|

|

市場調査レポート

商品コード

1393949

フッ素樹脂材料:各種技術と世界の市場Fluoropolymer Materials: Technologies and Global Markets |

||||||

|

|||||||

| フッ素樹脂材料:各種技術と世界の市場 |

|

出版日: 2023年12月07日

発行: BCC Research

ページ情報: 英文 178 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のフッ素樹脂材料の市場規模は、2023年の346.97キロトンから、予測期間中は5.0%のCAGRで推移し、2028年には442.79キロトンの規模に成長すると予測されています。

地域別では、アジア太平洋地域が2023年の171.33キロトンから、5.4%のCAGRで推移し、2028年には223.06キロトンに達すると予測されています。また、北米地域は2023年の83.55キロトンから、4.6%のCAGRで推移し、2028年には104.66キロトンに達すると予測されています。

当レポートでは、世界のフッ素樹脂材料の市場を調査し、市場の定義・背景・概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、特許動向、ESGの展開、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

第3章 市場概要

- フッ素樹脂産業の定義

- 業界の背景

- フッ素樹脂ファミリー

- ホモポリマー

- コポリマー

- フルオロエラストマー

- 原材料の分析

第4章 市場力学

- 市場力学

- 促進要因

- 課題

- 抑制要因

- 機会

- サプライチェーン分析

- COVID-19とロシア・ウクライナ戦争の影響

- 価格分析

第5章 新たな技術と開発

- 新興技術と主な開発

- PTFE製造用のProPAppプロセス

- 環境発電システム用のフレキシブルPVDFベースの圧電ポリマーデバイスの開発

- PVDFとゴムをブレンドする新しい技術

- 石灰化がフッ素樹脂のケミカルリサイクルを促進

- Dongyue Group:重要な製品開発

- フッ素系界面活性剤を使用しないフッ素樹脂

- 特許分析

第6章 市場分析:樹脂タイプ別

- 概要

- ポリテトラフルオロエチレン (PTFE)

- 用途

- 市場規模・予測

- ポリフッ化ビニリデン (PVDF)

- 用途

- 市場規模・予測

- フッ素化エチレンプロピレン (FEP)

- 用途

- 市場規模・予測

- エチレンテトラフルオロエチレン (ETFE)

- 用途

- 市場規模・予測

- その他のフッ素樹脂

- フルオロエラストマー

- 用途

- 市場規模・予測

第7章 市場分析:エンドユーザー産業別

- 概要

- 産業用

- 用途

- 市場規模・予測

- 電気・電子

- 用途

- エネルギー転換の推進におけるフッ素樹脂の役割

- 市場規模・予測

- 輸送

- フッ素樹脂の需要喚起におけるリチウムイオン電池の役割

- フッ素樹脂の輸送用途

- 市場規模・予測

- 建築・建設

- 用途

- 市場規模・予測

- その他の市場

- 用途

- 調理器具・耐熱皿の市場

- 医療市場

- 市場規模・予測

第8章 市場分析:地域別

- 概要

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- その他のアジア太平洋地域

- その他の地域

第9章 ESGの展開

- フッ素樹脂市場におけるESGの重要性

- ESGの評価と指標

- フッ素樹脂材料市場におけるESGの取り組み

- フッ素樹脂市場におけるESGの現状

- フッ素樹脂市場におけるESGに対する消費者の意識

- ESGの未来

- ケーススタディ:Solvay

- 環境面

- 社会面

- ガバナンス面

第10章 競合情勢

- 競合シナリオ分析

- 最新の展開戦略

第11章 企業プロファイル

- 3M CO.

- AGC CHEMICALS AMERICAS INC.

- ARKEMA

- CHENGUANG RESEARCH INSTITUTE OF CHEMICAL INDUSTRY

- THE CHEMOURS CO.

- DAIKIN INDUSTRIES LTD.

- ENSINGER GMBH

- FLUOROCARBON CO. LTD.

- FLUOROTHERM POLYMERS INC.

- FUXIN HENG TONG FLUORINE CHEMICALS CO. LTD.

- GUARNIFLON SPA

- GUJARAT FLUOROCHEMICALS LTD.

- HALOPOLYMER OJSC

- HONEYWELL INTERNATIONAL INC.

- ISOFLON

- JIANGSU MEILAN CHEMICAL CO. LTD.

- KUREHA CORP.

- MURTFELDT KUNSTSTOFFE GMBH & CO. KG

- NEWAGE INDUSTRIES

- PARKER HANNIFIN CORP.

- SAINT-GOBAIN

- SHAMROCK TECHNOLOGIES

- SHANDONG DONGYUE POLYMER MATERIAL CO. LTD.

- SHANGHAI HUAYI 3F NEW MATERIALS CO. LTD.

- SIMONA AG

- SOLVAY

- THERMOSEAL INC.

- WESTLAKE PLASTICS

- ZEUS INDUSTRIAL PRODUCTS INC.

- ZIBO BAINAISI CHEMICAL CO. LTD.

第12章 付録:頭字語

List of Tables

- Summary Table : Global Market Volumes of Fluoropolymer Materials, by Region, Through 2028

- Table 1 : Recent Patents in Global Fluoropolymer Materials Market, 2023

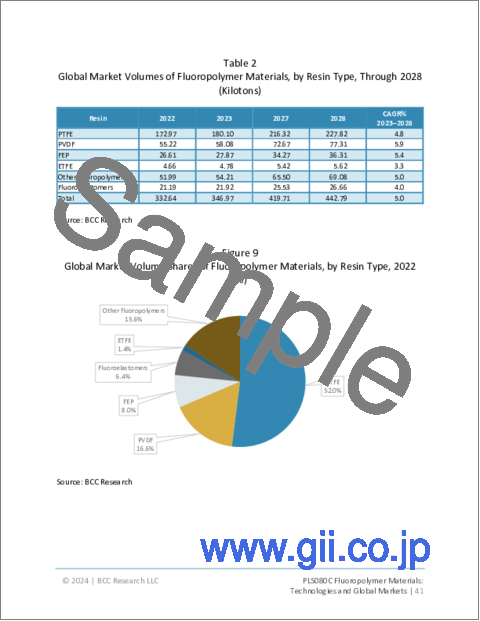

- Table 2 : Global Market Volumes of Fluoropolymer Materials, by Resin Type, Through 2028

- Table 3 : Popular Applications of PTFE in Key Industries

- Table 4 : Global Market Volumes of PTFE, by Application, Through 2028

- Table 5 : Global Market Volumes of PTFE, by Region, Through 2028

- Table 6 : Principal Applications of PVDF in Key Industries

- Table 7 : Global Market Volumes of PVDF, by Application, Through 2028

- Table 8 : Global Market Volumes of PVDF, by Region, Through 2028

- Table 9 : Principal Applications of FEP in Key Industries

- Table 10 : Global Market Volumes of FEP, by Application, Through 2028

- Table 11 : Global Market Volumes of FEP, by Region, Through 2028

- Table 12 : Principal Applications of ETFE in Key Industries

- Table 13 : Global Market Volumes of ETFE, by Application, Through 2028

- Table 14 : Global Market Volumes of ETFE, by Region, Through 2028

- Table 15 : Global Market Volumes of Other Fluoropolymers, by Application, Through 2028

- Table 16 : Global Market Volumes of Other fluoropolymers, by Region, Through 2028

- Table 17 : Types of Fluoroelastomers

- Table 18 : Principal Applications of Fluoroelastomer in Key Industries

- Table 19 : Global Market Volumes of Fluoroelastomers, by Application, Through 2028

- Table 20 : Global Market Volumes of Fluoroelastomers, by Region, Through 2028

- Table 21 : Global Market Volumes of Fluoropolymer Materials, by Application, Through 2028

- Table 22 : Global Market Volumes of Fluoropolymer Materials in Industrial Applications, by Resin Type, Through 2028

- Table 23 : Global Market Volumes of Fluoropolymer Materials in Electrical and Electronics Applications, by Resin Type, Through 2028

- Table 24 : Global Market Volumes of Fluoropolymer Materials in Transportation Applications, by Resin Type, Through 2028

- Table 25 : Global Market Volumes of Fluoropolymer Materials in Building and Construction Applications, by Resin Type, Through 2028

- Table 26 : Global Market Volumes of Fluoropolymer Materials in Other Applications, by Resin Type, Through 2028

- Table 27 : Global Market for Fluoropolymer Materials, Through 2028

- Table 28 : North American Market Volumes of Fluoropolymer Materials, by Resin Type, Through 2028

- Table 29 : North American Market Volumes of Fluoropolymer Materials, by Country, Through 2028

- Table 30 : European Market Volumes of Fluoropolymer Materials, by Resin Type, Through 2028

- Table 31 : European Market Volumes of Fluoropolymer Materials, by Country, Through 2028

- Table 32 : Asia-Pacific Market Volumes of Fluoropolymer Materials, by Resin Type, Through 2028

- Table 33 : Asia-Pacific Market Volumes of Fluoropolymer Materials, by Country, Through 2028

- Table 34 : Rest of the World Market Volumes of Fluoropolymer Materials, by Resin Type, Through 2028

- Table 35 : ESG Ratings and Metrics: Explained

- Table 36 : Environment Issue Analysis in the Fluoropolymers Market

- Table 37 : Social Issue Analysis in the Fluoropolymers Market

- Table 38 : Governance Issue Analysis in the Fluoropolymers Market

- Table 39 : ESG Risk Rating of Key Players in the Fluoropolymers Market

- Table 40 : Leading Fluoropolymer Producers, by Type of Product

- Table 41 : Key Market Developments, 2023

- Table 42 : 3M Co.: Financial Performance, 2022

- Table 43 : 3M Co.: News, 2022

- Table 44 : 3M Co.: Fluoropolymer Product Portfolio

- Table 45 : AGC Chemical Americas Inc.: News, 2023

- Table 46 : AGC Chemical Americas Inc.: Fluoropolymer Product Portfolio

- Table 47 : Arkema: Financial Performance, 2022

- Table 48 : Arkema: News, 2022

- Table 49 : Arkema: Fluoropolymer Product Portfolio

- Table 50 : Chemical Industry Zhonghao Chenguang Research Institute: Fluoropolymer Product Portfolio

- Table 51 : The Chemours Co.: Financial Performance, 2022

- Table 52 : The Chemours Co.: News, 2023

- Table 53 : The Chemours Co.: Fluoropolymer Product Portfolio

- Table 54 : Daikin Industries Ltd.: Financial Performance, 2022

- Table 55 : Daikin Industries Ltd.: News, 2023

- Table 56 : Daikin Industries Ltd.: Fluoropolymer Product Portfolio

- Table 57 : Ensinger GMBH: Fluoropolymer Product Portfolio

- Table 58 : Fluorocarbon Co. Ltd.: Fluoropolymer Product Portfolio

- Table 59 : Fluorotherm: News, 2023

- Table 60 : Fluorotherm: Fluoropolymer Product Portfolio

- Table 61 : Fuxin Heng Tong Fluorine Chemicals: Fluoropolymer Product Portfolio

- Table 62 : Guarniflon S.P.A.: Fluoropolymer Product Portfolio

- Table 63 : Gujarat Fluorochemicals Ltd.: Financial Performance, 2023

- Table 64 : Gujarat Fluorochemicals Ltd.: News, 2022

- Table 65 : Gujarat Fluorochemicals Ltd.: Fluoropolymer Product Portfolio

- Table 66 : HaloPolymer OJSC : Fluoropolymer Product Portfolio

- Table 67 : Honeywell International Inc.: Financial Performance, 2022

- Table 68 : Honeywell International Inc.: Fluoropolymer Product Portfolio

- Table 69 : ISOFLON: Fluoropolymer Product Portfolio

- Table 70 : Jiangsu Meilan Chemical Co. Ltd.: Fluoropolymer Product Portfolio

- Table 71 : Kureha Corp.: Financial Performance, 2023

- Table 72 : Kureha Corp.: News, 2023

- Table 73 : Kureha Corp.: Fluoropolymer Product Portfolio

- Table 74 : Murtfeldt Kunststoffe GmbH & Co. KG: Fluoropolymer Product Portfolio

- Table 75 : NewAge Industries: Fluoropolymer Product Portfolio

- Table 76 : Parker Hannifin Corp.: Financial Performance, 2023

- Table 77 : Parker Hannifin Corp.: News, 2021

- Table 78 : Parker Hannifin Corp.: Fluoropolymer Product Portfolio

- Table 79 : Saint Gobain: Financial Performance, 2022

- Table 80 : Saint Gobain: Fluoropolymer Product Portfolio

- Table 81 : Shamrock Technologies: Fluoropolymer Product Portfolio

- Table 82 : Shandong Dongyue Polymer Material Co. Ltd.: Financial Performance, 2022

- Table 83 : Shandong Dongyue Polymer Material Co. Ltd.: Fluoropolymer Product Portfolio

- Table 84 : Shanghai 3F New Materials Co. Ltd: Fluoropolymer Product Portfolio

- Table 85 : Simona AG: Fluoropolymer Product Portfolio

- Table 86 : Solvay: Financial Performance, 2022

- Table 87 : Solvay: News, 2023

- Table 88 : Solvay: Fluoropolymer Product Portfolio

- Table 89 : Thermoseal Inc.: Fluoropolymer Product Portfolio

- Table 90 : Westlake Plastics: Fluoropolymer Product Portfolio

- Table 91 : Zeus Industrial Products Inc.: Fluoropolymer Product Portfolio

- Table 92 : Zibo Bainaisi Chemical Co. Ltd.: Fluoropolymer Product Portfolio

- Table 93 : Acronyms Used in This Report

List of Figures

Figure A : Research Methodology

- Summary Figure : Global Market Volume Share for Fluoropolymers, by Region, 2022

- Figure 1 : Leading Exporters of Fluorspar, 2021

- Figure 2 : Key Market Dynamics: Drivers and Challenges

- Figure 3 : Global Semiconductor Industry Sales, 2019-2022

- Figure 4 : Benefits of Fluoropolymers in Renewable Energy Systems

- Figure 5 : Net Renewable Electricity Capacity Additions, by Technology, 2020-2024

- Figure 6 : Supply Chain Overview of the Fluoropolymer Materials Market

- Figure 7 : Change in PTFE Prices Across Key Countries, from Q4 2022 to Q1 2023

- Figure 8 : PTFE Price Changes: Quarter-Over-Quarter and Year-Over-Year

- Figure 9 : Global Market Volume Shares of Fluoropolymer Materials, by Resin Type, 2022

- Figure 10 : Global Market Volume Shares of PTFE, by Application, 2022

- Figure 11 : Global Market Volume Shares of PTFE, by Region, 2022

- Figure 12 : Global Market Volume Shares of PVDF, by Application, 2022

- Figure 13 : Global Market Volume Shares of PVDF, by Region, 2022

- Figure 14 : Global Market Volume Shares of FEP, by Application, 2022

- Figure 15 : Global Market Volume Shares of FEP, by Region, 2022

- Figure 16 : Global Market Volume Shares of ETFE, by Application, 2022

- Figure 17 : Global Market Volume Shares of ETFE, by Region, 2022

- Figure 18 : Global Market Volume Shares of Other Fluoropolymers, by Application, 2022

- Figure 19 : Global Market Volume Shares of Other Fluoropolymers, by Region, 2022

- Figure 20 : Global Market Volume Shares of Fluoroelastomers, by Application, 2022

- Figure 21 : Global Market Volume Shares of Fluoroelastomers, by Region, 2022

- Figure 22 : Global Market Volume Shares of Fluoropolymer Materials, by Application, 2022

- Figure 23 : Global Market Volume Shares of Fluoropolymer Materials in Industrial Applications, by Resin Type, 2022

- Figure 24 : Global Market Volume Shares of Fluoropolymer Materials in Electrical and Electronics Applications, by Resin Type, 2022

- Figure 25 : Benefits of Fluoropolymer Materials in the Transportation Industry

- Figure 26 : Electric Car Sales, 2019-2023

- Figure 27 : Global Market Volume Shares of Fluoropolymer Materials in Transportation Applications, by Resin Type, 2022

- Figure 28 : Benefits of Fluoropolymers in the Building and Construction Industry

- Figure 29 : Global Market Volume Shares of Fluoropolymer Materials in Building and Construction Applications, by Resin Type, 2022

- Figure 30 : Key Demand Drivers for Cookware and Bakeware Products

- Figure 31 : Global Market Volume Shares of Fluoropolymer Materials in Other Applications, by Resin Type, 2022

- Figure 32 : North American Market Volume Shares of Fluoropolymer Materials, by Resin Type, 2022

- Figure 33 : North American Market Volume Shares of Fluoropolymer Materials, by Country, 2022

- Figure 34 : European Market Volume Shares of Fluoropolymer Materials, by Resin Type, 2022

- Figure 35 : European Market Volume Shares of Fluoropolymer Materials, by Country, 2022

- Figure 36 : Asia-Pacific Market Volume Shares of Fluoropolymer Materials, by Resin Type, 2022

- Figure 37 : Asia-Pacific Market Volume Shares of Fluoropolymer Materials, by Country, 2022

- Figure 38 : Rest of the World Market Volume Shares of Fluoropolymer Materials, by Resin Type, 2022

- Figure 39 : ESG Issues in the Fluoropolymers Market

- Figure 40 : Main ESG Index of Solvay

- Figure 41 : 3M Co.: Financial Performance, 2021 and 2022

- Figure 42 : 3M Co.: Revenue Shares, by Business Unit, 2022

- Figure 43 : Arkema: Financial Performance, 2021 and 2022

- Figure 44 : Arkema.: Revenue Shares, by Business Unit, 2022

- Figure 45 : The Chemours Co.: Financial Performance, 2021 and 2022

- Figure 46 : The Chemours Co.: Revenue Shares, by Business Unit, 2022

- Figure 47 : The Chemours Co.: Revenue Shares, by Region, 2022

- Figure 48 : Daikin Industries Ltd.: Financial Performance, 2021 and 2022

- Figure 49 : Daikin Industries Ltd.: Revenue Shares, by Business Unit, 2022

- Figure 50 : Daikin Industries Ltd.: Revenue Shares of Material Segment, by Region, 2022

- Figure 51 : Gujarat Fluorochemicals Ltd.: Financial Performance, 2022 and 2023

- Figure 52 : Honeywell International Inc.: Financial Performance, 2021 and 2022

- Figure 53 : Honeywell International Inc.: Revenue Shares, by Business Unit, 2022

- Figure 54 : Honeywell International Inc.: Revenue Shares, by Country/Region, 2022

- Figure 55 : Kureha Corp.: Financial Performance, 2021 and 2022

- Figure 56 : Kureha Corp.: Revenue Shares, by Business Unit, 2022

- Figure 57 : Parker Hannifin Corp.: Financial Performance, 2022 and 2023

- Figure 58 : Parker Hannifin Corp.: Revenue Shares, by Business Unit, 2023

- Figure 59 : Parker Hannifin Corp.: Revenue Shares, by Region, 2023

- Figure 60 : Saint Gobain: Financial Performance, 2021 and 2022

- Figure 61 : Saint Gobain: Revenue Shares, by Business Unit, 2022

- Figure 62 : Shandong Dongyue Polymer Material Co. Ltd.: Financial Performance, 2021 and 2022

- Figure 63 : Solvay: Annual Revenue, 2021 and 2022

- Figure 64 : Solvay: Revenue Shares, by Business Unit, 2022

- Figure 65 : Solvay: Revenue Shares, by Region, 2022

Highlights:

The global market volume for fluoropolymer materials is estimated to increase from 346.97 kilotons in 2023 to reach 442.79 kilotons by 2028, at a compound annual growth rate (CAGR) of 5.0% from 2023 through 2028.

Asia-Pacific market volume for fluoropolymer materials is estimated to increase from 171.33 kilotons in 2023 to reach 223.06 kilotons by 2028, at a compound annual growth rate (CAGR) of 5.4% from 2023 through 2028.

North American market volume for fluoropolymer materials is estimated to increase from 83.55 kilotons in 2023 to reach 104.66 kilotons by 2028, at a compound annual growth rate (CAGR) of 4.6% from 2023 through 2028.

##img_0##

Report Scope:

The report provides an overview of the global market for fluoropolymer materials and analyzes key market trends. The base year considered for analysis is 2022, while the market estimates and forecasts are given for 2023 to 2028. The market estimates are only provided in terms of revenue (USD million) and volume (kilotons) at the global level, whereas for the remaining segments, only volume estimation is provided.

The market is segmented based on resin type, end-user industry, and region. Within resin type, PTFE, PVDF, FEP, ETFE, other fluoropolymers, and fluoroelastomers are considered. Other fluoropolymers include polyvinyl fluoride (PVF), polychlorotrifluoroethylene (PCTFE), perfluoroalkoxy alkanes (PFA), ethylene-chlorotrifluoroethylene (ECTFE), sulfonated tetrafluoroethylene (PFSA), amorphous fluoropolymers (AF), poly(TFE-CO-HFP-CO-VDF) (THV) and fluoroplastic foam resin (FFR). Within the end-user segmentation, industrial, electrical and electronics, transportation, building and construction, and other markets are considered. Other markets include cookware and bakeware product coatings, medical devices, and fabric protection.

The report study provides a cross-segmentation analysis at the global level of each resin type within end-user and regional segments. This enables the reader to attain a better understanding of the relative penetration of each resin within every end-user as well as regional segment.

The report also analyzes fluoropolymer technology developments, industry structure, and market dynamics. Profiles of the leading fluoropolymer resin companies and processors describe company products, markets, geographic focus, market shares, and recent corporate developments. The impact of COVID-19 and the Russia-Ukraine war conflict has also been considered while deriving market estimates.

Report Includes:

- 38 data tables and 56 additional tables

- An up-to-date overview and industry analysis of the global markets for fluoropolymer materials (all the commercially available grades actively utilized and consumed worldwide)

- Analyses of the global market trends, with historical market revenue data (sales figures) for 2022, estimates for 2023, forecasts for 2027, and projections of compound annual growth rates (CAGRs) through 2028

- Estimation of the actual market size and growth forecast for fluoropolymers markets both in revenue/value (USD millions) and consumption/volumetric (Kilo tons) terms, and corresponding market share analysis based on resin type, end-use application, and region

- In-depth information (facts and figures) concerning the major factors influencing the progress of this market (drivers, restraints, opportunities, and industry-specific challenges) with respect to specific growth trends, upcoming prospects, and contributions to the overall market

- Analysis of the market growth opportunities with a holistic review of Porter's five forces analysis and PESTLE analysis considering both micro- and macro environmental factors prevailing in the industry

- Understanding of ESG perspectives on the worldwide market for fluoropolymers, with emphasis on the impact of ESG factors on performance, ratings and matrices; consumer attitudes; and ESG followed practices

- A relevant patent analysis with significant allotments of the patent data featuring fluoropolymers

- Identification of the major stakeholders, and analysis of their company competitive landscape based on recent developments, segmental revenues, and operational integration

- Descriptive company profiles of the leading market players, including Arkema, The Chemours Co, Daikin Industries Ltd., Kureha Corp., Saint Gobain, and Solvay

Table of Contents

Chapter 1 Introduction

- Study Goals and Objectives

- Reasons for Doing This Study

- Scope of Report

- What's New in This Update?

- Methodology

- Information Sources

- Geographic Breakdown

- Segmentation Breakdown

Chapter 2 Summary and Highlights

- Market Outlook

- Market Summary

Chapter 3 Market Overview

- Definition of the Fluoropolymer Industry

- Industry Background

- The Fluoropolymer Family

- Homopolymers

- Copolymers

- Fluoroelastomers

- Raw Material Analysis

Chapter 4 Market Dynamics

- Market Dynamics

- Drivers

- Challenges

- Restraint

- Opportunity

- Supply Chain Analysis

- Impact of COVID-19 and Russia-Ukraine war

- Pricing Analysis

Chapter 5 Emerging Technologies and Developments

- Emerging Technologies and Key Developments

- ProPApp process for PTFE production

- Developments in Flexible PVDF-based Piezoelectric Polymer Devices for Energy Harvesting Systems

- Novel Technology to Blend PVDF with Rubber

- Mineralization Aids the Chemical Recycling of Fluoropolymers.

- Significant Product Development by Dongyue Group

- Fluoropolymers Without the Use of Fluorosurfactants.

- Patent Analysis

Chapter 6 Market Analysis by Type of Resin

- Overview

- Polytetrafluoroethylene (PTFE)

- Applications

- Market Size and Forecast

- Polyvinylidene Fluoride (PVDF)

- Applications

- Market Size and Forecast

- Fluorinated Ethylene Propylene (FEP)

- Applications

- Market Size and Forecast

- Ethylene Tetrafluoroethylene (ETFE)

- Applications

- Market Size and Forecast

- Other Fluoropolymers

- Fluoroelastomers

- Applications

- Market Size and Forecast

Chapter 7 Market Breakdown by End-Use Industry

- Overview

- Industrial

- Applications

- Market Size and Forecast

- Electrical and Electronics

- Applications

- Role of Fluoropolymers in Propelling the Energy Transition

- Market Size and Forecast

- Transportation

- Role of Lithium-ion Batteries in Creating a Demand Pull for Fluoropolymers

- Transportation Applications of Fluoropolymers

- Market Size and Forecast

- Building and Construction

- Applications

- Market Size and Forecast

- Other Markets

- Applications

- Cookware and Bakeware Markets

- Medical Markets

- Market Size and Forecast

Chapter 8 Market Analysis by Region

- Overview

- North America

- U.S.

- Canada

- Europe

- Germany

- Italy

- Rest of Europe

- Asia-Pacific (APAC)

- China

- India

- Japan

- Rest of Asia Pacific

- Rest of the World (RoW)

Chapter 9 ESG Development

- Importance of ESG in Fluoropolymers Market

- ESG Ratings and Metrics

- ESG Practices in the Fluoropolymer Materials Market

- Current Status of ESG in the Fluoropolymers Market

- Consumer Attitudes towards ESG in the Fluoropolymers Market

- Future of ESG

- Case Study: Solvay

- Environmental

- Social

- Governance

Chapter 10 Competitive Landscape

- Competitive Scenario Analysis

- Latest Development Strategies

Chapter 11 Company Profiles

- 3M CO.

- AGC CHEMICALS AMERICAS INC.

- ARKEMA

- CHENGUANG RESEARCH INSTITUTE OF CHEMICAL INDUSTRY

- THE CHEMOURS CO.

- DAIKIN INDUSTRIES LTD.

- ENSINGER GMBH

- FLUOROCARBON CO. LTD.

- FLUOROTHERM POLYMERS INC.

- FUXIN HENG TONG FLUORINE CHEMICALS CO. LTD.

- GUARNIFLON SPA

- GUJARAT FLUOROCHEMICALS LTD.

- HALOPOLYMER OJSC

- HONEYWELL INTERNATIONAL INC.

- ISOFLON

- JIANGSU MEILAN CHEMICAL CO. LTD.

- KUREHA CORP.

- MURTFELDT KUNSTSTOFFE GMBH & CO. KG

- NEWAGE INDUSTRIES

- PARKER HANNIFIN CORP.

- SAINT-GOBAIN

- SHAMROCK TECHNOLOGIES

- SHANDONG DONGYUE POLYMER MATERIAL CO. LTD.

- SHANGHAI HUAYI 3F NEW MATERIALS CO. LTD.

- SIMONA AG

- SOLVAY

- THERMOSEAL INC.

- WESTLAKE PLASTICS

- ZEUS INDUSTRIAL PRODUCTS INC.

- ZIBO BAINAISI CHEMICAL CO. LTD.