|

|

市場調査レポート

商品コード

1344202

EV向けSiC (炭化ケイ素) の世界市場 (2023~2032年):推進タイプ・車両タイプ・用途・製品タイプ・電圧・国別の分析・予測Silicon Carbide (SiC) Market for Electric Vehicles - A Global and Regional Analysis: Focus on Propulsion Type, Vehicle Type, Application Type, Product Type, Voltage Type, and Country-Level Analysis - Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| EV向けSiC (炭化ケイ素) の世界市場 (2023~2032年):推進タイプ・車両タイプ・用途・製品タイプ・電圧・国別の分析・予測 |

|

出版日: 2023年08月28日

発行: BIS Research

ページ情報: 英文 240 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のEV向けSiC (炭化ケイ素) の市場規模は、2022年の5億1,300万米ドルから、予測期間中は33.02%のCAGRで推移し、2032年には90億3,120万米ドルの規模に成長すると予測されています。

同市場の成長は、シリコンと比較してSiC材料の特性が優れていること、EV需要が伸びていること、SiCの製造能力強化に向けた投資が増加していることが背景にあると予測されています。

市場ライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2032年: |

| 2023年評価: | 6億9,260万米ドル |

| 2032年予測: | 90億3,120万米ドル |

| CAGR | 33.02% |

EV向けSiC市場は成長段階にあり、SiC技術が電気モビリティ分野で示す魅力的な利点によって、急速な成長と変貌を遂げています。SiC技術のEVパワーエレクトロニクスへの統合は、車両性能に革命をもたらし、より速い加速、走行距離の延長、効率的なエネルギー利用を可能にし、最終的にはEV走行体験全体を向上させます。SiCの高周波能力は、高出力の急速充電ステーションに不可欠であり、充電インフラの拡張を加速し、EVの充電時間を短縮します。電気自動車メーカー、半導体企業、研究機関の協力がSiC技術の革新を推進し、継続的な進歩とコスト削減を実現しています。

用途別で見ると、トラクションインバーターの部門が優位を示す見通しです。自動車産業が持続可能性と効率に軸足を移す中、トラクションインバーターは技術革新の焦点として浮上しています。SiCを搭載したトラクションインバーターは、より優れたエネルギー効率、走行距離の延長、電池利用の最適化を約束し、EVエコシステムにおける極めて重要な懸念に対処します。

推進タイプ別では、BEVの部門が2022年の市場を独占しました。シリコンパワー半導体に対するSiCパワー半導体の利点は、電力損失の大幅な削減などであり、BEVでの材料利用を促進しています。SiCを統合したEVコンポーネントの市場開拓や、先進的な新型BEVモデルへの採用が、市場成長を後押しすると予想されています。

当レポートでは、世界のEV向けSiC (炭化ケイ素) の市場を調査し、産業の概要、技術ロードマップ、進行中のプログラム、需要促進要因および課題の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 市場

- 業界の展望

- 動向:現在と未来

- エコシステム/進行中のプログラム

- サプライチェーンネットワーク

- 技術ロードマップ

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業戦略

- 経営戦略

- 事業機会

- SiCのその他の用途

- エネルギー・電力

- 産業

- 電気通信

- その他

第2章 用途

- EV向けSiCの世界市場:用途と仕様

- 世界のEV向けSiC市場(用途別)

- 世界のEV向けSiC市場(車種別)

- 世界のEV向けSiC市場(推進方式別)

- EV向けSiC市場(用途別)- 需要分析

- EV向けSiC市場(用途別)

- EV向けSiC市場(車種別)

- EV向けSiC市場(推進タイプ別)

第3章 製品

- EV向けSiCの世界市場:製品と仕様

- 世界のEV向けSiC市場(製品別)

- 世界のEV向けSiC市場(電圧別)

- EV向けSiC市場(製品別)- 需要分析

- EV向けSiC市場(製品別)

- EV向けSiC市場(電圧別)

第4章 地域

- 北米

- 欧州

- 英国

- 中国

- アジア太平洋と日本

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 市場シェア分析

- 企業プロファイル

- Wolfspeed, Inc.

- Infineon Technologies

- Onsemi

- Coherent Corp. (旧 II-VI Incorporated)

- STMicroelectronics

- Robert Bosch GmbH

- ROHM CO., LTD.

- Microchip Technology Inc.

- Mitsubishi Electric

- Alpha and Omega Semiconductor

- Toshiba Corporation

- Littelfuse, Inc.

- GeneSiC Semiconductor

- Fuji Electric Co. Ltd.

- WeEn Semiconductors

- Solitron Devices, Inc.

第6章 調査手法

List of Figures

- Figure 1: Silicon Carbide (SiC) Market for Electric Vehicles Overview, Thousand Units, 2022-2032

- Figure 2: Silicon Carbide (SiC) Market for Electric Vehicles Overview, $Million, 2022-2032

- Figure 3: Silicon Carbide (SiC) Market for Electric Vehicles (by Vehicle Type), $Million, 2022-2032

- Figure 4: Silicon Carbide (SiC) Market for Electric Vehicles (by Propulsion Type), $Million, 2022-2032

- Figure 5: Silicon Carbide (SiC) Market for Electric Vehicles (by Application), $Million, 2022-2032

- Figure 6: Silicon Carbide (SiC) Market for Electric Vehicles (by Product), $Million, 2022-2032

- Figure 7: Silicon Carbide (SiC) Market for Electric Vehicles (by Voltage), $Million, 2022-2032

- Figure 8: Silicon Carbide (SiC) Market for Electric Vehicles (by Region), Value, $Million, 2022

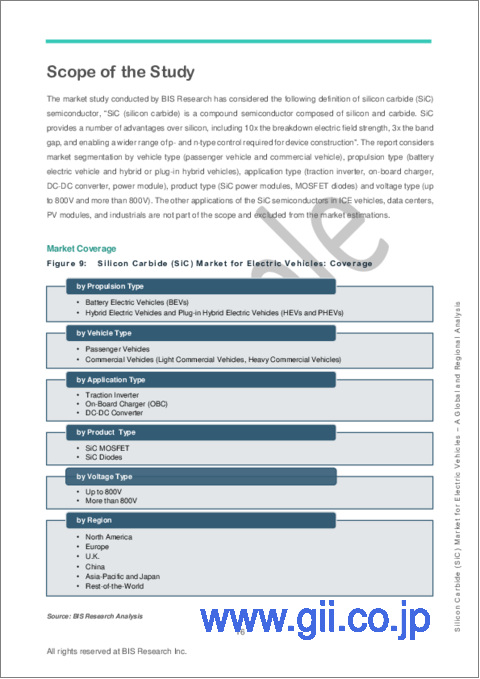

- Figure 9: Silicon Carbide (SiC) Market for Electric Vehicles: Coverage

- Figure 10: Sales of Electric Vehicles, Million Units, 2020-2022

- Figure 11: Supply Chain Network

- Figure 12: Technology Roadmap for Silicon Carbide (SiC) Market for Electric Vehicles

- Figure 13: Business Dynamics for Global SiC Market for Electric Vehicles

- Figure 14: Sales of Electric Vehicles, Million Units, 2020-2022

- Figure 15: Share of Key Market Strategies and Developments, January 2021-July 2023

- Figure 16: Share of Developments (by Company), January 2021-June 2023

- Figure 17: Silicon Carbide (SiC) Market for Electric Vehicle (Traction Inverter), $Million and Units, 2022-2032

- Figure 18: Silicon Carbide (SiC) Market for Electric Vehicle (On-Board Charger (OBC)), $Million and Units, 2022-2032

- Figure 19: Silicon Carbide (SiC) Market for Electric Vehicle (DC-DC Converter), $Million and Units, 2022-2032

- Figure 20: Silicon Carbide (SiC) Market for Electric Vehicle (Passenger Vehicles), $Million and Units, 2022-2032

- Figure 21: Silicon Carbide (SiC) Market for Electric Vehicle (Commercial Vehicles), $Million and Units, 2022-2032

- Figure 22: Silicon Carbide (SiC) Market for Electric Vehicle (Battery Electric Vehicles (BEVs)), $Million and Units, 2022-2032

- Figure 23: Silicon Carbide (SiC) Market for Electric Vehicle (HEVs and PHEVs), $Million and Units, 2022-2032

- Figure 24: Silicon Carbide (SiC) Market for Electric Vehicle (SiC MOSFETs), $Million and Units, 2022-2032

- Figure 25: Silicon Carbide (SiC) Market for Electric Vehicle (SiC Diodes), $Million and Units, 2022-2032

- Figure 26: Silicon Carbide (SiC) Market for Electric Vehicle (Up to 800V), $Million Units, 2022-2032

- Figure 27: Silicon Carbide (SiC) Market for Electric Vehicle (More than 800V), $Million Units, 2022-2032

- Figure 28: Competitive Benchmarking for Silicon Carbide (SiC) Market for Electric Vehicles (EVs)

- Figure 29: Wolfspeed, Inc.: R&D Expenditure

- Figure 30: Infineon Technologies.: R&D Expenditure

- Figure 31: Onsemi.: R&D Expenditure

- Figure 32: Coherent Corp.: R&D Expenditure

- Figure 33: STMicroelectronics.: R&D Expenditure

- Figure 34: Robert Bosch GmbH: R&D Expenditure

- Figure 35: ROHM CO., LTD.: R&D Expenditure

- Figure 36: Microchip Technology Inc.: R&D Expenditure

- Figure 37: Mitsubishi Electric: R&D Expenditure

- Figure 38: Alpha and Omega Semiconductor: R&D Expenditure

- Figure 39: Toshiba Corporation: R&D Expenditure

- Figure 40: Littelfuse, Inc.: R&D Expenditure

- Figure 41: Fuji Electric Co. Ltd.: R&D Expenditure

- Figure 42: Research Methodology

- Figure 43: Data Triangulation

- Figure 44: Top-Down and Bottom-Up Approach

- Figure 45: Assumptions and Limitations

List of Tables

- Table 1: Silicon Carbide (SiC) Market for Electric Vehicles Overview

- Table 2: Consortiums, Associations, and Regulatory Bodies

- Table 3: Key Product Developments, January 2021-June 2023

- Table 4: Key Market Developments, January 2021-June 2023

- Table 5: Key Partnerships, Collaborations, Acquisition, and Joint Ventures, January 2021-July 2023

- Table 6: Silicon Carbide (SiC) Market for Electric Vehicles (by Application), Units, 2022-2032

- Table 7: Silicon Carbide (SiC) Market for Electric Vehicles (by Application), $Million, 2022-2032

- Table 8: Silicon Carbide (SiC) Market for Electric Vehicles (by Vehicle Type), Units, 2022-2032

- Table 9: Silicon Carbide (SiC) Market for Electric Vehicles (by Vehicle Type), $Million, 2022-2032

- Table 10: Silicon Carbide (SiC) Market for Electric Vehicles (by Propulsion Type), Units, 2022-2032

- Table 11: Silicon Carbide (SiC) Market for Electric Vehicles (by Propulsion Type), $Million, 2022-2032

- Table 12: Silicon Carbide (SiC) Market for Electric Vehicles (by Product), Units, 2022-2032

- Table 13: Silicon Carbide (SiC) Market for Electric Vehicles (by Product), $Million, 2022-2032

- Table 14: Silicon Carbide (SiC) Market for Electric Vehicles (by Voltage), Units, 2022-2032

- Table 15: Silicon Carbide (SiC) Market for Electric Vehicles (by Voltage), $Million, 2022-2032

- Table 16: Silicon Carbide (SiC) Market for Electric Vehicles (by Region), Units, 2022-2032

- Table 17: Silicon Carbide (SiC) Market for Electric Vehicles (by Region), $Million, 2022-2032

- Table 18: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 19: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 20: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 21: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 22: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 23: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 24: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 25: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 26: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 27: North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 28: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 29: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 30: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 31: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 32: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 33: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 34: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 35: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 36: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 37: U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 38: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 39: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 40: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 41: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 42: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 43: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 44: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 45: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 46: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 47: Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 48: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 49: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 50: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 51: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 52: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 53: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 54: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 55: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 56: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 57: Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 58: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 59: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 60: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 61: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 62: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 63: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 64: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 65: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 66: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 67: Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 68: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 69: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 70: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 71: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 72: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 73: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 74: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 75: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 76: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 77: Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 78: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 79: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 80: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 81: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 82: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 83: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 84: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 85: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 86: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 87: France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 88: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 89: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 90: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 91: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 92: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 93: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 94: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 95: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 96: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 97: Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 98: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 99: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 100: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 101: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 102: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 103: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 104: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 105: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 106: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 107: Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 108: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 109: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 110: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 111: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 112: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 113: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 114: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 115: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 116: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 117: Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 118: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 119: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 120: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 121: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 122: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 123: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 124: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 125: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 126: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 127: U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 128: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 129: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 130: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 131: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 132: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 133: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 134: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 135: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 136: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 137: China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 138: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 139: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 140: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 141: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 142: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 143: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 144: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 145: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 146: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 147: Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 148: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 149: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 150: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 151: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 152: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 153: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 154: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 155: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 156: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 157: Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 158: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 159: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 160: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 161: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 162: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 163: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 164: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 165: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 166: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 167: South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 168: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 169: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 170: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 171: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 172: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 173: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 174: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 175: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 176: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 177: India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 178: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 179: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 180: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 181: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 182: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 183: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 184: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 185: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 186: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 187: Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 188: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Units, 2022-2032

- Table 189: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), $Million, 2022-2032

- Table 190: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Units, 2022-2032

- Table 191: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), $Million, 2022-2032

- Table 192: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Units, 2022-2032

- Table 193: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), $Million, 2022-2032

- Table 194: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Units, 2022-2032

- Table 195: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), $Million, 2022-2032

- Table 196: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Units, 2022-2032

- Table 197: Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), $Million, 2022-2032

- Table 198: Market Share Analysis: Silicon Carbide (SiC) Wafer Market

Silicon Carbide (SiC) Market for Electric Vehicles (EVs) Overview

The global silicon carbide (SiC) market for electric vehicles is projected to reach $9,031.2 million by 2032 from $513.0 million in 2022, growing at a CAGR of 33.02% during the forecast period 2023-2032. The growth in the silicon carbide (SiC) market for electric vehicles (EVs) is expected to be driven by the superior properties of silicon carbide (SiC) material as compared to silicon, growth in the demand for electric vehicles, and increasing investment toward enhancing SiC manufacturing capacity.

Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $692.6 Million |

| 2032 Forecast | $9,031.2 Million |

| CAGR | 33.02% |

The silicon carbide (SiC) market for electric vehicles (EVs) is in a growth phase. The silicon carbide (SiC) market for electric vehicles is experiencing rapid growth and transformation, driven by the compelling advantages that SiC technology offers to the electric mobility sector. SiC, a semiconductor material with superior properties compared to traditional silicon, is revolutionizing the power electronics landscape in EVs. Silicon carbide (SiC) technology's integration into EV power electronics is revolutionizing vehicle performance, enabling faster acceleration, extended range, and efficient energy usage, ultimately enhancing the overall EV driving experience. Silicon carbide (SiC)'s high-frequency capabilities are vital for high-power, fast-charging stations, accelerating the expansion of charging infrastructure and reducing charging times for electric vehicles. Collaborations between electric vehicle manufacturers, semiconductor companies, and research institutions are driving innovation in SiC technology, resulting in continuous advancements and cost reductions. However, silicon carbide currently comes at a higher cost compared to traditional silicon-based components, impacting its widespread adoption. Scaling up silicon carbide (SiC) production to meet the growing demand from the EV market remains a challenge, requiring further investments in manufacturing capabilities and supply chain optimization. Therefore, addressing cost challenges and expanding manufacturing capabilities is expected to be crucial for companies in realizing silicon carbide (SiC)'s full potential in shaping the electric vehicle landscape.

Impact

The silicon carbide (SiC) market for electric vehicles (EVs) is driven by several factors, such as the benefits of silicon carbide (SiC) material over silicon, growing electric vehicle sales, and growing investment toward encouraging SiC manufacturing capacity by the SiC manufacturers.

Silicon carbide (SiC) manufacturers are partnering with other key stakeholders and investing significantly toward the development of improved silicon carbide (SiC) materials with enhanced properties to mitigate the growing need for advanced power electronics in electric vehicles. With growing efforts by electric vehicle original equipment manufacturers (OEMs) toward improving their electric vehicle offerings, the silicon carbide (SiC) market for electric vehicles (EVs) is expected to grow significantly during the forecast years.

Market Segmentation:

Segmentation 1: by Application

- Traction Inverter

- On-Board Charger (OBC)

- DC-DC Converter

The traction inverter application type segment is poised to assert its dominance in the silicon carbide (SiC) market for electric vehicles. As the automotive landscape pivots toward sustainability and efficiency, the traction inverter segment emerges as a focal point for innovation. SiC-equipped traction inverters hold the promise of better energy efficiency, extended driving ranges, and optimized battery utilization, addressing pivotal concerns in the EV ecosystem.

Segmentation 2: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Based on vehicle type, the passenger vehicle segment accounted for a majority stake in the silicon carbide (SiC) market for electric vehicles (EVs) in 2022. Production and sales of passenger electric vehicles are anticipated to be higher than that of commercial vehicles, as more users are rapidly adopting EVs and replacing their IC engine vehicles with EVs due to their cost efficiency and various government subsidies, among others.

Segmentation 3: by Propulsion Type

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs)

Of the two defined propulsion categories, the battery electric vehicles (BEVs) category dominated the silicon carbide (SiC) market for electric vehicles (EVs) in 2022. The advantages of silicon carbide (SiC) power semiconductors over silicon power semiconductors, such as significant reduction in power losses, are driving the usage of materials in BEVs. The developments of EV components with the integration of SiC and the use of such components in advanced new BEV models are expected to support the market growth.

Segmentation 4: by Product

- SiC MOSFETs

- SiC Diodes

Based on products, the silicon carbide (SiC) market for electric vehicles has been categorized into SiC MOSFETs and SiC diodes. Of the two product categories, the SiC MOSFETs segment dominated the global silicon carbide (SiC) market for electric vehicles (EVs) in 2022. SiC MOSFETs product type is widely used in the silicon carbide (SiC) market for electric vehicles. The unique characteristics of SiC, including high breakdown voltage, low on-resistance, and superior thermal conductivity, translate into MOSFETs that excel in high-power, high-temperature environments. This makes them particularly well-suited for the rigorous demands of EV power electronics.

Segmentation 5: by Voltage

- Up to 800V

- More than 800V

Based on voltage, the up to 800 V voltage segment offers a well-balanced solution that caters to the requirements of modern electric vehicles. This voltage range enables EV manufacturers to design compact and lightweight power electronics systems, which are essential for enhancing vehicle range and overall performance. Furthermore, the up to 800 V voltage type allows for effective integration of SiC components, resulting in reduced switching losses and increased overall efficiency.

Segmentation 6: by Region

- North America

- Europe

- U.K.

- China

- Asia-Pacific and Japan (AP&J)

- Rest-of-the-World (RoW)

The demand within the silicon carbide (SiC) market for electric vehicles varies according to various geographical regions. China is expected to dominate the global silicon carbide (SiC) market for electric vehicles as the region has witnessed significant growth in the electric vehicle industry, driven by supportive government policies, increasing environmental concerns, and advancements in technology. China's government support, research investments, and partnerships with silicon carbide (SiC) manufacturers have accelerated the development and implementation of this cutting-edge technology within the electric vehicle ecosystem. Moreover, China's well-established supply chain infrastructure and robust manufacturing capabilities provide a competitive edge in SiC production, contributing to cost reductions and scalability.

Recent Developments in the Silicon Carbide (SiC) Market for Electric Vehicles (EVs)

- In June 2023, Infineon Technologies launched 1200 V CoolSiC MOSFETs in TO263-7 for automotive applications. In on-board charging (OBC) and DC-DC applications, the automotive-grade silicon carbide (SiC) MOSFET generation delivers great power density and efficiency, permits bi-directional charging, and dramatically lowers system cost.

- In April 2023, Wolfspeed, Inc. announced that it would provide silicon carbide devices to power future Mercedes-Benz electric vehicle (EV) platforms, enabling higher powertrain efficiency. The next-generation powertrain systems for numerous Mercedes-Benz vehicle lines would include semiconductors from Wolfspeed, Inc.

- In March 2023, Mitsubishi Electric announced that it would be investing $1.87 billion in the coming five years to boost the production capacity of silicon carbide (SiC) power semiconductors. The investment would be used to construct a new wafer plant.

- In February 2023, Microchip Technology Inc. announced that it would be investing $880 million in the upcoming years in order to increase its SiC and silicon production capacity.

- In January 2023, Wolfspeed, Inc. and ZF established a strategic alliance to enhance silicon carbide systems and devices for mobility, industry, and energy applications. This agreement would entail the establishment of a collaborative innovation lab. The cooperation also includes a sizable investment by ZF to enable the development of the largest and most sophisticated 200mm silicon carbide device fab in the world in Ensdorf, Germany.

- In August 2022, Onsemi inaugurated its new silicon carbide (SiC) production facility in New Hampshire, U.S. The new facility would increase the company's SiC production capacity, which would help in catering to the growing demand.

Demand - Drivers and Limitations

The following are the demand drivers for the silicon carbide (SiC) market for electric vehicles (EVs):

- Superior Properties of Silicon Carbide Compared to Silicon

- Growth in the Demand for Electric Vehicles

- Increasing Investment toward Enhancing SiC Manufacturing Capacity

The following are the challenges for the silicon carbide (SiC) market for electric vehicles (EVs):

- Higher Manufacturing Cost Associated with SiC Semiconductors

- Limitation of Producing Large-Diameter SiC Wafers

How can this report add value to an organization?

- Product/Innovation Strategy: Globally, the leading and emerging silicon carbide (SiC) manufacturers are continuously working to make their SiC offerings more power-efficient than ever. High SiC device cost and low yield are among some of the major concerns among the silicon carbide (SiC) manufacturers in the silicon carbide (SiC) industry for electric vehicles (EVs). The players operating in the silicon carbide (SiC) market for electric vehicles (EVs) have been working on the development of improved silicon carbide (SiC) to mitigate the growing challenges associated with yield numbers and device costs.

- Growth/Marketing Strategy: The silicon carbide (SiC) market for electric vehicles (EVs) has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are product launches, partnerships, collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include market developments and partnerships, collaborations, acquisitions, and joint ventures.

- Competitive Strategy: The key players in the silicon carbide (SiC) market for electric vehicles (EVs) analyzed and profiled in the study include silicon carbide (SiC) manufacturers that design, develop and market silicon carbide (SiC) materials for electric vehicles (EVs). Moreover, a detailed competitive benchmarking of the players operating in the silicon carbide (SiC) market for electric vehicles (EVs) has been done to help the reader understand the ways in which players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

The global silicon carbide (SiC) market for electric vehicles (EVs) is highly consolidated, where the top two manufacturers alone accounted for around 70% of the market share in 2022, while the remaining companies operating in the market captured around 30% of the market share.

Key Companies Profiled:

|

|

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Trends: Current and Future

- 1.1.1.1 Growing Numbers of Electric Vehicles Worldwide

- 1.1.1.2 Surge in Investments and Funding in Silicon Carbide (SiC) Manufacturing for Electric Vehicles

- 1.1.1.3 Rapid Technological Advancements in Wide-Bandgap Power Semiconductors

- 1.1.2 Ecosystem/Ongoing Programs

- 1.1.2.1 Consortiums, Associations, and Regulatory Bodies

- 1.1.3 Supply Chain Network

- 1.1.4 Technology Roadmap

- 1.1.1 Trends: Current and Future

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Superior Properties of Silicon Carbide Compared to Silicon

- 1.2.1.2 Growth in the Demand for Electric Vehicles

- 1.2.1.3 Increasing Investment toward Enhancing SiC Manufacturing Capacity

- 1.2.2 Business Challenges

- 1.2.2.1 Higher Manufacturing Cost Associated with SiC Semiconductors

- 1.2.2.2 Limitation of Producing Large-Diameter SiC Wafers

- 1.2.3 Business Strategies

- 1.2.3.1 Product Developments

- 1.2.3.2 Market Developments

- 1.2.4 Corporate Strategies

- 1.2.5 Business Opportunities

- 1.2.5.1 Development of Autonomous Vehicles

- 1.2.1 Business Drivers

- 1.3 Other Applications of the Silicon Carbide (SiC)

- 1.3.1 Energy and Power

- 1.3.2 Industrial

- 1.3.3 Telecommunications

- 1.3.4 Others

- 1.3.4.1 Aerospace Industry

- 1.3.4.2 Medical Industry

2 Applications

- 2.1 Global Silicon Carbide (SiC) Market for Electric Vehicles - Applications and Specifications

- 2.1.1 Global Silicon Carbide (SiC) Market for Electric Vehicles (by Application)

- 2.1.1.1 Traction Inverter

- 2.1.1.2 On-Board Charger (OBC)

- 2.1.1.3 DC-DC Converter

- 2.1.2 Global Silicon Carbide (SiC) Market for Electric Vehicles (by Vehicle Type)

- 2.1.2.1 Passenger Vehicles

- 2.1.2.2 Commercial Vehicles

- 2.1.3 Global Silicon Carbide (SiC) Market for Electric Vehicles (by Propulsion Type)

- 2.1.3.1 Battery Electric Vehicles (BEVs)

- 2.1.3.2 Hybrid Electric Vehicles and Plug-in Hybrid Electric Vehicles (HEVs and PHEVs)

- 2.1.1 Global Silicon Carbide (SiC) Market for Electric Vehicles (by Application)

- 2.2 Silicon Carbide (SiC) Market for Electric Vehicles (by Application) - Demand Analysis

- 2.2.1 Silicon Carbide (SiC) Market for Electric Vehicles (by Application), Volume and Value Data

- 2.2.1.1 Traction Inverter

- 2.2.1.2 On-Board Charger (OBC)

- 2.2.1.3 DC-DC Converter

- 2.2.2 Silicon Carbide (SiC) Market for Electric Vehicles (by Vehicle Type), Volume and Value Data

- 2.2.2.1 Passenger Vehicles

- 2.2.2.2 Commercial Vehicles

- 2.2.3 Silicon Carbide (SiC) Market for Electric Vehicles (by Propulsion Type), Volume and Value Data

- 2.2.3.1 Battery Electric Vehicles (BEVs)

- 2.2.3.2 Hybrid Electric Vehicles and Plug-in Hybrid Electric Vehicles (HEVs and PHEVs)

- 2.2.1 Silicon Carbide (SiC) Market for Electric Vehicles (by Application), Volume and Value Data

3 Products

- 3.1 Global Silicon Carbide (SiC) Market for Electric Vehicles - Products and Specifications

- 3.1.1 Global Silicon Carbide (SiC) Market for Electric Vehicles (by Product)

- 3.1.1.1 SiC MOSFETs

- 3.1.1.2 SiC Diodes

- 3.1.2 Global Silicon Carbide (SiC) Market for Electric Vehicles (by Voltage)

- 3.1.2.1 Up to 800V

- 3.1.2.2 More than 800V

- 3.1.1 Global Silicon Carbide (SiC) Market for Electric Vehicles (by Product)

- 3.2 Silicon Carbide (SiC) Market for Electric Vehicles (by Product) - Demand Analysis

- 3.2.1 Silicon Carbide (SiC) Market for Electric Vehicles (by Product), Volume and Value Data

- 3.2.1.1 SiC MOSFETs

- 3.2.1.2 SiC Diodes

- 3.2.2 Silicon Carbide (SiC) Market for Electric Vehicles (by Voltage), Volume and Value Data

- 3.2.2.1 Up to 800V

- 3.2.2.2 More than 800V

- 3.2.1 Silicon Carbide (SiC) Market for Electric Vehicles (by Product), Volume and Value Data

4 Regions

- 4.1 North America

- 4.1.1 Market

- 4.1.1.1 Buyer Attributes

- 4.1.1.2 Key Manufacturers/Suppliers in North America

- 4.1.1.3 Business Challenges

- 4.1.1.4 Business Drivers

- 4.1.2 Application

- 4.1.2.1 North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.1.2.2 North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.1.2.3 North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.1.3 Product

- 4.1.3.1 North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.1.3.2 North America Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.1.4 North America: Country-Level Analysis

- 4.1.4.1 U.S.

- 4.1.4.1.1 Market

- 4.1.4.1.1.1 Buyer Attributes

- 4.1.4.1.1.2 Key Manufacturers/Suppliers in the U.S.

- 4.1.4.1.1.3 Business Challenges

- 4.1.4.1.1.4 Business Drivers

- 4.1.4.1.2 Application

- 4.1.4.1.2.1 U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.1.4.1.2.2 U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.1.4.1.2.3 U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.1.4.1.3 Product

- 4.1.4.1.3.1 U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.1.4.1.3.2 U.S. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.1.4.1.1 Market

- 4.1.4.2 Canada

- 4.1.4.2.1 Market

- 4.1.4.2.1.1 Buyer Attributes

- 4.1.4.2.1.2 Key Manufacturers/Suppliers in Canada

- 4.1.4.2.1.3 Business Challenges

- 4.1.4.2.1.4 Business Drivers

- 4.1.4.2.2 Application

- 4.1.4.2.2.1 Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.1.4.2.2.2 Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.1.4.2.2.3 Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.1.4.2.3 Product

- 4.1.4.2.3.1 Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.1.4.2.3.2 Canada Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.1.4.2.1 Market

- 4.1.4.3 Mexico

- 4.1.4.3.1 Market

- 4.1.4.3.1.1 Buyer Attributes

- 4.1.4.3.1.2 Key Manufacturers/Suppliers in Mexico

- 4.1.4.3.1.3 Business Challenges

- 4.1.4.3.1.4 Business Drivers

- 4.1.4.3.2 Application

- 4.1.4.3.2.1 Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.1.4.3.2.2 Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.1.4.3.2.3 Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.1.4.3.3 Product

- 4.1.4.3.3.1 Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.1.4.3.3.2 Mexico Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.1.4.3.1 Market

- 4.1.4.1 U.S.

- 4.1.1 Market

- 4.2 Europe

- 4.2.1 Market

- 4.2.1.1 Buyer Attributes

- 4.2.1.2 Key Manufacturers/Suppliers in Europe

- 4.2.1.3 Business Challenges

- 4.2.1.4 Business Drivers

- 4.2.2 Application

- 4.2.2.1 Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.2.2.2 Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.2.2.3 Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.2.3 Product

- 4.2.3.1 Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.2.3.2 Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.2.4 Europe: Country-Level Analysis

- 4.2.4.1 Germany

- 4.2.4.1.1 Market

- 4.2.4.1.1.1 Buyer Attributes

- 4.2.4.1.1.2 Key Manufacturers/Suppliers in Germany

- 4.2.4.1.1.3 Business Challenges

- 4.2.4.1.1.4 Business Drivers

- 4.2.4.1.2 Application

- 4.2.4.1.2.1 Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.2.4.1.2.2 Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.2.4.1.2.3 Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.2.4.1.3 Product

- 4.2.4.1.3.1 Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Produc), Volume and Value Data

- 4.2.4.1.3.2 Germany Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.2.4.1.1 Market

- 4.2.4.2 France

- 4.2.4.2.1 Market

- 4.2.4.2.1.1 Buyer Attributes

- 4.2.4.2.1.2 Key Manufacturers/Suppliers in France

- 4.2.4.2.1.3 Business Challenges

- 4.2.4.2.1.4 Business Drivers

- 4.2.4.2.2 Application

- 4.2.4.2.2.1 France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.2.4.2.2.2 France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.2.4.2.2.3 France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.2.4.2.3 Product

- 4.2.4.2.3.1 France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.2.4.2.3.2 France Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.2.4.2.1 Market

- 4.2.4.3 Italy

- 4.2.4.3.1 Market

- 4.2.4.3.1.1 Buyer Attributes

- 4.2.4.3.1.2 Key Manufacturers/Suppliers in Italy

- 4.2.4.3.1.3 Business Challenges

- 4.2.4.3.1.4 Business Drivers

- 4.2.4.3.2 Application

- 4.2.4.3.2.1 Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.2.4.3.2.2 Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.2.4.3.2.3 Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.2.4.3.3 Product

- 4.2.4.3.3.1 Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.2.4.3.3.2 Italy Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.2.4.3.1 Market

- 4.2.4.4 Spain

- 4.2.4.4.1 Market

- 4.2.4.4.1.1 Buyer Attributes

- 4.2.4.4.1.2 Key Manufacturers/Suppliers in Spain

- 4.2.4.4.1.3 Business Challenges

- 4.2.4.4.1.4 Business Drivers

- 4.2.4.4.2 Application

- 4.2.4.4.2.1 Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.2.4.4.2.2 Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.2.4.4.2.3 Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.2.4.4.3 Product

- 4.2.4.4.3.1 Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.2.4.4.3.2 Spain Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.2.4.4.1 Market

- 4.2.4.5 Rest-of-Europe

- 4.2.4.5.1 Market

- 4.2.4.5.1.1 Buyer Attributes

- 4.2.4.5.1.2 Key Manufacturers/Suppliers in Rest-of-Europe

- 4.2.4.5.1.3 Business Challenges

- 4.2.4.5.1.4 Business Drivers

- 4.2.4.5.2 Application

- 4.2.4.5.2.1 Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.2.4.5.2.2 Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.2.4.5.2.3 Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.2.4.5.3 Product

- 4.2.4.5.3.1 Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.2.4.5.3.2 Rest-of-Europe Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.2.4.5.1 Market

- 4.2.4.1 Germany

- 4.2.1 Market

- 4.3 U.K.

- 4.3.1 Market

- 4.3.1.1 Buyer Attributes

- 4.3.1.2 Key Manufacturers/Suppliers in the U.K.

- 4.3.1.3 Business Challenges

- 4.3.1.4 Business Drivers

- 4.3.2 Application

- 4.3.2.1 U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.3.2.2 U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.3.2.3 U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.3.3 Product

- 4.3.3.1 U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.3.3.2 U.K. Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.3.1 Market

- 4.4 China

- 4.4.1 Market

- 4.4.1.1 Buyer Attributes

- 4.4.1.2 Key Manufacturers/Suppliers in China

- 4.4.1.3 Business Challenges

- 4.4.1.4 Business Drivers

- 4.4.2 Application

- 4.4.2.1 China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.4.2.2 China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.4.2.3 China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.4.3 Product

- 4.4.3.1 China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.4.3.2 China Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.4.1 Market

- 4.5 Asia-Pacific and Japan

- 4.5.1 Market

- 4.5.1.1 Buyer Attributes

- 4.5.1.2 Key Manufacturers/Suppliers in Asia-Pacific and Japan

- 4.5.1.3 Business Challenges

- 4.5.1.4 Business Drivers

- 4.5.2 Application

- 4.5.2.1 Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.5.2.2 Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.5.2.3 Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.5.3 Product

- 4.5.3.1 Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.5.3.2 Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.5.4 Asia-Pacific and Japan: Country-Level Analysis

- 4.5.4.1 Japan

- 4.5.4.1.1 Market

- 4.5.4.1.1.1 Buyer Attributes

- 4.5.4.1.1.2 Key Manufacturers/Suppliers in Japan

- 4.5.4.1.1.3 Business Challenges

- 4.5.4.1.1.4 Business Drivers

- 4.5.4.1.2 Application

- 4.5.4.1.2.1 Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.5.4.1.2.2 Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.5.4.1.2.3 Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.5.4.1.3 Product

- 4.5.4.1.3.1 Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.5.4.1.3.2 Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.5.4.1.1 Market

- 4.5.4.2 South Korea

- 4.5.4.2.1 Market

- 4.5.4.2.1.1 Buyer Attributes

- 4.5.4.2.1.2 Key Manufacturers/Suppliers in South Korea

- 4.5.4.2.1.3 Business Challenges

- 4.5.4.2.1.4 Business Drivers

- 4.5.4.2.2 Application

- 4.5.4.2.2.1 South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.5.4.2.2.2 South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.5.4.2.2.3 South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.5.4.2.3 Product

- 4.5.4.2.3.1 South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.5.4.2.3.2 South Korea Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.5.4.2.1 Market

- 4.5.4.3 India

- 4.5.4.3.1 Market

- 4.5.4.3.1.1 Buyer Attributes

- 4.5.4.3.1.2 Key Manufacturers/Suppliers in India

- 4.5.4.3.1.3 Business Challenges

- 4.5.4.3.1.4 Business Drivers

- 4.5.4.3.2 Application

- 4.5.4.3.2.1 India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.5.4.3.2.2 India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.5.4.3.2.3 India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.5.4.3.3 Product

- 4.5.4.3.3.1 India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.5.4.3.3.2 India Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.5.4.3.1 Market

- 4.5.4.4 Rest-of-Asia-Pacific and Japan

- 4.5.4.4.1 Market

- 4.5.4.4.1.1 Buyer Attributes

- 4.5.4.4.1.2 Key Manufacturers/Suppliers in Rest-of-Asia-Pacific and Japan

- 4.5.4.4.1.3 Business Challenges

- 4.5.4.4.1.4 Business Drivers

- 4.5.4.4.2 Application

- 4.5.4.4.2.1 Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.5.4.4.2.2 Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.5.4.4.2.3 Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.5.4.4.3 Product

- 4.5.4.4.3.1 Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.5.4.4.3.2 Rest-of-Asia-Pacific and Japan Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.5.4.4.1 Market

- 4.5.4.1 Japan

- 4.5.1 Market

- 4.6 Rest-of-the-World

- 4.6.1 Market

- 4.6.1.1 Buyer Attributes

- 4.6.1.2 Key Manufacturers/Suppliers in Rest-of-the-World

- 4.6.1.3 Business Challenges

- 4.6.1.4 Business Drivers

- 4.6.2 Application

- 4.6.2.1 Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Application), Volume and Value Data

- 4.6.2.2 Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Vehicle Type), Volume and Value Data

- 4.6.2.3 Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Propulsion Type), Volume and Value Data

- 4.6.3 Product

- 4.6.3.1 Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Product), Volume and Value Data

- 4.6.3.2 Rest-of-the-World Silicon Carbide (SiC) Market for Electric Vehicles (EVs) (by Voltage), Volume and Value Data

- 4.6.1 Market

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Competitive Benchmarking

- 5.2 Market Share Analysis

- 5.2.1 Market Share Analysis: Silicon Carbide (SiC) Wafer Market

- 5.3 Company Profiles

- 5.3.1 Wolfspeed, Inc.

- 5.3.1.1 Company Overview

- 5.3.1.1.1 Role of Wolfspeed, Inc. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.1.1.1.1 Product Portfolio

- 5.3.1.1.2 Production Sites

- 5.3.1.1.3 R&D Analysis

- 5.3.1.1.4 Business Strategies

- 5.3.1.1.4.1 Market Development

- 5.3.1.1.5 Corporate Strategies

- 5.3.1.1.5.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 5.3.1.1.6 Analyst View

- 5.3.1.1.1 Role of Wolfspeed, Inc. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.1.1 Company Overview

- 5.3.2 Infineon Technologies

- 5.3.2.1 Company Overview

- 5.3.2.1.1 Role of Infineon Technologies in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.2.1.1.1 Product Portfolio

- 5.3.2.1.2 R&D Analysis

- 5.3.2.1.3 Business Strategies

- 5.3.2.1.3.1 Product Development

- 5.3.2.1.4 Corporate Strategies

- 5.3.2.1.4.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 5.3.2.1.5 Analyst View

- 5.3.2.1.1 Role of Infineon Technologies in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.2.1 Company Overview

- 5.3.3 Onsemi

- 5.3.3.1 Company Overview

- 5.3.3.1.1 Role of Onsemi in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.3.1.1.1 Product Portfolio

- 5.3.3.1.2 R&D Analysis

- 5.3.3.1.3 Business Strategies

- 5.3.3.1.3.1 Market Development

- 5.3.3.1.4 Corporate Strategies

- 5.3.3.1.4.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 5.3.3.1.5 Analyst View

- 5.3.3.1.1 Role of Onsemi in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.3.1 Company Overview

- 5.3.4 Coherent Corp. (previously known as II-VI Incorporated)

- 5.3.4.1 Company Overview

- 5.3.4.1.1 Role of Coherent Corp. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.4.1.1.1 Product Portfolio

- 5.3.4.1.2 R&D Analysis

- 5.3.4.1.3 Corporate Strategies

- 5.3.4.1.3.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 5.3.4.1.4 Analyst View

- 5.3.4.1.1 Role of Coherent Corp. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.4.1 Company Overview

- 5.3.5 STMicroelectronics

- 5.3.5.1 Company Overview

- 5.3.5.1.1 Role of STMicroelectronics in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.5.1.1.1 Product Portfolio

- 5.3.5.1.2 R&D Analysis

- 5.3.5.1.3 Business Strategies

- 5.3.5.1.3.1 Market Development

- 5.3.5.1.4 Corporate Strategies

- 5.3.5.1.4.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 5.3.5.1.5 Analyst View

- 5.3.5.1.1 Role of STMicroelectronics in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.5.1 Company Overview

- 5.3.6 Robert Bosch GmbH

- 5.3.6.1 Company Overview

- 5.3.6.1.1 Role of Robert Bosch GmbH in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.6.1.1.1 Product Portfolio

- 5.3.6.1.2 R&D Analysis

- 5.3.6.1.3 Business Strategies

- 5.3.6.1.3.1 Market Development

- 5.3.6.1.4 Corporate Strategies

- 5.3.6.1.4.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 5.3.6.1.5 Analyst View

- 5.3.6.1.1 Role of Robert Bosch GmbH in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.6.1 Company Overview

- 5.3.7 ROHM CO., LTD.

- 5.3.7.1 Company Overview

- 5.3.7.1.1 Role of ROHM CO., LTD. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.7.1.1.1 Product Portfolio

- 5.3.7.1.2 R&D Analysis

- 5.3.7.1.3 Production Sites

- 5.3.7.1.4 Corporate Strategies

- 5.3.7.1.4.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 5.3.7.1.5 Analyst View

- 5.3.7.1.1 Role of ROHM CO., LTD. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.7.1 Company Overview

- 5.3.8 Microchip Technology Inc.

- 5.3.8.1 Company Overview

- 5.3.8.1.1 Role of Microchip Technology Inc. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.8.1.1.1 Product Portfolio

- 5.3.8.1.2 R&D Analysis

- 5.3.8.1.3 Business Strategies

- 5.3.8.1.3.1 Market Development

- 5.3.8.1.4 Analyst View

- 5.3.8.1.1 Role of Microchip Technology Inc. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.8.1 Company Overview

- 5.3.9 Mitsubishi Electric

- 5.3.9.1 Company Overview

- 5.3.9.1.1 Role of Mitsubishi Electric in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.9.1.1.1 Product Portfolio

- 5.3.9.1.2 R&D Analysis

- 5.3.9.1.3 Business Strategies

- 5.3.9.1.3.1 Market Development

- 5.3.9.1.4 Corporate Strategies

- 5.3.9.1.4.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 5.3.9.1.5 Analyst View

- 5.3.9.1.1 Role of Mitsubishi Electric in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.9.1 Company Overview

- 5.3.10 Alpha and Omega Semiconductor

- 5.3.10.1 Company Overview

- 5.3.10.1.1 Role of Alpha and Omega Semiconductor in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.10.1.1.1 Product Portfolio

- 5.3.10.1.2 R&D Analysis

- 5.3.10.1.3 Business Strategies

- 5.3.10.1.3.1 Market Development

- 5.3.10.1.4 Analyst View

- 5.3.10.1.1 Role of Alpha and Omega Semiconductor in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.10.1 Company Overview

- 5.3.11 Toshiba Corporation

- 5.3.11.1 Company Overview

- 5.3.11.1.1 Role of Toshiba Corporation in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.11.1.1.1 Product Portfolio

- 5.3.11.1.2 R&D Analysis

- 5.3.11.1.3 Business Strategies

- 5.3.11.1.3.1 Market Development

- 5.3.11.1.4 Analyst View

- 5.3.11.1.1 Role of Toshiba Corporation in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.11.1 Company Overview

- 5.3.12 Littelfuse, Inc.

- 5.3.12.1 Company Overview

- 5.3.12.1.1 Role of Littelfuse, Inc. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.12.1.1.1 Product Portfolio

- 5.3.12.1.2 Production Sites

- 5.3.12.1.3 R&D Analysis

- 5.3.12.1.4 Business Strategies

- 5.3.12.1.4.1 Market Development

- 5.3.12.1.5 Analyst View

- 5.3.12.1.1 Role of Littelfuse, Inc. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.12.1 Company Overview

- 5.3.13 GeneSiC Semiconductor

- 5.3.13.1 Company Overview

- 5.3.13.1.1 Role of GeneSiC in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.13.1.1.1 Product Portfolio

- 5.3.13.1.2 Analyst View

- 5.3.13.1.1 Role of GeneSiC in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.13.1 Company Overview

- 5.3.14 Fuji Electric Co. Ltd.

- 5.3.14.1 Company Overview

- 5.3.14.1.1 Role of Fuji Electric Co. Ltd in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.14.1.1.1 Product Portfolio

- 5.3.14.1.2 R&D Analysis

- 5.3.14.1.3 Business Strategies

- 5.3.14.1.3.1 Market Development

- 5.3.14.1.4 Analyst View

- 5.3.14.1.1 Role of Fuji Electric Co. Ltd in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.14.1 Company Overview

- 5.3.15 WeEn Semiconductors

- 5.3.15.1 Company Overview

- 5.3.15.1.1 Role of WeEn Semiconductors in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.15.1.1.1 Product Portfolio

- 5.3.15.1.2 Analyst View

- 5.3.15.1.1 Role of WeEn Semiconductors in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.15.1 Company Overview

- 5.3.16 Solitron Devices, Inc.

- 5.3.16.1 Company Overview

- 5.3.16.1.1 Role of Solitron Devices, Inc. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.16.1.1.1 Product Portfolio

- 5.3.16.1.2 Business Strategies

- 5.3.16.1.2.1 Market Development

- 5.3.16.1.3 Analyst View

- 5.3.16.1.1 Role of Solitron Devices, Inc. in the Silicon Carbide (SiC) Market for Electric Vehicles

- 5.3.16.1 Company Overview

- 5.3.1 Wolfspeed, Inc.

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.2 Data Triangulation

- 6.3 Market Estimation and Forecast

- 6.3.1 Factors for Data Prediction and Modeling