|

|

市場調査レポート

商品コード

1735434

アクリル塗料:技術・エンドユーザー・世界市場Acrylic Coatings: Technologies, End Users and Global Markets |

||||||

|

|||||||

| アクリル塗料:技術・エンドユーザー・世界市場 |

|

出版日: 2025年05月16日

発行: BCC Research

ページ情報: 英文 144 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のアクリル塗料の市場規模は、2024年の686億ドルから、2029年末には878億ドルに拡大すると見込まれており、2024年から2029年にかけてのCAGRは5.1%と予測されています。

アジア太平洋地域の市場規模は、2024年の352億ドルから、2029年末には466億ドルに拡大すると見込まれており、同期間のCAGRは5.8%とされています。

北米にの市場規模は、2024年の166億ドルから、2029年末には211億ドルに拡大すると見込まれており、同期間のCAGRは4.9%と予測されています。

当レポートでは、世界のアクリル塗料の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

第2章 市場概要

- 市場定義

- アクリル塗料の選択に影響を与える要因

- アクリル塗料の重要性

第3章 市場力学

- 重要ポイント

- 市場力学スナップショット

- 促進要因

- 建築用塗料の需要の増加

- 自動車業界におけるアクリル塗料の消費量の増加

- 抑制要因

- 生産者に対する規制上の負担

- 熟練労働者の不足

- 機会

- 買収による地理的拡大

- 航空宇宙・防衛産業における成長機会

- 課題

- 激しい競合

第4章 規制状況

- 重要ポイント

- 世界のアクリル塗料市場における規制機関

第5章 新興技術と開発

- 重要ポイント

- 最新技術

- 自己修復性水性アクリルラテックス塗料

- 放射冷却アクリル塗料

第6章 世界のアクリル塗料市場のサプライチェーン分析

- 世界のアクリル塗料市場のサプライチェーン分析

- 製造業者

- 販売

第7章 市場セグメンテーション分析

- 重要ポイント

- セグメンテーションの内訳

- 市場分析:タイプ別

- 熱可塑性プラスチック

- 熱硬化性樹脂

- 市場分析:技術別

- 水性

- 溶剤系アクリル

- 粉末

- その他

- 市場分析:基質別

- コンクリート

- 金属

- プラスチック

- 木材

- その他

- 市場分析:エンドユーザー産業別

- 建築・建設

- 一般産業

- 自動車

- 家具

- その他

- 地理的内訳

- 市場分析:地域別

- アジア太平洋

- 中国

- インド

- 日本

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

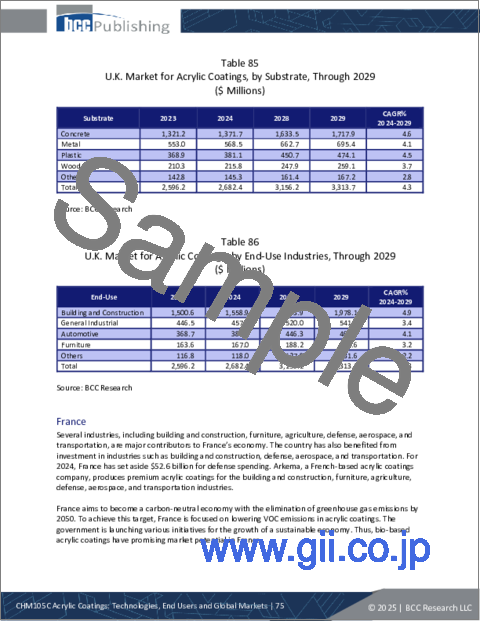

- 英国

- フランス

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- 中東

- アフリカ

第8章 競合情報

- アクリル塗料市場:市場シェア分析

- 戦略分析

第9章 アクリル塗料の持続可能性:ESGの観点

- アクリル塗料におけるESGの重要性

- アクリル塗料におけるESGの実践

- アクリル塗料におけるESGの現状

- リスクスケール、露出スケール、管理スケール

- ESGの未来:新たな動向と機会

- BCCによる総論

第10章 付録

- 調査手法

- 情報源

- 略語

- 参考文献

- 企業プロファイル

- AKZO NOBEL N.V.

- ARKEMA

- ASIAN PAINTS

- AXALTA COATING SYSTEMS LLC

- BASF

- DOW

- JAMESTOWN COATING TECHNOLOGIES

- JOHNS MANVILLE

- JOTUN

- NIPPON PAINT HOLDINGS CO. LTD.

- PPG INDUSTRIES INC.

- RPM INTERNATIONAL INC.

- SBL COATINGS PVT. LTD.

- SPECIALTY COATING SYSTEMS INC.

- THE SHERWIN-WILLIAMS CO.

List of Tables

- Summary Table : Global Market for Acrylic Coatings, by Region, Through 2029

- Table 1 : Export of Wooden Furniture, by Country, 2022

- Table 2 : Global Announced Greenfield Projects, by Region, 2023

- Table 3 : Leading Automobile Producing Countries in the EU, 2022 and 2023

- Table 4 : Key Mergers and Acquisitions in the Acrylic Coatings Market, 2024

- Table 5 : Military Expenditures, by Region, 2023

- Table 6 : Regulatory Bodies in the Acrylic Coatings Markets, 2024

- Table 7 : Global Market for Acrylic Coatings, by Type, Through 2029

- Table 8 : Global Market for Thermoplastic Acrylic Coatings, by Region, Through 2029

- Table 9 : Global Market for Thermoset Acrylic Coatings, by Region, Through 2029

- Table 10 : Worldwide Crude Oil Production, by Country, 2023

- Table 11 : Global Market for Acrylic Coatings, by Technology, Through 2029

- Table 12 : Global Market for Waterborne Acrylic Coatings, by Region, Through 2029

- Table 13 : Global Market for Solvent-borne Acrylic Coatings, by Region, Through 2029

- Table 14 : Global Market for Powder Acrylic Coatings, by Region, Through 2029

- Table 15 : Global Market for Other Technologys of Acrylic Coatings, by Region, Through 2029

- Table 16 : Global Market for Acrylic Coatings, by Substrate, Through 2029

- Table 17 : Export of Cement, by Country, 2023

- Table 18 : Global Market for Concrete Acrylic Coatings, by Region, Through 2029

- Table 19 : Crude Steel Production, by Country, 2023

- Table 20 : Global Market for Acrylic Metal Coatings, by Region, Through 2029

- Table 21 : Global Market for Plastic Acrylic Coatings, by Region, Through 2029

- Table 22 : Global Market for Wood Acrylic Coatings, by Region, Through 2029

- Table 23 : Production, Import, Export, and Consumption of Paper in India, 2022 and 2023

- Table 24 : Global Market for Other Substrates of Acrylic Coatings, by Region, Through 2029

- Table 25 : Military Expenditure, by Region, 2022 and 2023

- Table 26 : Global Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 27 : Global Announced Greenfield Projects, by Region, 2024

- Table 28 : Global Market for Building and Construction Acrylic Coatings, by Region, Through 2029

- Table 29 : Global Market for General Industrial Acrylic Coatings, by Region, Through 2029

- Table 30 : Global Market for Automotive Acrylic Coatings, by Region, Through 2029

- Table 31 : Global Market for Furniture Acrylic Coatings, by Region, Through 2029

- Table 32 : Global Market for Other End-Use Industries of Acrylic Coatings, by Region, Through 2029

- Table 33 : Total Number of Cars Sold, 2023

- Table 34 : Global Market for Acrylic Coatings, by Region, Through 2029

- Table 35 : Asia-Pacific Market for Acrylic Coatings, by Country, Through 2029

- Table 36 : Asia-Pacific Market for Acrylic Coatings, by Type, Through 2029

- Table 37 : Asia-Pacific Market for Acrylic Coatings, by Technology, Through 2029

- Table 38 : Asia-Pacific Market for Acrylic Coatings, by Substrate, Through 2029

- Table 39 : Asia-Pacific Market for Acrylic Coatings, by End-Use Industry, Through 2029

- Table 40 : Chinese Market for Acrylic Coatings, by Type, Through 2029

- Table 41 : Chinese Market for Acrylic Coatings, by Technology, Through 2029

- Table 42 : Chinese Market for Acrylic Coatings, by Substrate, Through 2029

- Table 43 : Chinese Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 44 : Indian Market for Acrylic Coatings, by Type, Through 2029

- Table 45 : Indian Market for Acrylic Coatings, by Technology, Through 2029

- Table 46 : Indian Market for Acrylic Coatings, by Substrate, Through 2029

- Table 47 : Indian Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 48 : Japanese Market for Acrylic Coatings, by Type, Through 2029

- Table 49 : Japanese Market for Acrylic Coatings, by Technology, Through 2029

- Table 50 : Japanese Market for Acrylic Coatings, by Substrate, Through 2029

- Table 51 : Japanese Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 52 : Rest of the Asia-Pacific Market for Acrylic Coatings, by Type, Through 2029

- Table 53 : Rest of the Asia-Pacific Market for Acrylic Coatings, by Technology, Through 2029

- Table 54 : Rest of the Asia-Pacific Market for Acrylic Coatings, by Substrate, Through 2029

- Table 55 : Rest of Asia-Pacific Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 56 : North American Spending on Building Construction, 2023

- Table 57 : North American Market for Acrylic Coatings, by Country, Through 2029

- Table 58 : North American Market for Acrylic Coatings, by Type, Through 2029

- Table 59 : North American Market for Acrylic Coatings, by Technology, Through 2029

- Table 60 : North American Market for Acrylic Coatings, by Substrate, Through 2029

- Table 61 : North American Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 62 : U.S. Market for Acrylic Coatings, by Type, Through 2029

- Table 63 : U.S. Market for Acrylic Coatings, by Technology, Through 2029

- Table 64 : U.S. Market for Acrylic Coatings, by Substrate, Through 2029

- Table 65 : U.S. Market for Acrylic Coatings, by End-Use Industry, Through 2029

- Table 66 : Canadian Market for Acrylic Coatings, by Type, Through 2029

- Table 67 : Canadian Market for Acrylic Coatings, by Technology, Through 2029

- Table 68 : Canadian Market for Acrylic Coatings, by Substrate, Through 2029

- Table 69 : Canadian Market for Acrylic Coatings, by End-Use Industry, Through 2029

- Table 70 : Mexican Market for Acrylic Coatings, by Type, Through 2029

- Table 71 : Mexican Market for Acrylic Coatings, by Technology, Through 2029

- Table 72 : Mexican Market for Acrylic Coatings, by Substrate, Through 2029

- Table 73 : Mexican Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 74 : European Market for Acrylic Coatings, by Country, Through 2029

- Table 75 : European Market for Acrylic Coatings, by Type, Through 2029

- Table 76 : European Market for Acrylic Coatings, by Technology, Through 2029

- Table 77 : European Market for Acrylic Coatings, by Substrate, Through 2029

- Table 78 : European Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 79 : German Market for Acrylic Coatings, by Type, Through 2029

- Table 80 : German Market for Acrylic Coatings, by Technology, Through 2029

- Table 81 : German Market for Acrylic Coatings, by Substrate, Through 2029

- Table 82 : German Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 83 : U.K. Market for Acrylic Coatings, by Type, Through 2029

- Table 84 : U.K. Market for Acrylic Coatings, by Technology, Through 2029

- Table 85 : U.K. Market for Acrylic Coatings, by Substrate, Through 2029

- Table 86 : U.K. Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 87 : French Market for Acrylic Coatings, by Type, Through 2029

- Table 88 : French Market for Acrylic Coatings, by Technology, Through 2029

- Table 89 : French Market for Acrylic Coatings, by Substrate, Through 2029

- Table 90 : French Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 91 : Rest of European Market for Acrylic Coatings, by Type, Through 2029

- Table 92 : Rest of European Market for Acrylic Coatings, by Technology, Through 2029

- Table 93 : Rest of European Market for Acrylic Coatings, by Substrate, Through 2029

- Table 94 : Rest of European Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 95 : South American Market for Acrylic Coatings, by Country, Through 2029

- Table 96 : South American Market for Acrylic Coatings, by Type, Through 2029

- Table 97 : South American Market for Acrylic Coatings, by Technology, Through 2029

- Table 98 : South American Market for Acrylic Coatings, by Substrate, Through 2029

- Table 99 : South American Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 100 : Brazilian Market for Acrylic Coatings, by Type, Through 2029

- Table 101 : Brazilian Market for Acrylic Coatings, by Technology, Through 2029

- Table 102 : Brazilian Market for Acrylic Coatings, by Substrate, Through 2029

- Table 103 : Brazilian Market for Acrylic Coatings, by End-Use Industry, Through 2029

- Table 104 : Argentine Market for Acrylic Coatings, by Type, Through 2029

- Table 105 : Argentine Market for Acrylic Coatings, by Technology, Through 2029

- Table 106 : Argentine Market for Acrylic Coatings, by Substrate, Through 2029

- Table 107 : Argentine Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 108 : Rest of South American Market for Acrylic Coatings, by Type, Through 2029

- Table 109 : Rest of South American Market for Acrylic Coatings, by Technology, Through 2029

- Table 110 : Rest of South American Market for Acrylic Coatings, by Substrate, Through 2029

- Table 111 : Rest of South American Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 112 : Middle Eastern and African Market for Acrylic Coatings, by Country, Through 2029

- Table 113 : Middle Eastern and African Market for Acrylic Coatings, by Type, Through 2029

- Table 114 : Middle Eastern and African Market for Acrylic Coatings, by Technology, Through 2029

- Table 115 : Middle Eastern and African Market for Acrylic Coatings, by Substrate, Through 2029

- Table 116 : Middle Eastern and African Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 117 : Middle Eastern Market for Acrylic Coatings, by Type, Through 2029

- Table 118 : Middle Eastern Market for Acrylic Coatings, by Technology, Through 2029

- Table 119 : Middle Eastern Market for Acrylic Coatings, by Substrate, Through 2029

- Table 120 : Middle Eastern Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 121 : African Market for Acrylic Coatings, by Type, Through 2029

- Table 122 : African Market for Acrylic Coatings, by Technology, Through 2029

- Table 123 : African Market for Acrylic Coatings, by Substrate, Through 2029

- Table 124 : African Market for Acrylic Coatings, by End-Use Industries, Through 2029

- Table 125 : Leading Acrylic Coatings Companies, 2024

- Table 126 : ESG Environmental Economy Issue Analysis

- Table 127 : Labor Social Issue Analysis

- Table 128 : Governance Issue Analysis

- Table 129 : ESG Score Card of Companies

- Table 130 : Risk Scale, Exposure Scale, and Management Scale

- Table 131 : Abbreviations Used Acrylic Coatings Market Report

- Table 132 : Akzo Nobel N.V.: Company Snapshot

- Table 133 : Akzo Nobel N.V.: Financial Performance, FY 2023 and 2024

- Table 134 : Akzo Nobel N.V.: Product Portfolio

- Table 135 : Akzo Nobel N.V.: News/Key Developments, 2024

- Table 136 : Arkema: Company Snapshot

- Table 137 : Arkema: Financial Performance, FY 2023 and 2024

- Table 138 : Arkema: Product Portfolio

- Table 139 : Asian Paints: Company Snapshot

- Table 140 : Asian Paints: Financial Performance, FY 2022 and 2023

- Table 141 : Asian Paints: Product Portfolio

- Table 142 : Axalta Coating Systems LLC: Company Snapshot

- Table 143 : Axalta Coating Systems LLC: Financial Performance, FY 2023 and 2024

- Table 144 : Axalta Coating Systems LLC: Product Portfolio

- Table 145 : Axalta Coating Systems LLC: News/Key Developments, 2024

- Table 146 : BASF: Company Snapshot

- Table 147 : BASF: Financial Performance, FY 2023 and 2024

- Table 148 : BASF: Product Portfolio

- Table 149 : Dow: Company Snapshot

- Table 150 : Dow: Financial Performance, FY 2023 and 2024

- Table 151 : Dow: Product Portfolio

- Table 152 : Jamestown Coating Technologies: Company Snapshot

- Table 153 : Jamestown Coating Technologies: Product Portfolio

- Table 154 : Johns Manville: Company Snapshot

- Table 155 : Johns Manville: Product Portfolio

- Table 156 : Jotun: Company Snapshot

- Table 157 : Jotun: Financial Performance, FY 2023 and 2024

- Table 158 : Jotun: Product Portfolio

- Table 159 : Nippon Paint Holdings Co. Ltd.: Company Snapshot

- Table 160 : Nippon Paint Holdings Co. Ltd.: Financial Performance, FY 2023 and 2024

- Table 161 : Nippon Paint Holdings Co. Ltd.: Product Portfolio

- Table 162 : PPG Industries Inc.: Company Snapshot

- Table 163 : PPG Industries Inc.: Financial Performance, FY 2023 and 2024

- Table 164 : PPG Industries Inc.: Product Portfolio

- Table 165 : RPM International Inc.: Company Snapshot

- Table 166 : RPM International Inc.: Financial Performance, FY 2022 and 2023

- Table 167 : RPM International Inc.: Product Portfolio

- Table 168 : SBL Coatings Pvt. Ltd.: Company Snapshot

- Table 169 : SBL Coatings Pvt. Ltd.: Product Portfolio

- Table 170 : Specialty Coating Systems Inc.: Company Snapshot

- Table 171 : Specialty Coating Systems Inc.: Product Portfolio

- Table 172 : The Sherwin-Williams Co.: Company Snapshot

- Table 173 : The Sherwin-Williams Co.: Financial Performance, FY 2023 and 2024

- Table 174 : The Sherwin-Williams Co.: Product Portfolio

- Table 175 : The Sherwin-Williams Co.: News/Key Developments, 2022-2025

List of Figures

- Summary Figure : Global Market Shares for Acrylic Coatings, by Region, 2023

- Figure 1 : Snapshot of Market Dynamics of Acrylic Coatings

- Figure 2 : Supply Chain Analysis of Global Acrylic Coatings Markets

- Figure 3 : Global Market Shares for Acrylic Coatings, by Type, 2023

- Figure 4 : Global Market Shares of Acrylic Coatings, by Technology, 2023

- Figure 5 : Global Market Shares of Acrylic Coatings, by Substrate, 2023

- Figure 6 : Global Plastics Production, 2021-2023

- Figure 7 : Demand Projection for Furniture Industry in India, 2025-2035

- Figure 8 : Global Market Shares for Acrylic Coatings, by End-Use Industries, 2023

- Figure 9 : Global Furniture Market, 2023-2028

- Figure 10 : Global Market Shares for Acrylic Coatings, by Region, 2023

- Figure 11 : Asia-Pacific Vehicle Production, by Country, 2023

- Figure 12 : Asia-Pacific Market Shares of Acrylic Coatings, by Country, 2023

- Figure 13 : Chinese Infrastructure Investment by Sector, 2023

- Figure 14 : FDI Inflows in India, 2024 and 2025

- Figure 15 : North American Market Shares of Acrylic Coatings, by Country, 2023

- Figure 16 : Canadian Aerospace Manufacturing Industry, 2021-2023

- Figure 17 : European Market Shares of Acrylic Coatings, by Country, 2023

- Figure 18 : Car Registrations in South America and Brazil, 2022 and 2023

- Figure 19 : South American Market Shares for Acrylic Coatings, by Country, 2023

- Figure 20 : Middle Eastern and African Market Shares of Acrylic Coatings, by Country, 2023

- Figure 21 : Overview of ESG Factors

- Figure 22 : Akzo Nobel N.V.: Revenue Shares, by Business Unit, FY 2024

- Figure 23 : Akzo Nobel N.V.: Revenue Shares, by Region, FY 2024

- Figure 24 : Arkema: Revenue Shares, by Business Unit, FY 2024

- Figure 25 : Arkema: Revenue Shares, by Region, FY 2024

- Figure 26 : Asian Paints: Revenue Shares, by Business Unit, FY 2023

- Figure 27 : Axalta Coating Systems LLC: Revenue Shares, by Business Unit, FY 2024

- Figure 28 : Axalta Coating Systems LLC: Revenue Shares, by Region, FY 2024

- Figure 29 : BASF: Revenue Shares, by Business Unit, FY 2024

- Figure 30 : BASF: Revenue Shares, by Country/Region, FY 2024

- Figure 31 : Dow: Revenue Shares, by Business Unit, FY 2024

- Figure 32 : Dow: Revenue Shares, by Region, FY 2024

- Figure 33 : Jotun: Revenue Shares, by Business Unit, FY 2024

- Figure 34 : Jotun: Revenue Shares, by Region, FY 2024

- Figure 35 : Nippon Paint Holdings Co. Ltd.: Revenue Shares, by Business Unit, FY 2024

- Figure 36 : Nippon Paint Holdings Co. Ltd.: Revenue Shares, by Business Group or Country/Region, FY 2024

- Figure 37 : PPG Industries Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 38 : PPG Industries Inc.: Revenue Shares, by Country/Region, FY 2024

- Figure 39 : RPM International Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 40 : RPM International Inc.: Revenue Shares, by Region, FY 2023

- Figure 41 : The Sherwin-Williams Co.: Revenue Shares, by Business Unit, FY 2024

The global acrylic coatings market is expected to grow from $68.6 billion in 2024 and is projected to reach $87.8 billion by the end of 2029, at a compound annual growth rate (CAGR) of 5.1% during the forecast period of 2024 to 2029.

The Asia-Pacific acrylic coatings market is expected to grow from $35.2 billion in 2024 and is projected to reach $46.6 billion by the end of 2029, at a CAGR of 5.8% during the forecast period of 2024 to 2029.

The North American acrylic coatings market is expected to grow from $16.6 billion in 2024 and is projected to reach $21.1 billion by the end of 2029, at a CAGR of 4.9% during the forecast period of 2024 to 2029.

Report Scope

The report will include details about various types, substrates, technologies and end-use industries for acrylic coatings. Estimated values are based on manufacturers' total revenues. Projected revenue values are in constant U.S. dollars, unadjusted for inflation. The report also contains comprehensive information regarding acrylic coatings and their users.

The global acrylic coatings market is segmented into the following categories:

- Type (thermoplastics and thermosets)

- Substrate (concrete, metal, plastic, wood, and others)

- Technology (waterborne, solvent-borne, powder, and others)

- End use (building and construction, general industrial, automotive, furniture, and others)

- Region (North America, Europe, Asia-Pacific, South America, and Middle East & Africa)

Report Includes

- 135 data tables and 41 additional tables

- An overview of the global market for acrylic coatings

- An analysis of the global market trends with market revenue data from 2023, estimates for 2024, forecasts for 2028, and projected CAGRs through 2029

- Evaluation of the current market size and revenue growth prospects for the acrylic coatings market, accompanied by a market share analysis by type, substrate, technology, end-use industry, and region

- Assessment of the key drivers and constraints that will shape the market for acrylic coatings, as well as upcoming market opportunities

- Discussion of the properties of acrylic coatings, such as storage stability, superior hardness, gloss retention, weather and corrosion resistance, and adhesion to non-porous surfaces

- Coverage of the major technologies used in the acrylic coatings market such as waterborne, solvent-borne, and powder coatings

- Assessment of ESG ratings and metrics, and ESG practices in the acrylic coatings industry and their impact; and insights into governance policies

- Evaluation of industry acquisitions and strategic alliances, and a market share analysis of the leading suppliers

- Company Profile of leading market participants, including Akzo Nobel N.V., PPG Industries Inc., BASF, Dow, and Jotun

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Market Definition

- Factors Affecting the Choice of Acrylic Coatings

- Importance of Acrylic Coatings

Chapter 3 Market Dynamics

- Key Takeaways:

- Market Dynamics Snapshot

- Drivers

- Growing Demand for Architectural Coatings

- Rising Consumption of Acrylic Coatings by the Automotive Industry

- Restraints

- Regulatory Burden on Producers

- Shortage of Skilled Labor

- Opportunities

- Geographic Expansion Through Acquisitions

- Growth Opportunities in the Aerospace and Defense Industry

- Challenge

- Intense Competition

Chapter 4 Regulatory Landscape

- Key Takeaways

- Regulatory Bodies in the Global Acrylic Coatings Market

Chapter 5 Emerging Technologies and Developments

- Key Takeaways:

- Newest Technology

- Self-healing Waterborne Acrylic Latex Coating

- Radiative Cooling Acrylic Coating

Chapter 6 Supply Chain Analysis of Global Acrylic Coatings Markets

- Supply Chain Analysis of Global Acrylic Coatings Markets

- Manufacturer

- Sales

Chapter 7 Market Segmentation Analysis

- Key Takeaways:

- Segmentation Breakdown

- Market Analysis by Type

- Thermoplastics

- Thermosets

- Market Analysis by Technology

- Waterborne

- Solvent-borne Acrylic

- Powder

- Other Technology

- Market Analysis by Substrate

- Concrete

- Metal

- Plastic

- Wood

- Others

- Market Analysis by End-Use Industry

- Building and Construction

- General Industrial

- Automotive

- Furniture

- Others

- Geographic Breakdown

- Market Analysis by Region

- Asia-Pacific

- China

- India

- Japan

- Rest of Asia-Pacific

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- Middle East

- Africa

Chapter 8 Competitive Intelligence

- Acrylic Coatings Markets: Market Share Analysis

- Strategic Analysis

Chapter 9 Sustainability in Acrylic Coatings: ESG Perspective

- Importance of ESG in Acrylic Coatings: Markets

- ESG Practices in the Acrylic Coatings: Markets

- Current Status of ESG in the Acrylic Coatings: Market

- Risk Scale, Exposure Scale, and Management Scale

- Future of ESG: Emerging Trends and Opportunities

- Concluding Remarks from BCC

Chapter 10 Appendix

- Methodology

- Information Sources

- Abbreviations

- References

- Company Profiles

- AKZO NOBEL N.V.

- ARKEMA

- ASIAN PAINTS

- AXALTA COATING SYSTEMS LLC

- BASF

- DOW

- JAMESTOWN COATING TECHNOLOGIES

- JOHNS MANVILLE

- JOTUN

- NIPPON PAINT HOLDINGS CO. LTD.

- PPG INDUSTRIES INC.

- RPM INTERNATIONAL INC.

- SBL COATINGS PVT. LTD.

- SPECIALTY COATING SYSTEMS INC.

- THE SHERWIN-WILLIAMS CO.