|

|

市場調査レポート

商品コード

1296835

動物用ワクチンの世界市場Veterinary Vaccines: Global Markets |

||||||

| 動物用ワクチンの世界市場 |

|

出版日: 2023年06月16日

発行: BCC Research

ページ情報: 英文 313 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の動物用ワクチンの市場規模は、2022年の91億米ドル、2023年の96億米ドルから、2023年から2028年にかけての予測期間中は8.2%のCAGRで推移し、2028年には142億米ドルの規模に成長すると予測されています。

家畜の部門は、2022年の39億米ドル、2023年の41億米ドルから、8.3%のCAGRで推移し、2028年には61億米ドルの規模に成長すると予測されています。また、コンパニオンアニマルの部門は、2022年の8億1,510万米ドル、2023年の8億5,730万米ドルから、9.4%のCAGRで推移し、2028年には13億米ドルの規模に成長すると予測されています。

当レポートでは、世界の動物用ワクチンの市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

第3章 市場概要

- 動物用ワクチンの概要

- 動物のタイプとワクチン接種

- 家畜

- コンパニオンアニマル

- 馬

- 豚

- 家禽

- その他

- ワクチンおよび動物用医薬品の輸出

- 動物ヘルスケアの動向

- アニマルヘルス製品の需要の拡大

第4章 市場力学

- 市場力学

- 促進要因

- 抑制要因

- 機会

第5章 COVID-19:アニマルヘルスおよびプロダクション施設に与える影響

- 概要

- 短期的影響

- 長期的影響

- COVID-19によるアニマルウェルフェアへの影響

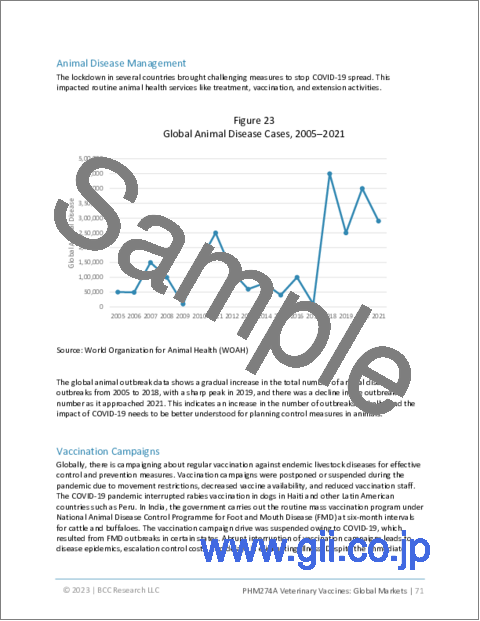

- 動物疾病管理

- 予防接種キャンペーン

第6章 動物用ワクチンの最新技術

- 概要

- 多価動物ワクチン

- mRNAワクチン

- 動物ワクチンのパイプライン分析

第7章 世界の動物用ワクチン市場:製品別

- 弱毒化ワクチン

- 不活化ワクチン

- トキソイドワクチン

- 組換えワクチン

第8章 世界の動物用ワクチン市場:動物タイプ別

- 概要

- 市場の見通し

- 家畜

- 家禽

- コンパニオンアニマル

- 豚

- 馬

- その他の動物

第9章 世界の動物用ワクチン市場:投与経路別

- 世界の動物用ワクチン市場:投与経路別

- 皮下投与

- 筋肉内投与

- 鼻腔内投与

- 経口投与

第10章 世界の動物用ワクチン市場:地域別

- 世界の動物用ワクチン市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

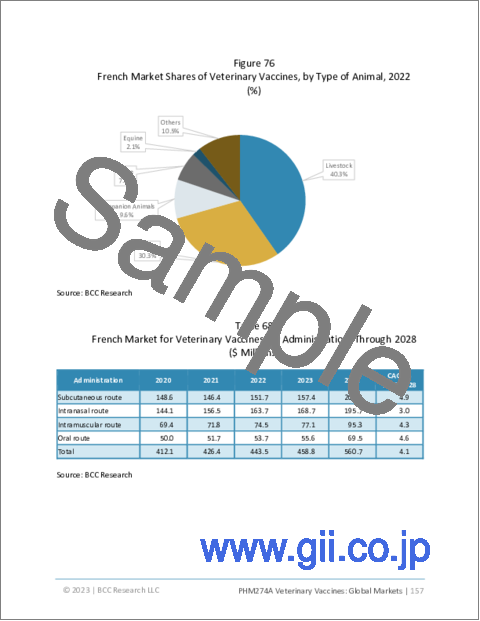

- フランス

- 英国

- スペイン

- その他の欧州

- アジア太平洋

- 日本

- インド

- オーストラリア・ニュージーランド

- 中国

- その他のアジア太平洋地域

- ラテンアメリカ

- ブラジル

- アルゼンチン

- その他のラテンアメリカ地域

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

第11章 競合情勢

- 企業シェア

- SWOT分析

第12章 M&A・資金調達の見通し

- M&A分析

- 動物ヘルスケアにおける資金

第13章 アニマルヘルス産業の持続可能性:ESGの観点

- ESGの概要

- 動物ヘルスケア業界における主要なESG上の課題

- アニマルヘルス産業のESGパフォーマンス分析

第14章 企業プロファイル

- ARKO LABORATORIES

- AVIMEX

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- CEVA SANTE ANIMALE(CEVA)

- DECHRA PHARMACEUTICALS.

- ELANCO.

- MERCK & CO. INC.

- PHIBRO ANIMAL HEALTH CORP.

- VIRBAC

- ZOETIS SERVICES LLC.

List of Tables

- Summary Table : Global Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 1 : Subunit and Recombinant Protein Vaccines

- Table 2 : DIVA Vaccines

- Table 3 : Dairy Livestock Infection Category Vaccination

- Table 4 : Vaccines for Companion Animals

- Table 5 : Vaccines for Equine Infections

- Table 6 : Vaccines for Swine Infection

- Table 7 : Vaccines for Poultry Infection

- Table 8 : Vaccines for Other Animals Infections

- Table 9 : Vaccines and Veterinary Medicines Exports, by Country, 2021

- Table 10 : List of Different Types of Diseases in Animals

- Table 11 : Number of Outbreaks, Cases and Animal Losses Caused by ASF, 2021

- Table 12 : Coronavirus Reported Cases and Deaths, by Country, 2020

- Table 13 : Pipeline Analysis of Animal Vaccines

- Table 14 : Global Market for Veterinary Vaccines, by Product, Through 2028

- Table 15 : Global Market for Attenuated Vaccines, Through 2028

- Table 16 : Global Market for Recombinant Vaccines, Through 2022

- Table 17 : Veterinary Vaccines in Aquaculture

- Table 18 : Global Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 19 : Global Meat Trade, by Beef and Sheep

- Table 20 : Global Poultry Trade

- Table 21 : Global Swine Trade

- Table 22 : Global Market for Veterinary Vaccines, by Administration, Through 2028

- Table 23 : Global Market for Veterinary Vaccines, by Region, Through 2028

- Table 24 : North American Market for Veterinary Vaccines, by Product, Through 2028

- Table 25 : North American Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 26 : North American Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 27 : North American Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 28 : North American Market for Veterinary Vaccines, by Administration, Through 2028

- Table 29 : North American Market for Veterinary Vaccines, by Country, Through 2028

- Table 30 : U.S. Market for Veterinary Vaccines, by Product, Through 2028

- Table 31 : U.S. Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 32 : U.S. Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 33 : U.S. Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 34 : U.S. Market for Veterinary Vaccines, by Administration, Through 2028

- Table 35 : United States Pets Vaccine Cost

- Table 36 : Canadian Market for Veterinary Vaccines, by Product, Through 2028

- Table 37 : Canadian Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 38 : Canadian Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 39 : Canadian Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 40 : Canadian Market for Veterinary Vaccines, by Administration, Through 2028

- Table 41 : Flocks Confirmed with Avian Influenza in Canada, 2021

- Table 42 : Mexican Market for Veterinary Vaccines, by Product, Through 2028

- Table 43 : Mexican Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 44 : Mexican Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 45 : Mexican Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 46 : Mexican Market for Veterinary Vaccines, by Administration, Through 2028

- Table 47 : European Market for Veterinary Vaccines, by Product, Through 2028

- Table 48 : European Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 49 : European Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 50 : European Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 51 : European Market for Veterinary Vaccines, by Administration, Through 2028

- Table 52 : European Market for Veterinary Vaccines, by Country, Through 2028

- Table 53 : German Market for Veterinary Vaccines, by Product, Through 2028

- Table 54 : German Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 55 : German Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 56 : German Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 57 : German Market for Veterinary Vaccines, by Administration, Through 2028

- Table 58 : Italian Market for Veterinary Vaccines, by Product, Through 2028

- Table 59 : Italian Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 60 : Italian Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 61 : Italian Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 62 : Italian Market for Veterinary Vaccines, by Administration, Through 2028

- Table 63 : Number of Enzootic Bovine Leukosis Breakouts in Italy Region, 2011-2020

- Table 64 : French Market for Veterinary Vaccines, by Product, Through 2028

- Table 65 : French Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 66 : French Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 67 : French Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 68 : French Market for Veterinary Vaccines, by Administration, Through 2028

- Table 69 : U.K. Market for Veterinary Vaccines, by Product, Through 2028

- Table 70 : U.K. Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 71 : U.K. Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 72 : U.K. Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 73 : U.K. Market for Veterinary Vaccines, by Administration, Through 2028

- Table 74 : Spanish Market for Veterinary Vaccines, by Product, Through 2028

- Table 75 : Spanish Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 76 : Spanish Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 77 : Spanish Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 78 : Spanish Market for Veterinary Vaccines, by Administration, Through 2028

- Table 79 : Rest of European Market for Veterinary Vaccines, by Product, Through 2028

- Table 80 : Rest of European Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 81 : Rest of European Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 82 : Rest of European Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 83 : Rest of European Market for Veterinary Vaccines, by Administration, Through 2028

- Table 84 : Asia-Pacific Market for Veterinary Vaccines, by Product, Through 2028

- Table 85 : Asia-Pacific Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 86 : Asia-Pacific Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 87 : Asia-Pacific Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 88 : Asia-Pacific Market for Veterinary Vaccines, by Administration, Through 2028

- Table 89 : Asia-Pacific Market for Veterinary Vaccines, by Country, Through 2028

- Table 90 : Japanese Market for Veterinary Vaccines, by Product, Through 2028

- Table 91 : Japanese Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 92 : Japanese Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 93 : Japanese Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 94 : Japanese Market for Veterinary Vaccines, by Administration, Through 2028

- Table 95 : Indian Market for Veterinary Vaccines, by Product, Through 2028

- Table 96 : Indian Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 97 : Indian Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 98 : Indian Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 99 : Indian Market for Veterinary Vaccines, by Administration, Through 2028

- Table 100 : Australian and New Zealand Market for Veterinary Vaccines, by Product, Through 2028

- Table 101 : Australian and New Zealand Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 102 : Australian and New Zealand Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 103 : Australian and New Zealand Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 104 : Australian and New Zealand Market for Veterinary Vaccines, by Administration, Through 2028

- Table 105 : Chinese Market for Veterinary Vaccines, by Product, Through 2028

- Table 106 : Chinese Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 107 : Chinese Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 108 : Chinese Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 109 : Chinese Market for Veterinary Vaccines, by Administration, Through 2028

- Table 110 : Rest of Asia-Pacific Market for Veterinary Vaccines, by Product, Through 2028

- Table 111 : Rest of Asia-Pacific Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 112 : Rest of Asia-Pacific Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 113 : Rest of Asia-Pacific Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 114 : Rest of Asia-Pacific Market for Veterinary Vaccines, by Administration, Through 2028

- Table 115 : Latin American Market for Veterinary Vaccines, by Product, Through 2028

- Table 116 : Latin American Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 117 : Latin American Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 118 : Latin American Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 119 : Latin American Market for Veterinary Vaccines, by Administration, Through 2028

- Table 120 : Latin American Market for Veterinary Vaccines, by Country, Through 2028

- Table 121 : Brazilian Market for Veterinary Vaccines, by Product, Through 2028

- Table 122 : Brazilian Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 123 : Brazilian Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 124 : Brazilian Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 125 : Brazilian Market for Veterinary Vaccines, by Administration, Through 2028

- Table 126 : Argentinian Market for Veterinary Vaccines, by Product, Through 2028

- Table 127 : Argentinian Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 128 : Argentinian Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 129 : Argentinian Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 130 : Argentinian Market for Veterinary Vaccines, by Administration, Through 2028

- Table 131 : Argentinian Veterinary Vaccines Importers

- Table 132 : Rest of Latin American Market for Veterinary Vaccines, by Product, Through 2028

- Table 133 : Rest of Latin American Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 134 : Rest of Latin American Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 135 : Rest of Latin American Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 136 : Rest of Latin American Market for Veterinary Vaccines, by Administration, Through 2028

- Table 137 : Middle East & African Market for Veterinary Vaccines, by Product, Through 2028

- Table 138 : Middle East & African Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 139 : Middle East & African Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 140 : Middle East & African Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 141 : Middle East & African Market for Veterinary Vaccines, by Administration, Through 2028

- Table 142 : Middle East & African Market for Veterinary Vaccines, by Country, Through 2028

- Table 143 : Potential Research Collaborations

- Table 144 : GCC Countries Market for Veterinary Vaccines, by Product, Through 2028

- Table 145 : GCC Countries Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 146 : GCC Countries Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 147 : GCC Countries Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 148 : GCC Countries Market for Veterinary Vaccines, by Administration, Through 2028

- Table 149 : South African Market for Veterinary Vaccines, by Product, Through 2028

- Table 150 : South African Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 151 : South African Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 152 : South African Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 153 : South African Market for Veterinary Vaccines, by Administration, Through 2028

- Table 154 : Rest of Middle East and African Market for Veterinary Vaccines, by Product, Through 2028

- Table 155 : Rest of Middle East and African Market for Veterinary Vaccines, by Attenuated Vaccines, Through 2028

- Table 156 : Rest of Middle East and African Market for Veterinary Vaccines, by Recombinant Vaccines, Through 2028

- Table 157 : Rest of Middle East and African Market for Veterinary Vaccines, by Type of Animal, Through 2028

- Table 158 : Rest of Middle East and African Market for Veterinary Vaccines, by Administration, Through 2028

- Table 159 : Company Growth Ratio and Income Values

- Table 160 : SWOT Analysis: Market for Veterinary Vaccines

- Table 161 : M&A among Animal Healthcare Companies, 2021

- Table 162 : Startup Funding in Animal Healthcare, January 2022 to March 2023

- Table 163 : Arko Laboratories: Animal Vaccine Products

- Table 164 : Avimex: Animal Vaccine Products

- Table 165 : Avimex: Development and Strategy

- Table 166 : Boehringer Ingelheim: Annual Revenue, 2022

- Table 167 : Boehringer Ingelheim: News

- Table 168 : Boehringer Ingelheim: Animal Vaccine Products

- Table 169 : Ceva: Annual Revenue, 2022

- Table 170 : Ceva: News

- Table 171 : Ceva: Animal Vaccine Products

- Table 172 : Dechra: Annual Revenue, 2022

- Table 173 : Dechra: News

- Table 174 : Dechra: Animal Vaccine Products

- Table 175 : Annual Revenue, 2022

- Table 176 : Elanco: News

- Table 177 : Elanco: Animal Vaccine Products

- Table 178 : Merck & Co. Inc.: Annual Revenue, 2022

- Table 179 : Merck & Co. Inc.: News

- Table 180 : Merck & Co. Inc.: Animal Vaccine Products

- Table 181 : Phibro Animal Health Corp.: Annual Revenue, 2022

- Table 182 : Phibro Animal Health Corp.: News

- Table 183 : Phibro Animal Health Corp.: Animal Vaccine Products

- Table 184 : Virbac: Annual Revenue, 2021

- Table 185 : Virbac: News

- Table 186 : Virbac: Animal Vaccine Products

- Table 187 : Zoetis Services LLC: Annual Revenue, 2021

- Table 188 : Zoetis Services LLC: News

- Table 189 : Zoetis Services LLC: Animal Vaccine Products

List of Figures

- Summary Figure : Global Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 1 : Top Manufacturers in Animal Health Products

- Figure 2 : Increase in Livestock Commodity Production, 2020-2030

- Figure 3 : Pet Populations in Major Regions

- Figure 4 : Rise in Consumer Spending on Pets, 2016-2021

- Figure 5 : Comparison of Japan and the U.S. on Animal Life Expectancy

- Figure 6 : Snapshot of Genes, Single-Nucleotide Polymorphisms (SNPs), and Quantitative Trait Loci (QTL) Related to Cattle Longevity

- Figure 7 : New Tuberculosis Herd Incidents, Wales, 2022

- Figure 8 : Animals Slaughtered for TB Control, Wales, 2008-2022

- Figure 9 : Number of Countries Affected by HPAI, 2005-2021

- Figure 10 : Worldwide Distribution of SARS-CoV-2 Outbreaks in 23 Animals Species

- Figure 11 : Factors Affecting Livestock Diseases in African Countries

- Figure 12 : Drivers of Zoonotic Outbreaks

- Figure 13 : Livestock Pathogens and Zoonoses

- Figure 14 : Growing Population of the World

- Figure 15 : Global Production of Meat and Eggs

- Figure 16 : Barriers to Animal Vaccination

- Figure 17 : Modalities for Purchasing Rabies Vaccine from World Vaccine Bank, 2012-2021

- Figure 18 : Impact of COVID-19 on Pharma Industry

- Figure 19 : SARS CoV-2 Infections in Non-Human Animals

- Figure 20 : Impact of COVID-19 on Species Group

- Figure 21 : Impact of COVID-19 on Species Group, by Country

- Figure 22 : Impact of COVID-19 on Different Input Issues

- Figure 23 : Global Animal Disease Cases, 2005-2021

- Figure 24 : Patent Volumes: Multivalent Veterinary Vaccines

- Figure 25 : Global Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 26 : Global Market Shares of Attenuated Vaccines, 2022

- Figure 27 : Global Market Shares of Recombinant Vaccines, 2022

- Figure 28 : Global Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 29 : Growth of Meat Production, by Region, 2019-2023

- Figure 30 : Confirmed Cases of SARS-CoV-2 in the U.S., by Type of Animal, 2023

- Figure 31 : Pet Ownership in Europe, by Type of Animal, 2023

- Figure 32 : Global Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 33 : Global Market Shares of Veterinary Vaccines, by Region, 2022

- Figure 34 : North American Beef Cattle Inventory, 2000-2022

- Figure 35 : North American Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 36 : North American Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 37 : North American Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 38 : North American Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 39 : North American Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 40 : North American Market Shares of Veterinary Vaccines, by Country, 2022

- Figure 41 : U.S. Cattle Inventory

- Figure 42 : U.S. Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 43 : U.S. Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 44 : U.S. Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 45 : U.S. Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 46 : U.S. Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 47 : Canadian Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 48 : Canadian Market Shares of Veterinary Vaccines, by Attenuated Vaccine, 2022

- Figure 49 : Canadian Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 50 : Canadian Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 51 : Canadian Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 52 : Mexican Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 53 : Mexican Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 54 : Mexican Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 55 : Mexican Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 56 : Mexican Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 57 : European Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 58 : European Market Shares of Veterinary Vaccines, by Attenuated Vaccine, 2022

- Figure 59 : European Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 60 : European Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 61 : European Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 62 : European Market Shares of Veterinary Vaccines, by Country, 2022

- Figure 63 : German Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 64 : German Market Shares of Veterinary Vaccines, by Attenuated Vaccine, 2022

- Figure 65 : German Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 66 : German Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 67 : German Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 68 : Italian Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 69 : Italian Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 70 : Italian Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 71 : Italian Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 72 : Italian Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 73 : French Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 74 : French Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 75 : French Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 76 : French Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 77 : French Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 78 : U.K. Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 79 : U.K. Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 80 : U.K. Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 81 : U.K. Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 82 : U.K. Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 83 : Spanish Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 84 : Spanish Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 85 : Spanish Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 86 : Spanish Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 87 : Spanish Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 88 : Rest of European Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 89 : Rest of European Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 90 : Rest of European Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 91 : Rest of European Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 92 : Rest of European Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 93 : Growing Consumer Spending on Companion Animals

- Figure 94 : Asia-Pacific Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 95 : Asia-Pacific Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 96 : Asia-Pacific Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 97 : Asia-Pacific Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 98 : Asia-Pacific Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 99 : Asia-Pacific Market Shares of Veterinary Vaccines, by Country, 2022

- Figure 100 : Japanese Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 101 : Japanese Market Shares of Veterinary Vaccines, by Attenuated Vaccine, 2022

- Figure 102 : Japanese Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 103 : Japanese Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 104 : Japanese Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 105 : Japanese Cat and Dog Ownership

- Figure 106 : Indian Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 107 : Indian Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 108 : Indian Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 109 : Indian Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 110 : Indian Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 111 : Australian and New Zealand Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 112 : Australian and New Zealand Market Shares of Veterinary Vaccines, by Attenuated Vaccine, 2022

- Figure 113 : Australian and New Zealand Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 114 : Australian and New Zealand Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 115 : Australian and New Zealand Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 116 : Chinese Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 117 : Chinese Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 118 : Chinese Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 119 : Chinese Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 120 : Chinese Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 121 : Rest of Asia-Pacific Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 122 : Rest of Asia-Pacific Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 123 : Rest of Asia-Pacific Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 124 : Rest of Asia-Pacific Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 125 : Rest of Asia-Pacific Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 126 : Latin American Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 127 : Latin American Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 128 : Latin American Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 129 : Latin American Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 130 : Latin American Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 131 : Latin American Market Shares of Veterinary Vaccines, by Country, 2022

- Figure 132 : Brazilian Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 133 : Brazilian Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 134 : Brazilian Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 135 : Brazilian Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 136 : Brazilian Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 137 : Argentinian Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 138 : Argentinian Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 139 : Argentinian Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 140 : Argentinian Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 141 : Argentinian Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 142 : Number of Beef Cattle Vaccinated Against Foot-and-Mouth Disease in Argentina, 2018, by Province

- Figure 143 : Rest of Latin American Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 144 : Rest of Latin American Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 145 : Rest of Latin American Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 146 : Rest of Latin American Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 147 : Rest of Latin American Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 148 : Middle East & African Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 149 : Middle East & African Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 150 : Middle East & African Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 151 : Middle East & African Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 152 : Middle East & African Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 153 : Middle East & African Market Shares of Veterinary Vaccines, by Country, 2022

- Figure 154 : GCC Countries Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 155 : GCC Countries Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 156 : GCC Countries Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 157 : GCC Countries Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 158 : GCC Countries Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 159 : South African Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 160 : South African Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 161 : South African Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 162 : South African Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 163 : South African Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 164 : Rest of Middle East and African Market Shares of Veterinary Vaccines, by Product, 2022

- Figure 165 : Rest of the Middle East and African Market Shares of Veterinary Vaccines, by Attenuated Vaccines, 2022

- Figure 166 : Rest of Middle East and African Market Shares of Veterinary Vaccines, by Recombinant Vaccines, 2022

- Figure 167 : Rest of Middle East and African Market Shares of Veterinary Vaccines, by Type of Animal, 2022

- Figure 168 : Rest of Middle East and African Market Shares of Veterinary Vaccines, by Administration, 2022

- Figure 169 : Global Market Shares of Veterinary Vaccines, by Company, 2022

- Figure 170 : Top Animal Health Mergers and Acquisitions Worldwide, 2014-2018, by Enterprise Value

- Figure 171 : M&A among Animal Healthcare Companies Deals in 2021

- Figure 172 : Healthier Animals: A Solution To Significant Global Challenges

- Figure 173 : ESG Risk Rating of Top Companies

- Figure 174 : Boehringer Ingelheim: Annual Revenue, 2021 and 2022

- Figure 175 : Boehringer Ingelheim: Revenue Shares, by Business Unit, 2022

- Figure 176 : Boehringer Ingelheim: Revenue Shares, by Country/Region, 2022

- Figure 177 : Ceva: Annual Revenue, 2021-2022

- Figure 178 : Dechra: Annual Revenue, 2021 and 2022

- Figure 179 : Dechra: Revenue Shares, by Business Unit, 2022

- Figure 180 : Dechra: Revenue Shares, by Country/Region, 2022

- Figure 181 : Elanco: Annual Revenue, 2021 and 2022

- Figure 182 : Elanco: Revenue Shares, by Business Unit, 2022

- Figure 183 : Elanco: Revenue Shares, by Country/Region, 2022

- Figure 184 : Merck & Co. Inc.: Annual Revenue, 2021 and 2022

- Figure 185 : Merck & Co. Inc.: Revenue Shares, by Business Unit, 2022

- Figure 186 : Merck & Co. Inc.: Revenue Shares, by Country/Region, 2022

- Figure 187 : Phibro Animal Health Corp.: Annual Revenue, 2021 and 2022

- Figure 188 : Phibro Animal Health Corp.: Revenue Shares, by Business Unit, 2022

- Figure 189 : Phibro Animal Health Corp.: Revenue Shares, by Country/Region, 2022

- Figure 190 : Virbac: Annual Revenue, 2020 and 2021

- Figure 191 : Virbac: Revenue Shares, by Business Unit, 2022

- Figure 192 : Zoetis Services LLC: Annual Revenue, 2020 and 2021

- Figure 193 : Zoetis Services LLC: Revenue Shares, by Business Unit, 2022

- Figure 194 : Zoetis Services LLC: Revenue Shares, by Country/Region, 2022

Highlights:

The global veterinary vaccines market reached $9.1 billion in 2022, should reach $9.6 billion by 2023 and $14.2 billion by 2028 with a compound annual growth rate (CAGR) of 8.2% during the forecast period of 2023-2028.

Livestock segment of the global veterinary vaccines market reached $3.9 billion in 2022, should reach $4.1 billion by 2023 and $6.1 billion by 2028 with a CAGR of 8.3% during the forecast period of 2023-2028.

Companion animals segment of the global veterinary vaccines market reached $815.1 million in 2022, should reach $857.3 million by 2023 and $1.3 billion by 2028 with a CAGR of 9.4% during the forecast period of 2023-2028.

Report Scope:

This report aims to provide a comprehensive study of the global market for veterinary vaccines. It describes the different types of veterinary vaccines products, technology, and their current and historical market revenues.

Veterinary vaccines include designs and different technology along with applications. The product of veterinary vaccines are segmented into attenuated vaccine (live vaccine, modified live vaccine, live attenuated vaccine), inactivated vaccine, recombinant vaccine (subunit vaccine, polysaccharide vaccine, conjugate vaccine, chimeric vaccine, viral-vector vaccine), and toxoid vaccine.

This report also covers a detailed study of animal species in the veterinary vaccines market, including livestock, poultry, companion animals, swine, equine, and others (aquaculture, etc.) An in-depth analysis of the global market for veterinary vaccines includes historical data and market projections on sales by technology/system type, product, application, design, and region.

For an in-depth understanding of the market, profiles of market participants, essential marketed products, competitive landscape, key competitors, ESG analysis, and their respective market shares have been provided. This report also discusses the driving and restraining factors of the global veterinary vaccines market.

Report Includes:

- 145 data tables and 45 additional tables

- A comprehensive overview of the current and future global markets for veterinary vaccines

- Analyses of the global market trends, with historic market revenue data (sales figures) for 2020-2022, estimates for 2023, and projections of compound annual growth rates (CAGRs) through 2028

- Estimation of the actual market size and revenue forecast for global veterinary vaccines market in USD millions, and corresponding market share analysis based on the product, type of attenuated and recombinant vaccines, animal type, route of administration, and region

- Highlights of upcoming market opportunities and trends driving and restricting growth of global veterinary vaccines market and its sub-segments, and major regions and countries involved in the market developments

- In-depth information (facts and figures) concerning major market dynamics (DROs), technology advancements, regulatory aspects, and various macroeconomics factors influencing the demand and progress of this market

- Country specific data and market value analysis for the U.S., Canada, Mexico, Germany, France, Italy, Spain, the UK, Japan, China, India, Australia and New Zealand (ANZ), Brazil, Argentina, South Africa, and GCC countries, among others

- Information about ESG-related developments in the animal health industry, key issues, implementation strategies, and analyses of factors affecting ESG applications in the market

- Identification of the companies engaged in research and development (R&D) of vaccination and vaccine production, emerging technologies, and a SWOT analysis of leading competitors and their market penetration

- Company profiles of major players within the industry, including Boehringer Ingelheim, Dechra, Elanco, Merck & Co. Inc., and Zoetis Services LLC

Table of Contents

Chapter 1 Introduction

- Study Goals and Objectives

- Reasons for Doing This Study

- Scope of Report

- Information Sources

- Methodology

- Geographic Breakdown

- Analyst's Credentials

- BCC Custom Research

- Related BCC Research Reports

Chapter 2 Summary and Highlights

- Market Outlook

Chapter 3 Market Overview

- Overview of Veterinary Vaccines

- Animal Types and Vaccination

- Livestock

- Companion Animals

- Equine Animals

- Swine

- Poultry

- Other Animals

- Vaccines and Veterinary Products Export

- Trends in Animal Healthcare

- Growing Demand for Animal Health Products

Chapter 4 Market Dynamics

- Market Dynamics

- Drivers

- Incidence and Prevalence of Animal Disease

- Global Warming and Impact on Veterinary Animals

- Increase in Investment for Treating and Eradicating Diseases in Animals

- Emergence of Zoonotic Diseases

- Rise in Awareness Programs on Veterinary Vaccines

- Vaccines and Food Production

- Restraints

- Product Development and Manufacturing Challenges

- Side Effects of Vaccination

- Financial Prioritization and Herd Immunity Risk

- Other Restraints

- Opportunities

- Launch of New Veterinary Vaccines

- Reducing the Need for Antibiotics

- Funding for Innovative Veterinary Vaccines and Services

Chapter 5 Impact of COVID-19 on Animal Health and Production Facilities

- Overview

- Short-Term Impact

- Long-Term Impact

- COVID-19 Impact on Animal Welfare

- Animal Disease Management

- Vaccination Campaigns

Chapter 6 Emerging Technologies in Veterinary Vaccines

- Overview

- Multivalent Veterinary Vaccines

- mRNA Vaccine

- Pipeline Analysis of Animal Vaccines

Chapter 7 Global Market for Veterinary Vaccines, by Product

- Introduction

- Attenuated Vaccine

- Inactivated Vaccine

- Toxoid Vaccines

- Recombinant Vaccine

Chapter 8 Global Market for Veterinary Vaccines, by Type of Animal

- Overview

- Market Outlook

- Livestock

- Poultry

- Companion Animals

- Swine

- Equine

- Other Animals

Chapter 9 Global Market for Veterinary Vaccines, by Administration

- Global Market for Veterinary Vaccines by Administration

- Subcutaneous Route of Administration

- Intramuscular Route of Administration

- Intranasal Route of Administration

- Oral Route of Administration

Chapter 10 Global Market for Veterinary Vaccines, by Region

- Global Markets for Veterinary Vaccines by Region

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- Italy

- France

- United Kingdom

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- India

- Australia and New Zealand

- China

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East & Africa

Chapter 11 Competitive Landscape

- Global Analysis of Company Shares

- SWOT Analysis

Chapter 12 M&A and Funding Outlook

- M&A Analysis

- Fundings in Animal Healthcare

Chapter 13 Sustainability of the Animal Health Industry: An ESG Perspective

- Overview of ESG

- Key ESG Issues in the Animal Healthcare Industry

- Animal Health Industry ESG Performance Analysis

Chapter 14 Company Profiles

- ARKO LABORATORIES

- AVIMEX

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- CEVA SANTE ANIMALE (CEVA)

- DECHRA PHARMACEUTICALS.

- ELANCO.

- MERCK & CO. INC.

- PHIBRO ANIMAL HEALTH CORP.

- VIRBAC

- ZOETIS SERVICES LLC.