|

|

市場調査レポート

商品コード

1880574

医薬品ろ過:世界市場Pharmaceutical Filtration: Global Markets |

||||||

|

|||||||

| 医薬品ろ過:世界市場 |

|

出版日: 2025年11月28日

発行: BCC Research

ページ情報: 英文 152 Pages

納期: 即納可能

|

概要

世界の医薬品ろ過の市場規模は、2025年の120億米ドルから、2025年から2030年の予測期間中はCAGR 11.1%で推移し、2030年末には203億米ドルに達すると予測されています。

北米市場は、2025年の51億米ドルから、2025年から2030年の予測期間中は13.2%のCAGRで推移し、2030年末には95億米ドルに達すると予測されています。アジア太平洋市場は、2025年の29億米ドルから、2025年から2030年の予測期間中はCAGR 12%で推移し、2030年末には50億米ドルに達すると予測されています。

当レポートでは、世界の医薬品ろ過の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術動向、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場力学と成長要因

- 新興技術

- 将来の動向と発展

- セグメント分析

- 地域市場および新興市場

- 結論

第2章 市場概要

- 医薬品ろ過の役割

- 医薬品ろ過の選択に影響を与える要因

- 医薬品ろ過の重要性

第3章 市場力学

- 主なハイライト

- 市場力学スナップショット

- 市場促進要因

- 医薬品の需要増加

- 新興市場の成長

- 抑制要因

- 厳格な規制と検証要件

- 高い資本コストと運用コスト

- 機会

- 使い捨て技術の成長機会

- ろ過生産におけるAIシステムの導入

- 課題

- カスタマイズとスケールアップの問題

- 持続可能性と廃棄物処理

第4章 新興技術と開発

- 主なハイライト

- 新しい技術

- 窒化ホウ素から作られた超薄型フィルター

- 高温耐性膜

- ePTFE HEPAフィルター技術

第5章 サプライチェーン分析

- サプライチェーン分析

第6章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場分析:タイプ別

- 主なハイライト

- 滅菌ろ過

- 非滅菌ろ過

- 市場分析:製品別

- 主なハイライト

- フィルター

- ろ過システム

- その他

- 市場分析:用途別

- 主なハイライト

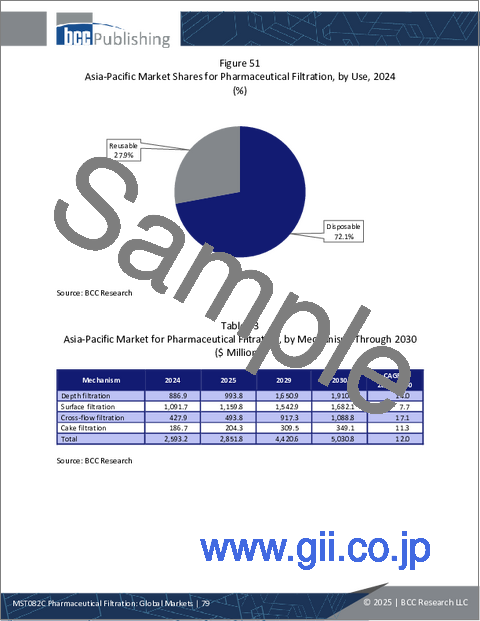

- 使い捨てフィルターシステム

- 再利用可能なろ過システム

- 市場分析:メカニズム別

- 主なハイライト

- 表面ろ過

- 深層ろ過

- クロスフローろ過

- ケークろ過

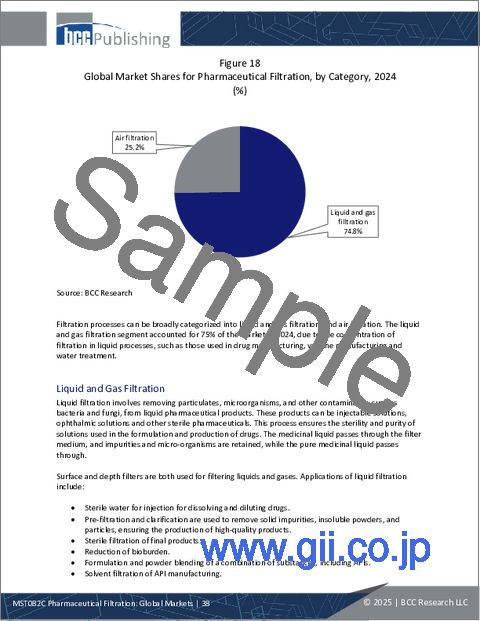

- 市場分析:カテゴリー別

- 主なハイライト

- 液体・ガスろ過

- 空気ろ過

- 市場分析:技術別

- 主なハイライト

- 限外ろ過

- 精密ろ過

- ナノろ過

- 逆浸透

- その他

- 市場分析:用途別

- 主なハイライト

- 医薬品製造

- 精製

- 品質管理

- 地理的内訳

- 市場分析:地域別

- 主なハイライト

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第7章 競合情報

- 業界構造

- 医薬品ろ過市場:企業シェア分析

- Merck KGaA/MilliporeSigma

- Thermo Fisher Scientific Inc.

- Danaher Corp.

- Parker Hannifin Corp.

- Asahi Kasei Corp.

- 戦略分析

第8章 医薬品ろ過における持続可能性:ESGの観点

- 医薬品ろ過業界におけるESGの重要性

- ESGの実践

- 企業のESGランキング

- リスクスケール

- ESGの未来:新たな動向と機会

- BCCによる総論

第9章 付録

- 調査手法

- 情報源

- 参考文献

- 略語

- 企業プロファイル

- ALFA LAVAL

- AMAZON FILTERS LTD.

- ASAHI KASEI LIFE SCIENCE CORP.

- COLE-PARMER INSTRUMENT CO. LLC.

- CYTIVA (DANAHER CORP.)

- EATON

- GRAVER TECHNOLOGIES

- MEISSNER FILTRATION PRODUCTS INC.

- MERCK KGAA

- PARKER HANNIFIN CORP.

- REPLIGEN CORP.

- SAINT-GOBAIN LIFE SCIENCES

- SARTORIUS AG

- SHANGHAI SOLUGET FILTRATION TECHNOLOGY CO. LTD.

- THERMO FISHER SCIENTIFIC INC.