|

|

市場調査レポート

商品コード

1621143

外科用機器:各種技術と世界市場Surgical Equipment: Technologies and Global Markets |

||||||

|

|||||||

| 外科用機器:各種技術と世界市場 |

|

出版日: 2024年12月11日

発行: BCC Research

ページ情報: 英文 160 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の外科用機器および技術の市場規模は、2023年の376億米ドル、2024年の400億米ドルから、予測期間中はCAGR 7.2%で推移し、2029年末には566億米ドルに達すると予測されています。

再利用可能機器の市場は、2024年の277億米ドルから、予測期間中はCAGR 6.1%で推移し、2029年末には371億米ドルに達すると予測されています。使い捨て機器の市場は、2024年の124億米ドルから、CAGR 9.5%で推移し、2029年末には195億米ドルに達すると予測されます。

当レポートでは、世界の外科用機器および技術の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場分析

第2章 市場概要

- 市場分析

- 規制状況

- 医療機器におけるサイバーセキュリティ

- 北米

- 欧州

- インド

- 中国

- 日本

第3章 市場力学

- 市場力学スナップショット

- 推進要因

- 低侵襲手術の増加

- 外科用機器の需要増加

- 外来手術センター

- 外来手術の増加

- 抑制要因

- 訓練を受けていないエンドユーザー

- 規制上の課題と法的障壁

- 機器の故障

- 外科用機器の高コスト

- 機会

- 技術の進歩

- 新興経済国

- 先進国における補充

- 課題

- 特殊機器の需要

- 品質管理システム規制(QMSR)

第4章 市場セグメンテーション分析

- セグメンテーションの内訳

- 外科用機器および技術市場:ユーザビリティ別

- 再利用可能機器

- 使い捨て機器

- 外科用機器および技術市場:製品カテゴリー別

- 腹腔鏡検査

- 整形外科

- 脳神経外科

- 心臓外科

- 泌尿器科

- 創傷閉鎖

- 電力システム

- 胸部外科

- 引き込みシステム

- 整形と再建

- 産婦人科

- 微小血管手術

- その他 <

- 外科用機器市場:技術別

- 手動機器

- 電気外科手術

- ワイヤレス機器

- 外科用機器および技術市場:エンドユーザー別

- 大手病院チェーン

- 中規模専門病院

- 小規模クリニック等

- 地理的内訳

- 外科用機器および技術市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 新たな動向と技術

- 概要

- ロボット手術の進歩

- 外科手術におけるAI

- ガラス繊維強化技術

- 先進複合材料

- 拡張現実技術

- ブロックチェーン技術

第6章 ESG開発

- 外科用機器市場におけるESG:イントロダクション

- 主要企業の外科機器におけるESGの持続可能性

- ESGリスク評価

- BCCによる見解

第7章 特許分析

- 特許分析

- 主要特許

- 特許レビュー:年別

第8章 競合情勢

- M&A・提携

- 企業シェア分析

- 戦略的提携

- 製品発売

第9章 付録

- 調査手法

- 出典

- 略語

- 企業プロファイル

- ABBOTT

- B. BRAUN SE

- BOSTON SCIENTIFIC CORP.

- INTUITIVE SURGICAL

- JOHNSON & JOHNSON SERVICES INC.

- MEDTRONIC

- OLYMPUS CORP.

- SMITH+NEPHEW

- STRYKER

- ZIMMER BIOMET

List of Tables

- Summary Table : Global Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 1 : Total Number of Hip and Knee Procedures Performed in the U.S., 2012-2022

- Table 2 : Total Number of Metabolic and Bariatric Procedures Performed in the U.S., 2011-2022

- Table 3 : Number of Cardiac Surgical Procedures Performed Annually per 100,000 People

- Table 4 : Delayed and Canceled Surgeries Per Hospital Category Due to Malfunctioning Equipment, 2018

- Table 5 : Top 20 Most Expensive Hospital Procedures in the U.S.

- Table 6 : Global Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 7 : Global Market for Reusable Surgical Equipment and Technologies, by Region, Through 2029

- Table 8 : Global Market for Disposable Surgical Equipment, by Region, Through 2029

- Table 9 : Global Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 10 : Global Market for Laparoscopy Surgical Equipment and Technologies, by Region, Through 2029

- Table 11 : Global Market for Orthopedic Surgical Equipment and Technologies, by Region, Through 2029

- Table 12 : Global Market for Neurosurgery Surgical Equipment and Technologies, by Region, Through 2029

- Table 13 : Global Market for Cardio Surgery and Technologies Equipment, by Region, Through 2029

- Table 14 : Global Market for Urology Surgical Equipment and Technologies, by Region, Through 2029

- Table 15 : Partially Stimuli-Responsive Antibacterial Hydrogel Wound Dressings

- Table 16 : Global Market for Wound Closure Surgical Equipment and Technologies, by Region, Through 2029

- Table 17 : Global Market for Power System Surgical Equipment and Technologies, by Region, Through 2029

- Table 18 : Global Market for Thoracic Surgical Equipment and Technologies, by Region, Through 2029

- Table 19 : Global Market for Surgical Retraction Systems, by Region, Through 2029

- Table 20 : Most Frequently Performed Cosmetic Surgery/Minimally Invasive/Reconstructive Surgical Procedures, 2022 and 2023

- Table 21 : Global Market for Plastic and Reconstructive Surgical Equipment, by Region, Through 2029

- Table 22 : Global Market for Obstetrics/Gynecology Surgical Equipment and Technologies, by Region, Through 2029

- Table 23 : Global Market for Microvascular Surgical Equipment and Technologies, by Region, Through 2029

- Table 24 : Global Market for Other Surgical Equipment and Technologies, by Region, Through 2029

- Table 25 : Global Market for Surgical Equipment and Technologies, by Technology Type, Through 2029

- Table 26 : Global Market for Manual Surgical Equipment and Technologies, by Region, Through 2029

- Table 27 : Global Market for Electrosurgical Equipment and Technologies, by Region, Through 2029

- Table 28 : Global Market for Wireless Surgical Equipment and Technologies, by Region, Through 2029

- Table 29 : Global Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 30 : Hospitals Performing the Most Surgeries in the U.S., 2023

- Table 31 : Global Market for Surgical Equipment and Technologies in Large Hospital Chains, by Region, Through 2029

- Table 32 : Global Market for Surgical Equipment and Technologies in Medium-Level Specialty Hospitals, by Region, Through 2029

- Table 33 : Global Market for Surgical Equipment and Technologies in Small Clinics and Other Healthcare Facilities, by Region, Through 2029

- Table 34 : Global Market for Surgical Equipment and Technologies, by Region, Through 2029

- Table 35 : North American Market for Surgical Equipment and Technologies, by Country, Through 2029

- Table 36 : U.S. Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 37 : U.S. Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 38 : U.S. Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 39 : U.S. Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 40 : Canadian Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 41 : Canadian Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 42 : Canadian Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 43 : Canadian Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 44 : Mexican Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 45 : Mexican Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 46 : Mexican Market for Surgical Equipment, by Technology, Through 2029

- Table 47 : Mexican Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 48 : European Market for Surgical Equipment and Technologies, by Country, Through 2029

- Table 49 : U.K. Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 50 : U.K. Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 51 : U.K. Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 52 : U.K. Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 53 : French Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 54 : French Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 55 : French Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 56 : French Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 57 : Italian Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 58 : Italian Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 59 : Italian Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 60 : Italian Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 61 : German Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 62 : German Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 63 : German Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 64 : German Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 65 : Spanish Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 66 : Spanish Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 67 : Spanish Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 68 : Spanish Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 69 : Rest of European Countries' Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 70 : Rest of European Countries' Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 71 : Rest of European Countries' Market for Surgical Equipment, by Technology, Through 2029

- Table 72 : Rest of European Countries' Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 73 : Key Points on Partnerships to Improve Surgical Care in the Asia-Pacific Region, 2023

- Table 74 : Asia-Pacific Market for Surgical Equipment and Technologies, by Country, Through 2029

- Table 75 : Chinese Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 76 : Chinese Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 77 : Chinese Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 78 : Chinese Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 79 : Indian Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 80 : Indian Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 81 : Indian Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 82 : Indian Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 83 : Japanese Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 84 : Japanese Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 85 : Japanese Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 86 : Japanese Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 87 : Australian Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 88 : Australian Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 89 : Australian Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 90 : Australian Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 91 : South Korean Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 92 : South Korean Market for Surgical Equipment and Technologies, by Technology, Through 2029

- Table 93 : South Korean Market for Surgical Equipment and Technologies, by Product Category, Through 2029

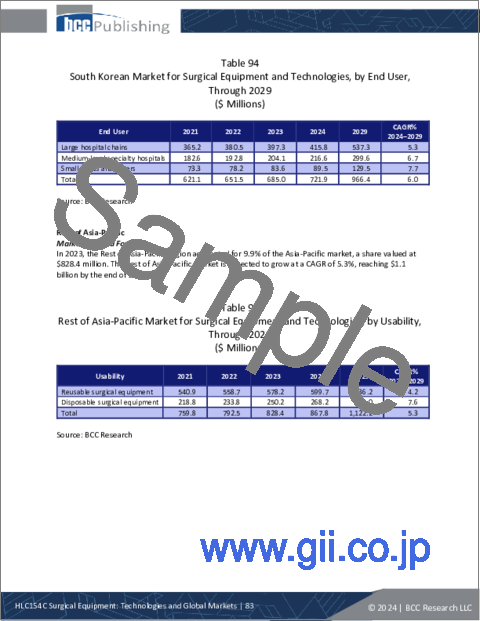

- Table 94 : South Korean Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 95 : Rest of Asia-Pacific Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 96 : Rest of Asia-Pacific Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 97 : Rest of Asia-Pacific Market for Surgical Equipment, by Technology, Through 2029

- Table 98 : Rest of Asia-Pacific Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 99 : RoW Market for Surgical Equipment and Technologies, by Usability, Through 2029

- Table 100 : RoW Market for Surgical Equipment and Technologies, by Product Category, Through 2029

- Table 101 : RoW Market for Surgical Equipment, by Technology, Through 2029

- Table 102 : RoW Market for Surgical Equipment and Technologies, by End User, Through 2029

- Table 103 : SASB Standards Disclosure Topics and Accounting Metrics

- Table 104 : Companies' ESG Developments, 2023

- Table 105 : ESG Rankings for Surgical Equipment and Technologies Manufacturing Firms, 2023

- Table 106 : Select Granted Patents on Surgical Equipment and Technologies, 2021

- Table 107 : Published Patents on Surgical Equipment and Technologies, 2022

- Table 108 : Published Patents on Surgical Equipment and Technologies, 2023

- Table 109 : Published Patents on Surgical Equipment and Technologies, 2024*

- Table 110 : Patent Filings for Surgical Equipment and Technologies, by Year, 2021-August 2024

- Table 111 : M&A in the Surgical Equipment Industry, 2021-2024

- Table 112 : Product Launches in the Surgical Equipment and Technologies Market, 2021-2024

- Table 113 : Information Sources in this Report

- Table 114 : Abbreviations Used in This Report

- Table 115 : Abbott: Company Snapshot

- Table 116 : Abbott: Financial Performance, FY 2022 and 2023

- Table 117 : Abbott: Product Portfolio

- Table 118 : Abbott: News/Key Developments, 2021-2024

- Table 119 : B Braun SE: Company Snapshot

- Table 120 : B Braun SE: Financial Performance, FY 2022 and 2023

- Table 121 : B. Braun SE: Product Portfolio

- Table 122 : B. Braun SE: News/Key Developments, 2022-2024

- Table 123 : Boston Scientific Corp.: Company Snapshot

- Table 124 : Boston Scientific Corp.: Financial Performance, FY 2022 and 2023

- Table 125 : Boston Scientific Corp.: Product Portfolio

- Table 126 : Boston Scientific Corp.: News/Key Developments, 2023 and 2024

- Table 127 : Intuitive Surgical: Company Snapshot

- Table 128 : Intuitive Surgical: Financial Performance, FY 2022 and 2023

- Table 129 : Intuitive Surgical: Product Portfolio

- Table 130 : Intuitive Surgical: News/Key Developments, 2022-2024

- Table 131 : Johnson & Johnson Services Inc.: Company Snapshot

- Table 132 : Johnson & Johnson Services Inc.: Financial Performance, FY 2022 and 2023

- Table 133 : Johnson & Johnson Services Inc.: Product Portfolio

- Table 134 : Johnson & Johnson Services Inc.: News/Key Developments, 2022-2024

- Table 135 : Medtronic: Company Snapshot

- Table 136 : Medtronic: Financial Performance, FY 2022 and 2023

- Table 137 : Medtronic: Product Portfolio

- Table 138 : Medtronic: News/Key Developments, 2022-2024

- Table 139 : Olympus Corp.: Company Snapshot

- Table 140 : Olympus Corp.: Financial Performance, FY 2022 and 2023

- Table 141 : Olympus Corp.: Product Portfolio

- Table 142 : Olympus Corp.: News/Key Developments, 2023 and 2024

- Table 143 : Smith+Nephew: Company Snapshot

- Table 144 : Smith+Nephew: Financial Performance, FY 2022 and 2023

- Table 145 : Smith+Nephew: Product Portfolio

- Table 146 : Smith+Nephew: News/Key Developments, 2021-2024

- Table 147 : Stryker: Company Snapshot

- Table 148 : Stryker: Financial Performance, FY 2022 and 2023

- Table 149 : Stryker: Product Portfolio

- Table 150 : Stryker: News/Key Developments, 2021-2024

- Table 151 : Zimmer Biomet: Company Snapshot

- Table 152 : Zimmer Biomet: Financial Performance, FY 2022 and 2023

- Table 153 : Zimmer Biomet: Product Portfolio

- Table 154 : Zimmer Biomet: News/Key Developments, 2023 and 2024

List of Figures

- Summary Figure : Global Market for Surgical Equipment and Technologies, by Usability, 2021-2029

- Figure 1 : Cycle of Surgical Instrument Use and Sterilization

- Figure 2 : Lifecycle of Surgical Devices

- Figure 3 : Snapshot of the Dynamics of the Surgical Equipment and Technologies Market

- Figure 4 : Breakdown of Countries Protecting Health Workers in Reporting Patient Safety Incidents

- Figure 5 : Global Market for Surgical Equipment and Technologies, by Usability, 2021-2029

- Figure 6 : Share of Global Market for Surgical Equipment and Technologies, by Usability, 2023

- Figure 7 : Share of Global Market for Surgical Equipment and Technologies, by Technology Type, 2023

- Figure 8 : Share of Global Market for Surgical Equipment and Technologies, by End User, 2023

- Figure 9 : Global Market for Surgical Equipment and Technologies, by Region, 2021-2029

- Figure 10 : Share of Global Market for Surgical Equipment and Technologies, by Region, 2023

- Figure 11 : AI-Driven Surgical Performance Metrics and Feedback System

- Figure 12 : Environmental Impact Per Functional Unit (Set for One Surgery) in Percentage Related to the Reusable Set, 2020

- Figure 13 : 2024 Progress Assessment: Tracking the Sustainable Development Goals

- Figure 14 : Patent Applications and Granted Patents Related to Surgical Equipment and Technologies, 2010-August 2024

- Figure 15 : Share of Patents Registered/Approved, by Country, 2021-August 2024

- Figure 16 : Share of Global Market for Surgical Equipment and Technologies, by Company, 2023

- Figure 17 : Abbott: Revenue Share, by Business Unit, FY 2023

- Figure 18 : Abbott: Revenue Share, by Country/Region, FY 2023

- Figure 19 : B Braun SE: Revenue Share, by Business Unit, FY 2023

- Figure 20 : B Braun SE: Revenue Share, by Country/Region, FY 2023

- Figure 21 : Boston Scientific Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 22 : Boston Scientific Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 23 : Intuitive Surgical: Revenue Share, by Business Unit, FY 2023

- Figure 24 : Intuitive Surgical: Revenue Share, by Country/Region, FY 2023

- Figure 25 : Johnson & Johnson Services Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 26 : Johnson & Johnson Services Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 27 : Medtronic: Revenue Share, by Business Unit, FY 2023

- Figure 28 : Medtronic: Revenue Share, by Country/Region, FY 2023

- Figure 29 : Olympus Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 30 : Olympus Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 31 : Smith+Nephew: Revenue Share, by Business Unit, FY 2023

- Figure 32 : Smith+Nephew: Revenue Share, by Country/Region, FY 2023

- Figure 33 : Stryker: Revenue Share, by Business Unit, FY 2023

- Figure 34 : Stryker: Revenue Share, by Country/Region, FY 2023

- Figure 35 : Zimmer Biomet: Revenue Share, by Business Unit, FY 2023

- Figure 36 : Zimmer Biomet: Revenue Share, by Country/Region, FY 2023

The global market for surgical equipment and technologies was valued at $37.6 billion in 2023. This market is expected to grow from $40.0 billion in 2024 to $56.6 billion by 2029, at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2029.

The global market for reusable surgical equipment is expected to grow from $27.7 billion in 2024 to $37.1 billion by 2029, at a CAGR of 6.1% from 2024 to 2029.

The global market for disposable surgical equipment is expected to grow from $12.4 billion in 2024 to $19.5 billion by 2029, at a CAGR of 9.5% from 2024 to 2029.

Report Scope

This report analyzes the surgical equipment and technologies market, and provides forecasts and sales projections through 2029. It covers the leading companies, technology trends, market dynamics, competitive intelligence and regional trends. The report evaluates how fundamental market dynamics have shifted due to the COVID-19 pandemic and discusses the supply chain, including manufacturers, suppliers, retailers and hospitals. The analysis also includes the effects of economic factors such as healthcare spending, medical tourism and government initiatives to enhance healthcare access.

The report examines emerging technologies, such as the integration of AI and machine learning (ML) into surgical procedures. In this report, the surgical equipment and technologies market is segmented by usability, product category, technology, end user and region. By usability, the market is segmented into disposable and reusable surgical equipment. Product categories includes laparoscopy, orthopedic surgery, neurosurgery, cardio surgery, urology, wound closure, power systems, thoracic surgery, retraction systems, plastic and reconstructive, obstetrics/gynecology and microvascular surgery. By technology, the market is segmented into manual, electrosurgical, manual and wireless surgical equipment. End users are large hospital chains, medium-level specialty hospitals and small clinics.

The market is also segmented into four geographic regions: North America, Europe, Asia-Pacific and the Rest of the World (RoW). Countries focused on include the U.S., Canada, Mexico, France, Germany, the U.K., Italy, Spain, Japan, India, Australia, South Korea and China.

Report Includes

- 113 data tables and 42 additional tables

- An overview of the global market and technologies for general surgical equipment

- Analyses of the global market trends, with data from 2021-2023, estimates for 2024, and projections of compound annual growth rates (CAGRs) through 2029

- Estimation of actual market size and revenue forecast for general surgical equipment market, and corresponding market share analysis based on usability, product category, technology type, end user, and region

- Information on the global surgical equipment market structure and technological innovations such as surgical robotics, powered surgical tools, and a significant focus on minimally invasive procedures

- Insights into healthcare regulations, policies and implications; and discussion on regulated or proposed to be regulated medical devices

- Coverage of the factors impacting market growth and analyze trends and opportunities in major regions, and the trends, gaps and opportunities in each micro market

- Assessment of events like mergers & acquisitions, joint ventures, collaborations or partnerships, and other key market strategies

- A discussion of ESG challenges and ESG practices in the market and impact of COVID-19 on micro and macro environment factors that influence surgical equipment markets

- Company profiles of the market leading participants, including Medtronic, Johnson & Johnson Services Inc., Stryker Corp., Intuitive Surgical Inc., and Zimmer Biomet

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Market Insights

- Regulatory Landscape

- Cybersecurity in Medical Devices

- North America

- Europe

- India

- China

- Japan

Chapter 3 Market Dynamics

- Market Dynamics Snapshot

- Drivers

- Increase in Minimally Invasive Procedures

- Increased Demand for Surgical Equipment

- Ambulatory Surgical Centers

- Increase in Outpatient Surgeries

- Restraints

- Untrained End Users

- Regulatory Challenges and Legal Barriers

- Equipment Malfunctions

- High Cost of Surgical Equipment

- Opportunities

- Technological Advances

- Emerging Economies

- Replenishment in Developed Economies

- Challenges

- Demand for Specialized Instruments

- Quality Management System Regulations (QMSR)

Chapter 4 Market Segmentation Analysis

- Segmentation Breakdown

- Surgical Equipment and Technologies Market, by Usability

- Reusable Surgical Equipment

- Disposable Surgical Equipment

- Surgical Equipment Market, by Product Category

- Laparoscopy

- Orthopedic Surgery

- Neurosurgery

- Cardio Surgery

- Urology

- Wound Closure

- Power Systems

- Thoracic Surgery

- Retraction Systems

- Plastic and Reconstructive

- Obstetrics/Gynecology

- Microvascular Surgery

- Other Product Categories

- Surgical Equipment Market, by Technology

- Manual

- Electrosurgical

- Wireless

- Surgical Equipment and Technologies Market, by End User

- Large Hospital Chains

- Medium-Level Specialty Hospitals

- Small Clinics and Others

- Geographic Breakdown

- Surgical Equipment and Technologies Market, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 5 Emerging Trends and Technologies

- Overview

- Advances in Robotic Surgery

- AI in Surgery

- Glass Fiber-Reinforced Technology

- Advanced Composites

- Augmented Reality Technology

- Blockchain Technology

Chapter 6 ESG Development

- Introduction to ESG in the Surgical Equipment Market

- ESG Sustainability in Leading Companies' Surgical Equipment

- ESG Risk Ratings

- BCC Research Viewpoint

Chapter 7 Patent Analysis

- Patent Analysis

- Select Patent Grants

- Patent Review, by Year

Chapter 8 Competitive Landscape

- Mergers and Acquisitions (M&A) and Collaborations

- Company Share Analysis

- Strategic Alliances

- Product Launches

Chapter 9 Appendix

- Methodology

- Sources

- Abbreviations

- Company Profiles

- ABBOTT

- B. BRAUN SE

- BOSTON SCIENTIFIC CORP.

- INTUITIVE SURGICAL

- JOHNSON & JOHNSON SERVICES INC.

- MEDTRONIC

- OLYMPUS CORP.

- SMITH+NEPHEW

- STRYKER

- ZIMMER BIOMET