|

市場調査レポート

商品コード

1735762

無人兵站・後方支援の世界市場(2025年~2035年)Global Unmanned Battlefield Logistics and Support Market 2025-2035 |

||||||

|

|||||||

| 無人兵站・後方支援の世界市場(2025年~2035年) |

|

出版日: 2025年05月29日

発行: Aviation & Defense Market Reports (A&D)

ページ情報: 英文 150+ Pages

納期: 3営業日

|

全表示

- 概要

- 図表

- 目次

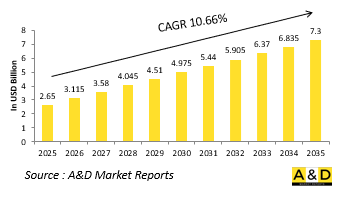

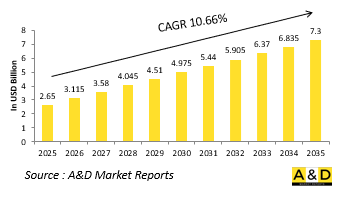

世界の無人兵站・後方支援の市場規模は、2025年に推定26億5,000万米ドルであり、2035年までに73億米ドルに達すると予測され、予測期間の2025年~2035年にCAGRで10.66%の成長が見込まれます。

無人兵站・後方支援市場における技術の影響

技術革新は、現代の作戦地帯における兵站・後方支援機能の実行方法を根本的に変えつつあります。無人陸上機や無人航空機は現在、先進の自律性で動作し、AIを使用して地形を航行し、障害物を回避し、配送ルートの優先順位をリアルタイムで決定します。強化されたオンボードセンサーと適応航行アルゴリズムにより、これらのプラットフォームは環境の変化や戦場の脅威に動的に対応することができます。バッテリーと燃料電池の進歩により運用範囲が拡大し、人間の介入を必要としない長時間の作戦が可能になっています。さらに、モジュラーペイロードシステムにより、無人プラットフォームは負傷者の避難から燃料補給作戦まで、多様な作戦に向け迅速に再構成することができます。通信技術も重要な役割を果たし、無人システムと司令部のセキュアな暗号化された連携を可能にします。兵站管理ソフトウェアとの統合は、リアルタイムの在庫追跡と予測的な補給を保証し、無駄を省いて運用効率を向上させます。さらに、スウォームや輸送隊を調整する技術により、無人システムのグループが協調して動作することが可能になり、人間の護衛を必要とせずに配送の数量と速度が向上します。こうした技術革新の積み重ねが、今日の戦場の複雑性と不安定さに対応した、より機敏で効率的かつ残存可能な兵站インフラの実現につながっています。技術の成熟が進むにつれて、その影響は戦略的部隊の実現要因として無人後方支援をさらに強固なものにするとみられます。

無人兵站・後方支援市場の主な促進要因

防衛部門における無人兵站・後方支援システムに対する需要の高まりは、作戦上の必要性、技術的実現可能性、戦略的変革の組み合わせによるものです。現代の戦争は、従来の補給路が常に脅威にさらされている環境で展開されることが多く、有人補給作戦のリスクが高まります。無人システムは、人員を危険な場所から排除することでこのリスクを軽減しながら、兵站のスループットを維持、あるいは向上させます。また、機動性の高い分散した部隊を支援しなければならないという圧力も、目まぐるしく変化する状況に適応できる柔軟な兵站ソリューションへの関心を高めています。同時に、ネットワーク化されたデータ主導の軍事作戦への移行により、デジタル指揮系統にシームレスに統合できるシステムが重視されています。非対称的な脅威やハイブリッド戦の台頭は、紛争状況下でも独立して活動できる自律ソリューションの必要性をさらに強く示しています。無人プラットフォームは、長期的には費用対効果の高い選択肢となることが多く、大規模な人員の必要性を減らし、メンテナンスのオーバーヘッドを削減することができます。さらに、特に制圧された環境や劣化した環境において、作戦の継続性を追求するためには、自律性が重要な利点となります。これらの要因により、軍事組織はスピード、信頼性、残存可能性を重視し、将来対応可能な兵力構造の中核的要素として、無人兵站に多額の投資を行うようになりつつあります。

地域の無人兵站・後方支援市場の動向

無人兵站・後方支援技術の採用は地域によって異なり、地域の紛争力学、防衛上の優先順位、産業能力によって形成されます。北米、特に米国の軍事計画では、無人兵站を共同作戦や将来の部隊設計に統合することに強い焦点が当てられています。こうした取り組みには、従来の作戦と遠征作戦の双方に合わせた自律輸送隊システム、貨物ドローン、ロボット補給車が含まれます。欧州諸国もこの分野で前進しており、特に過酷な環境下での迅速な展開と持続可能性を必要とする作戦では、多国間の枠組みにおけるモジュール性と相互運用性を優先することが多いです。アジア太平洋では、地域の緊張が高まり、群島や山岳地帯で迅速な対応が必要となっているため、アクセスが困難な地域に適した機敏な無人補給プラットフォームへの投資が進んでいます。

当レポートでは、世界の無人兵站・後方支援市場について調査分析し、成長促進要因、今後10年間の見通し、各地域の動向などの情報を提供しています。

目次

無人兵站・後方支援市場レポートの定義

無人兵站・後方支援市場のセグメンテーション

タイプ別

地域別

サイズ別

今後10年間の無人兵站・後方支援市場の分析

無人兵站・後方支援市場の技術

世界の無人兵站・後方支援市場の予測

地域の無人兵站・後方支援市場の動向と予測

北米

促進要因、抑制要因、課題

PEST

市場予測とシナリオ分析

主要企業

サプライヤーのTierの情勢

企業ベンチマーク

欧州

中東

アジア太平洋

南米

無人兵站・後方支援市場の分析:国別

米国

防衛プログラム

最新ニュース

特許

この市場における現在の技術成熟度

市場予測とシナリオ分析

カナダ

イタリア

フランス

ドイツ

オランダ

ベルギー

スペイン

スウェーデン

ギリシャ

オーストラリア

南アフリカ

インド

中国

ロシア

韓国

日本

マレーシア

シンガポール

ブラジル

無人兵站・後方支援市場の機会マトリクス

無人兵站・後方支援市場レポートに関する専門家の意見

結論

Aviation and Defense Market Reportsについて

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Size, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Size, 2025-2035

List of Figures

- Figure 1: Global Unmanned Battlefield Logistics and Support Market Forecast, 2025-2035

- Figure 2: Global Unmanned Battlefield Logistics and Support Market Forecast, By Region, 2025-2035

- Figure 3: Global Unmanned Battlefield Logistics and Support Market Forecast, By Type, 2025-2035

- Figure 4: Global Unmanned Battlefield Logistics and Support Market Forecast, By Size, 2025-2035

- Figure 5: North America, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 6: Europe, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 8: APAC, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 9: South America, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 10: United States, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 11: United States, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 12: Canada, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 14: Italy, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 16: France, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 17: France, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 18: Germany, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 24: Spain, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 30: Australia, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 32: India, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 33: India, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 34: China, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 35: China, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 40: Japan, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Size (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Size (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Unmanned Battlefield Logistics and Support Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Unmanned Battlefield Logistics and Support Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Unmanned Battlefield Logistics and Support Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Unmanned Battlefield Logistics and Support Market, By Region, 2025-2035

- Figure 58: Scenario 1, Unmanned Battlefield Logistics and Support Market, By Type, 2025-2035

- Figure 59: Scenario 1, Unmanned Battlefield Logistics and Support Market, By Size, 2025-2035

- Figure 60: Scenario 2, Unmanned Battlefield Logistics and Support Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Unmanned Battlefield Logistics and Support Market, By Region, 2025-2035

- Figure 62: Scenario 2, Unmanned Battlefield Logistics and Support Market, By Type, 2025-2035

- Figure 63: Scenario 2, Unmanned Battlefield Logistics and Support Market, By Size, 2025-2035

- Figure 64: Company Benchmark, Unmanned Battlefield Logistics and Support Market, 2025-2035

The Global Unmanned Battlefield Logistics and Support market is estimated at USD 2.65 billion in 2025, projected to grow to USD 7.30 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 10.66% over the forecast period 2025-2035.

Introduction to Unmanned Battlefield Logistics and Support Market

Unmanned systems are reshaping the landscape of battlefield logistics and support by offering faster, safer, and more adaptive methods for sustaining combat operations. These systems are engineered to deliver critical supplies-such as ammunition, fuel, medical aid, and food-while minimizing risk to personnel. In unpredictable or high-threat environments, the ability to transport cargo autonomously or via remote control has become an invaluable asset for military planners. The role of unmanned logistics extends beyond simple transport; it encompasses maintenance, evacuation, infrastructure repair, and real-time resupply, all with the objective of increasing operational resilience and mobility. Ground vehicles, aerial drones, and hybrid systems are being employed in tandem to create a responsive supply network that keeps pace with rapidly shifting front lines. These capabilities are especially vital in dispersed and contested terrains, where traditional supply routes are often compromised. The global defense community is increasingly integrating these systems into standard operations, valuing their capacity to operate around the clock without fatigue or delay. As conflict dynamics evolve, the reliance on unmanned logistics and support systems is expected to grow, transforming how militaries sustain combat effectiveness and ensure continuity of operations under pressure, without exposing human operators to unnecessary harm.

Technology Impact in Unmanned Battlefield Logistics and Support Market:

Technological innovation is fundamentally altering how logistics and support functions are executed in modern combat zones. Unmanned ground and aerial vehicles now operate with advanced autonomy, using artificial intelligence to navigate terrain, avoid obstacles, and prioritize delivery routes in real-time. Enhanced onboard sensors and adaptive navigation algorithms allow these platforms to respond dynamically to environmental changes and battlefield threats. Battery and fuel cell advancements are extending operational ranges, enabling longer missions without the need for human intervention. In addition, modular payload systems allow unmanned platforms to be rapidly reconfigured for diverse missions, from casualty evacuation to refueling operations. Communication technology also plays a crucial role, enabling secure, encrypted coordination between unmanned systems and command centers-even in contested or GPS-denied environments. Integration with logistics management software ensures real-time inventory tracking and predictive resupply, reducing waste and improving operational efficiency. Furthermore, swarm and convoy coordination technologies enable groups of unmanned systems to operate collaboratively, increasing the volume and speed of deliveries without requiring human escorts. The cumulative effect of these innovations is a more agile, efficient, and survivable logistics infrastructure, tailored for the complexity and volatility of today's battlefield. As technologies continue to mature, their impact will further cement unmanned support as a strategic force enabler.

Key Drivers in Unmanned Battlefield Logistics and Support Market:

The growing demand for unmanned logistics and support systems in defense is driven by a combination of operational necessity, technological feasibility, and strategic transformation. Modern warfare often unfolds in environments where traditional supply routes are under constant threat, making manned resupply missions increasingly risky. Unmanned systems reduce this risk by removing personnel from harm's way while maintaining or even enhancing logistical throughput. The pressure to support highly mobile and dispersed units also drives interest in flexible logistics solutions that can adapt to fast-changing conditions. At the same time, the shift toward networked and data-driven military operations places a premium on systems that can integrate seamlessly into digital command structures. The rise of asymmetric threats and hybrid warfare has further highlighted the need for autonomous solutions capable of operating independently under contested conditions. Budget considerations also factor in-unmanned platforms often present cost-effective alternatives over the long term, reducing the need for extensive personnel and lowering maintenance overhead. Additionally, the pursuit of operational continuity, especially in denied or degraded environments, makes autonomy a critical advantage. Together, these factors are pushing military organizations to invest heavily in unmanned logistics as a core component of future-ready force structures, emphasizing speed, reliability, and survivability.

Regional Trends in Unmanned Battlefield Logistics and Support Market:

Adoption of unmanned logistics and support technologies varies by region, shaped by local conflict dynamics, defense priorities, and industrial capabilities. In North America, especially within U.S. military programs, there is a strong focus on integrating unmanned logistics into joint operations and future force design. These efforts include autonomous convoy systems, cargo drones, and robotic supply vehicles tailored for both conventional and expeditionary missions. European nations are also advancing in this domain, often prioritizing modularity and interoperability within multinational frameworks, particularly for missions requiring rapid deployment and sustainability in austere environments. In the Asia-Pacific, rising regional tensions and the need for rapid response across archipelagic and mountainous terrain have driven investment in agile, unmanned resupply platforms suited for difficult-to-access areas. Middle Eastern countries are adopting these technologies for base support, border security logistics, and remote surveillance outposts, often blending imported systems with indigenous innovation. In Latin America and Africa, interest in unmanned logistics is growing, particularly for humanitarian missions, disaster response, and peacekeeping operations, where efficiency and personnel safety are vital. Across all regions, the trend is clear: unmanned logistics and support are transitioning from experimental to operational assets, driven by the shared need to enhance resilience, mobility, and force protection on increasingly complex battlefields.

Key Unmanned Battlefield Logistics and Support Program:

Germany has supplied 30 Gereon RCS unmanned ground vehicles (UGVs) to Ukraine as part of its ongoing military support, aiming to reduce troop exposure in combat environments. This delivery is part of a broader package that includes reconnaissance drones, munitions, and other military equipment. Funded by the German government, the UGVs are expected to be delivered in full by the end of the year. Developed by ARX Robotics, the Gereon RCS is a tracked robotic platform designed for roles such as logistics support, casualty evacuation, and reconnaissance. It can carry payloads of up to 500 kg and operate over distances of up to 40 kilometers. The Gereon RCS is part of ARX Robotics' modular system family, which also includes the Gereon ATR-a light armored target carrier used in training-and the Gereon 3, a versatile platform capable of carrying drones or sensors.

Table of Contents

Unmanned Battlefield Logistics and Support Market Report Definition

Unmanned Battlefield Logistics and Support Market Segmentation

By Type

By Region

By Size

Unmanned Battlefield Logistics and Support Market Analysis for next 10 Years

The 10-year unmanned battlefield logistics and support market analysis would give a detailed overview of unmanned battlefield logistics and support market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Unmanned Battlefield Logistics and Support Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Unmanned Battlefield Logistics and Support Market Forecast

The 10-year unmanned battlefield logistics and support market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Unmanned Battlefield Logistics and Support Market Trends & Forecast

The regional unmanned battlefield logistics and support market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Unmanned Battlefield Logistics and Support Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Unmanned Battlefield Logistics and Support Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Unmanned Battlefield Logistics and Support Market Report

Hear from our experts their opinion of the possible analysis for this market.