|

|

市場調査レポート

商品コード

1669763

糖尿病ケアデバイスの世界市場Global Diabetic Care Devices Market |

||||||

|

|||||||

| 糖尿病ケアデバイスの世界市場 |

|

出版日: 2025年02月25日

発行: BCC Research

ページ情報: 英文 103 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の糖尿病ケアデバイスの市場規模は、2024年の166億米ドルから、2024年から2029年までの予測期間中は10.1%のCAGRで推移し、2029年末には268億米ドルに成長すると予測されています。

世界の持続グルコースモニタリング (CGM) システムの市場規模は、2024年の111億米ドルから、予測期間中は13.4%のCAGRで推移し、2029年末には209億米ドルに成長すると予測されています。また、世界の自己血糖測定 (SMBG) デバイスの市場規模は、2024年の55億米ドルから、1.7%のCAGRで推移し、2029年末には59億米ドルに成長すると予測されています。

当レポートでは、世界の糖尿病ケアデバイスの市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- 市場の定義

- 糖尿病

- 糖尿病の種類

- 自己モニタリング糖尿病ケアデバイス

第3章 市場力学

- 市場力学

- 市場促進要因

- 糖尿病の罹患率の増加

- 高齢化人口の増加

- より優れた個人用糖尿病管理ツールの需要

- 医療および償還政策

- 予防ヘルスケアへの注目

- 市場抑制要因

- 継続的データの欠如

- CGMの高コスト

- 低所得地域でのアクセス上の制約

- 市場における機会

- 糖尿病管理ソリューションの必要性

- パートナーシップ

- 市場の課題

- 血糖値測定器とCGMの精度不足

第4章 新興技術と開発

- 概要

- 埋め込み型CGM技術

- CGMモニタリングにおけるAI統合

- 非侵襲性CGMシステム

- 臨床試験

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- 世界の糖尿病モニタリングデバイス市場:タイプ別

- 自己血糖測定 (SMBG) デバイス

- 持続血糖モニタリング (CGM) システム

- 地理的内訳

- 世界の糖尿病モニタリングデバイス市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第6章 競合情報

- 業界シナリオ

- 競合情勢

第7章 糖尿病ケアデバイス市場における持続可能性:ESGの観点

- ESG:イントロダクション

- ESGパフォーマンス分析

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- BCCによる総論

第8章 付録

- 調査手法

- 参考文献

- 略語

- 企業プロファイル

- ABBOTT

- ACON LABORATORIES INC.

- AGAMATRIX

- ARKRAY INC.

- B. BRAUN SE

- DEXCOM INC.

- F. HOFFMANN-LA ROCHE LTD.

- I-SENS INC.

- LIFESCAN IP HOLDINGS LLC.

- MEDTRONIC

- PHC HOLDINGS CORP.

- SENSEONICS

- SINOCARE

- TERUMO CORP.

- YPSOMED

List of Tables

- Summary Table : Global Market for Diabetes Monitoring Devices, by Product Type, Through 2029

- Table 1 : Blood Glucose Test Strip Manufacturers and Products

- Table 2 : Blood Glucose Device Products and Manufacturers

- Table 3 : Blood Glucose Lancets/Lancet Devices Products and Manufacturers

- Table 4 : CGM Sensor and Transmitter Products and Manufacturers

- Table 5 : CGM Receiver Products and Manufacturers

- Table 6 : Diabetes Cases, by Country, 2021

- Table 7 : Comparison of Eversense, Abbott, Medtronic and Dexcom CGMs

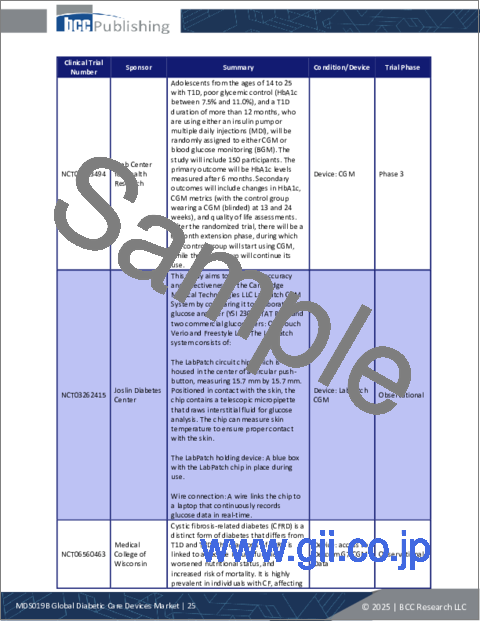

- Table 8 : Selected Clinical Trials of Diabetic Care Devices

- Table 9 : Global Market for Diabetes Monitoring Devices, by Type, Through 2029

- Table 10 : Global Market for SMBG Devices, by Product Type, Through 2029

- Table 11 : Global Market for CGM Systems, by Product Type, Through 2029

- Table 12 : Global Market for Diabetes Monitoring Devices, by Region, Through 2029

- Table 13 : Global Market for SMBG Devices, by Region, Through 2029

- Table 14 : Global Market for Blood Glucose Test Strips, by Region, Through 2029

- Table 15 : Global Market for Blood Glucose Meters/Devices, by Region, Through 2029

- Table 16 : Global Market for Lancets and Lancet Devices, by Region, Through 2029

- Table 17 : Global Market for CGM Systems, by Region, Through 2029

- Table 18 : Global Market for Sensors and Transmitters Used in CGM Devices, by Region, Through 2029

- Table 19 : Global Market for Receivers Used in CGM Devices, by Region, Through 2029

- Table 20 : Global Market for Diabetes Monitoring Devices, by End User, Through 2029

- Table 21 : North American Market for Diabetes Monitoring Devices, by Country, Through 2029

- Table 22 : European Market for Diabetes Monitoring Devices, by Country, Through 2029

- Table 23 : Asia-Pacific Market for Diabetes Monitoring Devices, by Country, Through 2029

- Table 24 : South American Market for Diabetes Monitoring Devices, by Country, Through 2029

- Table 25 : RoW Market for Diabetes Monitoring Devices, Through 2029

- Table 26 : ESG: Environmental Performance

- Table 27 : ESG: Social Impact

- Table 28 : ESG: Governance Impact

- Table 29 : Acronyms Used in this Report

- Table 30 : Abbott: Company Snapshot

- Table 31 : Abbott: Financial Performance, FY 2022 and 2023

- Table 32 : Abbott: Product Portfolio

- Table 33 : Abbott: News/Key Developments, 2024

- Table 34 : Acon Laboratories Inc.: Company Snapshot

- Table 35 : Acon Laboratories Inc.: Product Portfolio

- Table 36 : AgaMatrix: Company Snapshot

- Table 37 : AgaMatrix: Product Portfolio

- Table 38 : Arkray Inc.: Company Snapshot

- Table 39 : Arkray Inc.: Product Portfolio

- Table 40 : B. Braun SE: Company Snapshot

- Table 41 : B. Braun SE: Financial Performance, FY 2022 and 2023

- Table 42 : B. Braun SE: Product Portfolio

- Table 43 : Dexcom Inc.: Company Snapshot

- Table 44 : Dexcom Inc.: Financial Performance, FY 2022 and 2023

- Table 45 : Dexcom Inc.: Product Portfolio

- Table 46 : Dexcom Inc.: News/Key Developments, 2022

- Table 47 : F. Hoffmann-La Roche Ltd.: Company Snapshot

- Table 48 : F. Hoffmann-La Roche Ltd.: Financial Performance, FY 2022 and 2023

- Table 49 : F. Hoffmann-La Roche Ltd.: Product Portfolio

- Table 50 : i-SENS Inc.: Company Snapshot

- Table 51 : i-SENS Inc.: Financial Performance, FY 2022 and 2023

- Table 52 : i-SENS Inc.: Product Portfolio

- Table 53 : i-SENS Inc: News/Key Developments, 2023

- Table 54 : LifeScan IP Holdings LLC.: Company Snapshot

- Table 55 : LifeScan IP Holdings LLC.: Product Portfolio

- Table 56 : Medtronic: Company Snapshot

- Table 57 : Medtronic: Financial Performance, FY 2023 and 2024

- Table 58 : Medtronic: Product Portfolio

- Table 59 : Medtronic: News/Key Developments, 2023

- Table 60 : PHC Holdings Corp.: Company Snapshot

- Table 61 : PHC Holdings Corp.: Financial Performance, FY 2022 and 2023

- Table 62 : PHC Holdings Corp.: Product Portfolio

- Table 63 : Senseonics: Company Snapshot

- Table 64 : Senseonics: Financial Performance, FY 2022 and 2023

- Table 65 : Senseonics: Product Portfolio

- Table 66 : Senseonics: News/Key Developments, 2022

- Table 67 : Sinocare: Company Snapshot

- Table 68 : Sinocare: Financial Performance, FY 2022 and 2023

- Table 69 : Sinocare: Product Portfolio

- Table 70 : Sinocare: News/Key Developments, 2024

- Table 71 : Terumo Corp: Company Snapshot

- Table 72 : Terumo Corp.: Financial Performance, FY 2022 and 2023

- Table 73 : Terumo Corp: Product Portfolio

- Table 74 : Ypsomed: Company Snapshot

- Table 75 : Ypsomed: Financial Performance, FY 2022 and 2023

- Table 76 : Ypsomed: Product Portfolio

List of Figures

- Summary Figure A : Global Market for Diabetes Monitoring Devices, by Product Type, 2021-2029

- Summary Figure B : Share of Global Market for Diabetes Monitoring Devices, by Product Type, 2023

- Figure 1 : Snapshot of the Market Dynamics for Diabetic Care Devices

- Figure 2 : Worldwide Diabetes Cases

- Figure 3 : Emerging Trends and Technologies in Diabetes Monitoring Devices

- Figure 4 : Share of Global Market for Diabetes Monitoring Devices, by Type, 2023

- Figure 5 : Share of Global Market for SMBG Devices, by Product Type, 2023

- Figure 6 : Share of Global Market for CGM Systems, by Product Type, 2023

- Figure 7 : Share of Global Market for Diabetes Monitoring Devices, by Region, 2023

- Figure 8 : Share of Global Market for SMBG Devices, by Region, 2023

- Figure 9 : Share of Global Market for Blood Glucose Test Strips, by Region, 2023

- Figure 10 : Share of Global Market for Blood Glucose Meters/Devices, by Region, 2023

- Figure 11 : Share of Global Market for Lancets and Lancet Devices, by Region, 2023

- Figure 12 : Share of Global Market for CGM Systems, by Region, 2023

- Figure 13 : Share of Global Market for Sensors and Transmitters Used in CGM Devices, by Region, 2023

- Figure 14 : Share of Global Market for Receivers Used in CGM Devices, by Region, 2023

- Figure 15 : Share of North American Market for Diabetes Monitoring Devices, by Country, 2023

- Figure 16 : Share of European Market for Diabetes Monitoring Devices, by Country, 2023

- Figure 17 : Share of Asia-Pacific Market for Diabetes Monitoring Devices, by Country, 2023

- Figure 18 : Share of South American Market for Diabetes Monitoring Devices, by Country, 2023

- Figure 19 : Share of Global Market for Diabetes Monitoring Devices, by Company, 2023

- Figure 20 : Three Pillars of ESG

- Figure 21 : Advantages of ESG for Companies

- Figure 22 : Abbott: Revenue Share, by Business Unit, FY 2023

- Figure 23 : Abbott: Revenue Share, by Country/Region, FY 2023

- Figure 24 : B. Braun SE: Revenue Share, by Business Unit, FY 2023

- Figure 25 : B. Braun SE: Revenue Share, by Country/Region, FY 2023

- Figure 26 : Dexcom Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 27 : F. Hoffmann-La Roche Ltd.: Revenue Share, by Business Unit, FY 2023

- Figure 28 : F. Hoffmann-La Roche Ltd.: Revenue Share, by Country/Region, FY 2023

- Figure 29 : i-SENS Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 30 : i-SENS Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 31 : Medtronic: Revenue Share, by Business Unit, FY 2024

- Figure 32 : Medtronic: Revenue Share, by Country/Region, FY 2024

- Figure 33 : PHC Holdings Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 34 : PHC Holdings Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 35 : Senseonics: Revenue Share, by Country/Region, FY 2023

- Figure 36 : Sinocare: Revenue Share, by Business Unit, FY 2023

- Figure 37 : Sinocare: Revenue Share, by Country/Region, FY 2023

- Figure 38 : Terumo Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 39 : Terumo Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 40 : Ypsomed: Revenue Share, by Business Unit, FY 2023

- Figure 41 : Ypsomed: Revenue Share, by Country/Region, FY 2023

The global market for diabetes monitoring devices is expected to grow from $16.6 billion in 2024 to $26.8 billion by the end of 2029, at a compound annual growth rate (CAGR) of 10.1% from 2024 through 2029.

The global market for continuous glucose monitoring systems is expected to grow from $11.1 billion in 2024 to $20.9 billion by the end of 2029, at a CAGR of 13.4% from 2024 through 2029.

The global market for self-monitoring blood glucose devices is expected to grow from $5.5 billion in 2024 to $5.9 billion by the end of 2029, at a CAGR of 1.7% from 2024 through 2029.

Report Scope

This report provides an analysis of the market for diabetes monitoring devices, along with a competitive landscape and profiles of key companies that include their revenues, product portfolios and recent activities. It analyzes trends and market dynamics, including drivers, limitations, challenges, and opportunities, and discusses historical, current and potential market size. The report will enable readers to make informed decisions about the production and licensing of goods and services, as well as market developments and trends. The study segments the market by product type, including self-monitoring blood glucose (SMBG) devices such as blood glucose meter devices, blood glucose test strips, lancets and lancet devices; and continuous glucose monitoring (CGM) device products, including transmitters and receivers. A regional market analysis, including country-level analysis, is provided for all segments. The report covers only diabetes monitoring devices; diabetes therapeutic devices, which include insulin delivery systems and any other equipment used in hospitals are outside the scope of the report.

Self-monitoring blood glucose (SMBG) devices:

- Blood glucose meter devices.

- Blood glucose test strips.

- Lancets and lancet devices.

Continuous glucose monitoring (CGM) systems:

- Sensors and transmitters.

- Receivers.

End users:

- Hospitals.

- Home care settings.

- Diagnostic centers.

Report Includes:

- 30 data tables and 47 additional tables

- An analysis of the global market for diabetes care devices, including self-glucose monitoring devices and continuous glucose monitoring systems

- Analyses of the global market trends, with market revenue data (sales figures) for 2021-2022, estimates for 2023, forecasts for 2024, and projected CAGRs through 2029

- Estimates of the market size and revenue prospects, along with a corresponding market share analysis by product type and sub-type, end user and region

- Discussion of the market potential and opportunities in the diabetes care industry, along with an analysis of the competitive environment, regulatory scenario and technological advances

- Facts and figures pertaining to R&D activity, industry-specific challenges, and the impact of macroeconomic factors

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, and the ESG scores and practices of leading companies

- Patent analysis featuring key granted and published patents

- Emerging new developments and clinical trials in the diabetes care market

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Profiles of leading companies, including Abbott, Medtronic, Dexcom Inc., F. Hoffmann-La Roche Ltd., and LifeScan IP Holdings LLC.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Market Definitions

- Diabetes Mellitus

- Types of Diabetes

- Self-Monitoring Diabetic Care Devices

Chapter 3 Market Dynamics

- Market Dynamics

- Market Drivers

- Increasing Prevalence of Diabetes

- Increasing Aging Population

- Demand for Better Personal Diabetes Management Tools

- Healthcare and Reimbursement Policies

- Increasing Focus on Preventive Healthcare

- Market Restraints

- Lack of Continuous Data

- High Cost of CGMs

- Limited Access in Low-Income Regions

- Opportunities in the Market

- Need for Diabetes Management Solutions

- Partnerships

- Market Challenges

- Lack of Glucose Meter and CGM Accuracy

Chapter 4 Emerging Technologies and Developments

- Overview

- Implantable CGM Technology

- AI Integration in CGM Monitoring

- Non-Invasive CGM System

- Clinical Trials

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Global Market for Diabetes Monitoring Devices, by Type

- Self-Monitoring Blood Glucose (SMBG) Devices

- Continuous Glucose Monitoring (CGM) Systems

- Geographic Breakdown

- Global Market for Diabetes Monitoring Devices, by Region

- North America

- Europe

- Asia-Pacific

- South America

- Rest of the World

Chapter 6 Competitive Intelligence

- Industry Scenario

- Competitive Landscape

Chapter 7 Sustainability in the Diabetic Care Devices Market: An ESG Perspective

- Introduction to ESG

- ESG Performance Analysis

- Environmental Performance

- Social Performance

- Governance Performance

- Concluding Remarks from BCC Research

Chapter 8 Appendix

- Research Methodology

- References

- Abbreviations

- Company Profiles

- ABBOTT

- ACON LABORATORIES INC.

- AGAMATRIX

- ARKRAY INC.

- B. BRAUN SE

- DEXCOM INC.

- F. HOFFMANN-LA ROCHE LTD.

- I-SENS INC.

- LIFESCAN IP HOLDINGS LLC.

- MEDTRONIC

- PHC HOLDINGS CORP.

- SENSEONICS

- SINOCARE

- TERUMO CORP.

- YPSOMED