|

|

市場調査レポート

商品コード

1365697

中古タイヤ市場:タイプ別、デザイン別、車種別:世界の機会分析と産業予測、2023~2032年Second Hand Tire Market By Type (Tube Tire, Tubeless Tire), By Design (Radial, Bias), By Vehicle Type (Two Wheelers, Passenger Cars, Commercial Vehicles, Others): Global Opportunity Analysis and Industry Forecast, 2023-2032 |

||||||

|

|||||||

| 中古タイヤ市場:タイプ別、デザイン別、車種別:世界の機会分析と産業予測、2023~2032年 |

|

出版日: 2023年07月01日

発行: Allied Market Research

ページ情報: 英文 193 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

中古タイヤ市場の2018年の市場規模は81億米ドルで、2023年から2032年までのCAGRは4%で成長し、2032年には125億米ドルに達すると推定されます。

中古タイヤとは、他の自動車に再び使用するために比較的安価で販売される中古タイヤのことです。これらのタイヤは、各国の政府によって規定されたトレッド深さを下回らないです。中古タイヤは、乗用車、商用車、二輪車、産業用車両など、一般的なすべての車両に使用可能です。

人口の増加は、世界の自動車セクターの成長、特に発展途上国の成長に役立っています。発展途上国の様々な車両所有者にとって、車両のタイヤを交換することは高価なことであるため、中古タイヤを選択します。さらに、中古タイヤは自動車修理工場やタイヤ小売店で容易に入手できます。Emanuel Tire、Liberty Tire Recycling、ASM Auto Recycling Ltd.などの多くの企業が、中古タイヤをバルト販売や小売販売用に提供しています。

しかし、中古タイヤが適切に検査されていない場合、装着されている車両だけでなく、道路上の他の交通にも安全上の懸念が生じる可能性があります。これが中古タイヤ市場の大きな抑制要因となっています。さらに、環境保護に関する庶民の意識の高まりや、使用可能なタイヤの再利用を含む持続可能な素材への需要は、中古タイヤ市場の成長に有利な機会を提供すると予想されます。

さらに、石油・ガス価格は、主にウクライナ・ロシア戦争に起因するインフレの上昇により、世界的に変動が大きくなっています。このため、輸送コストが上昇し、最終的にエンドユーザー向けの中古タイヤ価格が上昇しています。

中古タイヤ市場は、タイプ、デザイン、車種、地域によって区分されます。タイプ別では、市場はチューブ入り中古タイヤとチューブレス中古タイヤに分けられます。デザインによって、市場はラジアルタイヤとバイアス中古タイヤに分類されます。車種別では、二輪車、乗用車、商用車、その他を対象としています。また、市場は北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカを含む地域に分けられ、世界中で分析されています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 市場概要

- 市場の定義と範囲

- 主な調査結果

- 影響要因

- 主な投資機会

- ポーターのファイブフォース分析

- 市場力学

- 促進要因

- 自動車台数の増加

- 中古タイヤの利点

- 中古タイヤの入手容易性

- 抑制要因

- 中古タイヤに関連する安全性の問題、政府の厳しい規制

- 機会

- 持続可能性への注目の高まり

- 促進要因

- COVID-19市場への影響分析

第4章 中古タイヤ市場:タイプ別

- 概要

- チューブタイヤ

- チューブレスタイヤ

第5章 中古タイヤ市場:デザイン別

- 概要

- ラジアル

- バイアス

第6章 中古タイヤ市場:車種別

- 概要

- 二輪車

- 乗用車

- 商用車

- その他

第7章 中古タイヤ市場:地域別

- 概要

- 北米

- 米国

- カナダ

- メキシコ

- ポルト・リコ

- ドミニカ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- オランダ

- ベルギー

- トルコ

- その他

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- パキスタン

- その他のアジア

- ASEAN

- オーストラリア

- ニュージーランド

- アフリカ

- 南アフリカ

- エジプト

- チュニジア

- アルジェリア

- モロッコ

- リビア

- その他のアフリカ

- 中東

- サウジアラビア

- オマーン

- バーレーン

- カタール

- その他中東

- ラテンアメリカ

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他のラテンアメリカ

第8章 競争情勢

- イントロダクション

- 主要成功戦略

- 主要10社の製品マッピング

- 競合ダッシュボード

- 競合ヒートマップ

- 主要企業のポジショニング、2018年

第9章 企業プロファイル

- 2nd Time Around Tires

- Allgemeine Gummiwertstoff und Reifenhandels GmbH

- ASM Auto Recycling Ltd.

- BURD Automobile

- Emanuel Tire

- German Used Tires Co.

- JBees Tires

- Liberty Tire Recycling

- Turak Tyres

- Tire Hunt

LIST OF TABLES

- TABLE 01. GLOBAL SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 02. GLOBAL SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 03. SECOND HAND TIRE MARKET FOR TUBE TIRE, BY REGION, 2018-2032 ($MILLION)

- TABLE 04. SECOND HAND TIRE MARKET FOR TUBE TIRE, BY REGION, 2018-2032 (METRIC TON)

- TABLE 05. SECOND HAND TIRE MARKET FOR TUBELESS TIRE, BY REGION, 2018-2032 ($MILLION)

- TABLE 06. SECOND HAND TIRE MARKET FOR TUBELESS TIRE, BY REGION, 2018-2032 (METRIC TON)

- TABLE 07. GLOBAL SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

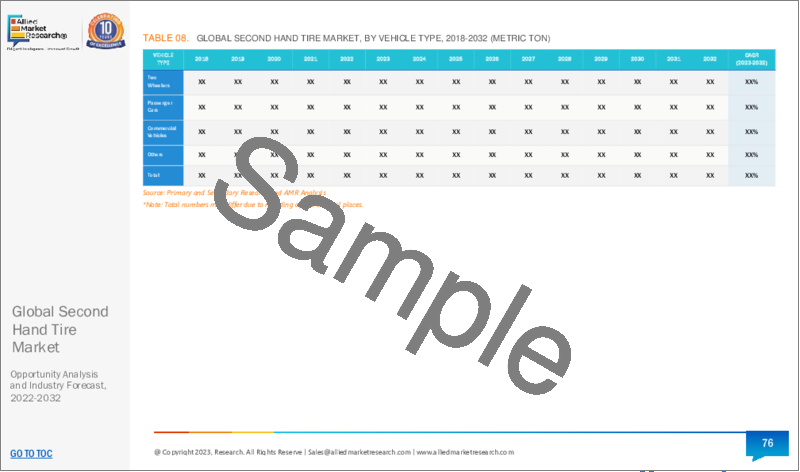

- TABLE 08. GLOBAL SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 09. SECOND HAND TIRE MARKET FOR RADIAL, BY REGION, 2018-2032 ($MILLION)

- TABLE 10. SECOND HAND TIRE MARKET FOR RADIAL, BY REGION, 2018-2032 (METRIC TON)

- TABLE 11. SECOND HAND TIRE MARKET FOR BIAS, BY REGION, 2018-2032 ($MILLION)

- TABLE 12. SECOND HAND TIRE MARKET FOR BIAS, BY REGION, 2018-2032 (METRIC TON)

- TABLE 13. GLOBAL SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 14. GLOBAL SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 15. SECOND HAND TIRE MARKET FOR TWO WHEELERS, BY REGION, 2018-2032 ($MILLION)

- TABLE 16. SECOND HAND TIRE MARKET FOR TWO WHEELERS, BY REGION, 2018-2032 (METRIC TON)

- TABLE 17. SECOND HAND TIRE MARKET FOR PASSENGER CARS, BY REGION, 2018-2032 ($MILLION)

- TABLE 18. SECOND HAND TIRE MARKET FOR PASSENGER CARS, BY REGION, 2018-2032 (METRIC TON)

- TABLE 19. SECOND HAND TIRE MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2018-2032 ($MILLION)

- TABLE 20. SECOND HAND TIRE MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2018-2032 (METRIC TON)

- TABLE 21. SECOND HAND TIRE MARKET FOR OTHERS, BY REGION, 2018-2032 ($MILLION)

- TABLE 22. SECOND HAND TIRE MARKET FOR OTHERS, BY REGION, 2018-2032 (METRIC TON)

- TABLE 23. SECOND HAND TIRE MARKET, BY REGION, 2018-2032 ($MILLION)

- TABLE 24. SECOND HAND TIRE MARKET, BY REGION, 2018-2032 (METRIC TON)

- TABLE 25. NORTH AMERICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 26. NORTH AMERICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 27. NORTH AMERICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 28. NORTH AMERICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 29. NORTH AMERICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 30. NORTH AMERICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 31. NORTH AMERICA SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 ($MILLION)

- TABLE 32. NORTH AMERICA SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 (METRIC TON)

- TABLE 33. U.S. SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 34. U.S. SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 35. U.S. SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 36. U.S. SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 37. U.S. SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 38. U.S. SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 39. CANADA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 40. CANADA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 41. CANADA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 42. CANADA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 43. CANADA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 44. CANADA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 45. MEXICO SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 46. MEXICO SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 47. MEXICO SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 48. MEXICO SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 49. MEXICO SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 50. MEXICO SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 51. PORTO RICO SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 52. PORTO RICO SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 53. PORTO RICO SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 54. PORTO RICO SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 55. PORTO RICO SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 56. PORTO RICO SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 57. DOMINICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 58. DOMINICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 59. DOMINICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 60. DOMINICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 61. DOMINICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 62. DOMINICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 63. EUROPE SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 64. EUROPE SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 65. EUROPE SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 66. EUROPE SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 67. EUROPE SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 68. EUROPE SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 69. EUROPE SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 ($MILLION)

- TABLE 70. EUROPE SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 (METRIC TON)

- TABLE 71. GERMANY SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 72. GERMANY SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 73. GERMANY SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 74. GERMANY SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 75. GERMANY SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 76. GERMANY SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 77. FRANCE SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 78. FRANCE SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 79. FRANCE SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 80. FRANCE SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 81. FRANCE SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 82. FRANCE SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 83. UK SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 84. UK SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 85. UK SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 86. UK SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 87. UK SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 88. UK SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 89. ITALY SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 90. ITALY SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 91. ITALY SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 92. ITALY SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 93. ITALY SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 94. ITALY SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 95. SPAIN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 96. SPAIN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 97. SPAIN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 98. SPAIN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 99. SPAIN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 100. SPAIN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 101. NETHERLANDS SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 102. NETHERLANDS SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 103. NETHERLANDS SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 104. NETHERLANDS SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 105. NETHERLANDS SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 106. NETHERLANDS SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 107. BELGIUM SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 108. BELGIUM SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 109. BELGIUM SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 110. BELGIUM SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 111. BELGIUM SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 112. BELGIUM SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 113. TURKEY SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 114. TURKEY SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 115. TURKEY SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 116. TURKEY SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 117. TURKEY SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 118. TURKEY SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 119. REST OF EUROPE SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 120. REST OF EUROPE SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 121. REST OF EUROPE SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 122. REST OF EUROPE SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 123. REST OF EUROPE SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 124. REST OF EUROPE SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 125. ASIA-PACIFIC SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 126. ASIA-PACIFIC SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 127. ASIA-PACIFIC SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 128. ASIA-PACIFIC SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 129. ASIA-PACIFIC SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 130. ASIA-PACIFIC SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 131. ASIA-PACIFIC SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 ($MILLION)

- TABLE 132. ASIA-PACIFIC SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 (METRIC TON)

- TABLE 133. CHINA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 134. CHINA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 135. CHINA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 136. CHINA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 137. CHINA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 138. CHINA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 139. INDIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 140. INDIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 141. INDIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 142. INDIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 143. INDIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 144. INDIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 145. JAPAN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 146. JAPAN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 147. JAPAN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 148. JAPAN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 149. JAPAN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 150. JAPAN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 151. SOUTH KOREA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 152. SOUTH KOREA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 153. SOUTH KOREA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 154. SOUTH KOREA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 155. SOUTH KOREA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 156. SOUTH KOREA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 157. MALAYSIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 158. MALAYSIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 159. MALAYSIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 160. MALAYSIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 161. MALAYSIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 162. MALAYSIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 163. PAKISTAN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 164. PAKISTAN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 165. PAKISTAN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 166. PAKISTAN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 167. PAKISTAN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 168. PAKISTAN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 169. REST OF ASIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 170. REST OF ASIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 171. REST OF ASIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 172. REST OF ASIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 173. REST OF ASIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 174. REST OF ASIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 175. ASEAN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 176. ASEAN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 177. ASEAN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 178. ASEAN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 179. ASEAN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 180. ASEAN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 181. ASEAN SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 ($MILLION)

- TABLE 182. ASEAN SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 (METRIC TON)

- TABLE 183. AUSTRALIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 184. AUSTRALIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 185. AUSTRALIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 186. AUSTRALIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 187. AUSTRALIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 188. AUSTRALIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 189. NEW ZEALAND SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 190. NEW ZEALAND SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 191. NEW ZEALAND SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 192. NEW ZEALAND SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 193. NEW ZEALAND SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 194. NEW ZEALAND SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 195. AFRICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 196. AFRICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 197. AFRICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 198. AFRICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 199. AFRICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 200. AFRICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 201. AFRICA SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 ($MILLION)

- TABLE 202. AFRICA SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 (METRIC TON)

- TABLE 203. SOUTH AFRICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 204. SOUTH AFRICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 205. SOUTH AFRICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 206. SOUTH AFRICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 207. SOUTH AFRICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 208. SOUTH AFRICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 209. EGYPT SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 210. EGYPT SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 211. EGYPT SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 212. EGYPT SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 213. EGYPT SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 214. EGYPT SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 215. TUNISIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 216. TUNISIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 217. TUNISIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 218. TUNISIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 219. TUNISIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 220. TUNISIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 221. ALGERIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 222. ALGERIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 223. ALGERIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 224. ALGERIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 225. ALGERIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 226. ALGERIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 227. MORROCCO SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 228. MORROCCO SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 229. MORROCCO SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 230. MORROCCO SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 231. MORROCCO SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 232. MORROCCO SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 233. LIBYA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 234. LIBYA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 235. LIBYA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 236. LIBYA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 237. LIBYA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 238. LIBYA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 239. REST OF AFRICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 240. REST OF AFRICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 241. REST OF AFRICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 242. REST OF AFRICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 243. REST OF AFRICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 244. REST OF AFRICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 245. MIDDLE EAST SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 246. MIDDLE EAST SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 247. MIDDLE EAST SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 248. MIDDLE EAST SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 249. MIDDLE EAST SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 250. MIDDLE EAST SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 251. MIDDLE EAST SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 ($MILLION)

- TABLE 252. MIDDLE EAST SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 (METRIC TON)

- TABLE 253. SAUDI ARABIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 254. SAUDI ARABIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 255. SAUDI ARABIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 256. SAUDI ARABIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 257. SAUDI ARABIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 258. SAUDI ARABIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 259. OMAN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 260. OMAN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 261. OMAN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 262. OMAN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 263. OMAN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 264. OMAN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 265. BAHRAIN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 266. BAHRAIN SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 267. BAHRAIN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 268. BAHRAIN SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 269. BAHRAIN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 270. BAHRAIN SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 271. QATAR SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 272. QATAR SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 273. QATAR SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 274. QATAR SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 275. QATAR SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 276. QATAR SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 277. REST OF MIDDLE EAST SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 278. REST OF MIDDLE EAST SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 279. REST OF MIDDLE EAST SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 280. REST OF MIDDLE EAST SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 281. REST OF MIDDLE EAST SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 282. REST OF MIDDLE EAST SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 283. LATIN AMERICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 284. LATIN AMERICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 285. LATIN AMERICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 286. LATIN AMERICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 287. LATIN AMERICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 288. LATIN AMERICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 289. LATIN AMERICA SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 ($MILLION)

- TABLE 290. LATIN AMERICA SECOND HAND TIRE MARKET, BY COUNTRY, 2018-2032 (METRIC TON)

- TABLE 291. BRAZIL SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 292. BRAZIL SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 293. BRAZIL SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 294. BRAZIL SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 295. BRAZIL SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 296. BRAZIL SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 297. ARGENTINA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 298. ARGENTINA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 299. ARGENTINA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 300. ARGENTINA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 301. ARGENTINA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 302. ARGENTINA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 303. COLOMBIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 304. COLOMBIA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 305. COLOMBIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 306. COLOMBIA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 307. COLOMBIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 308. COLOMBIA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 309. CHILE SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 310. CHILE SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 311. CHILE SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 312. CHILE SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 313. CHILE SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 314. CHILE SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 315. PERU SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 316. PERU SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 317. PERU SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 318. PERU SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 319. PERU SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 320. PERU SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 321. REST OF LATIN AMERICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 ($MILLION)

- TABLE 322. REST OF LATIN AMERICA SECOND HAND TIRE MARKET, BY TYPE, 2018-2032 (METRIC TON)

- TABLE 323. REST OF LATIN AMERICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 ($MILLION)

- TABLE 324. REST OF LATIN AMERICA SECOND HAND TIRE MARKET, BY DESIGN, 2018-2032 (METRIC TON)

- TABLE 325. REST OF LATIN AMERICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 ($MILLION)

- TABLE 326. REST OF LATIN AMERICA SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018-2032 (METRIC TON)

- TABLE 327. 2ND TIME AROUND TIRES: KEY EXECUTIVES

- TABLE 328. 2ND TIME AROUND TIRES: COMPANY SNAPSHOT

- TABLE 329. 2ND TIME AROUND TIRES: PRODUCT SEGMENTS

- TABLE 330. 2ND TIME AROUND TIRES: PRODUCT PORTFOLIO

- TABLE 331. ALLGEMEINE GUMMIWERTSTOFF UND REIFENHANDELS GMBH: KEY EXECUTIVES

- TABLE 332. ALLGEMEINE GUMMIWERTSTOFF UND REIFENHANDELS GMBH: COMPANY SNAPSHOT

- TABLE 333. ALLGEMEINE GUMMIWERTSTOFF UND REIFENHANDELS GMBH: PRODUCT SEGMENTS

- TABLE 334. ALLGEMEINE GUMMIWERTSTOFF UND REIFENHANDELS GMBH: PRODUCT PORTFOLIO

- TABLE 335. ASM AUTO RECYCLING LTD.: KEY EXECUTIVES

- TABLE 336. ASM AUTO RECYCLING LTD.: COMPANY SNAPSHOT

- TABLE 337. ASM AUTO RECYCLING LTD.: PRODUCT SEGMENTS

- TABLE 338. ASM AUTO RECYCLING LTD.: PRODUCT PORTFOLIO

- TABLE 339. BURD AUTOMOBILE: KEY EXECUTIVES

- TABLE 340. BURD AUTOMOBILE: COMPANY SNAPSHOT

- TABLE 341. BURD AUTOMOBILE: PRODUCT SEGMENTS

- TABLE 342. BURD AUTOMOBILE: PRODUCT PORTFOLIO

- TABLE 343. EMANUEL TIRE: KEY EXECUTIVES

- TABLE 344. EMANUEL TIRE: COMPANY SNAPSHOT

- TABLE 345. EMANUEL TIRE: PRODUCT SEGMENTS

- TABLE 346. EMANUEL TIRE: PRODUCT PORTFOLIO

- TABLE 347. GERMAN USED TIRES CO.: KEY EXECUTIVES

- TABLE 348. GERMAN USED TIRES CO.: COMPANY SNAPSHOT

- TABLE 349. GERMAN USED TIRES CO.: PRODUCT SEGMENTS

- TABLE 350. GERMAN USED TIRES CO.: PRODUCT PORTFOLIO

- TABLE 351. JBEES TIRES: KEY EXECUTIVES

- TABLE 352. JBEES TIRES: COMPANY SNAPSHOT

- TABLE 353. JBEES TIRES: PRODUCT SEGMENTS

- TABLE 354. JBEES TIRES: PRODUCT PORTFOLIO

- TABLE 355. LIBERTY TIRE RECYCLING: KEY EXECUTIVES

- TABLE 356. LIBERTY TIRE RECYCLING: COMPANY SNAPSHOT

- TABLE 357. LIBERTY TIRE RECYCLING: PRODUCT SEGMENTS

- TABLE 358. LIBERTY TIRE RECYCLING: PRODUCT PORTFOLIO

- TABLE 359. TURAK TYRES: KEY EXECUTIVES

- TABLE 360. TURAK TYRES: COMPANY SNAPSHOT

- TABLE 361. TURAK TYRES: PRODUCT SEGMENTS

- TABLE 362. TURAK TYRES: PRODUCT PORTFOLIO

- TABLE 363. TIRE HUNT: KEY EXECUTIVES

- TABLE 364. TIRE HUNT: COMPANY SNAPSHOT

- TABLE 365. TIRE HUNT: PRODUCT SEGMENTS

- TABLE 366. TIRE HUNT: PRODUCT PORTFOLIO

LIST OF FIGURES

- FIGURE 01. SECOND HAND TIRE MARKET, 2018-2032

- FIGURE 02. SEGMENTATION OF SECOND HAND TIRE MARKET, 2018-2032

- FIGURE 03. SECOND HAND TIRE MARKET,2018-2032

- FIGURE 04. TOP INVESTMENT POCKETS IN SECOND HAND TIRE MARKET (2023-2032)

- FIGURE 05. LOW BARGAINING POWER OF SUPPLIERS

- FIGURE 06. LOW THREAT OF NEW ENTRANTS

- FIGURE 07. LOW THREAT OF SUBSTITUTES

- FIGURE 08. LOW INTENSITY OF RIVALRY

- FIGURE 09. LOW BARGAINING POWER OF BUYERS

- FIGURE 10. GLOBAL SECOND HAND TIRE MARKET:DRIVERS, RESTRAINTS AND OPPORTUNITIES

- FIGURE 11. SECOND HAND TIRE MARKET, BY TYPE, 2018(%)

- FIGURE 12. COMPARATIVE SHARE ANALYSIS OF SECOND HAND TIRE MARKET FOR TUBE TIRE, BY COUNTRY 2018 AND 2032(%)

- FIGURE 13. COMPARATIVE SHARE ANALYSIS OF SECOND HAND TIRE MARKET FOR TUBELESS TIRE, BY COUNTRY 2018 AND 2032(%)

- FIGURE 14. SECOND HAND TIRE MARKET, BY DESIGN, 2018(%)

- FIGURE 15. COMPARATIVE SHARE ANALYSIS OF SECOND HAND TIRE MARKET FOR RADIAL, BY COUNTRY 2018 AND 2032(%)

- FIGURE 16. COMPARATIVE SHARE ANALYSIS OF SECOND HAND TIRE MARKET FOR BIAS, BY COUNTRY 2018 AND 2032(%)

- FIGURE 17. SECOND HAND TIRE MARKET, BY VEHICLE TYPE, 2018(%)

- FIGURE 18. COMPARATIVE SHARE ANALYSIS OF SECOND HAND TIRE MARKET FOR TWO WHEELERS, BY COUNTRY 2018 AND 2032(%)

- FIGURE 19. COMPARATIVE SHARE ANALYSIS OF SECOND HAND TIRE MARKET FOR PASSENGER CARS, BY COUNTRY 2018 AND 2032(%)

- FIGURE 20. COMPARATIVE SHARE ANALYSIS OF SECOND HAND TIRE MARKET FOR COMMERCIAL VEHICLES, BY COUNTRY 2018 AND 2032(%)

- FIGURE 21. COMPARATIVE SHARE ANALYSIS OF SECOND HAND TIRE MARKET FOR OTHERS, BY COUNTRY 2018 AND 2032(%)

- FIGURE 22. SECOND HAND TIRE MARKET BY REGION, 2018(%)

- FIGURE 23. U.S. SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 24. CANADA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 25. MEXICO SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 26. PORTO RICO SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 27. DOMINICA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 28. GERMANY SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 29. FRANCE SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 30. UK SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 31. ITALY SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 32. SPAIN SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 33. NETHERLANDS SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 34. BELGIUM SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 35. TURKEY SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 36. REST OF EUROPE SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 37. CHINA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 38. INDIA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 39. JAPAN SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 40. SOUTH KOREA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 41. MALAYSIA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 42. PAKISTAN SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 43. REST OF ASIA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 44. AUSTRALIA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 45. NEW ZEALAND SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 46. SOUTH AFRICA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 47. EGYPT SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 48. TUNISIA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 49. ALGERIA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 50. MORROCCO SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 51. LIBYA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 52. REST OF AFRICA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 53. SAUDI ARABIA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 54. OMAN SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 55. BAHRAIN SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 56. QATAR SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 57. REST OF MIDDLE EAST SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 58. BRAZIL SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 59. ARGENTINA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 60. COLOMBIA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 61. CHILE SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 62. PERU SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 63. REST OF LATIN AMERICA SECOND HAND TIRE MARKET, 2018-2032 ($MILLION)

- FIGURE 64. TOP WINNING STRATEGIES, BY YEAR

- FIGURE 65. TOP WINNING STRATEGIES, BY DEVELOPMENT

- FIGURE 66. TOP WINNING STRATEGIES, BY COMPANY

- FIGURE 67. PRODUCT MAPPING OF TOP 10 PLAYERS

- FIGURE 68. COMPETITIVE DASHBOARD

- FIGURE 69. COMPETITIVE HEATMAP: SECOND HAND TIRE MARKET

- FIGURE 70. TOP PLAYER POSITIONING, 2018

According to a new report published by Allied Market Research, titled, "Second Hand Tire Market," The second hand tire market was valued at $8.1 billion in 2018, and is estimated to reach $12.5 billion by 2032, growing at a CAGR of 4% from 2023 to 2032. Second hand tires are used tires that are sold at a relatively lower cost to be used again in other vehicles. These tires still have a tread depth not less than the limits stipulated by the governments in different countries. Second hand tire are available for all common vehicles such as passenger cars, commercial vehicles, two-wheelers, and industrial vehicles.

Rise in population has been instrumental in the growth of the automotive sector globally, especially in developing nations. For various vehicle owners in developing nations, replacing the tires of their vehicles is an expensive affair, therefore, they opt for second hand tires. Moreover, second hand tires are readily available at the vehicle repair shops or with the tire retailers. Many companies such as Emanuel Tire, Liberty Tire Recycling, ASM Auto Recycling Ltd., and others offer second hand tires for bult sales and also retail sales.

However, if second hand tires are not properly inspected, there can be safety concerns for the vehicles in which they are installed as well as for other traffic on the road. This is a major restraining factor for the second hand tire market. Furthermore, increasing awareness among the common man regarding environmental protection and demand for sustainable materials, which also include the reuse of usable tires, are anticipated to provide lucrative opportunities for the growth of the second hand tire market.

Furthermore, the price of oil & gas is experiencing increased volatility globally, due to rise in inflation, mainly driven by Ukraine-Russia war. This has led to increased cost of shipping, eventually increasing the prices of second hand tires for end users.

The second hand tire market is segmented on the basis of type, design, vehicle type, and region. By type, the market is divided into tube and tubeless second hand tires. Depending upon design, the market is categorized into radial and bias second hand tires. The vehicle type considered in the report are two wheelers, passenger cars, commercial vehicles, and others. The market is also analyzed across the world, parted into regions including North America, Europe, Asia, Pacific, Latin America, the Middle East, and Africa.

Competition Analysis

Key companies profiled in the second hand tire market report include 2nd Time Around Tires, Allgemeine Gummiwertstoff und Reifenhandels GmbH, ASM Auto Recycling Ltd., BURD Automobile, Emanuel Tire, German Used Tires Co., JBees Tires, Liberty Tire Recycling, Tire Hut, and Turak Tyres. The major players are primarily involved in the export of second hand tires mostly from European and North American countries to countries in Latin America, Africa, and Asia-Pacific.

Key benefits for stakeholders

- The report provides an extensive analysis of the current and emerging second hand tire market trends, historic data, and volume data.

- In-depth second hand tire market analysis is conducted by constructing market estimations for key market segments between 2018 and 2032.

- Extensive analysis of the second hand tire market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The second hand tire market revenue and volume forecast analysis from 2023 to 2032 is included in the report, and 2022 is the base year.

- The key players within the second hand tire market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the second hand tire industry.

Additional benefits you will get with this purchase are:

- Quarterly Update and* (only available with a corporate license, on listed price)

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Five and Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 20% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Five and Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline talk to the sales executive to know more)

- Consumer Buying Behavior Analysis

- End user preferences and pain points

- Average Consumer Expenditure

- Consumer Preference and Product Specifications

- Distributor margin Analysis

- Additional company profiles with specific to client's interest

- Additional country or region analysis- market size and forecast

- Average Selling Price Analysis / Price Point Analysis

- Expanded list for Company Profiles

- Historic market data

- Import Export Analysis/Data

- Market share analysis of players at global/region/country level

- SWOT Analysis

- Volume Market Size and Forecast

Key Market Segments

By Type

- Tube Tire

- Tubeless Tire

By Design

- Radial

- Bias

By Vehicle Type

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Porto Rico

- Dominica

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Belgium

- Turkey

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Pakistan

- Rest Of Asia

- ASEAN

- Australia

- New Zealand

- Africa

- South Africa

- Egypt

- Tunisia

- Algeria

- Morrocco

- Libya

- Rest Of Africa

- Middle East

- Saudi Arabia

- Oman

- Bahrain

- Qatar

- Rest Of Middle East

- Latin America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Rest of Latin America

Key Market Players:

- 2nd Time Around Tires

- Allgemeine Gummiwertstoff und Reifenhandels GmbH

- ASM Auto Recycling Ltd.

- BURD Automobile

- Emanuel Tire

- German Used Tires Co.

- JBees Tires

- Liberty Tire Recycling

- Tire Hunt

- Turak Tyres

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report description

- 1.2. Key market segments

- 1.3. Key benefits to the stakeholders

- 1.4. Research Methodology

- 1.4.1. Primary research

- 1.4.2. Secondary research

- 1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

- 3.1. Market definition and scope

- 3.2. Key findings

- 3.2.1. Top impacting factors

- 3.2.2. Top investment pockets

- 3.3. Porter's five forces analysis

- 3.3.1. Low bargaining power of suppliers

- 3.3.2. Low threat of new entrants

- 3.3.3. Low threat of substitutes

- 3.3.4. Low intensity of rivalry

- 3.3.5. Low bargaining power of buyers

- 3.4. Market dynamics

- 3.4.1. Drivers

- 3.4.1.1. Growth in the number of automobiles

- 3.4.1.2. Advantages of second-hand tires

- 3.4.1.3. Ready availability of second-hand tires

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.2.1. Safety Issues Associated with the second-hand tires and strict government regulations

- 3.4.3. Opportunities

- 3.4.3.1. Rising focus on sustainability

- 3.5. COVID-19 Impact Analysis on the market

CHAPTER 4: SECOND HAND TIRE MARKET, BY TYPE

- 4.1. Overview

- 4.1.1. Market size and forecast

- 4.2. Tube Tire

- 4.2.1. Key market trends, growth factors and opportunities

- 4.2.2. Market size and forecast, by region

- 4.2.3. Market share analysis by country

- 4.3. Tubeless Tire

- 4.3.1. Key market trends, growth factors and opportunities

- 4.3.2. Market size and forecast, by region

- 4.3.3. Market share analysis by country

CHAPTER 5: SECOND HAND TIRE MARKET, BY DESIGN

- 5.1. Overview

- 5.1.1. Market size and forecast

- 5.2. Radial

- 5.2.1. Key market trends, growth factors and opportunities

- 5.2.2. Market size and forecast, by region

- 5.2.3. Market share analysis by country

- 5.3. Bias

- 5.3.1. Key market trends, growth factors and opportunities

- 5.3.2. Market size and forecast, by region

- 5.3.3. Market share analysis by country

CHAPTER 6: SECOND HAND TIRE MARKET, BY VEHICLE TYPE

- 6.1. Overview

- 6.1.1. Market size and forecast

- 6.2. Two Wheelers

- 6.2.1. Key market trends, growth factors and opportunities

- 6.2.2. Market size and forecast, by region

- 6.2.3. Market share analysis by country

- 6.3. Passenger Cars

- 6.3.1. Key market trends, growth factors and opportunities

- 6.3.2. Market size and forecast, by region

- 6.3.3. Market share analysis by country

- 6.4. Commercial Vehicles

- 6.4.1. Key market trends, growth factors and opportunities

- 6.4.2. Market size and forecast, by region

- 6.4.3. Market share analysis by country

- 6.5. Others

- 6.5.1. Key market trends, growth factors and opportunities

- 6.5.2. Market size and forecast, by region

- 6.5.3. Market share analysis by country

CHAPTER 7: SECOND HAND TIRE MARKET, BY REGION

- 7.1. Overview

- 7.1.1. Market size and forecast By Region

- 7.2. North America

- 7.2.1. Key trends and opportunities

- 7.2.2. Market size and forecast, by Type

- 7.2.3. Market size and forecast, by Design

- 7.2.4. Market size and forecast, by Vehicle Type

- 7.2.5. Market size and forecast, by country

- 7.2.5.1. U.S.

- 7.2.5.1.1. Key market trends, growth factors and opportunities

- 7.2.5.1.2. Market size and forecast, by Type

- 7.2.5.1.3. Market size and forecast, by Design

- 7.2.5.1.4. Market size and forecast, by Vehicle Type

- 7.2.5.2. Canada

- 7.2.5.2.1. Key market trends, growth factors and opportunities

- 7.2.5.2.2. Market size and forecast, by Type

- 7.2.5.2.3. Market size and forecast, by Design

- 7.2.5.2.4. Market size and forecast, by Vehicle Type

- 7.2.5.3. Mexico

- 7.2.5.3.1. Key market trends, growth factors and opportunities

- 7.2.5.3.2. Market size and forecast, by Type

- 7.2.5.3.3. Market size and forecast, by Design

- 7.2.5.3.4. Market size and forecast, by Vehicle Type

- 7.2.5.4. Porto Rico

- 7.2.5.4.1. Key market trends, growth factors and opportunities

- 7.2.5.4.2. Market size and forecast, by Type

- 7.2.5.4.3. Market size and forecast, by Design

- 7.2.5.4.4. Market size and forecast, by Vehicle Type

- 7.2.5.5. Dominica

- 7.2.5.5.1. Key market trends, growth factors and opportunities

- 7.2.5.5.2. Market size and forecast, by Type

- 7.2.5.5.3. Market size and forecast, by Design

- 7.2.5.5.4. Market size and forecast, by Vehicle Type

- 7.3. Europe

- 7.3.1. Key trends and opportunities

- 7.3.2. Market size and forecast, by Type

- 7.3.3. Market size and forecast, by Design

- 7.3.4. Market size and forecast, by Vehicle Type

- 7.3.5. Market size and forecast, by country

- 7.3.5.1. Germany

- 7.3.5.1.1. Key market trends, growth factors and opportunities

- 7.3.5.1.2. Market size and forecast, by Type

- 7.3.5.1.3. Market size and forecast, by Design

- 7.3.5.1.4. Market size and forecast, by Vehicle Type

- 7.3.5.2. France

- 7.3.5.2.1. Key market trends, growth factors and opportunities

- 7.3.5.2.2. Market size and forecast, by Type

- 7.3.5.2.3. Market size and forecast, by Design

- 7.3.5.2.4. Market size and forecast, by Vehicle Type

- 7.3.5.3. UK

- 7.3.5.3.1. Key market trends, growth factors and opportunities

- 7.3.5.3.2. Market size and forecast, by Type

- 7.3.5.3.3. Market size and forecast, by Design

- 7.3.5.3.4. Market size and forecast, by Vehicle Type

- 7.3.5.4. Italy

- 7.3.5.4.1. Key market trends, growth factors and opportunities

- 7.3.5.4.2. Market size and forecast, by Type

- 7.3.5.4.3. Market size and forecast, by Design

- 7.3.5.4.4. Market size and forecast, by Vehicle Type

- 7.3.5.5. Spain

- 7.3.5.5.1. Key market trends, growth factors and opportunities

- 7.3.5.5.2. Market size and forecast, by Type

- 7.3.5.5.3. Market size and forecast, by Design

- 7.3.5.5.4. Market size and forecast, by Vehicle Type

- 7.3.5.6. Netherlands

- 7.3.5.6.1. Key market trends, growth factors and opportunities

- 7.3.5.6.2. Market size and forecast, by Type

- 7.3.5.6.3. Market size and forecast, by Design

- 7.3.5.6.4. Market size and forecast, by Vehicle Type

- 7.3.5.7. Belgium

- 7.3.5.7.1. Key market trends, growth factors and opportunities

- 7.3.5.7.2. Market size and forecast, by Type

- 7.3.5.7.3. Market size and forecast, by Design

- 7.3.5.7.4. Market size and forecast, by Vehicle Type

- 7.3.5.8. Turkey

- 7.3.5.8.1. Key market trends, growth factors and opportunities

- 7.3.5.8.2. Market size and forecast, by Type

- 7.3.5.8.3. Market size and forecast, by Design

- 7.3.5.8.4. Market size and forecast, by Vehicle Type

- 7.3.5.9. Rest of Europe

- 7.3.5.9.1. Key market trends, growth factors and opportunities

- 7.3.5.9.2. Market size and forecast, by Type

- 7.3.5.9.3. Market size and forecast, by Design

- 7.3.5.9.4. Market size and forecast, by Vehicle Type

- 7.4. Asia-Pacific

- 7.4.1. Key trends and opportunities

- 7.4.2. Market size and forecast, by Type

- 7.4.3. Market size and forecast, by Design

- 7.4.4. Market size and forecast, by Vehicle Type

- 7.4.5. Market size and forecast, by country

- 7.4.5.1. China

- 7.4.5.1.1. Key market trends, growth factors and opportunities

- 7.4.5.1.2. Market size and forecast, by Type

- 7.4.5.1.3. Market size and forecast, by Design

- 7.4.5.1.4. Market size and forecast, by Vehicle Type

- 7.4.5.2. India

- 7.4.5.2.1. Key market trends, growth factors and opportunities

- 7.4.5.2.2. Market size and forecast, by Type

- 7.4.5.2.3. Market size and forecast, by Design

- 7.4.5.2.4. Market size and forecast, by Vehicle Type

- 7.4.5.3. Japan

- 7.4.5.3.1. Key market trends, growth factors and opportunities

- 7.4.5.3.2. Market size and forecast, by Type

- 7.4.5.3.3. Market size and forecast, by Design

- 7.4.5.3.4. Market size and forecast, by Vehicle Type

- 7.4.5.4. South Korea

- 7.4.5.4.1. Key market trends, growth factors and opportunities

- 7.4.5.4.2. Market size and forecast, by Type

- 7.4.5.4.3. Market size and forecast, by Design

- 7.4.5.4.4. Market size and forecast, by Vehicle Type

- 7.4.5.5. Malaysia

- 7.4.5.5.1. Key market trends, growth factors and opportunities

- 7.4.5.5.2. Market size and forecast, by Type

- 7.4.5.5.3. Market size and forecast, by Design

- 7.4.5.5.4. Market size and forecast, by Vehicle Type

- 7.4.5.6. Pakistan

- 7.4.5.6.1. Key market trends, growth factors and opportunities

- 7.4.5.6.2. Market size and forecast, by Type

- 7.4.5.6.3. Market size and forecast, by Design

- 7.4.5.6.4. Market size and forecast, by Vehicle Type

- 7.4.5.7. Rest Of Asia

- 7.4.5.7.1. Key market trends, growth factors and opportunities

- 7.4.5.7.2. Market size and forecast, by Type

- 7.4.5.7.3. Market size and forecast, by Design

- 7.4.5.7.4. Market size and forecast, by Vehicle Type

- 7.5. ASEAN

- 7.5.1. Key trends and opportunities

- 7.5.2. Market size and forecast, by Type

- 7.5.3. Market size and forecast, by Design

- 7.5.4. Market size and forecast, by Vehicle Type

- 7.5.5. Market size and forecast, by country

- 7.5.5.1. Australia

- 7.5.5.1.1. Key market trends, growth factors and opportunities

- 7.5.5.1.2. Market size and forecast, by Type

- 7.5.5.1.3. Market size and forecast, by Design

- 7.5.5.1.4. Market size and forecast, by Vehicle Type

- 7.5.5.2. New Zealand

- 7.5.5.2.1. Key market trends, growth factors and opportunities

- 7.5.5.2.2. Market size and forecast, by Type

- 7.5.5.2.3. Market size and forecast, by Design

- 7.5.5.2.4. Market size and forecast, by Vehicle Type

- 7.6. Africa

- 7.6.1. Key trends and opportunities

- 7.6.2. Market size and forecast, by Type

- 7.6.3. Market size and forecast, by Design

- 7.6.4. Market size and forecast, by Vehicle Type

- 7.6.5. Market size and forecast, by country

- 7.6.5.1. South Africa

- 7.6.5.1.1. Key market trends, growth factors and opportunities

- 7.6.5.1.2. Market size and forecast, by Type

- 7.6.5.1.3. Market size and forecast, by Design

- 7.6.5.1.4. Market size and forecast, by Vehicle Type

- 7.6.5.2. Egypt

- 7.6.5.2.1. Key market trends, growth factors and opportunities

- 7.6.5.2.2. Market size and forecast, by Type

- 7.6.5.2.3. Market size and forecast, by Design

- 7.6.5.2.4. Market size and forecast, by Vehicle Type

- 7.6.5.3. Tunisia

- 7.6.5.3.1. Key market trends, growth factors and opportunities

- 7.6.5.3.2. Market size and forecast, by Type

- 7.6.5.3.3. Market size and forecast, by Design

- 7.6.5.3.4. Market size and forecast, by Vehicle Type

- 7.6.5.4. Algeria

- 7.6.5.4.1. Key market trends, growth factors and opportunities

- 7.6.5.4.2. Market size and forecast, by Type

- 7.6.5.4.3. Market size and forecast, by Design

- 7.6.5.4.4. Market size and forecast, by Vehicle Type

- 7.6.5.5. Morrocco

- 7.6.5.5.1. Key market trends, growth factors and opportunities

- 7.6.5.5.2. Market size and forecast, by Type

- 7.6.5.5.3. Market size and forecast, by Design

- 7.6.5.5.4. Market size and forecast, by Vehicle Type

- 7.6.5.6. Libya

- 7.6.5.6.1. Key market trends, growth factors and opportunities

- 7.6.5.6.2. Market size and forecast, by Type

- 7.6.5.6.3. Market size and forecast, by Design

- 7.6.5.6.4. Market size and forecast, by Vehicle Type

- 7.6.5.7. Rest Of Africa

- 7.6.5.7.1. Key market trends, growth factors and opportunities

- 7.6.5.7.2. Market size and forecast, by Type

- 7.6.5.7.3. Market size and forecast, by Design

- 7.6.5.7.4. Market size and forecast, by Vehicle Type

- 7.7. Middle East

- 7.7.1. Key trends and opportunities

- 7.7.2. Market size and forecast, by Type

- 7.7.3. Market size and forecast, by Design

- 7.7.4. Market size and forecast, by Vehicle Type

- 7.7.5. Market size and forecast, by country

- 7.7.5.1. Saudi Arabia

- 7.7.5.1.1. Key market trends, growth factors and opportunities

- 7.7.5.1.2. Market size and forecast, by Type

- 7.7.5.1.3. Market size and forecast, by Design

- 7.7.5.1.4. Market size and forecast, by Vehicle Type

- 7.7.5.2. Oman

- 7.7.5.2.1. Key market trends, growth factors and opportunities

- 7.7.5.2.2. Market size and forecast, by Type

- 7.7.5.2.3. Market size and forecast, by Design

- 7.7.5.2.4. Market size and forecast, by Vehicle Type

- 7.7.5.3. Bahrain

- 7.7.5.3.1. Key market trends, growth factors and opportunities

- 7.7.5.3.2. Market size and forecast, by Type

- 7.7.5.3.3. Market size and forecast, by Design

- 7.7.5.3.4. Market size and forecast, by Vehicle Type

- 7.7.5.4. Qatar

- 7.7.5.4.1. Key market trends, growth factors and opportunities

- 7.7.5.4.2. Market size and forecast, by Type

- 7.7.5.4.3. Market size and forecast, by Design

- 7.7.5.4.4. Market size and forecast, by Vehicle Type

- 7.7.5.5. Rest Of Middle East

- 7.7.5.5.1. Key market trends, growth factors and opportunities

- 7.7.5.5.2. Market size and forecast, by Type

- 7.7.5.5.3. Market size and forecast, by Design

- 7.7.5.5.4. Market size and forecast, by Vehicle Type

- 7.8. Latin America

- 7.8.1. Key trends and opportunities

- 7.8.2. Market size and forecast, by Type

- 7.8.3. Market size and forecast, by Design

- 7.8.4. Market size and forecast, by Vehicle Type

- 7.8.5. Market size and forecast, by country

- 7.8.5.1. Brazil

- 7.8.5.1.1. Key market trends, growth factors and opportunities

- 7.8.5.1.2. Market size and forecast, by Type

- 7.8.5.1.3. Market size and forecast, by Design

- 7.8.5.1.4. Market size and forecast, by Vehicle Type

- 7.8.5.2. Argentina

- 7.8.5.2.1. Key market trends, growth factors and opportunities

- 7.8.5.2.2. Market size and forecast, by Type

- 7.8.5.2.3. Market size and forecast, by Design

- 7.8.5.2.4. Market size and forecast, by Vehicle Type

- 7.8.5.3. Colombia

- 7.8.5.3.1. Key market trends, growth factors and opportunities

- 7.8.5.3.2. Market size and forecast, by Type

- 7.8.5.3.3. Market size and forecast, by Design

- 7.8.5.3.4. Market size and forecast, by Vehicle Type

- 7.8.5.4. Chile

- 7.8.5.4.1. Key market trends, growth factors and opportunities

- 7.8.5.4.2. Market size and forecast, by Type

- 7.8.5.4.3. Market size and forecast, by Design

- 7.8.5.4.4. Market size and forecast, by Vehicle Type

- 7.8.5.5. Peru

- 7.8.5.5.1. Key market trends, growth factors and opportunities

- 7.8.5.5.2. Market size and forecast, by Type

- 7.8.5.5.3. Market size and forecast, by Design

- 7.8.5.5.4. Market size and forecast, by Vehicle Type

- 7.8.5.6. Rest of Latin America

- 7.8.5.6.1. Key market trends, growth factors and opportunities

- 7.8.5.6.2. Market size and forecast, by Type

- 7.8.5.6.3. Market size and forecast, by Design

- 7.8.5.6.4. Market size and forecast, by Vehicle Type

CHAPTER 8: COMPETITIVE LANDSCAPE

- 8.1. Introduction

- 8.2. Top winning strategies

- 8.3. Product Mapping of Top 10 Player

- 8.4. Competitive Dashboard

- 8.5. Competitive Heatmap

- 8.6. Top player positioning, 2018

CHAPTER 9: COMPANY PROFILES

- 9.1. 2nd Time Around Tires

- 9.1.1. Company overview

- 9.1.2. Key Executives

- 9.1.3. Company snapshot

- 9.1.4. Operating business segments

- 9.1.5. Product portfolio

- 9.2. Allgemeine Gummiwertstoff und Reifenhandels GmbH

- 9.2.1. Company overview

- 9.2.2. Key Executives

- 9.2.3. Company snapshot

- 9.2.4. Operating business segments

- 9.2.5. Product portfolio

- 9.3. ASM Auto Recycling Ltd.

- 9.3.1. Company overview

- 9.3.2. Key Executives

- 9.3.3. Company snapshot

- 9.3.4. Operating business segments

- 9.3.5. Product portfolio

- 9.4. BURD Automobile

- 9.4.1. Company overview

- 9.4.2. Key Executives

- 9.4.3. Company snapshot

- 9.4.4. Operating business segments

- 9.4.5. Product portfolio

- 9.5. Emanuel Tire

- 9.5.1. Company overview

- 9.5.2. Key Executives

- 9.5.3. Company snapshot

- 9.5.4. Operating business segments

- 9.5.5. Product portfolio

- 9.6. German Used Tires Co.

- 9.6.1. Company overview

- 9.6.2. Key Executives

- 9.6.3. Company snapshot

- 9.6.4. Operating business segments

- 9.6.5. Product portfolio

- 9.7. JBees Tires

- 9.7.1. Company overview

- 9.7.2. Key Executives

- 9.7.3. Company snapshot

- 9.7.4. Operating business segments

- 9.7.5. Product portfolio

- 9.8. Liberty Tire Recycling

- 9.8.1. Company overview

- 9.8.2. Key Executives

- 9.8.3. Company snapshot

- 9.8.4. Operating business segments

- 9.8.5. Product portfolio

- 9.9. Turak Tyres

- 9.9.1. Company overview

- 9.9.2. Key Executives

- 9.9.3. Company snapshot

- 9.9.4. Operating business segments

- 9.9.5. Product portfolio

- 9.10. Tire Hunt

- 9.10.1. Company overview

- 9.10.2. Key Executives

- 9.10.3. Company snapshot

- 9.10.4. Operating business segments

- 9.10.5. Product portfolio