|

|

市場調査レポート

商品コード

1691630

新興医療機器技術の世界市場Global Markets for Emerging Medical Device Technologies |

||||||

|

|||||||

| 新興医療機器技術の世界市場 |

|

出版日: 2025年03月27日

発行: BCC Research

ページ情報: 英文 170 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の新興医療機器技術の市場規模は、2024年の1,366億米ドルから、予測期間中はCAGR 10.4%で推移し、2029年には2,239億米ドルに達すると予測されています。

IVDの市場は、2024年の287億米ドルから、予測期間中はCAGR 10.9%で推移し、2029年には481億米ドルに達すると予測されています。心血管機器の市場は、2024年の234億米ドルから、CAGR 11.6%で推移し、2029年には406億米ドルに達すると予測されています。

当レポートでは、世界の新興医療機器技術の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

第2章 市場と技術の背景

- 背景

- イノベーション

- 概要

- 種類

- 現在の動向

- サイバーセキュリティに関する考察

- ウェアラブルフィットネス技術

- 医療用IoT

- ヘルスケアとロボット工学

- 3Dプリント

- 医療機器としてのデバイスの接続性とソフトウェア

- PESTLE分析

第3章 市場力学

- 市場促進要因

- 健康とウェルネスの新たな動向

- 医療機器におけるAI/MLの利用増加

- 慢性疾患の管理をサポートする技術とサービス

- 公衆衛生の改善の必要性

- 疾患の診断需要の増加

- 患者教育の強化

- 市場抑制要因

- 研究開発資金の課題

- ヘルスケアにおけるサイバーセキュリティのリスク

- 医療機器設計の失敗

- サプライチェーンのリスクと脆弱性

- 市場機会

- モバイル医療画像によるヘルスケアの提供

- 医療機器の技術開発

- 課題

第4章 新興技術と開発

- 2024年の主要な医療機器と技術の進歩

- アダプティブ補聴器

- バイオプリンティング

- 血糖値モニタリングデバイスとデジタルウェアラブル

- ブレインマシンインターフェース

- 2023年の主要な医療機器と技術の進歩

- 医療診断ソフトウェア

- 放射線科におけるAI

- 外科用ロボット

- 医療機器技術の動向

第5章 市場セグメント分析

- セグメンテーションの内訳

- 市場内訳:デバイスタイプ別

- 体外診断

- 市場規模・予測

- 心臓血管デバイス

- 市場規模・予測

- 神経

- 市場規模・予測

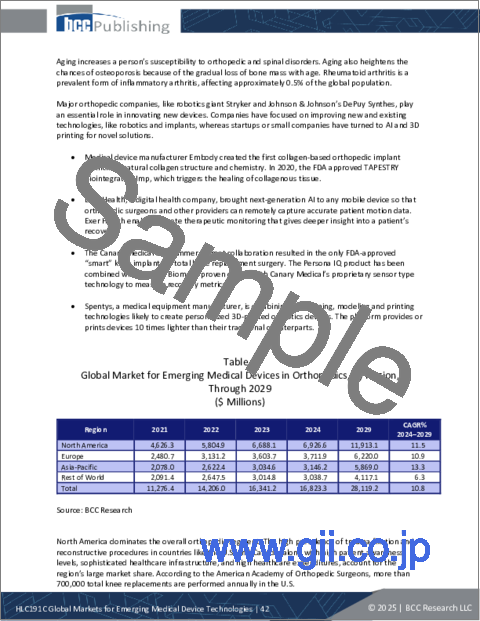

- 整形外科

- 市場規模・予測

- 糖尿病ケア

- 市場規模・予測

- 内視鏡検査

- 市場規模・予測

- 泌尿器科

- 市場規模・予測

- その他のデバイス

- 市場内訳:エンドユーザー別

- 病院・診療所

- 市場規模・予測

- 在宅ヘルスケア

- 市場規模・予測

- 診断センター

- 市場規模・予測

- 市場分析

- 外来手術センター

- 市場規模・予測

- その他

- 市場規模・予測

- 地理的内訳

- 市場内訳:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 日本

- 中国

- インド

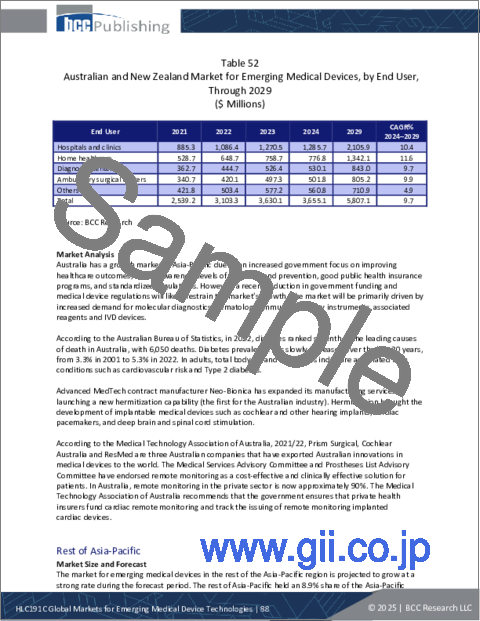

- オーストラリア・ニュージーランド

- その他のアジア太平洋地域

- その他の地域

- 市場規模・予測

- ブラジル

- GCC諸国

- その他

第6章 競合情報

- 企業ランキング

- 協定、協力、パートナーシップ

- スタートアップ

第7章 持続可能性

- 医療機器業界におけるESGの実践

- 環境パフォーマンス

- ESGランキング

- BCCの視点

第8章 付録

- 調査手法

- 参考文献

- 企業プロファイル

- 3M

- ABBOTT

- BD

- BAXTER

- BOSTON SCIENTIFIC CORP.

- DANAHER CORP.

- F. HOFFMANN-LA ROCHE LTD.

- GE HEALTHCARE

- JOHNSON & JOHNSON SERVICES INC.

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC

- QUIDELORTHO CORP.

- SIEMENS HEALTHINEERS AG

- STRYKER

- THERMO FISHER SCIENTIFIC INC.

List of Tables

- Summary Table : Global Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 1 : Medical Device Codes

- Table 2 : PESTLE Analysis on Medical Device Technology and Global Market

- Table 3 : Latest Medical Devices: Surgical Robotics, 2023 and 2024

- Table 4 : Latest Medical Devices: FDA Approved, 2021-2024

- Table 5 : Global Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 6 : Global Market for Emerging Medical Devices in IVD, by Region, Through 2029

- Table 7 : Global Market for Emerging Medical Devices in Cardiovascular Devices, by Region, Through 2029

- Table 8 : Global Market for Emerging Medical Devices in Neurology, by Region, Through 2029

- Table 9 : Global Market for Emerging Medical Devices in Orthopedics, by Region, Through 2029

- Table 10 : FDA Clearance of Diabetes Technology Devices, 2022 and 2023

- Table 11 : Global Market for Emerging Medical Devices in Diabetic Care, by Region, Through 2029

- Table 12 : Global Market for Emerging Medical Devices in Endoscopy, by Region, Through 2029

- Table 13 : Global Market for Emerging Medical Devices in Urology, by Region, Through 2029

- Table 14 : Global Market for Emerging Medical Devices in Other Devices, by Region, Through 2029

- Table 15 : Global Market for Emerging Medical Devices, by End User, Through 2029

- Table 16 : Global Market for Medical Devices in Hospitals and Clinics, by Region, Through 2029

- Table 17 : Global Market for Emerging Medical Devices in Home Healthcare, by Region, Through 2029

- Table 18 : Global Market for Emerging Medical Devices in Diagnostic Centers, by Region, Through 2029

- Table 19 : Global Market for Emerging Medical Devices in Ambulatory Surgical Centers, by Region, Through 2029

- Table 20 : Global Market for Emerging Medical Devices in Other End Users, by Region, Through 2029

- Table 21 : Global Market for Emerging Medical Devices, by Region, Through 2029

- Table 22 : North American Market for Emerging Medical Devices, by Country, Through 2029

- Table 23 : U.S. Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 24 : U.S. Market for Emerging Medical Devices, by End User, Through 2029

- Table 25 : Select U.S. FDA-Approved AI- and ML-Enabled Medical Devices, 2024

- Table 26 : Canadian Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 27 : Canadian Market for Emerging Medical Devices, by End User, Through 2029

- Table 28 : Mexican Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 29 : Mexican Market for Emerging Medical Devices, by End User, Through 2029

- Table 30 : European Market for Emerging Medical Devices, by Country, Through 2029

- Table 31 : German Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 32 : German Market for Emerging Medical Devices, by End User, Through 2029

- Table 33 : French Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 34 : French Market for Emerging Medical Devices, by End-user, Through 2029

- Table 35 : U.K. Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 36 : U.K. Market for Emerging Medical Devices, by End User, Through 2029

- Table 37 : Italian Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 38 : Italian Market for Emerging Medical Devices, by End User, Through 2029

- Table 39 : Spanish Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 40 : Spanish Market for Emerging Medical Devices, by End User, Through 2029

- Table 41 : Rest of European Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 42 : Rest of European Market for Emerging Medical Devices, by End User, Through 2029

- Table 43 : Asia-Pacific Market for Medical Devices, by Country, Through 2029

- Table 44 : Japanese Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 45 : Japanese Market for Emerging Medical Devices, by End User, Through 2029

- Table 46 : Chinese Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 47 : Chinese Market for Emerging Medical Devices, by End User, Through 2029

- Table 48 : Number of Applications and Approvals for Medical and IVD Devices in China, 2024

- Table 49 : Indian Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 50 : Indian Market for Emerging Medical Devices, by End User, Through 2029

- Table 51 : Australian and New Zealand Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 52 : Australian and New Zealand Market for Emerging Medical Devices, by End User, Through 2029

- Table 53 : Rest of Asia-Pacific Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 54 : Rest of Asia-Pacific Market for Emerging Medical Devices, by End User, Through 2029

- Table 55 : Rest of the World Market for Medical Devices, by Country/Region, Through 2029

- Table 56 : Brazilian Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 57 : Brazilian Market for Emerging Medical Devices, by End User, Through 2029

- Table 58 : GCC Countries Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 59 : GCC Countries Market for Emerging Medical Devices, by End User, Through 2029

- Table 60 : Other Rest of the World Market for Emerging Medical Devices, by Device Type, Through 2029

- Table 61 : Other Rest of the World Market for Emerging Medical Devices, by End User, Through 2029

- Table 62 : ESG Practices: Environmental

- Table 63 : ESG Practices: Social Performance

- Table 64 : ESG Practices: Governance Performance

- Table 65 : ESG Rankings for Major Medical Device Companies, 2023-2024*

- Table 66 : 3M: Company Snapshot

- Table 67 : 3M: Financial Performance, FY 2022 and 2023

- Table 68 : 3M: Product Portfolio

- Table 69 : 3M: News/Key Developments, 2022 and 2023

- Table 70 : Abbott: Company Snapshot

- Table 71 : Abbott: Financial Performance, FY 2022 and 2023

- Table 72 : Abbott: Product Portfolio

- Table 73 : Abbott: News/Key Developments, 2022-2024

- Table 74 : BD: Company Snapshot

- Table 75 : BD: Financial Performance, FY 2023 and 2024

- Table 76 : BD: Product Portfolio

- Table 77 : BD: News/Key Developments, 2023 and 2024

- Table 78 : Baxter: Company Snapshot

- Table 79 : Baxter: Financial Performance, FY 2022 and 2023

- Table 80 : Baxter: Product Portfolio

- Table 81 : Baxter: News/Key Developments, 2021-2024

- Table 82 : Boston Scientific Corp.: Company Snapshot

- Table 83 : Boston Scientific Corp.: Financial Performance, FY 2022 and 2023

- Table 84 : Boston Scientific Corp.: Product Portfolio

- Table 85 : Boston Scientific Corp.: News/Key Developments, 2023 and 2024

- Table 86 : Danaher Corp.: Company Snapshot

- Table 87 : Danaher Corp.: Financial Performance, FY 2022 and 2023

- Table 88 : Danaher Corp.: Product Portfolio

- Table 89 : Danaher Corp.: News/Key Developments, 2021-2024

- Table 90 : F. Hoffmann-La Roche Ltd.: Company Snapshot

- Table 91 : F. Hoffmann-La Roche Ltd.: Financial Performance, FY 2022 and 2023

- Table 92 : F. Hoffmann-La Roche Ltd.: Product Portfolio

- Table 93 : F. Hoffmann-La Roche Ltd.: News/Key Developments, 2022-2024

- Table 94 : GE HealthCare: Company Snapshot

- Table 95 : GE HealthCare: Financial Performance, FY 2022 and 2023

- Table 96 : GE HealthCare: Product Portfolio

- Table 97 : GE Healthcare: News/Key Developments, 2023 and 2024

- Table 98 : Johnson & Johnson Services Inc.: Company Snapshot

- Table 99 : Johnson & Johnson Services Inc.: Financial Performance, FY 2022 and 2023

- Table 100 : Johnson & Johnson Services Inc.: Product Portfolio

- Table 101 : Johnson & Johnson Services Inc.: News/Key Developments, 2023 and 2024

- Table 102 : Koninklijke Philips N.V.: Company Snapshot

- Table 103 : Koninklijke Philips N.V.: Financial Performance, FY 2022 and 2023

- Table 104 : Koninklijke Philips N.V.: Product Portfolio

- Table 105 : Koninklijke Philips N.V.: News/Key Developments, 2023 and 2024

- Table 106 : Medtronic: Company Snapshot

- Table 107 : Medtronic: Financial Performance, FY 2023 and 2024

- Table 108 : Medtronic: Product Portfolio

- Table 109 : Medtronic: News/Key Developments, 2022-2024

- Table 110 : QuidelOrtho Corp.: Company Snapshot

- Table 111 : QuidelOrtho Corp.: Financial Performance, FY 2022 and 2023

- Table 112 : QuidelOrtho Corp.: Product Portfolio

- Table 113 : QuidelOrtho Corp.: News/Key Developments, 2021-2024

- Table 114 : Siemens Healthineers AG: Company Snapshot

- Table 115 : Siemens Healthineers AG: Financial Performance, FY 2023 and 2024

- Table 116 : Siemens Healthineers AG: Product Portfolio

- Table 117 : Siemens Healthineers AG: News/Key Developments, 2021-2023

- Table 118 : Stryker: Company Snapshot

- Table 119 : Stryker: Financial Performance, FY 2022 and 2023

- Table 120 : Stryker: Product Portfolio

- Table 121 : Stryker: News/Key Developments, 2022-2024

- Table 122 : Thermo Fisher Scientific Inc.: Company Snapshot

- Table 123 : Thermo Fisher Scientific Inc.: Financial Performance, FY 2022 and 2023

- Table 124 : Thermo Fisher Scientific Inc.: Product Portfolio

- Table 125 : Thermo Fisher Scientific Inc.: News/Key Developments, 2022 and 2023

List of Figures

- Summary Figure : Global Market Share of Emerging Medical Devices, by Device Type 2023

- Figure 1 : Market Dynamics of Emerging Medical Device Technologies

- Figure 2 : Challenges in the Medical Device Market

- Figure 3 : Types of Medical Devices that Benefit from Advanced Software Solutions

- Figure 4 : Number of FDA Approvals of AI/ML-enabled Medical Devices, 2016-2023

- Figure 5 : Global Market Shares for Emerging Medical Devices, by Device Type, 2023

- Figure 6 : Global Market Share for Emerging Medical Devices, by End User, 2023

- Figure 7 : Global Market Share for Emerging Medical Devices, by Region, 2023

- Figure 8 : North American Market Shares for Emerging Medical Devices, by Device Type, 2023

- Figure 9 : North American Market Shares for Emerging Medical Devices, by End User, 2023

- Figure 10 : North American Market Shares for Emerging Medical Devices, by Country, 2023

- Figure 11 : European Market Shares for Emerging Medical Devices, by Device Type, 2023

- Figure 12 : European Market Shares for Emerging Medical Devices, by End User, 2023

- Figure 13 : European Market Shares for Emerging Medical Devices, by Country, 2023

- Figure 14 : Asia-Pacific Market Shares for Emerging Medical Devices, by Device Type, 2023

- Figure 15 : Asia-Pacific Market Shares for Emerging Medical Devices, by End User, 2023

- Figure 16 : Asia-Pacific Market Shares for Emerging Medical Devices, by Country, 2023

- Figure 17 : Rest of the World Market Shares for Emerging Medical Devices, by Device Type, 2023

- Figure 18 : Rest of the World Market Shares for Emerging Medical Devices, by End User, 2023

- Figure 19 : Rest of the World Market Shares for Emerging Medical Devices, by Country/Region, 2023

- Figure 20 : Global Market Shares for Emerging Medical Devices and Technologies, by Company, 2023

- Figure 21 : Snapshot: Key ESG Trends in the Medical Device Industry

- Figure 22 : Viewpoints on Sustainable Medical Devices

- Figure 23 : 3M: Revenue Shares, by Business Unit, FY 2023

- Figure 24 : 3M: Revenue Shares, by Country/Region, FY 2023

- Figure 25 : Abbott: Revenue Shares, by Business Unit, FY 2023

- Figure 26 : Abbott: Revenue Shares, by Country/Region, FY 2023

- Figure 27 : BD: Revenue Shares, by Business Unit, FY 2024

- Figure 28 : BD: Revenue Shares, by Country/Region, FY 2024

- Figure 29 : Baxter: Revenue Shares, by Business Unit, FY 2023

- Figure 30 : Baxter: Revenue Shares, by Country/Region, FY 2023

- Figure 31 : Boston Scientific Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 32 : Boston Scientific Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 33 : Danaher Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 34 : Danaher Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 35 : F. Hoffmann-La Roche Ltd.: Revenue Shares, by Business Unit, FY 2023

- Figure 36 : F. Hoffmann-La Roche Ltd.: Revenue Shares, by Country/Region, FY 2023

- Figure 37 : GE HealthCare: Revenue Shares, by Business Unit, FY 2023

- Figure 38 : GE HealthCare: Revenue Shares, by Country/Region, FY 2023

- Figure 39 : Johnson & Johnson Services Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 40 : Johnson & Johnson Services Inc.: Revenue Shares, by Country/Region, FY 2023

- Figure 41 : Koninklijke Philips N.V.: Revenue Shares, by Business Unit, FY 2023

- Figure 42 : Koninklijke Philips N.V.: Revenue Shares, by Country/Region, FY 2023

- Figure 43 : Medtronic.: Revenue Shares, by Business Unit, FY 2024

- Figure 44 : Medtronic: Revenue Shares, by Country/Region, FY 2024

- Figure 45 : QuidelOrtho Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 46 : QuidelOrtho Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 47 : Siemens Healthineers AG: Revenue Shares, by Business Unit, FY 2024

- Figure 48 : Siemens Healthineers AG: Revenue Shares, by Country/Region, FY 2024

- Figure 49 : Stryker: Revenue Shares, by Business Unit, FY 2023

- Figure 50 : Stryker: Revenue Shares, by Country/Region, FY 2023

- Figure 51 : Thermo Fisher Scientific Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 52 : Thermo Fisher Scientific Inc.: Revenue Shares, by Country/Region, FY 2023

The global market for emerging medical devices is estimated to increase from $136.6 billion in 2024 to reach $223.9 billion by 2029, at a compound annual growth rate (CAGR) of 10.4% from 2024 through 2029.

The IVD market for emerging medical devices is estimated to increase from $28.7 billion in 2024 to reach $48.1 billion by 2029, at a CAGR of 10.9% from 2024 through 2029.

The Cardiovascular devices market for emerging medical devices is estimated to increase from $23.4 billion in 2024 to reach $40.6 billion by 2029, at a CAGR of 11.6% from 2024 through 2029.

Report Scope

This report provides an in-depth analysis of the emerging medical device technology market, including market estimations and trends through 2029. Major players, competitive insights, imaginative innovations, advertising flow and geographic opportunities are examined in detail. The report looks at product innovations and item portfolios of major players. The report covers drivers, restraints, opportunities, emerging technologies and a regulatory scenario assessment. The report includes market projections for 2029 and market shares for key players.

The report's scope encompasses developing therapeutic devices, advances that create the most worldwide income. Dental devices with new innovations and a few imaging devices utilized in dentistry are covered under other devices.

Based on device type, the market is segmented into in vitro diagnostics (IVD), cardiovascular devices, neurology, orthopedics, diabetic care, endoscopy, urology and others. Based on the end-user type, the market is segmented into hospitals and clinics, home healthcare, ambulatory surgical centers and diagnostic laboratories.

The market is segmented by geographic region into North America, Europe, Asia-Pacific and the Rest of the World. Also included in the regional breakdown are detailed analyses of major countries such as the U.S., Germany, the U.K., Italy, France, Spain, Japan, China, India, Brazil, Mexico and Gulf Cooperation Council (GCC) countries. Each country's market is estimated with segmental analysis. For market estimates, data is provided for 2023 as the base year, with estimates for 2024 and a forecast value for 2029.

Report Includes

- 70 data tables and 56 additional tables

- Analyses of the global market trends for emerging medical device technologies, with market revenue data (sales figures) for 2021-2022, estimates for 2023, forecasts for 2024, and projected CAGRs through 2029

- Estimates of the market size and revenue prospects, along with a corresponding market share analysis by disease indication, application, end user and region

- Discussion of the market potential and opportunities in the medical device industry, along with an analysis of the competitive environment, regulatory scenario, and technological advances

- Facts and figures pertaining to R&D activity, technology issues, industry-specific challenges, and the impact of macroeconomic factors

- A look at the regulatory and pricing scenarios in the global market, with an emphasis on recent regulations in the U.S., Europe and Japan

- Insights derived from the Porter's Five Forces model, as well as global supply chain and PESTLE analyses

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, and the ESG scores and practices of leading companies

- Evaluation of recent patent activity and key granted and published patents

- Company profiles of major players within the industry, including Medtronic, Abbott, Siemens Healthineers AG, Boston Scientific Corp., and Johnson & Johnson Services Inc.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market and Technology Background

- Background

- Innovation

- Overview

- Types

- Current Trends

- Development in Cybersecurity Considerations

- Wearable Fitness Technology

- Internet of Medical Things Technology

- Healthcare and Robotics

- 3D Printing

- Device Connectivity and Software as a Medical Device

- PESTLE Analysis

Chapter 3 Market Dynamics

- Market Drivers

- Emerging Health and Wellness Trends

- Increasing Use of AI/ML in Medical Devices

- Technology and Services Support Chronic Disease Management

- Need for Improving Public Health

- Rise in Disease Diagnosis Demand

- Increased Patient Education

- Market Restraints

- Challenges in R&D Funding

- Cybersecurity Risks in Healthcare

- Failure in Medical Device Designs

- Supply Chain Risks and Vulnerabilities

- Market Opportunities

- Healthcare Delivery with Mobile Medical Imaging

- Technological Developments in Medical Devices

- Challenges

Chapter 4 Emerging Technologies and Developments

- Major Medical Device and Technology Advances in 2024

- Adaptive Hearing Aids

- Bioprinting

- Glucose Monitoring Devices and Digital Wearables

- Brain-Machine Interfaces

- Major Medical Device and Technology Advances in 2023

- Medical Diagnosis Software

- AI in Radiology

- Surgical Robots

- Trends in Medical Device Technology

Chapter 5 Market Segment Analysis

- Segmentation Breakdown

- Market Breakdown by Device Type

- In Vitro Diagnostics

- Market Size and Forecast

- Cardiovascular Devices

- Market Size and Forecast

- Neurology

- Market Size and Forecast

- Orthopedics

- Market Size and Forecast

- Diabetic Care

- Market Size and Forecast

- Endoscopy

- Market Size and Forecast

- Urology

- Market Size and Forecast

- Other Devices

- Market Breakdown by End User

- Hospitals and Clinics

- Market Size and Forecast

- Home Healthcare

- Market Size and Forecast

- Diagnostic Centers

- Market Size and Forecast

- Market Analysis

- Ambulatory Surgical Centers

- Market Size and Forecast

- Other End Users

- Market Size and Forecast

- Geographic Breakdown

- Market Analysis by Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia and New Zealand

- Rest of Asia-Pacific

- Rest of the World

- Market Size and Forecast

- Brazil

- GCC Countries

- Other Rest of the World Countries

Chapter 6 Competitive Intelligence

- Introduction

- Global Analysis of Company Market Rank

- Agreements, Collaborations and Partnerships

- Startups in the Medical Device Industry

Chapter 7 Sustainability

- ESG Practices in the Medical Device Industry

- Environmental Performance

- ESG Ranking

- BCC Research Viewpoint

Chapter 8 Appendix

- Research Methodology

- References

- Company Profiles

- 3M

- ABBOTT

- BD

- BAXTER

- BOSTON SCIENTIFIC CORP.

- DANAHER CORP.

- F. HOFFMANN-LA ROCHE LTD.

- GE HEALTHCARE

- JOHNSON & JOHNSON SERVICES INC.

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC

- QUIDELORTHO CORP.

- SIEMENS HEALTHINEERS AG

- STRYKER

- THERMO FISHER SCIENTIFIC INC.