|

|

市場調査レポート

商品コード

1388473

動物用サプリメント市場:成長、将来展望、競合分析、2023年~2031年Veterinary Supplements Market - Growth, Future Prospects and Competitive Analysis, 2023 - 2031 |

||||||

|

|||||||

| 動物用サプリメント市場:成長、将来展望、競合分析、2023年~2031年 |

|

出版日: 2023年10月20日

発行: Acute Market Reports

ページ情報: 英文 118 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

アニマルヘルスケアの重要な要素である動物用サプリメント市場は、2023年から2031年の予測期間中にCAGR 7%の伸びを予測しています。この市場は様々なタイプのサプリメントを含み、コンパニオンアニマルと家畜の両方に対応しています。この市場は、いくつかの促進要因と1つの重要な阻害要因の影響を受けています。動物用サプリメント市場は、2023年から2031年にかけて、様々なサプリメントの種類、動物の種類、地理的動向によって安定した成長を遂げます。規制上の課題が大きな阻害要因となっており、コンプライアンスと安全対策の必要性が強調されています。競合動向は、主要企業がこのダイナミックで進化する業界において、イノベーション、パートナーシップ、世界展開に引き続き注力することを示唆しています。

抗酸化物質が動物の健康を促進

抗酸化物質は2022年に動物用サプリメント市場の顕著な促進要因として浮上し、2023年から2031年までその重要性を維持すると予測されています。ビタミンCとE、セレン、コエンザイムQ10を含む抗酸化サプリメントは、動物の健康をサポートする上で重要な役割を果たしています。酸化ストレスと闘い、コンパニオンアニマルや家畜の慢性疾患のリスクを軽減するのに役立ちます。2022年における同分野の大幅な売上高は、動物の健康増進における抗酸化物質の利点に対するペットオーナーや家畜生産者の意識の高まりを反映しています。さらに、抗酸化物質セグメントは、動物の予防医療対策の採用増加により、予測期間中に最も高い年間平均成長率(CAGR)を示すと予測されています。

家畜栄養重視の高まり

2022年、畜産分野は動物用サプリメント市場で最も高い収益を獲得したが、この動向は2031年まで続くと予想されます。この成長は主に、高品質の肉と乳製品に対する世界の需要の高まりによるものです。この需要を満たすため、家畜生産者は家畜の栄養と健康の改善にますます力を入れるようになっています。ビタミン、タンパク質、アミノ酸を含む家畜用サプリメントは、こうした目標の達成に不可欠です。畜産分野は、動物の栄養と生産効率を最適化するための農家や牧場主の継続的な努力によって、予測期間中に大幅なCAGRを維持すると予測されています。

コンパニオンアニマルのウェルネスとプロバイオティクスの役割

プロバイオティクスは2022年の動物用サプリメント市場の促進要因として脚光を浴びたが、その主な理由はコンパニオンアニマルのウェルネスを高める役割にあります。プロバイオティクスのサプリメントは、ペットの消化器系の健康に良い影響を与え、バランスのとれた腸内細菌叢を維持するのに役立つことが認識されています。ペットの飼育動向の上昇とペット栄養の重要性に対する意識の高まりが、プロバイオティクスの需要に拍車をかけています。ペットの飼い主は最愛の動物の全体的な健康と幸福を優先し続けるため、この分野は予測期間中(2023~2031年)に堅調なCAGRを示すと予想されます。

動物用サプリメント市場の抑制要因

有望な成長にもかかわらず、動物用サプリメント市場の重大な抑制要因の1つは、製品の安全性と有効性に関する規制上の課題と懸念です。世界中の政府や規制機関は、動物ヘルスケア業界におけるサプリメントメーカーの主張をますます精査するようになっています。サプリメントが要求される品質基準を満たし、動物に期待される利益をもたらすことを確実にすることは、複雑で進化するプロセスです。規制状況は、新規参入企業にとっては市場参入の障壁となり、また、コンプライアンス上の問題が生じた場合には、製品の回収や販売中止につながることもあります。業界の利害関係者は、この制約を効果的に乗り切り、製品の安全性と有効性を確保するために、厳格な研究開発、臨床試験、コンプライアンス対策に投資する必要があります。

サプリメントの種類別市場セグメンテーション:抗酸化物質セグメントが市場を独占

2022年、動物用サプリメント市場の中で最も高い収益を上げたのは抗酸化物質セグメントでした。ビタミンCとE、セレン、コエンザイムQ10を含む抗酸化サプリメントは、コンパニオンアニマルや家畜の酸化ストレスに対抗し、慢性疾患のリスクを低減する上で重要な役割を果たしています。この優位性は2031年まで続くと予想され、酸化防止剤分野が最も高い年間平均成長率(CAGR)を示すと予測されています。予想される成長の原動力は、ペットや家畜のウェルネス傾向の高まりに伴い、動物の予防ヘルスケア対策の採用が増加していることです。

動物の種類別市場セグメンテーション:畜産セグメントが市場を独占

2022年の動物用サプリメント市場は、畜産セグメントが収益と成長性の両面でリードしています。この成長は、高品質の肉と乳製品に対する世界の需要の高まりによるものです。この需要に対応するため、家畜生産者は家畜の栄養と健康の改善にますます力を入れるようになっており、ビタミン、タンパク質、アミノ酸を含む家畜用サプリメントのニーズを牽引しています。このセグメントは、動物の栄養と生産効率を最適化する継続的な努力に支えられて、2023年から2031年まで優位性を維持すると予測されます。さらに、畜産セグメントは予測期間中に大幅なCAGRが見込まれます。

APACは世界のリーダーであり続ける

地理的動向では、北米が予測期間(2023~2031年)に最も高いCAGRを示すと予想されます。この成長は、ペットの健康とウェルネスに対する意識の高まりと、プレミアムペットサプリメントに対する需要の高まりによるものです。アジア太平洋地域、特に中国やインドのような国々は、2022年同様、最も売上比率の高い地域としての地位を維持すると予測されます。これらの国々では、可処分所得の増加、都市化、中間層の急増が動物用サプリメント市場の継続的成長に寄与しています。さらに、欧州は動物福祉と高度な獣医ヘルスケアへの取り組みを反映して、安定した成長を示すと思われます。

市場競争は予測期間中に激化へ

2022年、動物用サプリメント市場は主要企業間の激しい競争を目の当たりにしました。Zoetis Inc.、Nutramax Laboratories、Vetoquinol S.A.、Ceva Sante Animale、Elanco Animal Health、Dechra Pharmaceuticals plc、Merck Animal Health、Virbac S.A.、Boehringer Ingelheim、Norbrook Laboratories Limited、Hester Biosciences Limited、Merial Animal Health Limited、Novartis Animal Health, Inc.、Nutreco N.V.、Ouro Fino Saúde Animalなどの企業が市場をリードしています。これらの業界大手は、製品の多様化、動物病院との戦略的提携、新興市場への進出といった戦略に注力し、市場の優位性を維持しています。2023年から2031年までの予測期間に入ると、これらの企業は引き続き研究開発に投資し、動物特有のニーズに対応した革新的かつ特殊なサプリメントを投入していくと予想されます。さらに、デジタル・マーケティングとeコマース・チャネルを活用して、より広範な顧客層にリーチする可能性が高いです。製品の安全性と有効性を確保する一方で、天然素材やオーガニックのサプリメントに対する消費者の需要の変化に対応することに、今後も焦点が当てられると思われます。

目次

第1章 序文

- レポート内容

- 報告書の目的

- 対象者

- 主な提供商品

- 市場セグメンテーション

- 調査手法

- フェーズⅠ-二次調査

- フェーズⅡ-一次調査

- フェーズⅢ-有識者レビュー

- 前提条件

- 採用したアプローチ

第2章 エグゼクティブサマリー

第3章 動物用サプリメント市場:競合分析

- 主要ベンダーの市場での位置付け

- ベンダーが採用する戦略

- 主要な産業戦略

- ティア分析:2022 vs 2031

第4章 動物用サプリメント市場:マクロ分析と市場力学

- イントロダクション

- 世界の動物用サプリメント市場金額 2021-2031

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

- 促進要因と抑制要因の影響分析

- シーソー分析

第5章 動物用サプリメント市場:サプリメントの種類別 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 抗酸化物質

- ビタミン

- タンパク質・アミノ酸

- 酵素

- プロバイオティクス

- 必須脂肪酸

- その他

第6章 動物用サプリメント市場:動物の種類別 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- コンパニオンアニマル

- 犬

- 猫

- 家畜

- 牛

- 馬

- 羊

- その他

- コンパニオンアニマル

第7章 動物用サプリメント市場:用途別/メリット分野別 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 関節の健康サポート

- 鎮静/ストレス/不安

- 消化器の健康

- エネルギーと電解質

- 免疫サポート

- 皮膚と被毛の健康

- その他

第8章 動物用サプリメント市場:剤形別 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- ピル・錠剤

- チュアブル

- 粉末

- その他

第9章 動物用サプリメント市場:流通チャネル別 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 小型動物獣医

- 大型動物獣医

- 混合動物獣医

- 小売店

- ドラッグストア

- オンライン販売

第10章 北米の動物用サプリメント市場 2021-2031

- 市場概要

- 動物用サプリメント市場:サプリメントの種類別 2021-2031

- 動物用サプリメント市場:動物の種類別 2021-2031

- 動物用サプリメント市場:用途別/メリット分野別 2021-2031

- 動物用サプリメント市場:剤形別 2021-2031

- 動物用サプリメント市場:流通チャネル別 2021-2031

- 動物用サプリメント市場:地域別 2021-2031

- 北米

- 米国

- カナダ

- その他北米地域

- 北米

第11章 英国と欧州連合の動物用サプリメント市場 2021-2031

- 市場概要

- 動物用サプリメント市場:サプリメントの種類別 2021-2031

- 動物用サプリメント市場:動物の種類別 2021-2031

- 動物用サプリメント市場:用途別/メリット分野別 2021-2031

- 動物用サプリメント市場:剤形別 2021-2031

- 動物用サプリメント市場:流通チャネル別 2021-2031

- 動物用サプリメント市場:地域別 2021-2031

- 英国と欧州連合

- 英国

- ドイツ

- スペイン

- イタリア

- フランス

- その他欧州地域

- 英国と欧州連合

第12章 アジア太平洋の動物用サプリメント市場 2021-2031

- 市場概要

- 動物用サプリメント市場:サプリメントの種類別 2021-2031

- 動物用サプリメント市場:動物の種類別 2021-2031

- 動物用サプリメント市場:用途別/メリット分野別 2021-2031

- 動物用サプリメント市場:剤形別 2021-2031

- 動物用サプリメント市場:流通チャネル別 2021-2031

- 動物用サプリメント市場:地域別 2021-2031

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- アジア太平洋

第13章 ラテンアメリカの動物用サプリメント市場 2021-2031

- 市場概要

- 動物用サプリメント市場:サプリメントの種類別 2021-2031

- 動物用サプリメント市場:動物の種類別 2021-2031

- 動物用サプリメント市場:用途別/メリット分野別 2021-2031

- 動物用サプリメント市場:剤形別 2021-2031

- 動物用サプリメント市場:流通チャネル別 2021-2031

- 動物用サプリメント市場:地域別 2021-2031

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ地域

- ラテンアメリカ

第14章 中東・アフリカの動物用サプリメント市場 2021-2031

- 市場概要

- 動物用サプリメント市場:サプリメントの種類別 2021-2031

- 動物用サプリメント市場:動物の種類別 2021-2031

- 動物用サプリメント市場:用途別/メリット分野別 2021-2031

- 動物用サプリメント市場:剤形別 2021-2031

- 動物用サプリメント市場:流通チャネル別 2021-2031

- 動物用サプリメント市場:地域別 2021-2031

- 中東・アフリカ

- GCC

- アフリカ

- その他中東・アフリカ地域

- 中東・アフリカ

第15章 企業プロファイル

- Zoetis Inc.

- Nutramax Laboratories

- Vetoquinol S.A

- Ceva Sante Animale

- Elanco Animal Health

- Dechra Pharmaceuticals plc

- Merck Animal Health

- Virbac S.A.

- Boehringer Ingelheim

- Norbrook Laboratories Limited

- Hester Biosciences Limited

- Merial Animal Health Limited

- Novartis Animal Health Inc.

- Nutreco N.V.

- Ouro Fino SaAºde Animal

- その他の主要企業

List of Tables

- TABLE 1 Global Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 2 Global Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 3 Global Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 4 Global Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 5 Global Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 6 Global Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 7 Global Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 8 North America Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 9 North America Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 10 North America Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 11 North America Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 12 North America Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 13 North America Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 14 North America Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 15 U.S. Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 16 U.S. Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 17 U.S. Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 18 U.S. Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 19 U.S. Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 20 U.S. Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 21 U.S. Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 22 Canada Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 23 Canada Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 24 Canada Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 25 Canada Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 26 Canada Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 27 Canada Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 28 Canada Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 29 Rest of North America Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 30 Rest of North America Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 31 Rest of North America Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 32 Rest of North America Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 33 Rest of North America Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 34 Rest of North America Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 35 Rest of North America Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 36 UK and European Union Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 37 UK and European Union Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 38 UK and European Union Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 39 UK and European Union Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 40 UK and European Union Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 41 UK and European Union Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 42 UK and European Union Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 43 UK Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 44 UK Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 45 UK Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 46 UK Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 47 UK Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 48 UK Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 49 UK Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 50 Germany Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 51 Germany Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 52 Germany Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 53 Germany Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 54 Germany Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 55 Germany Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 56 Germany Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 57 Spain Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 58 Spain Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 59 Spain Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 60 Spain Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 61 Spain Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 62 Spain Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 63 Spain Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 64 Italy Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 65 Italy Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 66 Italy Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 67 Italy Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 68 Italy Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 69 Italy Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 70 Italy Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 71 France Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 72 France Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 73 France Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 74 France Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 75 France Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 76 France Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 77 France Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 78 Rest of Europe Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 79 Rest of Europe Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 80 Rest of Europe Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 81 Rest of Europe Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 82 Rest of Europe Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 83 Rest of Europe Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 84 Rest of Europe Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 85 Asia Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 86 Asia Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 87 Asia Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 88 Asia Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 89 Asia Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 90 Asia Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 91 Asia Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 92 China Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 93 China Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 94 China Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 95 China Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 96 China Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 97 China Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 98 China Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 99 Japan Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 100 Japan Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 101 Japan Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 102 Japan Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 103 Japan Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 104 Japan Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 105 Japan Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 106 India Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 107 India Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 108 India Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 109 India Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 110 India Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 111 India Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 112 India Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 113 Australia Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 114 Australia Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 115 Australia Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 116 Australia Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 117 Australia Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 118 Australia Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 119 Australia Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 120 South Korea Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 121 South Korea Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 122 South Korea Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 123 South Korea Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 124 South Korea Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 125 South Korea Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 126 South Korea Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 127 Latin America Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 128 Latin America Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 129 Latin America Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 130 Latin America Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 131 Latin America Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 132 Latin America Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 133 Latin America Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 134 Brazil Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 135 Brazil Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 136 Brazil Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 137 Brazil Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 138 Brazil Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 139 Brazil Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 140 Brazil Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 141 Mexico Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 142 Mexico Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 143 Mexico Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 144 Mexico Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 145 Mexico Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 146 Mexico Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 147 Mexico Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 148 Rest of Latin America Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 149 Rest of Latin America Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 150 Rest of Latin America Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 151 Rest of Latin America Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 152 Rest of Latin America Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 153 Rest of Latin America Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 154 Rest of Latin America Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 155 Middle East and Africa Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 156 Middle East and Africa Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 157 Middle East and Africa Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 158 Middle East and Africa Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 159 Middle East and Africa Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 160 Middle East and Africa Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 161 Middle East and Africa Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 162 GCC Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 163 GCC Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 164 GCC Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 165 GCC Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 166 GCC Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 167 GCC Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 168 GCC Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 169 Africa Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 170 Africa Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 171 Africa Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 172 Africa Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 173 Africa Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 174 Africa Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 175 Africa Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 176 Rest of Middle East and Africa Veterinary Supplements Market By Supplement Type, 2021-2031, USD (Million)

- TABLE 177 Rest of Middle East and Africa Veterinary Supplements Market By Animal Type, 2021-2031, USD (Million)

- TABLE 178 Rest of Middle East and Africa Veterinary Supplements Market By Companion Animals, 2021-2031, USD (Million)

TABLE 179 Rest of Middle East and Africa Veterinary Supplements Market By Livestock, 2021-2031, USD (Million)

TABLE 180 Rest of Middle East and Africa Veterinary Supplements Market By Application / Benefit Area, 2021-2031, USD (Million)

- TABLE 181 Rest of Middle East and Africa Veterinary Supplements Market By Dosage Form, 2021-2031, USD (Million)

- TABLE 182 Rest of Middle East and Africa Veterinary Supplements Market By Distribution Channel, 2021-2031, USD (Million)

List of Figures

- FIG. 1 Global Veterinary Supplements Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Veterinary Supplements Market: Quality Assurance

- FIG. 5 Global Veterinary Supplements Market, By Supplement Type, 2022

- FIG. 6 Global Veterinary Supplements Market, By Animal Type, 2022

- FIG. 7 Global Veterinary Supplements Market, By Application / Benefit Area, 2022

- FIG. 8 Global Veterinary Supplements Market, By Dosage Form, 2022

- FIG. 9 Global Veterinary Supplements Market, By Distribution Channel, 2022

- FIG. 10 Global Veterinary Supplements Market, By Geography, 2022

- FIG. 11 Market Geographical Opportunity Matrix - Global Veterinary Supplements Market, 2022

FIG. 12Market Positioning of Key Veterinary Supplements Market Players, 2022

FIG. 13Global Veterinary Supplements Market - Tier Analysis - Percentage of Revenues by Tier Level, 2022 Versus 2031

- FIG. 14 Global Veterinary Supplements Market, By Supplement Type, 2022 Vs 2031, %

- FIG. 15 Global Veterinary Supplements Market, By Animal Type, 2022 Vs 2031, %

- FIG. 16 Global Veterinary Supplements Market, By Application / Benefit Area, 2022 Vs 2031, %

- FIG. 17 Global Veterinary Supplements Market, By Dosage Form, 2022 Vs 2031, %

- FIG. 18 Global Veterinary Supplements Market, By Distribution Channel, 2022 Vs 2031, %

- FIG. 19 U.S. Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 20 Canada Veterinary Supplements Market (US$ Million), 2021 - 2031

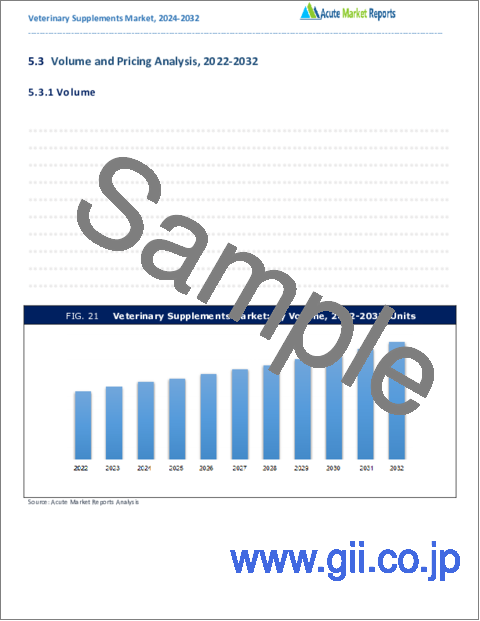

- FIG. 21 Rest of North America Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 22 UK Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 23 Germany Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 24 Spain Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 25 Italy Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 26 France Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 27 Rest of Europe Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 28 China Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 29 Japan Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 30 India Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 31 Australia Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 32 South Korea Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 33 Rest of Asia Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 34 Brazil Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 35 Mexico Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 36 Rest of Latin America Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 37 GCC Veterinary Supplements Market (US$ Million), 2021 - 2031

- FIG. 38 Africa Veterinary Supplements Market (US$ Million), 2021 - 2031

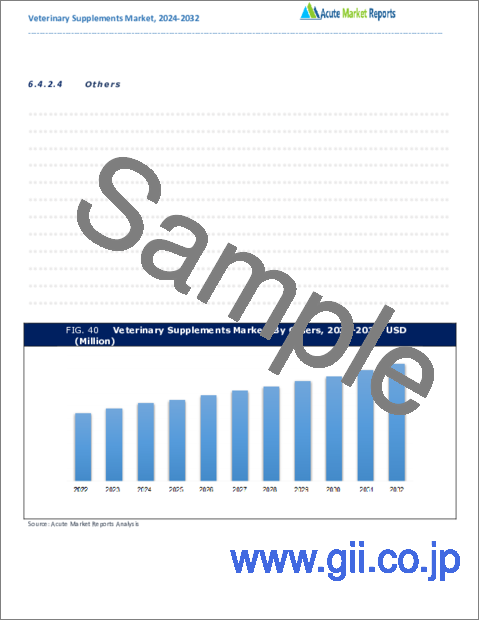

- FIG. 39 Rest of Middle East and Africa Veterinary Supplements Market (US$ Million), 2021 - 2031

The veterinary supplements market, a critical component of animal healthcare, is poised for a CAGR of 7% during the forecast period of 2023 to 2031. This market encompasses various supplement types and serves both companion animals and livestock. It is influenced by several driving factors and one significant restraint. The veterinary supplements market is set for steady growth from 2023 to 2031, driven by various supplement types, animal types, and geographic trends. Regulatory challenges pose a significant restraint, emphasizing the need for compliance and safety measures. Competitive trends suggest that key players will continue to focus on innovation, partnerships, and global expansion in this dynamic and evolving industry.

Antioxidants Boost Animal Wellness

Antioxidants emerged as a prominent driver in the veterinary supplements market in 2022 and are expected to maintain their significance from 2023 to 2031. Antioxidant supplements, including vitamins C and E, selenium, and coenzyme Q10, play a crucial role in supporting animal wellness. They help combat oxidative stress and reduce the risk of chronic diseases in both companion animals and livestock. The segment's substantial revenue in 2022 reflects the growing awareness among pet owners and livestock producers about the benefits of antioxidants in enhancing animal health. Moreover, the antioxidant segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period, driven by the increasing adoption of preventive healthcare measures for animals.

Growing Emphasis on Livestock Nutrition

In 2022, the Livestock segment garnered the highest revenue in the veterinary supplements market, a trend expected to persist through 2031. This growth is primarily attributed to the rising global demand for high-quality meat and dairy products. To meet this demand, livestock producers are increasingly focusing on improving the nutrition and health of their animals. Livestock supplements, including vitamins, proteins, and amino acids, are integral to achieving these goals. The Livestock segment is projected to maintain a substantial CAGR during the forecast period, driven by the continuous efforts of farmers and ranchers to optimize animal nutrition and production efficiency.

Companion Animal Wellness and the Role of Probiotics

Probiotics gained prominence as drivers in the veterinary supplements market in 2022, primarily due to their role in enhancing the wellness of companion animals. Probiotic supplements are recognized for their positive effects on the digestive health of pets, helping to maintain a balanced gut microbiome. The rising pet ownership trend, coupled with a growing awareness of the importance of pet nutrition, fueled the demand for probiotics. The segment is anticipated to exhibit a robust CAGR during the forecast period (2023 to 2031) as pet owners continue to prioritize the overall health and well-being of their beloved animals.

Restraint in the Veterinary Supplements Market

Despite the promising growth, one significant restraint in the veterinary supplements market is regulatory challenges and concerns regarding product safety and efficacy. Governments and regulatory bodies worldwide are increasingly scrutinizing the claims made by supplement manufacturers in the animal healthcare industry. Ensuring that supplements meet the required quality standards and that they deliver the expected benefits to animals is a complex and evolving process. The regulatory landscape can be a barrier to market entry for new players and can also lead to product recalls or discontinuations if compliance issues arise. Industry stakeholders need to invest in rigorous research and development, clinical trials, and compliance measures to navigate this restraint effectively and ensure the safety and efficacy of their products.

Market Segmentation by Supplement Type: Antioxidants Segment Dominates the Market

In 2022, within the Veterinary Supplements Market, the highest revenue was generated by the Antioxidants segment, reflecting the growing awareness of their benefits in animal health. Antioxidant supplements, including vitamins C and E, selenium, and coenzyme Q10, play a crucial role in combating oxidative stress and reducing the risk of chronic diseases in both companion animals and livestock. This dominance is expected to continue through 2031, with the Antioxidants segment projected to exhibit the highest Compound Annual Growth Rate (CAGR). The anticipated growth is driven by the increasing adoption of preventive healthcare measures for animals, aligning with the growing trend of pet and livestock wellness.

Market Segmentation by Animal Type: Livestock Segment Dominates the Market

The Livestock segment led the Veterinary Supplements Market in terms of both revenue and growth potential in 2022. This growth is attributed to the rising global demand for high-quality meat and dairy products. To meet this demand, livestock producers are increasingly focusing on improving the nutrition and health of their animals, driving the need for livestock supplements, including vitamins, proteins, and amino acids. This segment is projected to maintain its dominance from 2023 to 2031, supported by continuous efforts to optimize animal nutrition and production efficiency. Additionally, the Livestock segment is expected to have a substantial CAGR during the forecast period.

APAC Remains as the Global Leader

In terms of geographic trends, North America is expected to exhibit the highest CAGR during the forecast period (2023 to 2031). This growth is attributed to the increasing awareness of pet health and wellness and the growing demand for premium pet supplements. The Asia-Pacific region, particularly countries like China and India, is projected to maintain its position as the region with the highest revenue percentage as it was in 2022. The rising disposable income, urbanization, and a burgeoning middle-class population in these countries contribute to the continuous growth of the veterinary supplements market. Additionally, Europe is likely to show steady growth, reflecting the region's commitment to animal welfare and advanced veterinary healthcare practices.

Market Competition to Intensify During the Forecast Period

In 2022, the veterinary supplements market witnessed intense competition among key players. Companies such as Zoetis Inc., Nutramax Laboratories, Vetoquinol S.A, Ceva Sante Animale, Elanco Animal Health, Dechra Pharmaceuticals plc, Merck Animal Health, Virbac S.A., Boehringer Ingelheim, Norbrook Laboratories Limited, Hester Biosciences Limited, Merial Animal Health Limited, Novartis Animal Health, Inc., Nutreco N.V., and Ouro Fino Saúde Animal. were among the market leaders. These industry giants focused on strategies like product diversification, strategic partnerships with veterinary clinics, and expansion into emerging markets to maintain their market dominance. As we move into the forecast period from 2023 to 2031, it is expected that these players will continue to invest in research and development to introduce innovative and specialized supplements catering to the unique needs of animals. Moreover, digital marketing and e-commerce channels are likely to be leveraged to reach a broader customer base. The focus will remain on ensuring product safety and efficacy while meeting evolving consumer demands for natural and organic supplements.

Historical & Forecast Period

This study report represents analysis of each segment from 2021 to 2031 considering 2022 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2023 to 2031.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation ofVeterinary Supplements market are as follows:

- Research and development budgets of manufacturers and government spending

- Revenues of key companies in the market segment

- Number of end users and consumption volume, price and value.

Geographical revenues generate by countries considered in the report:

Micro and macro environment factors that are currently influencing the Veterinary Supplements market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

Market Segmentation

Supplement Type

- Antioxidants

- Vitamins

- Proteins / Amino acids

- Enzymes

- Probiotics

- Essential Fatty Acids

- Others

Animal Type

- Companion Animals

- Dog

- Cat

- Livestock

- Cattle

- Horse

- Sheep

- Others

Application / Benefit Area

- Joint Health Support

- Calming / Stress / Anxiety

- Digestive Health

- Energy & Electrolytes

- Immunity Support

- Skin & Coat Health

- Others

Dosage Form

- Pills & Tablets

- Chewables

- Powders

- Others

Distribution Channel

- Small Animal Veterinary

- Large Animal Veterinary

- Mixed Animal Veterinary

- Retail Stores

- Drug Stores

- Online Sales

Region Segment (2021-2031; US$ Million)

- North America

- U.S.

- Canada

- Rest of North America

- UK and European Union

- UK

- Germany

- Spain

- Italy

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC

- Africa

- Rest of Middle East and Africa

Key questions answered in this report:

- What are the key micro and macro environmental factors that are impacting the growth of Veterinary Supplements market?

- What are the key investment pockets with respect to product segments and geographies currently and during the forecast period?

- Estimated forecast and market projections up to 2031.

- Which segment accounts for the fastest CAGR during the forecast period?

- Which market segment holds a larger market share and why?

- Are low and middle-income economies investing in the Veterinary Supplements market?

- Which is the largest regional market for Veterinary Supplements market?

- What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

- Which are the key trends driving Veterinary Supplements market growth?

- Who are the key competitors and what are their key strategies to enhance their market presence in the Veterinary Supplements market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Veterinary Supplements Market

- 2.2. Global Veterinary Supplements Market, By Supplement Type, 2022 (US$ Million)

- 2.3. Global Veterinary Supplements Market, By Animal Type, 2022 (US$ Million)

- 2.4. Global Veterinary Supplements Market, By Application / Benefit Area, 2022 (US$ Million)

- 2.5. Global Veterinary Supplements Market, By Dosage Form, 2022 (US$ Million)

- 2.6. Global Veterinary Supplements Market, By Distribution Channel, 2022 (US$ Million)

- 2.7. Global Veterinary Supplements Market, By Geography, 2022 (US$ Million)

- 2.8. Attractive Investment Proposition by Geography, 2022

3. Veterinary Supplements Market: Competitive Analysis

- 3.1. Market Positioning of Key Veterinary Supplements Market Vendors

- 3.2. Strategies Adopted by Veterinary Supplements Market Vendors

- 3.3. Key Industry Strategies

- 3.4. Tier Analysis 2022 Versus 2031

4. Veterinary Supplements Market: Macro Analysis & Market Dynamics

- 4.1. Introduction

- 4.2. Global Veterinary Supplements Market Value, 2021 - 2031, (US$ Million)

- 4.3. Market Dynamics

- 4.3.1. Market Drivers

- 4.3.2. Market Restraints

- 4.3.3. Key Challenges

- 4.3.4. Key Opportunities

- 4.4. Impact Analysis of Drivers and Restraints

- 4.5. See-Saw Analysis

5. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2022 Versus 2031

- 5.3. Market Segmentation

- 5.3.1. Antioxidants

- 5.3.2. Vitamins

- 5.3.3. Proteins / Amino acids

- 5.3.4. Enzymes

- 5.3.5. Probiotics

- 5.3.6. Essential Fatty Acids

- 5.3.7. Others

6. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2022 Versus 2031

- 6.3. Market Segmentation

- 6.3.1. Companion Animals

- 6.3.1.1. Dog

- 6.3.1.2. Cat

- 6.3.2. Livestock

- 6.3.2.1. Cattle

- 6.3.2.2. Horse

- 6.3.2.3. Sheep

- 6.3.2.4. Others

- 6.3.1. Companion Animals

7. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 7.1. Market Overview

- 7.2. Growth & Revenue Analysis: 2022 Versus 2031

- 7.3. Market Segmentation

- 7.3.1. Joint Health Support

- 7.3.2. Calming / Stress / Anxiety

- 7.3.3. Digestive Health

- 7.3.4. Energy & Electrolytes

- 7.3.5. Immunity Support

- 7.3.6. Skin & Coat Health

- 7.3.7. Others

8. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 8.1. Market Overview

- 8.2. Growth & Revenue Analysis: 2022 Versus 2031

- 8.3. Market Segmentation

- 8.3.1. Pills & Tablets

- 8.3.2. Chewables

- 8.3.3. Powders

- 8.3.4. Others

9. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 9.1. Market Overview

- 9.2. Growth & Revenue Analysis: 2022 Versus 2031

- 9.3. Market Segmentation

- 9.3.1. Small Animal Veterinary

- 9.3.2. Large Animal Veterinary

- 9.3.3. Mixed Animal Veterinary

- 9.3.4. Retail Stores

- 9.3.5. Drug Stores

- 9.3.6. Online Sales

10. North America Veterinary Supplements Market, 2021-2031, USD (Million)

- 10.1. Market Overview

- 10.2. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 10.3. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 10.4. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 10.5. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 10.6. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.7.Veterinary Supplements Market: By Region, 2021-2031, USD (Million)

- 10.7.1.North America

- 10.7.1.1. U.S.

- 10.7.1.1.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 10.7.1.1.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 10.7.1.1.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 10.7.1.1.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 10.7.1.1.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.7.1.2. Canada

- 10.7.1.2.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 10.7.1.2.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 10.7.1.2.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 10.7.1.2.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 10.7.1.2.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.7.1.3. Rest of North America

- 10.7.1.3.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 10.7.1.3.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 10.7.1.3.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 10.7.1.3.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 10.7.1.3.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.7.1.1. U.S.

- 10.7.1.North America

11. UK and European Union Veterinary Supplements Market, 2021-2031, USD (Million)

- 11.1. Market Overview

- 11.2. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 11.3. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 11.4. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 11.5. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 11.6. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.7.Veterinary Supplements Market: By Region, 2021-2031, USD (Million)

- 11.7.1.UK and European Union

- 11.7.1.1. UK

- 11.7.1.1.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 11.7.1.1.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 11.7.1.1.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 11.7.1.1.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 11.7.1.1.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.7.1.2. Germany

- 11.7.1.2.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 11.7.1.2.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 11.7.1.2.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 11.7.1.2.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 11.7.1.2.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.7.1.3. Spain

- 11.7.1.3.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 11.7.1.3.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 11.7.1.3.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 11.7.1.3.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 11.7.1.3.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.7.1.4. Italy

- 11.7.1.4.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 11.7.1.4.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 11.7.1.4.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 11.7.1.4.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 11.7.1.4.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.7.1.5. France

- 11.7.1.5.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 11.7.1.5.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 11.7.1.5.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 11.7.1.5.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 11.7.1.5.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.7.1.6. Rest of Europe

- 11.7.1.6.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 11.7.1.6.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 11.7.1.6.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 11.7.1.6.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 11.7.1.6.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.7.1.1. UK

- 11.7.1.UK and European Union

12. Asia Pacific Veterinary Supplements Market, 2021-2031, USD (Million)

- 12.1. Market Overview

- 12.2. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 12.3. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 12.4. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 12.5. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 12.6. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.7.Veterinary Supplements Market: By Region, 2021-2031, USD (Million)

- 12.7.1.Asia Pacific

- 12.7.1.1. China

- 12.7.1.1.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 12.7.1.1.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 12.7.1.1.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 12.7.1.1.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 12.7.1.1.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.7.1.2. Japan

- 12.7.1.2.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 12.7.1.2.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 12.7.1.2.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 12.7.1.2.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 12.7.1.2.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.7.1.3. India

- 12.7.1.3.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 12.7.1.3.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 12.7.1.3.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 12.7.1.3.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 12.7.1.3.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.7.1.4. Australia

- 12.7.1.4.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 12.7.1.4.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 12.7.1.4.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 12.7.1.4.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 12.7.1.4.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.7.1.5. South Korea

- 12.7.1.5.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 12.7.1.5.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 12.7.1.5.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 12.7.1.5.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 12.7.1.5.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.7.1.6. Rest of Asia Pacific

- 12.7.1.6.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 12.7.1.6.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 12.7.1.6.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 12.7.1.6.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 12.7.1.6.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.7.1.1. China

- 12.7.1.Asia Pacific

13. Latin America Veterinary Supplements Market, 2021-2031, USD (Million)

- 13.1. Market Overview

- 13.2. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 13.3. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 13.4. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 13.5. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 13.6. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 13.7.Veterinary Supplements Market: By Region, 2021-2031, USD (Million)

- 13.7.1.Latin America

- 13.7.1.1. Brazil

- 13.7.1.1.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 13.7.1.1.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 13.7.1.1.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 13.7.1.1.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 13.7.1.1.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 13.7.1.2. Mexico

- 13.7.1.2.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 13.7.1.2.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 13.7.1.2.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 13.7.1.2.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 13.7.1.2.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 13.7.1.3. Rest of Latin America

- 13.7.1.3.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 13.7.1.3.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 13.7.1.3.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 13.7.1.3.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 13.7.1.3.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 13.7.1.1. Brazil

- 13.7.1.Latin America

14. Middle East and Africa Veterinary Supplements Market, 2021-2031, USD (Million)

- 14.1. Market Overview

- 14.2. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 14.3. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 14.4. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 14.5. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 14.6. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 14.7.Veterinary Supplements Market: By Region, 2021-2031, USD (Million)

- 14.7.1.Middle East and Africa

- 14.7.1.1. GCC

- 14.7.1.1.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 14.7.1.1.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 14.7.1.1.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 14.7.1.1.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 14.7.1.1.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 14.7.1.2. Africa

- 14.7.1.2.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 14.7.1.2.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 14.7.1.2.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 14.7.1.2.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 14.7.1.2.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 14.7.1.3. Rest of Middle East and Africa

- 14.7.1.3.1. Veterinary Supplements Market: By Supplement Type, 2021-2031, USD (Million)

- 14.7.1.3.2. Veterinary Supplements Market: By Animal Type, 2021-2031, USD (Million)

- 14.7.1.3.3. Veterinary Supplements Market: By Application / Benefit Area, 2021-2031, USD (Million)

- 14.7.1.3.4. Veterinary Supplements Market: By Dosage Form, 2021-2031, USD (Million)

- 14.7.1.3.5. Veterinary Supplements Market: By Distribution Channel, 2021-2031, USD (Million)

- 14.7.1.1. GCC

- 14.7.1.Middle East and Africa

15. Company Profile

- 15.1. Zoetis Inc.

- 15.1.1. Company Overview

- 15.1.2. Financial Performance

- 15.1.3. Product Portfolio

- 15.1.4. Strategic Initiatives

- 15.2. Nutramax Laboratories

- 15.2.1. Company Overview

- 15.2.2. Financial Performance

- 15.2.3. Product Portfolio

- 15.2.4. Strategic Initiatives

- 15.3. Vetoquinol S.A

- 15.3.1. Company Overview

- 15.3.2. Financial Performance

- 15.3.3. Product Portfolio

- 15.3.4. Strategic Initiatives

- 15.4. Ceva Sante Animale

- 15.4.1. Company Overview

- 15.4.2. Financial Performance

- 15.4.3. Product Portfolio

- 15.4.4. Strategic Initiatives

- 15.5. Elanco Animal Health

- 15.5.1. Company Overview

- 15.5.2. Financial Performance

- 15.5.3. Product Portfolio

- 15.5.4. Strategic Initiatives

- 15.6. Dechra Pharmaceuticals plc

- 15.6.1. Company Overview

- 15.6.2. Financial Performance

- 15.6.3. Product Portfolio

- 15.6.4. Strategic Initiatives

- 15.7. Merck Animal Health

- 15.7.1. Company Overview

- 15.7.2. Financial Performance

- 15.7.3. Product Portfolio

- 15.7.4. Strategic Initiatives

- 15.8. Virbac S.A.

- 15.8.1. Company Overview

- 15.8.2. Financial Performance

- 15.8.3. Product Portfolio

- 15.8.4. Strategic Initiatives

- 15.9. Boehringer Ingelheim

- 15.9.1. Company Overview

- 15.9.2. Financial Performance

- 15.9.3. Product Portfolio

- 15.9.4. Strategic Initiatives

- 15.10. Norbrook Laboratories Limited

- 15.10.1. Company Overview

- 15.10.2. Financial Performance

- 15.10.3. Product Portfolio

- 15.10.4. Strategic Initiatives

- 15.11. Hester Biosciences Limited

- 15.11.1. Company Overview

- 15.11.2. Financial Performance

- 15.11.3. Product Portfolio

- 15.11.4. Strategic Initiatives

- 15.12. Merial Animal Health Limited

- 15.12.1. Company Overview

- 15.12.2. Financial Performance

- 15.12.3. Product Portfolio

- 15.12.4. Strategic Initiatives

- 15.13. Novartis Animal Health, Inc.

- 15.13.1. Company Overview

- 15.13.2. Financial Performance

- 15.13.3. Product Portfolio

- 15.13.4. Strategic Initiatives

- 15.14. Nutreco N.V.

- 15.14.1. Company Overview

- 15.14.2. Financial Performance

- 15.14.3. Product Portfolio

- 15.14.4. Strategic Initiatives

- 15.15. Ouro Fino SaAºde Animal

- 15.15.1. Company Overview

- 15.15.2. Financial Performance

- 15.15.3. Product Portfolio

- 15.15.4. Strategic Initiatives

- 15.16. Other Notable Players

- 15.16.1. Company Overview

- 15.16.2. Financial Performance

- 15.16.3. Product Portfolio

- 15.16.4. Strategic Initiatives