|

|

市場調査レポート

商品コード

1365613

鉄道保守用機械市場:製品タイプ別、用途別、販売タイプ別:世界の機会分析と産業予測、2023~2032年Railway Maintenance Machinery Market By Product Type, By Application, By Sales Type : Global Opportunity Analysis and Industry Forecast, 2023-2032 |

||||||

|

|||||||

| 鉄道保守用機械市場:製品タイプ別、用途別、販売タイプ別:世界の機会分析と産業予測、2023~2032年 |

|

出版日: 2023年07月01日

発行: Allied Market Research

ページ情報: 英文 230 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

Allied Market Researchの最新レポート「鉄道保守用機械市場」によると、鉄道保守用機械市場は2021年に40億米ドルと評価され、2023年から2032年にかけてCAGR 5.5%で成長し、2032年には72億米ドルに達すると推定されています。

鉄道保守用機械とは、鉄道の安全かつ効率的な運行を確保するために設計された専用機器を指します。鉄道インフラの維持、修理、改善に使用されるさまざまなツールや車両が含まれます。これらの機械は、線路の状態を維持し、ダウンタイムを減らし、全体的な運行パフォーマンスを向上させる上で重要な役割を果たしています。これらの機械は通常、軌道検査、バラスト分配、タンピング、溶接、植生管理などの作業を処理するために装備されています。

世界の鉄道電化プロジェクトの増加が、鉄道保守用機械市場の成長を後押ししています。電気式列車は燃料式列車に比べて環境に優しいです。そのため、鉄道保守サービスの需要が伸びています。さらに、各国政府は鉄道線路の運行維持のためにハイブリッドタンピングマシンを承認しています。例えば、2022年12月、米国運輸省(米ドルOT)は、同国の都市間旅客鉄道網のアップグレードと拡大のため、約23億米ドルを拠出しました。北米では、特に人口密集地や交通量の多い回廊がある地域で、高速鉄道プロジェクトへの関心が高まっています。

鉄道保守業務におけるモノのインターネット(IoT)やクラウドベースのシステム採用の増加は、拡大性、高速性、継続的サポート、ITセキュリティサービスなどの特徴によるもので、鉄道保守用機械市場の成長を促進すると予想されます。しかし、鉄道保守用機械に関連する高コストが市場開拓の妨げになると予想されます。逆に、鉄道保守用機械における技術統合は、市場成長に有利な機会を提供すると予想されます。

さらに、ウクライナ・ロシア戦争を主因とするインフレの高まりにより、石油・ガス価格や原材料価格は世界中で変動が激しくなっています。このため、鉄道保守用機械市場とその関連産業の成長ペースは鈍化しています。

鉄道保守用機械市場は、製品タイプ、用途、販売タイプ、地域によって区分されます。製品タイプ別では、タンピングマシン、スタビライジングマシン、レールハンドリングマシン、バラストクリーニングマシン、カテナリーメンテナンスマシン、その他に分類されます。さらに用途別では、バラスト軌道と非バラスト軌道に分類されます。販売タイプによって、市場は新規販売とアフターマーケット販売に二分されます。地域別では、北米(米国、カナダ、メキシコ)、欧州(ドイツ、フランス、イタリア、英国、その他の欧州地域)、アジア太平洋(中国、インド、日本、韓国、その他のアジア太平洋)、ラテンアメリカ(中南米、中東・アフリカ)で分析されます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 市場概要

- 市場の定義と範囲

- 主な調査結果

- 影響要因

- 主な投資機会

- ポーターのファイブフォース分析

- 市場力学

- 促進要因

- 鉄道プロジェクト建設に対する政府支出の増加

- 鉄道電化プロジェクトの急増

- 鉄道保守用機械に関連するメリット

- 抑制要因

- 発展途上諸国における熟練スタッフの不足と償還不足。

- 機械の高コスト

- 機会

- 技術革新

- 促進要因

- COVID-19市場への影響分析

第4章 鉄道保守用機械市場:製品タイプ別

- 概要

- タンピング機械

- 安定化機械

- レールハンドリング機械

- バラスト清掃機

- カテナリー保守機

- その他

第5章 鉄道保守用機械市場:用途別

- 概要

- バラスト軌道

- 非バラスト軌道

第6章 鉄道保守用機械市場:販売タイプ別

- 概要

- 新規販売

- アフターマーケット販売

第7章 鉄道保守用機械市場:地域別

- 概要

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカ

- 中東

- アフリカ

第8章 競合情勢

- イントロダクション

- 主要成功戦略

- 主要10社の製品マッピング

- 競合ダッシュボード

- 競合ヒートマップ

- 主要企業のポジショニング(2021年)

第9章 企業プロファイル

- CRRC Corporation Limited

- System7 Rail Holding GmbH

- Harsco Corporation

- MER MEC S.p.A.

- Geatech Group s.r.l.

- Plasser & Theurer

- Sinara Transport Machines Holding

- Fluor Corporation(American Equipment Company)

- Loram Maintenance of Way, Inc.

- China Railway Construction Corporation Limited(CRCC High-Tech Equipment Co. Ltd)

LIST OF TABLES

- TABLE 01. GLOBAL RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 02. RAILWAY MAINTENANCE MACHINERY MARKET FOR TAMPING MACHINE, BY REGION, 2021-2032 ($MILLION)

- TABLE 03. RAILWAY MAINTENANCE MACHINERY MARKET FOR STABILIZING MACHINERY, BY REGION, 2021-2032 ($MILLION)

- TABLE 04. RAILWAY MAINTENANCE MACHINERY MARKET FOR RAIL HANDLING MACHINERY, BY REGION, 2021-2032 ($MILLION)

- TABLE 05. RAILWAY MAINTENANCE MACHINERY MARKET FOR BALLAST CLEANING MACHINE, BY REGION, 2021-2032 ($MILLION)

- TABLE 06. RAILWAY MAINTENANCE MACHINERY MARKET FOR CATENARY MAINTENANCE MACHINE, BY REGION, 2021-2032 ($MILLION)

- TABLE 07. RAILWAY MAINTENANCE MACHINERY MARKET FOR OTHERS, BY REGION, 2021-2032 ($MILLION)

- TABLE 08. GLOBAL RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 09. RAILWAY MAINTENANCE MACHINERY MARKET FOR BALLAST TRACK, BY REGION, 2021-2032 ($MILLION)

- TABLE 10. RAILWAY MAINTENANCE MACHINERY MARKET FOR NON-BALLAST TRACK, BY REGION, 2021-2032 ($MILLION)

- TABLE 11. GLOBAL RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 12. RAILWAY MAINTENANCE MACHINERY MARKET FOR NEW SALES, BY REGION, 2021-2032 ($MILLION)

- TABLE 13. RAILWAY MAINTENANCE MACHINERY MARKET FOR AFTERMARKET SALES, BY REGION, 2021-2032 ($MILLION)

- TABLE 14. RAILWAY MAINTENANCE MACHINERY MARKET, BY REGION, 2021-2032 ($MILLION)

- TABLE 15. NORTH AMERICA RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 16. NORTH AMERICA RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 17. NORTH AMERICA RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 18. NORTH AMERICA RAILWAY MAINTENANCE MACHINERY MARKET, BY COUNTRY, 2021-2032 ($MILLION)

- TABLE 19. U.S. RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 20. U.S. RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 21. U.S. RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 22. CANADA RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 23. CANADA RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 24. CANADA RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 25. MEXICO RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 26. MEXICO RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 27. MEXICO RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 28. EUROPE RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 29. EUROPE RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 30. EUROPE RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 31. EUROPE RAILWAY MAINTENANCE MACHINERY MARKET, BY COUNTRY, 2021-2032 ($MILLION)

- TABLE 32. GERMANY RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 33. GERMANY RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 34. GERMANY RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 35. UK RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 36. UK RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 37. UK RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 38. FRANCE RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 39. FRANCE RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 40. FRANCE RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 41. ITALY RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 42. ITALY RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 43. ITALY RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 44. REST OF EUROPE RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 45. REST OF EUROPE RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 46. REST OF EUROPE RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 47. ASIA-PACIFIC RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 48. ASIA-PACIFIC RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 49. ASIA-PACIFIC RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 50. ASIA-PACIFIC RAILWAY MAINTENANCE MACHINERY MARKET, BY COUNTRY, 2021-2032 ($MILLION)

- TABLE 51. CHINA RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 52. CHINA RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 53. CHINA RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 54. JAPAN RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 55. JAPAN RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 56. JAPAN RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 57. INDIA RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 58. INDIA RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 59. INDIA RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 60. SOUTH KOREA RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 61. SOUTH KOREA RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 62. SOUTH KOREA RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 63. REST OF ASIA-PACIFIC RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 64. REST OF ASIA-PACIFIC RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 65. REST OF ASIA-PACIFIC RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 66. LAMEA RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 67. LAMEA RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 68. LAMEA RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 69. LAMEA RAILWAY MAINTENANCE MACHINERY MARKET, BY COUNTRY, 2021-2032 ($MILLION)

- TABLE 70. LATIN AMERICA RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 71. LATIN AMERICA RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 72. LATIN AMERICA RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 73. MIDDLE EAST RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 74. MIDDLE EAST RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 75. MIDDLE EAST RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 76. AFRICA RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021-2032 ($MILLION)

- TABLE 77. AFRICA RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021-2032 ($MILLION)

- TABLE 78. AFRICA RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021-2032 ($MILLION)

- TABLE 79. CRRC CORPORATION LIMITED: KEY EXECUTIVES

- TABLE 80. CRRC CORPORATION LIMITED: COMPANY SNAPSHOT

- TABLE 81. CRRC CORPORATION LIMITED: PRODUCT SEGMENTS

- TABLE 82. CRRC CORPORATION LIMITED: PRODUCT PORTFOLIO

- TABLE 83. SYSTEM7 RAIL HOLDING GMBH: KEY EXECUTIVES

- TABLE 84. SYSTEM7 RAIL HOLDING GMBH: COMPANY SNAPSHOT

- TABLE 85. SYSTEM7 RAIL HOLDING GMBH: PRODUCT SEGMENTS

- TABLE 86. SYSTEM7 RAIL HOLDING GMBH: PRODUCT PORTFOLIO

- TABLE 87. SYSTEM7 RAIL HOLDING GMBH: KEY STRATERGIES

- TABLE 88. HARSCO CORPORATION: KEY EXECUTIVES

- TABLE 89. HARSCO CORPORATION: COMPANY SNAPSHOT

- TABLE 90. HARSCO CORPORATION: SERVICE SEGMENTS

- TABLE 91. HARSCO CORPORATION: PRODUCT PORTFOLIO

- TABLE 92. HARSCO CORPORATION: KEY STRATERGIES

- TABLE 93. MER MEC S.P.A.: KEY EXECUTIVES

- TABLE 94. MER MEC S.P.A.: COMPANY SNAPSHOT

- TABLE 95. MER MEC S.P.A.: PRODUCT SEGMENTS

- TABLE 96. MER MEC S.P.A.: PRODUCT PORTFOLIO

- TABLE 97. MER MEC S.P.A.: KEY STRATERGIES

- TABLE 98. GEATECH GROUP S.R.L.: KEY EXECUTIVES

- TABLE 99. GEATECH GROUP S.R.L.: COMPANY SNAPSHOT

- TABLE 100. GEATECH GROUP S.R.L.: PRODUCT SEGMENTS

- TABLE 101. GEATECH GROUP S.R.L.: PRODUCT PORTFOLIO

- TABLE 102. PLASSER & THEURER: KEY EXECUTIVES

- TABLE 103. PLASSER & THEURER: COMPANY SNAPSHOT

- TABLE 104. PLASSER & THEURER: PRODUCT SEGMENTS

- TABLE 105. PLASSER & THEURER: PRODUCT PORTFOLIO

- TABLE 106. SINARA TRANSPORT MACHINES HOLDING: KEY EXECUTIVES

- TABLE 107. SINARA TRANSPORT MACHINES HOLDING: COMPANY SNAPSHOT

- TABLE 108. SINARA TRANSPORT MACHINES HOLDING: PRODUCT SEGMENTS

- TABLE 109. SINARA TRANSPORT MACHINES HOLDING: PRODUCT PORTFOLIO

- TABLE 110. FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY): KEY EXECUTIVES

- TABLE 111. FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY): COMPANY SNAPSHOT

- TABLE 112. FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY): PRODUCT SEGMENTS

- TABLE 113. FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY): PRODUCT PORTFOLIO

- TABLE 114. FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY): KEY STRATERGIES

- TABLE 115. LORAM MAINTENANCE OF WAY, INC.: KEY EXECUTIVES

- TABLE 116. LORAM MAINTENANCE OF WAY, INC.: COMPANY SNAPSHOT

- TABLE 117. LORAM MAINTENANCE OF WAY, INC.: PRODUCT SEGMENTS

- TABLE 118. LORAM MAINTENANCE OF WAY, INC.: PRODUCT PORTFOLIO

- TABLE 119. LORAM MAINTENANCE OF WAY, INC.: KEY STRATERGIES

- TABLE 120. CHINA RAILWAY CONSTRUCTION CORPORATION LIMITED (CRCC HIGH- TECH EQUIPMENT CO. LTD): KEY EXECUTIVES

- TABLE 121. CHINA RAILWAY CONSTRUCTION CORPORATION LIMITED (CRCC HIGH- TECH EQUIPMENT CO. LTD): COMPANY SNAPSHOT

- TABLE 122. CHINA RAILWAY CONSTRUCTION CORPORATION LIMITED (CRCC HIGH- TECH EQUIPMENT CO. LTD): PRODUCT SEGMENTS

- TABLE 123. CHINA RAILWAY CONSTRUCTION CORPORATION LIMITED (CRCC HIGH- TECH EQUIPMENT CO. LTD): PRODUCT PORTFOLIO

LIST OF FIGURES

- FIGURE 01. RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032

- FIGURE 02. SEGMENTATION OF RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032

- FIGURE 03. RAILWAY MAINTENANCE MACHINERY MARKET,2021-2032

- FIGURE 04. TOP INVESTMENT POCKETS IN RAILWAY MAINTENANCE MACHINERY MARKET (2023-2032)

- FIGURE 05. LOW BARGAINING POWER OF SUPPLIERS

- FIGURE 06. LOW THREAT OF NEW ENTRANTS

- FIGURE 07. LOW THREAT OF SUBSTITUTES

- FIGURE 08. LOW INTENSITY OF RIVALRY

- FIGURE 09. LOW BARGAINING POWER OF BUYERS

- FIGURE 10. GLOBAL RAILWAY MAINTENANCE MACHINERY MARKET:DRIVERS, RESTRAINTS AND OPPORTUNITIES

- FIGURE 11. RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE, 2021(%)

- FIGURE 12. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR TAMPING MACHINE, BY COUNTRY 2021 AND 2032(%)

- FIGURE 13. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR STABILIZING MACHINERY, BY COUNTRY 2021 AND 2032(%)

- FIGURE 14. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR RAIL HANDLING MACHINERY, BY COUNTRY 2021 AND 2032(%)

- FIGURE 15. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR BALLAST CLEANING MACHINE, BY COUNTRY 2021 AND 2032(%)

- FIGURE 16. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR CATENARY MAINTENANCE MACHINE, BY COUNTRY 2021 AND 2032(%)

- FIGURE 17. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR OTHERS, BY COUNTRY 2021 AND 2032(%)

- FIGURE 18. RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION, 2021(%)

- FIGURE 19. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR BALLAST TRACK, BY COUNTRY 2021 AND 2032(%)

- FIGURE 20. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR NON-BALLAST TRACK, BY COUNTRY 2021 AND 2032(%)

- FIGURE 21. RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE, 2021(%)

- FIGURE 22. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR NEW SALES, BY COUNTRY 2021 AND 2032(%)

- FIGURE 23. COMPARATIVE SHARE ANALYSIS OF RAILWAY MAINTENANCE MACHINERY MARKET FOR AFTERMARKET SALES, BY COUNTRY 2021 AND 2032(%)

- FIGURE 24. RAILWAY MAINTENANCE MACHINERY MARKET BY REGION, 2021(%)

- FIGURE 25. U.S. RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 26. CANADA RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 27. MEXICO RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 28. GERMANY RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 29. UK RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 30. FRANCE RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 31. ITALY RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 32. REST OF EUROPE RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 33. CHINA RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 34. JAPAN RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 35. INDIA RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 36. SOUTH KOREA RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 37. REST OF ASIA-PACIFIC RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 38. LATIN AMERICA RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 39. MIDDLE EAST RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 40. AFRICA RAILWAY MAINTENANCE MACHINERY MARKET, 2021-2032 ($MILLION)

- FIGURE 41. TOP WINNING STRATEGIES, BY YEAR

- FIGURE 42. TOP WINNING STRATEGIES, BY DEVELOPMENT

- FIGURE 43. TOP WINNING STRATEGIES, BY COMPANY

- FIGURE 44. PRODUCT MAPPING OF TOP 10 PLAYERS

- FIGURE 45. COMPETITIVE DASHBOARD

- FIGURE 46. COMPETITIVE HEATMAP: RAILWAY MAINTENANCE MACHINERY MARKET

- FIGURE 47. TOP PLAYER POSITIONING, 2021

- FIGURE 48. CRRC CORPORATION LIMITED: NET SALES, 2020-2022 ($MILLION)

- FIGURE 49. CRRC CORPORATION LIMITED: RESEARCH & DEVELOPMENT EXPENDITURE, 2020-2022 ($MILLION)

- FIGURE 50. CRRC CORPORATION LIMITED: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 51. HARSCO CORPORATION: NET SALES, 2020-2022 ($MILLION)

- FIGURE 52. HARSCO CORPORATION: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 53. HARSCO CORPORATION: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 54. FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY): NET SALES, 2020-2022 ($MILLION)

- FIGURE 55. FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY): REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 56. FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY): REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 57. CHINA RAILWAY CONSTRUCTION CORPORATION LIMITED (CRCC HIGH- TECH EQUIPMENT CO. LTD): NET SALES, 2020-

- FIGURE 58. CHINA RAILWAY CONSTRUCTION CORPORATION LIMITED (CRCC HIGH- TECH EQUIPMENT CO. LTD): RESEARCH & DEVEL

- FIGURE 59. CHINA RAILWAY CONSTRUCTION CORPORATION LIMITED (CRCC HIGH- TECH EQUIPMENT CO. LTD): REVENUE SHARE BY

- FIGURE 60. CHINA RAILWAY CONSTRUCTION CORPORATION LIMITED (CRCC HIGH- TECH EQUIPMENT CO. LTD): REVENUE SHARE BY

According to a new report published by Allied Market Research, titled, "Railway Maintenance Machinery Market," The railway maintenance machinery market was valued at $4 billion in 2021, and is estimated to reach $7.2 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032. Railway maintenance machinery refers to specialized equipment designed to ensure the safe and efficient operation of railways. It encompasses a variety of tools and vehicles used for upkeep, repair, and improvement of rail infrastructure. These machines play a crucial role in maintaining track conditions, reducing downtime, and enhancing overall operational performance. They are typically equipped to handle tasks such as track inspection, ballast distribution, tamping, welding, and vegetation management.

Increase in number of railway electrification projects globally fuels the growth of the railway maintenance machinery market. Electric trains are more eco-friendly as compared to fuel-powered trains. Hence, this leads to growth in demand for the railway maintenance services. In addition, governments of different countries are approving hybrid tamping machines for maintaining operations of railway tracks. For instance, in December 2022, nearly $2.3 billion was made available by the U.S. Department of Transportation (USDOT) to upgrade and expand the country's intercity passenger rail network. There is a growing interest in high-speed rail projects in North America, particularly in regions with dense population centers and high traffic corridors.

Rise in adoption of internet of things (IoT) and cloud-based system in railway maintenance operations, owing to features such as scalability, high speed, continuous support, and IT security services, is expected to drive the growth of the railway maintenance machinery market. However, high costs associated with railway maintenance machinery are expected to hamper the development of the market. Conversely, technological integration in the railway maintenance machinery is anticipated to provide lucrative opportunities for the growth of the market.

Furthermore, due to rise in inflation mainly driven by Ukraine -Russia war, the price of oil & gas, as well the prices of raw materials are experiencing increased volatility across the world. This has led to slow paced growth of the railway maintenance machinery market and its related industries.

The railway maintenance machinery market is segmented on the basis of product type, application, sales type, and region. By product type, the market is categorized into tamping machine, stabilizing machinery, rail handling machinery, ballast cleaning machine, catenary maintenance machine and others. Furthermore, the application segment is further categorized into ballast track and non-ballast track. Depending upon the sales type, the market is bifurcated into new sales and aftermarket sales. Region wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, the UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competition Analysis

Competitive analysis and profiles of the major players in the railway maintenance machinery market are provided in the report. Major companies in the report include, System7 Rail Holding GmbH, MER MEC S.p.A, Fluor Corporation, Loram Maintenance of Way, Inc., Harsco Corporation, Geatech Group s.r.l., Plasser & Theurer, Sinara Transport Machines Holding, CRRC Corporation Limited, and China Railway Construction Corporation Limited.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the railway maintenance machinery market analysis from 2021 to 2032 to identify the prevailing railway maintenance machinery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the railway maintenance machinery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global railway maintenance machinery market trends, key players, market segments, application areas, and market growth strategies.

Additional benefits you will get with this purchase are:

- Quarterly Update and* (only available with a corporate license, on listed price)

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Five and Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 20% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Five and Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline talk to the sales executive to know more)

- Manufacturing Capacity

- Capital Investment breakdown

- End user preferences and pain points

- Industry life cycle assessment, by region

- Installed Base analysis

- Investment Opportunities

- Product Life Cycles

- Technology Trend Analysis

- Consumer Preference and Product Specifications

- Market share analysis of players by products/segments

- New Product Development/ Product Matrix of Key Players

- Pain Point Analysis

- Regulatory Guidelines

- Strategic Recommedations

- Additional company profiles with specific to client's interest

- Additional country or region analysis- market size and forecast

- Average Selling Price Analysis / Price Point Analysis

- Brands Share Analysis

- Criss-cross segment analysis- market size and forecast

- Expanded list for Company Profiles

- Historic market data

- Import Export Analysis/Data

- Key player details (including location, contact details, supplier/vendor network etc. in excel format)

- List of customers/consumers/raw material suppliers- value chain analysis

- Market share analysis of players at global/region/country level

- Per Capita Consumption Trends

- Product Consumption Analysis

- Reimbursement Scenario

- SWOT Analysis

- Volume Market Size and Forecast

Key Market Segments

By Product Type

- Tamping machine

- Stabilizing machinery

- Rail handling machinery

- Ballast cleaning machine

- Catenary Maintenance Machine

- Others

By Application

- Ballast track

- Non-ballast Track

By Sales Type

- New sales

- Aftermarket sales

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Market Players:

- China Railway Construction Corporation Limited (CRCC High- Tech Equipment Co. Ltd)

- CRRC Corporation Limited

- Fluor Corporation (American Equipment Company)

- Geatech Group s.r.l.

- Harsco Corporation

- Loram Maintenance of Way, Inc.

- MER MEC S.p.A.

- Plasser & Theurer

- Sinara Transport Machines Holding

- System7 Rail Holding GmbH

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report description

- 1.2. Key market segments

- 1.3. Key benefits to the stakeholders

- 1.4. Research Methodology

- 1.4.1. Primary research

- 1.4.2. Secondary research

- 1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

- 3.1. Market definition and scope

- 3.2. Key findings

- 3.2.1. Top impacting factors

- 3.2.2. Top investment pockets

- 3.3. Porter's five forces analysis

- 3.3.1. Low bargaining power of suppliers

- 3.3.2. Low threat of new entrants

- 3.3.3. Low threat of substitutes

- 3.3.4. Low intensity of rivalry

- 3.3.5. Low bargaining power of buyers

- 3.4. Market dynamics

- 3.4.1. Drivers

- 3.4.1.1. Increase in government spending on the construction of railway projects

- 3.4.1.2. Surge in the number of railway electrification projects

- 3.4.1.3. Benefits associated with railway maintenance machinery

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.2.1. Dearth of skilled staff and lack of reimbursement in developing countries

- 3.4.2.2. High cost of machine

- 3.4.3. Opportunities

- 3.4.3.1. Technological innovation

- 3.5. COVID-19 Impact Analysis on the market

CHAPTER 4: RAILWAY MAINTENANCE MACHINERY MARKET, BY PRODUCT TYPE

- 4.1. Overview

- 4.1.1. Market size and forecast

- 4.2. Tamping machine

- 4.2.1. Key market trends, growth factors and opportunities

- 4.2.2. Market size and forecast, by region

- 4.2.3. Market share analysis by country

- 4.3. Stabilizing machinery

- 4.3.1. Key market trends, growth factors and opportunities

- 4.3.2. Market size and forecast, by region

- 4.3.3. Market share analysis by country

- 4.4. Rail handling machinery

- 4.4.1. Key market trends, growth factors and opportunities

- 4.4.2. Market size and forecast, by region

- 4.4.3. Market share analysis by country

- 4.5. Ballast cleaning machine

- 4.5.1. Key market trends, growth factors and opportunities

- 4.5.2. Market size and forecast, by region

- 4.5.3. Market share analysis by country

- 4.6. Catenary Maintenance Machine

- 4.6.1. Key market trends, growth factors and opportunities

- 4.6.2. Market size and forecast, by region

- 4.6.3. Market share analysis by country

- 4.7. Others

- 4.7.1. Key market trends, growth factors and opportunities

- 4.7.2. Market size and forecast, by region

- 4.7.3. Market share analysis by country

CHAPTER 5: RAILWAY MAINTENANCE MACHINERY MARKET, BY APPLICATION

- 5.1. Overview

- 5.1.1. Market size and forecast

- 5.2. Ballast track

- 5.2.1. Key market trends, growth factors and opportunities

- 5.2.2. Market size and forecast, by region

- 5.2.3. Market share analysis by country

- 5.3. Non-ballast Track

- 5.3.1. Key market trends, growth factors and opportunities

- 5.3.2. Market size and forecast, by region

- 5.3.3. Market share analysis by country

CHAPTER 6: RAILWAY MAINTENANCE MACHINERY MARKET, BY SALES TYPE

- 6.1. Overview

- 6.1.1. Market size and forecast

- 6.2. New sales

- 6.2.1. Key market trends, growth factors and opportunities

- 6.2.2. Market size and forecast, by region

- 6.2.3. Market share analysis by country

- 6.3. Aftermarket sales

- 6.3.1. Key market trends, growth factors and opportunities

- 6.3.2. Market size and forecast, by region

- 6.3.3. Market share analysis by country

CHAPTER 7: RAILWAY MAINTENANCE MACHINERY MARKET, BY REGION

- 7.1. Overview

- 7.1.1. Market size and forecast By Region

- 7.2. North America

- 7.2.1. Key trends and opportunities

- 7.2.2. Market size and forecast, by Product Type

- 7.2.3. Market size and forecast, by Application

- 7.2.4. Market size and forecast, by Sales Type

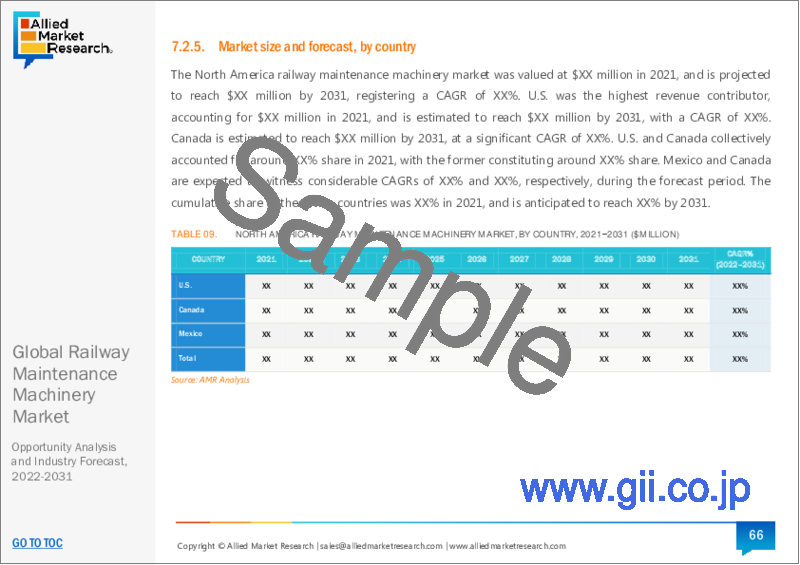

- 7.2.5. Market size and forecast, by country

- 7.2.5.1. U.S.

- 7.2.5.1.1. Key market trends, growth factors and opportunities

- 7.2.5.1.2. Market size and forecast, by Product Type

- 7.2.5.1.3. Market size and forecast, by Application

- 7.2.5.1.4. Market size and forecast, by Sales Type

- 7.2.5.2. Canada

- 7.2.5.2.1. Key market trends, growth factors and opportunities

- 7.2.5.2.2. Market size and forecast, by Product Type

- 7.2.5.2.3. Market size and forecast, by Application

- 7.2.5.2.4. Market size and forecast, by Sales Type

- 7.2.5.3. Mexico

- 7.2.5.3.1. Key market trends, growth factors and opportunities

- 7.2.5.3.2. Market size and forecast, by Product Type

- 7.2.5.3.3. Market size and forecast, by Application

- 7.2.5.3.4. Market size and forecast, by Sales Type

- 7.3. Europe

- 7.3.1. Key trends and opportunities

- 7.3.2. Market size and forecast, by Product Type

- 7.3.3. Market size and forecast, by Application

- 7.3.4. Market size and forecast, by Sales Type

- 7.3.5. Market size and forecast, by country

- 7.3.5.1. Germany

- 7.3.5.1.1. Key market trends, growth factors and opportunities

- 7.3.5.1.2. Market size and forecast, by Product Type

- 7.3.5.1.3. Market size and forecast, by Application

- 7.3.5.1.4. Market size and forecast, by Sales Type

- 7.3.5.2. UK

- 7.3.5.2.1. Key market trends, growth factors and opportunities

- 7.3.5.2.2. Market size and forecast, by Product Type

- 7.3.5.2.3. Market size and forecast, by Application

- 7.3.5.2.4. Market size and forecast, by Sales Type

- 7.3.5.3. France

- 7.3.5.3.1. Key market trends, growth factors and opportunities

- 7.3.5.3.2. Market size and forecast, by Product Type

- 7.3.5.3.3. Market size and forecast, by Application

- 7.3.5.3.4. Market size and forecast, by Sales Type

- 7.3.5.4. Italy

- 7.3.5.4.1. Key market trends, growth factors and opportunities

- 7.3.5.4.2. Market size and forecast, by Product Type

- 7.3.5.4.3. Market size and forecast, by Application

- 7.3.5.4.4. Market size and forecast, by Sales Type

- 7.3.5.5. Rest of Europe

- 7.3.5.5.1. Key market trends, growth factors and opportunities

- 7.3.5.5.2. Market size and forecast, by Product Type

- 7.3.5.5.3. Market size and forecast, by Application

- 7.3.5.5.4. Market size and forecast, by Sales Type

- 7.4. Asia-Pacific

- 7.4.1. Key trends and opportunities

- 7.4.2. Market size and forecast, by Product Type

- 7.4.3. Market size and forecast, by Application

- 7.4.4. Market size and forecast, by Sales Type

- 7.4.5. Market size and forecast, by country

- 7.4.5.1. China

- 7.4.5.1.1. Key market trends, growth factors and opportunities

- 7.4.5.1.2. Market size and forecast, by Product Type

- 7.4.5.1.3. Market size and forecast, by Application

- 7.4.5.1.4. Market size and forecast, by Sales Type

- 7.4.5.2. Japan

- 7.4.5.2.1. Key market trends, growth factors and opportunities

- 7.4.5.2.2. Market size and forecast, by Product Type

- 7.4.5.2.3. Market size and forecast, by Application

- 7.4.5.2.4. Market size and forecast, by Sales Type

- 7.4.5.3. India

- 7.4.5.3.1. Key market trends, growth factors and opportunities

- 7.4.5.3.2. Market size and forecast, by Product Type

- 7.4.5.3.3. Market size and forecast, by Application

- 7.4.5.3.4. Market size and forecast, by Sales Type

- 7.4.5.4. South Korea

- 7.4.5.4.1. Key market trends, growth factors and opportunities

- 7.4.5.4.2. Market size and forecast, by Product Type

- 7.4.5.4.3. Market size and forecast, by Application

- 7.4.5.4.4. Market size and forecast, by Sales Type

- 7.4.5.5. Rest of Asia-Pacific

- 7.4.5.5.1. Key market trends, growth factors and opportunities

- 7.4.5.5.2. Market size and forecast, by Product Type

- 7.4.5.5.3. Market size and forecast, by Application

- 7.4.5.5.4. Market size and forecast, by Sales Type

- 7.5. LAMEA

- 7.5.1. Key trends and opportunities

- 7.5.2. Market size and forecast, by Product Type

- 7.5.3. Market size and forecast, by Application

- 7.5.4. Market size and forecast, by Sales Type

- 7.5.5. Market size and forecast, by country

- 7.5.5.1. Latin America

- 7.5.5.1.1. Key market trends, growth factors and opportunities

- 7.5.5.1.2. Market size and forecast, by Product Type

- 7.5.5.1.3. Market size and forecast, by Application

- 7.5.5.1.4. Market size and forecast, by Sales Type

- 7.5.5.2. Middle East

- 7.5.5.2.1. Key market trends, growth factors and opportunities

- 7.5.5.2.2. Market size and forecast, by Product Type

- 7.5.5.2.3. Market size and forecast, by Application

- 7.5.5.2.4. Market size and forecast, by Sales Type

- 7.5.5.3. Africa

- 7.5.5.3.1. Key market trends, growth factors and opportunities

- 7.5.5.3.2. Market size and forecast, by Product Type

- 7.5.5.3.3. Market size and forecast, by Application

- 7.5.5.3.4. Market size and forecast, by Sales Type

CHAPTER 8: COMPETITIVE LANDSCAPE

- 8.1. Introduction

- 8.2. Top winning strategies

- 8.3. Product Mapping of Top 10 Player

- 8.4. Competitive Dashboard

- 8.5. Competitive Heatmap

- 8.6. Top player positioning, 2021

CHAPTER 9: COMPANY PROFILES

- 9.1. CRRC Corporation Limited

- 9.1.1. Company overview

- 9.1.2. Key Executives

- 9.1.3. Company snapshot

- 9.1.4. Operating business segments

- 9.1.5. Product portfolio

- 9.1.6. Business performance

- 9.2. System7 Rail Holding GmbH

- 9.2.1. Company overview

- 9.2.2. Key Executives

- 9.2.3. Company snapshot

- 9.2.4. Operating business segments

- 9.2.5. Product portfolio

- 9.2.6. Key strategic moves and developments

- 9.3. Harsco Corporation

- 9.3.1. Company overview

- 9.3.2. Key Executives

- 9.3.3. Company snapshot

- 9.3.4. Operating business segments

- 9.3.5. Product portfolio

- 9.3.6. Business performance

- 9.3.7. Key strategic moves and developments

- 9.4. MER MEC S.p.A.

- 9.4.1. Company overview

- 9.4.2. Key Executives

- 9.4.3. Company snapshot

- 9.4.4. Operating business segments

- 9.4.5. Product portfolio

- 9.4.6. Key strategic moves and developments

- 9.5. Geatech Group s.r.l.

- 9.5.1. Company overview

- 9.5.2. Key Executives

- 9.5.3. Company snapshot

- 9.5.4. Operating business segments

- 9.5.5. Product portfolio

- 9.6. Plasser & Theurer

- 9.6.1. Company overview

- 9.6.2. Key Executives

- 9.6.3. Company snapshot

- 9.6.4. Operating business segments

- 9.6.5. Product portfolio

- 9.7. Sinara Transport Machines Holding

- 9.7.1. Company overview

- 9.7.2. Key Executives

- 9.7.3. Company snapshot

- 9.7.4. Operating business segments

- 9.7.5. Product portfolio

- 9.8. Fluor Corporation (American Equipment Company)

- 9.8.1. Company overview

- 9.8.2. Key Executives

- 9.8.3. Company snapshot

- 9.8.4. Operating business segments

- 9.8.5. Product portfolio

- 9.8.6. Business performance

- 9.8.7. Key strategic moves and developments

- 9.9. Loram Maintenance of Way, Inc.

- 9.9.1. Company overview

- 9.9.2. Key Executives

- 9.9.3. Company snapshot

- 9.9.4. Operating business segments

- 9.9.5. Product portfolio

- 9.9.6. Key strategic moves and developments

- 9.10. China Railway Construction Corporation Limited (CRCC High- Tech Equipment Co. Ltd)

- 9.10.1. Company overview

- 9.10.2. Key Executives

- 9.10.3. Company snapshot

- 9.10.4. Operating business segments

- 9.10.5. Product portfolio

- 9.10.6. Business performance