|

|

市場調査レポート

商品コード

1522012

マイクロエレクトロニクス医療インプラント:製品・技術・機会Microelectronic Medical Implants: Products, Technologies & Opportunities |

||||||

|

|||||||

| マイクロエレクトロニクス医療インプラント:製品・技術・機会 |

|

出版日: 2024年07月23日

発行: BCC Research

ページ情報: 英文 130 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のマイクロエレクトロニクス医療インプラントの市場規模は、2024年の490億米ドルから、予測期間中はCAGR 11.7%で推移し、2029年末には851億米ドルに達すると予測されています。

ペースメーカーの部門は、2024年の198億米ドルから、CAGR 12.0%で推移し、2029年末には349億米ドルに達すると予測されています。また、除細動器の部門は、2024年の177億米ドルから、CAGR 11.2%で推移し、2029年末には301億米ドルに達すると予測されています。

当レポートでは、世界のマイクロエレクトロニクス医療インプラントの市場を調査し、市場概要、市場影響因子および市場機会の分析、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- 概要

- ポーターのファイブフォース分析

第3章 市場力学

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

第4章 規制と償還の情勢

- 規制シナリオ

- 米国

- EU

- アジア太平洋

- 償還の情勢

第5章 新興技術

- 概要

第6章 市場セグメンテーション分析

- セグメンテーションの内訳

- マイクロエレクトロニクス医療インプラント市場:製品タイプ別

- 世界市場の予測

- ペースメーカー

- 除細動器

- 神経刺激装置

- 聴覚インプラント

- 眼内インプラント

- その他

- マイクロエレクトロニクス医療インプラント市場:用途別

- 世界市場の予測

- 心臓病学

- 神経学

- 聴覚学

- 眼科

- その他

- 地理的内訳

- マイクロエレクトロニクス医療インプラント市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第7章 競合情報

- 競合情勢

第8章 マイクロエレクトロニクス医療インプラント産業における持続可能性:ESGの観点

- ESG:イントロダクション

- 業界における持続可能性

- 環境への影響

- 社会的責任

- ガバナンス

第9章 付録

- 調査手法

- 略語

- 出典

- 企業プロファイル

- ABBOTT

- BIOTRONIK

- BOSTON SCIENTIFIC CORP.

- COCHLEAR LTD.

- INSPIRE MEDICAL SYSTEMS INC.

- LIVANOVA PLC

- MEDTRONIC

- MICROPORT SCIENTIFIC CORP.

- NEUROPACE INC.

- NEVRO CORP.

List of Tables

- Summary Table : Global Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 1 : Porter's Five Forces Analysis: Microelectronic Medical Implants Market

- Table 2 : Global Population Growth, by Age Group, Through 2050

- Table 3 : Global Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 4 : Global Market for Pacemakers, by Region, Through 2029

- Table 5 : Global Market for Defibrillators, by Region, Through 2029

- Table 6 : Global Market for Neurostimulators, by Region, Through 2029

- Table 7 : Global Market for Hearing Implants, by Region, Through 2029

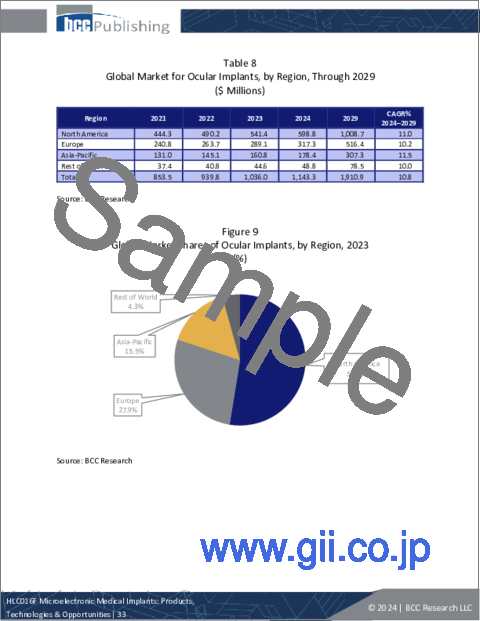

- Table 8 : Global Market for Ocular Implants, by Region, Through 2029

- Table 9 : Global Market for Other Implants, by Region, Through 2029

- Table 10 : Global Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 11 : Global Market for Microelectronic Medical Implants in Cardiology, by Region, Through 2029

- Table 12 : Global Market for Microelectronic Medical Implants in Neurology, by Region, Through 2029

- Table 13 : Percentage of Global Population with Hearing Loss and its Severity, 2021

- Table 14 : Global Market for Microelectronic Medical Implants in Audiology, by Region, Through 2029

- Table 15 : Global Market for Microelectronic Medical Implants in Ophthalmology, by Region, Through 2029

- Table 16 : Global Market for Microelectronic Medical Implants in Other Applications, by Region, Through 2029

- Table 17 : Global Market for Microelectronic Medical Implants, by Region, Through 2029

- Table 18 : North American Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 19 : North American Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 20 : North American Market for Microelectronic Medical Implants, by Country, Through 2029

- Table 21 : U.S. Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 22 : U.S. Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 23 : Canadian Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 24 : Canadian Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 25 : Mexican Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 26 : Mexican Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 27 : European Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 28 : European Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 29 : European Market for Microelectronic Medical Implants, by Country, Through 2029

- Table 30 : German Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 31 : German Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 32 : U.K. Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 33 : U.K. Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 34 : French Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 35 : French Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 36 : Rest of Europe Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 37 : Rest of Europe Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 38 : Asia-Pacific Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 39 : Asia-Pacific Market for Microelectronic Medical Implants, by Application, Through 2029

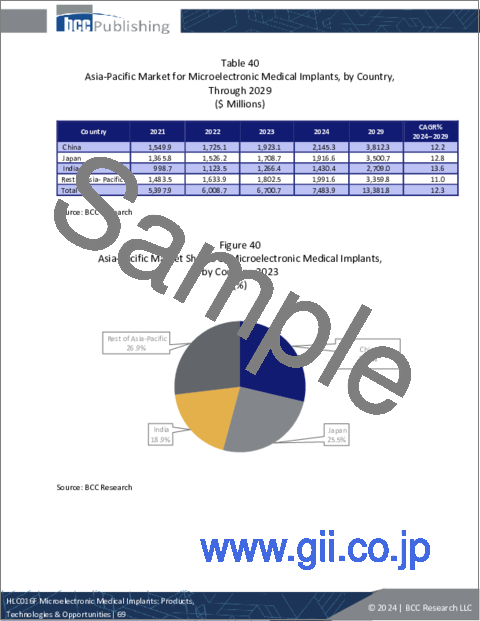

- Table 40 : Asia-Pacific Market for Microelectronic Medical Implants, by Country, Through 2029

- Table 41 : Chinese Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 42 : Chinese Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 43 : Japanese Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 44 : Japanese Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 45 : Indian Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 46 : Indian Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 47 : Rest of Asia-Pacific Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 48 : Rest of Asia-Pacific Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 49 : RoW Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 50 : RoW Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 51 : RoW Market for Microelectronic Medical Implants, by Sub-Region, Through 2029

- Table 52 : South American Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 53 : South American Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 54 : MEA Market for Microelectronic Medical Implants, by Product Type, Through 2029

- Table 55 : MEA Market for Microelectronic Medical Implants, by Application, Through 2029

- Table 56 : Abbreviations Used in this Report

- Table 57 : Report Sources

- Table 58 : Abbott: Company Snapshot

- Table 59 : Abbott: Financial Performance, FY 2022 and 2023

- Table 60 : Abbott: Key Developments, 2024

- Table 61 : Abbott: Key Developments, 2024

- Table 62 : Biotronik: Company Snapshot

- Table 63 : Biotronik: Product Portfolio

- Table 64 : Biotronik: Key Developments, 2024

- Table 65 : Boston Scientific Corp.: Company Snapshot

- Table 66 : Boston Scientific Corp.: Financial Performance, FY 2022 and 2023

- Table 67 : Boston Scientific Corp.: Product Portfolio

- Table 68 : Boston Scientific Corp.: Key Developments, 2024

- Table 69 : Cochlear Ltd.: Company Snapshot

- Table 70 : Cochlear Ltd.: Financial Performance, FY 2022 and 2023

- Table 71 : Cochlear Ltd.: Product Portfolio

- Table 72 : Cochlear Ltd.: Key Developments, 2024

- Table 73 : Inspire Medical Systems Inc.: Company Snapshot

- Table 74 : Inspire Medical Systems Inc.: Financial Performance, FY 2022 and 2023

- Table 75 : Inspire Medical Systems Inc.: Product Portfolio

- Table 76 : LivaNova PLC: Company Snapshot

- Table 77 : LivaNova PLC: Financial Performance, FY 2022 and 2023

- Table 78 : LivaNova PLC: Product Portfolio

- Table 79 : Medtronic: Company Snapshot

- Table 80 : Medtronic: Financial Performance, FY 2022 and 2023

- Table 81 : Medtronic: Product Portfolio

- Table 82 : Medtronic: Key Developments, 2024

- Table 83 : Microport Scientific Corp.: Company Snapshot

- Table 84 : Microport Scientific Corp.: Financial Performance, FY 2022 and 2023

- Table 85 : Microport Scientific Corp.: Product Portfolio

- Table 86 : Microport Scientific Corp.: Key Developments, 2024

- Table 87 : NeuroPace Inc.: Company Snapshot

- Table 88 : NeuroPace Inc.: Financial Performance, FY 2022 and 2023

- Table 89 : NeuroPace Inc.: Product Portfolio

- Table 90 : NEVRO CORP.: Company Snapshot

- Table 91 : NEVRO CORP.: Financial Performance, FY 2022 and 2023

- Table 92 : NEVRO CORP.: Product Portfolio

- Table 93 : NEVRO CORP.: Key Developments, 2023

List of Figures

- Summary Figure : Global Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 1 : Microelectronic Medical Implants: Market Dynamics

- Figure 2 : Share of Population 65 and Older in G7 Countries, 2021

- Figure 3 : Global Shares of Population 65 and Older, by Region, 2016 and 2050

- Figure 4 : Global Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 5 : Global Market Shares of Pacemakers, by Region, 2023

- Figure 6 : Global Market Shares of Defibrillators, by Region, 2023

- Figure 7 : Global Market Shares of Neurostimulators, by Region, 2023

- Figure 8 : Global Market Shares of Hearing Implants, by Region, 2023

- Figure 9 : Global Market Shares of Ocular Implants, by Region, 2023

- Figure 10 : Global Market Shares of Other Implants, by Region, 2023

- Figure 11 : Global Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 12 : Global Market Shares of Microelectronic Medical Implants in Cardiology, by Region, 2023

- Figure 13 : Global Market Shares of Microelectronic Medical Implants in Neurology, by Region, 2023

- Figure 14 : Global Market Shares of Microelectronic Medical Implants in Audiology, by Region, 2023

- Figure 15 : Global Market Shares of Microelectronic Medical Implants in Ophthalmology, by Region, 2023

- Figure 16 : Global Market Shares of Microelectronic Medical Implants in Other Applications, by Region, 2023

- Figure 17 : Global Market for Microelectronic Medical Implants, by Region, 2021-2029

- Figure 18 : North American Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 19 : North American Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 20 : North American Market Shares of Microelectronic Medical Implants, by Country, 2023

- Figure 21 : U.S. Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 22 : U.S. Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 23 : Canadian Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 24 : Canadian Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 25 : Mexican Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 26 : Mexican Market for Microelectronic Medical Implants, by Application, Through 2029

- Figure 27 : European Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 28 : European Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 29 : European Market Shares of Microelectronic Medical Implants, by Country, 2023

- Figure 30 : German Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 31 : German Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 32 : U.K. Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 33 : U.K. Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 34 : French Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 35 : French Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 36 : Rest of Europe Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 37 : Rest of Europe Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 38 : Asia-Pacific Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 39 : Asia-Pacific Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 40 : Asia-Pacific Market Shares of Microelectronic Medical Implants, by Country, 2023

- Figure 41 : Chinese Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 42 : Chinese Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 43 : Japanese Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 44 : Japanese Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 45 : Indian Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 46 : Indian Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 47 : Rest of Asia-Pacific Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 48 : Rest of Asia-Pacific Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 49 : RoW Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 50 : RoW Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 51 : RoW Market Shares of Microelectronic Medical Implants, by Sub-Region, 2023

- Figure 52 : South American Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 53 : South American Market for Microelectronic Medical Implants, by Application, Through 2029

- Figure 54 : MEA Market for Microelectronic Medical Implants, by Product Type, 2021-2029

- Figure 55 : MEA Market for Microelectronic Medical Implants, by Application, 2021-2029

- Figure 56 : Global Market Shares of Microelectronic Medical Implants, by Company, 2023

- Figure 57 : Pillars of ESG

- Figure 58 : Advantages of ESG for Companies

- Figure 59 : Level of ESG Adoption Across Industries, 2021 and 2022

- Figure 60 : Abbott: Revenue Shares, by Business Unit, FY 2023

- Figure 61 : Abbott: Revenue Shares, by Country/Region, FY 2023

- Figure 62 : Boston Scientific Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 63 : Boston Scientific Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 64 : Cochlear Ltd.: Revenue Shares, by Business Unit, FY 2023

- Figure 65 : Cochlear Ltd.: Revenue Shares, by Country/Region, FY 2023

- Figure 66 : Inspire Medical Systems Inc.: Revenue Shares, by Country/Region, FY 2023

- Figure 67 : LivaNova PLC: Revenue Shares, by Business Unit, FY 2023

- Figure 68 : LivaNova PLC: Revenue Shares, by Country/Region, FY 2023

- Figure 69 : Medtronic: Revenue Shares, by Business Unit, FY 2023

- Figure 70 : Medtronic: Revenue Shares, by Country/Region, FY 2023

- Figure 71 : Microport Scientific Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 72 : Microport Scientific Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 73 : NEVRO CORP.: Revenue Shares, by Country/Region, FY 2023

The global market for microelectronic medical implants is expected to grow from $49.0 billion in 2024 and is projected to reach $85.1 billion by the end of 2029, at a compound annual growth rate (CAGR) of 11.7% during the forecast period of 2024 to 2029.

The global market for microelectronic medical implants for pacemakers is expected to grow from $19.8 billion in 2024 and is projected to reach $34.9 billion by the end of 2029, at a CAGR of 12.0% during the forecast period of 2024 to 2029.

The global market for microelectronic medical implants for defibrillators is expected to grow from $17.7 billion in 2024 and is projected to reach $30.1 billion by the end of 2029, at a CAGR of 11.2% during the forecast period of 2024 to 2029.

Report Scope:

This report analyzes the trends in the global and regional markets for microelectronic medical implants with data from 2023, estimates from 2024, and projections of compound annual growth rates (CAGRs) for the forecast period of 2024 to 2029. This report also analyzes the competitive environment, including the market shares of leading companies, the regulatory scenario, and the drivers, restraints and opportunities in the market.

The market in this report is segmented into product types and applications. Product types include pacemakers, defibrillators, neurostimulators, hearing implants, ocular implants, and others. Applications includes cardiology, neurology, audiology, ophthalmology, and others.

The market is segmented into four regions: North America, Europe, Asia-Pacific and Rest of the World (RoW). The regional analysis include coverage of the markets in the U.S., Germany, the U.K., France, Japan, China, and India. The market value is estimated for 2023, with forecasts for 2024 and 2029.

The report's goals are to -

- Analyze main implant types and applications.

- Analyze global market size and segmentation.

- Understand market constraints and drivers.

- Provide detailed market forecasts up to 2029.

- Assess market shares, competitiveness, and industry structure.

- Identify potential long-term impacts on the microelectronic implants industry

Report Includes:

- 64 data tables and 30 additional tables

- An overview of the global market for microelectronic medical implants

- Analysis of global market trends, featuring historical revenue data for 2021-2023, estimated figures for 2024, forecasts for 2029, and projected CAGRs through 2029

- Evaluation of the current market size and revenue growth prospects, along with market share analysis by product type, application, and geographic region

- Discussion of innovations, technological advances, and product launches

- Analysis of the industry's regulatory framework and policies

- A look at the product pipeline

- Discussion of ESG practices of companies in the industry, and the ESG challenges facing them

- Analysis of the leading companies' market shares, proprietary technologies, and strategic alliances

- Evaluation of key patents

- Profiles of the leading players, including Abbott, Cochlear Ltd., LivaNova PLC, Medtronic, and NEVRO CORP.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Overview

- Porter's Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Potential for New Entrants

- Threat of Substitutes

- Competitiveness in the Industry

Chapter 3 Market Dynamics

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

Chapter 4 Regulatory and Reimbursement Landscape

- Regulatory Scenario

- United States

- European Union

- Asia-Pacific

- Reimbursement Landscape

Chapter 5 Emerging Technologies

- Overview

Chapter 6 Market Segmentation Analysis

- Segmentation Breakdown

- Market for Microelectronic Medical Implants, by Product Type

- Global Market Forecast

- Pacemakers

- Defibrillators

- Neurostimulators

- Hearing Implants

- Ocular Implants

- Other Implants

- Market for Microelectronic Medical Implants, by Application

- Global Market Forecast

- Cardiology

- Neurology

- Audiology

- Ophthalmology

- Other Applications

- Geographic Breakdown

- Global Market for Microelectronic Medical Implants, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 7 Competitive Intelligence

- Competitive Landscape

Chapter 8 Sustainability in the Microelectronic Medical Implant Industry: An ESG Perspective

- Introduction to ESG

- Sustainability in the Industry

- Environmental Impact

- Social Responsibility

- Governance

Chapter 9 Appendix

- Methodology

- Abbreviations

- Sources

- Company Profiles

- ABBOTT

- BIOTRONIK

- BOSTON SCIENTIFIC CORP.

- COCHLEAR LTD.

- INSPIRE MEDICAL SYSTEMS INC.

- LIVANOVA PLC

- MEDTRONIC

- MICROPORT SCIENTIFIC CORP.

- NEUROPACE INC.

- NEVRO CORP.