|

|

市場調査レポート

商品コード

1517505

一塩基多型 (SNP) ジェノタイピング:技術と世界市場Single Nucleotide Polymorphism (SNP) Genotyping: Technologies and Global Markets |

||||||

|

|||||||

| 一塩基多型 (SNP) ジェノタイピング:技術と世界市場 |

|

出版日: 2024年07月16日

発行: BCC Research

ページ情報: 英文 110 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の一塩基多型 (SNP) ジェノタイピングの市場規模は、2024年の320億米ドルから、予測期間中はCAGR 21.7%で推移し、2029年末には855億米ドルに達すると予測されています。

北米地域は、2024年の138億米ドルから、CAGR 21.9%で推移し、2029年末までに370億米ドルに達すると予測されています。また、欧州地域は、2024年の830万米ドルから、CAGR 21.2%で推移し、2029年末には217億米ドルに達すると予測されています。

当レポートでは、世界の一塩基多型 (SNP) ジェノタイピングの市場を調査し、市場概要、市場影響因子および市場機会の分析、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- 概要

- 変異解析のためのSNP

- SNPの定義

- SNPの調査方法

- SNPの分類

- PESTEL分析

第3章 市場力学

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

第4章 新興技術と開発

- SNPチップ

- 法医学におけるSNP遺伝子型判定技術

- SNPジェノタイピングにおけるAI

第5章 市場セグメンテーション分析

- 市場動向

- セグメンテーションの内訳

- 世界のSNPジェノタイピング市場:技術別

- マイクロアレイと遺伝子チップ

- SNPピロシーケンシング

- TaqMan Allelic Discrimination

- Applied Biosystems SNPlex Platform

- MassArray Maldi-TOF

- その他

- 世界のSNPジェノタイピング市場:用途別

- 医薬品と薬理ゲノム

- 診断研究

- 農業バイオテクノロジー

- 動物遺伝学

- 植物の改良

- 養殖

- その他

- 地理的内訳

- 世界のSNPジェノタイピング市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 競合情報

- 資金調達

- 主要企業

- 主要企業の採用した主要戦略

- パートナーシップ

- その他の戦略

第7章 SNPジェノタイピング市場における持続可能性:ESGの観点

- 市場におけるESGパフォーマンス

- SNPジェノタイピング業界におけるESG実践

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- ESGリスク評価

- BCCからの総論

第8章 付録

- 調査手法

- 頭字語

- 参考文献

- 企業プロファイル

- AGILENT TECHNOLOGIES INC.

- BECKMAN COULTER INC. (SUBSIDIARY OF DANAHER CORP.)

- BIO-RAD LABORATORIES INC.

- CYTIVA

- ENZO BIOCHEM INC.

- EPIGENDX

- F. HOFFMANN-LA ROCHE LTD.

- ILLUMINA INC.

- QIAGEN

- STANDARD BIOTOOLS

- THERMO FISHER SCIENTIFIC INC.

List of Tables

- Summary Table : Global Market for SNP Genotyping, by Region, Through 2029

- Table 1 : SNP Public Databases

- Table 2 : Role of SNP Genotyping in Stages of the Drug Development Process

- Table 3 : Global Market for SNP Genotyping, by Technology, Through 2029

- Table 4 : Global Market for Microarrays and GeneChips in SNP Genotyping, by Region, Through 2029

- Table 5 : Global Market for Pyrosequencing in SNP Genotyping, by Region, Through 2029

- Table 6 : Global Market for TaqMan Allelic Discrimination in SNP Genotyping, by Region, Through 2029

- Table 7 : Global Market for Applied Biosystems SNPlex Platform in SNP Genotyping, by Region, Through 2029

- Table 8 : Global Market for MassArray Maldi-TOF in SNP Genotyping, by Region, Through 2029

- Table 9 : Global Market for Other Technologies in SNP Genotyping, by Region, Through 2029

- Table 10 : Global Market for SNP Genotyping, by Application, Through 2029

- Table 11 : Global Market for Pharmaceuticals and Pharmacogenomics Applications in SNP Genotyping, by Region, Through 2029

- Table 12 : Global Market for Diagnostic Research Applications in SNP Genotyping, by Region, Through 2029

- Table 13 : Global Market for Agricultural Biotechnology Applications in SNP Genotyping, by Region, Through 2029

- Table 14 : Global Market for Animal Genetics Applications in SNP Genotyping, by Region, Through 2029

- Table 15 : Global Market for Plant Improvement Applications in SNP Genotyping, by Region, Through 2029

- Table 16 : Global Market for Aquaculture Applications in SNP Genotyping, by Region, Through 2029

- Table 17 : Global Market for Other Applications in SNP Genotyping, by Region, Through 2029

- Table 18 : Global Market for SNP Genotyping, by Region, Through 2029

- Table 19 : North American Market for SNP Genotyping, by Technology, Through 2029

- Table 20 : North American Market for SNP Genotyping, by Application, Through 2029

- Table 21 : National Genome Projects in Europe

- Table 22 : European Market for SNP Genotyping, by Technology, Through 2029

- Table 23 : European Market for SNP Genotyping, by Application, Through 2029

- Table 24 : Asia-Pacific Market for SNP Genotyping, by Technology, Through 2029

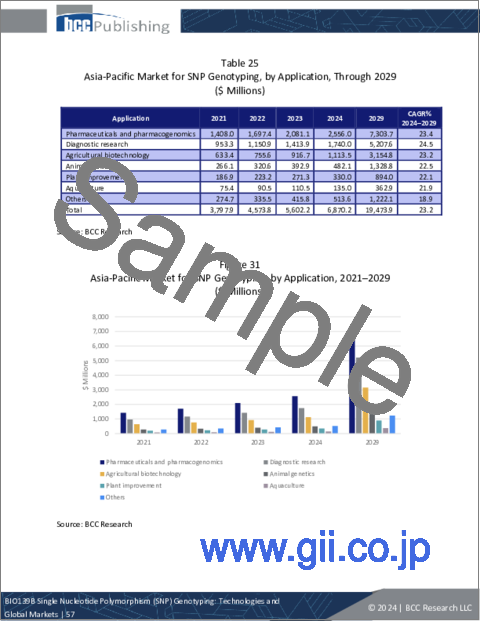

- Table 25 : Asia-Pacific Market for SNP Genotyping, by Application, Through 2029

- Table 26 : RoW Market for SNP Genotyping, by Technology, Through 2029

- Table 27 : RoW Market for SNP Genotyping, by Application, Through 2029

- Table 28 : Major Private and Public Funding Organizations

- Table 29 : National Human Genome Research Institute, NIH Funded and Completed Projects

- Table 30 : Leaders in the SNP Genotyping Market, 2023

- Table 31 : Business Expansions in the Global SNP Genotyping Market, 2021-2024

- Table 32 : Product Launches in the Global SNP Genotyping Market, 2021-2024

- Table 33 : Collaborations and Agreements in the Global SNP Genotyping Market, 2022 and 2023

- Table 34 : Partnerships in the Global SNP Genotyping Market, 2021-2024

- Table 35 : Other Business Strategies Adopted by Key Players in SNP Genotyping Market, 2021-2024

- Table 36 : Key Focus Areas in ESG Metrics

- Table 37 : Environmental Performance Initiatives in the SNP Genotyping Market

- Table 38 : Social Performance Initiatives in the SNP Genotyping Market

- Table 39 : Governance Performance Initiatives in the SNP Genotyping Market

- Table 40 : ESG Rankings for SNP Genotyping Companies, 2023*

- Table 41 : Abbreviations Used in This Report

- Table 42 : Agilent Technologies Inc.: Company Snapshot

- Table 43 : Agilent Technologies Inc.: Financial Performance, FY 2022 and 2023

- Table 44 : Agilent Technologies Inc.: Product Portfolio

- Table 45 : Agilent Technologies Inc.: News/Key Developments, 2021-2023

- Table 46 : Beckman Coulter Inc. (Subsidiary of Danaher Corp.): Company Snapshot

- Table 47 : Beckman Coulter Inc. (Subsidiary of Danaher Corp.): Product Portfolio

- Table 48 : Beckman Coulter Inc. (Subsidiary of Danaher Corp.): News/Key Developments, 2021-2023

- Table 49 : Bio-Rad Laboratories Inc.: Company Snapshot

- Table 50 : Bio-Rad Laboratories Inc.: Financial Performance, FY 2022 and 2023

- Table 51 : Bio-Rad Laboratories Inc.: Product Portfolio

- Table 52 : Cytiva: Company Snapshot

- Table 53 : Cytiva: Product Portfolio

- Table 54 : Cytiva: News/Key Developments, 2023

- Table 55 : Enzo Biochem Inc.: Company Snapshot

- Table 56 : Enzo Biochem Inc.: Financial Performance, FY 2022 and 2023

- Table 57 : Enzo Biochem Inc.: Product Portfolio

- Table 58 : Enzo Biochem Inc.: News/Key Developments, 2022

- Table 59 : EpigenDx.: Company Snapshot

- Table 60 : EpigenDx: Service Portfolio

- Table 61 : F. Hoffmann-La Roche Ltd.: Company Snapshot

- Table 62 : F. Hoffman-La Roche Ltd.: Financial Performance, FY 2022 and 2023

- Table 63 : F. Hoffman-La Roche Ltd.: Product Portfolio

- Table 64 : F. Hoffman-La Roche Ltd.: News/Key Developments, 2021

- Table 65 : Illumina Inc.: Company Snapshot

- Table 66 : Illumina Inc.: Financial Performance, FY 2022 and 2023

- Table 67 : Illumina Inc.: Services Portfolio

- Table 68 : Illumina Inc.: News/Key Developments, 2022 and 2023

- Table 69 : Qiagen: Company Snapshot

- Table 70 : Qiagen: Financial Performance, FY 2022 and 2023

- Table 71 : Qiagen: Product Portfolio

- Table 72 : Qiagen: News/Key Developments, 2023 and 2024

- Table 73 : Standard BioTools: Company Snapshot

- Table 74 : Standard BioTools: Financial Performance, FY 2022 and 2023

- Table 75 : Standard BioTools: Product Portfolio

- Table 76 : Standard BioTools: News/Key Developments, 2022 and 2023

- Table 77 : Thermo Fisher Scientific Inc.: Company Snapshot

- Table 78 : Thermo Fisher Scientific Inc.: Financial Performance, FY 2022 and 2023

- Table 79 : Thermo Fisher Scientific Inc.: Product Portfolio

- Table 80 : Thermo Fisher Scientific Inc.: News/Key Developments, 2022-2024

List of Figures

- Summary Figure : Global Market for SNP Genotyping, by Region, 2021-2029

- Figure 1 : Classification of SNPs

- Figure 2 : PESTEL Analysis: SNP Genotyping Market

- Figure 3 : Market Dynamics of SNP Genotyping

- Figure 4 : Average Cost Per Genome: Y-o-Y Trend, 2011-2022

- Figure 5 : Snapshot of SNP Genotyping Market: Business Strategies

- Figure 6 : Global Market Share for SNP Genotyping, by Technology, 2024

- Figure 7 : Global Market for Microarrays and GeneChips in SNP Genotyping, by Region, 2021-2029

- Figure 8 : Global Market for Pyrosequencing in SNP Genotyping, by Region, 2021-2029

- Figure 9 : Global Market for TaqMan Allelic Discrimination in SNP Genotyping, by Region, 2021-2029

- Figure 10 : Global Market for Applied Biosystems SNPlex in SNP Genotyping, by Region, 2021-2029

- Figure 11 : Global Market for MassArray Maldi-TOF in SNP Genotyping, by Region, 2021-2029

- Figure 12 : Global Market for Other Technologies in SNP Genotyping, by Region, 2021-2029

- Figure 13 : Global Market Share for SNP Genotyping, by Application, 2024

- Figure 14 : Global Market for Pharmaceuticals and Pharmacogenomics Applications in SNP Genotyping, by Region, 2021-2029

- Figure 15 : Global Market for Diagnostic Research Applications in SNP Genotyping, by Region, 2021-2029

- Figure 16 : Major Applications of SNP Genotyping in Agricultural Biotechnology

- Figure 17 : Global Market for Agricultural Biotechnology Applications in SNP Genotyping, by Region, 2021-2029

- Figure 18 : Applications of SNP Genotyping in Animal Genetics

- Figure 19 : Global Market for Animal Genetics Applications in SNP Genotyping, by Region, 2021-2029

- Figure 20 : Global Market for Plant Improvement Applications in SNP Genotyping, by Region, 2021-2029

- Figure 21 : Global Market for Aquaculture Applications in SNP Genotyping, by Region, 2021-2029

- Figure 22 : Global Market for Other Applications in SNP Genotyping, by Region, 2021-2029

- Figure 23 : Global Market Share for SNP Genotyping, by Region, 2024

- Figure 24 : Share of New Genetic Tests in the U.S., by CLIA-certified Laboratory, 2012 to 2022

- Figure 25 : North American Market for SNP Genotyping, by Technology, 2021-2029

- Figure 26 : North American Market for SNP Genotyping, by Application, 2021-2029

- Figure 27 : European Market for SNP Genotyping, by Technology, 2021-2029

- Figure 28 : European Market for SNP Genotyping, by Application, 2021-2029

- Figure 29 : Drivers of the Asia-Pacific Market for SNP Genotyping

- Figure 30 : Asia-Pacific Market for SNP Genotyping, by Technology, 2021-2029

- Figure 31 : Asia-Pacific Market for SNP Genotyping, by Application, 2021-2029

- Figure 32 : RoW Market for SNP Genotyping, by Technology, 2021-2029

- Figure 33 : RoW Market for SNP Genotyping, by Application, 2021-2029

- Figure 34 : Share of the Global SNP Genotyping Market, Competitive Intelligence, by Strategy, 2021-2024

- Figure 35 : How a Strong ESG Proposition Benefits Businesses

- Figure 36 : Agilent Technologies Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 37 : Agilent Technologies Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 38 : Bio-Rad Laboratories Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 39 : Bio-Rad Laboratories Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 40 : Enzo Biochem Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 41 : F. Hoffman-La Roche Ltd.: Revenue Share, by Business Unit, FY 2023

- Figure 42 : F. Hoffman-La Roche Ltd.: Revenue Share, by Country/Region, FY 2023

- Figure 43 : Illumina Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 44 : Illumina Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 45 : Qiagen: Revenue Share, by Business Unit, FY 2023

- Figure 46 : Qiagen: Revenue Share, by Country/Region, FY 2023

- Figure 47 : Standard BioTools: Revenue Share, by Business Unit, FY 2023

- Figure 48 : Standard BioTools: Revenue Share, by Country/Region, FY 2023

- Figure 49 : Thermo Fisher Scientific Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 50 : Thermo Fisher Scientific Inc.: Revenue Share, by Country/Region, FY 2023

The global market for single nucleotide polymorphism (SNP) is expected to grow from $32.0 billion in 2024 and is projected to reach $85.5 billion by the end of 2029, at a compound annual growth rate (CAGR) of 21.7% during the forecast period of 2024 to 2029.

The North American SNP market is expected to grow from $13.8 billion in 2024 and is projected to reach $37.0 billion by the end of 2029, at a CAGR of 21.9% during the forecast period of 2024 to 2029.

The European SNP market is expected to grow from $8.3 million in 2024 and is projected to reach $21.7 billion by the end of 2029, at a CAGR of 21.2% during the forecast period of 2024 to 2029.

Report Scope:

This report covers the worldwide market for SNP genotyping, with the market segmented by technology and application. It provides an in-depth analysis of the SNP genotyping market, including estimates and trends through 2029. In this report, the market is divided into four regions: North America, Europe, Asia-Pacific and Rest of the World (RoW). For market estimates, data has been provided for 2023 as the base year, with forecasts for 2024 through 2029. This report also uses analytical frameworks such as PESTEL, examines the competitive landscape, and explores trends in ESG and funding.

Report Includes:

- 37 data tables and 44 additional tables

- An overview of the global market for single nucleotide polymorphism (SNP) genotyping

- Analyses of global market trends, with data from 2021-2023, estimates for 2024, and projected CAGRs through 2029

- Evaluation of the current market size and revenue growth prospects specific to SNP genotyping, along with a market share analysis by technology, application, and region

- Discussion of the advantages of the most frequently used SNP genotyping techniques, such as Sequenom's MassArray DNA analysis platform, Bruker's MALDI-TOF array, SNP pyrosequencing, microarrays and gene chips, and Applied Biosystems' (now part of Thermo Fisher Scientific) SNPlex and TaqMan

- Analysis of the regulatory framework and policies affecting the industry

- Discussion of the ESG practices of, as well as challenges for, companies

- Analysis of the key companies' market shares and their proprietary technologies, strategic alliances and patents

- Company profiles of the leading players, including Agilent Technologies Inc., F. Hoffman-La Roche Ltd., Illumina Inc., Qiagen, and Thermo Fisher Scientific Inc.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Overview

- SNP for Mutational Analysis

- SNP Definition

- Methods of Studying SNPs

- Classification of SNPs

- PESTEL Analysis

- Political

- Economic

- Social

- Technological

- Environmental

- Legal

Chapter 3 Market Dynamics

- Market Dynamics

- Market Drivers

- Declining Prices of DNA Sequencing Methods

- Demand for Personalized Treatments

- Personalized Medicine and SNP Genotyping in the Drug Development Process

- Increasing Demand for Genome Analysis in Plants and Animal Livestock

- Market Restraints

- Reimbursement Policies

- Market Opportunities

- Increasing Applications of SNP Genotyping

- Rising Investments in Genomics Research

Chapter 4 Emerging Technologies and Developments

- SNP-Chip

- SNP Genotyping Technologies in Forensic Science

- Artificial Intelligence in SNP Genotyping

Chapter 5 Market Segmentation Analysis

- Market Trends

- Segmentation Breakdown

- Global Market for SNP Genotyping, by Technology

- Microarrays and GeneChips

- SNP Pyrosequencing

- TaqMan Allelic Discrimination

- Applied Biosystems SNPlex Platform

- MassArray Maldi-TOF

- Other SNP Genotyping Technologies

- Global Market for SNP Genotyping, by Application

- Pharmaceuticals and Pharmacogenomics

- Diagnostic Research

- Agricultural Biotechnology

- Animal Genetics

- Plant Improvements

- Aquaculture

- Other Applications

- Geographic Breakdown

- Global Market for SNP Genotyping, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 6 Competitive Intelligence

- Funding

- Leading Companies

- Key Strategies Adopted by Players

- Partnerships

- Other Strategies

Chapter 7 Sustainability in the SNP Genotyping Market: An ESG Perspective

- ESG Performance in the Market

- ESG Practices in the SNP Genotyping Industry

- Environmental Performance

- Social Performance

- Governance Performance

- ESG Risk Ratings

- Concluding Remarks from BCC Research

Chapter 8 Appendix

- Methodology

- Acronyms

- References

- Company Profiles

- AGILENT TECHNOLOGIES INC.

- BECKMAN COULTER INC. (SUBSIDIARY OF DANAHER CORP.)

- BIO-RAD LABORATORIES INC.

- CYTIVA

- ENZO BIOCHEM INC.

- EPIGENDX

- F. HOFFMANN-LA ROCHE LTD.

- ILLUMINA INC.

- QIAGEN

- STANDARD BIOTOOLS

- THERMO FISHER SCIENTIFIC INC.