Devices Market (by Product Type)

- 9.7.1.2 France Biopsy Devices Market (by Liquid Biopsy)

- 9.7.1.2.1 France Biopsy Devices Market (by Product Type)

- 9.7.1.2.2 France Biopsy Devices Market (by Anatomy)

- 9.7.1.2.3 France Biopsy Devices Market (by Disease Type)

- 9.7.1.1 France Biopsy Devices Market (by Tissue Biopsy)

- 9.7.1 Market Sizing and Forecast

- 9.8 Asia-Pacific

- 9.8.1 Market Sizing and Forecast

- 9.8.1.1 Asia-Pacific Biopsy Devices Market (by Tissue Biopsy)

- 9.8.1.1.1 Asia-Pacific Biopsy Devices Market (by Product Type)

- 9.8.1.1.1.1 Asia-Pacific Biopsy Devices Market (by Tissue Biopsy Devices)

- 9.8.1.1.1.1.1 Asia-Pacific Biopsy Devices Market (by Needle Biopsy Devices)

- 9.8.1.1.2 Asia-Pacific Biopsy Devices Market (by Biopsy Type)

- 9.8.1.1.3 Asia-Pacific Biopsy Devices Market (by Anatomy)

- 9.8.1.1.1 Asia-Pacific Biopsy Devices Market (by Product Type)

- 9.8.1.2 Asia-Pacific Biopsy Devices Market (by Liquid Biopsy)

- 9.8.1.2.1 Asia-Pacific Biopsy Devices Market (by Product Type)

- 9.8.1.2.2 Asia-Pacific Biopsy Devices Market (by Anatomy)

- 9.8.1.2.3 Asia-Pacific Biopsy Devices Market (by Disease Type)

- 9.8.1.1 Asia-Pacific Biopsy Devices Market (by Tissue Biopsy)

- 9.8.1 Market Sizing and Forecast

- 9.9 China

- 9.9.1 Market Sizing and Forecast

- 9.9.1.1 China Biopsy Devices Market (by Tissue Biopsy)

- 9.9.1.1.1 China Biopsy Devices Market (by Product Type)

- 9.9.1.1.1.1 China Biopsy Devices Market (by Tissue Biopsy Devices)

- 9.9.1.1.1.1.1 China Biopsy Devices Market (by Needle Biopsy Devices)

- 9.9.1.1.2 China Biopsy Devices Market (by Biopsy Type)

- 9.9.1.1.3 China Biopsy Devices Market (by Anatomy)

- 9.9.1.1.1 China Biopsy Devices Market (by Product Type)

- 9.9.1.2 China Biopsy Devices Market (by Liquid Biopsy)

- 9.9.1.2.1 China Biopsy Devices Market (by Product Type)

- 9.9.1.2.2 China Biopsy Devices Market (by Anatomy)

- 9.9.1.2.3 China Biopsy Devices Market (by Disease Type)

- 9.9.1.1 China Biopsy Devices Market (by Tissue Biopsy)

- 9.9.1 Market Sizing and Forecast

- 9.1 India

- 9.10.1 Market Sizing and Forecast

- 9.10.1.1 India Biopsy Devices Market (by Tissue Biopsy)

- 9.10.1.1.1 India Biopsy Devices Market (by Product Type)

- 9.10.1.1.1.1 India Biopsy Devices Market (by Tissue Biopsy Devices)

- 9.10.1.1.1.1.1 India Biopsy Devices Market (by Needle Biopsy Devices)

- 9.10.1.1.2 India Biopsy Devices Market (by Biopsy Type)

- 9.10.1.1.3 India Biopsy Devices Market (by Anatomy)

- 9.10.1.1.1 India Biopsy Devices Market (by Product Type)

- 9.10.1.2 India Biopsy Devices Market (by Liquid Biopsy)

- 9.10.1.2.1 India Biopsy Devices Market (by Product Type)

- 9.10.1.2.2 India Biopsy Devices Market (by Anatomy)

- 9.10.1.2.3 India Biopsy Devices Market (by Disease Type)

- 9.10.1.1 India Biopsy Devices Market (by Tissue Biopsy)

- 9.10.1 Market Sizing and Forecast

10 Competitive Landscape

- 10.1 Overview

- 10.2 Key Strategies and Developments

- 10.2.1 Synergistic Activities

- 10.2.2 Product and Service Launches

- 10.2.3 Regulatory Accreditations

- 10.2.4 Mergers and Acquisitions

- 10.2.5 Regulatory Approvals

- 10.3 Biopsy Devices Ecosystem Active Players

- 10.4 Global vs. Chinese Players' Analysis

- 10.5 Company Profiles

- 10.5.1 Tissue Biopsy Market Players

- 10.5.1.1 Global Players

- 10.5.1.1.1 Argon Medical Devices, Inc.

- 10.5.1.1.1.1 Role of Argon Medical Devices, Inc. in the Global Biopsy Devices Market

- 10.5.1.1.1.2 Recent Developments

- 10.5.1.1.1.3 Analyst Perspective

- 10.5.1.1.2 B. Braun SE

- 10.5.1.1.2.1 Role of B. Braun SE in the Global Biopsy Devices Market

- 10.5.1.1.2.2 Analyst Perspective

- 10.5.1.1.3 Becton, Dickinson and Company

- 10.5.1.1.3.1 Role of Becton, Dickinson and Company in the Global Biopsy Devices Market

- 10.5.1.1.3.2 Recent Developments

- 10.5.1.1.3.3 Analyst Perspective

- 10.5.1.1.4 Boston Scientific Corporation

- 10.5.1.1.4.1 Role of Boston Scientific Corporation in the Global Biopsy Devices Market

- 10.5.1.1.4.2 Analyst Perspective

- 10.5.1.1.5 Cardinal Health, Inc.

- 10.5.1.1.5.1 Role of Cardinal Health, Inc. in the Global Biopsy Devices Market

- 10.5.1.1.5.2 Analyst Perspective

- 10.5.1.1.6 Cook Group Incorporated

- 10.5.1.1.6.1 Role of Cook Group Incorporated in the Global Biopsy Devices Market

- 10.5.1.1.6.2 Analyst Perspective

- 10.5.1.1.7 Conmed Corporation

- 10.5.1.1.7.1 Role of Conmed Corporation in the Global Biopsy Devices Market

- 10.5.1.1.7.2 Analyst Perspective

- 10.5.1.1.8 FUJIFILM Holdings Corporation

- 10.5.1.1.8.1 Role of FUJIFILM Holdings Corporation in the Global Biopsy Devices Market

- 10.5.1.1.8.2 Analyst Perspective

- 10.5.1.1.9 GE HealthCare

- 10.5.1.1.9.1 Role of GE HealthCare in the Global Biopsy Devices Market

- 10.5.1.1.9.2 Recent Developments

- 10.5.1.1.9.3 Analyst Perspective

- 10.5.1.1.10 Inrad, Inc.

- 10.5.1.1.10.1 Role of Inrad, Inc. in the Global Biopsy Devices Market

- 10.5.1.1.10.2 Analyst Perspective

- 10.5.1.1.11 Medtronic plc

- 10.5.1.1.11.1 Role of Medtronic plc in the Global Biopsy Devices Market

- 10.5.1.1.11.2 Analyst Perspective

- 10.5.1.1.12 Olympus Corporation

- 10.5.1.1.12.1 Role of Olympus Corporation in the Global Biopsy Devices Market

- 10.5.1.1.12.2 Recent Developments

- 10.5.1.1.12.3 Analyst Perspective

- 10.5.1.1.13 Siemens Healthineers AG

- 10.5.1.1.13.1 Role of Siemens Healthineers AG in the Global Biopsy Devices Market

- 10.5.1.1.13.2 Recent Developments

- 10.5.1.1.13.3 Analyst Perspective

- 10.5.1.1.14 Stryker Corporation

- 10.5.1.1.14.1 Role of Stryker Corporation in the Global Biopsy Devices Market

- 10.5.1.1.14.2 Analyst Perspective

- 10.5.1.1.15 Zamar Care

- 10.5.1.1.15.1 Role of Zamar Care in the Global Biopsy Devices Market

- 10.5.1.1.15.2 Analyst Perspective

- 10.5.1.1.1 Argon Medical Devices, Inc.

- 10.5.1.2 Chinese Players

- 10.5.1.2.1 Changzhou Jiuhong Medical Instrument Co., Ltd.

- 10.5.1.2.1.1 Role of Changzhou Jiuhong Medical Instrument Co., Ltd. in the Global Biopsy Devices Market

- 10.5.1.2.1.2 Analyst Perspective

- 10.5.1.2.2 Kindly (KDL) Meditech

- 10.5.1.2.2.1 Role of Kindly (KDL) Meditech in the Global Biopsy Devices Market

- 10.5.1.2.2.2 Recent Developments

- 10.5.1.2.2.3 Analyst Perspective

- 10.5.1.2.3 Ningbo Xinwell Medical Technology Co., LTD.

- 10.5.1.2.3.1 Role of Ningbo Xinwell Medical Technology Co., LTD. in the Global Biopsy Devices Market

- 10.5.1.2.3.2 Analyst Perspective

- 10.5.1.2.4 Shenzhen Manners Technology Co., Ltd.

- 10.5.1.2.4.1 Role of Shenzhen Manners Technology Co., Ltd. in the Global Biopsy Devices Market

- 10.5.1.2.4.2 Analyst Perspective

- 10.5.1.2.5 Zhejiang Soudon Medical Technology Co., Ltd

- 10.5.1.2.5.1 Role of Zhejiang Soudon Medical Technology Co., Ltd in the Global Biopsy Devices Market

- 10.5.1.2.5.2 Recent Developments

- 10.5.1.2.5.3 Analyst Perspective

- 10.5.1.2.1 Changzhou Jiuhong Medical Instrument Co., Ltd.

- 10.5.1.1 Global Players

- 10.5.2 Liquid Biopsy Market Players

- 10.5.2.1.1 Agilent Technologies, Inc.

- 10.5.2.1.1.1 Role of Agilent Technologies, Inc. in the Global Biopsy Devices Market

- 10.5.2.1.1.2 Recent Developments

- 10.5.2.1.1.3 Analyst Perspective

- 10.5.2.1.2 BGI Group

- 10.5.2.1.2.1 Role of BGI Group in the Global Biopsy Devices Market

- 10.5.2.1.2.2 Recent Developments

- 10.5.2.1.2.3 Analyst Perspective

- 10.5.2.1.3 Biocept, Inc.

- 10.5.2.1.3.1 Role of Biocept, Inc. in the Global Biopsy Devices Market

- 10.5.2.1.3.2 Recent Developments

- 10.5.2.1.3.3 Analyst Perspective

- 10.5.2.1.4 Bio-Rad Laboratories, Inc.

- 10.5.2.1.4.1 Role of Bio-Rad Laboratories, Inc. in the Global Biopsy Devices Market

- 10.5.2.1.4.2 Recent Developments

- 10.5.2.1.4.3 Analyst Perspective

- 10.5.2.1.5 Dxcover Limited

- 10.5.2.1.5.1 Role of Dxcover Limited in the Global Biopsy Devices Market

- 10.5.2.1.5.2 Recent Developments

- 10.5.2.1.5.3 Analyst Perspective

- 10.5.2.1.6 Elypta Limited

- 10.5.2.1.6.1 Role of Elypta Limited in the Global Biopsy Devices Market

- 10.5.2.1.6.2 Recent Developments

- 10.5.2.1.6.3 Analyst Perspective

- 10.5.2.1.7 F. Hoffmann-La Roche Ltd

- 10.5.2.1.7.1 Role of F. Hoffmann-La Roche Ltd in the Global Biopsy Devices Market

- 10.5.2.1.7.2 Recent Developments

- 10.5.2.1.7.3 Analyst Perspective

- 10.5.2.1.8 Illumina, Inc.

- 10.5.2.1.8.1 Role of Illumina, Inc. in the Global Biopsy Devices Market

- 10.5.2.1.8.2 Recent Developments

- 10.5.2.1.8.3 Analyst Perspective

- 10.5.2.1.9 Micronoma

- 10.5.2.1.9.1 Role of Micronoma in the Global Biopsy Devices Market

- 10.5.2.1.9.2 Recent Developments

- 10.5.2.1.9.3 Analyst Perspective

- 10.5.2.1.10 QIAGEN

- 10.5.2.1.10.1 Role of QIAGEN in the Global Biopsy Devices Market

- 10.5.2.1.10.2 Recent Developments

- 10.5.2.1.10.3 Analyst Perspective

- 10.5.2.1.11 Revvity, Inc.

- 10.5.2.1.11.1 Role of Revvity, Inc. in the Global Biopsy Devices Market

- 10.5.2.1.11.2 Recent Developments

- 10.5.2.1.11.3 Analyst Perspective

- 10.5.2.1.12 Sysmex Corporation

- 10.5.2.1.12.1 Role of Sysmex Corporation in the Global Biopsy Devices Market

- 10.5.2.1.12.2 Analyst Perspective

- 10.5.2.1.13 Thermo Fisher Scientific Inc.

- 10.5.2.1.13.1 Role of Thermo Fisher Scientific Inc. in the Global Biopsy Devices Market

- 10.5.2.1.13.2 Recent Developments

- 10.5.2.1.13.3 Analyst Perspective

- 10.5.2.1.1 Agilent Technologies, Inc.

- 10.5.1 Tissue Biopsy Market Players