|

|

市場調査レポート

商品コード

1350743

研磨材の世界市場:材料・製品・用途Global Abrasive Market: Materials, Products, and Applications |

||||||

|

|||||||

| 研磨材の世界市場:材料・製品・用途 |

|

出版日: 2023年09月20日

発行: BCC Research

ページ情報: 英文 147 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の研磨材の市場規模は、2022年の550億米ドル、2023年の578億米ドルから、予測期間中は5.1%のCAGRで推移し、2028年には740億米ドルの規模に成長すると予測されています。

タイプ別では、砥粒の部門が2023年の290億米ドルから、5.4%のCAGRで推移し、2028年には377億米ドルの規模に成長すると予測されています。また、研磨製品の部門は、2023年の289億米ドルから、4.7%のCAGRで推移し、2028年には363億米ドルの規模に成長すると予測されています。

当レポートでは、世界の研磨材の市場を調査し、市場および技術の概要、市場影響因子の分析、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、技術および特許の動向、ESGの展開、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

- 市場の展望

- 市場サマリー

第3章 市場概要

- 市場の定義

- 産業の歴史

- 研磨材の選択に影響を与える要因

- 研磨産業の重要性

第4章 市場力学

- 市場促進要因

- 自動車産業からの研磨材の需要の増加

- 建設業における研磨材の需要の拡大

- 市場機会

- 歯科、医療、宝飾品の製造における研磨材のニッチな用途

- 超砥粒の需要拡大

- 市場の課題

- 環境規制

- 原材料費の高騰

第5章 世界の研磨材市場:タイプ別

- 砥粒

- アルミナ工業

- 炭化ケイ素の世界の生産能力と使用量

- ダイヤモンド市場

- 立方晶窒化ホウ素など

- 金属研磨材

- 切削工具産業

- 天然研磨材

- 研磨粉と砥粒

- 研磨製品

- 遊離研磨材

- 結合研磨材

- コーティング研磨材

- 不織研磨材

- 超砥粒

- 研磨製品

第6章 世界の研磨材市場:用途別

- バフ研磨

- 切断

- 研削

- ホーニング

- ラッピング

- マシニング

- ポリッシング

第7章 世界の研磨材市場:エンドユーザー産業別

- 自動車

- 金属製造

- 建築・建設

- エレクトロニクス

- 木材・複合材料

- エネルギー

- 医療

第8章 世界の研磨材市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第9章 研磨産業の持続可能性:ESGの観点

- 研磨産業におけるESGの重要性

- ESG評価と指標:データの理解

- 研磨材業界におけるESGの実践

- 研磨材市場におけるESGの現状

- リスクスケール・エクスポージャスケール・管理スケール

- ケーススタディ:ESG導入の成功例

- 環境への取り組み

- 社会への取り組み

- ガバナンスへの取り組み

- 結果

- 投資

- ESGの未来:新たな動向と機会

- BCCによる総論

第10章 新たな技術と開発

- 主なハイライト

- 動向

- 新たな研磨材と研磨材製造プロセスの開発

- 研磨材のリサイクル

第11章 特許分析

第12章 M&Aの見通し

第13章 競合情報

- 産業構造

- 市場構造

第14章 企業プロファイル

- 3M CO.

- ALMATIS GMBH

- ARC ABRASIVES INC.

- ASAHI DIAMOND INDUSTRIAL CO., LTD.

- CARBORUNDUM UNIVERSAL LTD.

- DUPONT DE NEMOURS INC.

- EHWA DIAMOND INDUSTRIAL CO., LTD.

- FUJIMI INC.

- HENKEL AG & CO. KGAA

- ROBERT BOSCH GMBH

- SAK INDUSTRIES PVT. LTD.

- SAINT-GOBAIN

- TYROLIT-SCHLEIFMITTELWERKE SWAROVSKI AG & CO. KG

第15章 付録:頭字語

List of Tables

- Summary Table : Global Market for Abrasives, by Type, Through 2028

- Table 1 : Mohs Hardness Scale of Various Minerals

- Table 2 : Mohs Hardness List of Natural and Synthetic Materials

- Table 3 : Factors Affecting Abrasives

- Table 4 : Effect of Particle Size on Surface Finish of Processed Part

- Table 5 : Recommended Abrasives for Various Materials

- Table 6 : Worldwide Change in Car Production, 2011-2022

- Table 7 : Application of Abrasive Materials in Dentistry

- Table 8 : Comparison in Cost Summary for Conventional Versus Super Abrasives

- Table 9 : Four-year Growth in Producer Price Index for Abrasive Products, 1991-2022

- Table 10 : Global Market for Abrasives, by Type, Through 2028

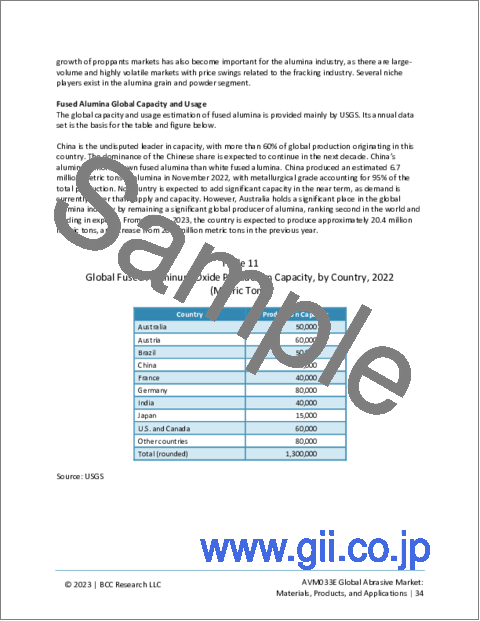

- Table 11 : Global Fused Aluminum Oxide Production Capacity, by Country, 2022

- Table 12 : Major Producers of Alumina, by Company, 2022

- Table 13 : Global Silicon Carbide Production Capacity, by Country, 2022

- Table 14 : Global Industrial-grade Natural Diamond Production, by Country, 2022

- Table 15 : Abrasive Tools and Applications

- Table 16 : Abrasive Materials for Various Blasting Applications

- Table 17 : Bonding Materials Used in Conventional Bonded Abrasives

- Table 18 : Typical Composition of a Coated Abrasive

- Table 19 : Typical Products in the Nonwoven Abrasives Product Category and Their Features

- Table 20 : Recommended Super Abrasives for Various Substrates

- Table 21 : Typical Abrasives Used in Polishing

- Table 22 : Parameters Affecting Properties of Polishing-grade Alumina

- Table 23 : Global Market for Abrasives, by Application, Through 2028

- Table 24 : Abrasive Choices for the Honing of Various Materials

- Table 25 : Honing Process Applications, by Industry

- Table 26 : Advanced Machining Processes

- Table 27 : Specific Energy Requirements for Machining of Various Materials

- Table 28 : Major Polishing Agent Components

- Table 29 : Global Market for Abrasives, by End-use Industry, Through 2028

- Table 30 : Global Market for Abrasives, by Region, Through 2028

- Table 31 : North American Gross Domestic Product Growth Rate, by Country, 2018-2022

- Table 32 : North American Market for Abrasives, by Country, Through 2028

- Table 33 : North American Market for Abrasives, by Type, Through 2028

- Table 34 : North American Market for Abrasives, by Application, Through 2028

- Table 35 : North American Market for Abrasives, by End-use Industry, Through 2028

- Table 36 : European Gross Domestic Product Growth Rate, by Country, 2018-2022

- Table 37 : European Market for Abrasives, by Country, Through 2028

- Table 38 : European Market for Abrasives, by Type, Through 2028

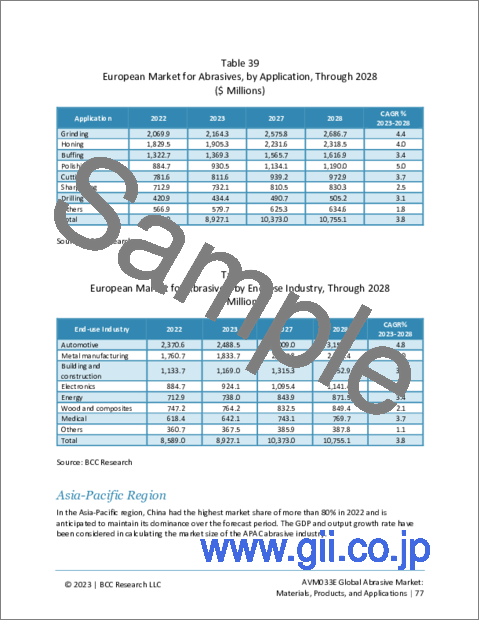

- Table 39 : European Market for Abrasives, by Application, Through 2028

- Table 40 : European Market for Abrasives, by End-use Industry, Through 2028

- Table 41 : Asia-Pacific Gross Domestic Product Growth Rate, by Country, 2018-2022

- Table 42 : Asia-Pacific Market for Abrasives, by Country, Through 2028

- Table 43 : Asia-Pacific Market for Abrasives, by Type, Through 2028

- Table 44 : Asia-Pacific Market for Abrasives, by Application, Through 2028

- Table 45 : Asia-Pacific Market for Abrasives, by End-use Industry, Through 2028

- Table 46 : RoW Market for Abrasives, by Country/Region, Through 2028

- Table 47 : RoW Market for Abrasives, by Type, Through 2028

- Table 48 : RoW Market for Abrasives, by Application, Through 2028

- Table 49 : RoW Market for Abrasives, by End-use Industry, Through 2028

- Table 50 : ESG Ratings and Metrics

- Table 51 : ESG Diversity Issue Analysis

- Table 52 : ESG Employee Safety and Labor Practices Issue Analysis

- Table 53 : ESG Resource Efficiency and Emissions Issue Analysis

- Table 54 : ESG Waste Reduction Issue Analysis

- Table 55 : ESG Sustainable Supply Chain Analysis

- Table 56 : ESG Ethical Corporate Behavior Analysis

- Table 57 : ESG Scores of Companies

- Table 58 : Risk Scale, Exposure Scale, and Management Scale

- Table 59 : Patents Related to Abrasives, by Country of Origin, January 2018-July 2023

- Table 60 : Patents Related to Abrasives, by Year Issued, January 2018-July 2023

- Table 61 : Patents Related to Abrasives, by Company, January 2018-July 2023

- Table 62 : List of Patents in Abrasives, July 2022-July 2023

- Table 63 : Mergers and Acquisitions, Global Market for Abrasives, January 2020-June 2023

- Table 64 : Global Market Share Analysis of Abrasives, by Company, 2022

- Table 65 : 3M Co.: Annual Revenue, 2022

- Table 66 : 3M Co.: News/Developments, 2021-2023

- Table 67 : 3M Co.: Abrasive Product Portfolio

- Table 68 : Almatis GmbH: News/Developments, 2021 and 2022

- Table 69 : Almatis GmbH: Abrasive Product Portfolio

- Table 70 : ARC Abrasives Inc.: News/Developments, 2023

- Table 71 : ARC Abrasives Inc.: Abrasives Product Portfolio

- Table 72 : Asahi Diamond Industrial: News/Developments, 2023

- Table 73 : Asahi Diamond Industrial: Annual Revenue, 2023

- Table 74 : Asahi Diamond Industrial: Abrasive Product Portfolio

- Table 75 : Carborundum Universal Ltd.: Annual Revenue, 2022

- Table 76 : Carborundum Universal Ltd.: News/Developments, 2022

- Table 77 : Carborundum Universal Ltd.: Abrasive Product Portfolio

- Table 78 : DuPont de Nemours Inc.: Annual Revenue, 2023

- Table 79 : DuPont de Nemours Inc.: Abrasive Product Portfolio

- Table 80 : EHWA Diamond Industrial Co., Ltd.: Abrasive Product Portfolio

- Table 81 : Fujimi Inc.: Annual Revenue, 2022

- Table 82 : Fujimi Inc.: News/Developments, 2021 and 2022

- Table 83 : Fujimi Inc.: Abrasive Product Portfolio

- Table 84 : Henkel: Annual Revenue, 2022

- Table 85 : Henkel: News/Developments, 2022 and 2023

- Table 86 : Henkel: Abrasive Product Portfolio

- Table 87 : Robert Bosch: Annual Revenue, 2022

- Table 88 : Robert Bosch: News/Developments, 2020-2023

- Table 89 : Robert Bosch: Abrasive Product Portfolio

- Table 90 : Sak Abrasives: News/Developments, 2023

- Table 91 : Sak Abrasives: Abrasive Product Portfolio

- Table 92 : Saint-Gobain: Annual Revenue, 2022

- Table 93 : Saint-Gobain: News/Developments, 2020-2023

- Table 94 : Saint-Gobain: Abrasive Product Portfolio

- Table 95 : Tyrolit: News/Developments, 2022 and 2023

- Table 96 : Tyrolit: Abrasive Product Portfolio

- Table 97 : Acronyms Used in This Report

List of Figures

- Summary Figure : Global Market for Abrasives, by Type, 2022-2028

- Figure 1 : Growth in Global Construction Industry, 2015-2030

- Figure 2 : Producer Price Index Trend of Abrasive Products, 1991-2022

- Figure 3 : Global Market Shares of Abrasives, by Type, 2022

- Figure 4 : Global Fused Aluminum Oxide Production Capacity, by Country, 2022

- Figure 5 : Global Silicon Carbide Production Capacity, by Country, 2022

- Figure 6 : Global Industrial-grade Natural Diamond Production Share, by Country, 2022

- Figure 7 : Abrasive Tools and Applications

- Figure 8 : Global Market Shares of Abrasives, by Application, 2022

- Figure 9 : Global Market Shares of Abrasives, by End-use Industry, 2022

- Figure 10 : Global Market Shares of Abrasives, by Region, 2022

- Figure 11 : North American Market Shares of Abrasives, by Country, 2022

- Figure 12 : European Market Shares of Abrasives, by Country, 2022

- Figure 13 : Asia-Pacific Market Shares of Abrasives, by Country, 2022

- Figure 14 : RoW Market Shares of Abrasives, by Country/Region, 2022

- Figure 15 : Overview of ESG Factors

- Figure 16 : Share of Public and Private Companies in the Global Market for Abrasives, 2022

- Figure 17 : 3M Co.: Annual Revenue, 2022 and 2023

- Figure 18 : 3M Co.: Revenue Share, by Business Unit, 2023

- Figure 19 : 3M Co.: Revenue Share, by Region, 2023

- Figure 20 : Asahi Diamond Industrial: Annual Revenue, 2022 and 2023

- Figure 21 : Asahi Diamond Industrial: Revenue Share, by Business Unit, 2023

- Figure 22 : Asahi Diamond Industrial: Revenue Share, by Region/Country, 2023

- Figure 23 : Carborundum Universal Ltd.: Annual Revenue, 2021 and 2022

- Figure 24 : Carborundum Universal Ltd.: Revenue Share, by Business Unit, 2022

- Figure 25 : Carborundum Universal Ltd.: Revenue Share, by Region/Country, 2022

- Figure 26 : DuPont de Nemours Inc.: Annual Revenue, 2022 and 2023

- Figure 27 : DuPont de Nemours Inc.: Revenue Share, by Business Unit, 2023

- Figure 28 : DuPont de Nemours Inc.: Revenue Share, by Region/Country, 2023

- Figure 29 : Fujimi Inc.: Annual Revenue, 2022 and 2023

- Figure 30 : Fujimi Inc.: Revenue Share, by Business Unit, 2023

- Figure 31 : Fujimi Inc.: Revenue Share, by Region/Country, 2023

- Figure 32 : Henkel: Annual Revenue, 2021 and 2022

- Figure 33 : Henkel: Revenue Share, by Business Unit, 2022

- Figure 34 : Henkel: Revenue Share, by Region/Country, 2022

- Figure 35 : Robert Bosch: Annual Revenue, 2021 and 2022

- Figure 36 : Robert Bosch: Revenue Share, by Business Unit, 2022

- Figure 37 : Robert Bosch: Revenue Share, by Region, 2022

- Figure 38 : Saint-Gobain: Annual Revenue, 2021 and 2022

- Figure 39 : Saint-Gobain: Revenue Share, by Business Unit, 20222

Highlights:

The global market for abrasives was valued at $55.0 billion in 2022. The market is estimated to grow from $57.8 billion in 2023 to reach $74.0 billion by 2028, at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2028.

The global market for abrasive grains is estimated to grow from $29.0 billion in 2023 to reach $37.7 billion by 2028, at a CAGR of 5.4% from 2023 to 2028.

The global market for abrasive products is estimated to grow from $28.9 billion in 2023 to reach $36.3 billion by 2028, at a CAGR of 4.7% from 2023 to 2028.

Report Scope:

The report contains comprehensive information regarding the abrasive industry and the users thereof. It includes details about various types of abrasives; materials used as abrasives; abrasive manufacturers' most commonly used grains; manufacturers' production with values; manufacturers of products using abrasive materials primarily for machine tools; users of abrasive tools and other applications; and users of loose abrasives. Estimated values are based on manufacturers' total revenues. Projected and forecast revenue values are in constant U.S. dollars, unadjusted for inflation.

The abrasive market is segmented into the follow categories -

- Type (abrasive grains and abrasive products).

- Application (buffing, honing, drilling, grinding, polishing, cutting, and sharpening).

- End use (metal manufacturing, automotive, electronics, medical, energy, building and construction, and wood and composites).

- Region: North America, Europe, Asia-Pacific (APAC), and the Rest of the World (RoW).

Report includes:

- 45 data tables and 53 additional tables

- Overview and an up-to-date analysis of the global abrasives market with emphasis on materials, products and applications

- Analyses of the global market trends, with historical market revenue data (sales figures) for 2022, estimates for 2023, forecasts for 2027, and projections of compound annual growth rates (CAGRs) through 2028

- Estimate of the actual market size and revenue forecast for the global abrasives market in USD millions, and a corresponding market share analysis based on type, application, end-use industry, and region

- In-depth information (facts and figures) pertaining to the market growth drivers, challenges, opportunities and prospects; the technologies and regulatory scenarios; and the impacts of COVID-19 and the Russia-Ukraine war on the market

- Discussion of the importance of ESG in the global abrasives market, including consumer attitudes, an assessment of risks and opportunities, and the ESG practices followed by manufacturers and suppliers of abrasives

- Review of new and existing U.S. patents issued for abrasive technologies

- A look at the major vendors in the global market for abrasives, and an analysis of the structure of this industry with respect to company market shares, venture fundings, and recent mergers and acquisitions (M&A) activity

- Identification of the major stakeholders and analysis of the competitive landscape based on recent developments, key financials and segmental revenues, and operational integration

- Profiles of the leading market players

Table of Contents

Chapter 1 Introduction

- Study Goals and Objectives

- Reasons for Doing This Study

- What's New in This Update?

- Scope of Report

- Research Methodology

- Information Sources

- Geographic Breakdown

Chapter 2 Summary and Highlights

- Market Outlook

- Market Summary

Chapter 3 Market Overview

- Market Definition

- Industry History

- Factors Affecting Choice of Abrasives

- Importance of the Abrasive Industry

Chapter 4 Market Dynamics

- Market Drivers

- Increasing Demand for Abrasives from Automotive Industry

- Growth in Demand for Abrasives from Construction Industry

- Market Opportunities

- Niche Applications of Abrasives in Dental, Medical, and Jewelry Manufacturing

- Growing Demand for Super Abrasives

- Market Challenges

- Environmental Regulations

- Rising Raw Material Costs

Chapter 5 Global Market for Abrasives by Type

- Introduction

- Abrasive Grains

- Alumina Industry

- Silicon Carbide Global Capacity and Usage

- Diamond Market

- Cubic Boron Nitride and Others

- Metallic Abrasives

- Cutting Tool Industry

- Natural Abrasives

- Abrasive Powder and Grains

- Abrasive Products

- Loose Abrasives

- Bonded Abrasives

- Coated Abrasives

- Nonwoven Abrasives

- Super Abrasives

- Polishing Products

Chapter 6 Global Market for Abrasives by Application

- Introduction

- Buffing

- Cutting

- Grinding

- Honing

- Lapping

- Machining

- Polishing

Chapter 7 Global Market for Abrasives by End-use Industry

- Introduction

- Automotive

- Metal Manufacturing

- Building and Construction

- Electronics

- Wood and Composites

- Energy

- Medical

Chapter 8 Global Market for Abrasives by Region

- Introduction

- North American Region

- European Region

- Asia-Pacific Region

- Rest of the World

Chapter 9 Sustainability in Abrasive Industry: An ESG Perspective

- Importance of ESG in the Abrasive Industry

- ESG Ratings and Metrics: Understanding the Data

- ESG Practices in the Abrasive Industry

- Current Status of ESG in the Abrasive Market

- Risk Scale, Exposure Scale, and Management Scale

- Case Study: Example of Successful ESG Implementation

- Environmental Initiatives

- Social Initiatives

- Governance Initiatives

- Outcomes

- Investments

- Future of ESG: Emerging Trends and Opportunities

- Concluding Remarks from BCC

Chapter 10 Emerging Technologies and Developments

- Key Highlights

- Trends

- Development of New Abrasive Materials and Abrasive Manufacturing Processes

- Abrasive Recycling

Chapter 11 Patent Analysis

- Significance of Patents

- Importance of Patent Analysis

- Patent Analysis Based on Country of Origin

- Patent Analysis Based on Year Issued

- Patent Analysis Based on Companies to Which Patents Were Issued

Chapter 12 Merger and Acquisition Outlook

- Merger and Acquisition Analysis

Chapter 13 Competitive Intelligence

- Industry Structure

- Abrasive Industry Market Structure

Chapter 14 Company Profiles

- 3M CO.

- ALMATIS GMBH

- ARC ABRASIVES INC.

- ASAHI DIAMOND INDUSTRIAL CO., LTD.

- CARBORUNDUM UNIVERSAL LTD.

- DUPONT DE NEMOURS INC.

- EHWA DIAMOND INDUSTRIAL CO., LTD.

- FUJIMI INC.

- HENKEL AG & CO. KGAA

- ROBERT BOSCH GMBH

- SAK INDUSTRIES PVT. LTD.

- SAINT-GOBAIN

- TYROLIT-SCHLEIFMITTELWERKE SWAROVSKI AG & CO. KG