|

|

市場調査レポート

商品コード

1691633

アドバンストセラミックスおよびナノセラミック粉末Advanced Ceramics and Nanoceramic Powders |

||||||

|

|||||||

| アドバンストセラミックスおよびナノセラミック粉末 |

|

出版日: 2025年03月28日

発行: BCC Research

ページ情報: 英文 181 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のアドバンストセラミックスおよびナノセラミック粉末の市場規模は、2023年の222億米ドル、2024年の239億米ドルから、予測期間中はCAGR 8.0%で推移し、2029年末には351億米ドルに達すると予測されています。

アドバンストセラミックスの市場は、2024年の171億米ドルから、予測期間中はCAGR 7.1%で推移し、2029年末には241億米ドルに達すると予測されています。ナノセラミック粉末の市場は、2024年の67億米ドルから、10.2%のCAGRで推移し、2029年末には110億米ドルに達すると予測されています。

当レポートでは、世界のアドバンストセラミックスおよびナノセラミック粉末の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

第2章 市場概要

- セラミックスの定義

- 従来型セラミックスとアドバンストセラミックス

- アドバンストセラミックスの事例と応用

- ナノセラミックス

- ナノセラミックスの特性

- ナノセラミックスの応用

- サプライチェーン分析

- ポーターのファイブフォース分析

第3章 市場力学

- 市場力学:スナップショット

- 市場促進要因

- 高性能コーティングの需要の増加

- 新しいエンドユーザー産業におけるアドバンストセラミックスの採用

- ナノセラミックスのバイオメディカルおよびヘルスケアへの応用

- 市場機会

- 水ろ過と環境持続可能性におけるナノセラミック粉末

- 次世代スマートセラミックスと自己修復材料

- 市場の課題と制約

- セラミックコーティングの製造とメンテナンスにかかる高コスト

- アドバンストセラミックス市場における代替材料

第4章 規制状況

- 規制分析

第5章 新興技術

- アドバンストセラミックスとナノセラミック粉末における新技術の革新

- 付加製造

- ナノ構造および高エントロピーセラミックス

- 自己修復セラミックスとスマートセラミックス

- 次世代固体電池とエネルギー貯蔵

- 先進セラミックコーティングと遮熱コーティング

- バイオメディカルナノセラミックスとバイオプリンティング

- セラミック膜と環境アプリケーション

- 光学および防衛用途向け透明セラミックス

- イノベーションを推進する動向

- セラミック加工における材料特性の最適化のためのAIとML

- グリーン製造技術

- ナノ複合材料と機能化コーティングを備えたハイブリッドセラミック

- セラミックスベースのエレクトロニクスの進歩

第6章 市場セグメンテーション分析

- アドバンストセラミックスのセグメント別内訳

- アドバンストセラミックス市場:製品タイプ別

- アルミナ

- ジルコニア

- シリコンカーバイド

- 窒化シリコン

- その他

- アドバンストセラミックス市場:エンドユーザー別

- エレクトロニクスおよび半導体

- エネルギーと電力

- 自動車

- 医療

- 航空宇宙および防衛

- 産業

- その他

- アドバンストセラミックス市場:地域別

- 北米

- 欧州

- アジア太平洋

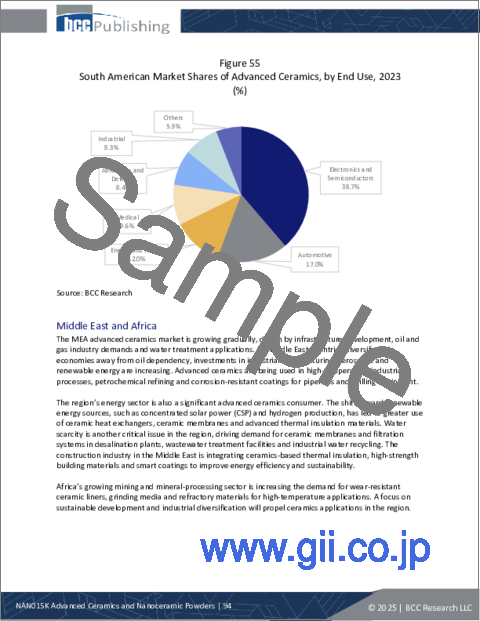

- 南米

- 中東・アフリカ

- ナノセラミック粉末のセグメンテーションの内訳

- ナノセラミック粉末市場:製品タイプ別

- 酸化物

- 炭化物

- 窒化物

- ボロン

- その他

- ナノセラミック粉末市場:エンドユーザー別

- エレクトロニクス・半導体

- エネルギー・電力

- 自動車

- 医学

- 航空宇宙・防衛

- 産業

- その他

- ナノセラミック粉末の地理的内訳

- ナノセラミック粉末市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第7章 競合情勢

- 市場競争力

- 企業の位置づけ

- 企業ポジショニング分析

- 戦略的取り組み

第8章 アドバンストセラミックスおよびナノセラミック粉末産業における持続可能性:ESGの観点

- ESGの重要性

- ESGの実践

- 新たな持続可能性の動向

- BCCからの総論

第9章 付録

- 調査手法

- 情報源

- 参考文献

- 略語

- 企業プロファイル

- 3M

- ABM ADVANCE BALL MILL INC.

- ADVANCED CERAMIC MATERIALS

- CERAMTEC GMBH

- CERION LLC.

- COORSTEK INC.

- CUMI

- DENKA CO. LTD.

- ELAN TECHNOLOGY

- FERROTEC (USA) CORP.

- GENERAL ATOMICS

- GENERAL ELECTRIC CO.

- INNOVACERA

- KYOCERA CORP.

- SAINT-GOBAIN

List of Tables

- Summary Table : Global Market for Advanced Ceramics and Nanoceramic Powders, by Segment, Through 2029

- Table 1 : Traditional Ceramics vs. Advanced Ceramics

- Table 2 : Regulations for Advanced Ceramics and Nanoceramic Powders, 2023

- Table 3 : Global Market for Advanced Ceramics, by Product Type, Through 2029

- Table 4 : Global Market for Alumina Advanced Ceramics, by End Use, Through 2029

- Table 5 : Global Market for Alumina Advanced Ceramics, by Region, Through 2029

- Table 6 : Global Market for Zirconia Advanced Ceramics, by End Use, Through 2029

- Table 7 : Global Market for Zirconia Advanced Ceramics, by Region, Through 2029

- Table 8 : Global Market for Silicon Carbide Advanced Ceramics, by End Use, Through 2029

- Table 9 : Global Market for Silicon Carbide Advanced Ceramics, by Region, Through 2029

- Table 10 : Global Market for Silicon Nitride Advanced Ceramics, by End Use, Through 2029

- Table 11 : Global Market for Silicon Nitride Advanced Ceramics, by Region, Through 2029

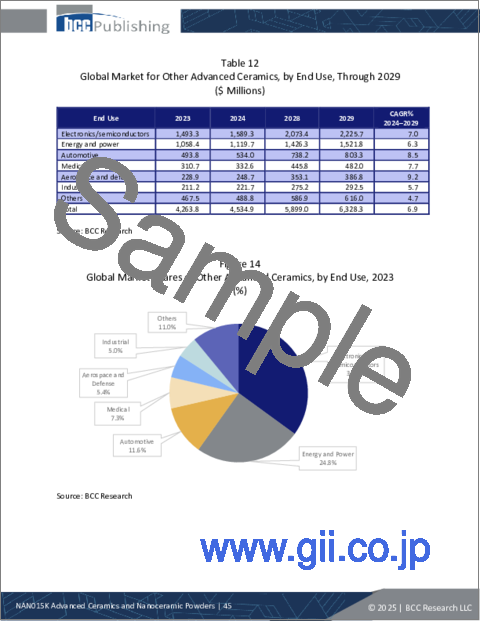

- Table 12 : Global Market for Other Advanced Ceramics, by End Use, Through 2029

- Table 13 : Global Market for Other Advanced Ceramics, by Region, Through 2029

- Table 14 : Global Market for Advanced Ceramics, by End Use, Through 2029

- Table 15 : Global Market for Advanced Ceramics Used in Electronics and Semiconductors, by Region, Through 2029

- Table 16 : Global Market for Advanced Ceramics Used in Energy and Power Applications, by Region, Through 2029

- Table 17 : Global Market for Advanced Ceramics Used in Automotive Applications, by Region, Through 2029

- Table 18 : Global Market for Advanced Ceramics Used in Medical Applications, by Region, Through 2029

- Table 19 : Global Market for Advanced Ceramics Used in the Aerospace and Defense Sector, by Region, Through 2029

- Table 20 : Global Market for Advanced Ceramics Used in Industrial Applications, by Region, Through 2029

- Table 21 : Global Market for Advanced Ceramics for the Other End Uses, by Region, Through 2029

- Table 22 : Global Market for Advanced Ceramics, by Region, Through 2029

- Table 23 : North American Market for Advanced Ceramics, by Country, Through 2029

- Table 24 : North American Market for Advanced Ceramics, by Product Type, Through 2029

- Table 25 : North American Market for Alumina Advanced Ceramics, by End Use, Through 2029

- Table 26 : North American Market for Zirconia Advanced Ceramics, by End Use, Through 2029

- Table 27 : North American Market for Silicon Carbide Advanced Ceramics, by End Use, Through 2029

- Table 28 : North American Market for Silicon Nitride Advanced Ceramics, by End Use, Through 2029

- Table 29 : North American Market for Other Advanced Ceramics, by End Use, Through 2029

- Table 30 : North American Market for Advanced Ceramics, by End Use, Through 2029

- Table 31 : European Market for Advanced Ceramics, by Country, Through 2029

- Table 32 : European Market for Advanced Ceramics, by Product Type, Through 2029

- Table 33 : European Market for Alumina Advanced Ceramics, by End Use, Through 2029

- Table 34 : European Market for Zirconia Advanced Ceramics, by End Use, Through 2029

- Table 35 : European Market for Silicon Carbide Advanced Ceramics, by End Use, Through 2029

- Table 36 : European Market for Silicon Nitride Advanced Ceramics, by End Use, Through 2029

- Table 37 : European Market for Other Advanced Ceramics, by End Use, Through 2029

- Table 38 : European Market for Advanced Ceramics, by End Use, Through 2029

- Table 39 : Asia-Pacific Market for Advanced Ceramics, by Country, Through 2029

- Table 40 : Asia-Pacific Market for Advanced Ceramics, by Product Type, Through 2029

- Table 41 : Asia-Pacific Market for Alumina Advanced Ceramics, by End Use, Through 2029

- Table 42 : Asia-Pacific Market for Zirconia Advanced Ceramics, by End Use, Through 2029

- Table 43 : Asia-Pacific Market for Silicon Carbide Advanced Ceramics, by End Use, Through 2029

- Table 44 : Asia-Pacific Market for Silicon Nitride Advanced Ceramics, by End Use, Through 2029

- Table 45 : Asia-Pacific Market for Other Advanced Ceramics, by End Use, Through 2029

- Table 46 : Asia-Pacific Market for Advanced Ceramics, by End Use, Through 2029

- Table 47 : South American Market for Advanced Ceramics, by Product Type, Through 2029

- Table 48 : South American Market for Alumina Advanced Ceramics, by End Use, Through 2029

- Table 49 : South American Market for Zirconia Advanced Ceramics, by End Use, Through 2029

- Table 50 : South American Market for Silicon Carbide Advanced Ceramics, by End Use, Through 2029

- Table 51 : South American Market for Silicon Nitride Advanced Ceramics, by End Use, Through 2029

- Table 52 : South American Market for Other Advanced Ceramics, by End Use, Through 2029

- Table 53 : South American Market for Advanced Ceramics, by End Use, Through 2029

- Table 54 : MEA Market for Advanced Ceramics, by Product Type, Through 2029

- Table 55 : MEA Market for Alumina Advanced Ceramics, by End Use, Through 2029

- Table 56 : MEA Market for Zirconia Advanced Ceramics, by End Use, Through 2029

- Table 57 : MEA Market for Silicon Carbide Advanced Ceramics, by End Use, Through 2029

- Table 58 : MEA Market for Silicon Nitride Advanced Ceramics, by End Use, Through 2029

- Table 59 : MEA Market for Other Advanced Ceramics, by End Use, Through 2029

- Table 60 : MEA Market for Advanced Ceramics, by End Use, Through 2029

- Table 61 : Global Market for Nanoceramic Powders, by Product Type, Through 2029

- Table 62 : Global Market for Oxide-Based Nanoceramic Powders, by Region, Through 2029

- Table 63 : Global Market for Carbide-Based Nanoceramic Powders, by Region, Through 2029

- Table 64 : Global Market for Nitride-Based Nanoceramic Powders, by Region, Through 2029

- Table 65 : Global Market for Boron-Based Nanoceramic Powders, by Region, Through 2029

- Table 66 : Global Market for Other Nanoceramic Powders, by Region, Through 2029

- Table 67 : Global Market for Nanoceramic Powders, by End Use, Through 2029

- Table 68 : Global Market for Nanoceramic Powders Used in Electronics and Semiconductors, by Region, Through 2029

- Table 69 : Global Market for Nanoceramic Powders Used in Energy and Power Applications, by Region, Through 2029

- Table 70 : Global Market for Nanoceramic Powders Used in Automotive Applications, by Region, Through 2029

- Table 71 : Global Market for Nanoceramic Powders Used in Medical Applications, by Region, Through 2029

- Table 72 : Global Market for Nanoceramic Powders Used in the Aerospace and Defense Sector, by Region, Through 2029

- Table 73 : Global Market for Nanoceramic Powders Used in Industrial Applications, by Region, Through 2029

- Table 74 : Global Market for Nanoceramic Powders for the Other End Uses, by Region, Through 2029

- Table 75 : Global Market for Nanoceramic Powders, by Region, Through 2029

- Table 76 : North American Market for Nanoceramic Powders, by Country, Through 2029

- Table 77 : North American Market for Nanoceramic Powders, by Product Type, Through 2029

- Table 78 : North American Market for Nanoceramic Powders, by End Use, Through 2029

- Table 79 : European Market for Nanoceramic Powders, by Country, Through 2029

- Table 80 : European Market for Nanoceramic Powders, by Product Type, Through 2029

- Table 81 : European Market for Nanoceramic Powders, by End Use, Through 2029

- Table 82 : Asia-Pacific Market for Nanoceramic Powders, by Country, Through 2029

- Table 83 : Asia-Pacific Market for Nanoceramic Powders, by Product Type, Through 2029

- Table 84 : Asia-Pacific Market for Nanoceramic Powders, by End Use, Through 2029

- Table 85 : South American Market for Nanoceramic Powders, by Product Type, Through 2029

- Table 86 : South American Market for Nanoceramic Powders, by End Use, Through 2029

- Table 87 : MEA Market for Nanoceramic Powders, by Product Type, Through 2029

- Table 88 : MEA Market for Nanoceramic Powders, by End Use, Through 2029

- Table 89 : ESG Carbon Footprint Issue Analysis

- Table 90 : Abbreviations Used in This Report

- Table 91 : 3M: Company Snapshot

- Table 92 : 3M: Financial Performance, FY 2022 and 2023

- Table 93 : 3M: Product Portfolio

- Table 94 : 3M: News/Key Developments, 2021

- Table 95 : ABM Advance Ball Mill Inc.: Company Snapshot

- Table 96 : ABM Advance Ball Mill Inc.: Product Portfolio

- Table 97 : Advanced Ceramic Materials: Company Snapshot

- Table 98 : Advanced Ceramic Materials: Product Portfolio

- Table 99 : CeramTec GmbH: Company Snapshot

- Table 100 : CeramTec GmbH: Product Portfolio

- Table 101 : CeramTec GmbH: News/Key Developments, 2021

- Table 102 : Cerion LLC.: Company Snapshot

- Table 103 : Cerion LLC.: Product Portfolio

- Table 104 : CoorsTek Inc.: Company Snapshot

- Table 105 : CoorsTek Inc.: Product Portfolio

- Table 106 : CUMI: Company Snapshot

- Table 107 : CUMI: Financial Performance, FY 2022 and 2023

- Table 108 : CUMI: Product Portfolio

- Table 109 : Denka Co. Ltd.: Company Snapshot

- Table 110 : Denka Co. Ltd.: Financial Performance, FY 2022 and 2023

- Table 111 : Denka Co. Ltd.: Product Portfolio

- Table 112 : Elan Technology: Company Snapshot

- Table 113 : Elan Technology: Product Portfolio

- Table 114 : Ferrotec (USA) Corp.: Company Snapshot

- Table 115 : Ferrotec (USA) Corp.: Product Portfolio

- Table 116 : General Atomics: Company Snapshot

- Table 117 : General Atomics: Product Portfolio

- Table 118 : General Atomics: News/Key Developments, 2024

- Table 119 : General Electric Co.: Company Snapshot

- Table 120 : General Electric Co.: Financial Performance, FY 2022 and 2023

- Table 121 : General Electric Co.: Product Portfolio

- Table 122 : Innovacera: Company Snapshot

- Table 123 : Innovacera: Product Portfolio

- Table 124 : Kyocera Corp.: Company Snapshot

- Table 125 : Kyocera Corp.: Financial Performance, FY 2022 and 2023

- Table 126 : Kyocera Corp.: Product Portfolio

- Table 127 : Kyocera Corp.: News/Key Developments, 2024

- Table 128 : Saint-Gobain: Company Snapshot

- Table 129 : Saint-Gobain: Financial Performance, FY 2022 and 2023

- Table 130 : Saint-Gobain: Product Portfolio

List of Figures

- Summary Figure : Global Market for Advanced Ceramics and Nanoceramic Powders, by Segment, 2023-2029

- Figure 1 : Supply Chain for Advanced Ceramics and Nanoceramic Powders

- Figure 2 : Porter's Five Forces Analysis of Advanced Ceramics and Nanoceramic Powders

- Figure 3 : Market Dynamics: Drivers and Challenges

- Figure 4 : Global Market for High-Performance Coatings, 2023-2029

- Figure 5 : Global Market Shares for Advanced Ceramics, by Product Type, 2023

- Figure 6 : Global Market Shares of Alumina Advanced Ceramics, by End Use, 2023

- Figure 7 : Global Market Shares of Alumina Advanced Ceramics, by Region, 2023

- Figure 8 : Global Market Shares of Zirconia Advanced Ceramics, by End Use, 2023

- Figure 9 : Global Market Shares of Zirconia Advanced Ceramics, by Region, 2023

- Figure 10 : Global Market Shares of Silicon Carbide Advanced Ceramics, by End Use, 2023

- Figure 11 : Global Market Shares of Silicon Carbide Advanced Ceramics, by Region, 2023

- Figure 12 : Global Market Shares of Silicon Nitride Advanced Ceramics, by End Use, 2023

- Figure 13 : Global Market Shares of Silicon Nitride Advanced Ceramics, by Region, 2023

- Figure 14 : Global Market Shares of Other Advanced Ceramics, by End Use, 2023

- Figure 15 : Global Market Shares of Other Advanced Ceramics, by Region, 2023

- Figure 16 : Global Market Shares of Advanced Ceramics, by End Use, 2023

- Figure 17 : Global Market Shares of Advanced Ceramics Used in Electronics and Semiconductors, by Region, 2023

- Figure 18 : Global Market Shares of Advanced Ceramics Used in Energy and Power Applications, by Region, 2023

- Figure 19 : Global Market Shares of Advanced Ceramics Used in Automotive Applications, by Region, 2023

- Figure 20 : Global Market Shares of Advanced Ceramics Used in Medical Applications, by Region, 2023

- Figure 21 : Global Market Shares of Advanced Ceramics Used in the Aerospace and Defense Sector, by Region, 2023

- Figure 22 : Global Market Shares of Advanced Ceramics Used in Industrial Applications, by Region, 2023

- Figure 23 : Global Market Shares of Advanced Ceramics for the Other End Uses, by Region, 2023

- Figure 24 : Global Market Shares of Advanced Ceramics, by Region, 2023

- Figure 25 : North American Market Shares of Advanced Ceramics, by Country, 2023

- Figure 26 : North American Market Shares of Advanced Ceramics, by Product Type, 2023

- Figure 27 : North American Market Shares of Alumina Advanced Ceramics, by End Use, 2023

- Figure 28 : North American Market Shares of Zirconia Advanced Ceramics, by End Use, 2023

- Figure 29 : North American Market Shares of Silicon Carbide Advanced Ceramics, by End Use, 2023

- Figure 30 : North American Market Shares of Silicon Nitride Advanced Ceramics, by End Use, 2023

- Figure 31 : North American Market Shares of Other Advanced Ceramics, by End Use, 2023

- Figure 32 : North American Market Shares of Advanced Ceramics, by End Use, 2023

- Figure 33 : European Market Shares of Advanced Ceramics, by Country, 2023

- Figure 34 : European Market Shares of Advanced Ceramics, by Product Type, 2023

- Figure 35 : European Market Shares of Alumina Advanced Ceramics, by End Use, 2023

- Figure 36 : European Market Shares of Zirconia Advanced Ceramics, by End Use, 2023

- Figure 37 : European Market Shares of Silicon Carbide Advanced Ceramics, by End Use, 2023

- Figure 38 : European Market Shares of Silicon Nitride Advanced Ceramics, by End Use, 2023

- Figure 39 : European Market Shares of Other Advanced Ceramics, by End Use, 2023

- Figure 40 : European Market Shares of Advanced Ceramics, by End Use, 2023

- Figure 41 : Asia-Pacific Market Shares of Advanced Ceramics, by Country, 2023

- Figure 42 : Asia-Pacific Market Shares of Advanced Ceramics, by Product Type, 2023

- Figure 43 : Asia-Pacific Market Shares of Alumina Advanced Ceramics, by End Use, 2023

- Figure 44 : Asia-Pacific Market Shares of Zirconia Advanced Ceramics, by End Use, 2023

- Figure 45 : Asia-Pacific Market Shares of Silicon Carbide Advanced Ceramics, by End Use, 2023

- Figure 46 : Asia-Pacific Market Shares of Silicon Nitride Advanced Ceramics, by End Use, 2023

- Figure 47 : Asia-Pacific Market Shares of Other Advanced Ceramics, by End Use, 2023

- Figure 48 : Asia-Pacific Market Shares of Advanced Ceramics, by End Use, 2023

- Figure 49 : South American Market Shares of Advanced Ceramics, by Product Type, 2023

- Figure 50 : South American Market Shares of Alumina Advanced Ceramics, by End Use, 2023

- Figure 51 : South American Market Shares of Zirconia Advanced Ceramics, by End Use, 2023

- Figure 52 : South American Market Shares of Silicon Carbide Advanced Ceramics, by End Use, 2023

- Figure 53 : South American Market Shares of Silicon Nitride Advanced Ceramics, by End Use, 2023

- Figure 54 : South American Market Shares of Other Advanced Ceramics, by End Use, 2023

- Figure 55 : South American Market Shares of Advanced Ceramics, by End Use, 2023

- Figure 56 : MEA Market Shares of Advanced Ceramics, by Product Type, 2023

- Figure 57 : MEA Market Shares of Alumina Advanced Ceramics, by End Use, 2023

- Figure 58 : MEA Market Shares of Zirconia Advanced Ceramics, by End Use, 2023

- Figure 59 : MEA Market Shares of Silicon Carbide Advanced Ceramics, by End Use, 2023

- Figure 60 : MEA Market Shares of Silicon Nitride Advanced Ceramics, by End Use, 2023

- Figure 61 : MEA Market Shares of Other Advanced Ceramics, by End Use, 2023

- Figure 62 : MEA Market Shares of Advanced Ceramics, by End Use, 2023

- Figure 63 : Global Market Shares of Nanoceramic Powders, by Product Type, 2023

- Figure 64 : Global Market Shares of Oxide-Based Nanoceramic Powders, by Region, 2023

- Figure 65 : Global Market Shares of Carbide-Based Nanoceramic Powders, by Region, 2023

- Figure 66 : Global Market Shares of Nitride-Based Nanoceramic Powders, by Region, 2023

- Figure 67 : Global Market Shares of Boron-Based Nanoceramic Powders, by Region, 2023

- Figure 68 : Global Market Shares of Other Nanoceramic Powders, by Region, 2023

- Figure 69 : Global Market Shares of Nanoceramic Powders, by End Use, 2023

- Figure 70 : Global Market Shares of Nanoceramic Powders Used in Electronics and Semiconductors, by Region, 2023

- Figure 71 : Global Market Shares of Nanoceramic Powders Used in Energy and Power Applications, by Region, 2023

- Figure 72 : Global Market Shares of Nanoceramic Powders Used in Automotive Applications, by Region, 2023

- Figure 73 : Global Market Shares of Nanoceramic Powders Used in Medical Applications, by Region, 2023

- Figure 74 : Global Market Shares of Nanoceramic Powders Used in the Aerospace and Defense Sector, by Region, 2023

- Figure 75 : Global Market Shares of Nanoceramic Powders Used in Industrial Applications, by Region, 2023

- Figure 76 : Global Market Shares of Nanoceramic Powders for the Other End Uses, by Region, 2023

- Figure 77 : Global Market Shares of Nanoceramic Powders, by Region, 2023

- Figure 78 : North American Market Shares of Nanoceramic Powders, by Country, 2023

- Figure 79 : North American Market Shares of Nanoceramic Powders, by Product Type, 2023

- Figure 80 : North American Market Shares of Nanoceramic Powders, by End Use, 2023

- Figure 81 : European Market Shares of Nanoceramic Powders, by Country, 2023

- Figure 82 : European Market Shares of Nanoceramic Powders, by Product Type, 2023

- Figure 83 : European Market Shares of Nanoceramic Powders, by End Use, 2023

- Figure 84 : Asia-Pacific Market Shares of Nanoceramic Powders, by Country, 2023

- Figure 85 : Asia-Pacific Market Shares of Nanoceramic Powders, by Product Type, 2023

- Figure 86 : Asia-Pacific Market Shares of Nanoceramic Powders, by End Use, 2023

- Figure 87 : South American Market Shares of Nanoceramic Powders, by Product Type, 2023

- Figure 88 : South American Market Shares of Nanoceramic Powders, by End Use, 2023

- Figure 89 : MEA Market Shares of Nanoceramic Powders, by Product Type, 2023

- Figure 90 : MEA Market Shares of Nanoceramic Powders, by End Use, 2023

- Figure 91 : Company Positioning Analysis, 2023

- Figure 92 : 3M: Revenue Share, by Business Unit, FY 2023

- Figure 93 : 3M: Revenue Share, by Country/Region, FY 2023

- Figure 94 : CUMI: Revenue Share, by Business Unit, FY 2023

- Figure 95 : CUMI: Revenue Share, by Country/Region, FY 2023

- Figure 96 : Denka Co. Ltd.: Revenue Share, by Business Unit, FY 2023

- Figure 97 : General Electric Co.: Revenue Share, by Business Unit, FY 2023

- Figure 98 : General Electric Co.: Revenue Share, by Country/Region, FY 2023

- Figure 99 : Kyocera Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 100 : Kyocera Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 101 : Saint-Gobain: Revenue Share, by Business Unit/Region, FY 2023

The global market for advanced ceramics and nanoceramic powders totaled $22.2 billion in 2023. It is expected to grow from $23.9 billion in 2024 to reach $35.1 billion by the end of 2029, at a compound annual growth rate (CAGR) of 8.0% from 2024 through 2029.

The global market for advanced ceramics is expected to grow from $17.1 billion in 2024 to reach $24.1 billion by the end of 2029, at a CAGR of 7.1% from 2024 through 2029.

The global market for nanoceramic powders is expected to grow from $6.7 billion in 2024 to reach $11.0 billion by the end of 2029, at a CAGR of 10.2% from 2024 through 2029.

Report Scope

This report analyzes the global market for advanced ceramics and nanoceramic powders by segmenting it based on product type, end use and region at the global and regional levels. The base year for this analysis is 2023, and market estimates and forecasts are provided from 2024 through 2029. The market estimates are provided in terms of revenue ($ million).

By product type, the advanced ceramics market is segmented into:

- Alumina (Al2O3).

- Zirconia (ZrO2).

- Silicon carbide (SiC).

- Silicon nitride (Si3N4).

- Others.

By end use, the advanced ceramics market is segmented into:

- Electronics and semiconductor.

- Energy and power.

- Automotive.

- Medical.

- Aerospace and defense.

- Industrial.

- Others.

By region, the advanced ceramics market is segmented into:

- North America.

- Europe.

- Asia-Pacific.

- South America.

- Middle East and Africa.

By product type, the nanoceramic powders market is segmented into:

- Oxide.

- Carbide.

- Nitride.

- Boron.

- Others.

By end use, the nanoceramic powders market is segmented into:

- Electronics and semiconductors.

- Energy and power.

- Automotive.

- Medical.

- Aerospace and defense.

- Industrial.

- Others.

Based on region, the nanoceramic powders market is segmented into:

- North America.

- Europe.

- Asia-Pacific.

- South America.

- Middle East and Africa.

Report Includes

- 93 data tables and 38 additional tables

- A review of the global market for advanced ceramics and nanoceramic powders

- Analyses of the global market trends, with sales data for 2023, estimates for 2024, forecasts for 2028, and projections of compound annual growth rates (CAGRs) through 2029

- Evaluation and forecast of the size of the market for advanced ceramics and nanoceramic powders, and a corresponding market share analysis by product type, end use industry and region

- Analysis of emerging technologies, opportunities and gaps in current and future demand for advanced ceramics and nanoceramic powders

- Discussion of the properties, advantages and disadvantages of ceramic and nanosized ceramic powders

- Coverage of the technological and business issues related to the commercial production and use of advanced ceramic and nanoceramic powders

- Identification of the companies best positioned to meet demand for these products

- Discussion of the industry value chain, demand-supply gap, and factors driving the growth of market

- A patent analysis with emphasis on emerging technologies and new developments in the market

- A discussion of the industry's ESG challenges and practices

- Market share analysis of the key companies and their proprietary technologies, strategic alliances, and other market strategies

- Profiles of the leading companies, including 3M, CeramTec GmbH, CoorsTek Inc., CUMI, Kyocera Corp., and Ferrotec (USA) Corp.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Definition of Ceramics

- Traditional vs. Advanced Ceramics

- Examples and Applications of Advanced Ceramics

- Nanoceramics

- Properties of Nanoceramics

- Applications of Nanoceramics

- Supply Chain Analysis

- Feedstock

- Distribution and Logistics

- Consumers

- Porter's Five Forces Analysis

- Bargaining Power of Suppliers: High

- Bargaining Power of Buyers: Moderate

- Competition in the Industry: High

- Threat of Substitutes: Moderate

- Potential for Market Entry: Low

Chapter 3 Market Dynamics

- Market Dynamics Snapshot

- Market Drivers

- Increasing Demand for High-Performance Coatings

- Adoption of Advanced Ceramics in Emerging End-Use Industries

- Biomedical and Healthcare Applications of Nanoceramics

- Market Opportunities

- Nanoceramic Powders in Water Filtration and Environmental Sustainability

- Next-Generation Smart Ceramics and Self-Healing Materials

- Market Challenges and Restraints

- High Cost Involved in Production and Maintenance of Ceramic Coatings

- Alternative Materials in the Advanced Ceramics Market

Chapter 4 Regulatory Landscape

- Regulatory Analysis

Chapter 5 Emerging Technologies

- Emerging Technologies Innovations in Advanced Ceramics and Nanoceramic Powders

- Additive Manufacturing

- Nanostructured and High-Entropy Ceramics

- Self-Healing Ceramics and Smart Ceramics

- Next-Generation Solid-State Batteries and Energy Storage

- Advanced Ceramic Coatings and Thermal Barrier Coatings

- Biomedical Nanoceramics and Bioprinting

- Ceramic Membranes and Environmental Applications

- Transparent Ceramics for Optical and Defense Applications

- Trends Driving Innovation

- AI and ML in Ceramic Processing for Optimizing Material Properties

- Green Manufacturing Techniques

- Hybrid Ceramics with Nanocomposites and Functionalized Coatings

- Advances in Ceramics-Based Electronics

Chapter 6 Market Segmentation Analysis

- Advanced Ceramics Segmentation Breakdown

- Advanced Ceramics Market, by Product Type

- Alumina

- Zirconia

- Silicon Carbide

- Silicon Nitride

- Others

- Advanced Ceramics Market, by End Use

- Electronics and Semiconductors

- Energy and Power

- Automotive

- Medical

- Aerospace and Defense

- Industrial

- Other End Uses

- Advanced Ceramics Geographic Breakdown

- Advanced Ceramics Market, by Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

- Nanoceramic Powders Segmentation Breakdown

- Nanoceramic Powders Market, by Product Type

- Oxide

- Carbide

- Nitride

- Boron

- Others

- Nanoceramic Powders Market, by End Use

- Electronics and Semiconductors

- Energy and Power

- Automotive

- Medical

- Aerospace and Defense

- Industrial

- Other Applications

- Nanoceramic Powders Geographic Breakdown

- Nanoceramic Powders Market, by Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Chapter 7 Competitive Landscape

- Market Competitiveness

- Company Positioning

- Company Positioning Analysis

- Strategic Initiatives

Chapter 8 Sustainability in the Advanced Ceramics and Nanoceramic Powders Industry: An ESG Perspective

- Importance of ESG

- ESG Practices

- Emerging Sustainability Trends

- Concluding Remarks from BCC Research

Chapter 9 Appendix

- Methodology

- Information Sources

- References

- Abbreviations

- Company Profiles

- 3M

- ABM ADVANCE BALL MILL INC.

- ADVANCED CERAMIC MATERIALS

- CERAMTEC GMBH

- CERION LLC.

- COORSTEK INC.

- CUMI

- DENKA CO. LTD.

- ELAN TECHNOLOGY

- FERROTEC (USA) CORP.

- GENERAL ATOMICS

- GENERAL ELECTRIC CO.

- INNOVACERA

- KYOCERA CORP.

- SAINT-GOBAIN