|

|

市場調査レポート

商品コード

1568390

医療機器:各種技術と世界市場Medical Devices: Technologies and Global Markets |

||||||

|

|||||||

| 医療機器:各種技術と世界市場 |

|

出版日: 2024年10月07日

発行: BCC Research

ページ情報: 英文 179 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医療機器の市場規模は、2023年の7,396億米ドル、2024年の8,104億米ドルから、予測期間中は9.8%のCAGRで推移し、2029年末には1兆3,000億米ドルの規模に成長すると予測されています。

ドラッグデリバリーデバイスの部門は、2024年の1,861億米ドルから、8.1%のCAGRで推移し、2029年末には2,742億米ドルに成長すると予測されています。イメージングデバイスの部門は、2024年の1,073億米ドルから、10.9%のCAGRで推移し、2029年末には1,800億米ドルに成長すると予測されています。

当レポートでは、世界の医療機器の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場と技術の背景

- イノベーション

- 概要

- 種類

- 現在の動向

- 強化されたサイバーセキュリティ

- ウェアラブルフィットネス技術

- 医療用IoT

- ヘルスケアとロボティクス

- 3Dプリント

- デバイスコネクティビティ

- 法規制

- PESTLE分析

第3章 市場力学

- 概要

- 市場促進要因

- 高齢化と診断処置の増加

- 医療機器におけるAI利用の増加

- 慢性疾患の発症率の上昇

- 公衆衛生の改善の必要性

- 疾患診断の改善

- 患者教育の強化

- 市場抑制要因

- 医療におけるサイバーセキュリティのリスク

- 医療機器設計の失敗

- サプライチェーンの問題と品質に関する懸念

- 市場機会

- モバイル医療画像による医療の提供

- ポイントオブケア超音波 (POCUS) の利用の拡大

- 医療機器の技術開発

第4章 新興技術と開発

- 主要な医療機器と技術の進歩

- 適応型補聴器

- バイオプリンティング

- 血糖値モニタリングウェアラブル

- ブレインマシンインターフェース

- 主要な医療機器と技術の進歩

- 医療診断ソフトウェア

- 自動医療コーディング

- 放射線医療におけるAI

- 外科用ロボット

- 医療機器技術の動向

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場分析:デバイスタイプ別

- ドラッグデリバリーデバイス

- 体外診断

- 泌尿器科・腎臓科

- 整形外科・脊椎

- イメージングデバイス

- 心臓血管デバイス

- 内視鏡検査

- 市場分析:エンドユーザー別

- 病院・診療所

- 在宅医療

- 外来手術センター

- 診断センター

- その他

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 競合情報

- 企業ランキング

- 合意・協力・提携

- デバイスの承認

- 医療機器のスタートアップ

第7章 持続可能性

- 医療機器製造業界におけるESGの重要性

- 医療機器業界におけるESGの実践

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- ESGリスクランキング

- BCC Researchの見解

第8章 付録

- 調査手法

- 参考文献

- 企業プロファイル

- 3M

- ABBOTT

- BD

- BAYER AG

- BAXTER

- BOSTON SCIENTIFIC CORP.

- DANAHER CORP.

- F. HOFFMANN-LA ROCHE LTD.

- GE HEALTHCARE

- JOHNSON & JOHNSON SERVICES INC.

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC

- QUIDELORTHO CORP.

- SIEMENS HEALTHNIEERS AG

- STRYKER

- THERMO FISHER SCIENTIFIC INC.

List of Tables

- Summary Table : Global Market for Medical Devices, by Device Type, Through 2029

- Table 1 : Medical Device Codes

- Table 2 : PESTLE Analysis on Medical Device Technology Market

- Table 3 : Latest Medical Devices: Surgical Robotics, 2024

- Table 4 : Global Market for Medical Devices, by Device Type, Through 2029

- Table 5 : Global Market for Drug Delivery Devices, by Region, Through 2029

- Table 6 : Global Market for In Vitro Diagnostics Medical Devices, by Type, Through 2029

- Table 7 : Global Market for In Vitro Diagnostics Medical Devices, by Region, Through 2029

- Table 8 : Global Market for Immunochemistry IVD, by Region, Through 2029

- Table 9 : Global Market for Clinical Chemistry IVD, by Region, Through 2029

- Table 10 : Global Market for Molecular Diagnostics IVD, by Region, Through 2029

- Table 11 : Global Market for IVD Point-of-Care Testing, by Region, Through 2029

- Table 12 : Global Market for Hematology IVD, by Region, Through 2029

- Table 13 : Global Market for Urology and Renal Medical Devices, by Region, Through 2029

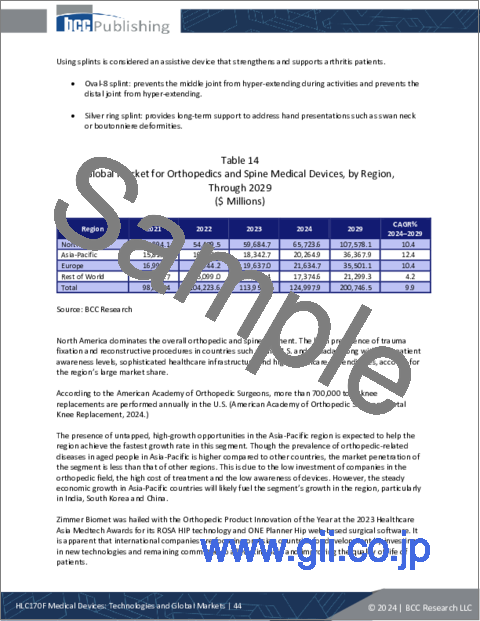

- Table 14 : Global Market for Orthopedics and Spine Medical Devices, by Region, Through 2029

- Table 15 : Global Market for Imaging Medical Devices, by Type, Through 2029

- Table 16 : Global Market for Imaging Medical Devices, by Region, Through 2029

- Table 17 : Global Market for Magnetic Resonance Imaging Systems, by Region, Through 2029

- Table 18 : Global Market for Ultrasound Systems, by Region, Through 2029

- Table 19 : Global Market for X-ray Systems, by Region, Through 2029

- Table 20 : Global Market for Computed Tomography, by Region, Through 2029

- Table 21 : PET Imaging Volume Share, by Hospital Department, 2023

- Table 22 : Global Market for Nuclear Medicine/PET Systems, by Region, Through 2029

- Table 23 : Global Market for Interventional Radiology Systems, by Region, Through 2029

- Table 24 : Global Market for Clinical and Point-of-Care Imaging Systems, by Region, Through 2029

- Table 25 : Global Market for Laser Imaging Systems, by Region, Through 2029

- Table 26 : Global Market for Cardiovascular Medical Devices, by Type, Through 2029

- Table 27 : Global Market for Cardiovascular Medical Devices, by Region, Through 2029

- Table 28 : Global Market for Defibrillators, by Region, Through 2029

- Table 29 : Global Market for Pacemakers, by Region, Through 2029

- Table 30 : Global Market for Ventricular Assist Devices, by Region, Through 2029

- Table 31 : Global Market for Loop Recorders, by Region, Through 2029

- Table 32 : Global Market for Other Cardiovascular Medical Devices, by Region, Through 2029

- Table 33 : Global Market for Endoscopy Medical Devices, by Region, Through 2029

- Table 34 : Global Market for Medical Devices, by End User, Through 2029

- Table 35 : Global Market for Medical Devices in Hospitals and Clinics, by Region, Through 2029

- Table 36 : Global Market for Medical Devices in Home Healthcare, by Region, Through 2029

- Table 37 : Global Market for Medical Devices in Ambulatory Surgical Centers, by Region, Through 2029

- Table 38 : Global Market for Medical Devices in Diagnostic Laboratories, by Region, Through 2029

- Table 39 : Global Market for Medical Devices in Other End Users, by Region, Through 2029

- Table 40 : Global Market for Medical Devices, by Region, Through 2029

- Table 41 : North American Market for Medical Devices, by Country, Through 2029

- Table 42 : Select U.S. FDA-Approved Artificial Intelligence- and Machine Learning-Enabled Medical Devices, 2024

- Table 43 : European Market for Medical Devices, by Country, Through 2029

- Table 44 : Asia-Pacific Market for Medical Devices, by Country, Through 2029

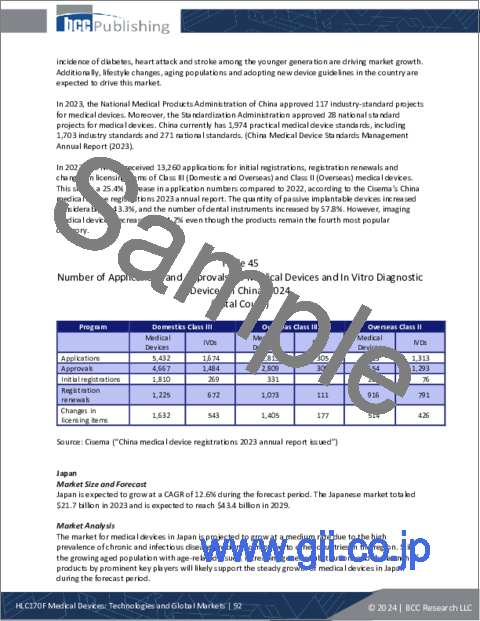

- Table 45 : Number of Applications and Approvals for Medical Devices and In Vitro Diagnostic Devices in China, 2024

- Table 46 : Rest of the World Market for Medical Devices, by Country, Through 2029

- Table 47 : Medical Devices Cleared or Approved by the FDA, 2023

- Table 48 : ESG Practices: Environmental Performance

- Table 49 : ESG Practices: Social Performance

- Table 50 : ESG Practices: Governance Performance

- Table 51 : ESG Rankings for Major Medical Device Companies, 2023-2024*

- Table 52 : 3M: Company Snapshot

- Table 53 : 3M: Financial Performance, FY 2022 and 2023

- Table 54 : 3M: Product Portfolio

- Table 55 : 3M: News/Key Developments, 2022 and 2023

- Table 56 : Abbott: Company Snapshot

- Table 57 : Abbott: Financial Performance, FY 2022 and 2023

- Table 58 : Abbott: Product Portfolio

- Table 59 : Abbott: News/Key Developments, 2022-2024

- Table 60 : BD: Company Snapshot

- Table 61 : BD: Financial Performance, FY 2022 and 2023

- Table 62 : BD: Product Portfolio

- Table 63 : BD: News/Key Developments, 2023 and 2024

- Table 64 : Bayer AG: Company Snapshot

- Table 65 : Bayer AG: Financial Performance, FY 2022 and 2023

- Table 66 : Bayer AG: Product Portfolio

- Table 67 : Bayer AG: News/Key Developments, 2023 and 2024

- Table 68 : Baxter: Company Snapshot

- Table 69 : Baxter: Financial Performance, FY 2022 and 2023

- Table 70 : Baxter: Product Portfolio

- Table 71 : Baxter: News/Key Developments, 2021-2024

- Table 72 : Boston Scientific Corp.: Company Snapshot

- Table 73 : Boston Scientific Corp.: Financial Performance, FY 2022 and 2023

- Table 74 : Boston Scientific Corp.: Product Portfolio

- Table 75 : Boston Scientific Corp.: News/Key Developments, 2023 and 2024

- Table 76 : Danaher Corp.: Company Snapshot

- Table 77 : Danaher Corp.: Financial Performance, FY 2022 and 2023

- Table 78 : Danaher Corp.: Product Portfolio

- Table 79 : Danaher Corp.: News/Key Developments, 2021-2024

- Table 80 : F. Hoffmann-La Roche Ltd.: Company Snapshot

- Table 81 : F. Hoffmann-La Roche Ltd.: Financials, FY 2022-2023

- Table 82 : F. Hoffmann-La Roche Ltd.: Product Portfolio

- Table 83 : F. Hoffmann-La Roche Ltd.: News/Key Developments, 2022-2024

- Table 84 : GE HealthCare: Company Snapshot

- Table 85 : GE HealthCare: Financial Performance, FY 2022 and 2023

- Table 86 : GE HealthCare: Product Portfolio

- Table 87 : GE HealthCare: News/Key Developments, 2023 and 2024

- Table 88 : Johnson and Johnson Services Inc.: Company Snapshot

- Table 89 : Johnson and Johnson Services Inc.: Financial Performance, FY 2022 and 2023

- Table 90 : Johnson and Johnson Services Inc.: Product Portfolio

- Table 91 : Johnson and Johnson Services Inc.: News/Key Developments, 2023 and 2024

- Table 92 : Koninklijke Philips N.V.: Company Snapshot

- Table 93 : Koninklijke Philips N.V.: Financial Performance, FY 2022 and 2023

- Table 94 : Koninklijke Philips N.V.: Product Portfolio

- Table 95 : Koninklijke Philips N.V.: News/Key Developments, 2023 and 2024

- Table 96 : Medtronic: Company Snapshot

- Table 97 : Medtronic: Financial Performance, FY 2022 and 2023

- Table 98 : Medtronic: Product Portfolio

- Table 99 : Medtronic: News/Key Developments, 2022-2024

- Table 100 : QuidelOrtho Corp.: Company Snapshot

- Table 101 : QuidelOrtho Corp.: Financial Performance, FY 2022 and 2023

- Table 102 : QuidelOrtho Corp.: Product Portfolio

- Table 103 : QuidelOrtho Corp.: News/Key Developments, 2021-2024

- Table 104 : Siemens Healthineers AG: Company Snapshot

- Table 105 : Siemens Healthineers AG: Financial Performance, FY 2022 and 2023

- Table 106 : Siemens Healthineers AG: Product Portfolio

- Table 107 : Siemens Healthineers AG: News/Key Developments, 2021-2023

- Table 108 : Stryker: Company Snapshot

- Table 109 : Stryker: Financial Performance, FY 2022 and 2023

- Table 110 : Stryker: Product Portfolio

- Table 111 : Stryker: News/Key Developments, 2022-2024

- Table 112 : Thermo Fisher Scientific Inc.: Company Snapshot

- Table 113 : Thermo Fisher Scientific Inc.: Financial Performance, FY 2022 and 2023

- Table 114 : Thermo Fisher Scientific Inc.: Product Portfolio

- Table 115 : Thermo Fisher Scientific Inc.: News/Key Developments, 2022 and 2023

List of Figures

- Summary Figure : Global Market Share of Medical Devices, by Device Type 2023

- Figure 1 : Market Dynamics Snapshot for Medical Device Technologies and Global Markets

- Figure 2 : Global Projected Shares of Elderly Population (Aged 65 and Above), by Region, 2050

- Figure 3 : Types of Medical Devices that Benefit from Advanced Software Solutions

- Figure 4 : Share of Trends in the Medical Device Sector, 2023

- Figure 5 : Global Market Share of Medical Devices, by Device Type, 2023

- Figure 6 : Global Market Share of In Vitro Diagnostics Medical Devices, by Type, 2023

- Figure 7 : Global Market Share of Imaging Medical Devices, by Type, 2023

- Figure 8 : Global Market Share of Cardiovascular Medical Devices, by Type, 2023

- Figure 9 : Global Market Share of Medical Devices, by End User, 2023

- Figure 10 : Global Market Share of Medical Devices, by Region, 2023

- Figure 11 : North American Market Share of Medical Devices, by Device Type, 2023

- Figure 12 : North American Market Share of Imaging Medical Devices, by Type, 2023

- Figure 13 : North American Market Share of In Vitro Diagnostics Medical Devices, by Type, 2023

- Figure 14 : North American Market Share of Medical Devices, by End User, 2023

- Figure 15 : North American Market Share of Medical Devices, by End User, 2023

- Figure 16 : North American Market Share of Medical Devices, by Country, 2023

- Figure 17 : European Market Share of Medical Devices, by Device Type, 2023

- Figure 18 : European Market Share of Imaging Medical Devices, by Type, 2023

- Figure 19 : European Market Share of In Vitro Diagnostics Medical Devices, by Type, 2023

- Figure 20 : European Market Share of Cardiovascular Medical Devices, by Type, 2023

- Figure 21 : European Market Share of Medical Devices, by End User, 2023

- Figure 22 : European Market Share of Medical Devices, by Country, 2023

- Figure 23 : Asia-Pacific Market Share of Medical Devices, by Device Type, 2023

- Figure 24 : Asia-Pacific Market Share of Imaging Medical Devices, by Type, 2023

- Figure 25 : Asia-Pacific Market Share of In Vitro Diagnostics Medical Devices, by Type, 2023

- Figure 26 : Asia-Pacific Market Share of Cardiovascular Medical Devices, by Type, 2023

- Figure 27 : Asia-Pacific Market Share of Medical Devices, by End User, 2023

- Figure 28 : Asia-Pacific Market Share of Medical Devices, by Country, 2023

- Figure 29 : Rest of the World Market Share of Medical Devices, by Device Type, 2023

- Figure 30 : Rest of the World Market Share of Imaging Medical Devices, by Type, 2023

- Figure 31 : Rest of the World Market Share of In Vitro Diagnostics Medical Devices, by Type, 2023

- Figure 32 : Rest of the World Market Share of Cardiovascular Medical Devices, by Type, 2023

- Figure 33 : Rest of the World Market Share of Medical Devices, by End User, 2023

- Figure 34 : Rest of the World Market Share of Medical Devices, by Country, 2023

- Figure 35 : Global Market Share of Medical Devices and Technologies, by Company, 2023

- Figure 36 : Snapshot: Key ESG Trends in the Medical Device Industry

- Figure 37 : Viewpoints on Sustainable Medical Devices

- Figure 38 : 3M: Revenue Share, by Country/Region, FY 2023

- Figure 39 : 3M: Revenue Share, by Business Unit, FY 2023

- Figure 40 : Abbott: Revenue Share, by Business Unit, FY 2023

- Figure 41 : Abbott: Revenue Share, by Country/Region, FY 2023

- Figure 42 : BD: Revenue Share, by Country/Region, FY 2023

- Figure 43 : BD: Revenue Share, by Business Unit, FY 2023

- Figure 44 : Bayer AG: Revenue Share, by Country/Region, FY 2023

- Figure 45 : Bayer AG: Revenue Share, by Business Unit, FY 2023

- Figure 46 : Baxter: Revenue Share, by Business Unit, FY 2023

- Figure 47 : Baxter: Revenue Share, by Country/Region, FY 2023

- Figure 48 : Boston Scientific Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 49 : Boston Scientific Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 50 : Danaher Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 51 : Danaher Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 52 : F. Hoffmann-La Roche Ltd.: Revenue Share, by Business Unit, FY 2023

- Figure 53 : F. Hoffmann-La Roche Ltd.: Revenue Share, by Country/Region, FY 2023

- Figure 54 : GE HealthCare: Revenue Share, by Business Unit, FY 2023

- Figure 55 : GE HealthCare: Revenue Share, by Country/Region, FY 2023

- Figure 56 : Johnson and Johnson Services Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 57 : Johnson and Johnson Services Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 58 : Koninklijke Philips N.V.: Revenue Share, by Business Unit, FY 2023

- Figure 59 : Koninklijke Philips N.V.: Revenue Share, by Country/Region, FY 2023

- Figure 60 : Medtronic.: Revenue Share, by Business Unit, FY 2023

- Figure 61 : Medtronic: Revenue Share, by Country/Region, FY 2023

- Figure 62 : QuidelOrtho Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 63 : QuidelOrtho Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 64 : Siemens Healthineers AG: Revenue Share, by Business Unit, FY 2023

- Figure 65 : Siemens Healthineers AG: Revenue Share, by Country/Region, FY 2023

- Figure 66 : Stryker: Revenue Share, by Business Unit, FY 2023

- Figure 67 : Stryker: Revenue Share, by Country/Region, FY 2023

- Figure 68 : Thermo Fisher Scientific Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 69 : Thermo Fisher Scientific Inc.: Revenue Share, by Country/Region, FY 2023

The global market for medical devices reached $739.6 billion in 2023. It is expected to grow from $810.4 billion in 2024 to $1.3 trillion by the end of 2029, at a compound annual growth rate (CAGR) of 9.8% from 2024 through 2029.

The global market for drug delivery devices is expected to grow from $186.1 billion in 2024 to $274.2 billion by the end of 2029, at a CAGR of 8.1% from 2024 through 2029.

The global market for imaging medical devices is expected to grow from $107.3 billion in 2024 to $180.0 billion by the end of 2029, at a CAGR of 10.9% from 2024 through 2029.

Report Scope

This report provides an in-depth analysis of the market for medical device technology, including market estimations and trends through 2029. Major players, competitive intelligence, innovative technologies, market dynamics, and regional opportunities are discussed in detail. The report examines recent developments and product portfolios of major players. The report covers drivers, restraints, opportunities, emerging technologies, and a regulatory scenario assessment. The report includes market projections for 2029 and market shares for key players.

The report's scope extends to only those medical device technologies that generate the most global revenue. Dental device technologies and some imaging devices used in dentistry overlap with other devices that are already covered under the imaging device technologies segments, so these have been excluded.

Based on device type, the market is segmented into drug delivery devices, in vitro diagnostics (IVD), urology and renal, orthopedics and spine, imaging devices, cardiovascular devices, and endoscopy. The imaging devices are categorized into X-ray systems, ultrasound systems, computed tomography, magnetic resonance imaging, clinical/point of care, interventional radiology, nuclear medicine/positron emission tomography, and laser imaging. Based on type of in vitro device, the market is segmented into immunochemistry, clinical chemistry, molecular diagnostics, point-of-care tests, and hematology. Based on type of cardiovascular device, the market is segmented into defibrillators, pacemakers, ventricular-assist devices, loop recorders, and others. Based on type of end user, the market is segmented into hospitals and clinics, home healthcare, ambulatory surgical centers, and diagnostic centers.

The market is segmented by geographical region into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Also included in the geographic breakdown are detailed analyses of major countries such as the U.S., Germany, the U.K., Italy, France, Spain, Japan, China, India, Brazil, Mexico, and Gulf Cooperation Council (GCC) countries. For market estimates, data is provided for 2023 as the base year, with estimates for 2024 and a forecast value for 2029.

Report Includes

- 58 data tables and 58 additional tables

- An analysis of the current and future global markets and technologies for medical devices

- Analyses of global market trends, with market revenue data (sales figures) for 2021-2023, estimates for 2024, and projected CAGRs through 2029

- Estimates of the market size and revenue forecasts for the global medical device market, with market share analysis by device types and subtypes, end-user, and region

- Discussion of the market dynamics, opportunities, and challenges, as well as emerging technologies

- Discussion of key regulations of the industry and coverage of advancements and recent innovations in the medical device industry

- Overview of sustainability trends and ESG developments in the industry, with emphasis on the ESG practices of leading companies, their ESG rankings, and consumer attitudes

- Competitive intelligence, including companies' market shares, recent M&A activity, and venture funding.

- Profiles of the leading companies, including Abbott, BD, Danaher Corp., Medtronic and F. Hoffmann-La Roche Ltd.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market and Technology Background

- Innovation

- Overview

- Types

- Current Trends

- Enhanced Cybersecurity

- Wearable Fitness Technology

- Internet of Medical Things

- Healthcare and Robotics

- 3D Printing

- Device Connectivity

- Regulations

- Delay in Legacy of Medical Device Compliance: Europe

- U.S. FDA Implements Electronic Submission Templates

- Revision of Brazil's ANVISA

- Mexico COFEPRIS Releases Edition 5.0

- Developments in Thailand and Israel

- Regulation of Medical Devices in India

- Regulation of Medical Devices in China

- PESTLE Analysis

Chapter 3 Market Dynamics

- Overview

- Market Drivers

- Rise in the Aging Population and Diagnosis Procedures

- Increasing Use of Artificial Intelligence in Medical Devices

- Rising Incidence of Chronic Disease

- Need for Improving Public Health

- Improving Disease Diagnosis

- Increased Patient Education

- Market Restraints

- Cybersecurity Risks in Healthcare

- Failure in Medical Device Designs

- Supply Chain Issues and Quality Concerns

- Market Opportunities

- Healthcare Delivery with Mobile Medical Imaging

- Expanding Use of Point-of-Care Ultrasound (POCUS)

- Technological Developments in Medical Devices

Chapter 4 Emerging Technologies and Developments

- Major Medical Device and Technology Advances in 2024

- Adaptive Hearing Aids

- Bioprinting

- Glucose Monitoring Wearables

- Brain-Machine Interfaces

- Major Medical Device and Technology Advances in 2023

- Medical Diagnosis Software

- Automated Medical Coding

- Artificial Intelligence in Radiology

- Surgical Robots

- Trends in Medical Device Technology

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Market Analysis by Device Type

- Drug Delivery Devices

- In Vitro Diagnostics

- Urology and Renal

- Orthopedics and Spine

- Imaging Devices

- Cardiovascular Devices

- Endoscopy

- Market Analysis by End User

- Hospitals and Clinics

- Home Healthcare

- Ambulatory Surgical Centers

- Diagnostic Centers

- Other End Users

- Geographical Breakdown

- Market Analysis by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 6 Competitive Intelligence

- Introduction

- Global Analysis of Company Market Rank

- Agreements, Collaborations and Partnerships

- Siemens Healthineers and Sysmex Enter into a Global Agreement

- Roche Enters Agreement with PathAI

- Quidel Corp. Signs Agreement to Acquire Ortho Clinical Diagnostics

- GE HealthCare Collaborates with Boston Scientific

- Medtronic Collaborates with Nvidia Corp.

- 2023 Device Approvals

- Start-ups in Medical Devices

Chapter 7 Sustainability

- Importance of ESG in Medical Devices Manufacturing Industry

- ESG Practices in the Medical Device Industry

- Environmental Performance

- Social Performance

- Governance Performance

- ESG Risk Rankings

- BCC Research Viewpoint

Chapter 8 Appendix

- Research Methodology

- References

- Company Profiles

- 3M

- ABBOTT

- BD

- BAYER AG

- BAXTER

- BOSTON SCIENTIFIC CORP.

- DANAHER CORP.

- F. HOFFMANN-LA ROCHE LTD.

- GE HEALTHCARE

- JOHNSON & JOHNSON SERVICES INC.

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC

- QUIDELORTHO CORP.

- SIEMENS HEALTHNIEERS AG

- STRYKER

- THERMO FISHER SCIENTIFIC INC.