|

|

市場調査レポート

商品コード

1402419

ラボ用分析機器製造:世界市場Analytical Laboratory Instruments Manufacturing: Global Markets |

||||||

|

|||||||

| ラボ用分析機器製造:世界市場 |

|

出版日: 2023年12月29日

発行: BCC Research

ページ情報: 英文 137 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のラボ用分析機器の市場規模は、2023年の609億米ドルから、予測期間中は6.3%のCAGRで推移し、2028年には825億米ドルの規模に成長すると予測されています。

北米市場は、2023年の243億米ドルから、6.4%のCAGRで推移し、2028年には332億米ドルに達すると予測されています。また、欧州市場は、2023年の170億米ドルから、5.4%のCAGRで推移し、2028年には221億米ドルの規模に成長すると予測されています。

当レポートでは、世界のラボ用分析機器の市場を調査し、市場の定義・概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術動向、ESGの展開、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

- 市場の見通し

- 市場サマリー

- ラボ用分析機器市場のハイライト

第3章 市場概要

- 概要

- PESTEL分析

- ポーターのファイブフォース分析

- 業界内の競合

- 規制の枠組み

- サプライチェーン分析

- R&Dと規制当局の承認

- 原材料の調達

- 製造

- 流通

- COVID-19の影響

第4章 市場力学

- 促進要因

- 化学および石油化学業界での採用の増加

- 製薬およびバイオ医薬品業界の高い成長

- 課題

- 高コストのコンポーネントと機器

- 熟練したラボ専門家の不足

- 機会

- 技術の進歩:ラボ機器と統合された自動化およびロボティクス技術

- 精密利用の高い導入率

第5章 新たな技術と開発

- 現在の市場動向

- 分析機器の小型化

- 主要市場動向

- AIの統合

- クロマトグラフィーにおけるナノテクノロジー

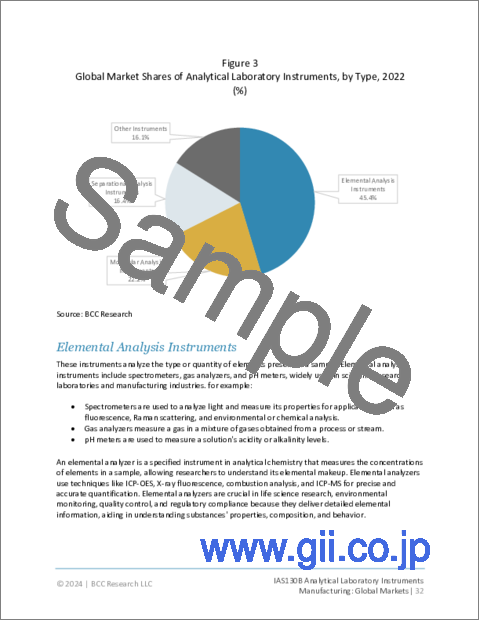

第6章 世界のラボ用分析機器市場:タイプ別

- 概要

- 元素分析機器

- 環境試験における元素分析

- 製薬および法医学における元素分析

- 市場規模・予測

- 分子分析機器

- 赤外分光法

- ラマン分光法

- 蛍光分光法

- 市場規模・予測

- 分離分析機器

- 市場規模・予測

- その他の機器

- 市場規模・予測

第7章 世界のラボ用分析機器市場:エンドユーザー産業別

- 概要

- ライフサイエンス

- 市場規模・予測

- 化学/石油化学および石油・ガス

- 市場規模・予測

- 食品検査

- 市場規模・予測

- 水と廃水

- 市場規模・予測

- その他(材料科学、環境試験、法医学)

- 環境試験

- 材料

- 科学捜査

- 市場規模・予測

第8章 世界のラボ用分析機器市場:地域別

- 概要

- 北米

- カナダ

- 欧州

- ドイツ

- イタリア

- 英国

- フランス

- アジア太平洋

- 中国

- インド

- 日本

- その他の地域

第9章 ラボ用分析機器業界の持続可能性:ESGの観点

- 概要

- ラボ用分析機器の世界市場におけるESGパフォーマンス

- 環境面の影響

- 社会面の影響

- ガバナンス面の影響

- 世界の分析検査機器市場におけるESGの現状

- 世界の分析検査機器市場におけるESGに対する消費者の態度

- 世界の分析検査機器市場におけるESGの実践

- ケーススタディ:Thermo Fisher

- 研究、イノベーション、公平性の加速

- サステナブルファイナンス

- BCCによる総論

第10章 特許分析

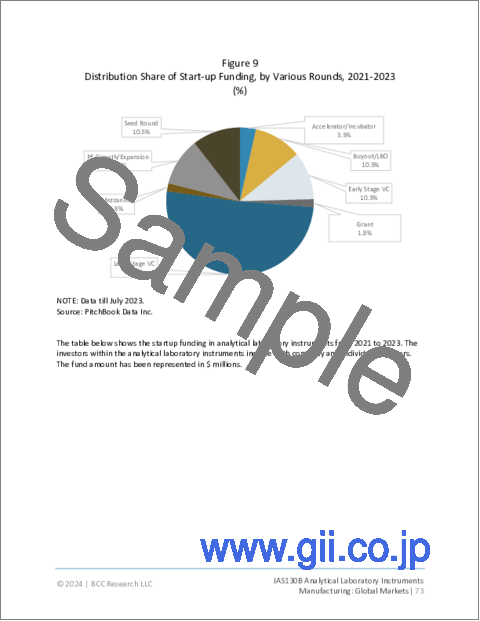

第11章 M&A・ベンチャー資金調達の見通し

- M&A分析

- ラボ用分析機器のスタートアップの資金調達

第12章 競合情報

- 主要企業の市場シェア

- 主要戦略

第13章 企業プロファイル

- AGILENT TECHNOLOGIES INC.

- AMETEK INC.

- AVANTOR INC.

- BRUKER

- DANAHER CORP.

- HITACHI LTD.

- JEOL

- LECO CORP.

- MALVERN PANALYTICAL LTD.

- METTLER-TOLEDO

- PERKINELMER INC.

- SHIMADZU CORP.

- THERMO FISHER SCIENTIFIC

- WATERS CORP.

- ZEISS GROUP

第14章 付録:頭字語

List of Tables

- Summary Table : Global Market for Analytical Laboratory Instruments, by Region, Through 2028

- Table 1 : Regulatory Framework for Analytical Laboratory Instrument Across Countries

- Table 2 : R&D Expenditures of Top Pharmaceutical Companies, 2022

- Table 3 : Statistics Related to Clinical Laboratory Technicians and Technologists in the U.S.

- Table 4 : Global Market for Analytical Laboratory Instruments, by Type, Through 2028

- Table 5 : Global Market for Elemental Analysis Instruments, by Region, Through 2028

- Table 6 : Global Market for Molecular Analysis Instruments, by Region, Through 2028

- Table 7 : Global Market for Separation Analysis Instruments, by Region, Through 2028

- Table 8 : Global Market for Other Instruments, by Region, Through 2028

- Table 9 : Global Market for Analytical Laboratory Instruments, by End-User Industry, Through 2028

- Table 10 : Global Market for Life Science Applications, by Region, Through 2028

- Table 11 : Global Market for Chemical/Petrochemical and Oil Gas Applications, by Region, Through 2028

- Table 12 : Global Market for Food Testing Applications, by Region, Through 2028

- Table 13 : Global Market for Water and Wastewater Applications, by Region, Through 2028

- Table 14 : Global Market for Other Applications, by Region, Through 2028

- Table 15 : Global Market for Analytical Laboratory Instruments, by Region, Through 2028

- Table 16 : North American Market for Analytical Laboratory Instruments, by Country, Through 2028

- Table 17 : North American Market for Analytical Laboratory Instruments, by Type, Through 2028

- Table 18 : North American Market for Analytical Laboratory Instruments, by End-User Industry, Through 2028

- Table 19 : European Market for Analytical Laboratory Instruments, by Country, Through 2028

- Table 20 : European Market for Analytical Laboratory Instruments, by Type, Through 2028

- Table 21 : European Market for Analytical Laboratory Instruments, by End-User Industry, Through 2028

- Table 22 : Asia-Pacific Market for Analytical Laboratory Instruments, by Country, Through 2028

- Table 23 : Asia-Pacific Market for Analytical Laboratory Instruments, by Type, Through 2028

- Table 24 : Asia-Pacific Market for Analytical Laboratory Instruments, by End-User Industry, Through 2028

- Table 25 : RoW Market for Analytical Laboratory Instruments, by Type, Through 2028

- Table 26 : RoW Market for Analytical Laboratory Instruments, by End-User Industry, Through 2028

- Table 27 : ESG Impact on the Global Market for Analytical Laboratory Instruments

- Table 28 : ESG Risk Ratings Metric, by Company, 2022

- Table 29 : Number of Patents Issued on Analytical Laboratory Instruments, by Region, 2020-2023

- Table 30 : Number of Patents Issued on Analytical Laboratory Instruments, by Applicant, 2020-2023

- Table 31 : Select Patents on Analytical Laboratory Instruments, 2023

- Table 32 : M&A, January 2021- October 2023

- Table 33 : Start-up Funding for Analytical Laboratory Instruments, by Type of Series/Round, 2021-2023

- Table 34 : Key Strategies Used in the Global Market for Analytical Laboratory Instruments, 2021-2023

- Table 35 : Agilent Technologies Inc.: Company Snapshot

- Table 36 : Agilent Technologies: Annual Revenue, FY 2021 and 2022

- Table 37 : Agilent Technologies: Product Portfolio

- Table 38 : Agilent Technologies: Key Developments, 2023

- Table 39 : Ametek Inc.: Company Snapshot

- Table 40 : Ametek Inc.: Annual Revenue, FY 2021 and 2022

- Table 41 : Ametek Inc.: Product Portfolio

- Table 42 : Avantor Inc.: Company Snapshot

- Table 43 : Avantor Inc.: Annual Revenue, FY 2021 and 2022

- Table 44 : Avantor Inc.: Product Portfolio

- Table 45 : Bruker: Company Snapshot

- Table 46 : Bruker: Annual Revenue, FY 2021 and 2022

- Table 47 : Bruker: Product Portfolio

- Table 48 : Bruker: Key Developments, 2023

- Table 49 : Danaher Corp.: Company Snapshot

- Table 50 : Danaher Corp.: Annual Revenue, FY 2021 and 2022

- Table 51 : Danaher Corp.: Product Portfolio

- Table 52 : Danaher Corp.: Key Developments, 2023

- Table 53 : Hitachi Ltd.: Company Snapshot

- Table 54 : Hitachi Ltd.: Annual Revenue, FY 2021 and 2022

- Table 55 : Hitachi Ltd.: Product Portfolio

- Table 56 : Hitachi Ltd.: Key Developments, 2021-2023

- Table 57 : JEOL: Company Snapshot

- Table 58 : JEOL: Annual Revenue, FY 2021 and 2022

- Table 59 : JEOL: Product Portfolio

- Table 60 : LECO Corp.: Company Snapshot

- Table 61 : LECO Corp.: Product Portfolio

- Table 62 : LECO Corp.: Key Developments, 2023

- Table 63 : Malvern Panalytical Ltd.: Company Snapshot

- Table 64 : Malvern Panalytical Ltd.: Product Portfolio

- Table 65 : Mettler-Toledo: Company Snapshot

- Table 66 : Mettler-Toledo: Annual Revenue, FY 2021 and 2022

- Table 67 : Mettler-Toledo: Product Portfolio

- Table 68 : PerkinElmer Inc.: Company Snapshot

- Table 69 : PerkinElmer Inc.: Annual Revenue, FY 2021 and 2022

- Table 70 : PerkinElmer Inc.: Product Portfolio

- Table 71 : Shimadzu Corp.: Company Snapshot

- Table 72 : Shimadzu Corp.: Annual Revenue, FY 2021 and 2022

- Table 73 : Shimadzu Corp.: Product Portfolio

- Table 74 : Shimadzu Corp.: Key Developments, 2023

- Table 75 : Thermo Fisher Scientific: Company Snapshot

- Table 76 : Thermo Fisher Scientific: Annual Revenue, FY 2021 and 2022

- Table 77 : Thermo Fisher Scientific: Product Portfolio

- Table 78 : Thermo Fisher Scientific: Key Developments, 2022 and 2023

- Table 79 : Waters Corp.: Company Snapshot

- Table 80 : Waters Corp: Annual Revenue, FY 2021 and 2022

- Table 81 : Waters Corp.: Product Portfolio

- Table 82 : Waters Corp.: Key Developments, 2023

- Table 83 : ZEISS Group: Company Snapshot

- Table 84 : Zeiss Group: Annual Revenue, FY 2021 and 2022

- Table 85 : Zeiss Group: Product Portfolio

- Table 86 : Acronyms Used in This Report

List of Figures

- Summary Figure : Global Market Shares of Analytical Laboratory Instruments, by Region, 2022

- Figure 1 : Supply Chain Analysis of Analytical Laboratory Instruments

- Figure 2 : Key Trends: Global Market for Analytical Laboratory Instruments

- Figure 3 : Global Market Shares of Analytical Laboratory Instruments, by Type, 2022

- Figure 4 : Global Market Shares of Analytical Laboratory Instruments, by End-User Industry, 2022

- Figure 5 : Global Market Shares of Analytical Laboratory Instruments, by Region, 2022

- Figure 6 : Shares of Patents Issued on Analytical Laboratory Instruments, by Country/Region, 2020-2023

- Figure 7 : M&A in the Analytical Laboratory Instruments Industry, by Year, 2021-2023

- Figure 8 : Start-up Funding in the Analytical Laboratory Instrument Industry, by Type, 2021-2023

- Figure 9 : Distribution Share of Start-up Funding, by Various Rounds, 2021-2023

- Figure 10 : Analytical Instruments: Top Companies Market Share Analysis

- Figure 11 : Agilent Technologies: Revenue Shares, by Business Unit, 2022

- Figure 12 : Agilent Technologies: Revenue Shares, by Country/Region, 2022

- Figure 13 : Ametek Inc.: Revenue Shares, by Business Unit, 2022

- Figure 14 : Ametek Inc.: Revenue Shares, by Country/Region, 2022

- Figure 15 : Avantor Inc.: Revenue Shares, by Business Unit, 2022

- Figure 16 : Avantor Inc.: Revenue Shares, by Country/Region, 2022

- Figure 17 : Bruker: Revenue Shares, by Business Unit, 2022

- Figure 18 : Bruker: Revenue Shares, by Country/Region, 2022

- Figure 19 : Danaher Corp.: Revenue Shares, by Business Unit, 2022

- Figure 20 : Danaher Corp.: Revenue Shares, by Country/Region, 2022

- Figure 21 : Hitachi Ltd.: Revenue Shares, by Business Unit, 2022

- Figure 22 : Hitachi Ltd. Revenue Shares, by Country/Region, 2022

- Figure 23 : JEOL: Revenue Shares, by Business Unit, 2022

- Figure 24 : JEOL: Revenue Shares, by Country/Region, 2022

- Figure 25 : Mettler-Toledo: Revenue Shares, by Business Unit, 2022

- Figure 26 : Mettler-Toledo: Revenue Shares, by Country/Region, 2022

- Figure 27 : PerkinElmer Inc.: Revenue Shares, by Business Unit, 2022

- Figure 28 : PerkinElmer Inc.: Revenue Shares, by Country/Region, 2022

- Figure 29 : Shimadzu Corp.: Revenue Shares, by Business Unit, 2022

- Figure 30 : Shimadzu Corp.: Revenue Shares by Country/Region, 2022

- Figure 31 : Thermo Fisher Scientific: Revenue Shares, by Business Unit, 2022

- Figure 32 : Thermo Fisher Scientific: Revenue Shares, by Country/Region, 2022

- Figure 33 : Waters Corp: Revenue Shares, by Business Unit, 2022

- Figure 34 : Waters Corp.: Revenue Shares, by Country/Region, 2022

- Figure 35 : Zeiss Group: Revenue Shares, by Business Unit, 2022

- Figure 36 : Zeiss Group: Revenue Shares, by Country/Region, 2022

Highlights:

The global market for analytical laboratory instruments is estimated to increase from $60.9 billion in 2023 to reach $82.5 billion by 2028, at a compound annual growth rate (CAGR) of 6.3% from 2023 through 2028.

North American market for analytical laboratory instruments is estimated to increase from $24.3 billion in 2023 to reach $33.2 billion by 2028, at a compound annual growth rate (CAGR) of 6.4% from 2023 through 2028.

European market for analytical laboratory instruments is estimated to increase from $17.0 billion in 2023 to reach $22.1 billion by 2028, at a compound annual growth rate (CAGR) of 5.4% from 2023 through 2028.

Report Scope:

The report's scope includes the instruments used for elemental, separation, and molecular analysis. The report further examines various end-user industries of laboratory analytical instruments, such as life science, chemical/ petrochemical and oil & gas, food testing, and others (environmental testing, materials, and forensic science). The market size and estimations are provided in value ($ millions), with 2022 as the base year and market forecasts from 2023 through 2028.

Further market study also examines growth perspective across regions, mainly North America, Europe, Asia-Pacific, and RoW. Major countries in each region have been further included to clarify the regional growth prospectus.

The report also features a separate section highlighting the sustainability perspective of the analytical laboratory instruments market at the global level. The section covers companies' performance on different ESG (Environment, Social, and Governance) parameters.

Report Includes:

- 39 data tables and 33 additional tables

- An overview of the global market for analytical laboratory instruments manufacturing

- In-depth analysis of global market trends, featuring historical revenue data for 2022, estimated figures for 2023, as well as forecasts for 2024 and 2026. This analysis includes projections of compound annual growth rates (CAGRs) through 2028

- Evaluation of the current market size and revenue growth prospects specific to the manufacture of analytical laboratory instruments, accompanied by a market share analysis by type, application and geographical region

- Examination of the influence of government regulations, current technology and the economic factors that are shaping the market

- Review of patents, the product pipeline, ESG trends and emerging technologies

- Market share analysis of the key companies in the industry and coverage of mergers & acquisitions, joint ventures, collaborations, partnerships, and other market strategies

- Profiles of leading market participants, including Thermo Fisher Scientific, Agilent Technologies, Shimadzu, Danhar, Mettler-Toledo International, and Bruker

Table of Contents

Chapter 1 Introduction

- Overview

- Study Goals and Objectives

- Reasons for Doing This Study

- Scope of Report

- What's New in this Update?

- Methodology

- Information Sources

- Geographic Breakdown

- Segment Breakdown

Chapter 2 Summary and Highlights

- Market Outlook

- Market Summary

- Highlights of the Market for Analytical Laboratory Instruments

Chapter 3 Market Overview

- Overview

- PESTEL Analysis

- Political

- Economic

- Social

- Technological

- Environmental

- Legal

- Porter's 5 Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Potential of New Entrants

- Threat of Substitutes

- Competition in the Industry

- Regulatory Framework

- Supply Chain Analysis

- R&D and Regulatory Approval

- Raw Materials Procurement

- Manufacturing

- Distribution

- Impact of COVID-19

Chapter 4 Market Dynamics

- Drivers

- Increasing Adoption in Chemical and Petrochemical Industries

- High Growth in the Pharma and Biopharma Industry

- Challenges

- High Cost of Components and Instruments

- Lack of Skilled Lab Professionals

- Opportunities

- Technological Advancements: Automation and Robotics Technology Integrated with Lab Equipment

- High Adoption of Precision Medicine

Chapter 5 Emerging Technologies and Developments

- Current Market Trends

- Miniaturization of Analytical Instruments

- Key Market Trends

- AI Integration

- Nanotechnology in Chromatography

Chapter 6 Global Market for Analytical Laboratory Instruments by Type

- Overview

- Elemental Analysis Instruments

- Elemental Analysis in Environmental Testing

- Elemental Analysis in Pharmaceutical & Forensic

- Market Size and Forecast

- Molecular Analysis Instruments

- Infrared Spectroscopy

- Raman Spectroscopy

- Fluorescence Spectroscopy

- Market Size and Forecast

- Separation Analysis Instruments

- Market Size and Forecast

- Other Instruments

- Market Size and Forecast

Chapter 7 Global Market for Analytical Laboratory Instruments by End-User Industry

- Overview

- Life Sciences

- Market Size and Forecast

- Chemical/Petrochemical and Oil & Gas

- Market Size and Forecast

- Food Testing

- Market Size and Forecast

- Water and Wastewater

- Market Size and Forecast

- Other (Material Science, Environmental Testing, Forensics)

- Environmental Testing

- Material

- Forensic Science

- Market Size and Forecast

Chapter 8 Global Market for Analytical Laboratory Instruments by Region

- Overview

- North America

- Canada

- Europe

- Germany

- Italy

- United Kingdom

- France

- Asia-Pacific

- China

- India

- Japan

- Rest of the World

Chapter 9 Sustainability in Analytical Laboratory Instruments Industry: An ESG Perspective

- Overview

- ESG Performance in the Global Market for Analytical Laboratory Instruments

- Environmental Impact

- Social Impact

- Governance Impact

- Current Status of ESG in the Global Market for Analytical Laboratory Instruments

- Consumer Attitudes toward ESG in the Global Market for Analytical Laboratory Instruments

- ESG Practices in the Global Market for Analytical Laboratory Instruments

- Case Study: Thermo Fisher

- Accelerating Research, Innovation, and Equity

- Sustainable Finance

- Concluding Remarks from BCC

Chapter 10 Patent Analysis

Chapter 11 M&A and Venture Funding Outlook

- M&A Analysis

- Start-up Funding for Analytical Laboratory Instruments

Chapter 12 Competitive Intelligence

- Top Companies' Market Shares

- Key Strategies

Chapter 13 Company Profiles

- AGILENT TECHNOLOGIES INC.

- AMETEK INC.

- AVANTOR INC.

- BRUKER

- DANAHER CORP.

- HITACHI LTD.

- JEOL

- LECO CORP.

- MALVERN PANALYTICAL LTD.

- METTLER-TOLEDO

- PERKINELMER INC.

- SHIMADZU CORP.

- THERMO FISHER SCIENTIFIC

- WATERS CORP.

- ZEISS GROUP