|

|

市場調査レポート

商品コード

1420457

健康&衛生包装の世界市場 (~2028年):製品タイプ (フィルム&シート・ラミネート・バッグ&パウチ・ボトル&ジャー・小袋・ラベル・チューブ・箱&カートン) ・形態・出荷形態・構造・最終用途産業・地域別Health & Hygiene Packaging Market by Product Type (Films & Sheets, Laminates, Bags & Pouches, Bottles & Jars, Sachets, Labels, Tubes, Boxes & Carton), Form, Shipping Form, Structure, End-user Industry, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 健康&衛生包装の世界市場 (~2028年):製品タイプ (フィルム&シート・ラミネート・バッグ&パウチ・ボトル&ジャー・小袋・ラベル・チューブ・箱&カートン) ・形態・出荷形態・構造・最終用途産業・地域別 |

|

出版日: 2024年01月29日

発行: MarketsandMarkets

ページ情報: 英文 257 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 数量 (メートル)・金額 (米ドル) |

| セグメント | 製品タイプ・出荷形態・フォーム・流通チャネル・最終用途産業・地域 |

| 対象地域 | 北米・アジア太平洋・欧州・中東&アフリカ・南米 |

健康&衛生包装の市場規模は、2023年の1,109億米ドルから、予測期間中は5.9%のCAGRで推移し、2028年には1,480億米ドルに達すると予測されています。

健康&衛生包装の需要の増加は、個人の健康や衛生基準に関する世界的な意識の高まりが原動力となっています。健康志向のライフスタイルの急増は、安全性と清潔さを保持する包装ソリューションの必要性を高めています。さらに、厳しい衛生習慣を重視する規制は、フィルム&シート、ボトル&ジャー、チューブなどの包装形態に対する需要の高まりに寄与しています。

形態別では、軟質包装の部門が予測期間中に最大のCAGRを示す見通しです。フィルムやパウチなどのプラスチック製軟質包装製品は、ケチャップ、石鹸、洗剤、チョコレート、スナック菓子、ナムキーンキャンディなど、さまざまな製品の包装に使用されています。軟質プラスチック包装市場は、食品の安全性の維持から保存期間の延長、病原菌や熱などの外部要因からのバリア保護まで、さまざまな機能を提供し、硬質プラスチック包装よりも高いペースで拡大しています。

地域別では、アジア太平洋地域が予測期間中、最大のCAGRで成長すると予測されています。同地域は、軟質包装市場で最も急速な成長を示しています。特にインド、中国、日本は、継続的な開発活動と迅速な経済の拡大により、成長が見込まれています。さらに、これらの国々では都市化の進展により、食品・飲料やFMCG製品の顧客層が拡大しており、予測期間中の市場成長に大きく寄与しています。

当レポートでは、世界の健康&衛生包装の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- 特許分析

- エコシステムマッピング

- 技術分析

- 関税と規制状況

- 貿易分析

- マクロ経済指標

- 顧客のビジネスに影響を与える動向/ディスラプション

- 主な会議とイベント

- ケーススタディ分析

- 主なステークホルダーと購入基準

- 価格分析

第6章 健康&衛生包装市場:製品タイプ別

- フィルム&シート

- バッグ&パウチ

- ラミネート

- ラベル

- ボトル・ジャー

- 小袋

- ボックス・カートン

- チューブ

- その他

第7章 健康&衛生包装市場:形態別

- 硬質包装

- 成形

- 押し出し

- その他

- 軟質包装

- 単層

- 多層

第8章 健康&衛生包装市場:出荷形態別

- 一次包装

- 二次包装

- 三次包装

第9章 健康&衛生包装市場:構造別

- 非多孔質

- 多孔質

第10章 健康&衛生包装市場:流通チャネル別

- スーパーマーケット・スーパーマーケット

- オンライン小売

- 直接販売

第11章 健康&衛生包装市場:最終用途産業別

- 栄養補助食品および食品供給

- パーソナルケアおよび化粧品包装

- 機能性飲料および健康飲料

- 医薬品およびOTC製剤

- ホームケア&トイレタリー

- その他

第12章 健康&衛生包装市場:地域別

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第13章 競合情勢

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオ・動向

第14章 企業プロファイル

- 主要企業

- BERRY GLOBAL INC.

- AMCOR PLC

- WESTROCK COMPANY

- GLENROY, INC.

- MONDI GROUP

- SONOCO PRODUCTS COMPANY

- COMAR PACKAGING SOLUTIONS

- AMERPLAST LTD.

- KIMBERLY-CLARK PROFESSIONAL

- ESSITY

- その他の企業

- NAPCO NATIONAL

- SLIGAN HOLDINGS INC.

- ALPLA GROUP

- MOD-PAC

- AMGRAPH PACKAGING, INC.

- KRIS FLEXIPACKS PVT. LTD.

- GEORGIA-PACIFIC

- JOHNSBYRNE COMPANY

- S.B. PACKAGINGS

- POLYFILM GROUP

- DORAN & WARD PACKAGING

- NOVUS HOLDINGS

- KLOCKNER PENTAPLAST

- PLASTIPACK HOLDINGS INC.

- SONIC PACKAGING INDUSTRIES INC.

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Volume (Million meters) and Value (USD) |

| Segments | Product Type, Shipping Form, Form, Distribution Channel, End-Use Industry, and Region |

| Regions covered | North America, APAC, Europe, Middle East & Africa, and South America |

The market for health & hygiene packaging is approximated to be USD 110.9 billion in 2023, and it is projected to reach USD 148.0 billion by 2028 at a CAGR of 5.9%. The increasing demand for health and hygiene packaging is driven by heightened global awareness regarding personal well-being and hygiene standards. The surge in health-conscious lifestyles amplifies the need for packaging solutions that convey safety and cleanliness. Furthermore, regulatory emphasis on stringent hygiene practices contributes to the rising demand for packaging formats such as films & sheets, bottles & jars, and tubes.

"By Product Type, Bags & Pouches accounted for the third highest CAGR during the forecast period."

The bags & pouches market in personal care is experiencing significant growth driven by consumer preferences for convenient and portable packaging. These flexible solutions offer practicality for on-the-go lifestyles, making them popular for personal care products. The demand for innovative and user-friendly packaging designs has propelled manufacturers to explore diverse materials and shapes. With a focus on aesthetics and functionality, bags & pouches enhance product visibility on shelves and contribute to brand differentiation. Additionally, the rise of e-commerce further fuels the demand for flexible and lightweight packaging, emphasizing the versatility and adaptability of bags & pouches in the dynamic personal care market.

"By Form, Flexible packaging accounted for the highest CAGR during the forecast period."

Flexible packaging products are made up of various raw materials such as plastic, paper, and metal. Plastic flexible packaging products, such as films, and pouches are used for packing various ranges of products such as ketchup, soaps, detergents, , chocolate, snacks, namkeencandies, and other food items. The flexible plastic packaging market is expanding at a higher rate than its counterpart, rigid plastic packaging, serving a variety of functions from maintaining food safety to increasing shelf life and to offering barrier protection from pathogens and heat and other external entities.

"By Shipping Form, Secondary accounted for the second highest CAGR during the forecast period."

Secondary packaging in the hygiene packaging market plays a pivotal role in ensuring the integrity and presentation of hygiene products. This layer of packaging, which includes boxes, cartons, and other outer coverings, provides an additional protective barrier during transportation and storage. It enhances the visibility of products on retail shelves, aids in brand differentiation, and contributes to overall product hygiene.

"By End Use Industry, Home Care packaging accounted for the second largest market share during the forecast period."

The home care packaging market is witnessing substantial growth propelled by evolving consumer preferences and industry dynamics. Growing awareness of hygiene and cleanliness is driving the demand for home care products, leading to an increased need for packaging. The surge in e-commerce and the popularity of convenient packaging formats are additional factors contributing to the expansion of the home care packaging market.

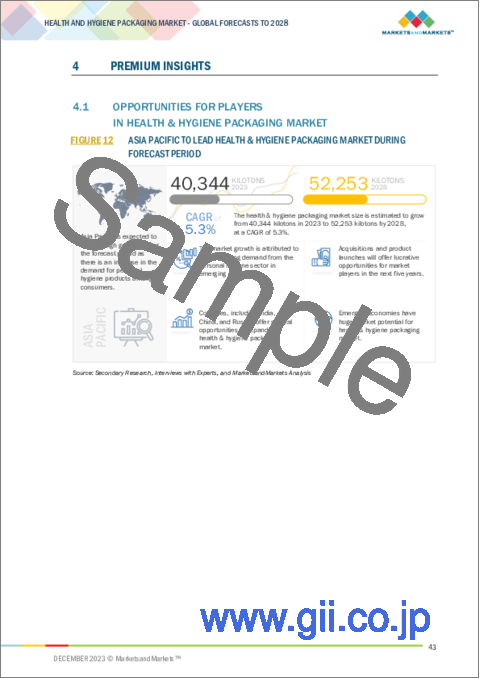

"Asia Pacific is projected to account for the highest CAGR in the health & hygiene packaging market during the forecast period."

The Asia Pacific region is witnessing the most rapid growth in the flexible packaging market. Encompassing countries like India, China, Japan, Australia, South Korea, and the Rest of Asia Pacific, this region is expected to see a surge in flexible packaging demand. India, China, and Japan, in particular, are poised for growth due to ongoing developmental activities and swift economic expansion. Furthermore, escalating urbanization in these nations is creating a substantial customer base for food, beverages, and FMCG products, contributing significantly to the projected growth of the health & hygiene packaging market in the forecast period.

By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

By Designation: C-level Executives: 20%, Directors: 10%, and Others: 70%

By Region: North America: 20%, Europe: 30%, Asia Pacific: 30%, South America: 10%, and Middle East & Africa: 10%

Companies Covered: Berry Global (US), Amcor Plc (Switzerland), WestRock (US) and Kimberly Clark (US) are some of the established players in the health & hygiene packaging market.

Research Coverage

The market study covers the Flexible Packaging market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on application, packaging type, material, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the flexible packaging market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall flexible packaging market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies.

The report provides insights on the following pointers:

- Analysis of drivers (the rising demand for flexible packaging in personal care & home care), restraints (recycling of health & hygiene packaging products), opportunities (growing demand for sustainable packaging) and challenges (swift technological advancements in the health & hygiene packaging) influencing the growth of health & hygiene packaging market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and mergers & acquisitions in the health & hygiene packaging market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for health & hygiene packaging market across regions.

- Market Diversification: Exhaustive information about new products % services, untapped geographies, recent developments and investments in the health & hygiene packaging market

- Market Penetration: Comprehensive information on the health & hygiene packaging market offered by top players in the global market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the health & hygiene packaging

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 HEALTH & HYGIENE PACKAGING: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 2 HEALTH & HYGIENE PACKAGING MARKET: TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- FIGURE 3 DEMAND-SIDE FORECAST PROJECTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 4 HEALTH & HYGIENE PACKAGING MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS

- 2.8 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 5 BOTTLES & JARS TO BE LARGEST PRODUCT TYPE DURING FORECAST PERIOD

- FIGURE 6 RIGID PACKAGING FORM TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 PRIMARY PACKAGING SHIPPING FORM TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 8 NONPOROUS PACKAGING TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 HYPERMARKETS DISTRIBUTION CHANNEL TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 10 PERSONAL CARE & COSMETICS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN HEALTH & HYGIENE PACKAGING MARKET

- FIGURE 12 ASIA PACIFIC TO LEAD HEALTH & HYGIENE PACKAGING MARKET DURING FORECAST PERIOD

- 4.2 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE

- FIGURE 13 FILMS & SHEETS TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- 4.3 HEALTH & HYGIENE PACKAGING MARKET, BY FORM

- FIGURE 14 RIGID PACKAGING TO BE LARGEST GROWING FORM BY 2028

- 4.4 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM

- FIGURE 15 TERTIARY PACKAGING TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.5 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE

- FIGURE 16 NONPOROUS TO BE FASTEST-GROWING MARKET BY 2028

- 4.6 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL

- FIGURE 17 HYPERMARKETS/SUPERMARKETS TO BE LARGEST DISTRIBUTION CHANNEL BY 2028

- 4.7 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY

- FIGURE 18 PERSONAL CARE & COSMETICS TO BE LARGEST END-USE INDUSTRY BY 2028

- 4.8 HEALTH & HYGIENE PACKAGING MARKET, BY KEY COUNTRY

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HEALTH & HYGIENE PACKAGING MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing consumer awareness and health consciousness

- 5.2.1.2 Rising demand for adult incontinence product packaging

- TABLE 1 SHARE OF ELDERLY POPULATION, BY COUNTRY

- 5.2.1.3 Innovation in sustainable packaging solutions

- 5.2.1.4 Surge in e-commerce and changing consumer patterns

- 5.2.1.5 Tamper resistance and product integrity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing raw material prices

- 5.2.2.2 Limited recycling infrastructure and environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advanced printing technologies for featured branding

- 5.2.3.2 Anti-counterfeiting technologies for product security

- 5.2.3.3 Advanced barrier systems for extended product shelf life

- 5.2.3.4 Nanotechnology for improved packaging performance

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration costs and adoption of new technologies

- 5.2.4.2 Regulatory compliance and standardization

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 HEALTH & HYGIENE PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 HEALTH & HYGIENE PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 22 HEALTH & HYGIENE PACKAGING MARKET: VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 MANUFACTURERS

- 5.4.3 DISTRIBUTORS

- 5.4.4 END USERS

- 5.5 PATENT ANALYSIS

- 5.5.1 METHODOLOGY

- 5.5.2 DOCUMENT TYPES

- FIGURE 23 GRANTED PATENTS

- FIGURE 24 PUBLICATION TRENDS IN LAST 10 YEARS

- 5.5.3 INSIGHTS

- FIGURE 25 JURISDICTION ANALYSIS

- 5.5.4 TOP APPLICANTS

- TABLE 3 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 5.6 ECOSYSTEM MAPPING

- FIGURE 26 HEALTH & HYGIENE PACKAGING MARKET ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 PRINTING METHODS FOR PRODUCT PACKAGING

- 5.7.1.1 Rotogravure

- 5.7.1.2 Lithography

- 5.7.1.3 Flexography

- 5.7.1.4 Digital printing

- 5.7.2 FORM FILL SEAL MACHINE FOR FLEXIBLE PACKAGING

- 5.7.3 STRETCHABLE PAPER FOR NOVEL APPLICATIONS

- 5.7.4 NEW PET PREFORM MOLDING SOLUTION

- 5.7.5 NEW TECHNOLOGY TO HELP RECYCLE SMALL PLASTIC BOTTLES

- 5.7.1 PRINTING METHODS FOR PRODUCT PACKAGING

- 5.8 TARIFF & REGULATORY LANDSCAPE

- 5.8.1 CONTAINER COMPLIANCE OPTIONS

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- FIGURE 27 IMPORT OF CHEMICALLY PURE FRUCTOSE IN SOLID FORM, BY KEY COUNTRY, 2018-2022

- 5.9.2 EXPORT SCENARIO

- FIGURE 28 EXPORT OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, BY KEY COUNTRY, 2018-2022

- 5.10 MACROECONOMIC INDICATORS

- 5.10.1 GDP TRENDS AND FORECASTS

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018-2025

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 REVENUE SHIFT FOR HEALTH & HYGIENE PACKAGING MANUFACTURERS

- 5.12 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 6 HEALTH & HYGIENE PACKAGING MARKET: KEY CONFERENCES & EVENTS, 2023-2024

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 SIMULIA-AMCOR CASE

- 5.13.2 PAPERPAK CASE STUDY FOR KATHMANDU

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.14.2 QUALITY

- 5.14.3 SERVICE

- FIGURE 31 SUPPLIER SELECTION CRITERION

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 32 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- 5.15.2 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY

- FIGURE 33 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY (USD/KG)

- 5.15.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 34 AVERAGE SELLING PRICE, BY KEY MARKET PLAYERS (USD/KG)

6 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- FIGURE 35 FILMS & SHEETS SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 9 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 10 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 11 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 12 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2023-2028 (KILOTON)

- 6.2 FILMS & SHEETS

- 6.2.1 ANTIMICROBIAL AND TAMPER-EVIDENT COATINGS TO DRIVE MARKET

- 6.3 BAGS & POUCHES

- 6.3.1 DEMAND FOR COMPACT AND ECO-FRIENDLY PACKAGING IN PERSONAL CARE PRODUCTS TO BOOST MARKET

- 6.4 LAMINATES

- 6.4.1 INCREASING DEMAND FOR AESTHETIC AND PROTECTIVE PACKAGING SOLUTIONS TO DRIVE MARKET

- 6.5 LABELS

- 6.5.1 SURGE IN DEMAND FOR OTC PHARMACEUTICAL PRODUCTS TO BOOST MARKET

- 6.6 BOTTLES & JARS

- 6.6.1 WIDE DEPLOYMENT IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- 6.7 SACHETS

- 6.7.1 COMPACTNESS AND SUSTAINABILITY TO FUEL DEMAND IN HEALTHCARE SECTOR

- 6.8 BOXES & CARTONS

- 6.8.1 VISUAL APPEAL AND STURDINESS TO SURGE DEMAND IN HEALTH & HYGIENE INDUSTRY

- 6.9 TUBES

- 6.9.1 EFFICIENT PACKAGING SOLUTIONS TO SPUR MARKET GROWTH

- 6.10 OTHER TYPES

7 HEALTH & HYGIENE PACKAGING MARKET, BY FORM

- 7.1 INTRODUCTION

- FIGURE 36 FLEXIBLE PACKAGING TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 13 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (USD MILLION)

- TABLE 14 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 15 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (KILOTON)

- TABLE 16 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (KILOTON)

- 7.2 RIGID PACKAGING

- 7.2.1 MOLDING

- 7.2.1.1 Increasing demand for bottles & jars to drive market

- 7.2.2 EXTRUSION

- 7.2.2.1 Rising need for tubes in OTC pharmaceuticals & personal care to boost market

- 7.2.3 OTHER RIGID FORMS

- 7.2.1 MOLDING

- 7.3 FLEXIBLE PACKAGING

- 7.3.1 SINGLE LAYER

- 7.3.1.1 Effective and sustainable solutions in health & hygiene packaging to drive market

- 7.3.2 MULTI LAYER

- 7.3.2.1 Growing demand for diapers to boost market

- 7.3.1 SINGLE LAYER

8 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM

- 8.1 INTRODUCTION

- FIGURE 37 TERTIARY PACKAGING TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 17 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020-2022 (USD MILLION)

- TABLE 18 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023-2028 (USD MILLION)

- TABLE 19 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020-2022 (KILOTON)

- TABLE 20 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023-2028 (KILOTON)

- 8.2 PRIMARY PACKAGING

- 8.2.1 WIDE USE OF TUBES AND POUCHES TO DRIVE MARKET

- 8.3 SECONDARY PACKAGING

- 8.3.1 HIGH DEMAND FOR LABELS AND LAMINATES TO FUEL MARKET

- 8.4 TERTIARY PACKAGING

- 8.4.1 SECURE AND ORGANIZED PACKAGING SOLUTIONS TO DRIVE GROWTH

9 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE

- 9.1 INTRODUCTION

- FIGURE 38 NONPOROUS SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 21 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020-2022 (USD MILLION)

- TABLE 22 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023-2028 (USD MILLION)

- TABLE 23 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020-2022 (KILOTON)

- TABLE 24 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023-2028 (KILOTON)

- 9.2 NONPOROUS

- 9.2.1 EXTENSIVE USE IN LIQUID PACKAGING TO DRIVE MARKET

- 9.3 POROUS

- 9.3.1 BIODEGRADABILITY AND MICROBIAL RESISTANCE TO FUEL DEMAND

10 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL

- 10.1 INTRODUCTION

- FIGURE 39 HYPERMARKETS & SUPERMARKETS TO BE LARGEST DISTRIBUTION CHANNEL DURING FORECAST PERIOD

- TABLE 25 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2022 (USD MILLION)

- TABLE 26 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 27 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2022 (KILOTON)

- TABLE 28 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (KILOTON)

- 10.2 HYPERMARKETS & SUPERMARKETS

- 10.2.1 GROWING DEMAND FOR SECURE AND HYGIENIC PACKAGING TO DRIVE MARKET

- 10.3 ONLINE RETAILERS

- 10.3.1 INCREASING CONSUMER PREFERENCE FOR CONVENIENT PACKAGING SOLUTIONS TO DRIVE GROWTH

- 10.4 DIRECT SALES

- 10.4.1 RISING DEMAND FOR SECURE AND TRANSPARENT SALES IN PHARMACEUTICAL INDUSTRY TO BOOST MARKET

11 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- FIGURE 40 PERSONAL CARE & COSMETICS PACKAGING TO DRIVE MARKET BETWEEN 2023 AND 2028

- TABLE 29 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 30 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 31 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 32 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 11.2 NUTRACEUTICAL & FOOD SUPPLIES

- 11.2.1 GROWING CONSUMER AWARENESS TOWARD NUTRITIONAL AND WELLNESS PRODUCTS TO DRIVE MARKET

- 11.3 PERSONAL CARE & COSMETICS PACKAGING

- 11.3.1 TECHNOLOGICAL ADVANCEMENTS AND GROWTH OF E-COMMERCE SECTOR TO FUEL MARKET

- 11.4 FUNCTIONAL & HEALTH BEVERAGES

- 11.4.1 INNOVATIVE AND CONVENIENT PACKAGING SOLUTIONS TO DRIVE MARKET

- 11.5 PHARMACEUTICALS & OTC FORMULATIONS

- 11.5.1 INCREASING GLOBAL CONSUMPTION OF PHARMACEUTICAL AND OTC FORMULATIONS TO DRIVE MARKET

- 11.6 HOME CARE & TOILETRIES

- 11.6.1 RISING FOCUS ON HEALTH & HYGIENE TO PROPEL MARKET

- 11.7 OTHER END-USE INDUSTRIES

12 HEALTH & HYGIENE PACKAGING MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 41 INDIA TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 33 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 34 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 36 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 37 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2022 (USD MILLION)

- TABLE 38 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 39 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE, 2020-2022 (KILOTON)

- TABLE 40 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- TABLE 41 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020-2022 (USD MILLION)

- TABLE 42 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023-2028 (USD MILLION)

- TABLE 43 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020-2022 (KILOTON)

- TABLE 44 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023-2028 (KILOTON)

- TABLE 45 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020-2022 (USD MILLION)

- TABLE 46 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023-2028 (USD MILLION)

- TABLE 47 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020-2022 (KILOTON)

- TABLE 48 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023-2028 (KILOTON)

- TABLE 49 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2022 (USD MILLION)

- TABLE 50 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 51 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2022 (KILOTON)

- TABLE 52 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (KILOTON)

- TABLE 53 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (USD MILLION)

- TABLE 54 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 55 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (KILOTON)

- TABLE 56 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (KILOTON)

- TABLE 57 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 58 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 59 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 60 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.2 NORTH AMERICA

- 12.2.1 RECESSION IMPACT

- FIGURE 42 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET SNAPSHOT

- TABLE 61 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 64 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 65 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (KILOTON)

- TABLE 68 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (KILOTON)

- TABLE 69 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 72 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.2.2 US

- 12.2.2.1 Surge in industrial demand for packaging products to boost market

- TABLE 73 US: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 74 US: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 75 US: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 76 US: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.2.3 CANADA

- 12.2.3.1 Highly diversified and developed economy to drive market

- TABLE 77 CANADA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 78 CANADA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 79 CANADA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 80 CANADA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.2.4 MEXICO

- 12.2.4.1 Cost-effective and efficient manufacturing and packaging solutions to drive growth

- TABLE 81 MEXICO: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 82 MEXICO: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 83 MEXICO: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 84 MEXICO: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.3 ASIA PACIFIC

- 12.3.1 RECESSION IMPACT

- FIGURE 43 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET SNAPSHOT

- TABLE 85 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 88 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 89 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (KILOTON)

- TABLE 92 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (KILOTON)

- TABLE 93 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 96 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.3.2 CHINA

- 12.3.2.1 Open economy and established manufacturing base to drive market

- TABLE 97 CHINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 98 CHINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 99 CHINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 100 CHINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.3.3 JAPAN

- 12.3.3.1 Increasing disposable income to drive market

- TABLE 101 JAPAN: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 102 JAPAN: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 103 JAPAN: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 104 JAPAN: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.3.4 INDIA

- 12.3.4.1 High demand from e-commerce sector to boost market

- TABLE 105 INDIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 106 INDIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 107 INDIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 108 INDIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.3.5 SOUTH KOREA

- 12.3.5.1 Rising need for functional health and nutraceutical items to drive market

- TABLE 109 SOUTH KOREA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 110 SOUTH KOREA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 112 SOUTH KOREA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.3.6 AUSTRALIA

- 12.3.6.1 Growth of industrial sector to boost market

- TABLE 113 AUSTRALIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 114 AUSTRALIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 115 AUSTRALIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 116 AUSTRALIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.3.7 REST OF ASIA PACIFIC

- TABLE 117 REST OF ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 120 REST OF ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.4 EUROPE

- 12.4.1 RECESSION IMPACT

- TABLE 121 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 123 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 124 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (USD MILLION)

- TABLE 125 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (KILOTON)

- TABLE 127 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (KILOTON)

- TABLE 128 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 129 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 131 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.4.2 GERMANY

- 12.4.2.1 Growth of packaging industry to drive market

- TABLE 132 GERMANY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 133 GERMANY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 134 GERMANY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 135 GERMANY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.4.3 FRANCE

- 12.4.3.1 Technological advancements in pharmaceutical industry to boost market

- TABLE 136 FRANCE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 137 FRANCE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 138 FRANCE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 139 FRANCE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.4.4 UK

- 12.4.4.1 Increasing demand for functional foods to fuel market

- TABLE 140 UK: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 141 UK: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 142 UK: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 143 UK: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.4.5 ITALY

- 12.4.5.1 High nutraceutical import by government to boost market

- TABLE 144 ITALY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 145 ITALY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 146 ITALY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 147 ITALY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.4.6 REST OF EUROPE

- TABLE 148 REST OF EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 149 REST OF EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 151 REST OF EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 RECESSION IMPACT

- TABLE 152 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.5.2 GCC COUNTRIES

- 12.5.2.1 Saudi Arabia

- 12.5.2.1.1 Rising demand for functional foods and beverages to drive market

- 12.5.2.1 Saudi Arabia

- TABLE 164 SAUDI ARABIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 165 SAUDI ARABIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 166 SAUDI ARABIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 167 SAUDI ARABIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.5.2.2 UAE

- 12.5.2.2.1 Increasing need for personal care products to drive market

- 12.5.2.2 UAE

- TABLE 168 UAE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 169 UAE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 170 UAE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 171 UAE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.5.2.3 Other GCC Countries

- TABLE 172 REST OF GCC COUNTRIES: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 173 REST OF GCC COUNTRIES: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 174 REST OF GCC COUNTRIES: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 175 REST OF GCC COUNTRIES: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.5.3 SOUTH AFRICA

- 12.5.3.1 High birth rate to fuel demand for hygiene products

- TABLE 176 SOUTH AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 177 SOUTH AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 178 SOUTH AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 179 SOUTH AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.5.4 REST OF THE MIDDLE EAST & AFRICA

- TABLE 180 REST OF MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.6 SOUTH AMERICA

- 12.6.1 RECESSION IMPACT

- TABLE 184 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 185 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 186 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 187 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 188 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (USD MILLION)

- TABLE 189 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 190 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (KILOTON)

- TABLE 191 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (KILOTON)

- TABLE 192 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 193 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 194 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 195 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.6.2 BRAZIL

- 12.6.2.1 Rising health consciousness and rapid urbanization to drive market

- TABLE 196 BRAZIL: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 197 BRAZIL: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 198 BRAZIL: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 199 BRAZIL: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.6.3 ARGENTINA

- 12.6.3.1 Strong focus on economic development to drive demand

- TABLE 200 ARGENTINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 201 ARGENTINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 202 ARGENTINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 203 ARGENTINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 12.6.4 REST OF SOUTH AMERICA

- TABLE 204 REST OF SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 206 REST OF SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 207 REST OF SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- FIGURE 44 COMPANIES ADOPTED PARTNERSHIP AND EXPANSION AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2023

- 13.3 REVENUE ANALYSIS

- FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES (2020-2022)

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 46 SHARE OF TOP COMPANIES IN HEALTH & HYGIENE PACKAGING MARKET

- TABLE 208 HEALTH & HYGIENE PACKAGING MARKET: DEGREE OF COMPETITION

- 13.5 COMPANY EVALUATION MATRIX

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 47 HEALTH & HYGIENE PACKAGING MARKET: COMPANY EVALUATION MATRIX, 2022

- 13.5.5 COMPANY FOOTPRINT

- TABLE 209 COMPANY END-USE INDUSTRY FOOTPRINT (25 COMPANIES)

- TABLE 210 COMPANY REGION FOOTPRINT (25 COMPANIES)

- FIGURE 48 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

- TABLE 211 COMPANY FOOTPRINT (25 COMPANIES)

- 13.6 START-UP/SME EVALUATION MATRIX

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 49 HEALTH & HYGIENE PACKAGING MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 212 HEALTH & HYGIENE PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (15 COMPANIES)

- TABLE 213 DETAILED LIST OF COMPANIES

- 13.7 COMPETITIVE SCENARIO AND TRENDS

- TABLE 214 PRODUCT LAUNCHES, 2018-2023

- TABLE 215 DEALS, 2018-2023

- TABLE 216 OTHERS, 2018-2023

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 14.1.1 BERRY GLOBAL INC.

- TABLE 217 BERRY GLOBAL INC.: COMPANY OVERVIEW

- FIGURE 50 BERRY GLOBAL INC.: COMPANY SNAPSHOT

- TABLE 218 BERRY GLOBAL INC.: PRODUCT OFFERINGS

- TABLE 219 BERRY GLOBAL INC.: PRODUCT LAUNCHES

- TABLE 220 BERRY GLOBAL: DEALS

- TABLE 221 BERRY GLOBAL: OTHERS

- 14.1.2 AMCOR PLC

- TABLE 222 AMCOR PLC: COMPANY OVERVIEW

- FIGURE 51 AMCOR PLC: COMPANY SNAPSHOT

- TABLE 223 AMCOR PLC: PRODUCT OFFERINGS

- TABLE 224 AMCOR PLC: PRODUCT LAUNCHES

- TABLE 225 AMCOR PLC: DEALS

- TABLE 226 AMCOR PLC: OTHERS

- 14.1.3 WESTROCK COMPANY

- TABLE 227 WESTROCK COMPANY: COMPANY OVERVIEW

- FIGURE 52 WESTROCK COMPANY: COMPANY SNAPSHOT

- TABLE 228 WESTROCK COMPANY: PRODUCT OFFERINGS

- TABLE 229 WESTROCK COMPANY: DEALS

- TABLE 230 WESTROCK COMPANY: OTHERS

- 14.1.4 GLENROY, INC.

- TABLE 231 GELENROY, INC.: COMPANY OVERVIEW

- TABLE 232 GLENROY, INC.: PRODUCT OFFERINGS

- TABLE 233 GLENROY, INC.: PRODUCT LAUNCHES

- TABLE 234 GLENROY INC.: OTHERS

- 14.1.5 MONDI GROUP

- TABLE 235 MONDI GROUP: COMPANY OVERVIEW

- FIGURE 53 MONDI GROUP: COMPANY SNAPSHOT

- TABLE 236 MONDI GROUP: PRODUCT OFFERINGS

- TABLE 237 MONDI GROUP: PRODUCT LAUNCHES

- TABLE 238 MONDI GROUP: DEALS

- TABLE 239 MONDI GROUP: OTHERS

- 14.1.6 SONOCO PRODUCTS COMPANY

- TABLE 240 SONOCO PRODUCTS COMPANY: COMPANY OVERVIEW

- FIGURE 54 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

- TABLE 241 SONOCO PRODUCTS COMPANY: PRODUCT OFFERINGS

- TABLE 242 SONOCO PRODUCTS COMPANY: PRODUCT LAUNCHES

- TABLE 243 SONOCO PRODUCTS COMPANY: DEALS

- 14.1.7 COMAR PACKAGING SOLUTIONS

- TABLE 244 COMAR PACKAGING SOLUTION: COMPANY OVERVIEW

- TABLE 245 COMAR PACKAGING SOLUTION: PRODUCT OFFERINGS

- TABLE 246 COMAR PACKAGING SOLUTION: DEALS

- TABLE 247 COMAR PACKAGING SOLUTION: OTHERS

- 14.1.8 AMERPLAST LTD.

- TABLE 248 AMERPLAST LTD.: COMPANY OVERVIEW

- TABLE 249 AMERPLAST LTD.: PRODUCT OFFERINGS

- TABLE 250 AMERPLAST LTD.: DEALS

- TABLE 251 AMERPLAST LTD.: OTHERS

- 14.1.9 KIMBERLY-CLARK PROFESSIONAL

- TABLE 252 KIMBERLY-CLARK PROFESSIONAL: COMPANY OVERVIEW

- TABLE 253 KIMBERLY-CLARK PROFESSIONAL: PRODUCT OFFERINGS

- 14.1.10 ESSITY

- TABLE 254 ESSITY: COMPANY OVERVIEW

- FIGURE 55 ESSITY: COMPANY SNAPSHOT

- TABLE 255 ESSITY: PRODUCT OFFERINGS

- TABLE 256 ESSITY: DEALS

- 14.2 OTHER PLAYERS

- 14.2.1 NAPCO NATIONAL

- TABLE 257 NAPCO NATIONAL: COMPANY OVERVIEW

- 14.2.2 SLIGAN HOLDINGS INC.

- TABLE 258 SLIGAN HOLDINGS INC.: COMPANY OVERVIEW

- 14.2.3 ALPLA GROUP

- TABLE 259 ALPLA GROUP: COMPANY OVERVIEW

- 14.2.4 MOD-PAC

- TABLE 260 MOD-PAC: COMPANY OVERVIEW

- 14.2.5 AMGRAPH PACKAGING, INC.

- TABLE 261 AMGRAPH PACKAGING, INC.: COMPANY OVERVIEW

- 14.2.6 KRIS FLEXIPACKS PVT. LTD.

- TABLE 262 KRIS FLEXIPACKS PVT. LTD.: COMPANY OVERVIEW

- 14.2.7 GEORGIA-PACIFIC

- TABLE 263 GEORGIA-PACIFIC: COMPANY OVERVIEW

- 14.2.8 JOHNSBYRNE COMPANY

- TABLE 264 JOHNSBRYNE COMPANY: COMPANY OVERVIEW

- 14.2.9 S.B. PACKAGINGS

- TABLE 265 S.B. PACKAGINGS: COMPANY OVERVIEW

- 14.2.10 POLYFILM GROUP

- TABLE 266 POLYFILM GROUP: COMPANY OVERVIEW

- 14.2.11 DORAN & WARD PACKAGING

- TABLE 267 DORAN & WARD PACKAGING: COMPANY OVERVIEW

- 14.2.12 NOVUS HOLDINGS

- TABLE 268 NOVUS HOLDINGS: COMPANY OVERVIEW

- 14.2.13 KLOCKNER PENTAPLAST

- TABLE 269 KLOCKNER PENTAPLAST: COMPANY OVERVIEW

- 14.2.14 PLASTIPACK HOLDINGS INC.

- TABLE 270 PLASTICPACK HOLDINGS INC.: COMPANY OVERVIEW

- 14.2.15 SONIC PACKAGING INDUSTRIES INC.

- TABLE 271 SONIC PACKAGING INDUSTRIES INC.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS